Part III: Luxottica

Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

I. Introduction to Luxottica

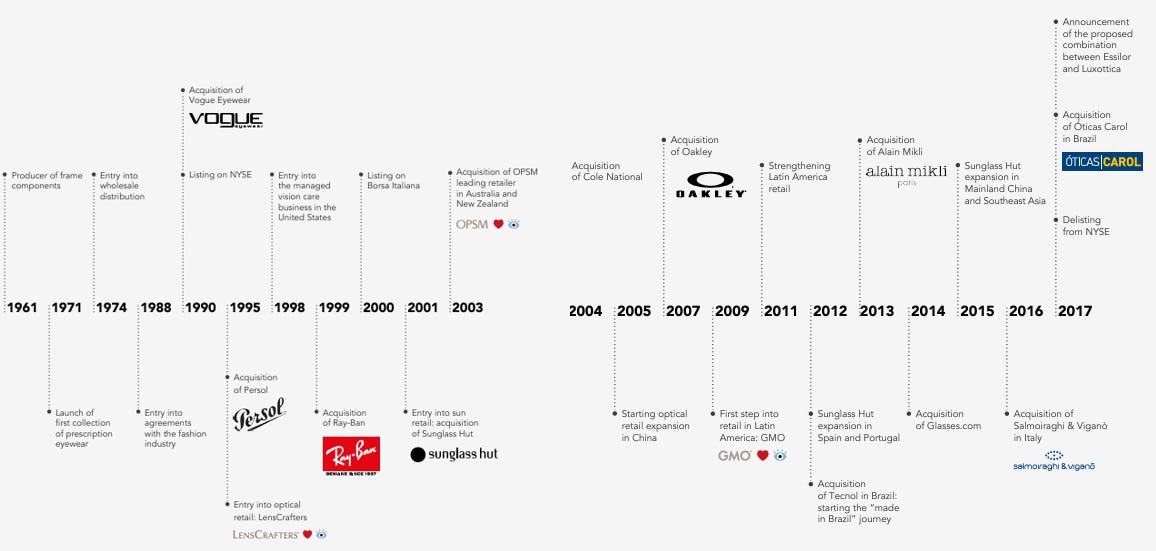

Luxottica, founded in 1961 by Leonardo Del Vecchio in Agordo, Italy, began as a small manufacturer of eyewear parts. Over the years, it expanded into producing complete eyewear frames and quickly established itself as a leader in the eyewear industry. By the 1970s, the company shifted its focus from being a supplier to a fully integrated eyewear manufacturer, producing and selling its own branded products.

In the 1980s, Luxottica expanded globally, and in 1990, it was listed on the New York Stock Exchange, signaling its growth as an international company. This period marked the beginning of its strategy to acquire well-known eyewear brands. It acquired its first major brand, Vogue Eyewear, in 1990, followed by Persol and Ray-Ban in the mid-1990s. Luxottica became a dominant force in both the luxury and mass-market segments, producing eyewear for both its own labels and licensed brands such as Armani, Chanel, and Prada.

"Together, we invented a phenomenon that did not exist: we immediately realised that glasses, from simple functional objects would become indispensable fashion accessories," Giorgio Armani

Luxottica's vertical integration model, controlling everything from design and manufacturing to distribution and retail, played a crucial role in its expansion. The company owned major retail chains like LensCrafters, Sunglass Hut, and Pearle Vision, which allowed it to dominate the eyewear market at multiple levels. By the early 2000s, Luxottica had become the largest eyewear company in the world.

By 2010, the company continued to solidify its dominance, acquiring even more brands and expanding its presence in the retail sector. However, despite its enormous success, Luxottica faced challenges related to its scale and increasing competition. As the global leader in eyewear, the company was primed for the next big step in its evolution.

This came in 2017 when Luxottica announced its merger with Essilor, a leading French company specializing in ophthalmic lenses. The merger, completed in 2018, combined Luxottica's eyewear expertise with Essilor's lens technology, creating EssilorLuxottica, a global powerhouse in vision care products. This move transformed the landscape of the eyewear and vision industry.1

“Today, 60 years after the founding of Luxottica, I am proud to say that my life-long dream of creating a fully integrated, all-round champion in the eyewear industry has come true”1

Leonardo del Vecchio

Unfortunately, Leonardo del Vecchio passed away in 2022. By the time he passed away, he was the second richest person in Italy. His family office called Delfin, has more than €40 billion of Assets Under Management (AUM), with stakes in the following companies:

32% stake in EssilorLuxottica

27% stake in Paris-listed Real Estate company called Covivio

~2% stake in Unicredit

~10% stake in Italian insurer Generali

His family situation was a little complex, and Delfin’s inheritance was divided as follows:

25% stake for Nicoletta Zampillo, his second wife whom he remarried in 2010

75% stake to be equally distributed among his six children (12.5% each), who come from different marriages (3 from his first marriage, one with second wife and two from another relationship)2

Given this complex situation, Del Vecchio took several measures to ensure the continuity of the Luxembourg-based holding:

a majority of 88.5% is required to approve deliberations

The Holding is managed by Francesco Milleri, the Chairman and CEO of EssilorLuxottica, and apparently a loyal member to the family.

This situation creates a strong sense of skin in the game, as he is acting on behalf of a family that owns 32% stake in the company valued worth more than €30 billion. This should provide an alignment of interests between management and shareholders. The situation is somehow similar to LVMH and Arnault family.

Additionally, two of Leonardo’s children play a key role in the company, contributing to a more stable situation for Delfin:

Leonardo Maria is the Chief Strategy Officer of EssilorLuxottica and CEO of the brand Salmoiraghi & Viganò, part of EssilorLuxottica

Matteo Del Vecchio: Head of Integration (Responsible for Group Integration Synergy achievement)

Claudio, the eldest son born in 1957 and the former CEO of U.S. menswear brand Brooks Brothers, lost his Luxottica board seat in 2015 in a management shake-up instigated by his father.3

Finally, this chart, extracted from 2017 annual report illustrates how the company has transformed to a vertically integrated eyewear company by acquiring other companies:

The historical return of the company has been impressive: from 0.19 per share to 55.8 per share, during 30 years.4

II. The Sunglasses Industry

The eyewear encompasses sunglasses, corrective lenses, reading glasses, safety glasses, etc. Luxottica manufactures sunglasses, frames for corrective glasses and some glasses. Therefore, its a global eyewear player.

Given the importance of sunglasses, we will focus in this segment.

How big is the sunglasses market?

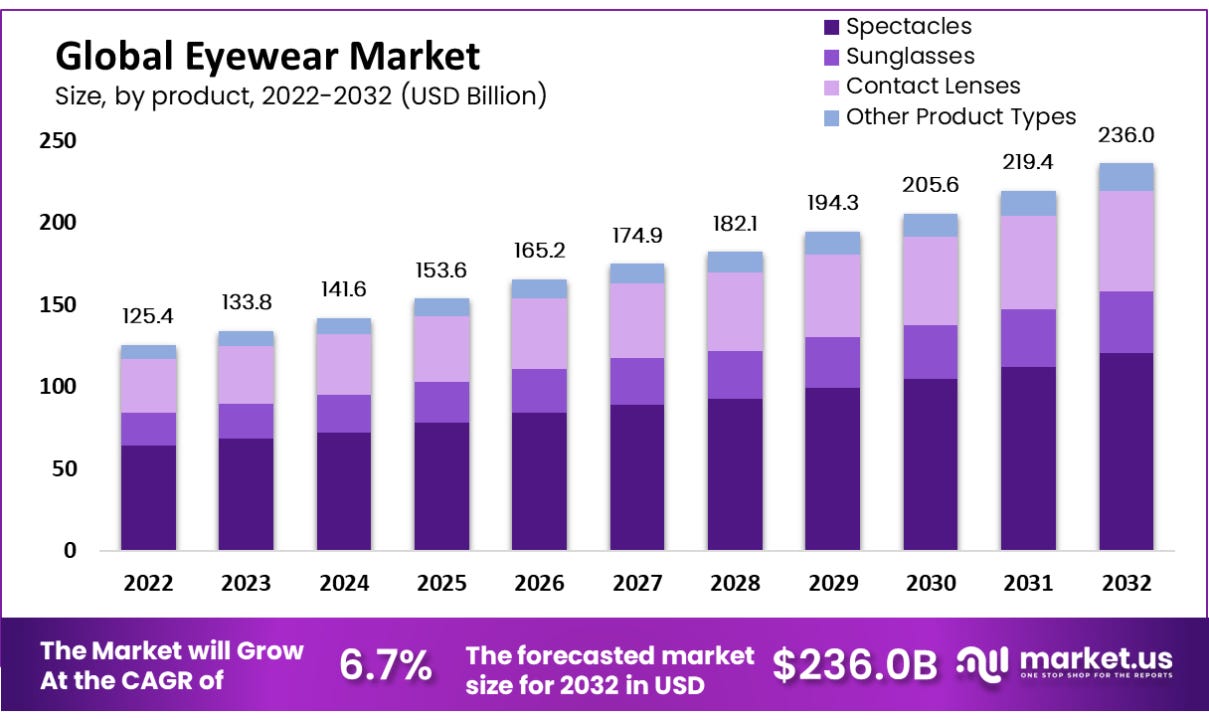

According to different estimates, the average market size will be around $28bn (~€31bn):

Grand View Research: $23.5bn5

Global Market Insights: $29bn6

MMR: $15.5bn7

Market Research Future: $40.4bn8

Statista: $25.4bn9

imarc: $38.2bn10

Mordor Intelligence: $23.3bn11

The global eyewear market grows at around mid-single-digit per year. Its a fragmented market with many brands offering their products. The sunglasses segment is significantly lower than spectacles and contact lenses.

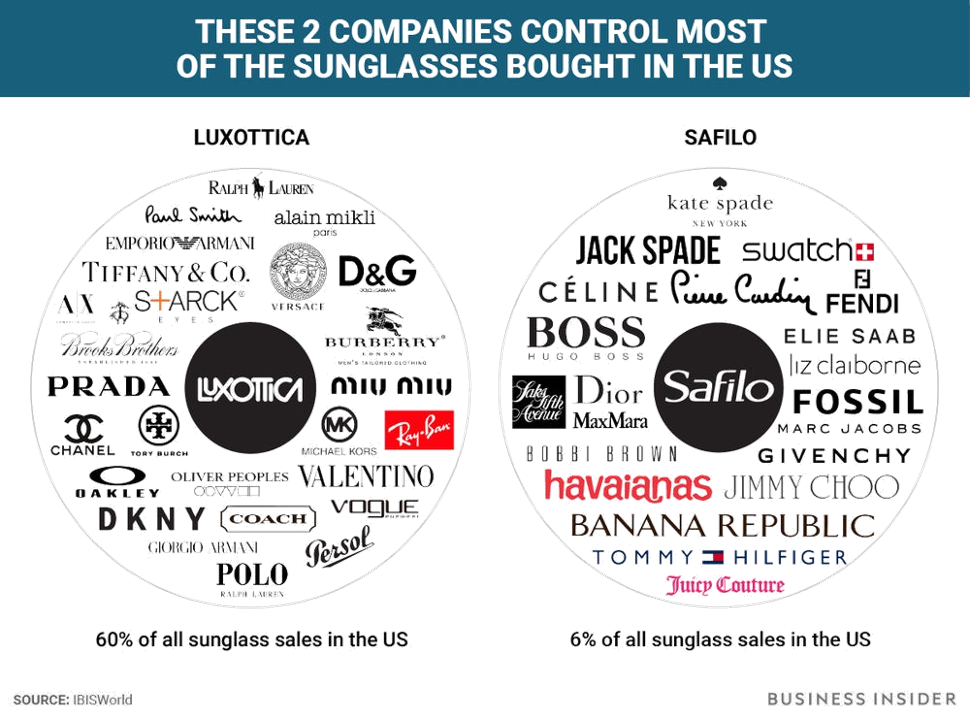

In this segment, Luxottica has the biggest or more important brands in the world: Ray-ban, Persol, Oakley, plus multiple franchise agreements (Prada, Chanel, Ralph Lauren, etc.)

Finally, it is important to highlight that Luxottica also manufactures frames, which provide them a strong revenue flows from the eyecare market, further diversifying their business.

An industry with no risk of disruption from new technologies

In the current days, only AI matters. However, many of today’s big tech companies will not exist in 10-15 years. The risk of disruption is huge in the technology space.

Sunglasses are the opposite. Its a product that has existed from more than a century and has remained essentially the same. The lens, materials, and designs are different, but the essence of the product is the same.

Its the kind of industry that has solid prospects: it is mature, highly fragmented and with a clear dominant player:

The dominant company can use its scale and resources to create barriers to entry, such as better distribution networks or pricing power.

Luxottica as the largest player had the opportunity to consolidate the market, either by acquiring other brands or by acquiring new stores

Luxottica can outcompete any of the smaller players

It can generate network effects

Despite being mature, there is still room to grow as the world’s population keeps improving their lifestyles.

Main competitors

The market is highly fragmented with dozens of brands. Its a market similar to clothing, with many players, pricing ranges and styles.

Luxottica is the biggest player in the industry, however its market share is very difficult to obtain, but they are leaders in the premium, luxury, and sport segments.

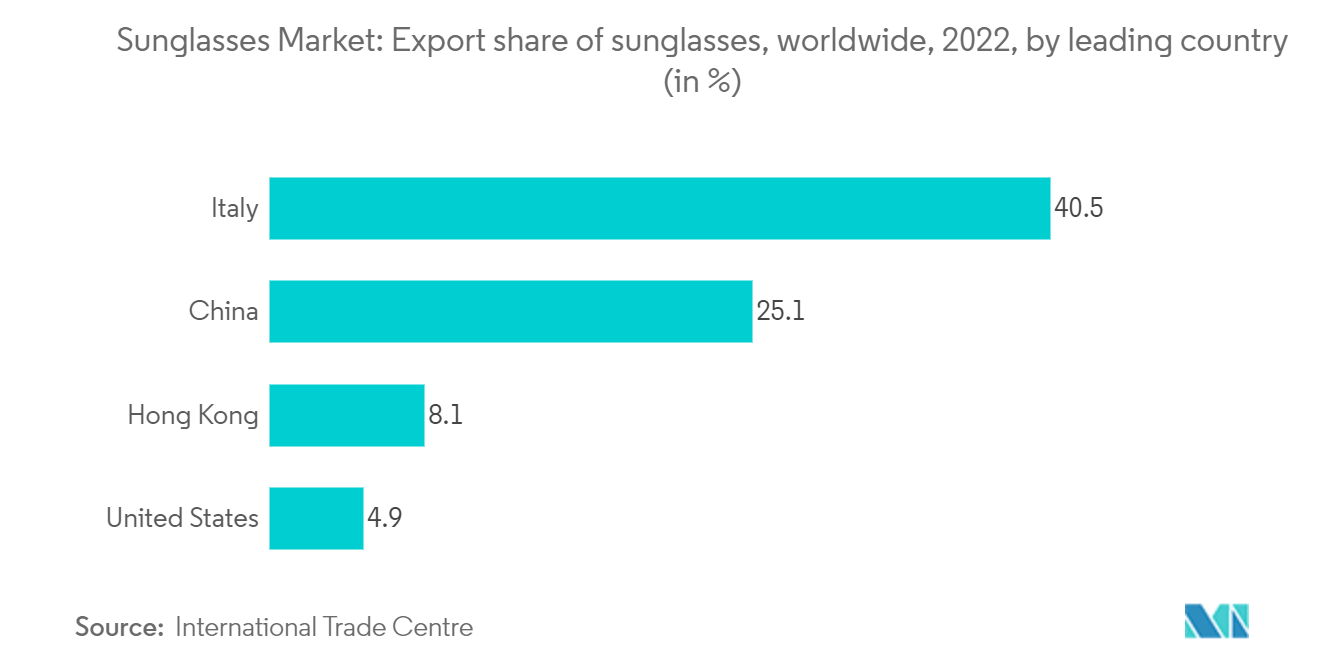

The sunglasses market is still dominated by Italian players, as sunglasses are a fashion item deeply rooted in European firms:

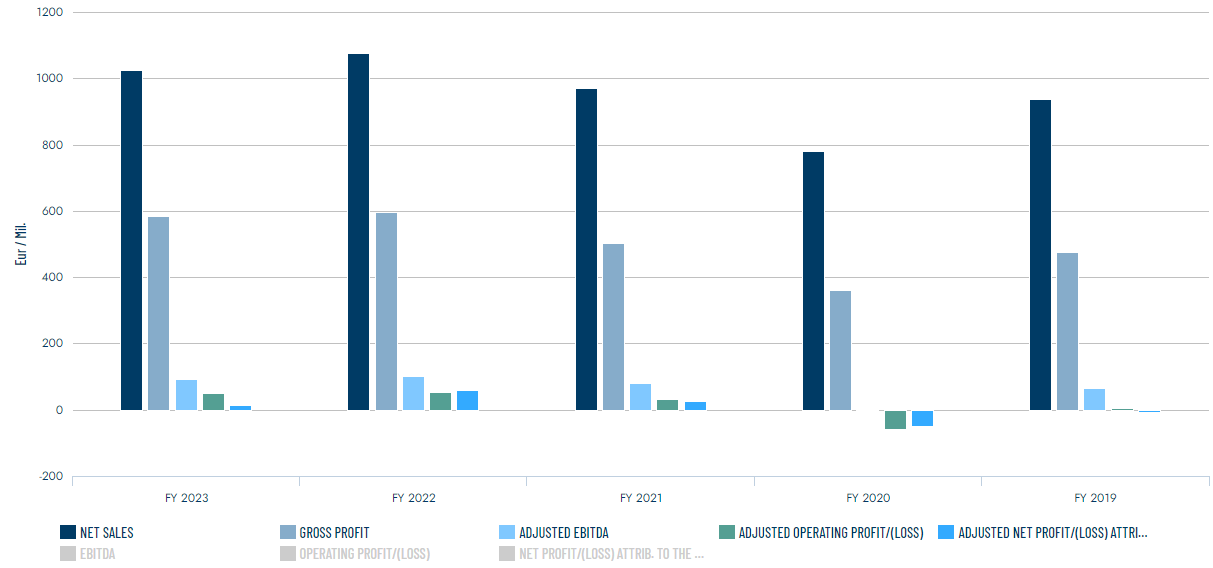

Luxottica: €9,600 million in 2019 (last year reported individually), EBITDA margin ~20%; EBIT margin of 17.5%

Kering eyewear: €1,500 million in 202312 (adjusted operating income of €276; operating margin of 18.4%)

Safilo Group (Italy): €1,025 million in revenue in 2023 (adj. EBITDA margin 8-9%) in 202313

Marchon: €925 million14 (Lacoste, DKNY, Nike, Ferragamo, Carl Lagerfeld, etc.)

Warby Parker: €620 million revenue in 2023 and adj. EBITDA margin of 7.8%15 (U.S.-based direct-to-consumer eyewear company that disrupted the traditional retail model by selling affordable eyewear online)

Essilor: €740 million in 2019 (Brands like Costa, Foster Grant, etc.)

Marcolin (significant stake from LVMH): €558 million and 14% adjusted EBITDA margin16

De Rigo Vision: €506 million in 2023 (Police, Sting, Chopard, etc.)

The main competitors generate around €5bn in revenues. Luxottica generates 2x the revenue of the biggest players combined. This gives Luxottica a huge market share above 30%, assuming a market size of $31bn:

#1: Luxottica: ~30%

#2: Kering: ~5%

#3: Safilo: ~3%

#6 Essilor: ~2.5%

Note that I’m using data from 2019 for Luxottica and Essilor to be conservative. This market share includes all its retail network, which might sell brands from competitors, so its fair to say they control around 1/3 of the market.

According to Bloomberg, the company will have a higher market share of 39% and Essilor of 8% (combined of 48%).17

Either way, it is obvious that Luxottica is the clear leader in the industry.

None of these competitors have the same level of vertical integration as Luxottica. This provides the company with the highest margins (only Kering’s adjusted margin is above 2019 Luxottica’s figures)

SAFILO

They have some global competitors and a lot of local competitors. One the main competitors is Safilo, an Italian company that owns brands such as Dior, Tommy Hilfiger, Bana Republic, etc.

Safilo lacks of an own distribution network like Luxottica. They rely on wholesale agreements, which is generally less profitable

Most of the brands are licensed brands, while Luxottica’s core brands are proprietary (Ray-Ban, Persol, Vogue or Oakley)

The company has a very low profitability compared to Luxottica

Marcolin

Initially a partnership with LVMH, now the French giant has a significant influence in the company since 2021. The end goal of this company is to control all eyewear output from LVMH’s brands.

Luxottica has minimal exposure to LVMH:

Bulgari: Partnership ended in December 2023

Tiffany & Co. partnership lasts until 2027. We should expect that this franchise agreement will end by that date.

Kering Eyewear

Similar to LVMH, Kering is pursuing the same strategy. Luxottica has no exposure to Kering brands. The revenue from Kering eyewear stands at €1.5bn, indicating how profitable selling sunglasses can be.

III. Business Model and Competitive Advantages

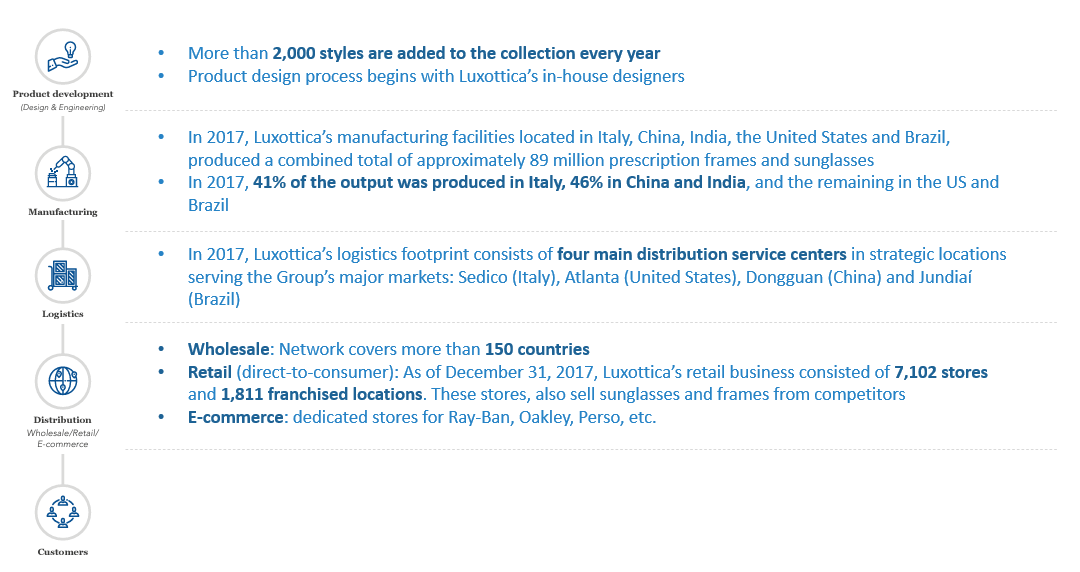

Prior to the merger, Luxottica was already a fully integrated player, controlling the whole value chain. This was something that Essilor didn’t have, as they didn’t operate their own stores

From manufacturing to final distribution, the company controlled every step of the value chain

It had manufacturing facilities in Italy, China, India, the US and Brazil

A distribution network that covers more than 150 countries, and 7,000+ stores

An impressive achievement that allows the company not only to control their own distribution, but also to diversify revenue by selling products from competitors.

Luxottica’s brands

Luxottica brands include proprietary brands and license agreements with tier-1 firms.

Proprietary brands: The main brands are Ray-Ban, Oakley, and Persol. Ray-Ban is the most recognized brand in the sunglasses industry, with iconic pairs such as Aviator or Wayfarer. Oakley is the global leader in sports’ sunglasses.

License agreements with other brands: Under these license agreements, Luxottica is required to pay a royalty ranging from 5% to 14% and a mandatory marketing contribution of between approximately 5% and 15% of net sales of the related collection. Less profitable products, but given the vertical integration of the company, Luxottica generates more profit than any other company with licensed agreements.

Kering and LVMH are consolidating their brands into owned companies. This represents a risk to Luxottica in case other brands decide to do the same. Taking a look to the latest partnership renewals, the portfolio seems very secured:

Dolce&Gabbana: lasts until 2039 (renewed 16 years in 2024)

Michael Kors until 2030 (renewed 5 years from 2025)

Moncler until 2028 (signed the first agreement last year)

Kodak: perpetual

Jimmy Choo: 5 years + 5 year call, until 2033

Swaroski: Until December 2028

Armani: Renewed in 2023 until December 2038

Brunello Cucinelli: Until December 2032

Coach: Renewed until 2026 with potential 5 year extension to 2031

Other key brands might be at risk:

Chanel: Ends this year; can be extended until December 2027

Prada and Miu Miu: Ends in December 2025

Ralph Lauren: Ends in December 2027

The risk of loosing some partnerships is very low in the short term. There are only 4 of the main brands that end in the next 3 years, but they might be extended at expiration.

Luxottica’s brands are also present in the retail sector. The company owns multiple brands in the optical retail stpace.

Many of these brands are widely known. Some examples for the readers:

France: c.400 stores of Générale d'Optique

Spain: 100+ MultiÓpticas

Germany: ~700 Apollo stores

Netherlands, Belgium, Austria: 500+ Pearle stores

UK: 850+ Vision Express stores

US: ~3,800 stores of Sunglass Hut and LensCrafters

Latam: ~500 MasVisión, ~300 GMO and ~400 Sunglass Hut, plus many others

Next week I will be publishing the full report of EssilorLuxottica, talking about Meta, the competitive advantages, and many more. Stay tuned!

European Value Investor

Thank you for reading the report. Please leave a comment if you have any questions or comments. I will be happy to discuss it!

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Thanks for reading The European Value Investor! Subscribe for free to receive new posts and support my work.

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

End notes

For efficiency purposes, these paragraphs were written with ChatGPT

Source: https://www.reuters.com/world/what-happens-italian-tycoon-del-vecchios-29-bln-fortune-2022-06-27/

Source: https://www.reuters.com/world/what-happens-italian-tycoon-del-vecchios-29-bln-fortune-2022-06-27/

Source: Investing.com

Source: https://www.grandviewresearch.com/industry-analysis/sunglasses-market

Source: https://www.gminsights.com/es/industry-analysis/plano-sunglasses-market

Source: https://www.maximizemarketresearch.com/market-report/sunglasses-market/128211/

Source: https://www.marketresearchfuture.com/reports/sunglasses-market-1857

Source: https://www.statista.com/outlook/cmo/eyewear/sunglasses/worldwide

Source: https://www.imarcgroup.com/sunglasses-market

Source: https://www.mordorintelligence.com/industry-reports/sunglasses-market

Source: https://www.kering.com/api/download-file/?path=Kering_Press_release_2023_Full_year_results_3388f09c4c.pdf

Source: https://www.visionmonday.com/business/article/safilo-group-reports-full-year-2023-financial-results/#:~:text=Safilo%20closed%202023%20with%20net,1%2C076.7%20million%20recorded%20in%202022.

The highest estimate I found

Source: https://www.zippia.com/marchon-eyewear-careers-30309/revenue/

Source: https://www.opticianonline.net/content/news/warby-parker-posts-2023-results/#:~:text=New%20York%2Dbased%20eyewear%20and,%2Don%2Dyear%20to%20%24287.

Source: https://www.marcolin.com/wp-content/uploads/2024/03/Press-Release_Marcolin_FY2023_Results_EN-final-1.pdf

Source: https://www.bloomberg.com/opinion/articles/2017-10-13/luxottica-s-53-billion-deal-looks-a-little-cracked

I love your articles.