LVMH, Qualitative assessment

Luxury is a necessity that begins where necessity ends

⚠️Disponible versión en castellano en el siguiente LINK

Dear Readers,

Today, I am pleased to present the Part I of our comprehensive analysis of LVMH. In this opening section, we will conduct a qualitative examination of each of the six business divisions within the conglomerate, under the leadership of Bernard Arnault.

In Part II, we will delve deeply into the financial aspects and valuation of the company.

Disclaimer. Please read full disclaimer at the end:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Executive Summary

Luxury is a necessity that begins where necessity ends

Coco Chanel

🎯 Our portfolio now includes a 5% stake in LVMH, acquired at an average price of €664.5 per share.

♟️ LVMH operates as a diversified conglomerate with six divisions, each specializing in luxury and premium market segments.

👜 Fashion and Leather Goods: This division encompasses high-end fashion brands like Louis Vuitton, Christian Dior, Loro Piana, and Loewe, among others, representing the pinnacle of luxury and premium fashion.

🍾 Wines and Spirits: This segment is renowned for its champagne labels such as Moët & Chandon, Dom Pérignon, and Ruinart, alongside spirits including Hennessy cognac, Belvedere vodka, and more.

💄 Perfumes and Cosmetics: LVMH boasts iconic fragrance brands like Christian Dior, Guerlain, Givenchy, and Loewe, alongside a diverse portfolio of cosmetic brands including Benefit, Make Up For Ever, and Kendo.

💎 Watches and Jewelry: The company's portfolio includes premium watch brands such as Tag Heuer and Hublot, and, since 2021, the New York-based jewelry firm Tiffany & Co.

🛍️ Selective Retailing: LVMH manages several retail outlets, including Sephora for perfume and beauty products, Duty Free Shoppers offering duty-free luxury retail in select airports, and other distinctive retail brands.

📈 LVMH has exhibited significant growth in recent years. Nevertheless, its stock price has declined from an all-time high of €900 per share to the current €770, despite a robust recovery driven by exceptionally strong annual results.

🔒 I am confident in the company's stability in the short term and, more crucially, over the long haul. Our strategy is to maintain this investment for many years to come.

I. The luxury sector

I understand that many of you are well-versed in this sector, so I'll strive for brevity in my explanation.

What defines luxury, and why do people pay substantial sums for items that, on the surface, seem to offer the same utility as others?

Luxury signifies a state of great comfort and lavish living. It usually involves goods or experiences far beyond life's basic necessities, characterized by superior quality, exclusivity, and a high price.

Luxury's roots trace back to Ancient Egypt (circa 3,000 B.C.), where gold and other materials were used to craft jewelry and adornments, signifying the elite's elevated status.

In modern times, luxury products have evolved but continue to confer status on their owners. Key characteristics of luxury products include:

Exclusivity: These are limited and high-priced items, accessible only to a select few, creating a sense of exclusivity.

Price Stability: True luxury products are never discounted, and their prices tend to increase over time.

Scarcity: Luxury brands often limit product availability through limited editions, extended delivery periods, etc.

Superior Quality: The highest quality in raw materials and craftsmanship is guaranteed. These products are markedly superior to premium products.

Social Significance: Luxury products enable individuals to distinguish themselves and convey a message of success. Whether it’s a car or a watch, these items symbolize membership in an exclusive club.

Luxury products are functional art pieces. Consider, for example, a silk scarf from Hermès or a watch from Cartier

This suggests that the industry is resilient, capable of withstanding periods of uncertainty and economic slowdown. The luxury sector benefits from recent decades' extraordinary wealth creation. Globalization and digital advancements are catalyzing unprecedented wealth generation, with much more anticipated in the coming years.

How do companies implement a luxury strategy?

True luxury will not exist if these companies where managed by Wall Street. Most leading luxury companies are family-owned, necessitating patient, ultra-long-term management, detached from short-term earnings pressures. This is Bernard Arnault's philosophy:

“Building a brand takes decades, and you can ruin it in a few years. I always tell my teams, 'Don't look at the short term; focus on the long term”

Bernard Arnault

These companies often grapple with balancing increased sales for profitability against maintaining scarcity to enhance desire. The latter defines luxury, while the former leans towards premium branding. For example, Hermès limits its iconic Birkin bags to 7,000-12,000 units, exclusively offered to select clients. Key principles of luxury strategy include:

Limited Supply: Often through special, high-priced limited editions.

Price Strategy: Prices increase over time, and discounts are unheard of. Unsold inventory is often destroyed rather than liquidated.

Heritage: The brands have weathered numerous challenges over decades or centuries to establish their luxury status.

Quality and Craftsmanship: Production is typically localized in the brand's home country, with stringent quality controls and skilled artisans.

Exclusivity: Achieved through exceptional service, product scarcity, and pricing.

The luxury market primarily caters to clients who are consistently willing and able to pay more over time.

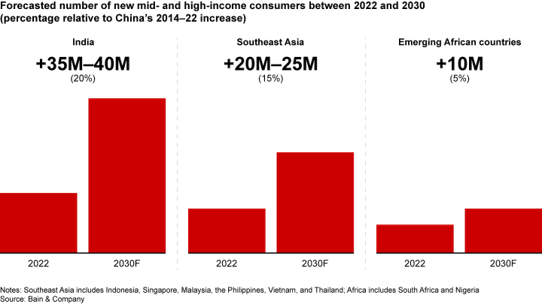

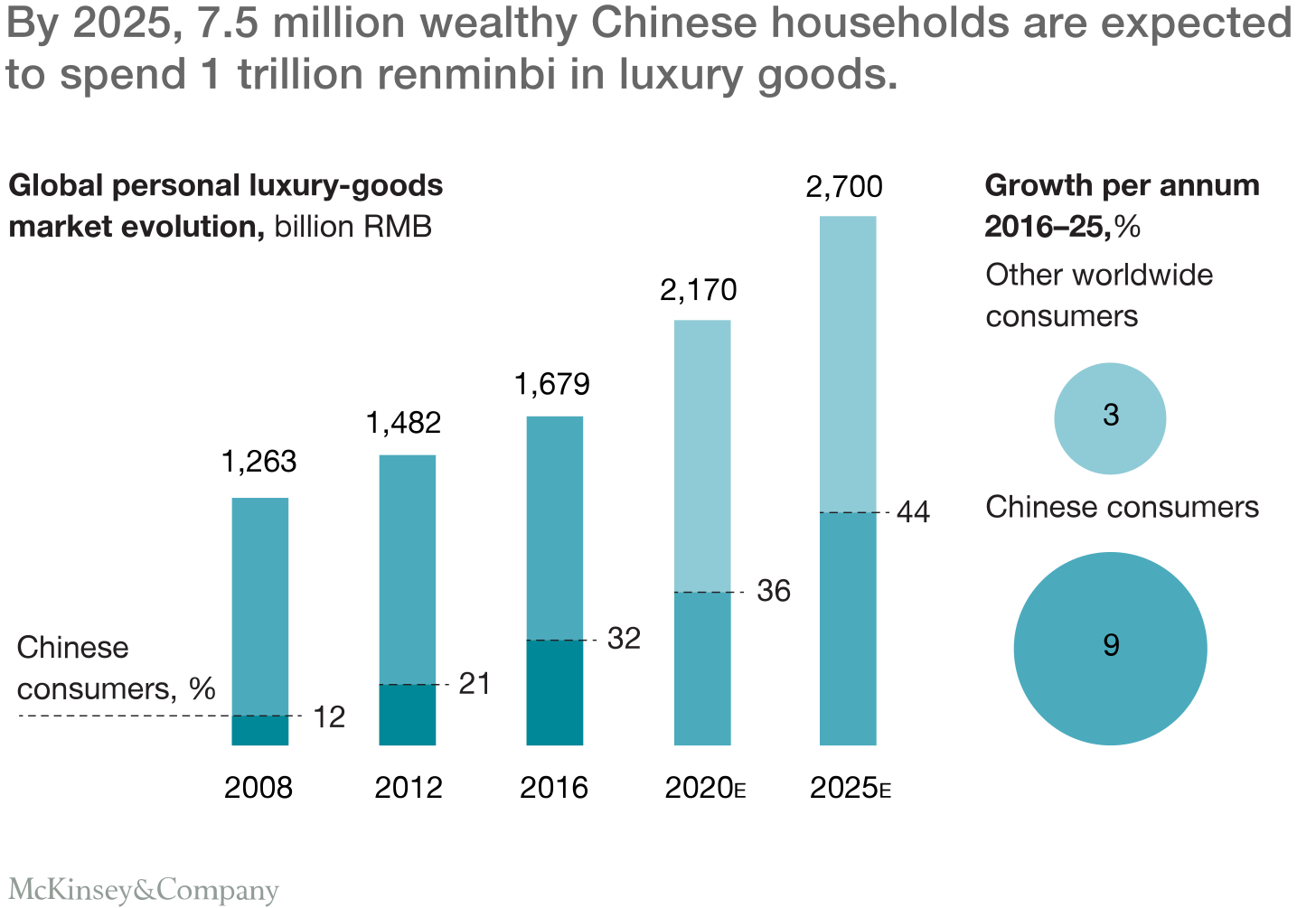

Contrary to some beliefs, luxury appeals not only to older generations. By 2030, younger generations are expected to form a significant portion of the luxury goods market, with substantial growth projected from China and other Asian countries. Despite China's slowing growth, the number of middle-class and wealthy individuals is predicted to rise exponentially in the coming decades.

As we will explore in our company analysis, LVMH holds a strong position in the luxury sector. However, it's a misconception to label all LVMH companies as luxury; some are luxury, while others are premium.

II. Introduction lo LVMH

LVMH operates as a conglomerate in the luxury and premium sectors, providing a diverse range of services. While a significant number of its brands are positioned in the luxury market, others are more appropriately categorized as premium, with some segments targeting mass consumption.

The conglomerate's history is marked by mergers and acquisitions. Bernard Arnault, initially an outsider in the sector, began constructing his luxury empire with the acquisition of Christian Dior in 1984, a company then struggling for survival. Following the acquisition of Dior, Arnault took control of LVMH, which at the time was a merger born of convenience between two families owning Louis Vuitton and Moët Hennessy. This merger was intended to prevent acquisition by external investors. However, marriages of convenience can be problematic, and the ensuing power struggle resulted in Arnault gaining control of both companies.

Since that pivotal moment, the group has expanded its portfolio to include all 75 brands it currently owns. Notably, the group has also experienced unsuccessful acquisition attempts with companies like Hermès and Gucci. For those interested in an in-depth exploration of LVMH's history, I highly recommend this podcast.

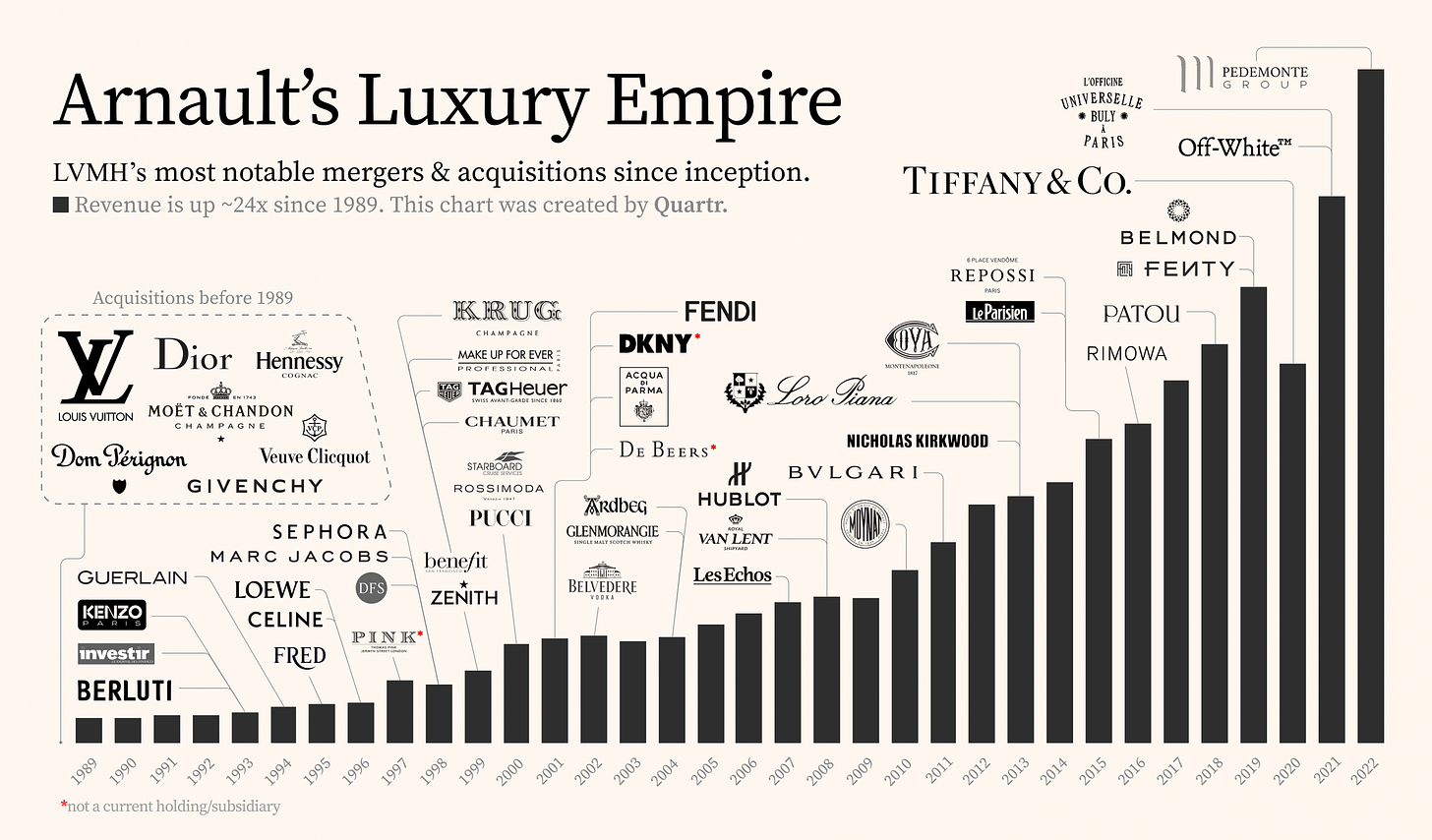

The M&A history in a chart

Main business segments

So, we can't just say LVMH is luxury. LVMH is much more complex as it sells multiple products with different market cycles and attributes:

👜 Luxury fashion brands such as Louis Vuitton and Christian Dior

🍾The best Champagne through Moët and premium distilled spirits such as Hennessy cognac

💎Watches and jewelry with worldwide known brands such as Tag Heuer and Tiffany

💄Make up and perfumes with top brands like Dior or Givenchy

🛍️Specialized retail stores (Sephora) or travel retails (Duty Free Shoppers)

🗞️ Different other businesses such as newspapers, hotels and even and a yacht builder!

Every segment has its own characteristics and market dynamics and their own financials. Therefore, we will talk about every segment rather than generalizing on LVMH.

How the conglomerate operates

These are the basic guidelines of how the conglomerate operates and one of the reasons of the success of the company:

Decentralized organization: Every brand has its own management and all “compete” against each other. This is key to maintain a close relationship with the client, something crucial in an industry where the client is at the core center of the strategy

Many people focus primarily on Bernard Arnault when discussing LVMH's success, but it's also essential to recognize the critical role of the secondary leadership. Each business under the LVMH umbrella is independently managed by its own team, allowing for distinct, specialized operation and leadership in each division. This autonomy is a key factor in the success of LVMH, as it ensures that each brand retains its unique identity and is guided by experts deeply familiar with their respective markets and customers.

”The independence of each brand is fundamental. It allows them to be true to their unique identity, heritage, and craftsmanship” ArnaultVertical integration. Luxury products demand the provision of the highest quality and the delivery of an unparalleled experience. LVMH's brands exemplify this by exerting control over both production and distribution. Production is primarily conducted in Europe, preserving the European heritage of its brands. Distribution, on the other hand, is managed through LVMH's own network of stores. This strategy not only ensures an optimal experience for clients but also reduces dependence on third-party channels. By managing both production and distribution, LVMH maintains the integrity and exclusivity of its luxury offerings

”It's not just about owning the factories or the stores; it's about mastering the entire process to ensure excellence” ArnaultSynergies: Although each maison within LVMH operates independently, the group successfully cultivates synergies that benefit all its brands. On the cost side, for instance, the group's perfumes are manufactured in LVMH-owned facilities, allowing for more favorable negotiations with retailers due to the group's representation of numerous iconic brands. However, the advantages of these synergies extend beyond mere cost savings:

"Creating synergies is about more than cost savings; it's about sharing expertise, innovation, and best practices across our brands” ArnaultSecuring expertise for the long term. As previously discussed, a successful luxury strategy is inherently long-term in its focus. LVMH has exemplified this approach, consistently implementing strategies that look several decades ahead to safeguard the prestige of its luxury products. This forward-thinking mindset positions the company as an ideal partner for competitors seeking to align with a larger, more influential group. Undeniably, LVMH stands out as the premier conglomerate within the luxury sector, a testament to its enduring commitment to excellence and strategic foresight.

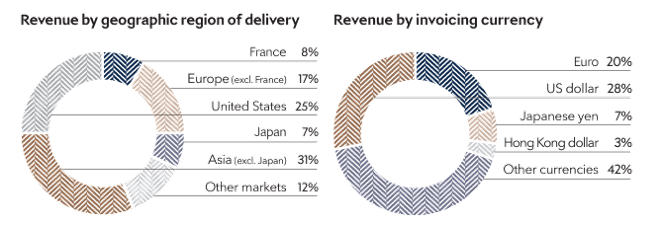

Balance across geographies. Despite common perceptions of dependency on China for growth, LVMH boasts a well-balanced global presence. While China's growth may slow in the short term, the combined growth from various regions is expected to continue. LVMH's strategic positioning in these areas ensures its robust performance in the global market.

Unique portfolio of brands. The company owns iconic brands such as Dior, Louis Vuitton, Moët et Chandon, Tag Heuer, Tiffany… But lacks other brands, especially in the watches segment

III. Business analysis by segment

Now, we'll proceed to a detailed, qualitative analysis of each LVMH business segment. This examination will focus on the distinct characteristics and performance of every unit. The financial analysis of these segments will be presented in the second part of this research.

1.Luxury fashion brands

c.50% of total revenue

“I’m not interested in the number of the next six months, but what interests me is that the desire for the brand will be the same in ten years” Bernard Arnault

This is by far the most important division of the group. It is the luxury division represented by iconic brands such as Louis Vuitton, Dior, Fendi, Loewe, Loro Piana, Celine, etc.

This segment has been instrumental in the share price surge post-pandemic, as the company effectively leveraged the competitive strengths of Dior, Louis Vuitton, and other brands:

Pricing Power: The luxury sector challenges conventional economic theories, which typically suggest that higher prices lead to lower demand, except for essential goods.

The dynamics in the luxury sector are distinct:

Desire Creation: Part of the strategy in luxury is to cultivate desire through pricing and branding. High prices foster exclusivity, thereby enhancing the appeal of luxury goods.

No Promotions: The absence of promotions in this sector means prices generally only increase. For instance, it's reported that Louis Vuitton destroys unsold inventory.

Volume and Pricing Balance: While higher prices don't necessarily mean lower volumes, luxury brands possess sufficient pricing power to increase prices in ways that other fashion brands cannot.

Market Stability: The luxury sector tends to be more stable and predictable compared to the premium mass market. The clientele does not anticipate promotions or stock clearances, adding a defensive quality to these brands.

Controlled Distribution: Luxury brands maintain control over their distribution networks, avoiding dependence on wholesale or distributors. This control is crucial for several reasons that will be explored further.

The brand power and its perpetuity over time

In the luxury sector, the most critical aspect is the focus of management on fortifying the brand and securing its market position for the next 10 to 20 years, rather than merely aiming for higher profitability in the next quarter. This approach embodies a strategic vision with a very long-term perspective.

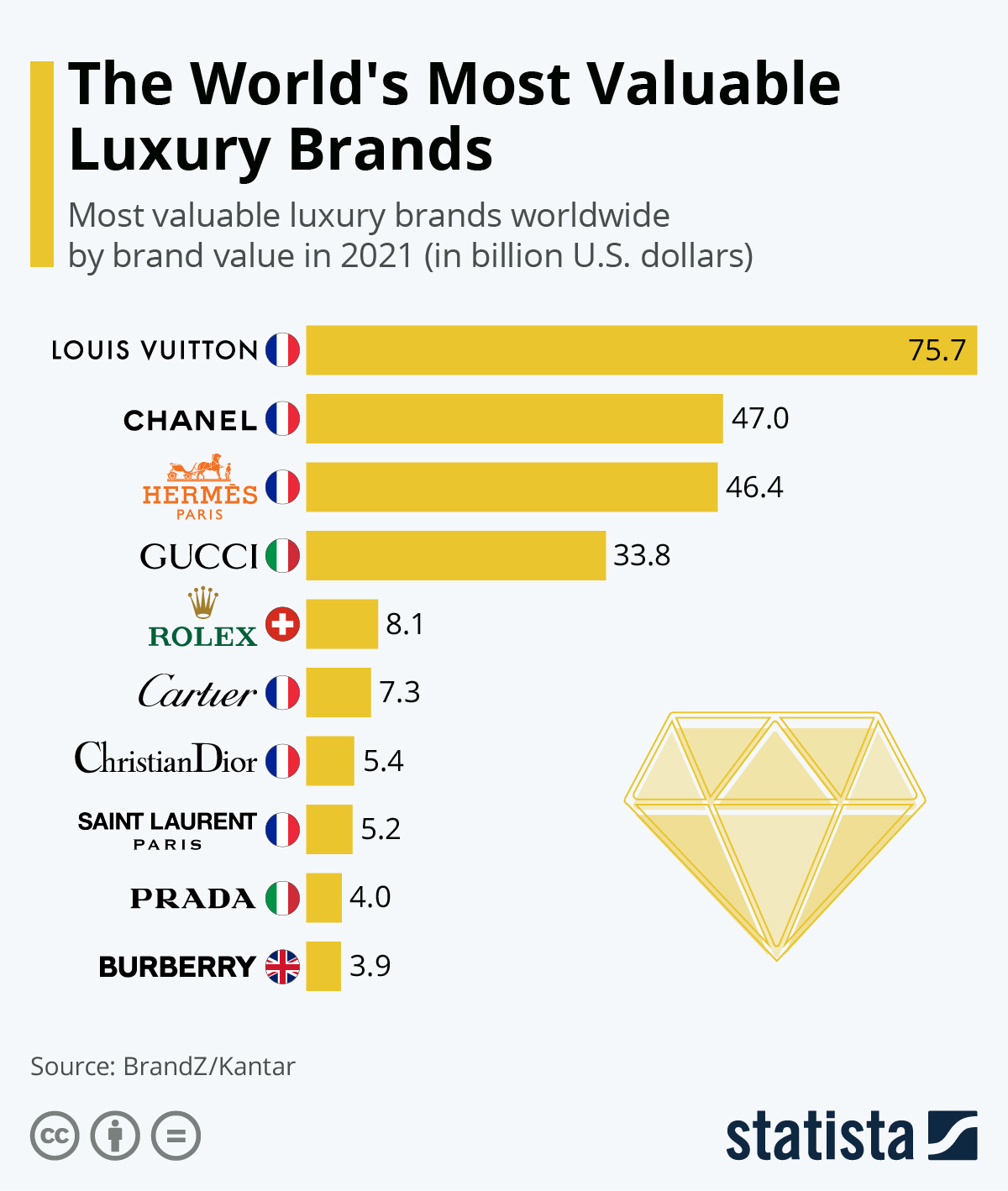

The value of these brands is immense, with Louis Vuitton recognized as the most valuable luxury brand globally. Furthermore, Christian Dior also ranks in the top 10, providing LVMH with a formidable and influential position within the luxury sector. This focus on brand strength and long-term positioning is key to the sustained success and prestige of LVMH's portfolio.

The enduring nature of luxury is partly illuminated by considering the founding dates of major luxury brands: Hermès (1837), Louis Vuitton (1854), Chanel (1910), Prada (1913), Gucci (1921), and Christian Dior (1946).

The lasting value of these brands through history can be attributed to several factors:

Pioneering Creativity: These brands have consistently been at the forefront of creative innovation. For instance, when Christian Dior introduced his first collection post-World War II, it was revolutionary, offering the French a means to move beyond the war's hardships.

Many fashion items from these esteemed brands transcend mere clothing and are regarded as authentic works of art, embodying not just style but also a lifestyle or a historical narrative.

The luxury sector sets the pace in fashion, attracting the most talented individuals in the textile industry. These brands employ some of the most gifted design directors globally, making them somewhat dependent on these key figures. Therefore, a symbiotic relationship between creative directors and management is crucial for maintaining the brand's integrity and success. For example:

In 1958, following the sudden passing of Christian Dior, Yves Saint Laurent was appointed as the new creative director. However, after a few collections, he was dismissed in 1960, and the brand's owner implemented a more conservative vision. This shift led Dior into a challenging period, culminating in bankruptcy before its acquisition by Arnault. This historical instance serves as a crucial lesson for the industry: while a CEO may not be the driving force behind creativity, creativity alone cannot sustain a business. It's essential to strike a balance between innovative design and pragmatic business management to ensure the brand's longevity and success.Luxury is synonymous with innovation and the pursuit of perfection. By focusing less on competing through margins, these companies maintain their production in Europe, adhering to the highest quality standards and preserving an image of perfection in their products.

Despite the growing prominence of online retail, the allure of the in-store experience remains a significant draw for customers. The ambiance and service offered by stores like Louis Vuitton are unparalleled, matched only by a select few, such as Hermès and Chanel.

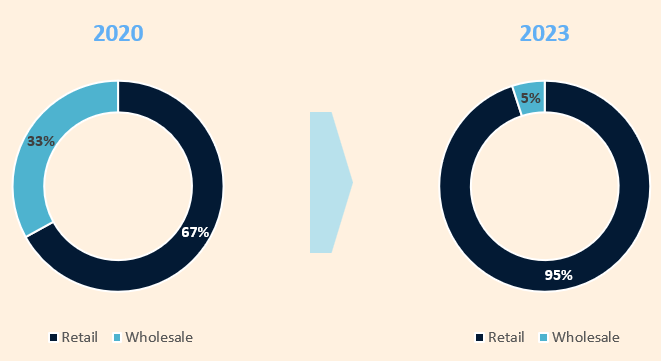

During the last years, the company has successfully transitioned to a model where they control 95% of their sales vs. 67% in 2018.Furthermore, the impact of extraordinary marketing campaigns and partnerships with celebrities cannot be overstated. Louis Vuitton, for instance, stands out as the only brand capable of uniting soccer icons Cristiano Ronaldo and Lionel Messi, or collaborating with Pharrell Williams to design custom outfits for Beyoncé's world tour. These strategies not only enhance brand visibility but also reinforce the luxury and exclusivity associated with these brands.

A commonly overlooked aspect is that these luxury brands are not exclusively targeted at the top 0.01% of the world's wealthiest individuals. Instead, they market themselves globally, as owning a product like a Christian Dior bag becomes an aspirational goal for many. A campaign from Louis Vuitton, for example, is not just a product advertisement; it's a message broadcast to the entire world.

Louis Vuitton doesn’t promote its products. They promote dreams, status and ambitions.

Louis Vuitton's marketing strategy goes beyond promoting mere products. They sell dreams, status, and ambition. This is achieved by partnering with celebrities who embody the brand's values, creating a connection between the star's popularity and the perceived value of the luxury items. Such strategies elevate the brand's appeal, making it a symbol of aspiration and success, attainable by only a select few but desired by many.

The way the FIFA World Cup trophy is presented at the final is indeed a powerful testament to the prestige of luxury brands. It arrives in a Louis Vuitton briefcase, a nod to the brand's iconic product line of trunks. This act of carrying the world's most coveted sports trophy in a Louis Vuitton case sends a profound message about the brand's status and recognition. It symbolizes not just luxury and quality, but also the intersection of high fashion with globally celebrated events. This strategic partnership highlights the brand's exclusivity and its association with pinnacle moments in world sports, further cementing Louis Vuitton's position as a symbol of unparalleled luxury and prestige.

This is the difference between Louis Vuitton and the premium brands. Luxury is a statement, is an aspiration. Being shareholder of LVMH implies to be owner of some of the most iconic brands in history.

Competitive landscape of the fashion sector

The market for high-end goods is indeed fragmented, and there often exists a misunderstanding regarding what constitutes luxury versus what is considered premium. LVMH primarily operates in the luxury segment, distinguished by its practice of charging premium prices for its products.

In the context of this fragmented market, it's helpful to consider a chart illustrating the largest luxury brands. Within this echelon, Chanel and Hermès stand out as top players, alongside Dior and Louis Vuitton. These brands represent the epitome of luxury, differentiated from premium brands by their exclusivity, pricing, and brand heritage. Understanding the nuances of these market segments is key to appreciating the strategies and positioning of companies like LVMH in the global luxury goods industry.

The luxury brand market is relatively small, with only a select few brands maintaining their independence. Many of these luxury brands are publicly traded, allowing for direct comparisons to the fashion division of LVMH.

Kering: This is LVMH's primary competitor, formed following Bernard Arnault's unsuccessful attempt to acquire Gucci. Kering owns several notable brands, including Gucci, Saint Laurent, Balenciaga, and Bottega Veneta. However, the company has encountered challenges. Kering's strategy to position its brands at the intersection of luxury and fashion has been problematic because fashion is often not perceived as timeless. In contrast, the enduring appeal of luxury brands allows them to consistently increase prices and control the entire value chain. Currently undergoing brand revision, Kering struggles to raise prices, reflected in their margins of 27% compared to the 40% of LV or Hermès.

Hermès and Chanel: These brands, along with Louis Vuitton, are arguably the pinnacle of luxury.

Other Brands: Includes Prada, Valentino, Brunello Cucinelli, Ferragamo, etc., each with their unique characteristics and target demographics.

Hermès and Chanel stand out as the true luxury players in the market. A more detailed financial comparison of these companies will be provided in Part II of this analysis, focusing on Financial Analysis.

Do they compete against each other?

Generally speaking, consumer behavior in the luxury market can indeed be complex. For some customers, shopping at Louis Vuitton might preclude a purchase at Hermès, while for others, it could be complementary. Determining the exact number of such customers is challenging. However, it's reasonable to surmise that repeat clients, who are vital to these brands, often have the means and inclination to shop across multiple luxury brands.

In most cities, luxury brand stores are clustered in the same high-end areas. It's typical to find Chanel, Hermès, and Louis Vuitton in close proximity. This is partly because they all seek prime city locations, which often have limited space, and also because this clustering creates synergies among the brands. It essentially forms a luxury shopping district, often accompanied by high-end jewelry stores and other premium businesses, fostering an environment that encourages consumers to visit multiple stores.

Each luxury brand employs its unique strategy. For instance, Louis Vuitton's products are often more visually distinct and recognizable, while other brands might opt for a more understated branding approach. The target audiences vary accordingly, much like in the premium segment, where preferences might differ between brands like Ralph Lauren and Hugo Boss. This diversity in brand positioning and strategy caters to the varied tastes and preferences of the luxury market's clientele.

The quiet luxury: an interesting trend

The trend of 'quiet luxury' is indeed gaining momentum, where affluent consumers are gravitating towards products with minimal branding and timeless designs. The success of Brunello Cucinelli exemplifies this shift.

LVMH has strategically positioned itself in this segment with Loro Piana. This brand is celebrated for its creation of timeless, high-quality garments, especially renowned for their exquisite cashmere products. Loro Piana's commitment to quality is evident in their choice of materials, sourcing the finest cashmere from Mongolia, vicuña from the Andes, and Merino wool from Australia and New Zealand.

These 'stealth wealth' fashion brands are increasingly significant in the luxury market, offering substantial growth potential. Loro Piana, with its century-long history, stands out for its association with the world's highest-quality wool. This brand aligns perfectly with the growing preference for understated, high-quality luxury goods that symbolize wealth without overt displays.

The Asian market

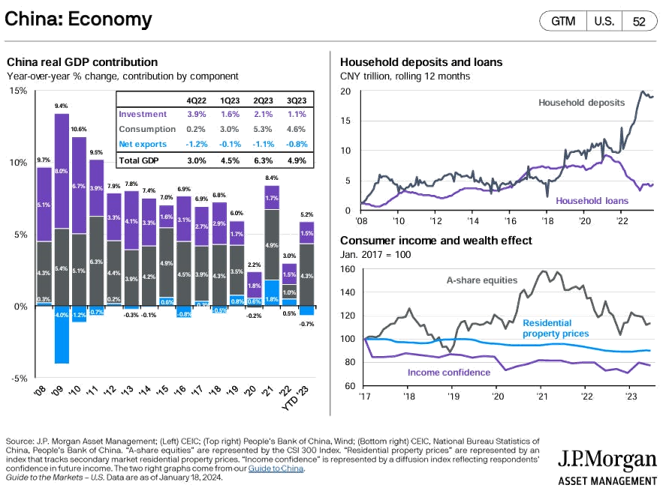

The significance of Asia, accounting for 36% of fashion sales, is undeniable for LVMH. The potential economic slowdown in China does raise concerns regarding LVMH's future growth prospects in the region.

The current debate centers on the potential impact of a slowing Chinese economy on LVMH, given its considerable exposure to the Asian market. While China is a major contributor, other markets like South Korea are also gaining prominence. From a long-term perspective, the short-term economic forecasts are less critical. The broader consensus points to the emergence of several million new millionaires in China and other regions, such as India. The growth potential in Southeast Asia remains substantial.

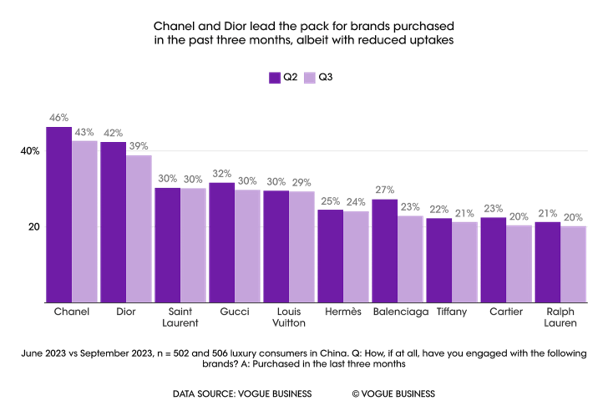

LVMH's positioning in China is notably strong, with three of its brands in the top 10, and Dior is on the cusp of becoming the number one brand. This robust presence in the Chinese market, despite short-term economic uncertainties, places LVMH in a favorable position to capitalize on the long-term growth and wealth creation in the region.

While China is a pivotal market for LVMH in Asia, other large countries in the region also present significant growth opportunities:

South Korea: This rapidly advancing economy boasts the highest per capita spending on luxury goods. Morgan Stanley analysts suggest that the demand for luxury goods among South Korean consumers is fueled by both increased purchasing power and a cultural emphasis on displaying social status.

India: Bain & Co predicts that India's luxury market could expand to 3.5 times its current size, reaching $200 billion by 2030. This represents an immense opportunity, especially for top brands like Christian Dior and Louis Vuitton, which are well-positioned to capitalize on this growth. Independent luxury players may face greater challenges, enhancing LVMH's competitive edge. The opening of Louis Vuitton's largest store in India in 2023 is a clear indicator of this trend.

India represents a huge opportunity for the next decadeDespite potential slowdowns, China's growth trajectory remains promising. The number of millionaires in China is expected to continue rising, driven by ongoing wealth creation in the country. Even a slowdown to 5-6% annual economic growth represents significant wealth accumulation. I remain confident about the long-term prospects. The main concern lies in government policies, which are difficult to predict. However, the luxury sector, compared to industries like technology or semiconductors, appears better positioned to navigate these uncertainties.

Conclusions of the fashion segment

✅LVMH has the greatest portfolio of brands among its peers. Although, Chanel and Hermès are two rivals with unique positioning and are likely to be the kings of luxury.

✅Diversified portfolio of brands: they cover multiple segments with Dior and Louis Vuitton. They compete in luxury bags with Celine, in silent luxury with Loro Piana, etc. Its a very balanced portfolio

✅Barriers to entry are very high. Not only because a few brands dominate the market but because it takes decades to become a luxury firm. Hermès, Louis Vuitton or Chanel are brands with over a century of history

✅The quality of the products is not a competitive advantage. The true competitive advantage relies on the power of the brand. Any company can produce a premium bag, but it won’t be a Dior or Louis Vuitton. The brands of LVMH have a unique positioning and are among the most recognized brands in the world

✅Potential for strong long term value creation. These brands have strong pricing power and leverage on decades of history. The Asian opportunity remains huge

✅As a global group generating billions of cash, they have strong resources to continue expanding the business. The independent players will face more challenges than LVMH, except the biggest ones like Chanel or Hermès

✅There are tons of growth opportunities through partnerships with other brands to create unique versions of iconic products combining the power of two brands

✅Disruption in the production seems limited as the raw material is very abundant (there are thousands of cows in Europe) and, LVMH constantly attracts talent and trains them each year, thus maintaining its productive capabilities. They even have a certificate and the first training program in the luxury industry with a work-study format, the ME Institute offers training in Creative, Craft and Client Experience métiers.

⚠️Competition remains high as there are many brands offering their products with some players trying to become luxury brands

⚠️Counterfeit can negatively impact both the brand reputation and the financials of the company

⚠️Brand reputation. The company must be obsessed with protecting its brand and developing it with the next 10, 20, 50 and 100 years in mind.

⚠️Change in customer preferences and the use of animal skin for their products can lead to unfavorable positioning in the society. It is key to maintain a sustainable supply. According to the annual report, the company has many policies regarding sustainability:

“the Maisons committed not to source any supplies of materials identified as under threat by the International Union for Conservation of Nature (IUCN) with effect from 2020.” Bernard Arnault

“supplies of exotic leather to be purchased from abattoirs and/or farms certified in accordance with standards covering animal and human welfare and care for the environment, such as the LVMH Standard for Responsible Crocodilian Production” Bernard Arnault

❓One of the biggest threats is the management of the company. Brand needs to be protected for the next century. Therefore, it is critical to have a management thinking in the long term. This will be test in the slowdown in sales that is coming now

❓The sector benefited from strong growth in consuming after the pandemic. Now, it might enter in a new phase with a more sustainable growth. This new market conditions will test the strategy of the brands (i.e., thinking long-term vs. short-term profits)

❓Regulatory risks can be a threat in the future. However, given the geographical balance of the group, impact from unfavorable regulation could be diluted at the group level

It is critical that the management of each of the brands, together with the management of the holding maintain the power of the brand in the next decades so the company can remain a luxury company and benefit form the competitive advantages of the luxury sector (mainly pricing power maintaining high demand of the products)

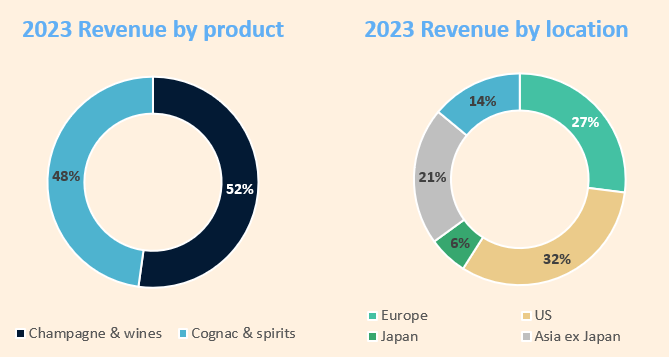

2.Wines and spirits (Moët Hennessy)

9% of total revenues

This division has been pivotal in the formation of the LVMH conglomerate. The merger of Moët Hennessy with Louis Vuitton in 1987 marked the beginning of what would become a significant chapter in luxury brand history.

LVMH boasts an impressive portfolio of premium and high-end wines and spirits. While many of its wines originate from France, the company also represents brands from around the globe. Its range includes various types of wines (champagne, red, and white wines) and spirits, such as Hennessy cognac, vodka, whisky, and tequila.

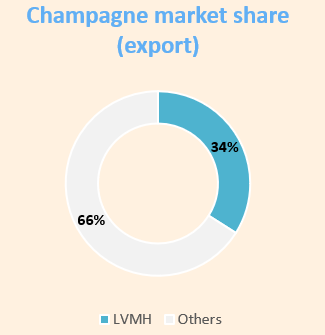

Champagne: This is the cornerstone of LVMH's wine segment, representing a significant part of the brand's identity in the wine market.

Wines: The selection includes wines from France, the U.S., Argentina, New Zealand, and Spain. These wines are known for their exceptional quality and high price points. In the wine segment, LVMH encounters considerable competition, and while wine sales might not contribute substantially to the group's overall revenue, they complement the champagne and spirits offerings well. This is largely due to the benefit of leveraging LVMH's extensive distribution network.

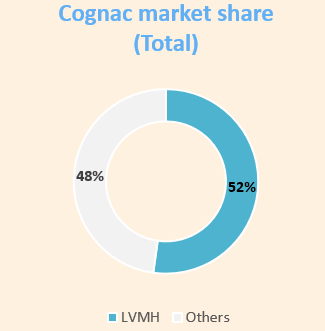

Spirits: The spirits portfolio is headlined by Hennessy cognac and includes other brands such as Belvedere vodka. Many of these brands have histories spanning one or two centuries, underscoring their heritage and value. Notably, LVMH is a global leader in the cognac market, boasting a market share of approximately 50%. This dominance in the cognac market is a testament to the company's expertise and longstanding reputation in the luxury spirits sector.

Champagne

LVMH's ownership of iconic brands in the wines and spirits sector is noteworthy. The portfolio includes renowned names such as Moët & Chandon, Dom Pérignon, Krug, Veuve Clicquot, and Ruinart. The presence of these brands positions LVMH as a dominant force in the premium segment, almost to the extent of a quasi-monopoly. It's important to distinguish, however, that while we're discussing premium brands, not all of them fall into the luxury category. Dom Pérignon may be regarded as a luxury product due to its exclusivity and prestige, but the others, despite their high quality and strong brand recognition, are better categorized as premium. This distinction is crucial in understanding LVMH's market positioning and strategy within the wines and spirits sector.

Spirits

In the cognac market, LVMH has established a significant presence, holding approximately 50% of the market share. This dominance is largely attributed to owning one of the most iconic brands in the sector: Hennessy (the 'H' in LVMH). Hennessy's product range is diverse, with prices ranging from €50 to €300 per bottle. However, the brand also offers some limited editions that can fetch prices as high as €30,000 per bottle, though these are less common.

Geographically, the United States accounts for a quarter of LVMH's cognac sales, while France contributes around 13%. This distribution highlights the brand's global appeal and market penetration. During 2023, sales in the US are decreasing, signalling that the segment is under pressure.

Additionally, LVMH has other spirits in its portfolio, primarily positioned in the premium market segment. These include brands like Belvedere vodka, which are particularly popular in luxury and high-end nightclubs. While these spirits (vodka, whisky, tequila) contribute to the company's diverse offerings, their sales likely constitute a relatively small portion of the segment’s overall revenues. Therefore, we will not delve into a detailed analysis of these particular products, focusing instead on the more dominant and revenue-driving aspects of LVMH's wines and spirits division.

The terminal value

The strength of LVMH's wines and spirits segment lies in its historic brands: Moët et Chandon (founded in 1743), Hennessy (1765), Dom Pérignon (17th century), and Veuve Clicquot (250 years old). This history creates immense terminal value, associating these brands with unparalleled quality and prestige. Establishing a new global brand to rival the stature of these time-honored names, particularly in premium French champagne, is an exceedingly challenging feat. These historic brands are key to LVMH's dominance in the luxury market.

Competition

In champagne, LVMH faces minimal competition in the premium segment and no other company has their international capabilities

In the spirits segment, the company is leader in cognac and has high-end premium products like Veldebere vodka, that has less competition than low and mid segment vodkas.

Main publicly traded competitors (however, LVMH products are premium while these brands sell products premium and non-premium):

Diageo and Pernod Ricard: These are the largest entities in the spirits segment, commanding a significant market share with a diverse portfolio.

Constellation Brands and Corby Spirits: These companies are key players in wine, spirits, and beer, owning a vast array of brands.

Other Spirits: Companies like Brown-Forman, known for Jack Daniels, and Campari.

Wine Makers: Notable names include Laurent Perrier in Champagne, France, Treasury Wine Estates in Australia, and Duckhorn Portfolio in the U.S.

LVMH's high pricing power and unique positioning afford it a significant competitive advantage, reflected in industry-leading margins. For context, Constellation Brands achieved margins of 34% in 2020 and 2021, indicating potential for further efficiency in the sector.

Marketing in this segment requires a unique approach due to the restrictions often placed on advertising alcoholic beverages, ranging from outright bans to various limitations. This necessitates creative and strategic marketing efforts to effectively promote these products while adhering to regulatory constraints.

Conclusions of the wines and spirits segment:

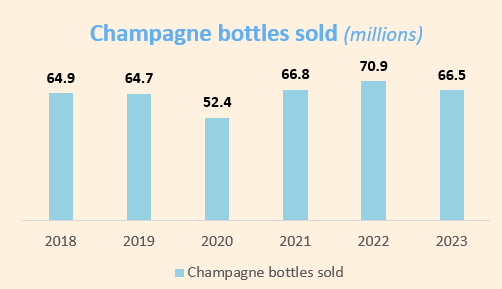

✅Ultra-high barriers to entry. Champagne is produced in the Champagne region of France and cannot be produced elsewhere. In addition, this region is regulated and there are restrictions to production. Data supports our beliefs, as the number of bottles sold by LVMH has not significantly increased over the years:

✅ Complex Production Methods: Champagne production involves blending wines from different years or varieties, requiring at least two years of aging for premium, vintage, and prestige cuvées. In spirits like cognac and whisky, production demands extensive eaux‑de‑vie supplies and time.

✅ Iconic Brands with Centuries of History: The wine sector is synonymous with prestige, quality, and status. Competing with LVMH's established brands requires substantial capital for brand development and positioning. As Bernard Arnault notes, these brands could endure another century.

We can be sure champagne will continue to exist in several decades but the same cannot be said with some of the current biggest brands such as Google, Instagram, etc. It’s probably the most predictable segment of the company

✅ Consistent Margins: The segment consistently shows 30-31% margins, indicative of a strong business moat. It's a robust cash generator with minimal threats and the potential for positive future returns.

✅ Expansion Potential: There's room to grow outside France, especially in the U.S., where Hennessy leads and champagne exports are rising annually. This trend is likely to continue as emerging markets demand quality, tradition, and heritage.

✅To enhance their distribution capabilities, the wines and spirit division is a JV with Diageo (one of the biggest alcoholic beverage companies). The agreement has been in place since 1987, were Diageo holds a 34% stake and helps strengthen the positions of the two groups, improve distribution control, enhance customer service and increase profitability by sharing distribution costs. This mainly involves Japan, China and France. In 2022, 26% of champagne and cognac sales were made through this channel.

⚠️New competitors could emerge. In the champagne industry there are still many independent producers that could be acquired by large distributors. Despite this risk, the world market seems large enough if more competitors were to emerge and it would take a lot of time and resources to develop brands such as Moët or Dom Perignon. Diageo partnership mitigates the risk as they are the biggest distributor

⚠️Business relies on distribution and marketing capabilities, which might affect margins as using intermediaries tends to be less profitable than direct sales channels. This distribution network requires a significant amount of resources, both human and capital. LVMH needs to constantly monitor that their products are being correctly distributed, not only in sales but also in positioning. This network is in charge to maintain and position the brand.

⚠️The climate change represents a threat to the business in the very long term as wine relies exclusively on the quality of the grapes (plus de savoir faire of the maisons). Also, climate can affect the quality of the product and can affect the output of a specific year. To protect against this, the company constantly maintains significant champagne inventories in its cellars. An average of 229 million bottles are stored in LVMH’s cellars in Champagne, equivalent to about 3 years of sales

⚠️The Group is exposed to external supplies. In champagne, they own 1,650 hectares under production, which provides only 20% of their annual needs. To mitigate the supply of grapes, they have multi-year agreements and their largest supplier represents less than 10% of total supplies.

In spirits, they rely on thousands of independent suppliers of eaux‑de‑vie

❓In the spirits segment, the company is leader in cognac but faces strong competition in the rest of drinks. Belvedere is probably the best-positioned premium vodka brand in the world but it faces competition from the rest of spirits like Absolut. In the champagne segment, MH is the leader in champagne exports and is a quasi-monopoly in the premium brands

❓The cognac business faces more competition than the champagne as there are many substitutes for this drink. However, champagne is the most reputed brand in the sparkling wine segment. Overall, we can conclude that half of the segment (champagne) is very well positioned and will be a stable business while the remaining (wines and spirits) face significantly more competition and might have periods with weaker results (like cognac in 2023)

❓Changes in consumer behavior could displace champagne consumption. However, this is not likely to happen in the medium term due to the reputation associated with the drink and all that surrounds it.

Strategic priorities

1. Enhance the brands: This is the key activity that LVMH has been doing so far and its the core strategy of luxury brands.

2. Expand production capabilities to ensure sustainable growth

3. Develop direct sales to end-consumers: This will increase margins in the mid-term as DTC channels eliminate intermediaries, reinforcing margins of the company

4. Improve the efficiency of distribution to expand margins.

Conclusions

The champagne business is a segment with a great moat (high barriers to entry, the best brands in the sector and some pricing power). The spirits segment is a good business, however less resilient than the champagne. Overall, this is a great division, with high operating margins of 30-31% and stable cash flows. The strong sales outside France reflect the big opportunity to keep exporting the brand in countries with significantly higher prices.

3.Watches and Jewelry

13% of total sales

This division operates famous brands like Tag Heuer, Bulgari or Tifany & Co. We remain in the luxury segment; however competition is tougher than in the fashion segment.

The luxury watch market

LVMH has several brands operating in the premium and luxury segments. However the company is not as well positioned than in the fashion segment.

This market is about psychology and not utility. A €20 Casio watch will give you the same utility as a €10,000 Hublot watch. Is it the same? Of course not!

Wearing a Rolex is an aspiration and is a symbol of status. Executives, celebrities and wealthy people that wear a watch, they probably wear a watch worth your car or even your house! Many people dream to where a Rolex, Patek Philippe, etc.

Its a market for men and women: Watches are the ultimate expression of success in men and women, as well as a unique accessory for women. Few accessories surpass the elegance of a watch.

Its a store of value. Why?

Scarcity: luxury watchmakers produce a limited number of pieces and clients need to wait a long time to receive their piece

Pricing: Major brands increase their prices every year, making the watches more valuable. Remember that luxury brands increase their prices constantly (if not, its not luxury)

There is lot of passion behind this item

The brand last forever: Many of these brands are century-old brands and many of the most iconic models where created many decades ago (e.g., Nautilus from Patek Philippe was introduced in 1976, the Rolex Submariner was introduced in 1953 or TAG Heuer Monaco in 1969). Brand relies on its heritage

As many other luxury products, these watches are a piece of art with functionality

Swiss brands are the leaders in this segment. everyone in the world associates the best watches with Switzerland. It is a centuries-old tradition that no other region in the world can match. Occasionally competitors may emerge in other countries, but none can carry all that Swiss watches represents: perfection and maximum quality, exclusivity, work of art and engineering, etc.

The LVMH portfolio and its main competitors

The luxury watch segment is intensely competitive, with numerous brands offering a broad array of models. Despite the presence of iconic models, each brand typically presents a wide range of products. This creates a competitive landscape where dozens of watchmakers vie for market share with their diverse collections.

A significant aspect of this business has traditionally been its reliance on multi-brand specialized retailers. However, there is a growing trend towards establishing brand-specific stores and pursuing vertical integration. This approach not only facilitates a better understanding of customer needs but also mitigates the higher costs and increased competition associated with relying on third-party retailers.

LVMH's strength in this sector lies in its diverse portfolio of watch brands, each catering to different styles and categories. This diversification mirrors their strategy in the fashion sector, providing a broad spectrum of options that allows LVMH to compete across various segments of the watch market. By offering a range of brands, LVMH can appeal to a wide audience, from those seeking classic elegance to consumers interested in modern, innovative designs.

Tag Heuer, the biggest brand of LVMH is not a luxury brand, but rather a combination of premium and luxury watches. Its not a weakness for LVMH because Tag Heuer can compete heavily in the premium segment. Tag Heuer is a brand that people who want to wear a great watch with a strong Swiss brand behind can buy. Its more mass market, but its always good to have a growth lever and diversification tool. I’m sure many of you know someone wearing a Tag Heuer

Luxury watches: Hublot and Zenith. This two brands operate in the luxury segment with expensive watches but non of these brands are as iconic brands as Louis Vuitton or Dior.

Hublot was founded in 1980 and has great watches. It is known for introducing innovative materials in their watches

Zenith was founded in 1865 and is renowned for creating the El Primero, the world's first integrated automatic chronograph movement, which was introduced in 1969.

Both firms sell watches at an average price of €10,000. However, Hublot is now competing against firms like Richard Mille, offering watches with the same aesthetics and a high prices (average €20,000 with some watches above €100,000)

Zenith sells more classical watches and Hublot tends to be more “futuristic”

Louis Vuitton is also a watchmaker and is selling ultra-luxury watches. As an example, the Tambour Einstein watch, selling at €500,000

LVMH's current portfolio in the luxury watch segment, while impressive, does not include a brand with the iconic status of Patek Philippe, Audemars Piguet, or Omega. These revered brands possess a certain mystique and longstanding heritage that LVMH's watch brands have yet to fully emulate.

Recognizing this gap, LVMH has publicly acknowledged the potential value of adding such a distinguished brand to its collection. An acquisition of this magnitude could significantly enhance LVMH's standing in the luxury watch market. However, LVMH maintains a strategic approach to acquisitions, indicating that any such move would only occur if a suitable opportunity arises. This cautious and calculated approach ensures that any addition to their portfolio aligns with the conglomerate's overarching vision and market position, reinforcing LVMH's commitment to excellence and prestige in the luxury sector.

The Jewelry segment and portfolio

The analysis of LVMH's watches and jewelry segment is indeed more complex due to its fragmentation and the presence of numerous local players. However, LVMH has made significant strides in this sector, particularly with its acquisition of Tiffany & Co. in 2021, which has notably elevated its position, especially in the U.S. market.

Tiffany & Co. stands as a key asset in this segment for LVMH. As an iconic American brand with global recognition, the acquisition of Tiffany has been a strategic success for LVMH, leading to a substantial increase in profits in just a few years. Its renowned status and appeal in both the U.S. and international markets make it a valuable addition to LVMH's portfolio.

Chaumet, established in 1780, boasts a rich heritage, having catered to historical figures like Napoleon. While it is a significant asset with a storied history, its market size is comparatively limited.

Bulgari, another prestigious name under LVMH, is an Italian luxury brand founded in Rome in 1884. Bulgari is celebrated for its exquisite jewelry, watches, fragrances, accessories, and hotels, contributing to the diversity and prestige of LVMH's jewelry portfolio. Each of these brands, with their unique histories and market positions, strengthens LVMH's presence in the luxury jewelry sector, allowing the conglomerate to cater to a wide range of consumer preferences and maintain a strong competitive stance.

In addition, let me talk about Chaumet CEO, who said several interesting things in an interview:

We think that it’s more important to do things the right way at the right time, but be successful and be understood by the client when we open in a new country or open a new store before going to the next one

Today, the core of what we do and what we experience is really through the store,” Mansvelt affirms. “And, of course, once you know Chaumet a little bit more, you already know the different collections and understand a little bit more about the maison, then the digital becomes a service”

Business analysis

✅Strong positioning in the premium market with Tag Heuer, which benefits from strong brand reputation (sponsor of events like the Olympics or the Fomula One). However, it is a very competitive segment and new brands can emerge as reputation or history is less relevant in the premium segment

✅Vertical integration is a key strength of all segments in LVMH. The company is developing more stores to be able to better attend their clients and improve the customer experience

✅The growth in Asia is a strong opportunity as its a key market for the watches industry. In addition, the acquisition of Tiffany puts LVMH in a strong position in the US and the company has already benefited from the acquisition.

✅Balanced geographical exposure: Asia represents nearly a third of the business and the US more than 25%. Europe represents 18%.

✅Opportunities to increase the business performance through partnerships with other brands (e.g., in 2021 Tiffany and Patek Philippe sold the first unit for $6.5 million)

✅Global wealth growth is expected to continue increasing in the next decades

✅The online segment represents an opportunity for the company and, according to their reports, they are investing in their digital experience

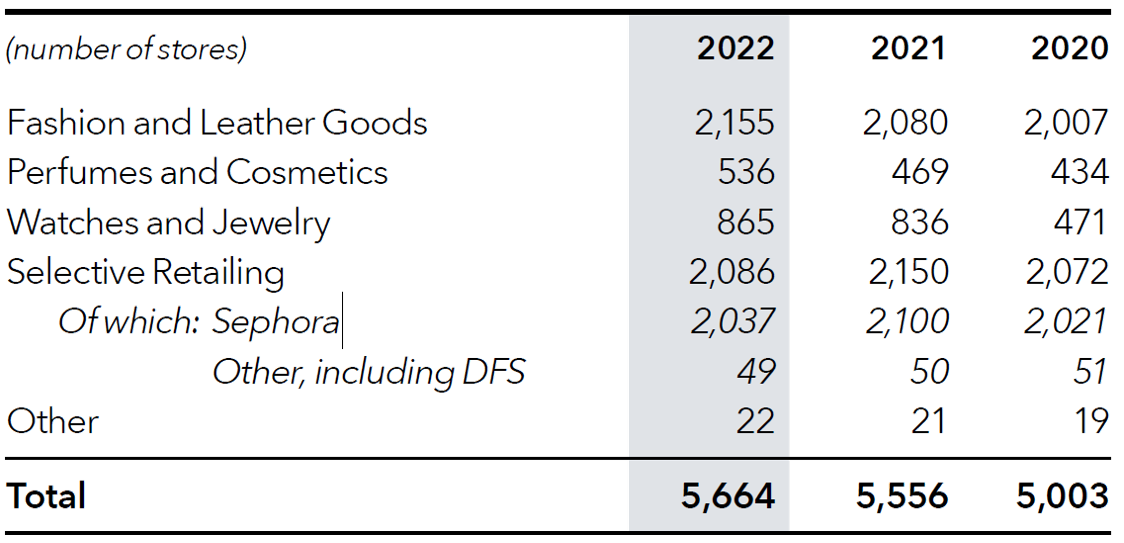

✅LVMH benefits from the synergies of its distribution network and the know-how of the brands in terms of in-store customer experience. The company has the capacity to expand its stores. Currently, there are 865 stores out of 5,664 (as of Dec-22), of which around 350 might be from Tiffany. There are around 500 stores for Tag Heuer, Hublot, Bulgari, Chaumet, Zenith and Fred, which we should expect the group to continue opening stores. To enhance the brand, the physical experience remains a key and the company has the know-how from Louis Vuitton

⚠️Counterfeit can negatively impact both the brand reputation and the financials

❓Smartwatches represent both an opportunity and a threat. LVMH has already launched smartwatches and seems to be well positioned with Tag Heuer, Hublot or Louis Vuitton. They are also testing the high-end segment with the launch of a smartwatch from Hublot connected to Google. However, smartwatches are a big threat for companies like Tag Heuer if consumers end up paying $1,000 for an Apple Watch in the future and a Tag Heuer costs $2,000. There can be disruption in that segment. In the high-end/luxury segment, disruption is much lower (quasi insignificant). I’m not sure where the industry is heading and I see some true disruption in the premium segment

❓Weak position in the high-end segment of watches (lack of a great brand such as Audemars Piguet), but there might be opportunities in the future to continue increasing the catalog. In addition, Arnault’s son is doing a great job and is trying to enhance the brands. As an example, they company has been able to sold the first Tag Heuer above $50,000 (in particular, they are selling dozens above approximately $500,000)

❓In jewelry, the company is very well positioned in the US, but also faces strong competition from other brands. Chaumet and Bulgari are significantly smaller than companies like Cartier and face strong competition from other brands. It is estimated that Chaumet generates several hundred million in revenue while Bulgari was €1bn ten years ago (probably might be in €1.5-2.0bn range), which is far less than the €6bn revenues generated by Cartier

❓The high-end sector has high barriers to entry, but less in the premium segment. In all segments, competition is intense and if the company wants to succeed in the luxury segment, they have to enhance their brands to compete against Rolex, Patek Philippe, Audemars Piguet, Omega, etc.

4.Perfumes and cosmetics

10% of the revenue

A premium segment operating through luxury brands

The perfumes and cosmetics segment of LVMH, while positioned among the most expensive in their category, are accessible to a broad demographic, including middle-class consumers. Products like a Christian Dior perfume priced at around €150 or lipsticks within the €40-50 range, though premium, are within reach for many. This accessibility broadens the potential customer base but also brings heightened competition. Key aspects of this segment include:

High-Quality Products: The perfumes and cosmetics offered by brands like Dior and Guerlain are recognized for their superior quality.

Moderate Pricing Power: The intense competition in this segment limits the pricing power of these products compared to other luxury goods.

Economic Sensitivity: These products are not typically considered defensive. Consumer spending on cosmetics and perfumes often decreases during economic downturns as people opt for more affordable alternatives. However, perfumes might have slightly more resilience, given that many individuals tend to stick with the same fragrance over time.

This segment, while offering premium products, operates in a highly competitive market where consumer loyalty and product quality are essential for maintaining a strong position, especially in times of economic uncertainty.

The perfumes and cosmetics business of LVMH, like many others, was significantly impacted during the COVID-19 pandemic, but it has shown recovery in recent quarters. Distribution for these products is primarily through a network of multi-brand retailers, including LVMH's own Sephora, which will be discussed in more detail later.

The profitability of this segment is generally lower compared to other LVMH sectors, for several reasons:

High Marketing Costs: In contrast to brands like Louis Vuitton or Moët et Chandon, the perfume and cosmetics lines necessitate extensive advertising campaigns. The target customer base for these products is much broader, necessitating wide-reaching marketing strategies, including television and billboard ads. The need to promote multiple brands simultaneously results in significant marketing expenditures.

Dependence on Retailers: This segment relies heavily on sales through specialized retailers and department stores, where competition is intense due to the presence of multiple competing brands in the same space.

Pricing and Discounts: While there is a general trend of price increases over time for these products, they are more likely to be offered at discounts compared to other luxury goods.

LVMH operates six facilities in France dedicated to the production of many of its products, particularly for Dior and Guerlain. Other perfumes and cosmetics are either produced in-house at these facilities or are outsourced to external manufacturers. This segment's lower profitability is offset by its broader market appeal and the opportunity to reach a wider customer base, but it requires careful management of marketing and distribution strategies to maximize its potential.

Competition

In the perfumes and cosmetics segment, LVMH is up against formidable competition from major industry players such as L'Oréal, Estée Lauder, and Shiseido, as well as from other luxury brands like Chanel and Hermès.

In Perfumes: LVMH's key brands include globally recognized names like Dior, Givenchy, Kenzo, and Loewe. However, the competition is intense, with rivals such as Armani, Chanel, Prada, and Yves Saint Laurent. The market is saturated with options, offering consumers a vast array of alternatives to choose from.

In Cosmetics: Similar to perfumes, LVMH's cosmetic brands are known for their high quality, but they operate in a highly competitive environment. The cosmetics market is dynamic, with a continuous influx of new products and innovations, making it a challenging sector for maintaining market share and brand loyalty.

Navigating this competitive landscape requires LVMH to consistently innovate and maintain the high quality of its products while executing effective marketing strategies to stand out in a crowded market. The key for LVMH in this segment is not just the quality of its products but also the ability to connect with consumers and differentiate its brands from the myriad of options available.

Segment conclusions

✅Repeating clients. Many people don’t change their perfume during their lives. It is part of oneself. Many people around us have a very characteristic smell. They have a specific perfume. If you take the best-selling perfumes, you will certainly be able to associate their smell with your acquaintances.

✅Many perfumes and fragrances have been existing for decades. Miss Dior was introduced in 1949 or Chanel n5, the top perfume was introduced a century ago. This is important because perfumes require less R&D than cosmetics and can leverage on decades of history.

✅Although the companies need to introduce new products constantly, R&D expense is not high and amounts to €140-170m, which represents l-2% of the segment revenue

✅LVMH benefit from their scale to obtain better positioning in the stores and more beneficial marketing terms

⚠️Perfume and cosmetics are recurring products, but switching costs are not high, specially in cosmetics. Marketing is needed to maintain a strong inflow of revenue. A person can switch their cosmetic product o perfume. Retention rate will also depend on the retailers and how they are selling their products.

⚠️Saturated growth. The market is highly competitive and every segment is saturated with a high number of competitors and products

⚠️Low barriers to entry. Many brands can introduce new perfumes and compete against LVMH brands

⚠️No moat as i) barriers to entry are low, ii) there is some bargaining power from the customers, iii) business relies on third parties to distribute their products, iv) requires high amounts of marketing in expensive channels such as TV and v) it is very competitive with huge amounts of alternative products

Although profitable, the operating cash generated by this segment is around €400-500m, representing less than 5% of the total cash generated by the company

5.Selective retailing

19% of revenues

The selective retailing division of LVMH encompasses a diverse range of businesses, including duty-free shops, specialized perfume and cosmetics retailers, department stores, and gourmet food stores. This segment plays a strategic role in the distribution of LVMH products, leveraging its network of specialized retailers.

In terms of intragroup sales, this segment significantly contributes to the distribution of LVMH's products, particularly in the perfumes & cosmetics category. Intragroup sales in this segment amounted to €1 billion, accounting for 13% of the perfumes & cosmetics sales. For the fashion & leather goods segment, intragroup revenue was relatively lower, at €72 million in 2022, similar to the watches & jewelry segment, which also saw €70 million.

Selective retailing accounts for approximately 20% of LVMH's total revenues. However, since the onset of the pandemic, the profitability of this segment has been impacted, with margins dropping to around 5%, compared to pre-pandemic levels of 8 to 10%. This reduction in profitability highlights the challenges faced by this division, largely due to the impact of the pandemic on retail and travel sectors.

Looking ahead, while there is potential for margin improvement, the selective retailing division is currently encountering the most significant challenges within the LVMH group. Its recovery is not anticipated in the short to medium term, given the lingering effects of the pandemic and the slow resurgence of global travel and retail activities. The focus for this segment will likely be on adapting to the changing retail landscape and finding innovative ways to boost profitability and recovery.

Sephora

Sephora is a French retailer of personal care and beauty products. They operate over 2,700 stores in 35 countries worldwide. The company was founded in 1970 and acquired by LVMH in 1997.

Sephora key markets are the US, France, Canada, Italy and Spain. In the US, the company has over 500 stores. The key characteristics are:

They have a huge product diversification: more than 340 brands and 45,000 products

What distinguishes them is their wide range of products, offering international products that are not found in the competition.

Very diversified business in terms of geographies. In terms of revenues, the US seems to be a key region (44% of the segment sales)

Strong competition: these retail businesses offer less growth potential from compounding capital as i) margins are low, ii) low pricing power, iii) strong competition and iv) high fixed operating expenses

Sephora is not only a retailer but its also a brand in cosmetics. Part of the strategy of the group is to offer the brand Sephora as part of affordable products strategy

They are well positioned in the digital world with a great e-commerce

They are part of the distribution network of LVMH as they sell Dior or Givenchy products

Duty Free Shoppers

Duty Free Shoppers (DFS) is a Hong Kong-based travel retailer of luxury products. It was founded in 1970 and acquired by LVMH in 1997. They have over 400 locations in 12 major airports and 23 downtown Galleria stores.

These Galleria stores are often found in major cities and tourist destinations. They feature a wide range of luxury goods, including designer fashion, watches, jewelry, fragrances, cosmetics, and other high-end products. The concept behind Galleria stores is to provide a luxurious and comprehensive shopping experience that mirrors the quality and exclusivity of the products they sell.

DFS, as a part of LVMH's selective retailing division, particularly stands out in the niche market of airport stores. This segment possesses several competitive advantages:

High Barriers to Entry: The limited availability of space in airports significantly restricts the entry of new competitors. This factor establishes a protective barrier for existing stores like DFS, ensuring a more stable market presence.

High Foot Traffic: DFS benefits from the millions of people who transit through airports annually. LVMH reports that DFS stores attract over 200 million visitors each year, providing a vast and diverse customer base.

Strategic Locations: DFS stores are primarily situated in key locations across the Asia-Pacific region and the American West Coast. These areas are crucial for capturing a significant segment of the luxury retail market in travel hubs.

Prime Airport Locations: DFS operates in major international airports, including those in Singapore, Tokyo, Honolulu, San Francisco, New York JFK, and Abu Dhabi. These airports are vital transit points for international travelers, offering significant opportunities for luxury retail.

Galleries in Major Cities: Beyond airports, DFS also has galleries in several major cities across China, Singapore, Vietnam, and Australia. These galleries further expand the reach of DFS in key luxury markets.

Overall, DFS's presence in airports and key international cities positions it well to capitalize on the luxury retail market within the travel sector. Its strategic location in high-traffic areas, coupled with the inherent exclusivity of airport retail spaces, provides DFS with a unique advantage in the selective retailing landscape.

DFS conclusions

High competitive advantages in terms of low competition in airports and huge flow of passengers in the airports

High barriers to entry: Increase in competition in the airports is very limited as space is limited

Business highly dependent in travel and concentrated in Asia. The company suffered hugely since covid-19 and now is regaining strong growth after the reopening of China

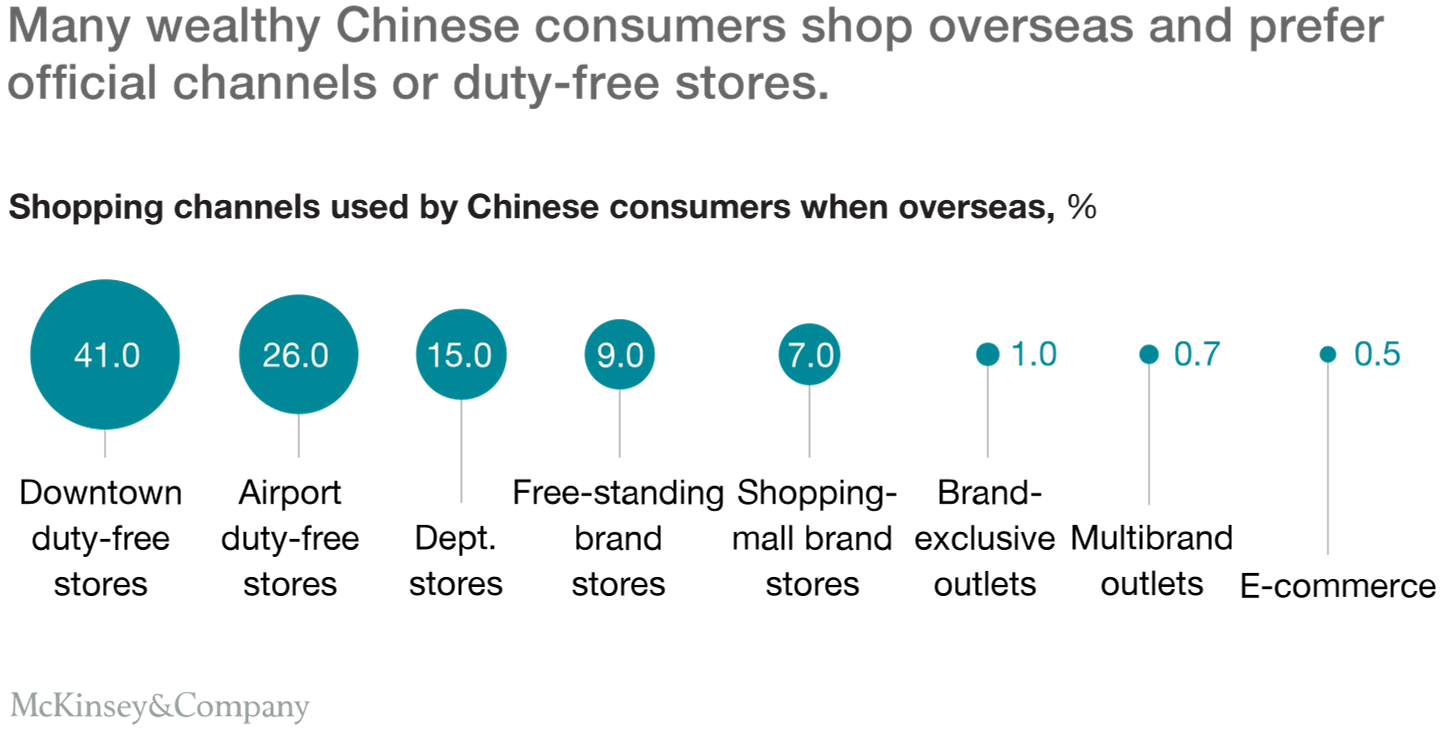

Duty free stores are still one of the favorite stores for Chinese people and are one of the main shopping channel used when they travel overseas

Others

The company has other retailing stores:

Le Bon Marché Rive Gauche: department store located in Paris. These businesses are facing strong headwinds. The positive is that it represents a small fraction of the company’s revenues

La Grande Épicerie de Paris: Two shops specialized in gourmet food. A great concept to sell premium food products and commercialize Moët Hennessy products. Very small business with very limited impact for the group

Conclusions of the retail segment

✅Sephora has a strong brand and it offers a great experience in its physical stores, where sales assistants are able to provide customized advisory and had the ability to sell more products (I personally saw this in some of their stores. You came for a lipstick and came out with two other products).

✅DFS division is well positioned and benefits from the Chinese costumers that like to shop in the airport duty-free stores

❓There is a big threat for retailers with the vertical integration of many brands that want to control all the value chain, including the distribution to the end consumer

⚠️Although Sephora and DFS are synergistic with wines, fashion, perfumes and watches, the two others (department stores and gourmet) are outliers to the group

⚠️Department stores are facing strong headwinds (same as retailers) due to the vertical integration of many brands, together with a highly competitive landscape and a promotional environment

⚠️No pricing power: retailers don’t have the ability to increase prices but rather compete on prices. Sephora has its own products, which give them some pricing power and inflation hedging, but its just a tiny part of the total divisional revenue

⚠️Very cyclical business with strong dependence on i) the economic cycle, and ii) relies on strong travel

6.Other activities

The company has other businesses, some of them unrelated to their business. I want to focus in the hotel management.

Hotel management

This area is an opportunity to the Group as there is a global trend of increasing demand for experiences. The group has long been invested in the hotel sector and is investing in creating luxury experiences in this sector.

It is a business that could be interesting to increase the prestige of the group and diversify its business. However, it should be clear that this type of business has a lower profitability and capacity for compounding in the long term:

The hotels are located in the most exclusive areas, which implies a high level of investment

They require a lot of costs in order to offer the best experiences and will require strong capital expenditures.

They have the option of becoming a resilient business that can better withstand difficult economic cycles: small hotels with limited for high net worth clients vs. a Four Seasons hotel with 100 rooms. It think the first (LVMH) has better chances to face headwinds as it has a lower operating leverage than big luxury hotels

The operate in a niche segment: Belmond has even luxury trains and boats, offering unique experiences

Strong growth potential as wealthy people demand for more exclusivity instead of 5 stars hotels with 100 rooms

Limited impact on the group's accounts as there are few hotels with very few rooms

The group already has two brands:

Cheval Blanc: 50-50 Joint venture. They currently operate 5 locations: Paris, St Tropez and Courchevel in France and St Barth and Randheli internationally

Belmond Hotels: This is a company that owns hotels, trains, boats and safari experiences

Cheval Blanc

Cheval Blanc is a joint venture where LVMH holds a 50% stake. This company is creating luxury hotels in different places in the world. It currently has 5 locations, 3 in France (Paris, St Tropez - the mediterranean sea - and, Courchevel in the French alps), together with 2 other locations in the Maldives islands and in the Caribbean island of St Barth

Belmond hotels

The company has hotels, trains, boats and safari experiences. Its very interesting because they offer luxury experiences very different to the plain vanilla hotel experience

They offer train experiences that reminds to the experience of traveling a century and half ago. They offer a wide range of routes in Europe, Machu Pichu and Singapore. They replicate the luxury travel by train that the wealthy people enjoyed a century ago

I see lot of synergies with Louis Vuitton! You just won’t take that train with your Samsonite trunk, but rather buy a Louis Vuitton trunk and enjoy the full experience!

These are unique experiences with little competition. Very niche business with the power to enhance the LVMH global brand and offer their clients unique experiences

You can also travel by boat in many rivers from France, enjoy safaris in Botswana and enjoy their hotels all over the world

As a conclusion, this segment has potential to grow significantly as consumers are demanding experiences. Le Cheval Blanc and Belmond offer unique experiences and have a great brand. However, these business are far less profitable than Louis Vuitton or Moët and the travel market is quite competitive. Having said that, its a great complement to LVMH current portfolio and enhance the global brand of LVMH. I expect this segment to continue growing and offering great experiences to current and new LVMH clients.

Other activities:

Les Echos Group: the leading financial newspaper in France Les Echos and Le Parisien daily newspaper

La Samaritaine: an iconic shopping mall in Paris. It is a real estate business

Royal Van Lent: LVMH owns a shipyard! The Feadship brand, one of the most prestigious in the world for yachts over 50 meters

The segment, including the hotels and other businesses, generates more than €1bn in revenues. Profitability is difficult to analyze as this segment includes also the corporate division (the corporate structure, which is almost 100% expenses). Do to this composition, the segment is always negative at operating income level

IV. THE MANAGEMENT

Bernard Arnault, as the founder and key leader of LVMH, has been instrumental in shaping the company and successfully implementing a strategy to enhance and grow its portfolio of brands.

Decentralized Management Model: LVMH operates on a decentralized model, allowing each maison (brand) to have its own independent management. This structure enables tailored strategies and management practices suited to the unique characteristics of each brand.

Executive Oversight: Despite the decentralized model, an executive committee oversees all business units, ensuring alignment with the group's overall strategy, financial goals, and development plans. This committee plays a crucial role in maintaining coherence across the diverse portfolio of LVMH.

Key Executives:

Antonio Belloni: He serves as the Group Managing Director, playing a significant role in the group's operations.

Delphine Arnault: As a member of the executive committee and the CEO of Dior, she is a notable figure in the group's leadership. Her position is particularly significant, given the discussions around succession planning within LVMH.

Succession Planning: A critical issue for LVMH is the future retirement of Bernard Arnault, who is currently 74 years old. Given that Arnault and his family own approximately 48% of LVMH's shares and nearly 64% of its voting rights, the succession plan is a topic of considerable importance. The company is believed to be actively engaged in planning for this transition to ensure stability and continuity in leadership.

The extensive management structure of LVMH, characterized by both decentralization and effective executive oversight, is a key factor in its success. The upcoming posts may delve deeper into individual management roles and strategies within the group, providing a more comprehensive understanding of how LVMH operates under the leadership of Bernard Arnault and his team.

The retirement of Arnault

In 2022, the Board updated the retirement age for Arnault from 75 to 80. He continues to be highly involved (according to the Group's CFO he still working every day (including weekends where he visits the shops and talks to clients). However, his retirement should come the sooner or later.

This is a big risk for LVMH because he is a very strong leader in the company. His vision of long term brand creation has been the key of success. Although the group's decentralized management (as every maisson operates independently) provide some relief, when a new management will come, things could turn differently.

The succession plan is a big secret and has not been publicly disclosed. I believe the plan is already in place and Arnault is training his children to, eventually, succeed him in the management of LVMH.

The main risks are:

Internal conflicts in the family and a battle between the brothers to run the business, leading to unsuccessful management

A change in the Group's strategy that can negatively impact the terminal value of the brands

Fail to execute successful M&A in the future

misalignment of interests between the family and the remaining shareholders

Currently, risk is low. However, need to account for it in case of a long term investment

The family

Bernard Arnault has five sons from two wifes. All five are working in the group exercising managerial roles in the company:

Delphine (48): She has recently been nominated as Chairman and CEO of Christian Dior and member of the Group’s executive committee and Board of Directors

Antoine (46) stepped back from his role as CEO of Berluti to head the family holding company Christian Dior SE. In addition he is the group’s head of image and sustainability

Alexandre (31) is currently leading the product and communications of Tiffany & Co. Previously, he was CEO of Rimowa (German fashion brand owned by LVMH). He will be a Board member from 2024

Frédéric (29) has recently being nominated as head of LVMH watches division. Prior, he was CEO of Tag Heuer. He will be a Board member from 2024

Jean (25), is the youngest of the sons and he is leading the watches segment of Louis Vuitton

How is he training his family for a future leading role in LVMH?

The succession planning at LVMH is a pivotal aspect of its current corporate narrative, with Bernard Arnault's children playing central roles in the company's future leadership. Here's an overview of the current state of succession and the involvement of Arnault's children:

Family Involvement in Decision-Making: Bernard Arnault holds regular monthly mini-conseil lunches with his five adult children. These 90-minute sessions are more than familial gatherings; they serve as platforms for discussing business strategies and seeking advice on various topics, indicating the children's active involvement in the company's affairs.

Board Appointments: Two of Arnault's sons, Alexandre (31) and Frédéric (29), have been nominated to the board of LVMH. They join their siblings Delphine (48), the current CEO of Dior, and Antoine (46), head of the family's holding company. Jean (25), who oversees watchmaking at Louis Vuitton, is the only one of the siblings not yet on the board.

Operational Roles of the Children:

Delphine Arnault has a prominent role, managing Dior as its CEO. Her unique position on both the Board of Directors and the Executive Committee of LVMH highlights her significant influence within the company.

Alexandre, Frédéric, Antoine, and Jean are also actively managing various aspects of the business, demonstrating the gradual transition of operational control to the next generation.

The preparation of Arnault's children for leadership roles within LVMH is a clear indication of the family's commitment to maintaining control and continuity in the company's management. This strategy not only ensures the preservation of the family's legacy in the luxury sector but also provides a stable foundation for LVMH's future growth and evolution. The careful positioning of the children in key roles reflects a well-thought-out succession plan, aiming to uphold the company's esteemed reputation and success in the years to come.