Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not have a vested interest in any of the companies mentioned in this article, and we do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

Executive Summary

🚗 Novem Group develops and supplies trim and decorative, functional elements in car interiors for the automotive industry.

🔝The firm specializes in the premium segment, supplying sophisticated trim elements for companies such as Audi, BMW, and Daimler.

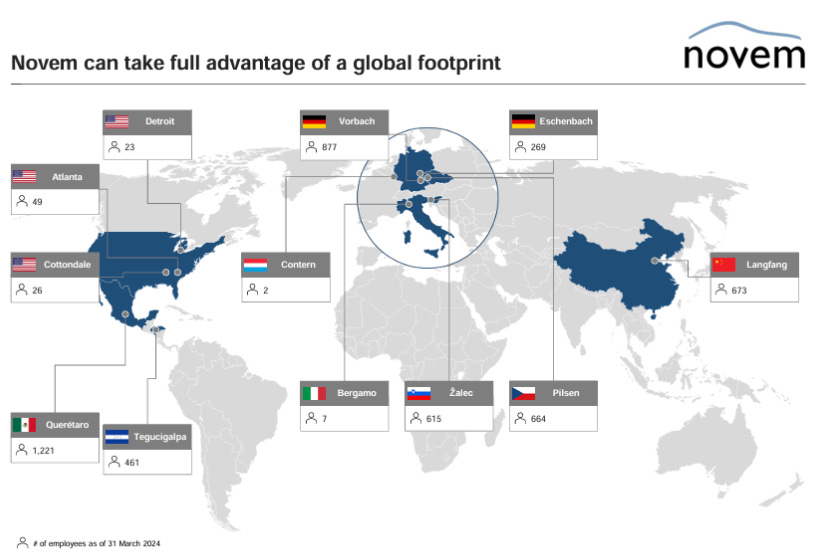

🌐It is a global firm with a presence in Europe, the US, and China.

📉 The company went public in 2021, reaching €20/sh. In 2023, the stock has declined by approximately 50% from the 52-week max of €11.3/sh to €5.9/sh. The current price is at a historical low, trading at -70% vs. 2021 max point.

📊 Today, the stock trades at c.5x earnings and c.5x FCF. We forecast very conservative assumptions that confirm there is a margin of safety

🔐 While the potential return is unknown, given the current macro environment, the margin of safety is high enough to establish a long position in the stock.

💰 We commit up to 6% of the portfolio to the stock (currently 4%).

1. Introduction to Novem

Founded in 1947, Novem Group develops and supplies premium trim and decorative, functional elements in car interiors for the automotive industry. It is a global firm with factories in Europe, America, and China. The company focuses on the premium market and has long-term relationships with premium car makers such as BMW, Audi, and Daimler. Additionally, it is entering the Chinese EV market with several platforms granted for the upcoming years.

The company is established in Luxembourg, although its headquarters are located in Vorbach (Bavaria, Germany). The company trades in the Frankfurt Stock Exchange (Germany) with the ticker NVM.

2. Competitive Positioning

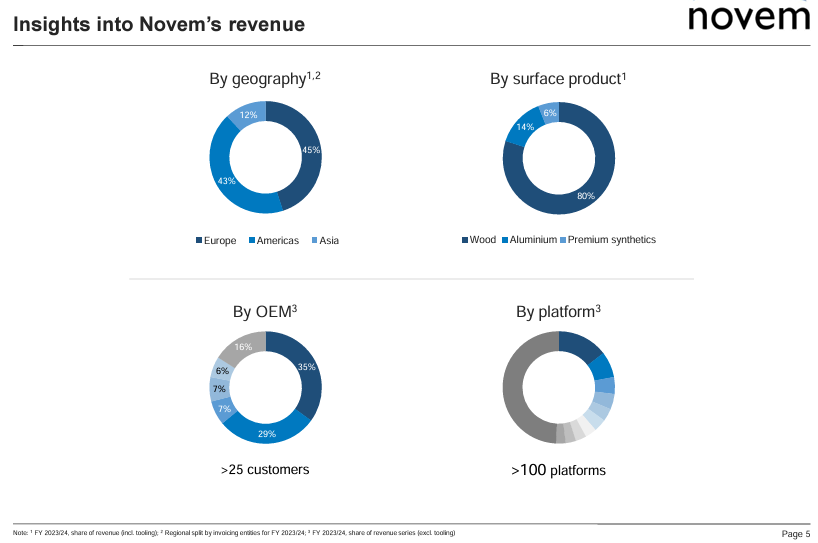

Global Scale: The company is present in Europe, the US, and China. By geography, Europe represents 48% of revenues, America 38%, and Asia 15%. Revenue in Europe has declined in the last years from €398m in 2019 to €333m in 2023, as the sector is experiencing strong headwinds. However, Americas and Asia are growing at double digits as the company has secured contracts with EV automakers such as Polestar, Avatr, Lucid, etc.

To supply customers in Europe, America, and Asia, the company has seven factories with broad material capabilities (4 in Europe, 2 in Central America, and 1 in China). The company has set the factories in low-cost production countries to reduce costs while being close to their customers. In August, the Italian factory was closed as the company continued moving production to countries with lower production costs.

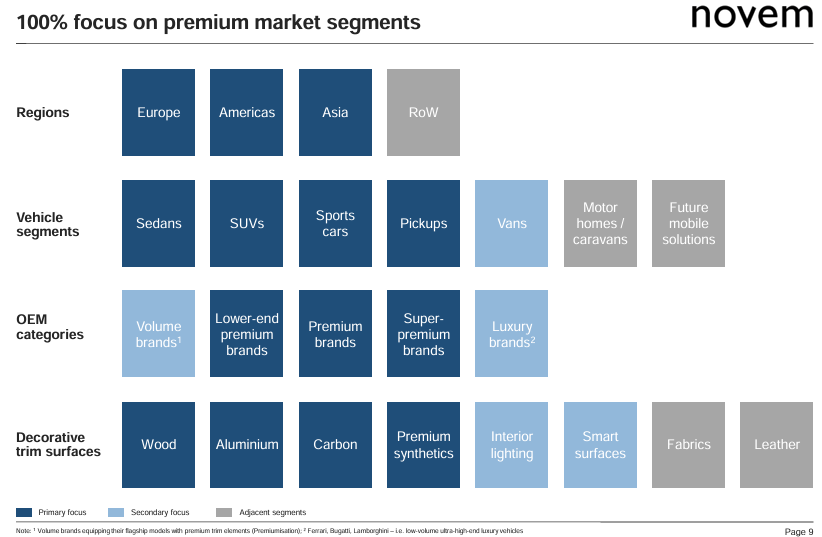

Segment: The company manufactures products for premium brands, including Audi, BMW, and Daimler. The company also operates with lower-end premium brands such as Opel. By the type of car, the company operates in all segments, except vans and caravans.

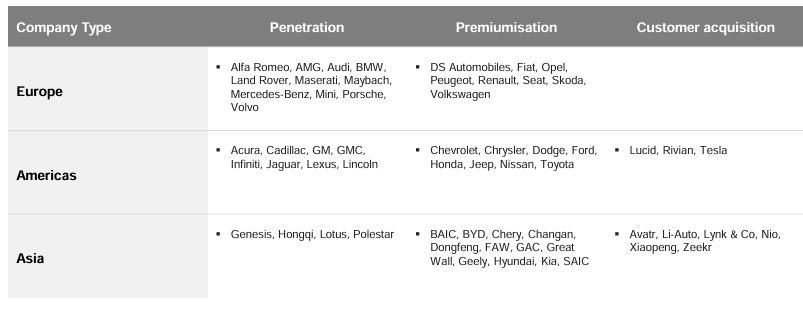

Among their clients are firms such as BMW, Mercedes-Benz, BMW, Maserati, GM, Lexus, Porsche, Polestar, etc.

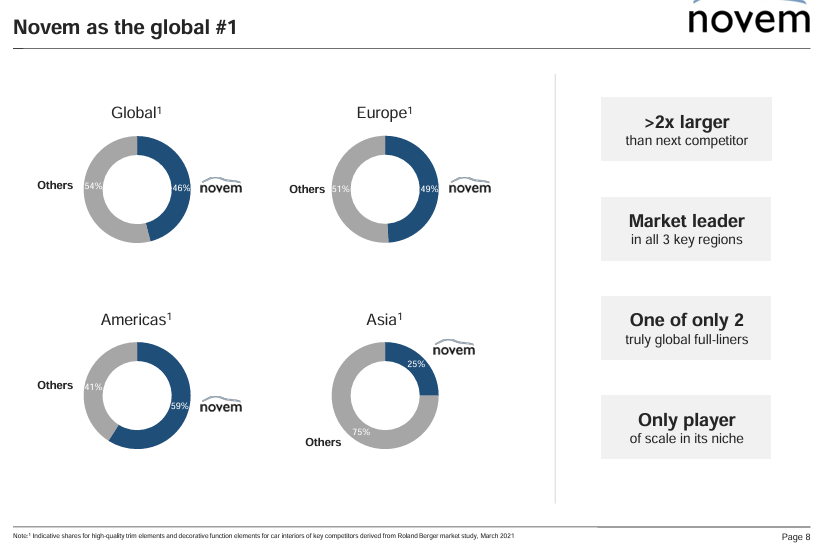

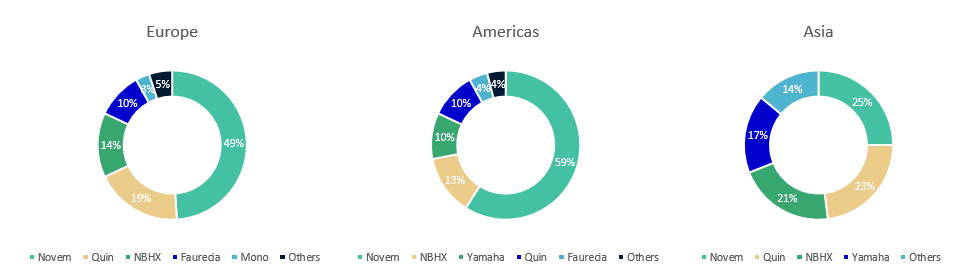

Market leader: According to a study by Roland Berger, the company is the market leader in the premium sector, owning 46% of the total global market share of premium trim elements.

In Europe and the Americas, it is the clear leader, while in Asia, the company will probably face higher competition (although this market has a superior potential than Europe with the emergence of new EV premium players)

Please note that these estimates by Rolland Berger in 2021 correspond to the 2019/2020 period. While some changes might have occurred, overall, the market shares should remain stable given the process of manufacturing and supply trim elements takes very long (discussed in section 4).

Competitors

1. Global scale competitors

NBHX and JoysonQuin are the main global competitors. Their market shares are 15% and 18%, respectively (vs. 46% Noven).

Quin is only focused on wood trim elements, and the company is not 100% focused on trim elements. The main segments are (i) automotive safety elements and (ii) electronics. Therefore, the only true global competitor in NBHX

NBHX has a global scale and is dedicated solely to trim elements using wood, aluminum, and synthetics. The company also supplies premium OEMs like BMW, Mercedes-Benz, and VW. While they have slightly below metrics (4,500 employees vs. 5,500 of Novem and c.€600m revenues vs. Novem c.€700m), their market share is significantly below Novem.

2. Other competitors

Yamaha: A Japanese competitor focused on wood materials in the Asian markets. Its main clients are Asian premium brands such as Lexus. They have an estimated 17% market share in Asia (lower than Novem’s 25%). The interior division is part of a vast conglomerate with many industries, including famous musical instruments. Not a global player that can compete against Novem in all geographies.

Faurecia: Now rebranded to Forvia. The company is one of the biggest suppliers to the automotive industry. However, they are not solely focused on trim elements and do not cover all the materials Novem covers. Only 40% of their platforms are premium.

The company is far less profitable than Novem, with a 4% EBIT margin vs 10-12% of Novem. Therefore, the company can’t compete in price against Novem. In addition, the company is focused on Europe and has a c.10% market share in Europe premium interior trim and decoration elements vs. 49% in Novem.WKW: Specialized in aluminum products with facilities in Germany, Hungary, and the US. They have a tiny market share, and their product offering is more concentrated on single products such as aluminum roof rail systems and decorative elements.

Mata: A company focused on wood and carbon trim elements. They are present in Europe and have a modest market share below 10%.

Mono: Competitor that offers a wide range of products, including wood, aluminum, and carbon; however, capabilities appear to be lower. They are only focused on Europe and have a modest market share of 3%. Their clients include names such as Aston Martin, Jaguar, and Land Rover, as the company is located in the UK and Turkey. Conversely, Novem is more focused on German manufacturers, whereas Mono has a lower presence.

3. The product

The company supplies car interiors for premium cars, developing door panels, instrumental panels, center consoles, and special parts such as lighting. Offering the highest quality standards is mandatory due to the focus on premium cars. The company has strong capabilities in developing products with wood, aluminum, and synthetic materials (carbon and others).

Because the company develops products for premium cars, offering the highest quality standards is mandatory. Indeed, it is one of its competitive advantages as the company has substantial know-how and capabilities in developing products using wood, aluminum, and synthetic materials (carbon and others).

Europe represents nearly half of the revenues while Asia is still relatively small (however, it is the market with the biggest growth potential)

Wood is the dominant material, representing 75% of revenues.

There is strong customer concentration as the top 3 customers represent c.70% of revenues (however, it is more diversified on a platform basis)

4. The production cycle

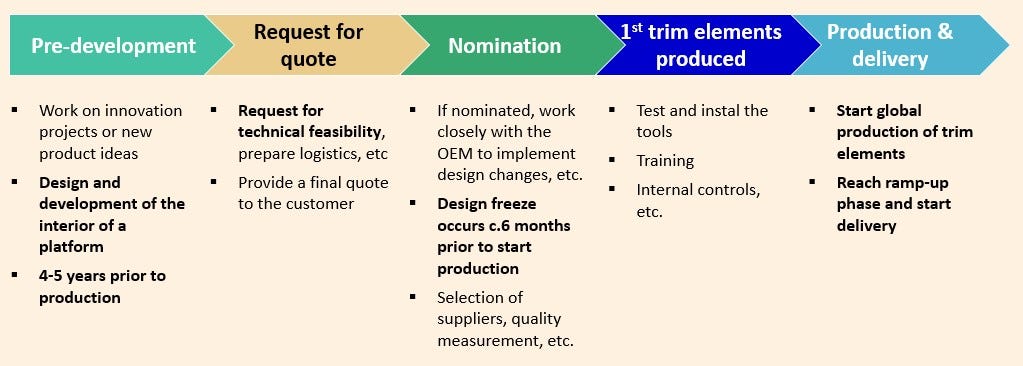

The pre-development starts 4-5 years before production. Once the company is nominated, the teams will implement changes to the design, and the design freeze occurs six months before starting production. Once the production begins and the company reaches the ramp-up phase, deliveries take place. The whole process until the platform ceases production can take up to 10 years. Given the significantly lengthy process, this is a key competitive advantage for the company.

Suppliers

Novem has a network of 400+ suppliers for the procurement of production materials. Out of the total cost of materials, c.80% of purchases are untreated galvanized and painted plastic parts, electrical components, surface material, granules, aluminum panels, and veneers.

To have more comprehensive control of the production chain and reduce transport costs and distance, 44% of the providers are local.

Energy consumption

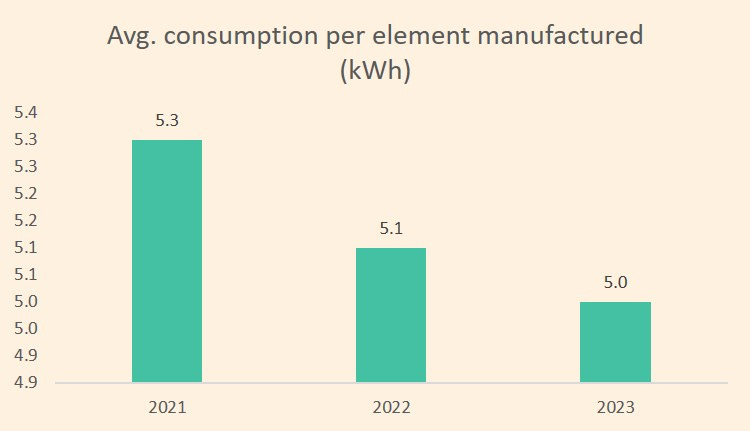

Novem is a high energy demanding company. The company has an energy consumption of c.150 GWh (the equivalent to c.15,000 households), of which 80% comes from non-renewable sources and 20% from renewable sources.

The company has implemented energy-saving programs that allowed the company to reduce the average energy consumption per component produced from 5.3 kWh in 2021 to 5.0 kWh in 2023

5. SWOT analysis and main competitive advantages

🔐 Strengths

It is a global player with an estimated 46% market share for high-quality trim elements (only two truly global firms are in the segment).

Revenue diversification: Asia and America should drive future growth, offsetting the macro headwinds in Europe.

It is the market leader for the premium segment in all three regions.

Longstanding relationships with BMW, Daimler, Audi, etc., which provide a competitive edge against their competitors.

Deep penetration in OEMs design and manufacturing capabilities (Company engineers and designers deployed in the OEMs facilities to foster collaboration and improve the design and production)

The company has established factories close to the OEMs’ production facilities (i.e., Audi, BMW, etc.) and in low-cost production countries without affecting the quality of their processes and products.

Strong capabilities across multiple materials, including wood, aluminum, and carbon.

Higher margins than its peers.

Lowest scrap rates among its peers, according to a Roland Berger report in 2021.

Low operating leverage (60% of the costs are variable).

❌ Weaknesses and risks

The company still has leverage (~1.0x EBITDA)

Strong client concentration: three clients represent 70% of the revenues. However, client concentration is much lower regarding platforms, as the largest three platforms represent 20% of the sales. In addition, every platform has its cycle and timings; therefore, Novem cannot lose all platforms from a customer at once. This generates more predictable cash flows.

There are no automatic pass-through mechanisms. Therefore, the company cannot pass through the inflation to their customers automatically, and it will require time to regain margins to 14-15% (vs. actual 10-11%).

Limited addressable market, as the company operates in a niche with low growth potential. However, some regions, such as Asia and the US, still present growth potential.

The company went public in 2021, and limited historical information regarding Novem is available. Therefore, there is a risk that management will underperform as data from past challenging situations is not available.

There is a new CEO in the Group whose track record is still being determined.

♟️ Opportunities

There is a significant opportunity in China with the emergence of new competitors.

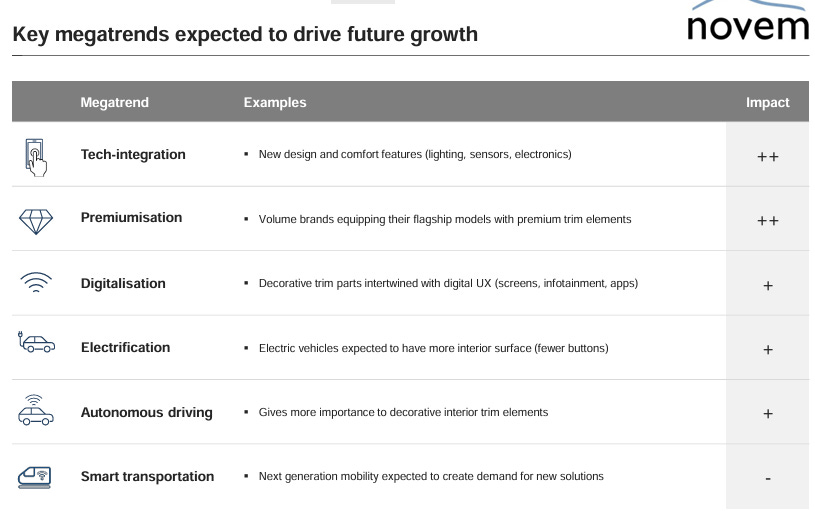

The EV segment presents additional opportunities as companies are radically redesigning car interiors.

There is a premiumization trend among OEMs as premium cars offer higher margins, which will require them to rely on Novem’s capabilities.

The company could enter new markets, such as yachts and private jets.

❓Threats

New entrants could emerge, although there are high barriers to entry.

Increasing competition from its main global rival, NBHX. However, both companies have similar sizes and dominate the market. This should limit unfavorable competitive conditions.

Macro headwinds affect not only the demand (i.e., total cars produced) but also the increase in prices and potential supply chain issues.

Company exposed to supply chain disruptions.

Currently, there is a strong volatility in the call-ups from the OEMS, challenging the whole production process.

Persistent high energy prices will negatively affect Novem’s operating margins as the company demands high amounts of energy to manufacture its products.

Unfavorable labor regulations in the countries in which Novem is present

The cyclical nature of the car industry. The industry faces headwinds in Europe due to regulation; however, deliveries of premium brands such as Mercedes, VW, and BMW are still high, although below pre-pandemic levels.

5. Competitive Advantages

1️⃣ The first competitive advantage for Novem is its longstanding relationships with the top automakers. For example, the company established its first relationship with BMW in the 1960s and Daimler in the 1980s. While the relationship itself is not a deep competitive advantage, it is a strong starting point given that developing a platform (i.e., the BMW X3 platform) takes several years, and the company has deployed designers and engineers in its clients' production and design facilities. This strengthens the relationship and improves current and future collaboration.

2️⃣ Novem has a global reach, allowing the company to secure contracts worldwide. On the one hand, it will enable the firm to provide worldwide services to the biggest automakers. On the other hand, it will enable signing agreements with new carmakers, especially in the EV industry (Tesla, Rivian, Avatr, etc.). Moreover, the firm has located its factories in low-cost producing countries, allowing management to manage operating expenses better.

3️⃣ High barriers to entry. There is only one competitor with a global scale that can challenge Novem. Other competitors will need to invest not only in factories in Asia, America, and Europe but also in knowledge regarding premium materials. In addition, they will need to develop strong relationships with the OEMs to compete against Novem.

Novem has seven factories across the world with more than 5,000 employees. Replicating the scale of Novem will require a significant amount of capital.

To compete against Novem, a competitor has to be able to work with a wide range of materials. The product that Novem delivers has to be top-notch, as buyers of premium cars expect high-quality materials with an attractive design and high durability. Therefore, it is important to have capabilities in wood, aluminum, carbon, etc., and to put in place the highest quality standards to manufacture premium products without being impacted by high scrap rates. Novem has both strong material knowledge and a very efficient process with low scrap rates.

4️⃣ Long ramp-up periods. For a potential competitor to enter the market, it will be a very long process for potential entrants, given the long cycle to develop a platform, as design and prototypes start 4-5 years before launching the platform. Then, the cars are manufactured for many years. The average production of a platform can take up to 10 years.

Given this extensive cycle and capital needs, reaching efficiency in a short period is virtually impossible. As a reference, the company has been awarded with 100+ platforms and delivers approximately 4 million sets per year (28 million pieces). It has a massive scale and is very difficult to replicate as all these sets require different materials (wood, aluminum, carbon, etc.), and the whole process is very lengthy.

5️⃣ Brand: Novem has strong brand recognition in the automotive industry as it is associated with high-quality standards. It is important because the premium segment requires high-quality materials to meet clients’ expectations.

6. The Management

The Group’s new CEO, Markus Wittmann, replaces the prior CEO, Günter Brenner. The prior CEO voluntarily resigned in August 2023 after ten years in the role. While the reason is unclear, one of the main reasons could be near retirement. The new CEO has held several management positions at Novem, including responsibility for global quality management. From 2015 to 2019, he acted as Vice President of Operations. Recently, he was responsible for technology.

Because Mr. Wittmann doesn’t have social media, it is difficult to track his past performance (although I admit I like to see CEOs without the need for public approval through social media). However, it is positive to see that the CEO comes from the company’s operations, given the importance of such an area in the company.

The CFO was appointed in 2012. Apparently, he is a good performer, given the company's high margins, together with strong working capital discipline. However, given the company's current market cap, a share buyback could be very interesting, given the significant discount at which the shares are trading.

7. The Shareholders and Illiquidity Problem

Novem is a family-owned company, albeit not directly. Novem Group is approximately 75% owned by Bregal, a private equity fund that belongs to COFRA Holding. The Brenninkmeijer family wholly owns this Swiss holding.

The remaining 25% (the free float) is owned by institutions such as Fidelity, Azimut, Norges Bank, Florida State Board Administration, etc.

While there is a majority shareholder, the influence might be diluted, given it is owned by a subsidiary of a family holding. Despite this, having a controlling shareholder is a very positive sign. Being part of private equity should be a positive sign, as these companies aim to maximize value.

On the negative side, given the recent fall in the share price, the company has a market cap of €250m, which implies that the free float market value is less than €75m. This creates a liquidity problem with very few shares traded every day and increased volatility. This illiquidity implies a discount in valuation, but it should not be a major problem once the stock trades at historical lows.

8. The Investment Thesis

From a competitive standpoint, the company is a clear market leader with the potential to continue growing. It is not a growth company; however, there are significant opportunities in the market:

First, companies are developing more premium cars as a way of differentiation.

The interior of cars has been reshaped, especially in the EV segment. Tesla has completely revolutionized the interior of vehicles, and many companies are redesigning the interiors with new materials, lighting, etc. Others, like Mercedes, are betting on renewed interiors with lighting and other functions. This creates a strong opportunity for Novem as they are truly experts in designing and manufacturing premium trim elements.

China is a big opportunity with the emergence of new players such as Polestar, Avatr, Lynk & Go, Nio, etc. The positive impact of these new platforms will take time, as the development of a platform takes up to 5 years. The company has already secured contracts with these OEMs, which is important as being one of the first suppliers offers strong benefits.

The company is well-managed, with superior margins and high discipline in managing working capital. With a majority shareholder behind, management decisions should be aligned with shareholders’ interests.

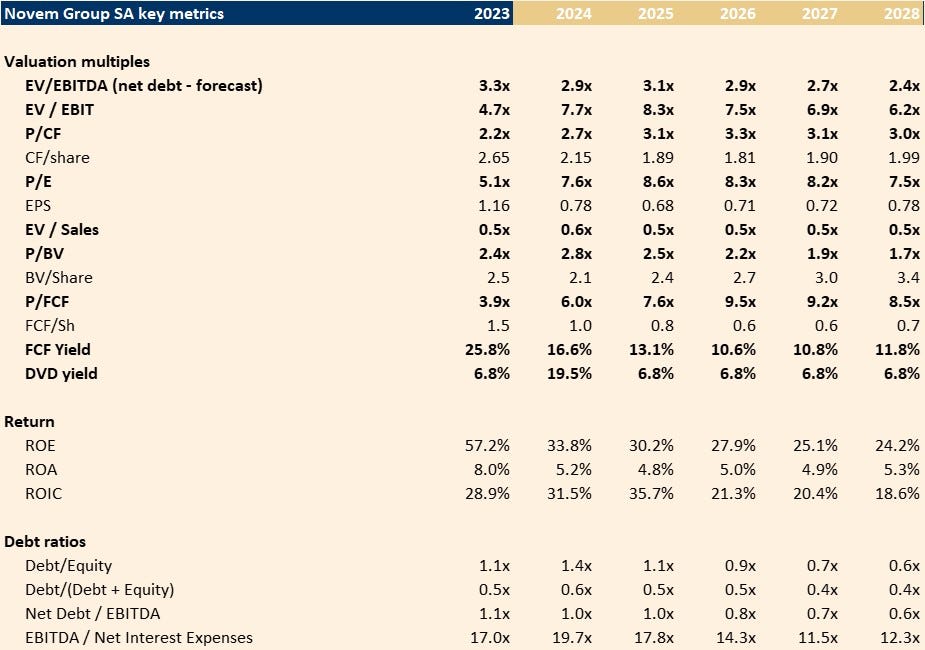

However, none of these characteristics are enough to invest in the company. The valuation must be in line with the quality of the company. The reality is that the valuation is disconnected from the company’s reality. Today, the stock trades at 4-5x current earnings and 5x current FCF. This undervaluation is a positive element as the margin of safety is very big. While the automotive segment is facing headwinds, EPS could fall by 50%, and the company will be trading at 10x earnings, which will be a reasonable valuation for a company of these characteristics.

The stock has fallen by 50%; however, the last quarterly results are not bad. Revenue decreased by 4%, while FCF turned negative to positive. The fall in revenue was due to lower tooling revenue*, while series revenue remained flat, which is the most important indicator.

*The company needs to acquire special tooling to manufacture the products. The company passes through the acquisition costs to the OEMs, earning a lower margin than with the series (the trim elements).

Stock is trading at historical lows: The company paid a dividend of €1.15/sh in August 2023 as the company had a balanced capital structure. Since then, the stock has fallen by c.50%.

Under current figures, the company will continue to be highly undervalued. It should not be very concerning if we see some revenue decline in the short term. The management maintains a CAGR of 4-5% in revenue in the medium term. The Novem case is not an isolated event, as many other small caps are experiencing significant undervaluations and are underperforming the main equity indices.

A forgotten stock?

While the stock is followed by six analysts (JP Morgan, Jefferies, Berenberg, Oddo, Kepler Cheuvreux, and Hauck Aufhäuser), only two of them had questions in the last earnings call and no questions at all in the full-year earnings presentation! However, I believe the community is forgetting the stock and is simply following the path of the big German OEMs with an intense overreaction.

It might take time for the market to recognize the value of the company given (i) illiquidity, (ii) lousy momentum for small caps, and (iii) potential headwinds in the European automobile industry.

9. Financial analysis

All financials are expressed in euro millions unless otherwise

Please note that the company's fiscal year ends in March (i.e., 2023 figures represent the full year ending in March 2023). Therefore, 2024 onwards are projections for the following years ending in March.

The auditors confirmed that financial statements represent the company’s performance fairly. However, they highlighted the risk that revenues can be overstated. Tooling revenue represents a small amount of revenue (10%), and we assume that the risk is limited, as the overestimate should not represent the whole revenue from tooling but rather a tiny fraction of it. Therefore, the impact should not be material.

The company wholly owns all of its subsidiaries outside Germany. No adjustment for minorities is needed.

Revenues

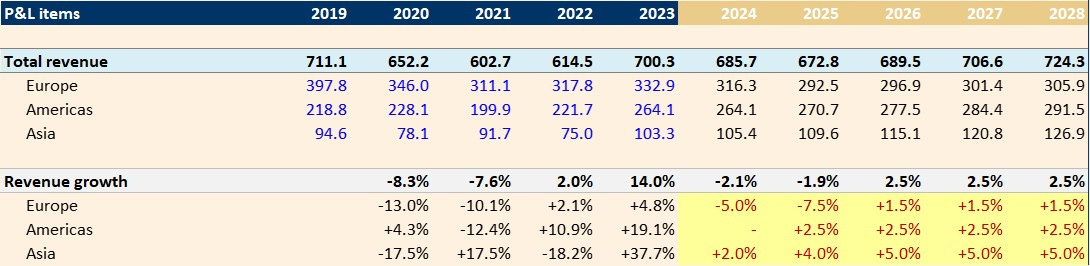

Novem generates €150-180m per quarter in revenue. Excluding tooling, revenue from series (i.e., the actual business) stands between €140-160m per quarter. Tooling revenue is more volatile and ranges between €10-30m per quarter. This implies that Novem can generate consistent annual revenue between €600-700m. In addition, the company has set the target to grow at 5-6% in the mid-term. We forecast a revenue decrease of -2% for the following two years and +2% growth from 2026.

We forecast a revenue decrease of -1% for the following two years and +2.5% growth from 2026 to 2028. By geography, we forecast Asia and the Americas to be the drivers of growth, especially Asia, where the company has secured contracts with multiple local OEMs (Avatr, Nio, etc.)

Expenses

Low operating leverage: Nearly 60% of the expenses are variable expenses, meaning the company has low operating leverage and can face difficulties better. The cost of materials is the most significant expense (~60%), while personnel represents ~30%. The company has c.5,500 employees (2,900 in Europe, 1,800 in the Americas, and 800 in Asia). The rest are order-related expenses, maintenance, legal and advisory, etc.

Expenses have been affected by the inflationary period that started in 2022. The company has a margin of around 50% in terms of gross margin. However, during 2022 (2023 FY, as the company fiscal year ends in March), they were below 50%. The company posted a 51% gross margin in the last quarterly results. Regarding EBIT margin, the inflationary process has negatively impacted Novem as the margin has decreased significantly from 14-18% to the current 11-12%. However, given the recent deleverage, the net income margin stands at 8%, higher than prior periods.

Expenses forecasts:

Cost of materials: These costs used to represent 47% of revenue; however, in the last two years, they have risen to 50.6%. We assume 51.0% for 2024 and a subsequent recovery to 50.2% in 2028.

Employee expenses: We assume a constant number of employees (despite decreasing from 6,016 in 2019 to 5,488 in 2023). We increase salaries by +4.0% in 2024 and +2.0% from 2025 onwards.

Other Opex: We assume the average 12.1% over sales of the last three years.

Other operating income: constant €14.1m vs. €12.7-25.8m range of the last five years). Other operating income excludes income disposal from PPE and foreign currency translations, as these items cannot be forecasted.

Capex Requirements

One of Novem’s competitive advantages is the low capex requirements. The company spends c. 3% of its revenue on capex, and there are no near-term plans to invest in new properties.

We forecast a 3.5% capex over revenue throughout the period to c.€25m annually.

Earnings and Free Cash Flow

In terms of earnings, the company has generated an EPS of €1.04 and €1.16 in 2022 and 2023, respectively. The current share price is €5.9/sh, implying a P/E ratio of 4-5x. In the last available earnings, the company generated €13m of Net Income (€0.33 per share) in one quarter (although I consider it unuseful, it will imply an annualized EPS of €1.32 vs €5.8 stock price). Cash flow generation is even stronger as the company generated €44m and €65m in 2022 and 2023, respectively (€1.0 and €1.5 of FCF per share). Therefore, the stock trades at 4x-6x FCF. (Note: FCF is after leases and interest payments).

WK assumptions: We project inventories, accounts receivable, and accounts payable using the last 3YR average DIH, DSO, and DPO. Other assets at 2.4% revenues (avg. last 3YR). The rest of the current assets and liabilities remain fixed during the period.

Interest rate increasing progressively to 4.5% in 2028 (current term loan matures in June 2026.

Tax rate of 30.0% (German tax rate of 29.9%).

Dividend

The company paid this year a dividend of €1.15 per share:

€0.40 ordinary dividend. We assume a constant €0.40 dividend per share policy, implying a dividend yield of 6.8% and a payout ratio of 50-60% (target of 50% to meet our investment thesis). The dividend yield is too high (80%) as it has been discounted for the stock’s illiquidity.

€0.75 extraordinary given FCF was €85m and leverage ratio was at 1.1x. The company decided to distribute extraordinary dividends as it would not affect the financial strategy of the company.

The dividend was proposed when the share price was €10.5. Today trades at €5.9. Given the current low valuation, we believe that if this year’s cash flow generation remains strong, the company should substitute a potential extraordinary dividend for a share buyback program. However, given the stock’s illiquidity, it might have negative impacts.

Forecast: Expected dividends for the upcoming years should be €0.40/sh (6.8% dividend yield)

Capital structure

The company has a €250m term loan matures in June 2026. In addition, the company has c. €40m leases and €27m of pension liability. Cash position stands at €170m as of June 2023.

The current leverage stands at 1.8x EBITDA (net debt, including leases).

Projections output

These are conservative projections as net profit will fall from €50m in 2023 to €25-28m. The same happens for FCF, generating significantly less cash in the following years. The main purpose of creating conservative projections is to lower valuation expectations. Despite these highly conservative estimates, the stock is still significantly undervalued.

We can conclude that we are not in a value trap by being extremely conservative.

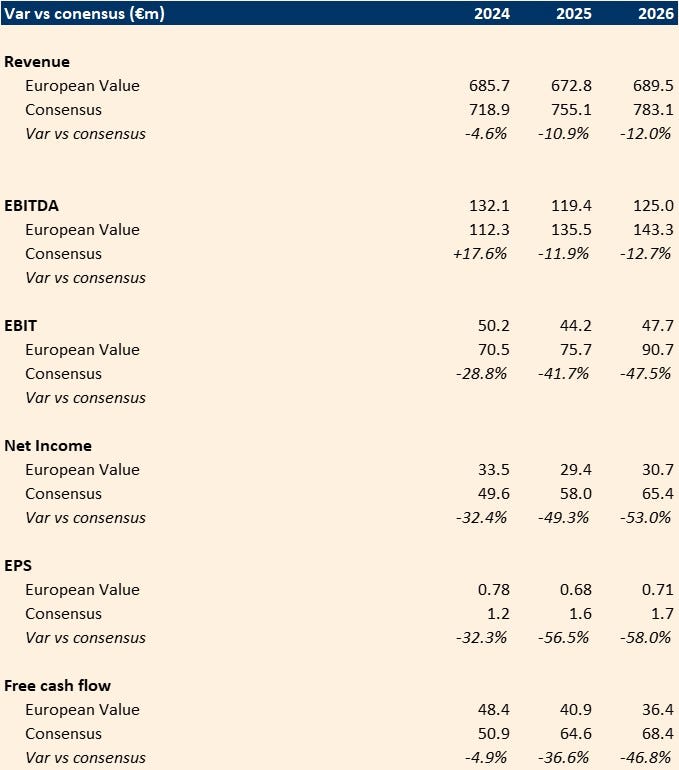

Are our forecasts higher than the consensus?

No, they are significantly lower for every single key metric:

Key metrics

10. Valuation

A) DCF model

We consider that, overall, our projections are very conservative. We set a lower revenue growth for the mid-term vs. management case and maintain expenses relatively high.

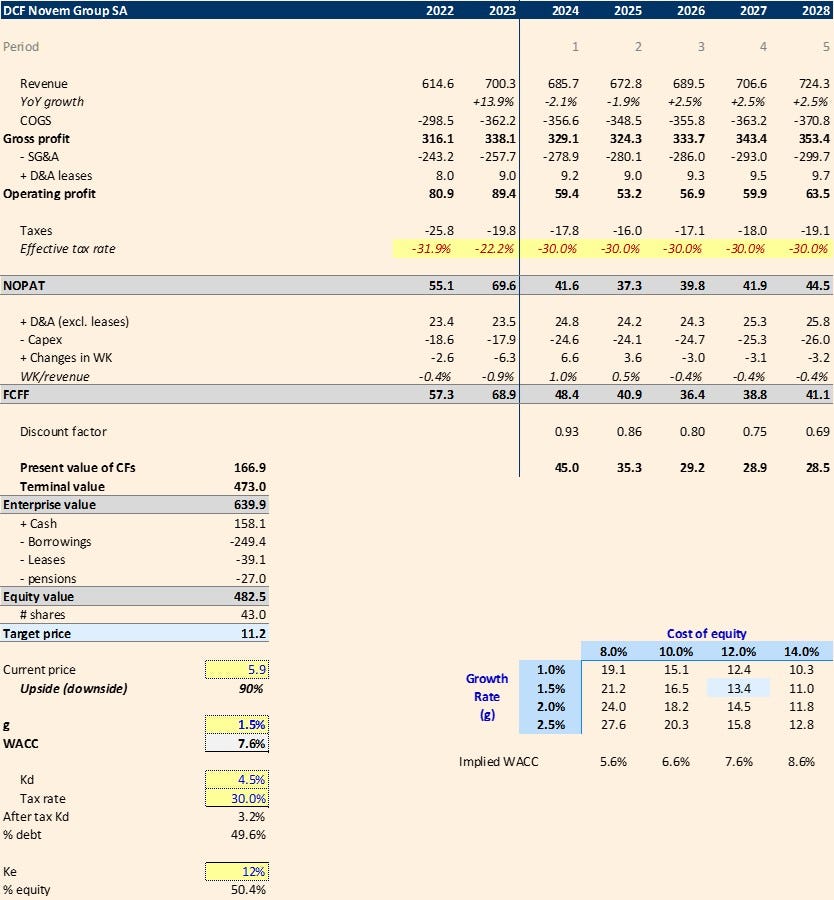

We value the company using a DCF with a WACC of 8.3% (12.0% cost of equity and 4.5% pre-tax debt cost) and a perpetuity growth rate of 1.5% (again, these are conservative figures).

This results in a valuation of €11.2 per share, implying a potential upside of +90%

If we use a lower cost of equity of 10%, the company will be worth €16.5/sh (+179% upside)

B) Multiples valuation

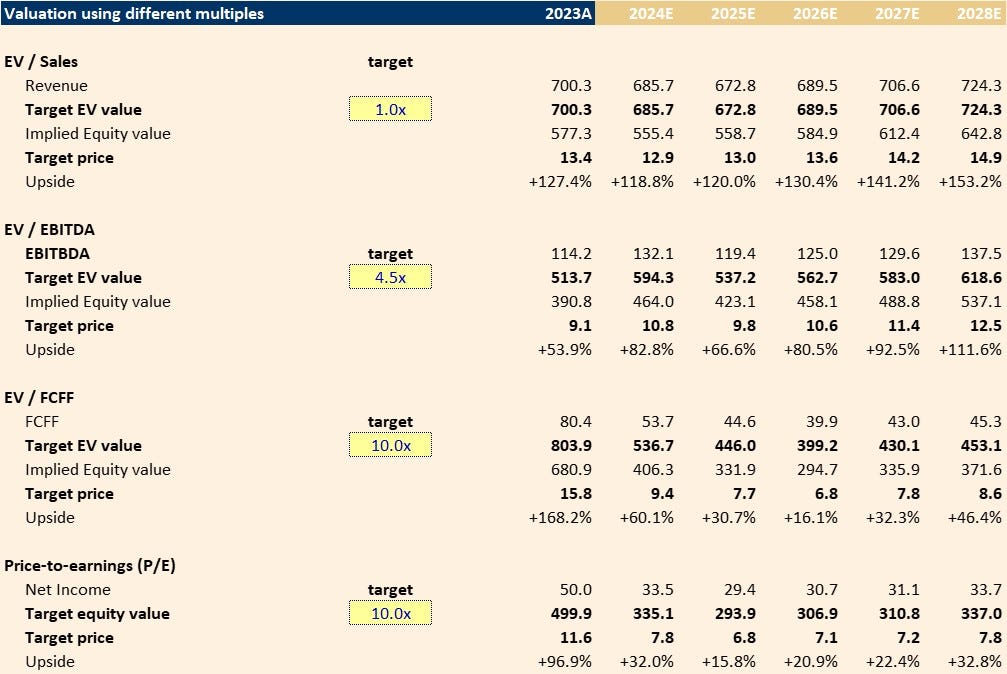

Using conservative multiples, the company will be worth between €6.8/sh (+16.1% upside) to €14.9/sh (+153% upside)

Note that we have significantly stressed the company’s earnings to considerably lower levels than the previous two years. Should the EPS be in the same range of 2022 and 2023 (c.€1.0-1.10/s), the company will be worth between €10.4/sh (+77% upside) and €11.6/sh (+97% upside)

Is our valuation forecast higher than the consensus?

No, it is significantly below consensus (€10.8 per share vs. €15.94 of average consensus). The lowest estimate in the consensus of €10.2/sh stands slightly below our forecast of €10.8/sh

Our investment

We have committed 6% of our portfolio (currently invested 4% at an average price of €5.837/share.

Thank you for reading the report. Please leave a comment if you have any questions or comments. I will be happy to discuss it!

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Contact me

Twitter: @Value_Europe

Mail: european.valueinvestor@gmail.com

Excellent analysis and opportunity!