Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Summary of the investment thesis

During August 2024, I invested in Porsche AG, the operating company of Porsche. Shares were acquired at €69.08 and currently represents ~8% of the portfolio with the goal to be ~3% once the portfolio is fully invested.

I’m investing in one of the most iconic brands in the world, trading at 13-14x FCF. The company went public in October 2022 at €84/sh, and currently trades 40% lower than historical max of €120/sh, at €70 per share.

Company is launching new vehicles during the next years (2024-2026), all electric and I believe the current product offering will be a great success. The company has no debt, and generates a significant cash flow every year, sustained by one of the highest operating margins in the sector.

There are risks in this investment, mainly related to the electric vehicles. Currently, demand is lower than expected, but its a reality that the market is going to that direction and its a question of time that EVs will dominate the market. In any case, the firm will continue selling cars with ICE.

In this post, I’m introducing my new checklist that compiles qualitative and quantitative criteria to categorize the quality and potential of the enterprise. The result is a score of 103 out of 150 possible points (69%).

Industry: Luxury Cars (18/30 points)

6️⃣Industry overview. Generally speaking, the whole automotive industry faces a difficult moment. However, the more luxury, the more resilient. Porsche is in the low-end of luxury cars. Margins in the luxury are high, compared to the traditional brands.

6️⃣Competitive landscape. The industry is highly competitive, with dozens of competitors. Porsche is a brand between the high-end premium and the low-end of luxury cars. The new cars to be launched will test this segment and challenge competitors.

6️⃣Protection against disruption. The industry is evolving to the electric vehicle (EV). Porsche is well positioned as it has already launched several fully electric models. Risk of disruption is relatively low in the mid-term, however given that electric engines require less engineering, it is unclear if these premium cars will remain highly demanded. The current product mix is balanced between ICE and EV, diversifying this risk.

Note that if this was Ferrari, overall industry score will be close to 30; if Volkswagen, the parent company of Porsche, probably less than 10 points.

Company - qualitative (35/50)

8️⃣ Company easy to understand. Porsche manufactures all-day sports cars, targeting the low end of the luxury segment. It is easy to understand, although its financials need some adjustments due to the financing services company.

7️⃣Global business. Porsche is a global business and sales are balanced towards Europe, America, and China. However, sales in China are suffering, earning a lower score for that.

6️⃣Competitive advantages. The brand and positioning are the major competitive advantage. This allows Porsche to earn higher margin than most premium OEMs.

8️⃣Market share. Porsche has around 20% market share in the luxury segment (from €80k to €200k), and occupies a niche where it faces competition from premium automakers, which put them in a good position given the power of the brand. In reality, the market share might be event higher as average selling price stands at ~€120k per vehicle).

6️⃣Management and corporate governance. The company is well managed and had a very successful evolution during the last decade. The biggest issue: the CEO of Porsche is also CEO of Volkswagen, which de facto implies that it is not 100% at Porsche. The preferred shares have no voting rights (i.e., as a shareholder, I have only economic rights), which reduces this score.

Company - quantitative (43/60)

6️⃣Future growth. The company is heading towards pricing rather than volume, which seems like the correct strategy. The company will launch a new vehicle in 2026 and will also launch electric vehicles during 2024-2026

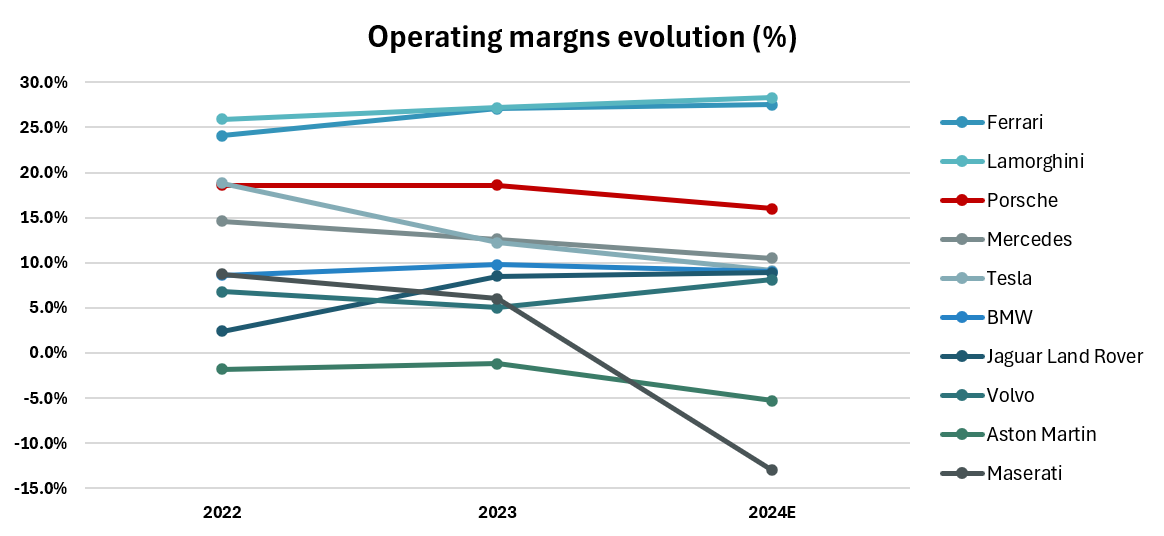

7️⃣Margins. The company is targeting an operating margin of 20% for the mid-term. The current margin stands at 16.0-18.6%, which is:

Above all premium manufacturers such as Jaguar, Maserati, BMW, Mercedes, etc.

Below the luxury high-end brands Ferrari and Lamborghini of ~27%

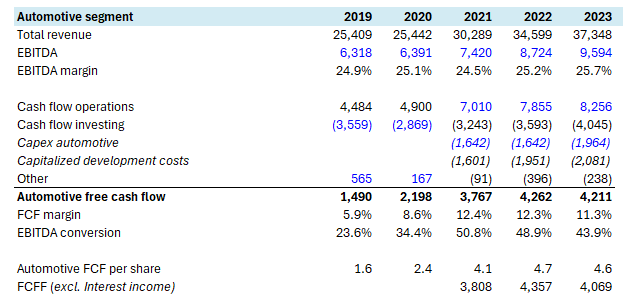

7️⃣Cash generation. The company generates ~€4bn of FCF and converts 40% of their EBITDA into cash flow. In terms of FCF margin (FCF/Revenue), it stands at 11-12%, which is not very high, but significantly better than premium OEMs and below Ferrari (~14-15%)

7️⃣ROIC. The company reported a return on investment of 24.7% in 2023, which is very high for the industry.

9️⃣Capital Structure and balance sheet. Excluding the financial services division, the company has no debt and the automotive division has an excess cash of more than €5 billion

7️⃣Shareholder retribution. Given the corporate structure, it is difficult to think about share buybacks and there will only be dividends. The company distributed €2.4 per share in 2023 and generated €4.6 of FCF per share from the automotive segment. Its a prudent and smart strategy.

Valuation (7/10)

7️⃣Valuation. The company trades at around ~13-14x free cash flow, which is not expensive given the terminal value of the brand and the margins of the company. It is however not a deep value investment, but it can provide a decent return during the next years given that the company can benefit from strong demand in their EVs from early adopters.

Investment thesis

Index

History of the company

Luxury Cars Industry Overview

Porsche brand and strategic vision

Strategy and product offering, manufacturing, and technology

Overview of Porsche cars

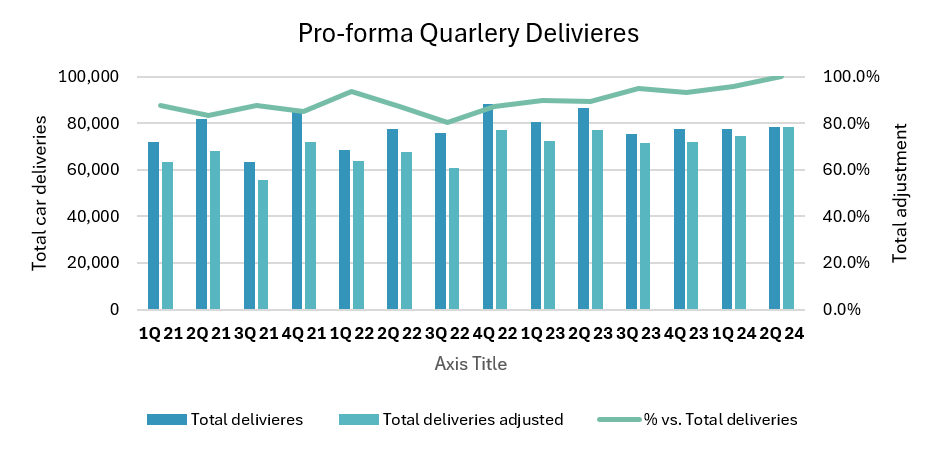

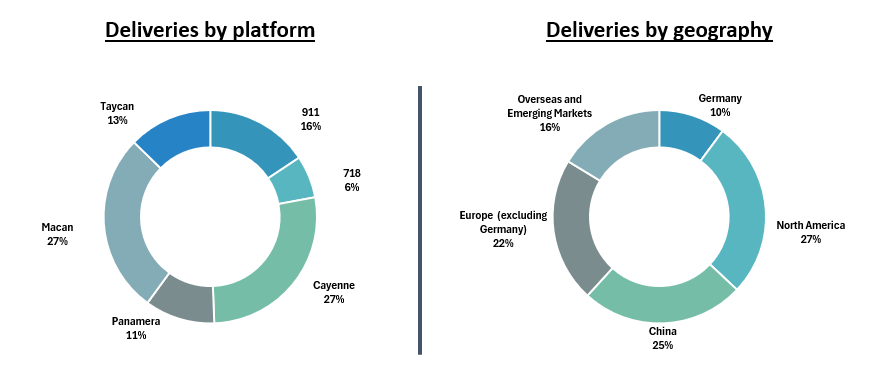

Breakdown of Porsche deliveries

Management and Corporate Structure

SWOT analysis

High-level financial analysis

Valuation

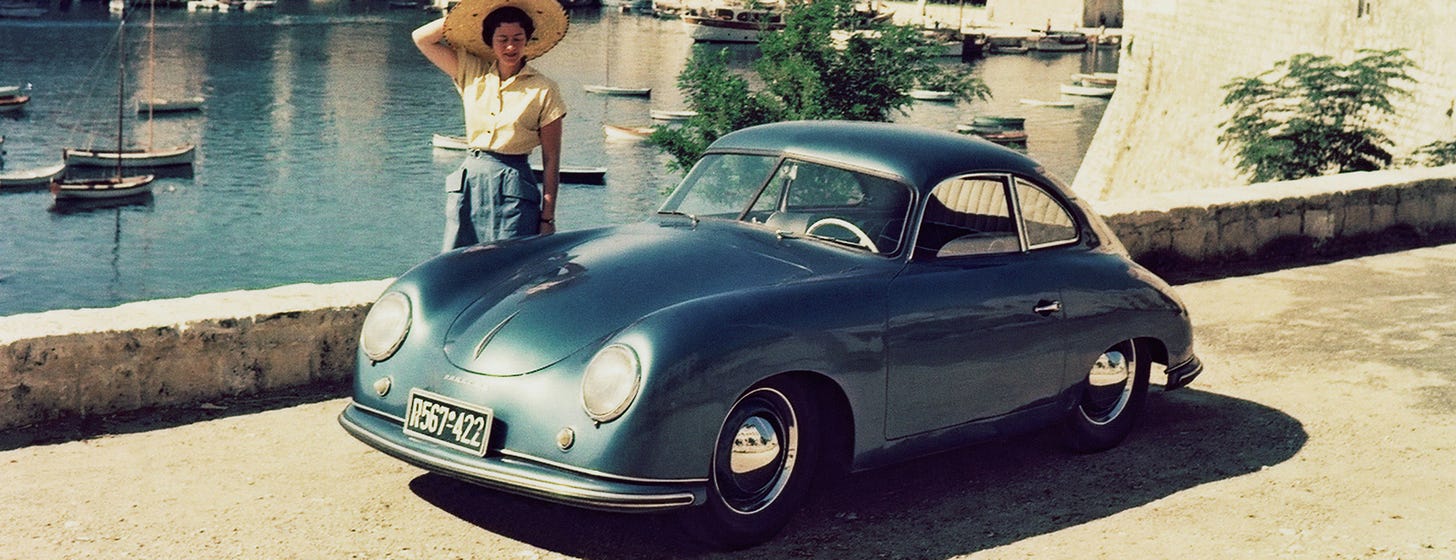

1. History of the company1

Before jumping to the company’s history, let me recommend you to listen the Porsche episode from Acquired Podcast:

Porsche was founded in 1931 by Ferdinand Porsche, an Austrian automotive engineer with a background in designing vehicles for other companies like Volkswagen. Initially, Porsche focused on providing consulting and development work rather than manufacturing cars. One of its first notable projects was the design of the Volkswagen Beetle, one of the most iconic cars in history. The company's engineering prowess set the foundation for its future as a premier sports car manufacturer.

The name of the company is Dr. Ing. h.c. F. Porsche AG, which stands for Doctor of Engineering Honoris Causa Ferdinand Porsche

Ferdinand’s son, Ferry Porsche, played a pivotal role in the company’s evolution. During World War II, Ferdinand was imprisoned, and Ferry took over the company’s operations. In 1948, Porsche introduced its first sports car, the 356, which became a foundation for the brand's reputation for combining performance with design. The 356 was built in Austria and later moved to Porsche's headquarters in Stuttgart, Germany.

The Porsche family has remained closely tied to the company. Ferry’s son, Ferdinand “Butzi” Porsche, designed the Porsche 911, which debuted in 1964. The 911 became the brand’s flagship model and is still in production today, with its iconic shape and rear-engine layout. The Porsche and Piëch families, descended from Ferdinand Porsche, continue to influence the company through various business roles and their ownership stakes.

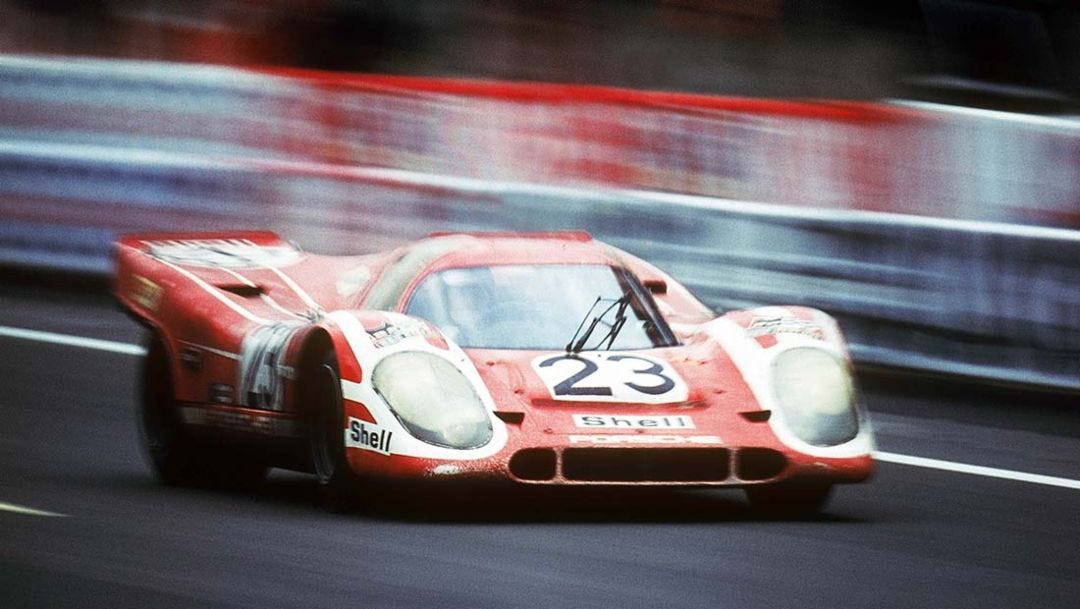

Porsche's success on the racetrack also contributed significantly to its brand identity. One of the company’s key milestones was its dominance in the 24 Hours of Le Mans, the world’s oldest endurance sports car race. Porsche has won the event more than 20 times, setting a record for the most victories by any manufacturer. Their victories, especially with the Porsche 917 in the 1970s, solidified the brand’s motorsport legacy.

Iconic models like the Porsche 911, 917, and later the Carrera GT and 918 Spyder, not only pushed boundaries in terms of technology and performance but also cemented Porsche’s reputation as one of the most desirable and innovative car manufacturers globally. The introduction of SUVs like the Cayenne and electric vehicles like the Taycan shows the company's adaptability while maintaining its focus on performance.

Key moments in Porsche’s history include the creation of Porsche AG in 1972 when the family stepped back from direct management, Porsche's public offering in 2022, and the constant evolution of the 911, which remains a symbol of Porsche's dedication to engineering excellence and driving passion.

2. Luxury Cars Industry Overview

Porsche operates in the luxury automotive industry, They are part of the low end of the luxury market, facing competition from the premium OEMs (e.g., the luxury cars of Mercedes)

Porsche dominates a segment with limited competition. Its a segment between premium (Audi, BMW, Mercedes) and the highest luxury cars (Ferrari, Lamborghini). They do face competition from premium brands in the SUVs and berlinas, but no competition from these in the sport cars.

This market is rapidly changing with the emerging Chinese players. In China, the competitive map is completely different, as local brands are gaining strong relevance. It is a market that is rapidly changing and this luxury vs. premium categories will be tested in the coming years (for more about China, see the China section)

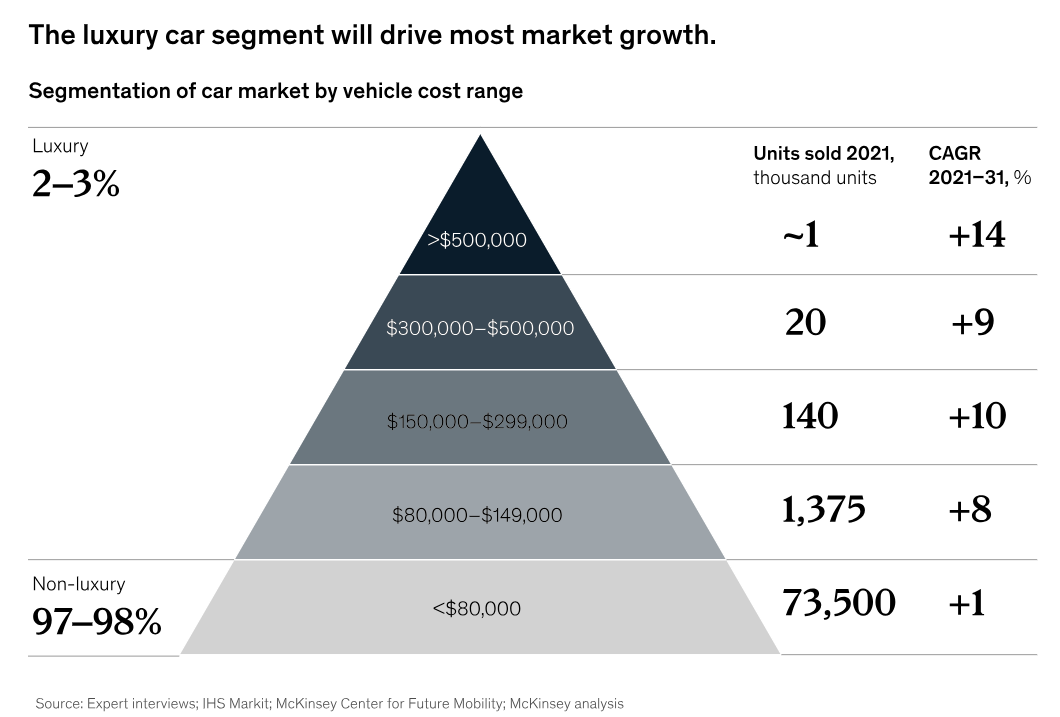

The segment where they operate are expected to growth at a 8-10 CAGR 2021-31.

According to this chart from McKinsey2, the company has a ~20% market share in the luxury market: it sells ~300k units per year in a market of ~1.5 million units. If we exclude cars below $100,000, the market share might be much higher than 20%.

The luxury car segment is a much better industry than the non-luxury one. Margins are higher and future growth prospects too.

In the non-luxury segment, competition is fierce and the transition to the EV is a real challenge. For luxury segment, the transition is different as margins in the industry are higher, therefore they do not compete in price, making the transition smoother in terms of margins.

It remains unclear whether brands like Porsche will continue to lead the luxury segment in the electric vehicles as engineering becomes less important and software gains more relevance. However, this is something that will not change in a few years and it should take around 7-10 years to see the impact.

Porsche benefits from strong tailwinds:

Luxury cars are proving to be resilient and its a category that maintains growth, especially companies like Ferrari and a solid demand

High Net Worth Individuals (HNWI) are expected to continue increasing

The segment has less risk of disruption than the premium or mass-market segments, where the transition to the EV is being very complex

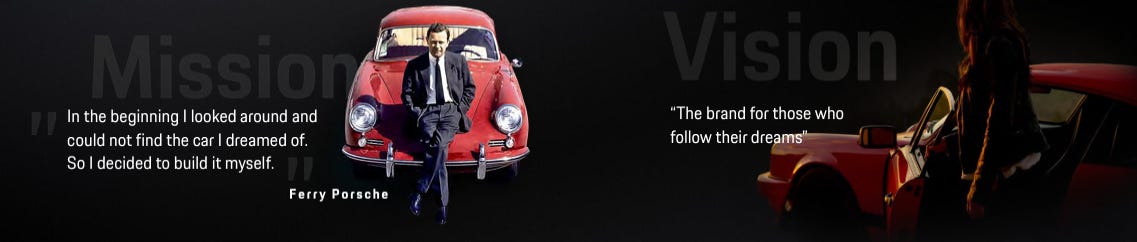

3. Porsche brand and strategic vision

The brand for those who follow their dreams

Porsche brand is one of the most iconic luxury brands in the world. The brand is one of the most valuable in the world according to different media. Porsche is one of the most iconic luxury brands in the world.

Porsche cars don’t need logos. You see a Porsche in the street, and you know its a Porsche.

Its a brand with strong heritage as it was born 80 years ago and has a very special relationship with motor sports and celebrities such as Steve McQueen.

The company is one of the most recognized sports brands in the world thanks to the Le Mans race. Its a magic relationship with the race and has decades of history. Same as the heritage in luxury firms such as Hermès or LV, Porsche is one of the most iconic brands in the sports car industry. Only Ferrari is able to challenge this heritage.

Porsche brand has many common characteristics to Rolex:

Both brands are not high-end luxury brands, but have a very powerful brand

The brand associated to luxury and quality allows both companies to tackle the premium high-end and low-end luxury segments, which offer strong margins and a higher TAM

Rolex watches and Porsche cars are aspirational products

Both companies sell thousands of units, allowing them to generate significant amount of profits

According to the Group’s customer surveys, the Porsche brand is the number one reason customers in France,Germany, Italy, Spain and the UK decide to buy a Porsche.3

The fan community is huge and there are over 700 independent Porsche clubs and over 240,000 members.

Who buys a Porsche?

According to the company, and based on the self-reporting by customers, the average household income of the customers was €320,000 in Germany, €410,000 in China, and €510,000 in the United States.

The company defines its customers as:

“A typical Porsche customer today is often an ambitious person with a high income and standard of living and, at least in Western markets, tends to be male. However, the Group is further targeting female and younger customers as well as creative leaders as potential Porsche customers.”

However, this is a generalization. In China, the type of customer is different. It has an average of 37 years and females represent 48% of the customer base.

The company now states it is targeting other customers such as driven youth, driven women, and Gen Z in China.

4. Strategy and product offering, manufacturing, and technology

Porsche’s iconic model is the 911 and during decades the company sold sport cars. However, 2002 marks the beginning of a new era with the introduction of their first SUV: the Cayenne.

Now, the Cayenne and Macan (both SUVs) are their most sold cars across the world.

This is what makes Porsche special: its a luxury product that can be used every day for every need.

The company offers three types of products:

Sport cars: The 718 series (low range), and the 911 versions (the highest end of Porsche)

Sedans: The Panamera, with an ICE and the Taycan, the first every EV from Porsche

SUVs: The Cayenne and the Macan, which now will turn fully electric in Europe

All the cars are being renewed, starting from 2024, and the company is going to have its youngest product offering in history. This should create a strong momentum in sales during the next years.

The company is transitioning very fast to the electric vehicle and by 2025, half of its product offering will be electric across the three types of cars. The strategy followed makes lot of sense, and seems very balanced:

Sport cars: The company recently launched the new 911 with a hybrid motor, but maintaining the essence of this icon with the ICE. The 718 series, which are cheaper, will turn 100% electric in 2025, testing the market for the electric two-door sport cars

Sedans: The Panamera remains with ICE (including hybrid technology) while the Tycan is the 100% electric version, that has been a success for Porsche

SUVs: The company is launching the Macan 100% electric, and will launch the Cayenne electric during 2025.

In terms of customer service offering, beyond the Group’s portfolio, the company offers:

Porsche Classic: the Group maintains a stock of around 60,000 different genuine parts, which underpins a series of Porsche Classic repair services,

including body repair, paint services, interiors, etc.

Although not very relevant in terms of sales (€150 million in 2021), the segment is key to provide service to the customers the best-in-class service for their cars. Approximately 60% of customers who owned a Porsche vehicle more than ten years earlier still owned it as of April of 2022Exclusive Manufaktur: Porsche offers a wide range of options for individualization available through Porsche dealerships. For an even further

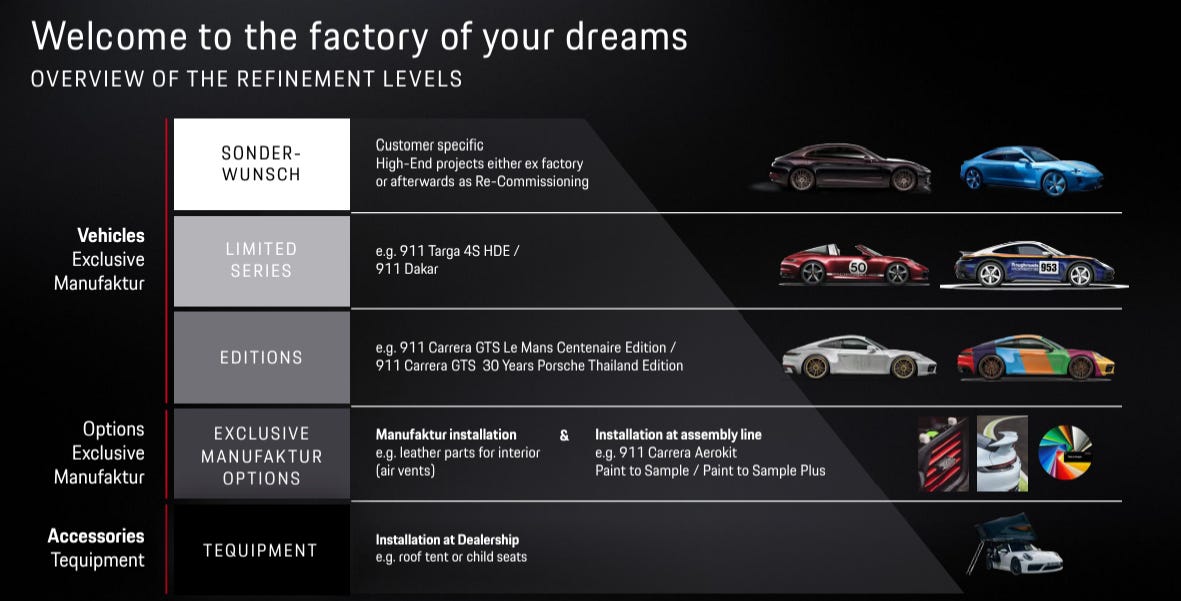

customized Porsche, customers can engage in co-creation and customization of a Porsche vehicle.

Its core to develop a strong product customization which allows for higher pricing, and further developing the brand

This segment generated €750 million in 2021, and there is room for further growth if the company maintains a true luxury approach.

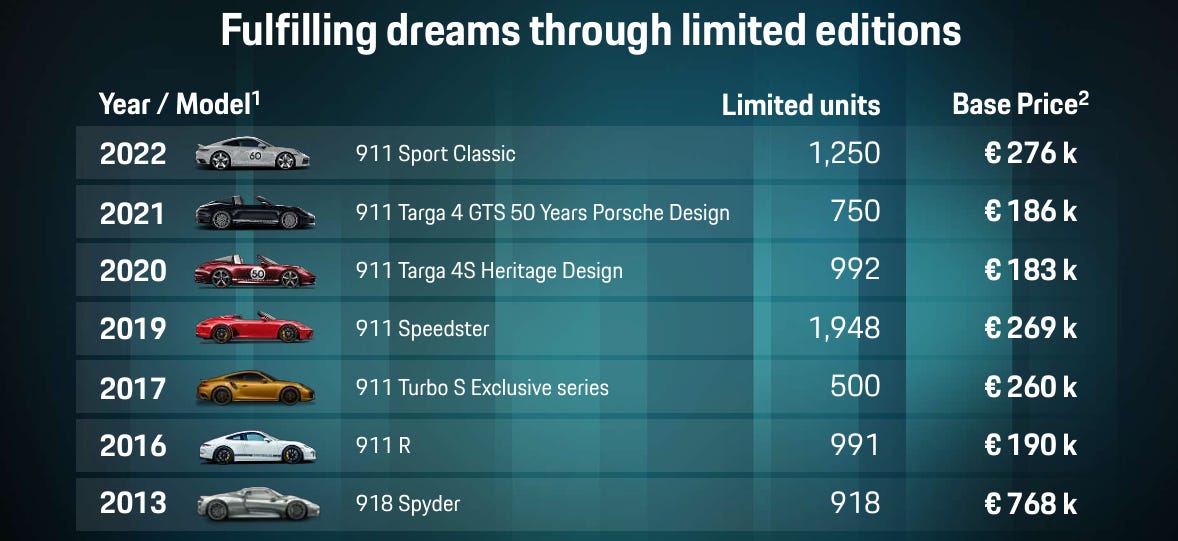

One of the key successes of brands like Ferrari is the limited editions, which are extremely profitable cars as they are unique cars sold at very high prices.

Porsche is doing something similar with their iconic 911. Still far from what Ferrari can do, but the company offers exclusive vehicles through limited series or special editions.

Customers can customize an entire car through the Sonderwunsch (special request service)

Limited series such as the 911 Dakar

Special editions of the high end cars such as the 911 Carrera GTS Le Mans Centenaire Edition

In the car industry, a real luxury car is one you can entirely customize, and all materials are of the highest quality. Porsche offers a strong service to customize a vehicle.

As you can appreciate in the previous image, the number of limited editions is growing, but realistically, the impact on revenues is limited (e.g., all the 911 Sport Classic at the base price will represent 345 million of revenue (~1% of total revenue).

The big sales potential comes from the customization service. It is one of the core elements to further enhance the brand for the next decades. To be truly luxury, the company need to offer a very strong customization service.

It is still represent low percentage of revenue, around 2% of total revenue.

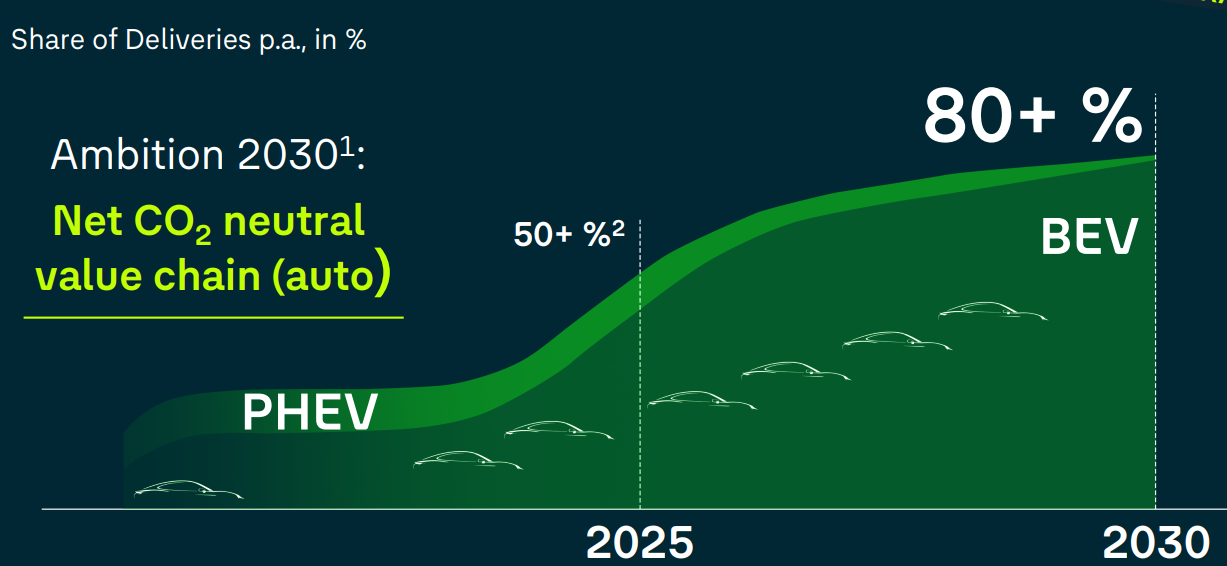

A high bet for the BEV

In 2022, the group stated:

“The Group’s ambition is that, in 2025, over 50% of new vehicles delivered will be Electrified Vehicles and, in 2030, over 80% of new vehicles delivered will be BEVs.”

They are on track to achieving it, and by 2025 half of the product offering will be 100% electric.

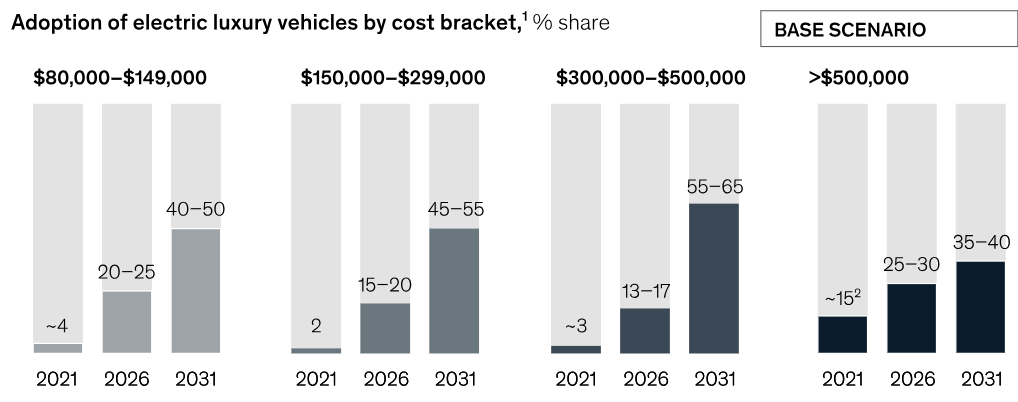

Based on a Mckinsey study, around half of the vehicles of Porsche’s segments will be electrical by 2031. The launch of new EVs during the next years will put Porsche in a strong position in the EV market.

Additionally, the SUVs are expected to dominate the market, and the Macan and Cayenne are market leaders.

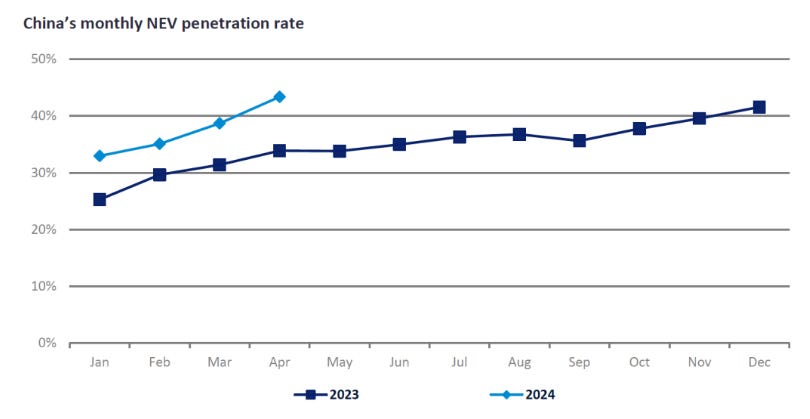

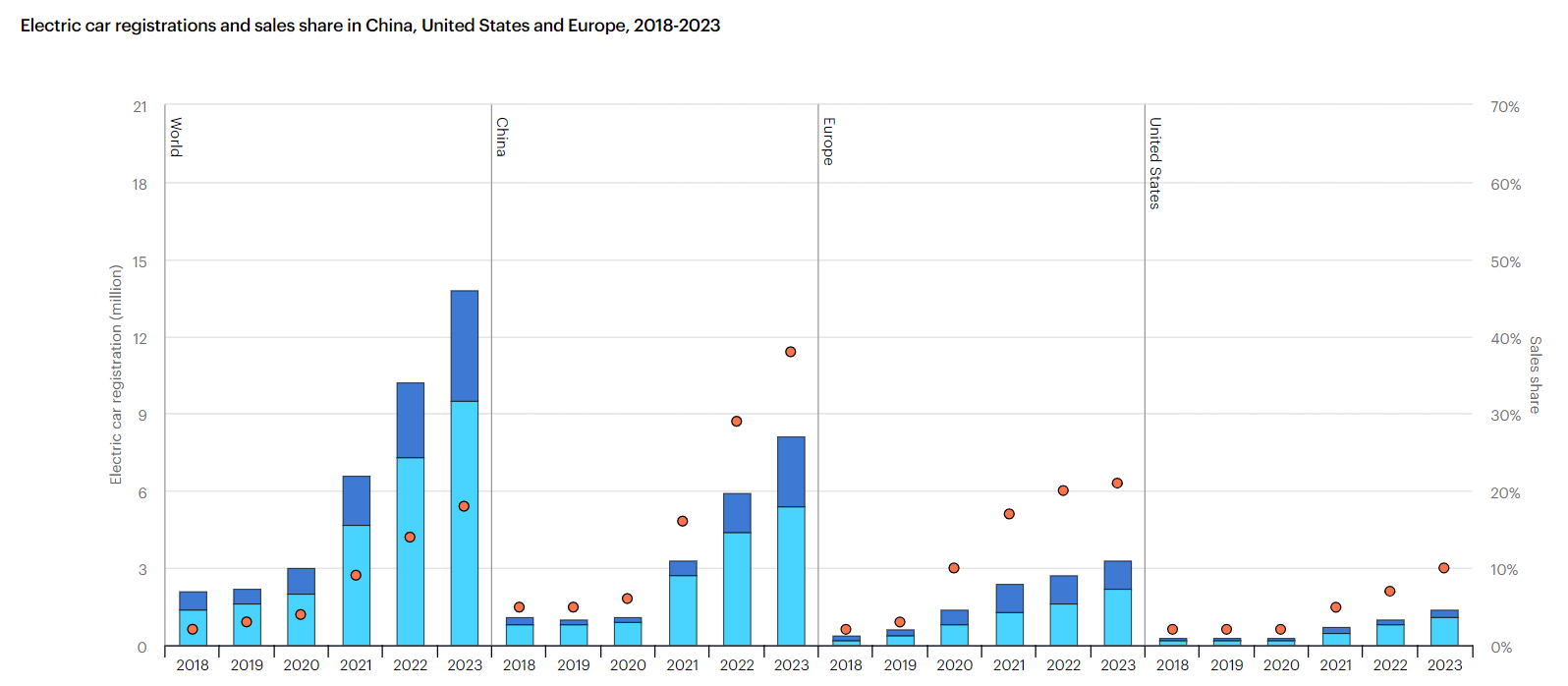

In general, the transition towards the Electric Vehicle is slower than expected, however the trend is clear. The market share of electric cars is growing, and 1 out 5 cars sold worldwide is electric. Additionally, if we think about who can buy an electric vehicle, clearly the potential Porsche customers.

In this transition towards the EV, many manufacturers are struggling to offering competitive products. For that reason, in the current market environment, only the most efficient firms or the ones selling in the high-end segments will maintain a solid profitability.

Volkswagen said it might close two factories in Germany if demand remains weak

Volvo has abandoned its target to become 100% electric by 2030

Mercedes has walked-back its mid-term EV sales target, etc.

Same as in other segments, the premium manufacturers are struggling given low consumption after the recent macro headwinds (inflation, interest rates, etc.).

Economy seems to remain a solid pace, but the premium segment has been very affected. Take the example of Kering vs. LVMH or Hermès, or many other premium players that are now suffering the consequences of the last macro events. Porsche could be more Louis Vuitton, in terms of luxury positioning.

Porsche is not a premium brand, and therefore its more protected than competitors like BMW or Audi. Its customers have more capacity to spend than the customers of premium brands.

For that reason, my modest opinion is that the new electric vehicles that the company will introduce have the capacity to become very popular as, its pricing its not that far from a BMW or Mercedes, and in the end… its a Porsche.

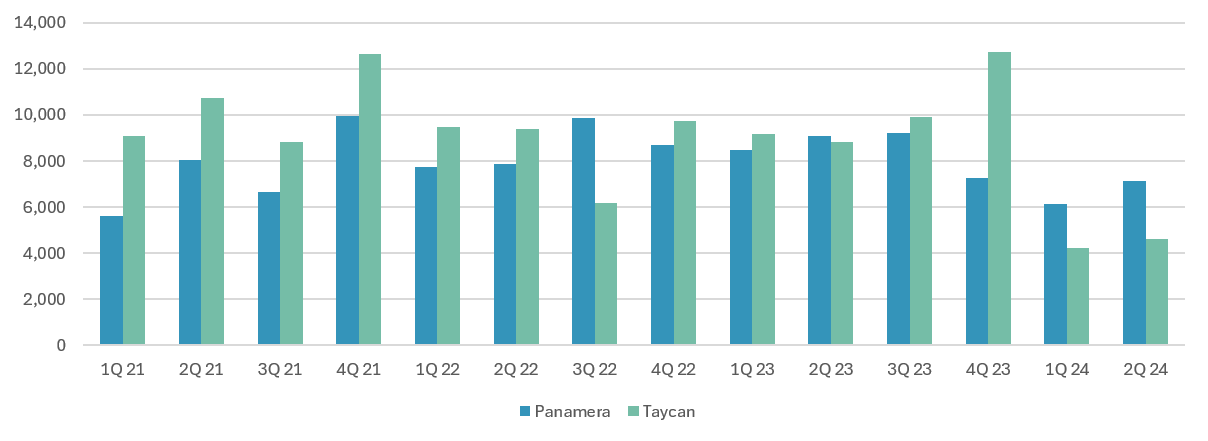

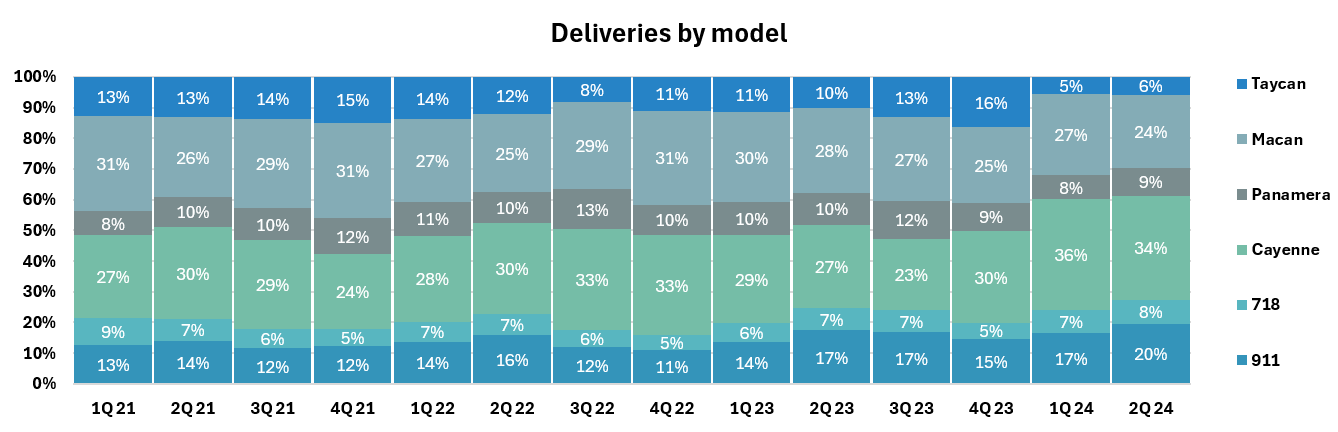

Finally, this chart shows that there is demand for electric Porsche cars: the deliveries of the Taycan are higher than the Panamera, two cars relatively similar in size, one ICE (Panamera), the other electric (Taycan).

Until 2023, every quarter the company has delivered more Taycans than Panameras. The year 2024, is being challenging, but in 11 out of 12 quarters, the Taycan has sold more units that Panamera.

As a conclusion:

Demand for new Porsche cars should remain stable in the future, leveraging on the power of the brand. I believe that the introduction of new electric vehicles might even accelerate the demand as there will be many early adopters and new customers

Production has increased significantly in the last decade, and the company is preparing itself to remain competitive with lower demand. In the case of Porsche, a drop in demand is not as significant than in its parent company Volkswagen

The big question is whether these new Porsche all-electric vehicles will be a success. In the near term, I’m not sure but in the future, electric vehicles will be the norm and there will always be people willing to increase their status with a sport car such as Porsche’s ones.

Porsche’s electrification process

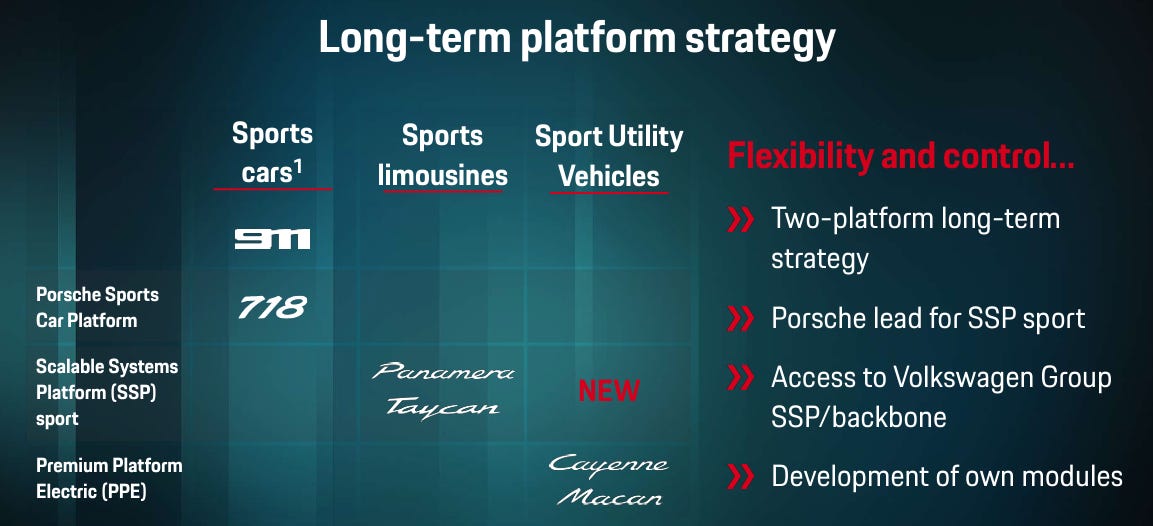

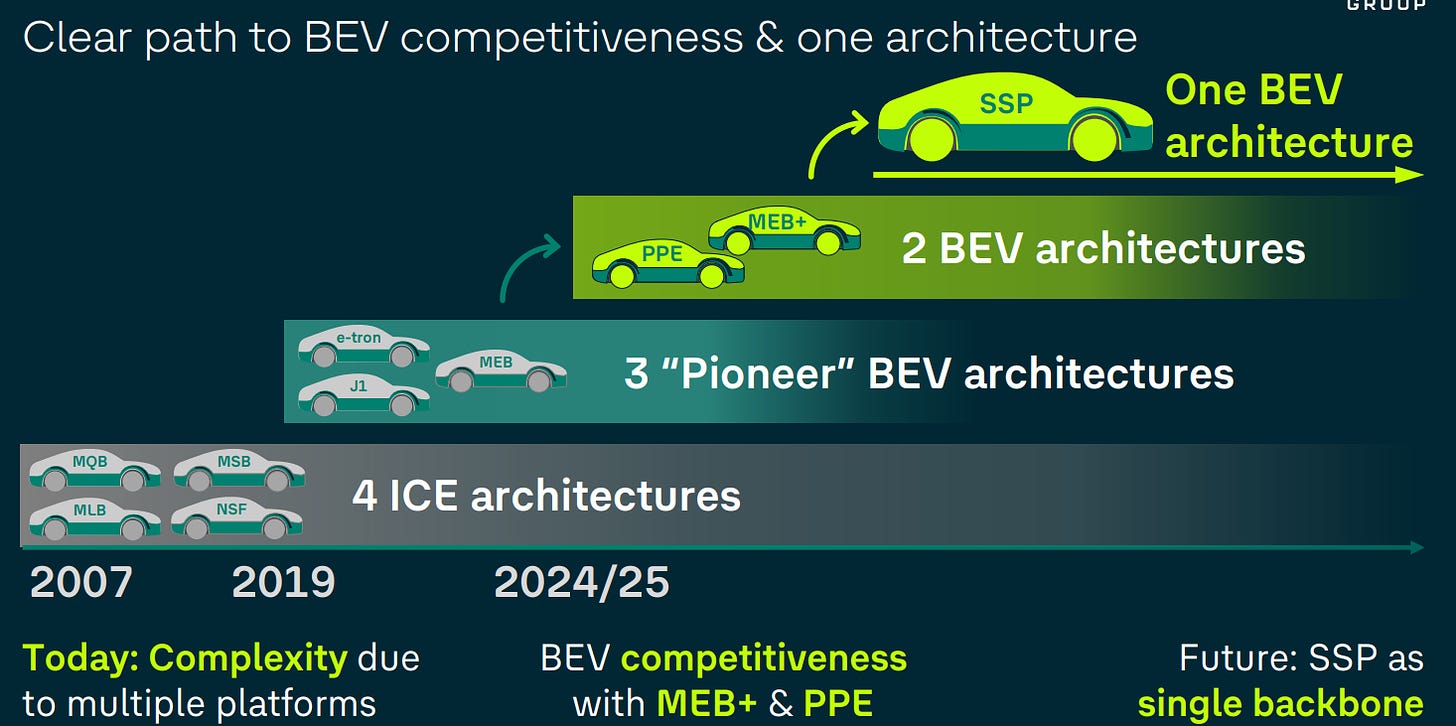

To achieve the successful transition towards EVs, the company leverages on Volkswagen platforms:

The 911 and 718 ICEs platforms are developed internally by Porsche. The future electric platforms will be fully developed by Porsche, maintaining the control over the two-door cars

The Cayenne, Panamera, and Macan ICEs rely on modular architectures designed by Volkswagen

For the new electric vehicles:

Porsche has developed, together with Audi, the Premium Platform Electric (PPE) as an intermediate solution for the Cayenne and Macan.

In addition, Porsche is developing the Scalable Systems Platform (SSP) for the long-term for the Panamera and Taycan models.

The Volkswagen group has committed to develop one single BEV architecture by the end of the decade, which adds concerns on whether Porsche will maintain its luxury sports car status.

The PPE platform

The PPE platform is one of the two platforms for BEV that Porsche has developed with Audi as a mid-term solution. This platform will host the Macan and Cayenne electric versions.

The Macan platform mounts 100-kWh battery with 800-volt architecture:

Porsche states that the 100 kWh battery is the best balance between range and performance

The 800-volt technology is pioneered by Porsche with the Taycan. Its the first manufacturer to employ this technology (the highest voltage usually employed is 400V)4. Thanks to this technology, the Macan can charge its battery from 5% to 80% in less than 25 minutes. It also supports the 400v technology.

PPE's battery design is relatively conservative, but it provides higher safety and has an aesthetic sense in engineering.5

The main advantages are of the 800v architecture mounting 100kWh batteries are:

Higher ranges. The Macan has significantly higher range than Tesla Model X( 370 miles vs. 335 Tesla)

Faster charging (from 5% to 80% in less than 25 minutes, 10% to 80% in 30 minutes for Tesla)

Easier to repair the battery as it is built with individual modules can be swapped out when faulty

Allows for thinner cables inside the system, which produce less resistance and less heat, and therefore enhance the entire system’s efficiency. It should produce less heat and therefore enhance battery longevity too.6

The 800v architecture was not designed by Tesla or the Chinese manufacturers. It was first introduced by a Croatian company named Rimac, in which Porsche holds a 22% stake.

However, this technology comes with a higher price, as it is more expensive to produce. For that reason, not all manufacturers are betting on the 800v architecture.

In case of Porsche, its an obvious move as their customers require the best performance and have the ability to pay for it. For non-premium cars, its a matter of finding the right balance between price and performance.

Software

A lot has been written about the problems of Volkswagen’s software division called CARIAD. Many problems led to multiple delays. Now, the Macan seems to be good in terms of software.

It’s a clear that VW Group software is far from Tesla’s capabilities.

VW wanted to develop a single software platform, to avoid all its brands developing their own softwares and create inefficiencies, but its being a complete disaster.

Now, Volkswagen is partnering with Rivian to develop future software and with Xpeng in China to adapt to this core market. Note that many of these partnerships will ultimately benefit Porsche as any improvements in the group are beneficial for Porsche.

The new Macan has 5 major computer processors and the development has been very complicated.

“We had a lot of problems with software,” said a Porsche Manager, adding that everything was fixed now. “We have a completely new electrical architecture so that is always a challenge.”

According to many sources, Porsche is starting to develop its own software partnerships to avoid further delays.

An example is that the new Macan is the first Porsche to feature Android Automotive, a system that goes far beyond the standard Android Auto smartphone connectivity.

Android Automotive has the capability to control all of the car's electronic functions, including the infotainment system, instrument cluster, seats, lights, ventilation, and more. For now, Porsche is taking a cautious approach with the Macan, limiting the Google-based system's role to managing infotainment.7

In fact, Porsche is open to expanding its use in the future, with one engineer noting that “there are lots of degrees of freedom with Android Automotive, but it’s in the future.”

Eventually the problems should be solved. The good news is that Tesla doesn’t compete in the luxury segment and Porsche has the ability to develop better software than its peers, which some lack the fact of being part of a very big group than can invest billions in software.

Is the autonomous car a threat?

The fully autonomous cars are still many years away from massive production, but they eventually become a reality, especially in the US.

For now, it doesn’t represent a big threat for the next years as Porsche is about driving and performance. But in the future, it might be a big challenge.

As of now, the VW Group lags significantly below Tesla and other autonomous softwares, and is many years behind:

This is a big risk, however its probably a long-term risk that will affect more other brands such as VW if they are not able to compete against Tesla. Given my investment horizon is probably no longer than 5 years, I don’t consider this a relevant risk for that period.

As we will see later, the Macan seems to be well equipped, with many infotainment advances. The new launches will not have an impressive software, but should be good enough to offer interesting EVs.

Batteries

Porsche, as many other manufacturers, is having problems to ramp-up production of electric vehicles. This is a process than can take years, as a company doesn’t transition automatically from ICE to EV.

The company has developed strong batteries, using different suppliers and technologies. The are investing in several companies. The most recent is a partnership with VARTA, which manufactures the batteries of the 911 Hybrid version.

One of the main problems is that the parent company Volkswagen is building half of the promised battery plants.

“Based on market conditions, including the sluggish ramp up of the BEV (battery electric vehicle) market in Europe… there is for the time being no business rationale for deciding on further sites” Oliver Blume, CEO of Porsche and VW8

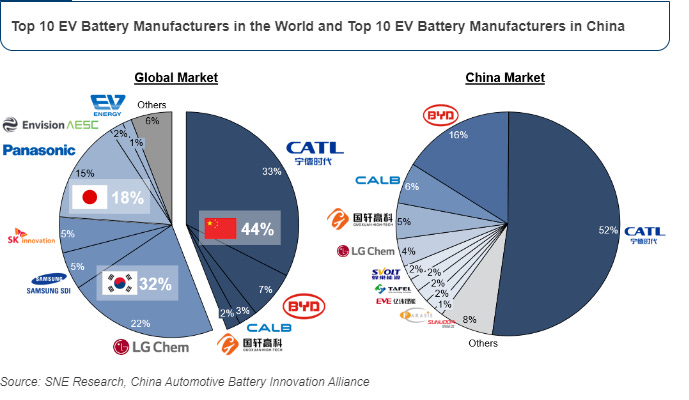

Western companies lag behind Asian players and need to rely on them for their batteries. The biggest player is CATL, and its the supplier of the batteries of the new Macan electric. Other players like Tesla also rely on CATL.

Porsche is exposed to risk of disruption in the supply chain, however being part of Volkswagen Group allows the company to be integrated in a group with high bargain power and huge resources. In case, the company (including all VW companies) lags behind in terms of battery production. However, the risk is mitigated to the fact that Porsche doesn’t compete in price.. but its something I want to see improved at the VW level.

The SSP platform

The SSP platform represents a significant step in the automotive industry's transition to electric mobility. By creating a common platform that can be used across a wide range of vehicles, Volkswagen Group, including Porsche, aims to standardize and optimize EV production.

Unified Platform for Multiple Models: The SSP is designed to replace several existing VW Group platforms, and the PPE (Premium Platform Electric), which Porsche and Audi co-developed for their luxury and high-performance EVs.

Scalability: The SSP platform is highly scalable, allowing it to be used across different vehicle segments. For Porsche, this will include everything from compact EV sports cars to high-performance electric SUVs like the Cayenne or Macan EV.

Enhanced Performance: Since Porsche’s brand identity is tied to performance, the SSP platform will focus on high-performance capabilities. Porsche will ensure the platform meets the high standards of handling, power delivery, and driving dynamics that its customers expect. Features like all-wheel drive, torque vectoring, and advanced battery management systems are likely to be integrated to enhance performance.

Advanced Software and Digitalization: SSP will leverage the VW Group’s software division (Cariad) to enhance connectivity, autonomous driving capabilities, and over-the-air updates. This allows Porsche to include advanced driver assistance systems (ADAS), seamless smartphone integration, and enhanced in-car digital experiences.

Battery Technology and Range: The SSP platform will support high-capacity batteries and new 800-volt architectures, ensuring faster charging times and longer ranges for Porsche’s EVs.

Production Efficiency: By using a common platform like SSP, Porsche can achieve economies of scale in production. 9

The key question is whether Porsche will ensure that future Porsche models remain true to the brand's heritage while embracing the future of automotive technology. I believe they will, as they are doing with the software, developing alternatives to VW Cariad’s division.

Production facilities

Porsche’s headquarters and principal manufacturing facilities are located in Stuttgart-Zuffenhausen.

The group has multiple facilities, mainly based in Germany. Because Porsche its part of Volkswagen Group, the company also produces cars in the multi-brand facility of Onsabrück, and Bratislava.

The Zuffenhausen plant is the home of Porsche’s two-door cars and also their Motorsport vehicles. Temporarily, the 718 series is being produced in a Volkswagen site as the company is upgrading the Zuffenhausen plant to adapt production for the upcoming EVs

Leipzig produces the Panamera and Macan series

The Cayenne is made in Bratislava and, some units in Malaysia (although not many cars are manufactured there)

Weissach, Germany, hosts the Porsche Research and Development Center, where Porsche vehicles are developed from first sketch to series production. Although different city, it is very close to Stuttgart, which is important.

5. Overview of Porsche cars

As explained before, Porsche sells three type of cars: sport cars, berlinas and SUVs.

As seen in the following chart, the core models are the SUVs, that represent more than 60% of total deliveries. The Cayenne, Macan, and the 911 represent 70-80% of deliveries. We will focus on these models, especially the new Macan Electric.

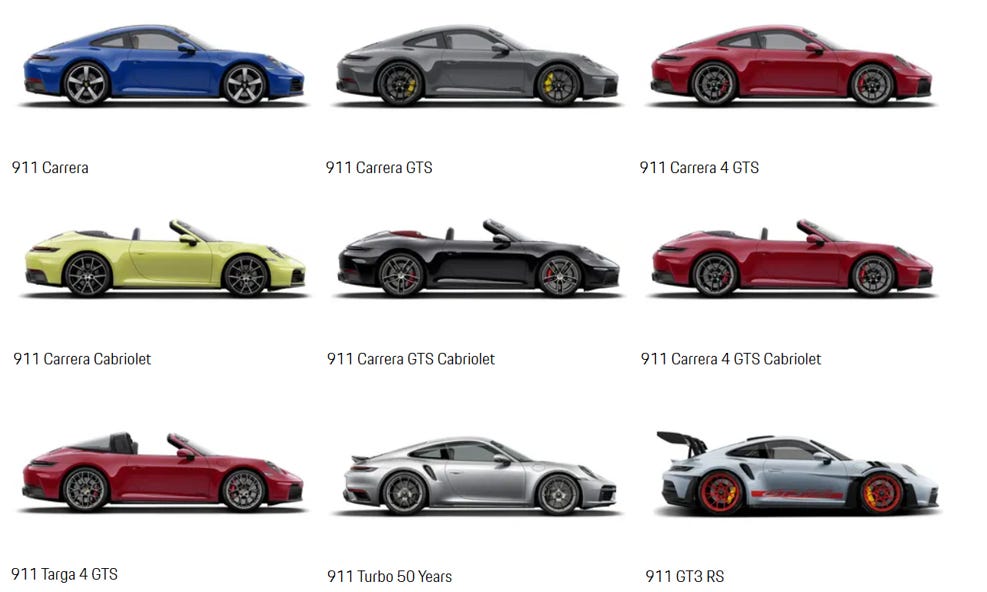

911 (a.k.a. Carrera)

The Porsche 911 is one of the most iconic cars in the sport industry. It was introduced in 1964 and is the flagship car of Porsche. Its original name was going to be 901 (first project of the 900 series), but Peugeot had a trademark for all three digit numbers with a 0 in the middle (206, 306, etc.). To avoid legal issues, they called it 911.

After 60 years since the first model was introduced, the shape of the car remains very similar.

The shape of the car has remained similar over the decades. This provides the 911 with a stronger legacy than any other brand. We all recognize a 911, but we don’t now the model of the last Ferrari (not a criticism of Ferrari, just a fact related to the legacy of this car).

This iconic car is the dream of many children, who eventually some will end up acquiring it. The 911 Carrera is the main version of the car, which comes with different performance categories such as GTS and Carrera 4 GTS.

The company has sold over a million 911s since 1964. During 2024, Porsche launched a new 911 with a hybrid powertrain. It is the first hybrid 911 as the company is planing to maintain the 911 with an ICE for the next years.

A hybrid version allows customers to go though the cities without a problem

It has been well welcomed in the market

The flagship sport car will remain ICE in the mid-term while Porsche will test the two-door EV with their cheaper version, the 718 platform.

Finally, most of the special editions are designed for this platform, as it represents performance and heritage.

718

These are the Cayman and the Boxter. The original Porsche 718 was a mid-engine race car from the late 1950s and early 1960s, known for its success in endurance racing. In 2016, Porsche revived the 718 name for the Boxster and Cayman models to emphasize their connection to that lightweight, agile racing heritage.

This is the first entry price for Porsche’s sports cars:

The 718 Cayman, starting at €64,000

The 718 Boxter, starting at €66,000

These models are ICE cars that will be fully renewed to fully electric cars starting from 2025.

The 718 series will be one of the first sports’ EVs in the market, and they will look really great, as you can see in the picture below:

The launch of these two door EVs marks an important milestone as designing an EV like this is challenging due to the higher weight of the car.

This platform will be the third launch of an electric vehicle by Porsche, a clear sign that the company is moving forward fast.

Porsche management has decided to test the market with this entry level cars, rather than risking the flagship 911 platform, which makes lot of sense. The Boxter has all the ingredients to be a clear success: electric, sporty, convertible... and Porsche.

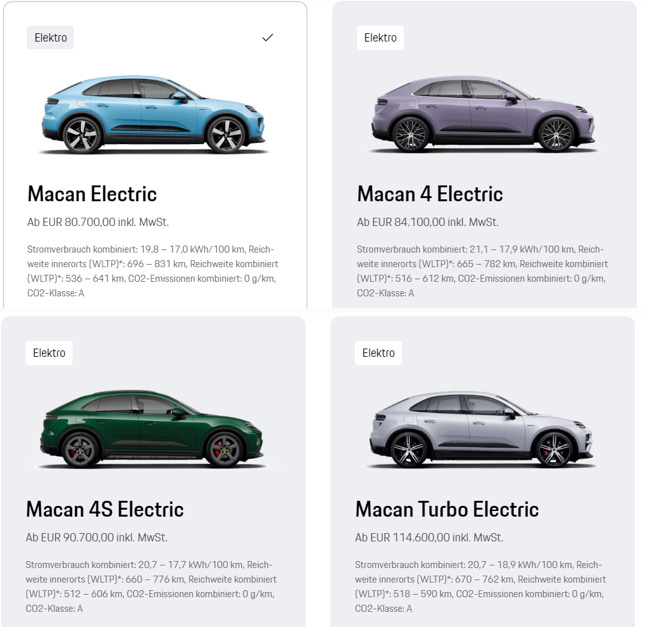

Macan

The name Macan is derived from the Indonesian word for tiger, with connotations of suppleness, power, fascination and dynamic

The Macan is the smaller version of their SUV offering. It is a lower entry price car, compared to the Cayenne, and its been a huge success for Porsche as it accounts for an average of 28% of deliveries (avg. 1Q21-2Q24).

In late 2024, the company is launching the all-electric Macan. This model is turning fully electric and is going to be a great product. Its a key moment for the brand as it will test the apetite for electric luxury SUVs.

Its a huge bet to become fully electric, but I think it will work

Outside, it looks completely new, with a design more curved. Inside, its the classical Porsche design, but upgraded with more technology. The company seems to be targeting wider segments, such as young people and people living in big cities.

This car has being renewed, with new design, fully electric now, and a great new interior. Porsche is getting serious and offers an SUV with a very good autonomy, given the weight and power of the car.

Porsche will offer up to four screens:

A fully digital cockpit

One screen in the middle + optional to add an additional for the copilot just above the glovebox

A new augmented reality head-up display that projects navigation images

The company offers four versions:

To provide some perspective of the performance, the Macan EV has more range than the Tesla Model Y (both models have the same dimensions). Its true that Macan is significantly more expensive, but performance is far better, a proof that Porsche is heading in the right direction. If the Tesla Model Y has a range of 310 miles, the Macan reaches up to 380 miles.10

I’m not comparing to Tesla as its they don’t operate the same segment, but the important aspect is to show that Porsche is developing really good EVs.

However, the car is far more expensive than the ICE version. Some reports suggest a price increase of more than $16,000-20,000.11 This is due to two factors:

The car is more powerful than the ICE and comes with a completely renewed infotainment elements, including two digital screens.

The management is not going to enter price wars and lower margin; the company wants to maintain the margin on the EVs

"We’ve always said when we move to [electric vehicles], we will have the same demands of profitability"

Lutz Meschke Porsche's Chief Financial Officer 12

Despite this price increase, the management informed of a very strong order book from the first customers, which could be a signal that Porsche’s strategies will deliver strong profits to the group

"We’re overwhelmed by orders coming in for the electric Macan, we’re confident it’s going to be a hit"

Oliver Blume, CEO of Porsche

The success of this launch is critical for short-term performance as the Macan is the second largest revenue contributor to the Group. Despite the price, I believe it has all the characteristics to become a success:

Its a compact SUV, making a good option for using in the cities, where electric vehicles are the best choice right now

The design and infotainment is great and will attract many young customers

It is fully electric, which will attract new customers

The Macan can be the perfect car for the day-to-day tasks

It has long-range, compared to other cars

Its pricing, although higher than BMW or Mercedes, is not that far away and its a Porsche

In my opiniion, its a perfect car for businessmen/women, luxury car customers, or young people that want to transition towards the EV,.

Porsche will test the luxury SUV market with this new SUV. If successful, performance of Porsche will boost in short term with many early adopters.

As a reference, 60% of Taycan buyers were new customers of the brand. There is more demand for EVs, so this model should attract new customers.

What are the European competitors offering in this segment?

The main German competitors are offering cars at slightly less price than the Macan. Mercedes EQE and BMW iX are selling at an entry price of €76-77k in Germany, vs. €80.7 of the Macan. Not a big difference, which puts the Macan in a great position against these cars.

Maserati launched the Grecale version, an SUV of the size of the Macan, but significantly more expensive, starting at €92,000.

All prices are from Germany, to be comparable. The Macan is available a slightly higher price, that EQE and iX, being very competitive in the market.

And in China?

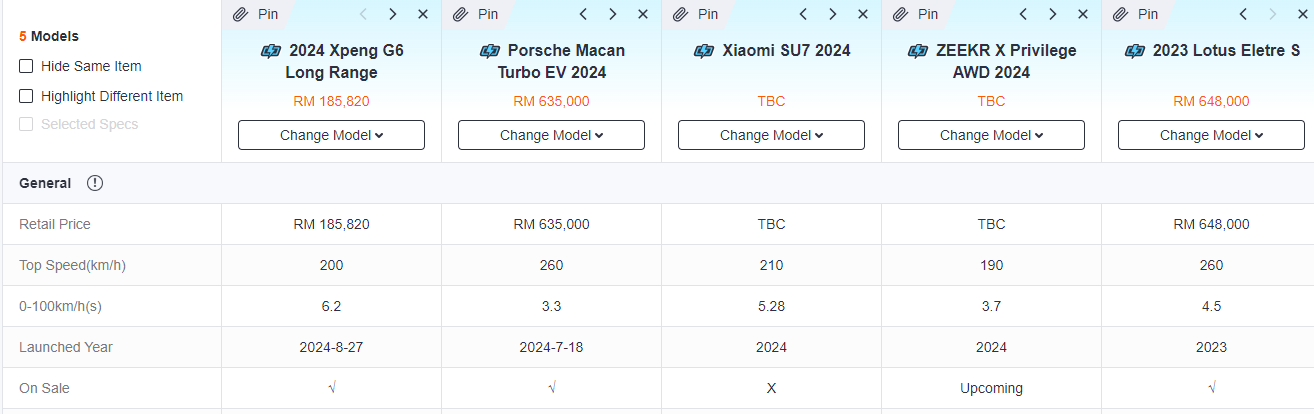

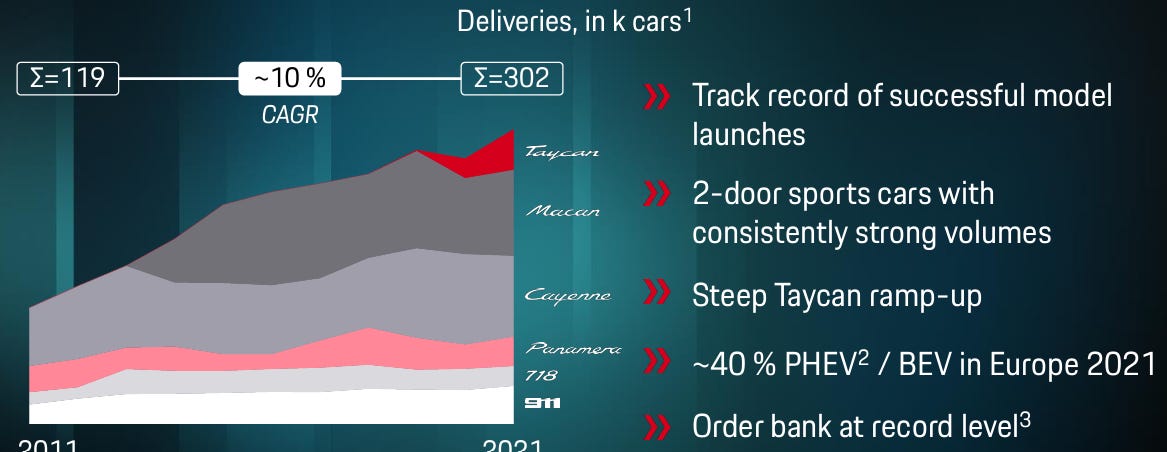

In China, the situation is much more difficult as the company will face strong competition from new players like Xiaomi, Xpeng or Lotus.

The Xpeng G6 comes with a very high discount compared to the Macan, and the car looks really great. Both cars have similar sizes and ranges, making difficult to compete:

Porsche Macan Electric: RM 430,000-635,000

Xpeng G6: RM 165,820 - 185,820

Not 100% comparable, but the price difference is huge.

In the outside, they look similar, while in the interior, Chinese are betting for a lean cockpit, while Porsche still relies on smaller screens.

In terms of quality, the interior of the Macan has much more quality, as it is a luxury car. The Xpeng has a lean and attractive design, while Porsche is made from huge quality materials

Chinese made good quality cars very cheap, while Porsche offers something more luxurious, being therefore not 100% comparable. The market for luxury cars should continue to increase and the Macan can perform well in the region, unless there is a shift towards quality/price rather than a combination of quality/status/performance.

Cayenne

The first Porsche’s SUV that was introduced in 2002. It has been a huge success and one of the reasons that Porsche is so valuable today.

The company is currently selling the third generation with ICE and hybrid engines, with a new variant that looks really great: the coupé version.

Since its launch in 2002, the company has sold over 1 million units worldwide. It is the best-selling car, with approximately 90,000 units sold annually (close to 1/3 of total deliveries).

In 2026, the company will launch the Cayenne EV, while improving the current one in 2025. The inside of the car looks great and Porsche offers a good infotainment systems.

By the time the company will launch the Cayenne all-electric, I will have data from the Macan electric series. This is important, because the bet is huge, as the Cayenne is the most important car for Porsche. The positive aspect is that the new Cayenne will also continue to offer hybrid and combustion engine variants, ensuring a diverse product lineup into the next decade.

This challenges the narrative about EVs, as the best selling car will still be offered with ICE alternatives.

The K1 project

Porsche will introduce a new model in the coming years: a three-row SUV. The model is expected to be introduced in 2025 and production to start in 2026.

Its going to be an SUV bigger than the Cayenne, targeting the bigger sizes and competing against cars like the BMW X7.

I can’t forecast the success to this new model; however, it is an interesting bet. My personal opinion is that this car is too big for a luxury sport car, but demand will judge this decision. Its a great option for families who need a big car, and this will be the top of the segment.

If the car is successful, the company can deliver additional cars every year. If they are able to sell 30,000 units every year, it will be an increase of 10% of deliveries and much more in revenues given the size of the car.

I see this car as a free option in the current valuation. Heads, we win, tails, we don’t loose much given the current valuation of the company.

Taycan (the lively young horse)

The Taycan was the first-ever 100% electric vehicle introduced by Porsche. It was introduced in 2019 and the company has sold close to 150,000 units. Since 2021, demand has remained very robust.

Compared to the Panamera, it is close in terms of deliveries, signaling that there is demand for these vehicles.

“Straight out of the blocks, the Taycan was brilliant. Not just supremely fast, but also easily the best electric car to drive. Indeed, it's so engaging and enjoyable that it compares well with petrol-powered performance models as well as all its electrified rivals.” www.whatacar.com13

This car has attracted new customers, as 60% of the Taycan buyers are first time Porsche customers. This signals a strong demand for luxury EVs.

In terms of performance, this car lags behind Tesla Model S, with lower range. However, Porsche is introducing a new version of the car in 2025 with higher range and better charging timings.

In the inside, the car looks really great, with lot of technology inside.

Panamera

The Panamera was Porsche's first attempt at a luxury four-door sedan, filling a niche for customers who wanted the performance of a Porsche but needed more space and practicality than the 911 could offer.

This is the fourth generation of a car very successful, especially in China. This platform will remain with ICE, and hybrid version, as the Taycan is the current electric sedan.

The company is launching the Panamera 4, a new version of the car that looks similar in the outside, but looks really great inside:

6. Breakdown of Porsche deliveries

Car deliveries

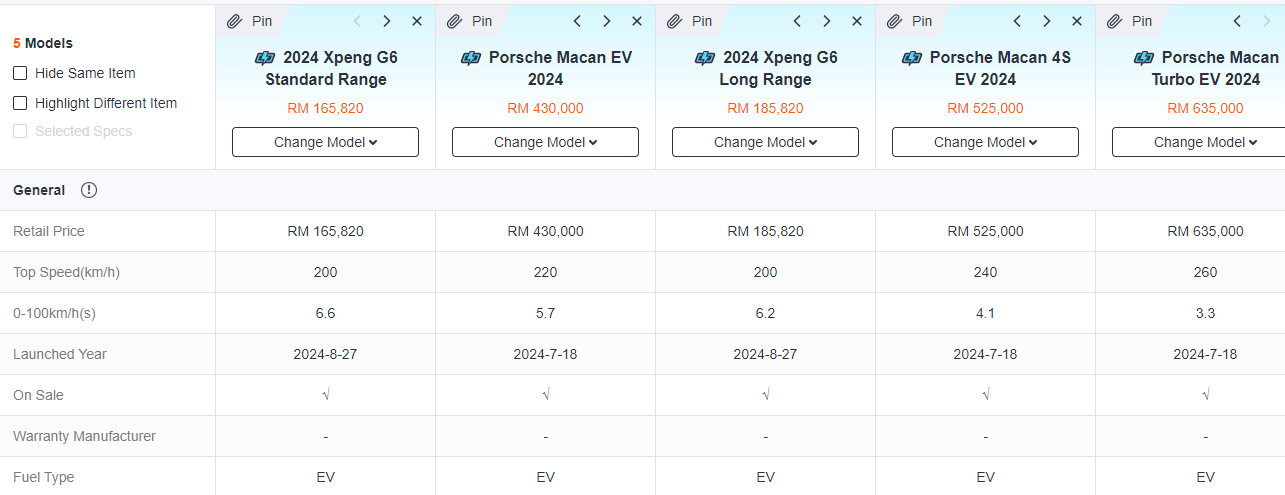

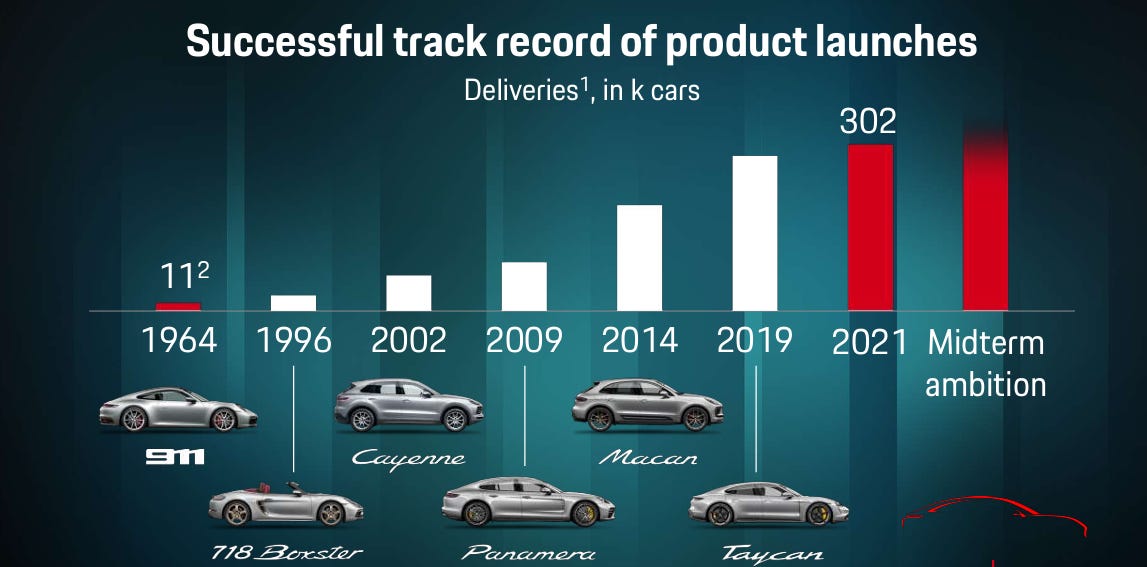

Porsche has a very strong track record of increasing deliveries, sustained by the launch of new models.

From 11k in 1964, to more than 300,000 in the current years. It’s a remarkable growth and now the question is what will be the future production levels?

Deliveries are affected by the number of models offered by the company. Part of the huge increase in deliveries over the las decade was driven by the launch of the Cayenne and Macan. Now, the company will launch a new SUV, the biggest one. The outcome its uncertain, whether it will compete with the Cayenne or will develop a new market.

The launch of new electric vehicles might generate strong demand for these cars attracting new customers around the world

However, the real answer to the question is that the company is adapting its cost structure to remain profitable even with 250,000 deliveries per year. This is because management is focusing on value over volume, which will be key to increase the terminal value of the brand.

I will be comfortable as long as the company adapts its cost structure to lower production levels and manages to increase total revenue per car over the next years.

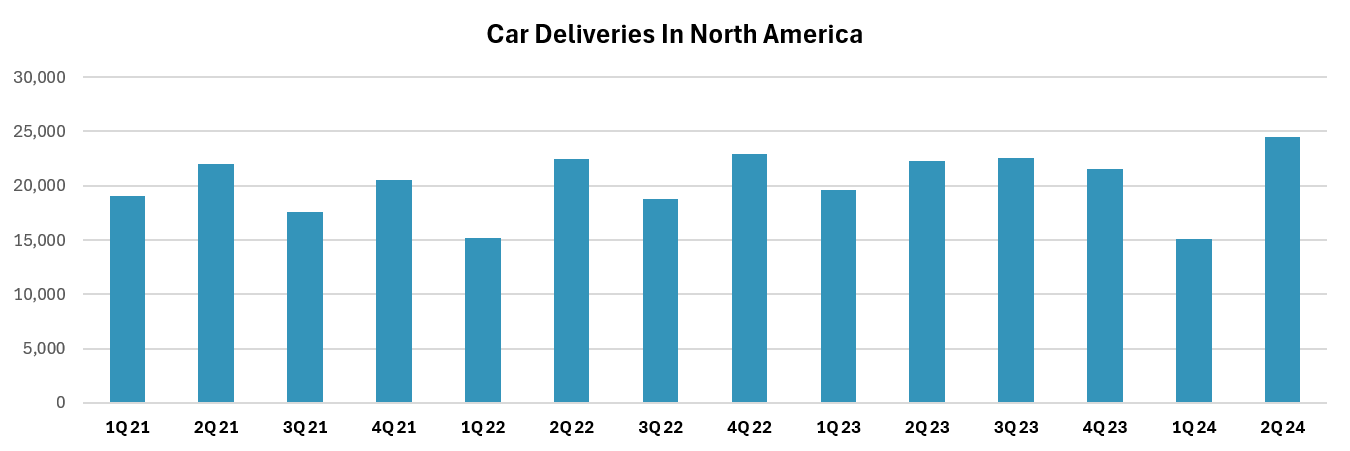

Geographical distribution

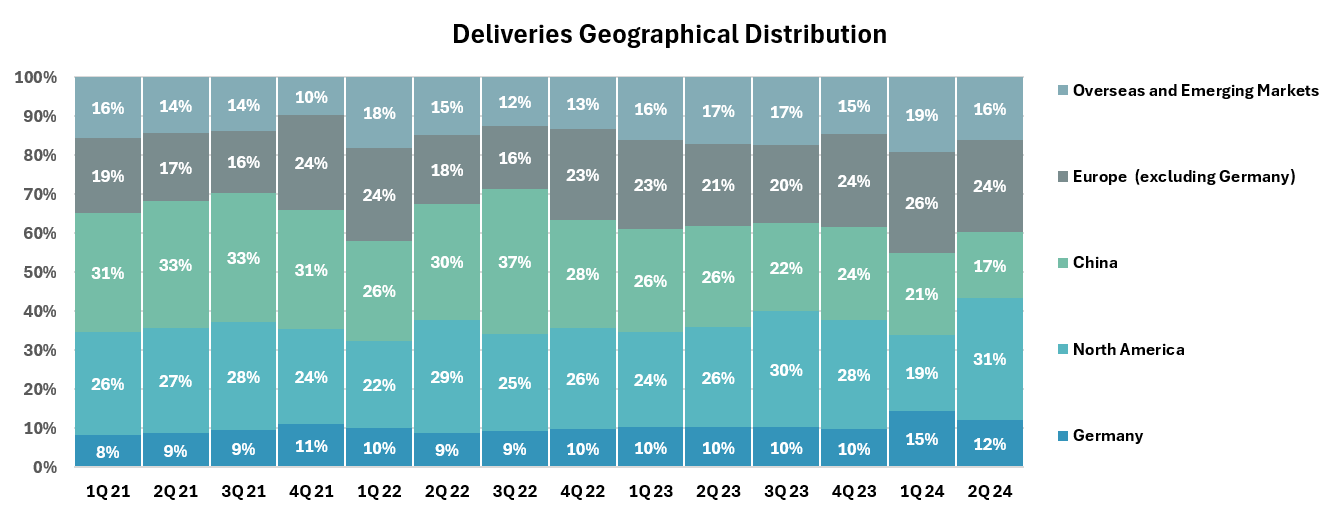

The current geographical distribution is fairly balanced across Europe, US, and China:

Europe, including Germany, has a share of ~30-35%. Germany itself is a very important region with very constant sales over the quarters

North America represents ~25-30%, being a key region to Porsche

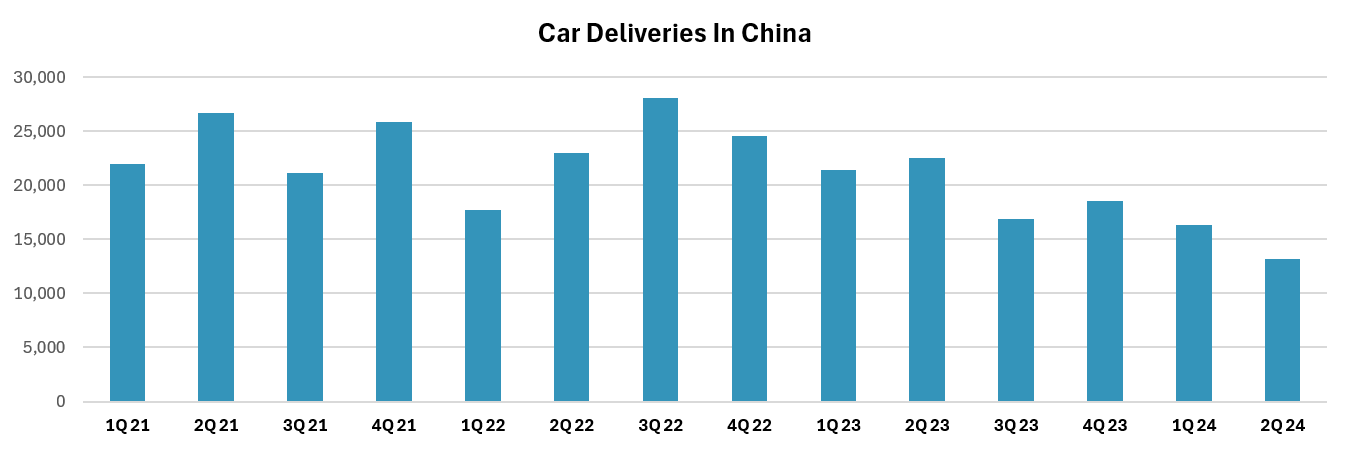

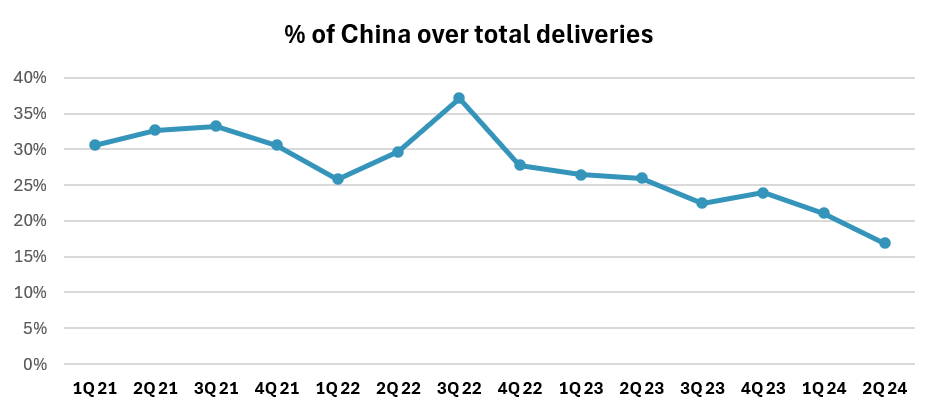

China is in crisis right now, and its weight is significantly declining in the last years from 30% to ~20%

Growth is partly coming from overseas regions (e.g., Saudi Arabia, South Korea, etc.)

China

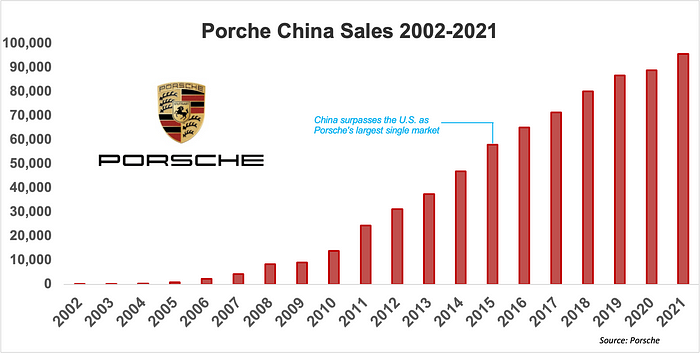

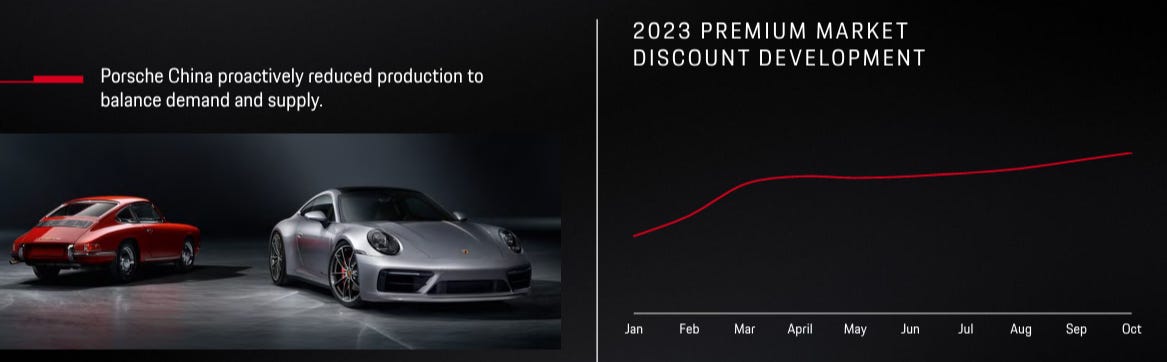

In China, the company is facing strong difficulties (same as many other foreign firms in the country). There is strong competition between premium sellers to increase sales, and high discounts are becoming the norm.

The history of deliveries in China is impressive, with a very strong growth in the last two decades. Now, deliveries are going back to 2015 levels.

The competition comes from many local players, that are able to sell cars much cheaper due to government subsidies. These local brands have developed great electric vehicles and the market in China is increasing every year, whereas in Western countries, EV sales are still not gaining the expected traction.

Some of the key competitors in the region are NIO, Xpeng or Xiamoi. As seen in the following chart, there is huge competition in the market, especially for premium and non-premium cars. As of today, Tesla is the only foreign brand able to compete face-to-face in the country, while Volkswagen is facing strong difficulties and is loosing significant market share in a key country for the firm.

The competitive landscape has changed, and Porsche now sees Lotus, Polestar or Nio has their new competitors in the region. It will be hard to compete against these firms that are able to sell a lower prices. However, as seen with the Porsche Macan analysis, the quality of the competitors is not the same as Porsche.

Unless there is a shift towards premium cars, the luxury segment can still perform well.

To avoid this situation, the management has decided not to participate in the discount wars and reduce production to balance demand and supply. They are starting to implement the luxury playbook. This will ensure that Porsche is not perceived as a Mercedes or BMW, but a more luxury car.

“We don't care and we don't fight volume in China.”

Oliver Blume, Chairman and CEO

Personal opinion: I’m not sure how much of the reduction in production comes directly from permanent lower demand instead of reducing it on purpose. But, overall, it makes sense to avoid discounts. A luxury brand has to remain committed to value.

There is a new country leader, which makes the outcome uncertain (every new management can bring either positive or negative results, so difficult to evaluate it)

They have frozen new dealer authorization and will safeguard dealer profitability by optimizing cost of franchise

Company will invest in the brand, to differentiate from competitors

Porsche is designing specific infotainment systems adapted to Chinese consumers

Car deliveries are in the lowest levels of the last years, and the situation is very challenging. The positive thing is that this trend might be reversed with the introduction of the electric models such as Macan and Boxter.

I still believe the company can compete in China by leveraging on its brand. Its a luxury firm with strong heritage that can compete with the local players. The new EVs should help the company regaining some market share.

One of the key questions is whether Chinese consumers will prefer to buy European luxury brands or acquire premium cars manufactured in their country

The key will be the launch of the new EVs. It will be a big test to see what is the level of demand for luxury EVs, which I think Porsche can still play a very important game.

The current narrative is that European players can’t compete against Chinese cars, which are less expensive and come with more technology. However, I still think Porsche is among the brands whose heritage offset a lower technology inside the car, which is not that far.

Its not unique to Porsche, as Ferrari sales are also decreasing in the region. However, the Italian company is not focusing on China.

Chinese love European luxury brands and the new Macan EV will test it. Are Chinese willing to pay more for a Porsche?

What if the Chinese sales never recover? Although the risk is limited as the company has a strong brand, lets assume that sales never recover. What would have been in the past?

Porsche will be delivering an average of 69,652 cars a quarter, vs. 77,712 without adjustment

The company can channel its vehicle offer to other countries where its brand is still very important

China percentage over total deliveries has fallen significantly over the last years. If sales don’t recover, Porsche will be loosing around 32,000 deliveries every year.

These deliveries can partly offset with the development of other countries

If Porsche is not able to solve it, the impact on revenues, assuming the last average selling price, will be around €1bn annually (2-3% of total revenues)

There are reasons to think that the trend can be reversed:

New management, value over volume strategy to offset lower deliveries

the demographic and macroeconomic trends are very positive for the luxury segment. Other like BMW or Mercedes will have more difficulties in the future to compete against local players.

For the reasons listed below, the current impact is limited as it is already reflected in the valuation of the company. The situation can still be solved and partly offset with price increases and development of other regions.

My base case scenario is that deliveries in China recover a little in the mid-term, but will not reach again the historical max of close to 100,000 units a year.

In a country with more than 1 billion people, it is not unreasonable to consider that 80,000 cars can be sold in the region, especially with the new EVs that the company is launching.

The US

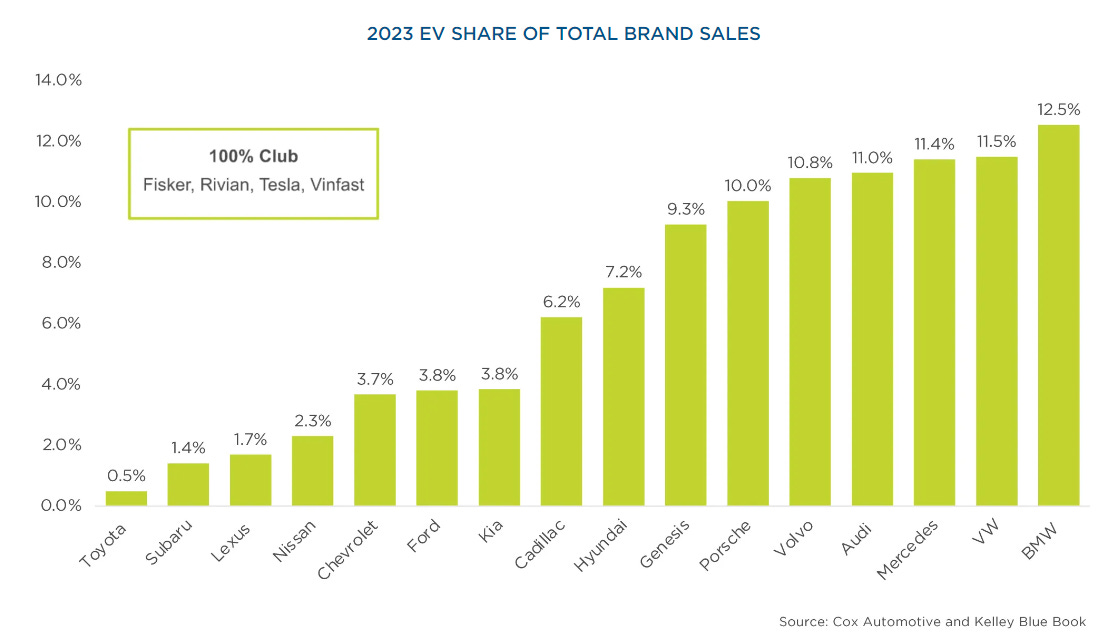

The US is a very big market, where Porsche can perform very well in the EV segment. In 2023, the company had a 10.0% market share in electric vehicles, which is huge given its a luxury brand.14

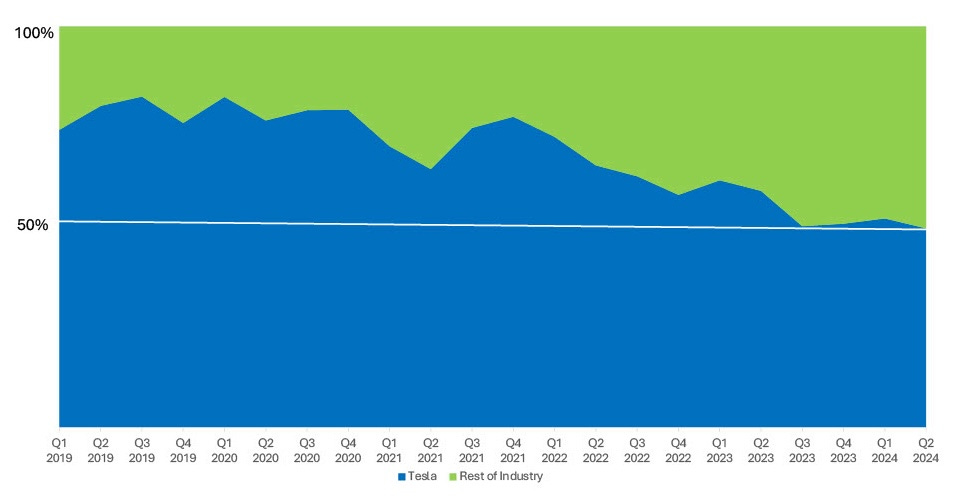

In the US, not everything is a Tesla and competitors are taking over Tesla’s market share every quarter. Competition is becoming intense, but Porsche can still perform well, given its luxury status.15

The region represents around 25-30% of Porsche’s deliveries. During the first quarter of 2024, deliveries hit a 3-year low, but recovered to a record quarter in June ‘24. The decline in the first quarter was related to customs delays due to some regulatory issues. Overall, sales are good in the region and the EVs can further increase its presence in the country.

There is a shift towards the US for many European brands that are experimenting the high competition in China. The brand will play a key role in differentiating from BMW or Mercedes.

The competition from Chinese players is much more limited in the region due to the tariffs imposed to Chinese exports.

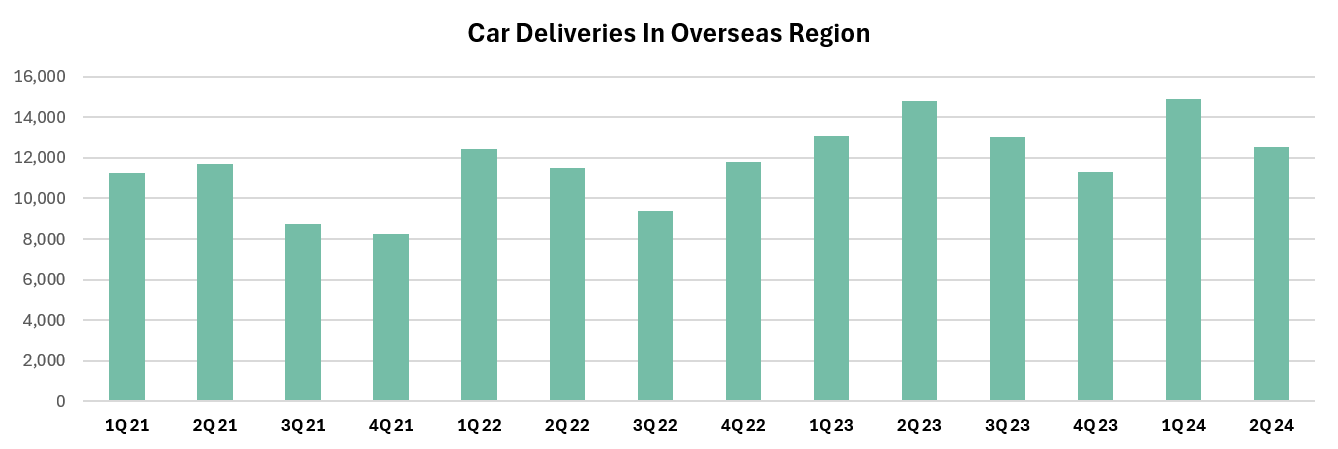

The overseas region

The overseas region consists of all countries other than Central Europe, US and China. These a countries where luxury spending is increasing every year, and therefore have strong potential.

Growth from overseas is expected to come from countries with high spending in luxury such as Saudi Arabia, which is developing multiple unique projects such as The Line or Neom Project, or countries like South Korea which is one the highest luxury spending per capita in the world.

As seen in the following chart, deliveries remain robust during the last quarters

This region can contribute to future growth and offset the decline in revenues in regions like China. Remember we are talking of countries like Saudi Arabia or South Korea, with very strong purchasing power for these cars.

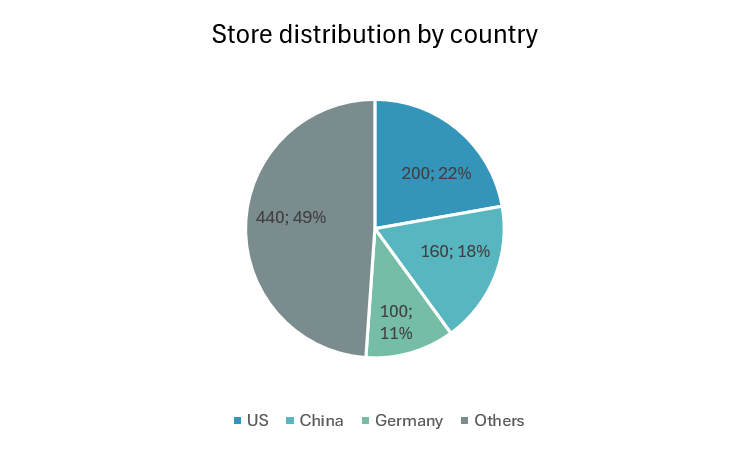

Distribution

Porsche sells cars in around 120 countries worldwide across a network of more than 900 Porsche Centers. The Group primarily sells its vehicles in wholesale transactions directly to Authorized Dealers, who then sell them to potential customers.

Additionally, the Group owned about 30 dealerships across 10 markets (including Shanghai and London)

Porsche Sales is launching a global initiative to modernize its sales sites for better customer engagement. By the end of 2021, 43 Porsche Centers had been revamped, with plans to upgrade 600 more by 2030.

Porsche is also introducing new retail formats, like urban Porsche Studios and pop-ups, which are located in busy city centers, offering a brand experience with showrooms, vehicle configuration lounges, and test drives.

This a bet towards customization of vehicles and offering the best posible experience, which will drive further top line growth. To be a true luxury player, the point of sales must be carefully designed. The new locations look really good and will help to consolidate the brand during the next years.

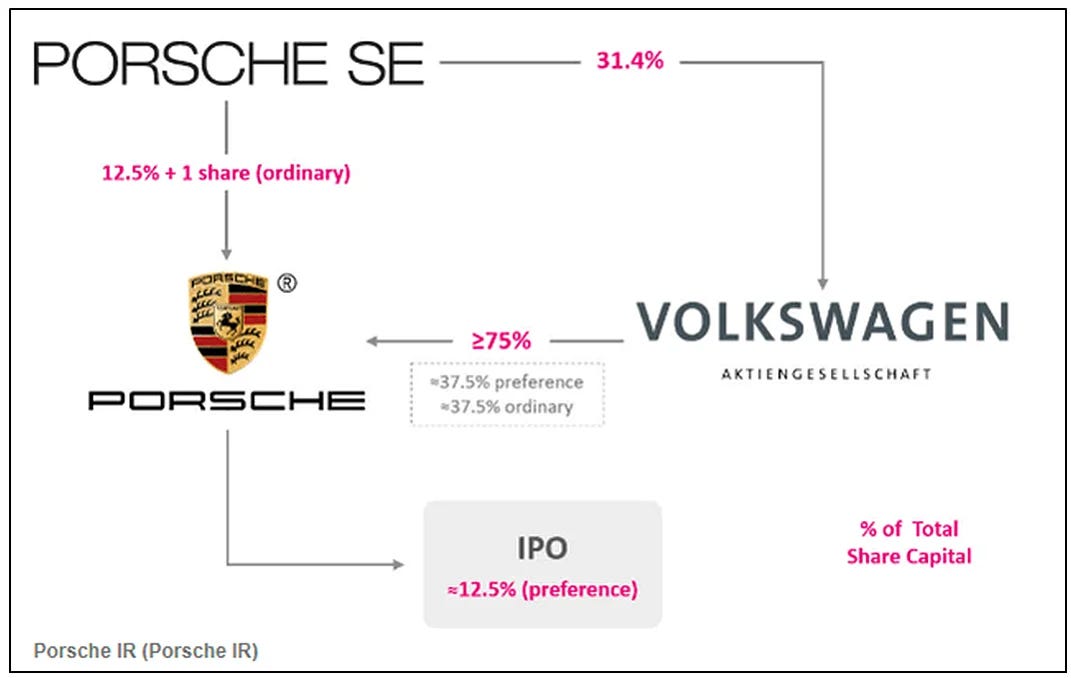

7. Management and corporate structure

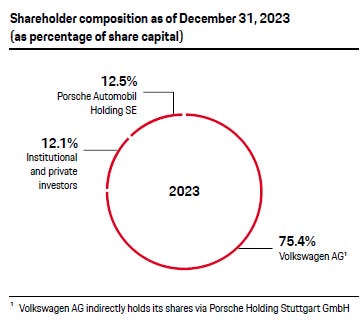

Porsche AG (the current company analyzed, ticker P911) is the operating company, while Porsche SE (Porsche Automobil Holding SE, ticker PAH3) is the holding company.

Porsche AG is owned by Volkswagen, Porsche SE and the free float. The company targeted a free float of 12.5% through preferred shares, with no voting rights. As a funny fact, there are 911,000,000 shares in the company.

There is strong skin in the game as the Porsche family, along with the Piëch family, effectively controls Porsche AG through their majority stake in Porsche Automobil Holding SE (Porsche SE), that also controls Volkswagen Group with ~53% of voting rights thanks to the non-voting shares.

Currently, the company has 12.1% of free float. This non-voting shares structure is something I don’t like but I understand that Porsche is deeply rooted into Volkswagen Group, making difficult to be independent. This is a weakness of the company given the poor strategy that VW is following (bad software development management, poor integration with Chinese customer, etc.). However, there are synergies in terms of costs and capex.

Under this corporate structure, no share buybacks can be expected, but rather dividend payments to the owners of the company. The company is targeting a dividend payout of 40% of net income, which currently translates to a DPS of 2.3 per share (~3% yield).

The best thing is that this spin-off comes with a very healthy balance sheet and very promising prospects.

The management

Porsche AG is managed by Oliver Blume, who is also CEO of Volkswagen Group. He is Chairman and CEO, which is normally not the best alternative as the role of Chairman and CEO should be separate.

The biggest weakness in terms of corporate governance is that the company is managed by the CEO of Volkswagen Group:

There is no independence in Porsche with VW Group. In the case of Lamborghini, they have a CEO which is not part of Volkswagen

Volkswagen Group is at a crossroads and its future is complicated

It transfers the good and bad things to Porsche (mostly negative during the last years with the software)

The capacity of Mr. Blume is not in question, as he is probably one of the most relevant persons in the auto industry. The problem is that he will be fighting for the survival of Volkswagen Group in the next years, which inevitably means he will not be working 100% on Porsche.

“When the Porsche CEO was handed the reins of its parent company in 2022, becoming the only person to head two Dax 40 companies simultaneously”

FT16

He has been CEO of Porsche since 2015, but the role in Volkswagen seems to time consuming given the huge responsibility in one of the most challenging periods of the history of the company

His mission at VW is being impacted by software mismanagement (he is Chairman of the Supervisory Board of VW's software division, Cariad, which is experiencing a lot of problems), or by poor adaptation to the Chinese market.

All these issues are also impacting Porsche, with delays in the introduction of EVs such as Macan or with weaker sales in China.

More about the CEO in the article from the FT:

https://www.ft.com/content/44ee53cd-2758-47f4-b146-a7d110de32a4

Lutz Meschke is the deputy Chairman since 2015, and member of the Executive Board at Porsche AG since 2009 with responsibility for Finance and IT.Since 2020, he has also been a member of the Executive Board of Porsche Automobil Holding SE with responsibility for investment management.

He has a strong financial background and his role is much more independent that the CEO. He has been part of Porsche and has strong experience. Overall, financial results are good.

Management retribution and incentive plans

The annual base salary of the CEO and CFO is not high, given the size of the company as they earn a base salary of €800,000 and €950,000 per year plus incentives that increase the retribution to €3 and 4 millions, respectively.

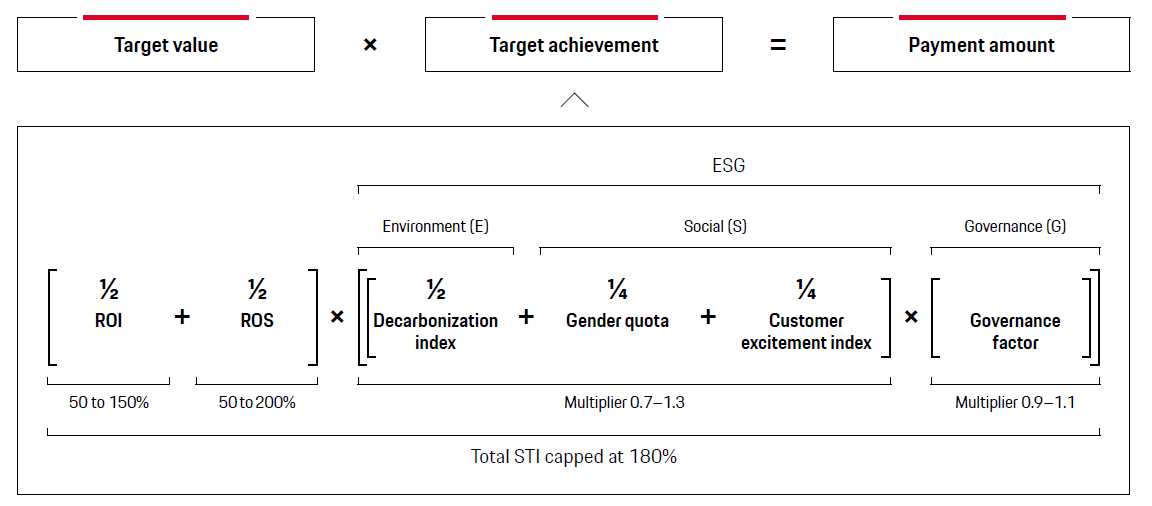

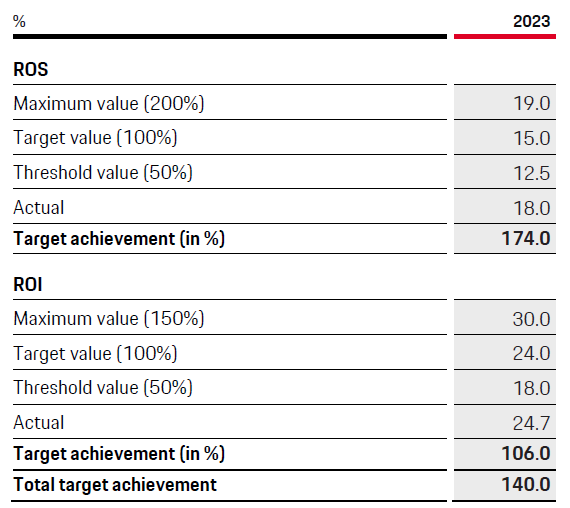

The variable retribution can reach up to 180% of base salary and depends on ROI and return on sales (ROS), which is the EBIT margin. The result is multiplied by an ESG factor.

It will be better to have a long-term value creation factor rather than an ESG factor that is not aligned with shareholder value creation. However, this is a common trend in public companies.

The company discloses the thresholds, which is very interesting to understand the level of ambition:

Targeting a 15.0% return on sales and delivering an 18.0% seems a little bit asymmetric.

Conclusion

Please note that this is a high-level introduction to the management and I’m not judging the individual capacities.

I believe Porsche is very well managed, with strong sales evolution during the last two decades and high operating margins. However:

I’m worried of having a CEO that is not working 100% of his working hours in the company, in a crucial moment

The company had really important supply problems in 2024, which is something should not happen in Porsche

There still problems related to software, which jeopardizes the transition to full-electric for 2040

Strong competition in China might require new commercial tactics. Porsche needs to find its own way to continue building a strong brand and leveraging on the heritage of performance and luxury

The variable retribution is based on financial criteria that make sense such as EBIT margin and ROI; however the ESG factor and the lack of other metrics such as cash flow make the variable retribution not fully aligned with long-term value creation

For these reasons, overall score is a 6/10

8. SWOT analysis and competitive advantages

🔐 Strengths

A unique brand, with strong heritage, widely known and associated to key automotive characteristics such as performance, experience and sport cars.

Dominates a niche where competition comes from premium carmakers such as BMW or Mercedes, but with less brand power and customization options than Porsche.

Its a profitable company that targets a 20% EBIT margin and that generates more than €4 billion of free cash flow every year. Its margins are above competitors and just behind Ferrari.

Its part of Volkswagen Group, which allows the company to extract synergies in manufacturing or development of cars.

Porsche has very loyal clients, which is not common in the auto industry.

♟️Opportunities

The luxury segment is expected to grow significantly faster than the premium one, where risk of disruption is lower

The company is transitioning to full electric by 2030. Currently, the company is launching the Macan and the Boxter full-electric versions. This should capture further growth as 60% of Taycan customers were new Porsche clients.

A new SUV model will be introduced in the coming years, an option to increase deliveries in the mid-term

Some competitors are struggling to offer alternatives to Porsche’s vehicles, leaving Porsche in a stronger position.

Customization of vehicles and launch of special editions to drive further growth in revenue

🤒Weakneses

Porsche plays in the low-end of the luxury market, which doesn’t allow them to be as profitable as Ferrari or Lamborghini, as the face stronger competition and more affected by changes in economic cycles

Supply chain issues such as the flooding in an aluminum tier-1 supplier made the management to readjust deliveries for 2024. It had a huge impact, and its something very negative for a Brand like Porsche, where delivery of cars is already long

Volkswagen Group still lags behind in terms of software and batteries

The CEO of Porsche is also CEO of Volkswagen Group, which de facto implies that it is not 100% at Porsche

⚠️ Threats

Porsche is going fully electric in the mid-term. This creates two threats in the mid-term:

Risk of demand for electric Porsches not performing as expected

Engineering becomes less relevant in an EV. Is it worth paying more for a Porsche? (the answer to me remains yes, as we are talking of luxury products, but it remains uncertain in the next decade)

Company is deeply rooted in Germany and might impact negatively if the country’s economy doesn’t start to recover, as a significant percentage of revenue comes from their home country

In China, Porsche is facing strong competition from local automakers. Company is betting for a value over discount strategy, and will test the market with the Macan in 2025. The outcome is still unknown.

Robotaxis or autonomous vehicles be a threat in the long-term (but not expected in the short-to-mid term)

9. High-level financial analysis

1. Revenue

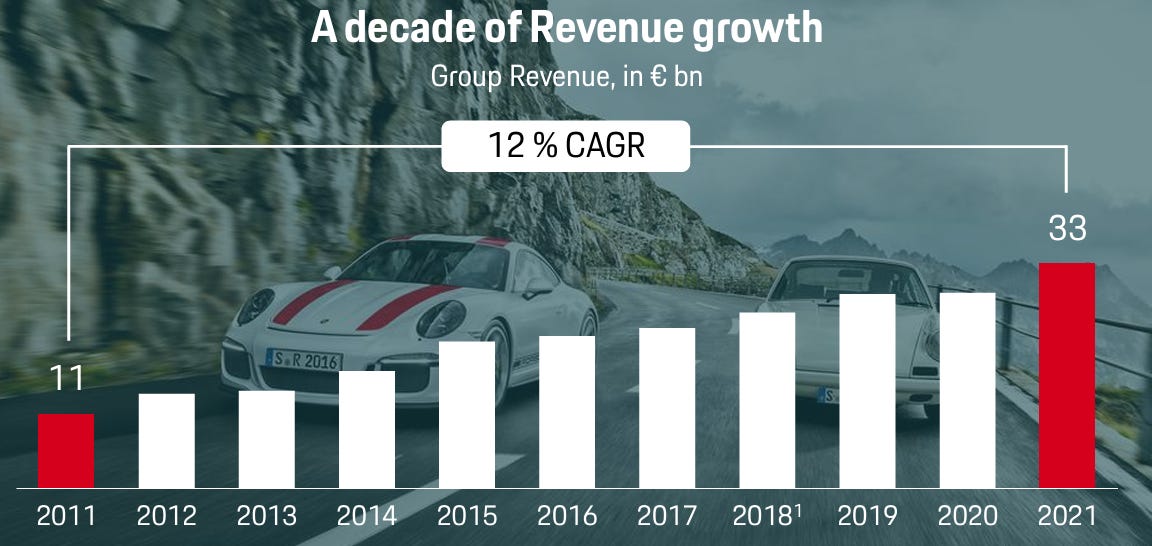

Porsche has experienced strong growth in the last decade, supported by a product offering that includes sport cars, SUVs and sedans.

During the period 2011-2021, revenue has grown at a 12% CARG, from €11 billion to €33 billion. Three years later, revenue is close to €40 bn.

During 2024, due to flooding of an aluminium plant of a tier-1 supplier, the company will report lower revenue than the previous year, reducing their estimates to €39-40 billion range.

Analyst predictions are around +5.0% in the next couple of years17, which I believe it can be easily achieved. I consider three scenarios:

Upside case: If the EVs launched are a clear success, the revenues could grow above the 5%, given the higher prices of these cars

Base case: a +5.0% case seems conservative, and below their historical average. Porsche maintains pricing power and could easily increase sales by 5% over the next years

Downside case: If the Macan EV doesn’t perform as expected, top line can be impacted limiting revenue growth to less than the average 5%. However, I don’t think we are there given that the whole industry is moving towards EVs

Revenue breakdown

SUVs represent above 50% of revenues, sedans around 25% and the remaining the two-door sport cars

Deliveries are well distributed across all geographies, being less exposed to China than Volkswagen

The company has plans to capture growth from overseas regions, which are expected to come from countries with high spending in luxury such as Saudi Arabia, which is developing multiple unique projects such as The Line or Neom Project, or South Korea which is one the highest luxury spending per capita in the world.

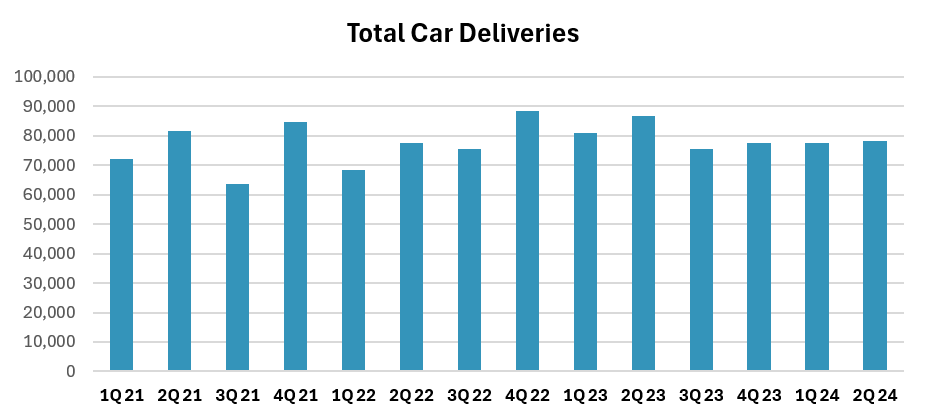

Total car deliveries remain strong at above 70,000 units per quarter, which represents around 300,000 vehicles per year. Note that 2024 is not a good year for the industry, therefore we can conclude that Porsche’s deliveries remain robust.

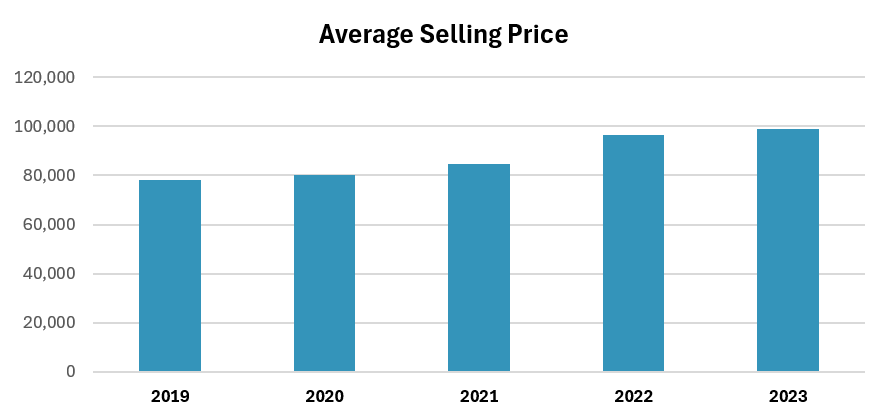

While deliveries are strong, but remained flat during the last quarters, the average selling price (Sales from new cars / deliveries) has increased from €80,000 in 2019 to €100,000 in 2023, representing a CAGR of 6.1%

This is telling us that Porsche has pricing power, and can offset lower deliveries in countries like China with price increases of new cars

A big part of the increase in ASP comes from 2022, but every year the ASP has increase between +2.5 to +5.3%

What can we expect for the future?

Total deliveries are uncertain, but the company is preparing to be profitable even with 250,000. I believe that is a worst case scenario and deliveries can remain at around 300,000 vehicles every year

With the introduction of the new models, the average selling price will continue to increase

This should offset the weaker demand in China, which is something the company can live with it

Finally, the company is launching a new SUV in the coming years. Its an important milestone given the historical success of Porsche’s SUVs

Financial services

Porsche's financial services segment, provides financial solutions to support the purchase and leasing of Porsche vehicles. This includes services like vehicle financing, leasing options, insurance packages, and mobility services.

The division generates between €3.2-3.4 billion revenues every year, representing around 8% of total revenue. Its a synergetic department with the automotive segment, as many customers will finance the acquisition of the cars through Porsche’s Financial Services product offering.

The financial services division generates a pre-tax return on equity of ~20% (~14% post tax), currently affected by the higher interest rate environment (pre-tax ROE was 21.2% and 20.5% in 2021, and 2022, respectively).

No further analysis is presented given the segment is only 8% of revenues.

2. Operating margins

Porsche margins sit between Ferrari’s and Mercedes, between the high luxury and the premium segment. Its margin is above companies like Mercedes or Tesla and has room for further improvements.

There are companies like Maserati and Aston Martin with negative EBIT margin, which shows that even some luxury firms are not able to generate strong returns to the shareholders. Although margin is far from the high-end luxury, if company is able to reach 18-20% levels, it will be very profitable to the shareholders.

Porsche’s 2024 margin is affected by a flood in a tier-1 supplier that will cause the group to deliver less cars during ‘24.

The mid-term target stands at 20%, however it will be difficult to achieve until several years, but if achieved, company will deliver very strong results.

We have to rescale our wholesale structure and also our retail structure, and lead also to cost savings in our sales costs in the future. We will be able to be very profitable also in the case that we are selling 250,000 to 300,000 cars a year. That's a clear target when it comes to the restructuring of our cost basis, and we are well on track to reach it.

Lutz Meschke, CFO of Porsche

3. Cash Flow Generation

Porsche’s automotive division generates around €4 billion of free cash flow every year. The automotive operations convert into cash more than 40% of the EBITDA and around 11-12% of the sales

The financial services division is more complex to evaluate and its impact on the income statement is more limited as it generates around €300 million of operating profit.

For simplification, the financial services division is not analyzed in this post.

4. Balance Sheet

Company went public in 2022 with a healthy balance sheet. The company generates around €4 billion of FCF every year.

As of December, the company has a net cash position of €3,452 million:

Financial liabilities (bonds and others): €1,321 million

Leases: €1,047 million

Excess cash: €5,942 million (see table below)

The financial services division seems to be well capitalized:

Its a very healthy balance sheet for an automotive company, which provides additional protection of the investment as there is no risk of bankruptcy in the mid-term given the net cash position.

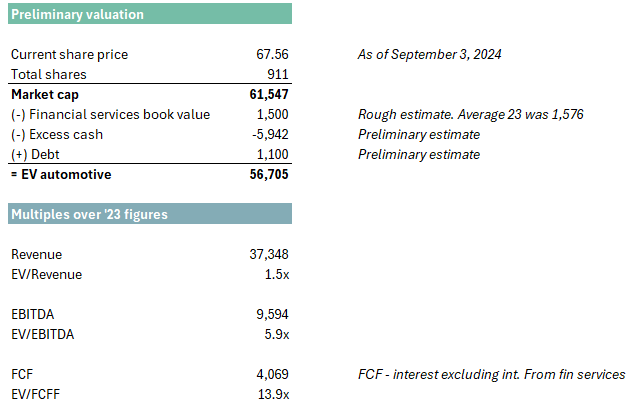

9. Valuation

Highly preliminary

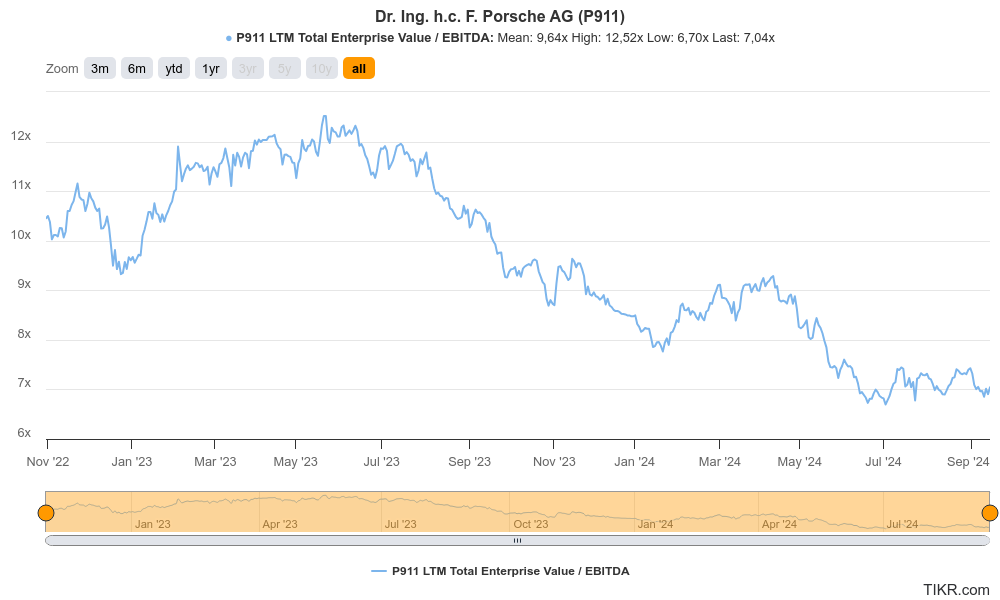

The stock (P911) is trading at around €67 per share, which means more than 40% less than historical max of July 2023. While that valuation might be to optimistic, the stock has fallen from €95 to €70 per share since April 2024.

The preliminary valuation indicates that the stock is trading at a reasonable or even cheap valuation. It is highly preliminary, but it provides some confidence that the stock can perform well in 2025.

I haven’t calculated the multiples for the following years, as the company is going to introduce significant changes in their product offering and, 2024 is affected by extraordinary manufacturing issues.

One of the most powerful brands in the world (top #1-#2 in the automotive industry) and a renown brand in the luxury space deserves a strong terminal value.

The current valuation, apparently doesn’t take it in to account as it should be trading at higher multiples (6-7x EBITDA is also an indication of some degree of margin of safety). Current EBITDA multiple is nearly half as they were in 2023

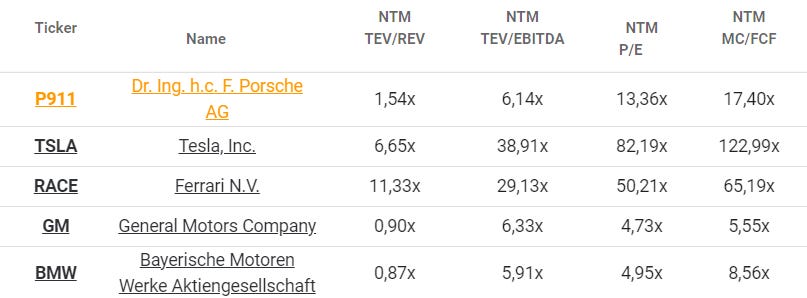

Compare this valuation to others like Ferrari, which is becoming more challenging than ever:

I don’t expect a very high potential, but I do see potential and a limited downside as I expect Porsche will perform well in 2025-2027 with their new lineup of electric vehicles.

If company performs as expected, a 14x FCF multiple seems cheap.

I remain confident it will be a good investment for the portfolio.

Thank you for reading

European Investor

Thank you for reading the report. Please leave a comment or send me a message if you have any questions or comments. I will be happy to discuss it!

Message European Value Investor

You can also contact me through Twitter:

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

End notes

The history section has been summarized with Chat GPT as I want to focus in the company today, rather than the history

Source: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/five-trends-shaping-tomorrows-luxury-car-market

Source: Porsche IPO prospectus

Source: https://prestigeandperformancecar.com/porsche/porsche-800v-ev-architecture-tech-guide/

Source: https://www.pcauto.com/my/news/porsche-ppe-platform-challenging-tesla-leading-the-luxury-electric-car-market-14069

Source: https://insideevs.com/features/710280/400-volt-800-volt-evs-explained/

Source: https://www.carsales.com.au/editorial/details/full-details-secrets-of-the-new-2024-porsche-macan-ev-revealed-144400/?__source=editorialArticle&driver_crosssell=editorial.in.article.link

Source: https://www.adamasintel.com/volkswagen-only-building-half-promised-battery-plants/

Bullet points generated through ChatGPT

https://insideevs.com/features/706488/macan-ev-model-y-comparison/

https://jalopnik.com/here-s-why-the-electric-porsche-macan-is-so-much-more-e-1851428489

https://insideevs.com/news/712077/porsche-macan-electric-orders-2024/

Source: https://www.whatcar.com/porsche/taycan/saloon/review/n20184

Source: https://www.coxautoinc.com/market-insights/q4-2023-ev-sales/

Source: https://www.coxautoinc.com/market-insights/q2-2024-ev-sales/

Source: https://www.ft.com/content/b184eb85-ac85-461e-aefc-05ebe12343df

Source: Tikr.com

Have you considered Porsche SE as well? It seems like it trades at a discount to Porsche AG and Volkswagen.

Is BMW also a good deal?