Antin Infrastructure Partners: Investment thesis

Disclaimer. Please read full disclaimer at the end of the page before reading the report.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Index

Introduction to Antin and the private markets

Analysis of Antin

Financials and valuation

Investment thesis conclusions

Appendix

Section I: Introduction to Antin and the private markets

Introduction to Antin

The private markets and the infrastructure segment

1. Introduction to Antin

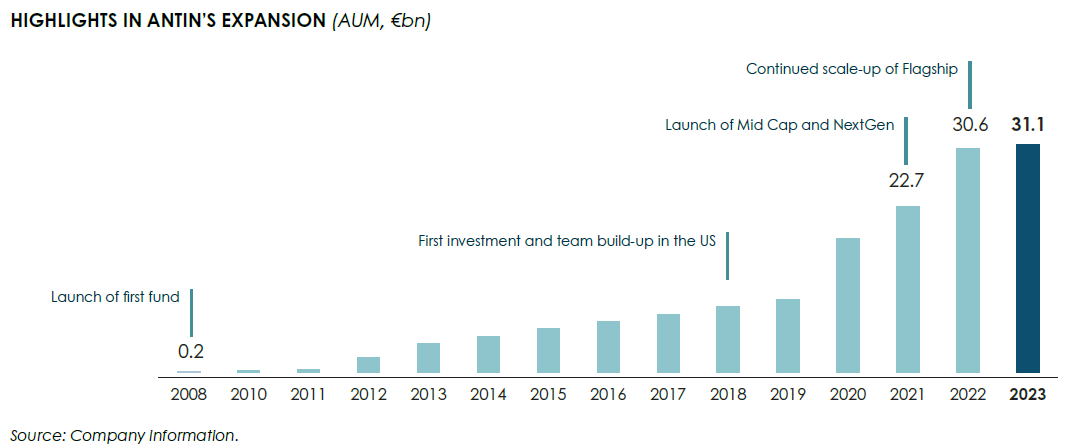

Antin is an alternative asset manager founded in 2007 by Alain Rauscher and Mark Crosbie (the Managing Partners). Initially, BNP Paribas held a passive minority stake in Antin. In 2012, the Managing Partners and other key employees acquired BNP’s stake in Antin. In 2021, the company went public and started trading in France. The company is owned by the management with limited free float.

Antin acquires companies in the infrastructure space. Instead of owning infrastructure assets, the company acquires businesses within the infra sector. Its a private equity company focused on infrastructure companies.

The company is active in the energy and environment, telecommunications, transportation and social infrastructure sectors across Europe and North America.

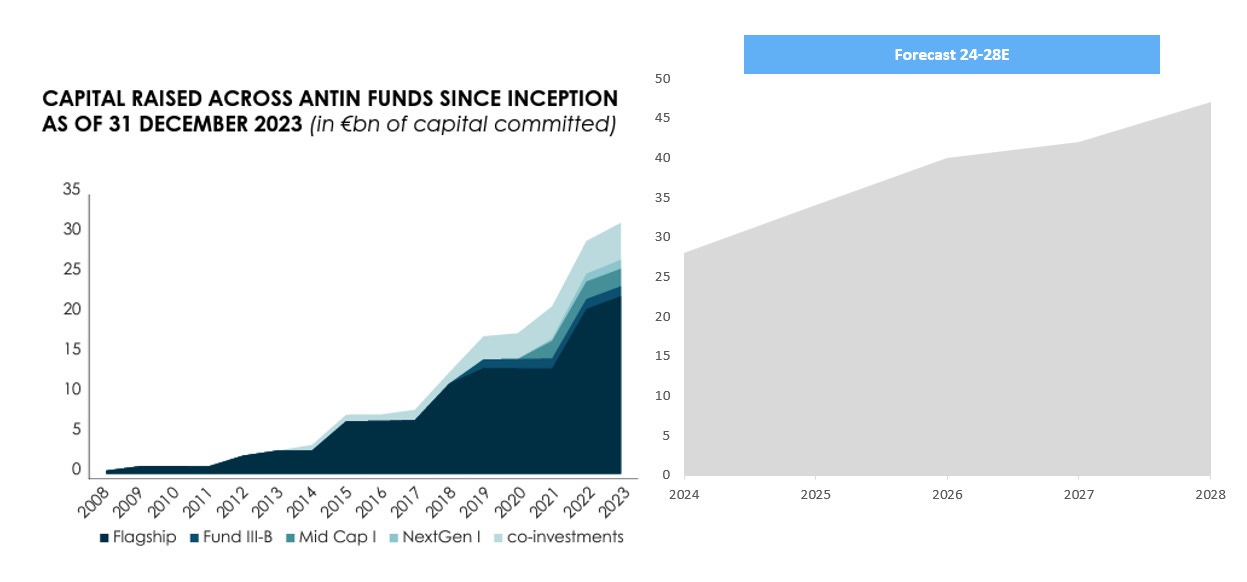

As of December 2023, the company manages more than €20bn fee earning AUM (total AUM of €31bn) across three strategies (Flagship, Mid Cap and Next Gen).

The company has experienced significant growth in the last years, benefiting from the tailwinds of alternative markets.

The company continues to invest in growing their capabilities, which should contribute to boost the growth of the company once private markets start to recover from the 2022-2023 financing crisis.

Since inception, the company has launched five Flagship funds and initiate two new strategies, mid-cap and next-gen.

2. The private markets and the infrastructure segment

Before continuing, there are two reports that I recommend to read if some of the readers are interested in private markets and private equity. These two reports are easy to read and provide a comprehensive view of the current situation:

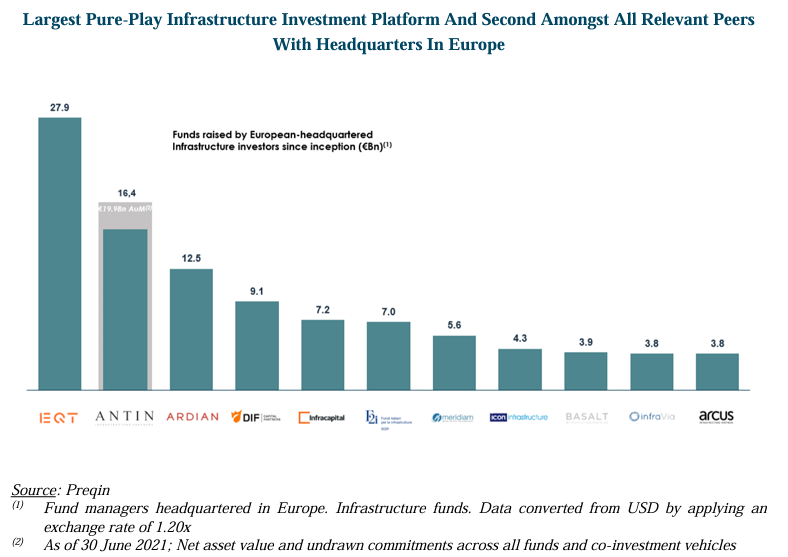

The private markets industry is highly fragmented. According to Preqin, there were 563 private infrastructure funds collectively targeting fundraising of ~$518 billion as of November 2023, including Antin with its Flagship Fund V1.

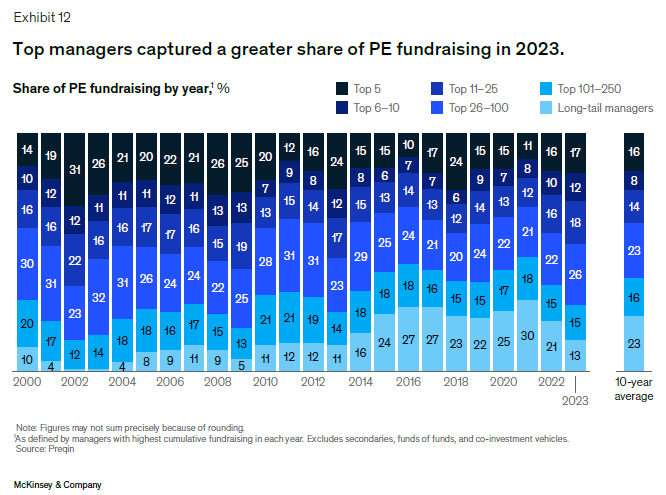

However, there is a trend of consolidation and big firms are acquiring smaller player and also are the ones raising most of the money.

From these funds, Antin only competes against a limited number of firms for investment opportunities and many of them lag behind Antin’s capabilities. According to the company, these were the main competitors in 20232:

Pure-play infrastructure investors: for example Stonepeak Infrastructure Partners, I Squared Capital

Diverse private market investors that have significant infrastructure investment activities: for example Blackstone, KKR, Brookfield, EQT, Global Infrastructure Partners (now part of BlackRock)

Sovereign wealth funds, pension funds and insurance firms that invest directly in infrastructure companies (e.g., a pension fund acquiring the fiber network of a telecom company).

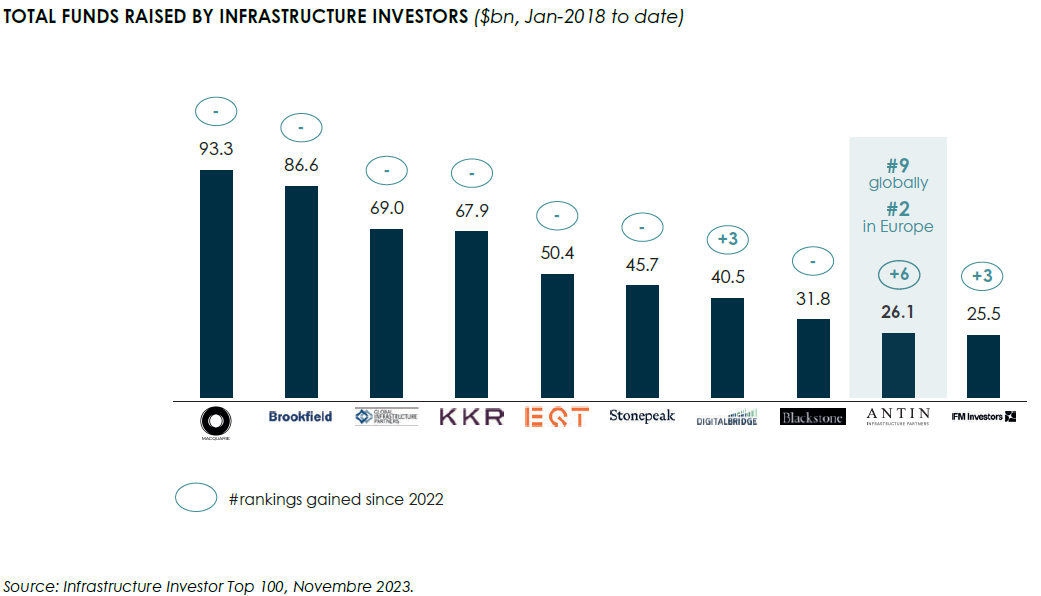

Antin is the second largest European infrastructure player, behind EQT and #9 globally. Firms like Brookfiled, KKR or EQT are not pure infrastructure players as they also manage different strategies such as real estate, healthcare, etc.

Antin operates a niche strategy that allow them to secure better terms for their investments and to achieve strong returns. Targeting a niche sector allows the company to generate more proprietary deals, instead of going to auctions.

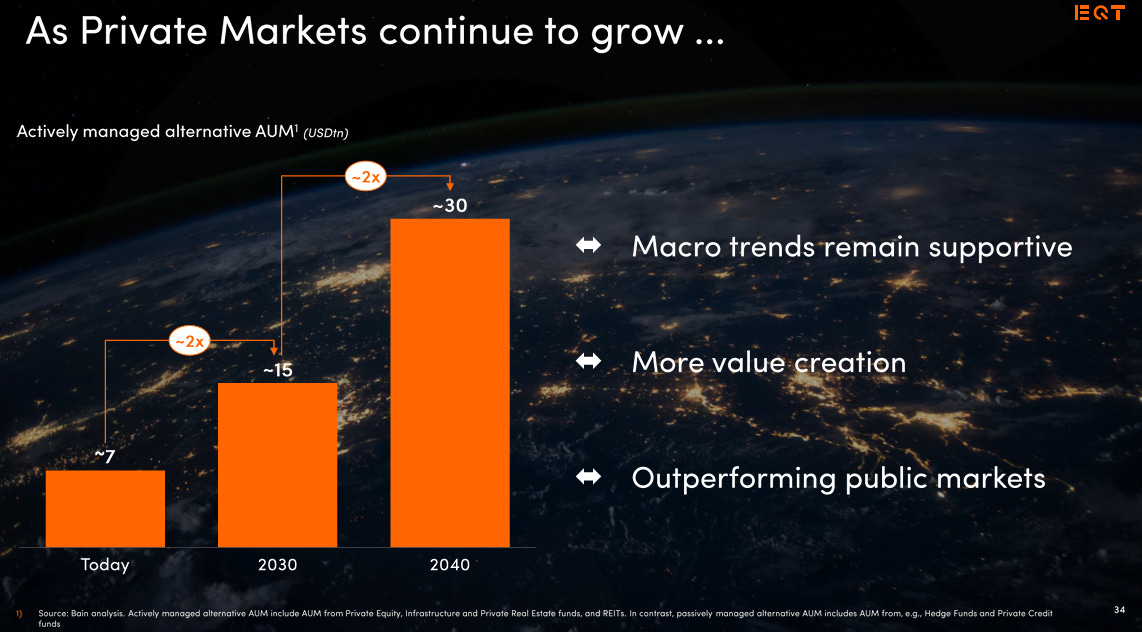

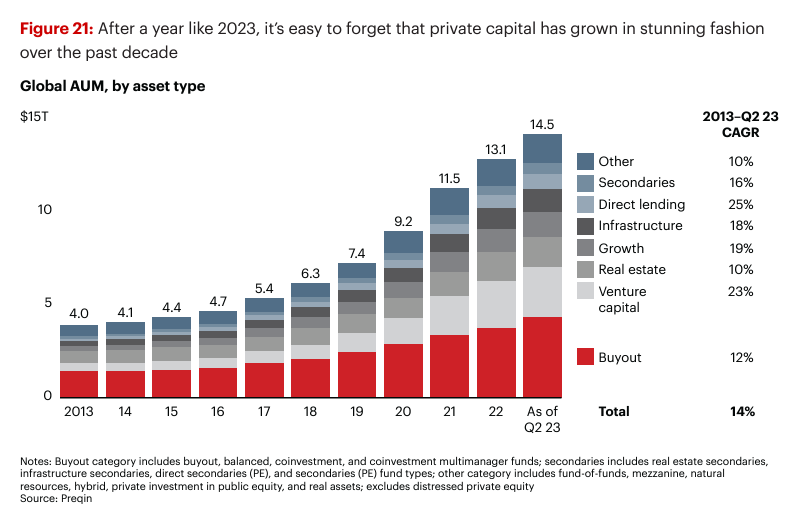

The private markets are expected to continue growing fast, which is a trend that will benefit Antin. According to EQT, the size of private markets is expected to double in 2030.

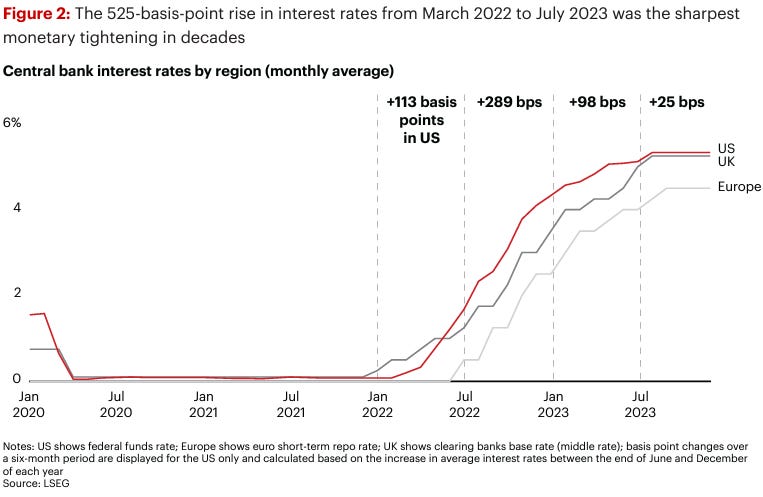

However, the private markets are facing a challenging environment amid the macro headwinds. The rate hikes are facing a strong negative impact in the industry:

Higher rates imply lower valuations and difficult financing conditions

This imply lower transaction volume as sellers and buyers do not match their valuations expectations (sellers don’t wish to sell at discount and buyers don’t wan’t to pay multiples from record year 2021)

Lower transaction implies that funds are either not investing the capital or returning capital to the investors increase dry powder to record levels

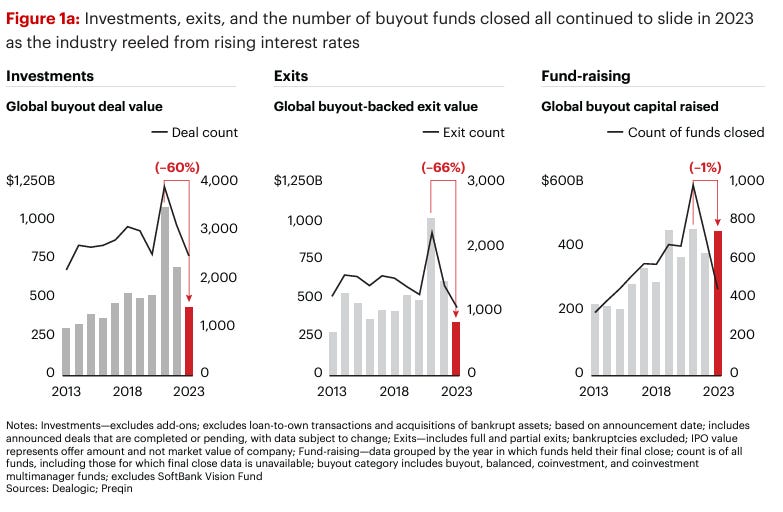

Its a perfect storm that is affecting negatively the industry. Volumes are at historical lows, especially the exit count. Take into consideration that the number PE funds is higher than 2013, while the number of total transactions is at historical lows:

The easing of the monetary policy expected for 2024-2025 period should provide some relief to the industry. In addition, its going to be mandatory for many funds to transact in 2024 in order to return capital to the LPs.

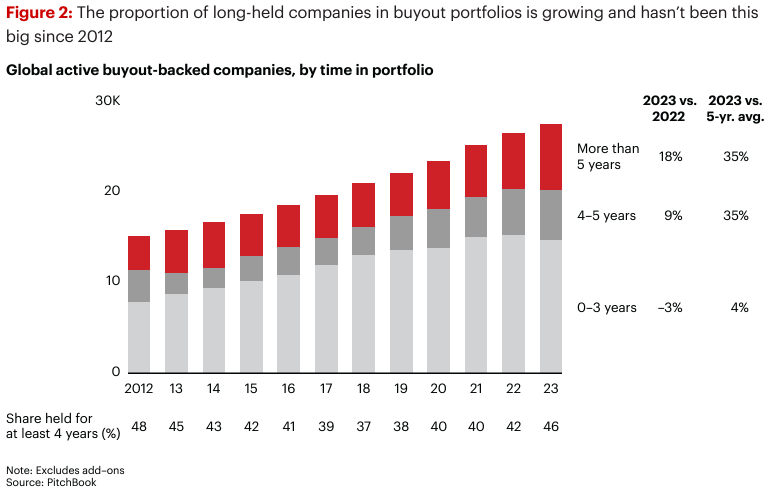

As you can see in the following chart from Bain & Co., the proportion of companies with more than 5 years in the porfolio is at historical highs, a clear sign that GPs are going to be forced to transact in order to return capital to the LPs, which will be either bad for forced sellers or could be an opportunity for buyers.

As a conclusion:

During 2022-2023 the private markets are experiencing a negative momentum in terms of fundraising, and 2024 is expected to remain similar

Private equity firms are not transacting, but they are going to be forced soon as they have to either invest the capital or sell portfolio companies to return capital to the investors

Under this challenging environment, there is a strong consolidation in the sector which is forcing smaller firms to seek deals with the big players. Antin is well positioned to navigate these waters and should act as a consolidator if opportunities arise

The private equity infrastructure segment

Infrastructure AUM have increased at a +18% CAGR since 2013, one of the highest of the alternative asset management industry.

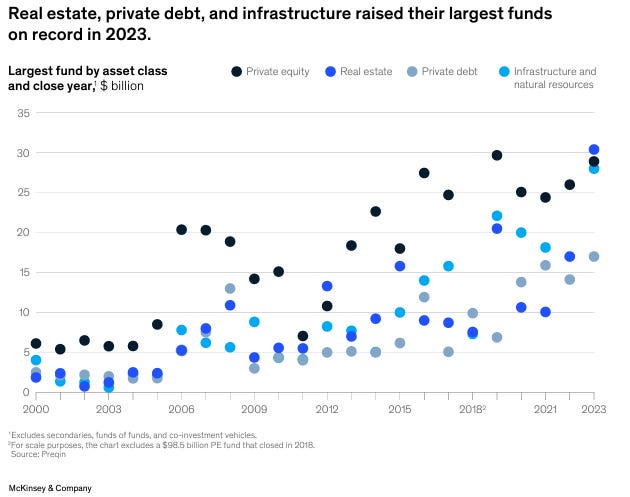

2023 was a complicated year for the segment, as fundraising declined by more than 50%. However, part of this decline is due to the fact that the biggest firms launched their flagship strategies in 2021 and 2022. In addition, despite having low aggregated figures, 2023 was a record year with the biggest ever closed fund.

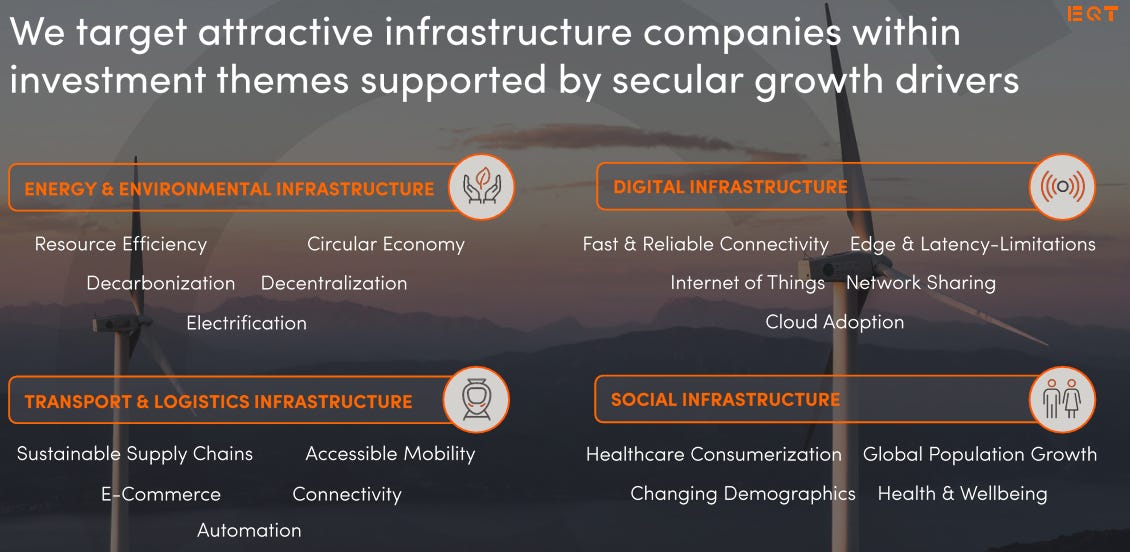

Some reports and companies suggest that Infrastructure will remain a key topic in the coming years. According to EQT, these are the main reasons that will support the growth of the asset class:

Europe and the US will need to invest significant amounts in infrastructure during the next decades, which will require heavy spending from both the public and private sectors

The energy and digital transition will accelerate the trend

Private markets are expected to continue growing, and infrastructure is one of the fastest growing asset classes among alternative assets

Limited partners (LPs) surveyed by McKinsey remain bullish on their deployment to the asset class, and at least a dozen vehicles targeting more than $10 billion were actively fundraising as of the end of 2023. Multiple recent acquisitions of large infrastructure GPs by global multi-asset-class managers also indicate marketwide conviction in the asset class’s potential.

McKinsey & Co.3

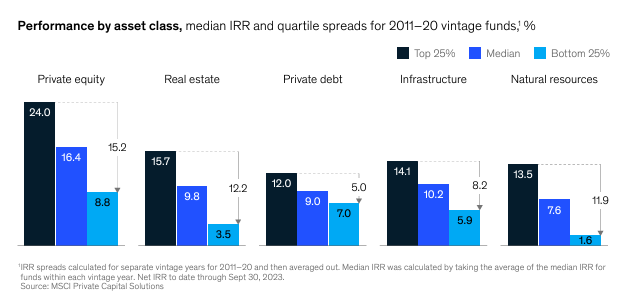

Finally, performance from the asset class remains strong and median returns offer an IRR 10.2%, which is the second highest among the different asset classes. Private equity remains the most profitable strategy.

The consolidation of the industry

The industry is highly fragmented and has started a process of consolidation.

Every industry eventually goes through consolidation. As markets become tougher, average players often see their growth plateau, small players lack the resources to push through the down cycle, and niche players are relegated to being niche players forever. The bottom line is that during tougher markets, consolidation occurs and the best-in-class players continue to perform, separating themselves from the rest.

Bruce Flatt, Brookfield CEO

Bruce Flatt, CEO of Brookfield predicts that industry is going to consolidate as many smaller managers will struggle to survive.

The attributes of leading asset managers are strong investment performance over a long period of time; access to scale capital; fund and geographic diversification; and a large-scale organization to service clients and capture future growth trends. Similar to the other major industries, there are only a handful of alternative asset managers who have these attributes today.

Industry consolidation is about reducing the number of players and concentrating fundraising. The latter is already happening as top investors are the ones raising more capital:

Main competitors

The Swedish EQT AB is the largest competitor of Antin in Europe. The firm manages several strategies and Infrastructure is the flagship strategy. EQT is targeting €20bn for the Flagship Fund VI, which is double the size of Antin’s Fund V.

The firm targets the same infra sectors as Antin. However, the funds target higher tickets given their size:

Antin is the second largest infrastructure player in Europe, which puts them in a very solid position to continue capturing growth in the future

Other competitors

Copenhagen Infrastructure Partners (CIP) is an investment firm from Denmark has €26bn AUM and manages 12 funds for ~150 investors. Its a firm of a slightly lower size than Antin, but its funds are close to Antin’s in terms of size. Last flagship fund reached €7bn. However, CIP focus on greenfield renewable energy projects rather than private companies. CIP and Antin do not compete in terms of investments (they might in terms of investors)

Ardian is currently facing strong difficulties, especially in the succession of the management. The company is willing to go public once markets recover or explore an acquisition to grow its asset base. In addition, there has been problems with the male senior management.4 The company has multiple strategies and its not a pure infrastructure player. In the infrastructure segment, they have €30bn of AUM invested in toll roads, airports, telecom assets (fiber, etc), heat and power plants, etc. It is therefore a direct competitor of Antin.

The fourth largest firm, DIF, was recently acquired by CVC. This company manages around €16bn, which is half the size of Antin. The company was acquired at €1.1bn valuation. No multiples have been disclosed. The funds are much smaller than Antin’s flaghisp (€4.0bn with smaller ticket size vs 10.0bn of Antin’s latest Flagship Fund, which implies that the company is not competing against Antin, at least in some of the deals). The flagship fund invest in greenfield projects, so little overlap with Antin.

Antin ranked #11 and #15 in 2021 and 2022, respectively, being the second largest infrastructure player in Europe:

Outside Europe, the biggest players are Macquarie (Australia), Brookfield (Canada), and Global Infrastructure Partners (US). GIP was acquired by BlackRock. This company has ~$100bn AUM and the valuation reached $12.5bn (analyst estimates P/E was around 25-29x.

Other firms such as Stonepeak and I Squared Capital are also key players. Stonepeak is focused in the Americas with only four investments made in Europe while I Squared has more presence in Europe. I Squared has a slightly higher size than Antin with $38bn AUM (~€35bn vs €30bn of Antin).

Antin competes against these firms, as many of them invest some of their capital in Europe. However, their competition might be smoother than local players.

A final word about EQT

EQT is clearly the wining player in Europe as the firm is growing exponentially. The stock as multiplied by 1.75x in the last year, with an impressive rally in the last month, climbing from €275 per share to current €350 per share, reflecting the high quality of the company.

However, valuation matters a lot in investing and the current multiples and stock performance may offer lower potential upside. It is difficult to predict which company might offer better returns in the next 5 years, but Antin is trading at a lower multiples and offers a strong opportunity to continue growing (more on the valuation section). In terms of quality, EQT is the clear leader in Europe, but Antin is a really good business that trades at below market-standard multiples and has strong growth prospects for the next decade.

For that reason, I have chosen Antin and not EQT. The company is well positioned to continue capturing growth given:

It has a solid investor base and is investing in growing

The company manages €30bn AUM and has room to continue growing. Every €1bn of new AUM has a meaningful impact. For firms like EQT, they need to raise significantly higher amounts of money to keep growing

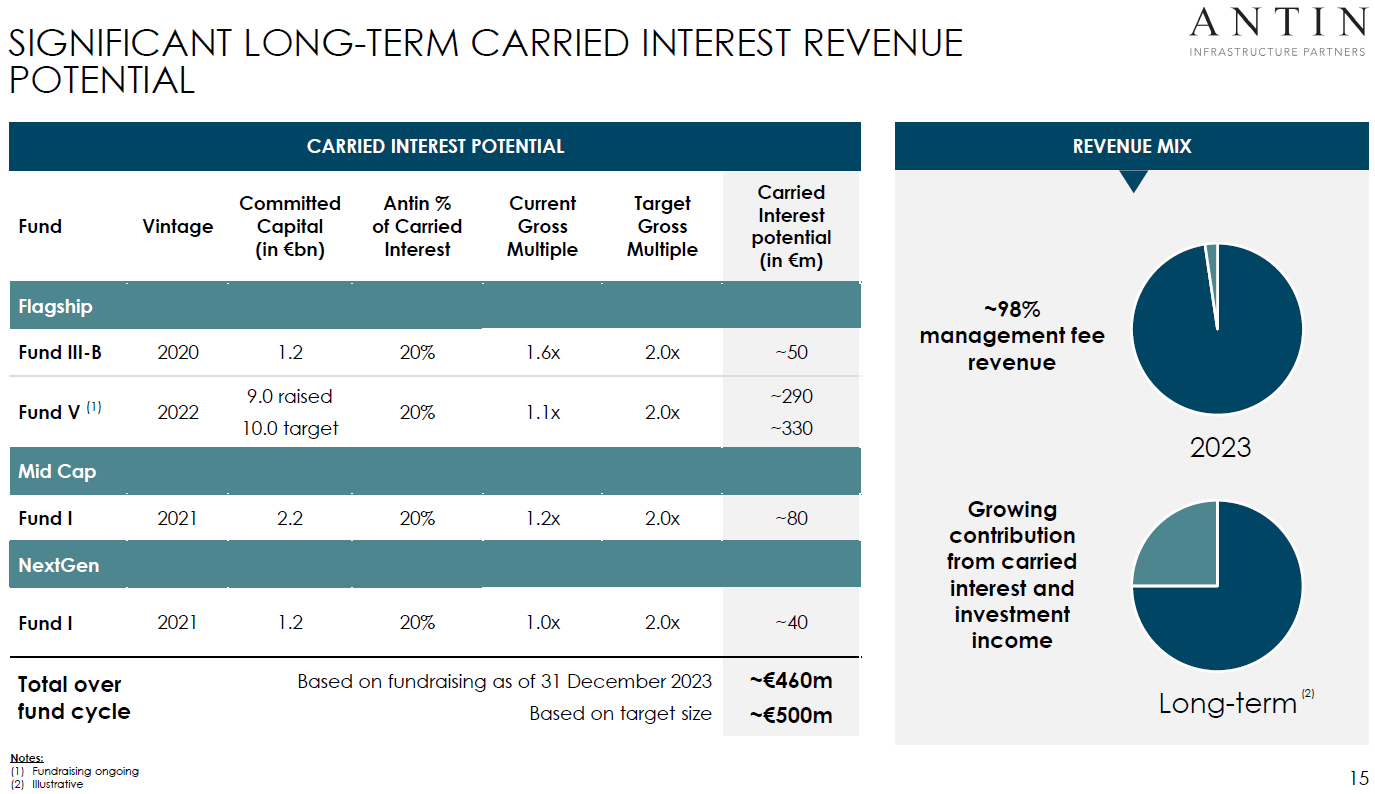

The carried interest potential might not be reflected in current valuation

Section II: Analysis of Antin

Antin business model

Strategies and investments

Investments

Returns

Investors

Management team

Shareholders

SWOT

1. Antin business model

Antin earns money through:

Management fees: They charge yearly ~1.2-1.5% management fees on committed or invested capital

Carried interest: Antin will retain 20% of the profits (20% to the company and 80% to the team)

Capital appreciation. The company invests in its own funds to accelerate fundraising and to align interests.

1. Management fees

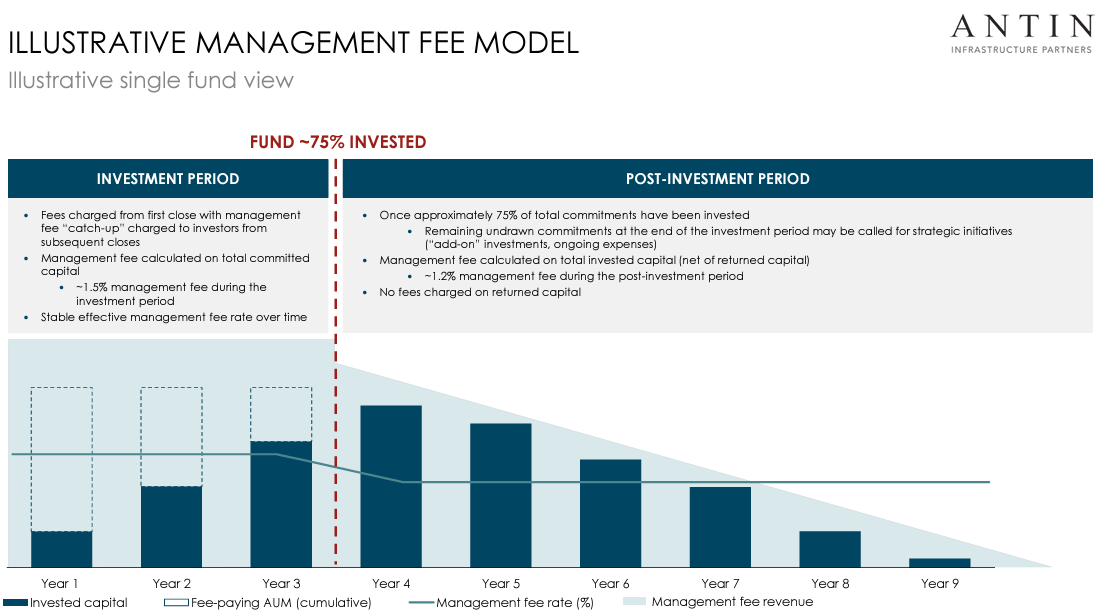

Management fees are dependent on two critical stages:

Investment period: The company earns 1.5% over committed capital. The investment period lasts around 3-5 years (when the fund invests 75% of commitments).

Post-investment period: The company earns a lower fee of c.1.2% over the capital invested (vs. committed capital in the investment period). This period has a duration of 5-7 years, depending on market conditions, timing of divestments, etc.

The management fees can vary depending on the negotiation with the investors (a large investor might receive discount of the management fees)

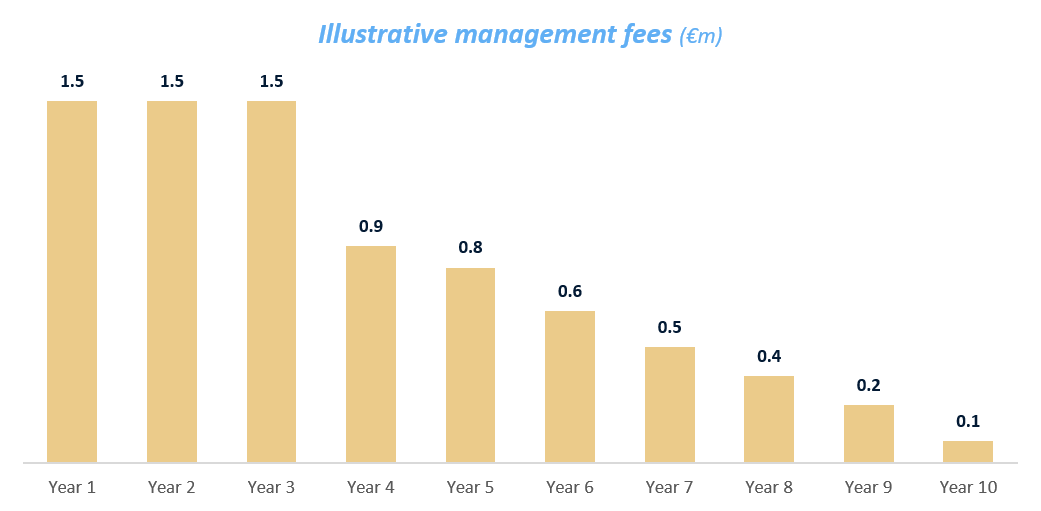

An illustrative example of the management fees:

An insurance company decides to invest €100m in Antin’s Flagship fund

Investment period. The insurance company will pay 1.5% over the capital committed (€100m) during the first 3 years (€1.5m during three years). The company will not deliver the €100m to Antin directly. During the period, Antin will call the capital when they invest in a company.

Post investment period. After three years, Antin will have called c.75% of the capital to invest in 10-12 companies. The investor will have invested €75m and will have €25m committed for further initiatives to enhance the porfolio. During this period, the company will pay 1.2% over the invested capital (e.g., 1.2% over the €75m, €0.9m). During this period, Antin will return capital to the investors whenever they sell a company. This capital will be subtracted from the invested capital (i.e., doesn’t pay fees)

Using this example, an investor will pay a total of €8m in management fees for every €100m invested in an Antin’s fund. Its an illustrative example as the final amount will depend on the total invested capital and the speed of divestments (the faster, the less fees they will pay).

The beauty of the business model is that for every €100m raised, the firm secures around €8-10m fees over a period of 10 years. Its a predictable cash flow model. Additionally, because its an asset light business, the bigger the fund, the higher the profits to the company due to the high operating leverage. The same time can manage extra €500m, which imply additional €40m revenues in a 10 year period that go directly to margin.

Advanced concept: catch-up fees. When Antin launches a fund, the fundraising period takes around three years. The investors who invest in year 2 and year 3, will pay catch-up fees (i.e., if an investor commits capital in year 3, will pay fees for the years 1 and 2). This makes sense because they benefit from the potential value creation of the investments already made.

2. Carried interest

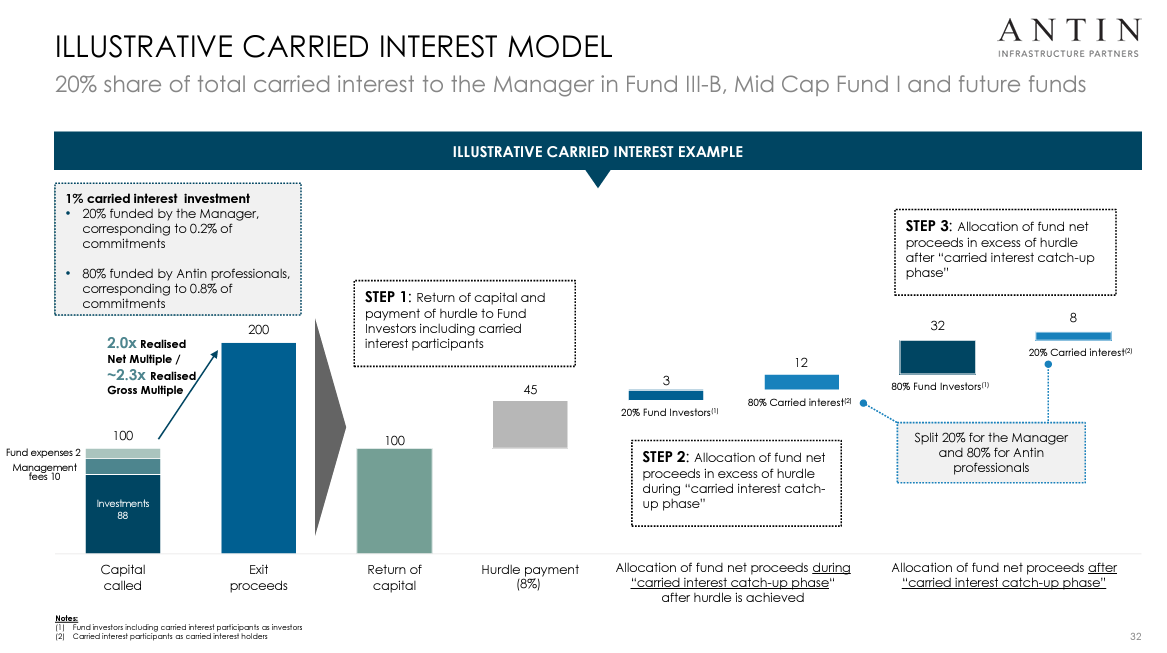

Antin earns money through profit sharing. Antin is entitled to 20% of the profits generated by their funds if the investors earn at least an 8% return (hurdle rate). The carried interest is split with the team (80% to the team, 20% to the firm). Therefore, Antin’s profit share is 4% of the profits (20% of the 20% of the profits).

The process is complicated, which made forecasts very difficult. The company is doing an excellent job in explaining how carried interest works (illustrative example):

Its complex because the capital is distributed once the companies are sold. Therefore, calculations and estimates are very complex as money is returned in a 5-year period

Using Antin’s above example:

The company invests €100m and generates €100m profit (i.e., the fund returns 2.0x multiple).

Out of the €200m proceeds, the investors will receive €100m (their capital invested) and €45m of hurdle (8% of minimum return). The step 1 of the example below

Once the investors have received their capital (€100m) and the minimum return (€45m), Antin will retain 80% of the profits until Antin’s share in the profits is 20% (step 2 of the example below)

When Antin’s share in profits is 20%, for every €100 of profits, Antin will retain 20 and the investor 80 (step 3)The quantification of future carried interest will be done in the financials and valuation section. The important thing to consider is that the 20% share of the company in the carried interest was established in 2021 after the IPO. This means that only funds from 2021 onward, will have carried interest attributable to the company. Therefore, carried interest will start to appear in the P&L in the mid-term (around 3-4 years)

3. GP commitments

Investors require private equity companies to invest alongside with them in the funds. This is called GP commitment. Its a way to align interests with investors and to accelerate fundraising.

The company has a policy to invest c.1% of the fund size with their own balance sheet. As a result, the company is invested in the funds and will benefit from the portfolio returns.

The company has off-balance sheet undrawn commitments of ~€150m and a cash balance of ~400m.

4. Other considerations

An asset manager is an asset light business that requires an office, people, and computers. However, it requires high salaries in order to attract the best talent.

Salaries represent around 25% of revenues but the real cost is in the carried interest. The employees are entitled to 80% of the carried interest, which implies a very significant sum of money. The balance between their profits and the profits to the shareholders is complicated because the interest in performing well is extremely important, but the 80-20 structure seems too asymmetric. This is the main problem of the model.

Margins are very high. EBITDA margin stand between 50-60%. The margins might not be stable given that they are dependent on the fees and other expenses such as placement fees (money paid to companies that raise capital for the funds).

The company doesn’t have strong capex needs as all the investments are in hiring new personnel, which are a cost reflected in salaries. Therefore, cash flow tends to be very similar to net income. For that reason, EV/EBTIDA and P/E are the most common multiples in this industry,

2. Strategies and investments

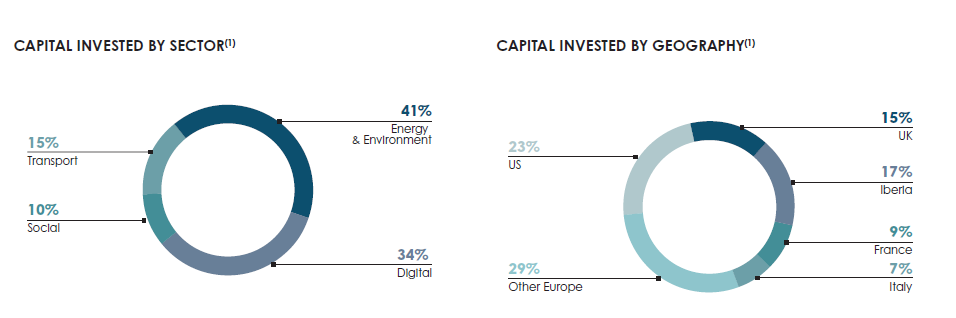

Antin invests in the energy and environment, digital, transport and social infrastructure sectors across Europe and North America

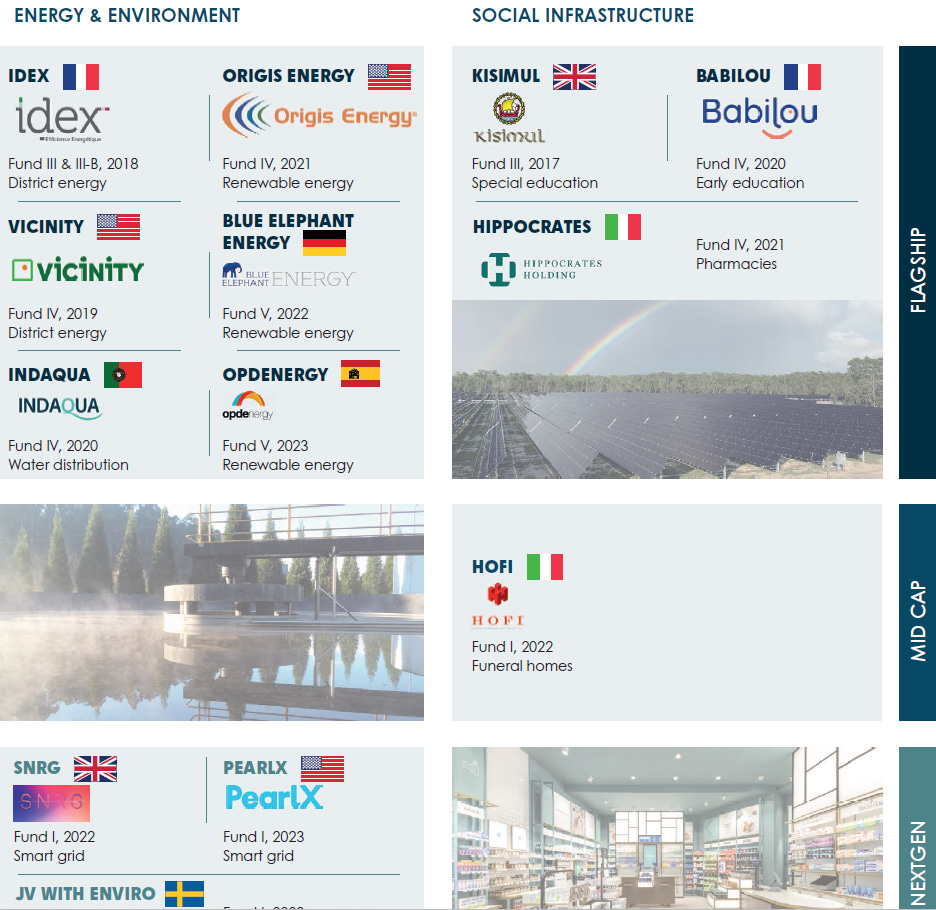

Antin manages three strategies:

Flagship fund. The core strategy of Antin, which invests large tickets (€600m - 1,000m). The company is currently raising its last fund with a target size of €10bn

Mid cap strategy. Invests tickets of €50-300m in energy and environment, digital, transport and social infrastructure sectors across Europe and North America. The strategy was launched in 2021

Next gen strategy. Invests tickets of €50-200m to scale infrastructure companies, less mature than mid cap and flagship fund. The strategy was launched in 2021

The company currently covers the upper mid-market with the flagship fund, the mid market with the mid-cap strategy and finally, the mid-to-low mid-market with the next gen strategy. Additionally, they cover mature companies (Flagship and mid-cap) and growth companies (next-gen).

Flagship fund

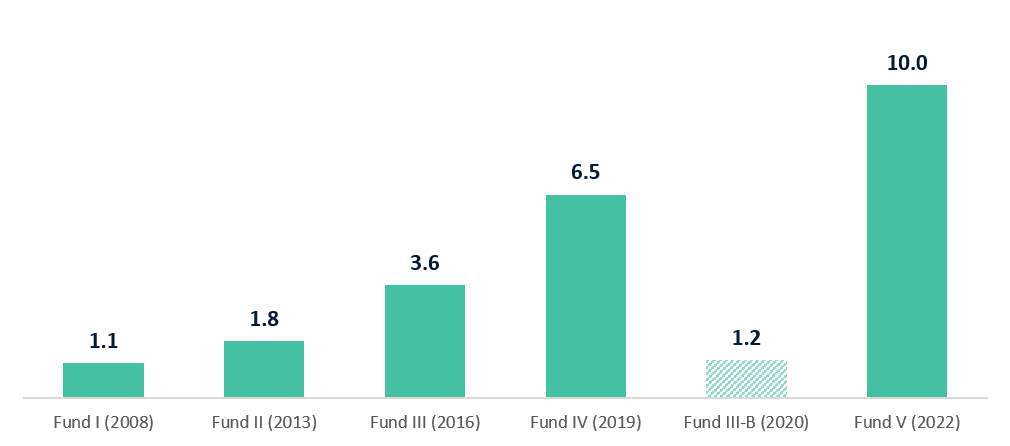

The company is currently raising capital for Fund V (€9bn already secured, targeting a final close of €10bn in 2024). The company launches a new fund every three years, having launched 5+1 funds (Fund IIIb is an annex fund) since inception. The growth in the fund size has been impressive in the last decade:

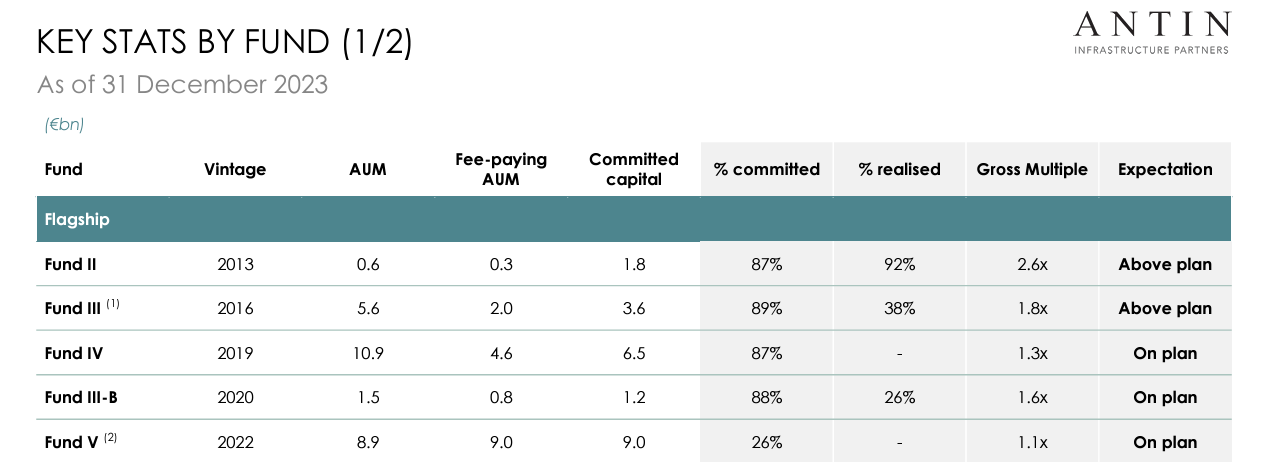

Since the first fund launched in 2008 (Fund I), the fund size has increased from €1.1bn to €10bn for the last fund. As of December 2023, the company had €16.8bn of fee-earning asset under management from this strategy.

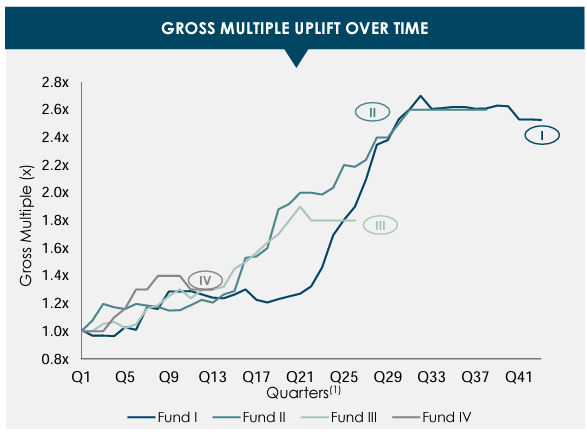

The returns of Fund II are strong with a gross multiple of 2.6x (total value / total investment). With 92% of the fund divested, the return for fund II is going to be very strong (Fund III is on track to reach a gross multiple above 2.0x). For the remaining funds, it is too early to evaluate performance as it takes years to divest the funds.

Take into consideration that this portfolios do not trade as the portfolios of mutual funds. The assets might be valued by independent third parties or in case of a transaction, so the real value appears when the company is sold. Therefore, returns only make sense when the company has divested the assets.

As seen in the chart below, the final returns appear at the end of the fund life when the manager has divested a significant part of the portfolio.

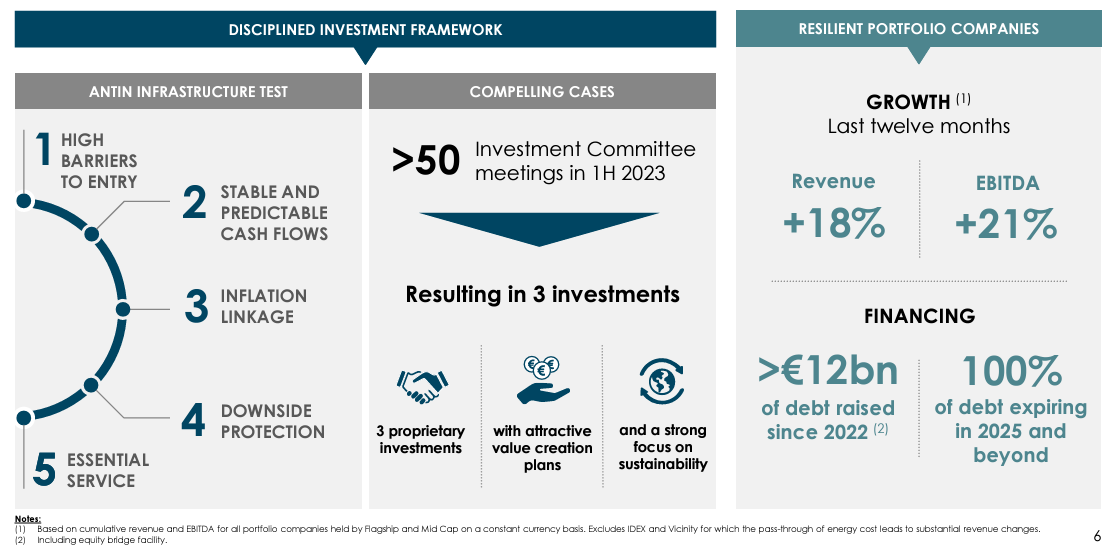

Investment process: Antin’s Infrastructure Test

To be selected for the Flagship fund, an investment must have the following characteristics:

Provide an essential service (e.g., fiber networks, funerary services, energy platforms, etc.)

Exhibit significant barriers to entry (many infrastructure companies have very high barriers to entry, such as oil storage and transportation facilities

Have stable and predictable cash flows (this is key in private equity due to the use of leverage)

Provide an inflation hedge

Display robust downside protection mostly insulated from the business cycle

While the characteristics above mentioned are important, the key is the investment process:

Rigorous and selective process. As an example, during the 1H 2023, a total of 50 companies where presented to the investment committee and the company only invested in three companies (plus many others where analyzed)

Deal sourcing. It is very common that private equity firms enter into auctions. Investing through auctions implies competing against other firms to buy the asset. In this case, the three investments where proprietary investments. Proprietary investments allow the company to avoid auctions, which normally implies paying less for an asset.

According to the IPO registration document of 2021, nearly 2/3 of the investments where proprietary deals (i.e., the company sourced them). This is very important because auctions can negatively affect the returns because price paid can be higher

To have a strong process like Antin’s, firms need to have critical mass and top talent. The results have been strong with most investments with a cash on cash multiple above 2.0x for funds with significant capital divested.

Mid cap strategy

In 2021, the company launched the mid cap strategy. This strategy is focused on the mid market (i.e., companies of lower size than the Flagship strategy). This strategy invest tickets of lower size, between €50m to €300m.

The strategy invests in the same sectors and geographies as Flagship fund (energy and environment, digital, transport and social infrastructure sectors across Europe and North America).

Fund size is smaller than flagship strategy given that its a new strategy (its always more difficult to raise capital for a new strategy with no track-record) and the companies are smaller. The first fund raised in 2021 secured €2.2bn in commitments.

The investment process is the same as the Flagship Fund.

Next gen fund

This strategy invests in the same sectors as the other strategies, however it is focused on growth companies.

The company launched the first fund in 2021 and has raised €1.2bn, which is a very decent amount for a first-time fund dedicated to growth investments.

The fund I will invest in fast growing infrastructure companies that benefit from megatrends. Because the type of company is less mature, the investments are not required to meet the Antin’s test, but they are required to meet these criteria at the exit. The fund has already invest in five companies in sectors such as EV charging, smart grids and a JV with Michelin to create a tyre recicling group.

3. The investments

The company has currently close to 30 portfolio companies in energy, transport, social and digital infrastructure sectors.

The investments are biased towards energy and digital, with most of the capital been deployed in Europe (US currently represents 23% vs. 21% in 2021 (weight is increasing every year as the company is focusing to grow in the US)

Transport: includes investments such as wellboats, rail transport, EV charghing stations, etc.

Digital: fiber operators in the UK, Spain or Netherlands, Data centers, etc.

Energy: renewable energy (solar PV parks in Europe and the US), heating and cooling networks in France, smart grid networks, etc.

Social: private nurseries, pharmacies, funeral infrastructure, etc.

The company targets majority acquisitions (next gen might consider some minority stakes).

The type of transaction varies and includes buyouts, acquisition to other private equities or even public-to-private transactions such as OPDENERGY in Spain.

4. Performance of the funds

Performance is probably the only thing that matters in the asset management industry. Therefore, it is critical to have strong performance in every fund. As Warren Buffet says:

It takes 20 years to build a reputation and five minutes to ruin it

The complicated thing is that performance needs to remain high in every vintage, which is difficult given that every economic cycle tends to have different impact on the capital markets.

"Ultimately, private equity is about superior returns. If you're not providing strong returns to your investors, you won't be in business for long." - David Rubenstein (Founder of The Carlyle Group)

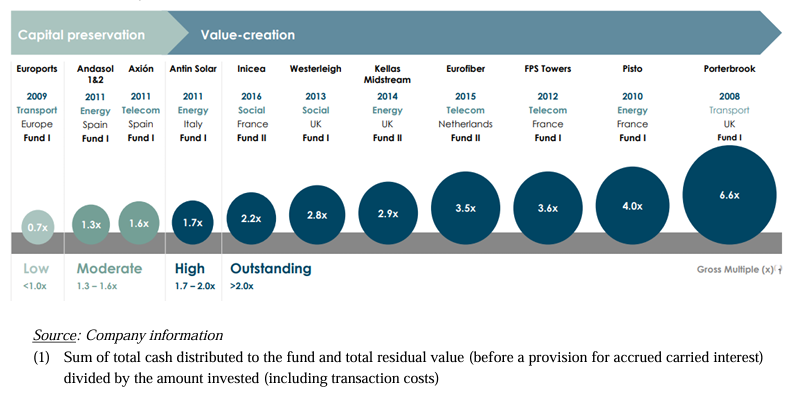

Performance of the realized investments has been strong. On average, the realized gross IRR stands at 22% and gross multiple at 2.6x, which is a very strong performance (imagine yourself realizing on average a return of 160% on every investment). In 2021, performance was slightly higher (24% IRR and 2.7x multiple)

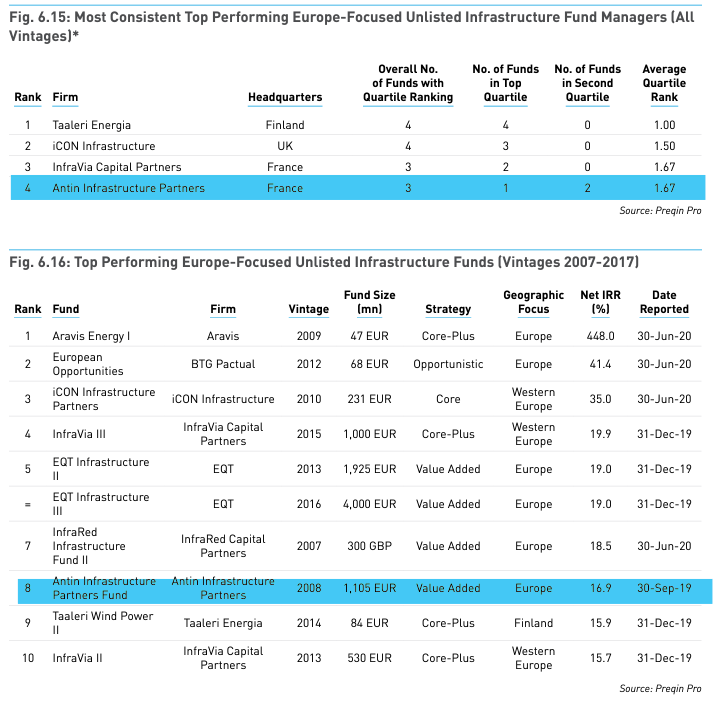

While Antin doesn’t compare its returns with other fund managers, some reports consider Antin as one of the most consisten top performing Europe-focused fund managers. However, reported performance from other funds such as EQT could be stronger.

Performance of Fund II and II has been strong, with most investments with gross multiples above 2.0x:

According to a Preqin report of 2020, Antin had one fund in top quartile and two in the second quartile of top performers.

Antin Fund I had a strong performance with a net IRR of 16.9% (vintage 2008). EQT performance could be higher at 19.0%. In any case, performance seems to be high. More recent data is not available for free, but past performance seems sufficiently strong (it is very complicated for small investors to have access to historical returns).

5. The investor base

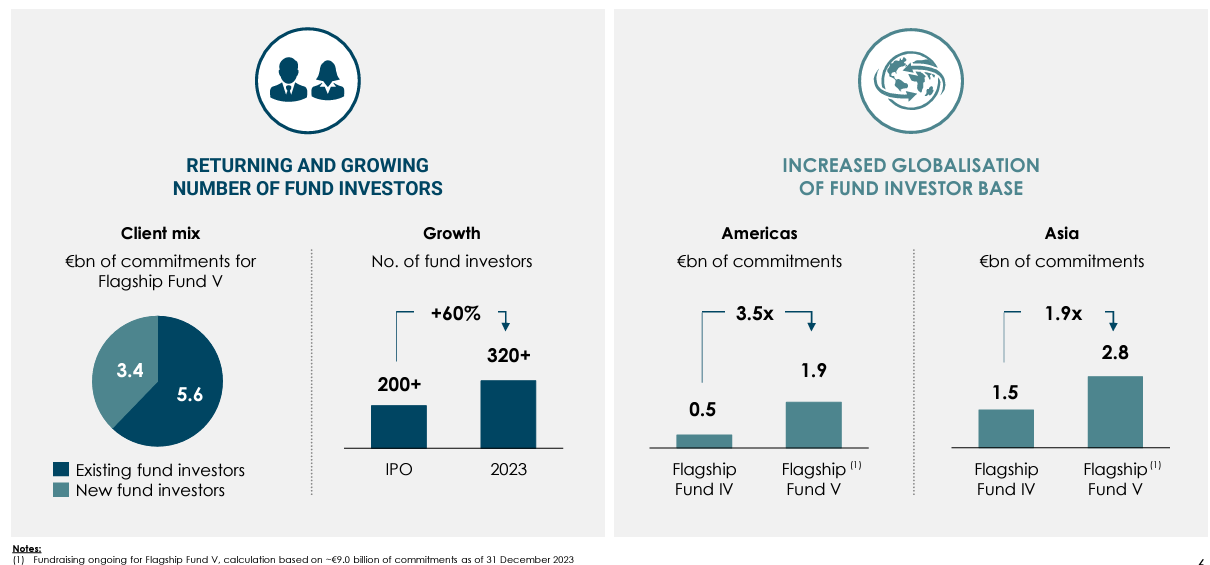

When the company went public, the company had nearly 213 investors with an average of €40m committed per investor. Now they have more than 300 investors (~+50% in less than three years).

The company is focused on expanding its investor base across the US and Asia.

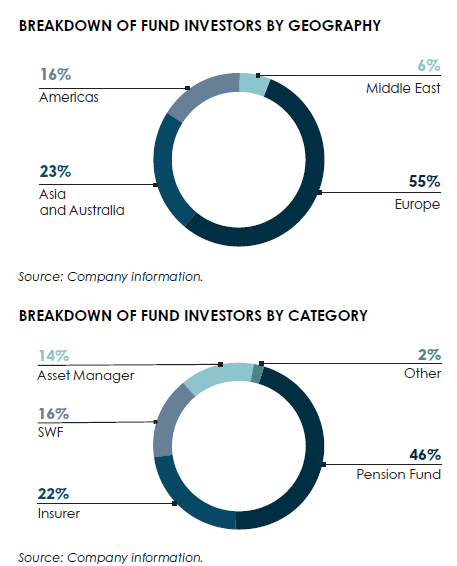

Capital raised in the US and Asia has grown exponentially and currently represents 39% of the total capital raised for Flagship Fund V.

In the US, the company is significantly growing the team and some analysts are expecting the company to launch a US-focused investment strategy.

In Asia, the company is investing in strengthening its capabilities with the opening of new offices such as Seoul (South Korea). In Korea, press reported that several pension funds and sovereign funds will invest $1bn in Antin’s funds5, signalling the positive impact of the geographical expansion.

The main investors are pension funds, insurers and sovereign wealth funds. This is also important because these institutional investors benefit from long term capital, which offers a strong support to Antin in terms of future fundraising.

In the fundraising of the Flagship fund, €5.6bn out of 9.0bn were raised from current investors. This is key to raise funds in the years ahead and a very positive sign. Repeating investors imply less time consumption and “permanent” capital for the company.

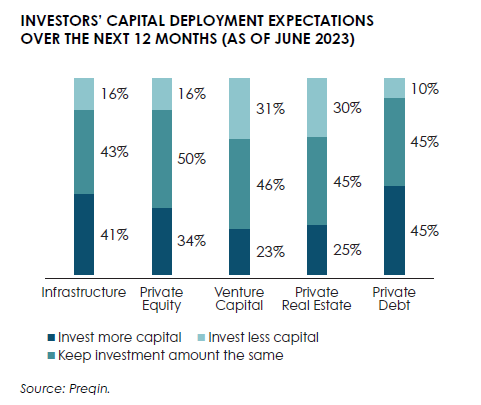

Additionally, worldwide investors expect to invest more (41% of them) or keep the investment amount (43%) in the private infrastructure asset class. It is one of the key areas where investors are going to focus in the short-to-mid term.

Investor concentration is not available, but these firms typically have several investors that commit an important amount of the total capital.

6. Management team

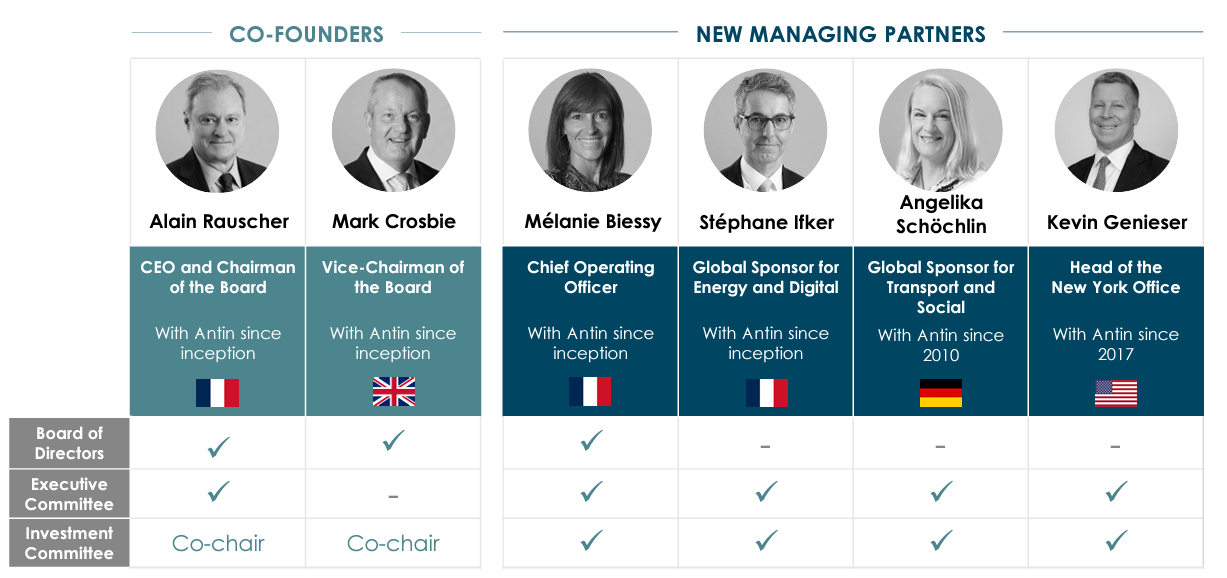

Since 2008, the company has been led by its two founding managing partners, Alain Rauscher and Mark Crosbie.

On November 2023, the company announced a leadership evolution:

Mark Crosbie decided to step down from the Executive Committee. He will remain a member of the Board of Directors and co-chair of the Investment Committee.

The company promoted four new Managing Partners

Today, the Executive Committee has five members,from France, Germany and the US. Alain Rauscher will remain as CEO and Chaiman. The recent changes are a normal development of a business that needs to expand its Executive Committee:

Alain Rauscher: CEO and Chairman

Mélanie Biessy: COO and member of de Board. She leads the operating platform and will oversee legal, tax, finance, compliance, IT and HR functions. She has been in Antin since inception.

Stéphane Ifker: leads the energy and digital sectors. He has been in Antin since inception.

Angelika Schöchlin: leads transport and social sectors. She joined Antin in 2010.

Kevin Genieser: head of NYC office. He has been involved in all Antin’s investments in the region, which now represent a significant portion (23% of the capital invested)

The company now enters a new phase, where new leaders are emerging to continue supporting the growth of the company. A new management implies always some risk, but it is important to have a succession plan to avoid problems such as rival Ardian is currently facing.

Alain Rauscher, the current CEO and Chairman is currently 65 years old.

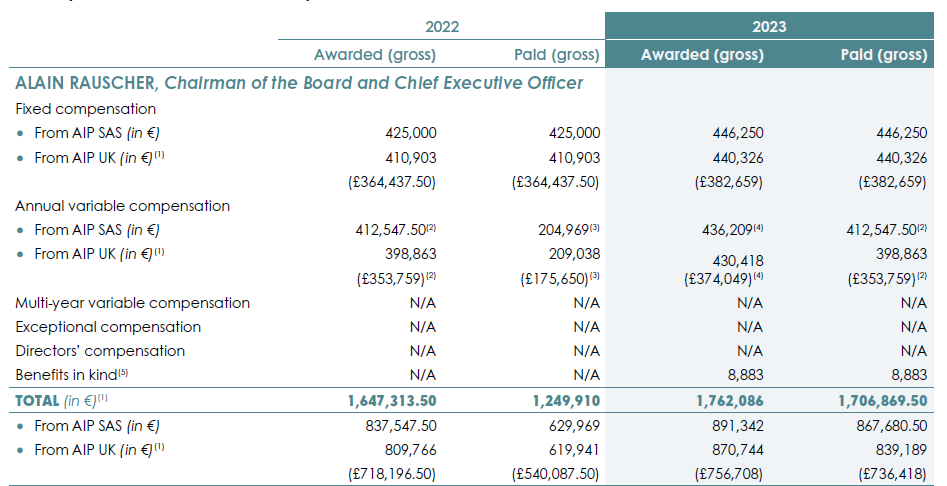

Compensation

Total compensation of the CEO for 2022 and 2023 was €1.2m and €1.7m in 2022 and 2023, respectively. This compensation is 4-6 times the average compensation of the employees:

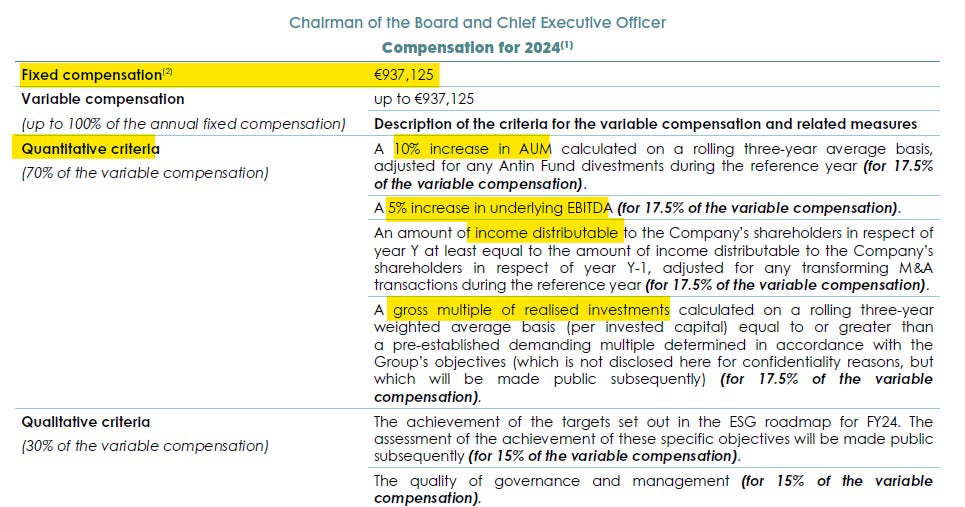

Compensation of the CEO for 2024 will be:

€937K fixed salary

Variable up to 100% of fixed salary based on the following criteria:

Variable compensation is based on the key drivers of the company:

Increase in AUM: depends on both fundraising and performance. It is critical for Antin to continue increasing AUM. A 10% increase of ~€3bn

Increase in EBITDA is a good performance measure given the company has no capex needs (i.e., no D&A impact) and has no financial leverage. The only item that is excluded is the lease expense, which is something meaningful. The compensation includes also distributable income to shareholders, which implies the cash generated of the company (these companies tend to generate similar FCF as Net Income). O

Gross multiple is the main performance indicator. While the multiple is not disclosed, it should be close to current average of 2.6x to maintain performance

Remaining 30% based on governance and ESG

Overall, the 70% allocation to quantitative metrics is based on metrics that are aligned to the interest of the shareholders. The remaining 30% is less quantifiable, but the quality of the management and governance is very important (if well defined by the company).

Other considerations:

The outlook provided for 2024 seems to be very conservative as:

Performance needs to be strong and company needs to raise at least €1bn this year in order to maintain 10% increase in AUM

Outlook for 2024 expects similar underlying EBITDA as 2023. However, variable retribution considers a 5% increase in EBITDA for 2024.

7. Shareholder structure

One key consideration is that the company is owned by the employees. The five managing partners hold more than half of the shares of the company:

Alain Rauscher (CEO): 30.5% of the shares

Mark Crosibe (co-founder): 17.3% of the shares

Mélanie Biessy (COO): 6.6% of the shares

Stéphane Ifker: 6.6%

Angelika Schöchlin: 5.9%

Kevin Geniesser (Head of NY office): Undisclosed

Other partners and employees hold 18% of the shares.

The management plus the employees hold 85% of the shares. This aligns interests with shareholders. However, it implies iliquidity, which might imply higher volatility. The current free float is around €300m

To reduce liquidity risk, the company has entered into a liquidity contract with BNP Paribas. According to the Annual Report: “The objective of the contract is to improve Antin’s share trading and monitor volatility on the regulated market of Euronext Paris”. However, the amount allocated to the contract is €2m, out of a free float of ~€400m.

8. SWOT analysis

🔐 Strengths

The company has a meaningful size with the last Flagship fund targeted size at €10bn. Size is key in the current environment.

Smaller firms are struggling to raise new capital, while the largest firms are the only ones raising significant capital. Antin should be one of those large firms and one of the winners of the next decade.

The company has generated strong returns in their funds, which puts them in a solid position for raising funds in the coming years.

The business model has predictable and stable cash flows. The company has no debt, allowing them to distribute a significant amount of the profits

Antin future growth requires new hirings but not significant amounts of capex. They do need capital to invest in their own funds. The company has €400m of cash, which will allow them to commit the target 1% of total fund size

Strong skin in the game from the management as they hold more than half of the shares

They charge slightly lower fees (1.5% mgmt fee), than traditional private equities that follow the 2/20 model (2.0% mgmt + 20% carried interest).

❌ Weaknesses and risks

Antin has not publicly introduced a plan to attract the retail clients, which represent a strong opportunity for the future. Companies like KKR or Blackstone are targeting this segment.

The current carried interest model is not aligned with Antin’s shareholders as only 20% is retained by the company and 80% by the employees. Companies like EQT have a 35/65 split, which is more aligned to the shareholders.

♟️Opportunities

The private markets are consolidating, which might offer growth opportunities

The private markets are expected to grow faster than public markets

Infrastructure is a critical segment and private markets are expected to play a key role in the future (especially given the weak financing positioning of governments)

There is significant opportunity to earn a high carried interest in the future, as the new policy was introduced in 2021 and takes 5-7 years to be effective.

❓Threats

The growth of competitors such as EQT might affect the capacity to attract and retain talent

They are only focused on infrastructure, which might be a threat in case this asset class faces more headwinds than others

The founding managing partners are retiring, which implies a transition period where a new management will progressively take the lead of the project, which always implies some risks

Private markets are facing challenging conditions, especially in the number of executed deals and the amounts of capital raised. Should this trends continue, Antin will face difficulties to grow and retain strong profitability

Summary of competitive advantages:

1️⃣There are high barriers to entry. In Europe, only a few players dominate the infrastructure segment. Only global firms like Brookfield could start competing in Europe against Antin, EQT or Ardian. Its is very complicated for a small firm to compete against Antin.

2️⃣Economies of scale. A fund of €8.0bn requires (approximately) the same human capital to manage the fund that a €7.0bn fund. Therefore, Antin can profit from the operating leverage of the company to increase profitability if fundraising conditions improve in the mid-term.

3️⃣Financial Strength: With substantial assets under management (AUM) and a history of successful fundraising, Antin has the financial resources to execute large-scale transactions and support portfolio companies throughout various stages of growth and development. The company has no financial leverage.

4️⃣Strong Track Record: Antin has a proven track record of successful investments and value creation (fund II performance above 2.0x, Fund III on track), which enhances its reputation within the private equity industry. This track record attracts high-quality management teams and business partners, providing Antin with access to attractive investment opportunities and co-investment opportunities.

5️⃣Global Presence: Antin has a strong international presence with offices in Europe, North America, and Asia. This global reach allows them to have access to a wider investor base with the potential to raise more funds and increase fund size and/or launch new strategies.

6️⃣Specialization in Infrastructure: Antin Infrastructure Partners specializes exclusively in infrastructure investments, allowing them to develop deep expertise and knowledge within the sector. This specialization enables Antin to identify attractive investment opportunities, conduct thorough due diligence, and add significant value to portfolio companies.

Section III: Financials and valuation

Fundraising

Current financials

Financial projections

Valuation

Disclaimer: The information in this blog is for informational purposes only and should not be considered financial advice. Consult a professional before making investment decisions. We strive for accuracy but do not guarantee it. Investing involves risks; do your own research. By reading this blog, you agree to release us from any liability.

1. Fundraising assumptions

Fee-earning AUM is the main driver of performance. However, it is difficult to predict the amount of fee-earning AUM will depend of future fundraising and the speed at which the company will divest the current funds.

The second driver is the personnel expenses, given its an asset light model. Personnel is highly qualified and the expense is significant. Currently, personnel expenses represent close to 25-30% of revenues.

The model will project Antin’s financials for a period of 5 years

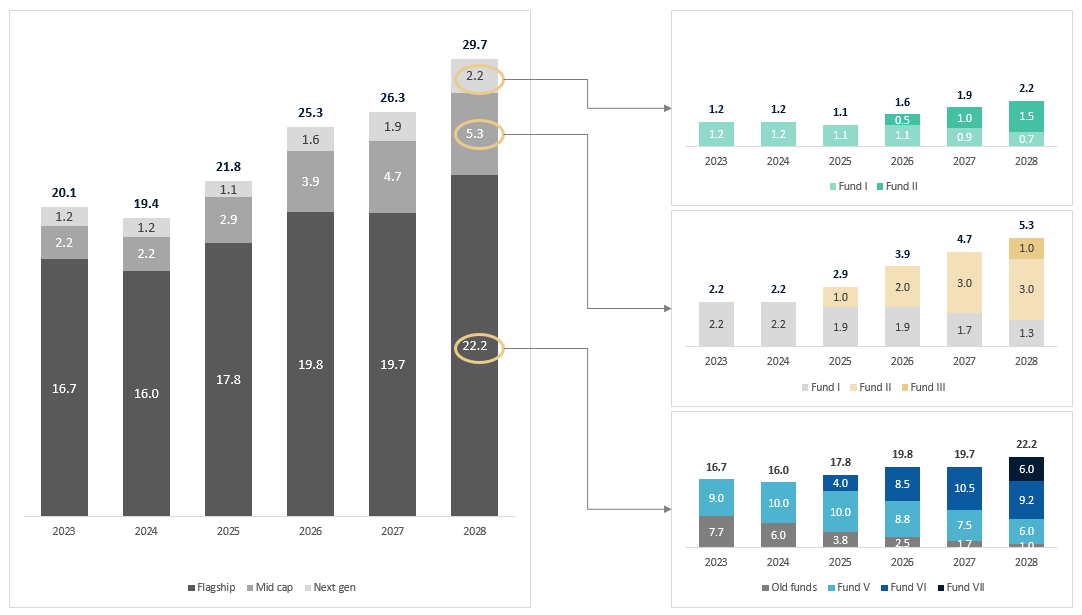

Fundraising assumptions:

Launch of Flagship Fund VI in 2025 (target €10.5bn, same as actual Fund V, €4.0.-4.4-2.0bn raised in 2026, 2027, and 2028, respectively)

Launch of Flagship Fund VII in 2028 (€6.0bn raised in 2028, last year of projections)

Launch of Mid Cap Fund II in 2026 (target €3.0bn, slightly higher than current fund of €2.2bn. Total raised of €1.0bn in 2025 and 1.0bn in 2026 and 2027, respectively)

Launch of Next Gen Fund II in 2026 (target €1.5bn, slightly higher than current fund of €1.2bn. Total raised of €0.5bn, 1.0bn, and €0.5bn in 2026 and 2027, respectively)

Note: The company is investing heavily in new hiring and will probably launch a new strategy in the near term. It is not included in the forecast to be conservative (will it might be negatively affecting margins)

Total fundraising of €20bn for the period 2024-2028:

It is challenging, but its only a continuation of the current fund sizes. Company should be able to raise these amounts after investing heavily in the US and Asia

The figure is not comparable to the historical average given the company has launched two additional strategies and invested to expand its global capabilities

In the last fund, 60% of the funds where raised from existing fund investors. This rate should increase for Fund VI if the performance remains strong.

In addition, the denominator effect should start to decrease with the current strong equity markets and the potential recovery of fixed income with decrease in long term rates

About denominator effect: Because 2022 was one of the worst years in history where both equities and bonds decreased with strong correlation between them, made that alternative investments such as private equity had higher weights in the portfolios, exceeding the target allocation (when equities and bonds fall, the total value of the portfolio falls. Private equity is less volatile, so its valuation remains equal. If a portfolio of 100 had 20 invested in alternatives, in 2023 the value of the portfolio could be 80 after the decline in bonds and equities and alternatives will represent 20 out of 80). This effect, should start easing in 2024, accelerating future fundraising.

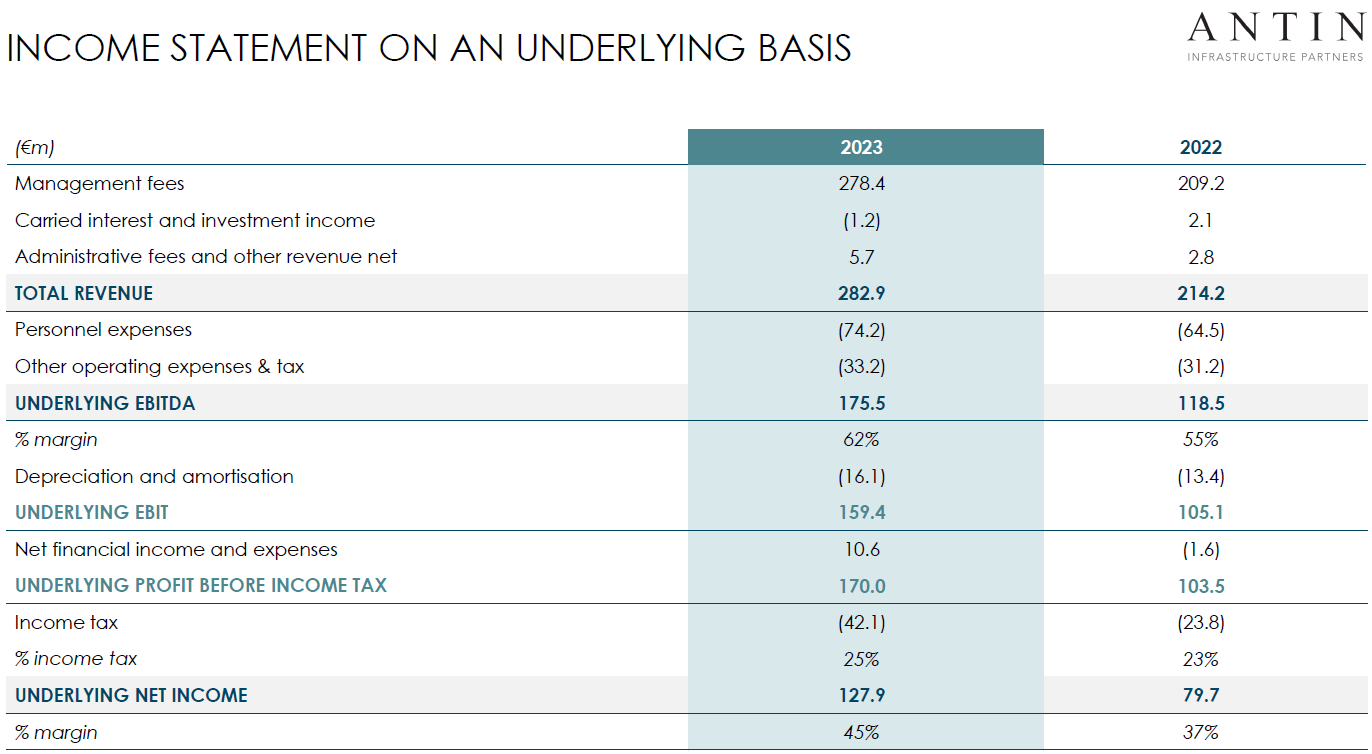

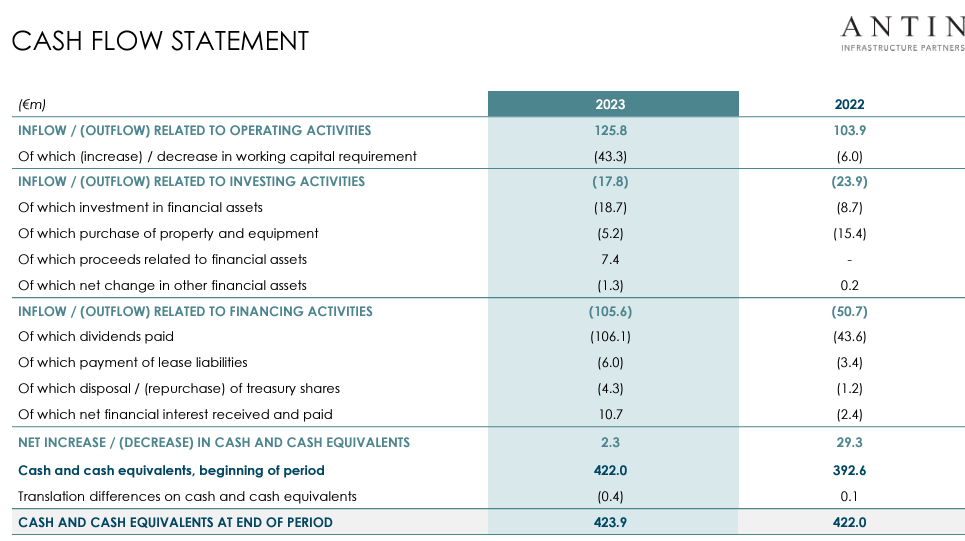

2. Current financials

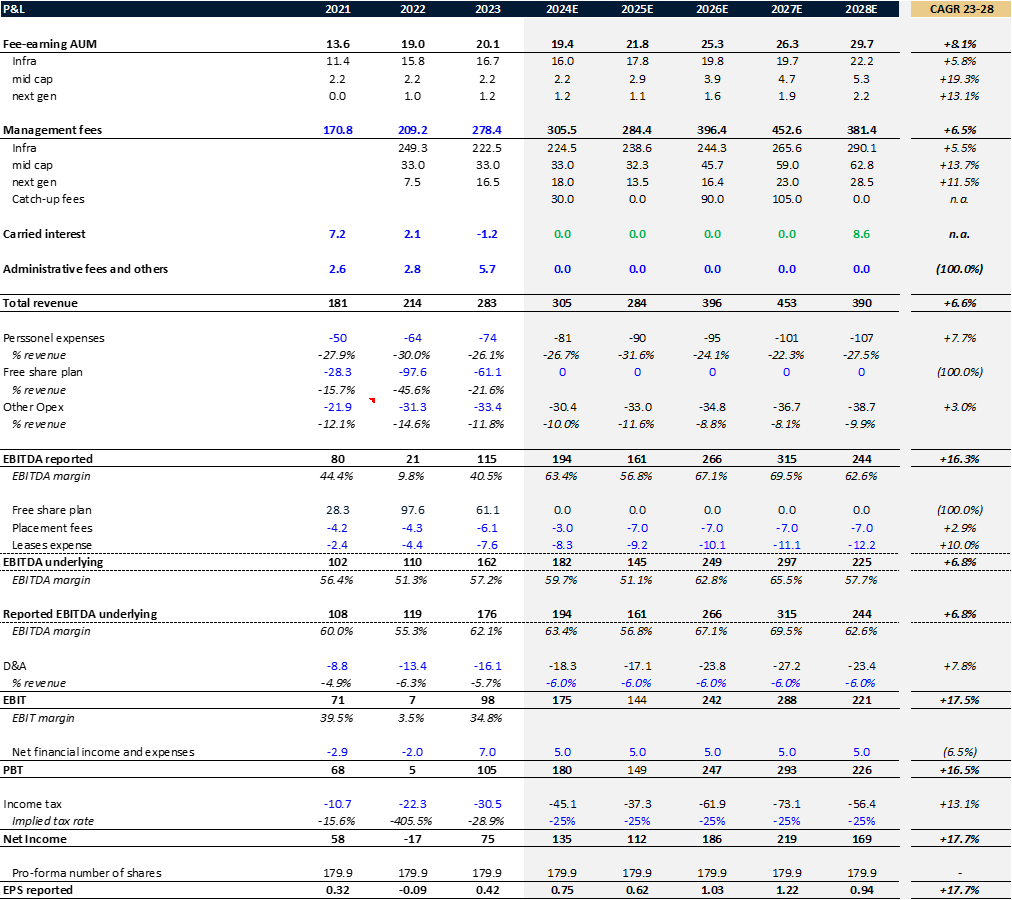

Current P&L of Antin (underlying metrics excluding free share plan):

The company generated €127.9m net profit, which will be distributed to the shareholders in 2024.

This company doesn’t have capex needs, so the can distribute the returns and continue growing. To continue growing, they invest in human capital, but not in expensive physical assets.

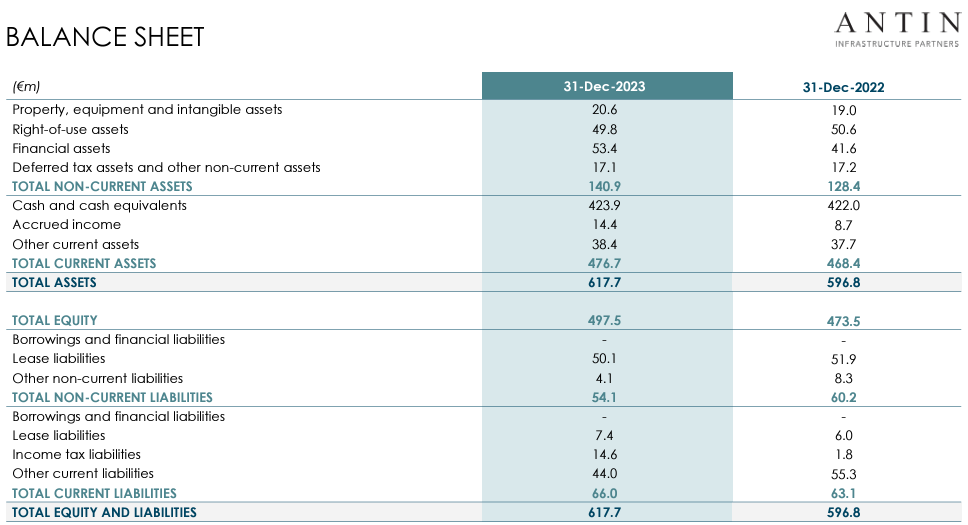

The company has no financial debt and a cash position of €424m. They have lease liabilities of €58m, but I treat leases as an expense at EBITDA level, rather than a debt-like item, which tends to be more precise as debt might have maturity in a few years and company will eventually need to extend or enter into a new lease agreement.

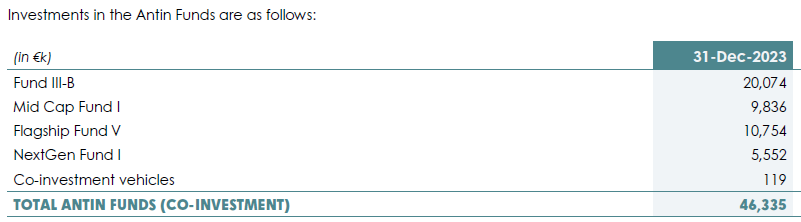

The balance sheet includes also €53m of financial assets, which are mainly investments in their own funds (known as GP commitments).

The company generated around €113m FCF (Cash flow operations - capex - lease payments + interest income), which compares with €128m underlying net income

3. Financial projections

Revenue: management fees include catch-up fees, no administrative fees considered as they are offset at opex level, and carried interest to begin in 2028. No income recognized from financial investments (recognized as increased value of the company)

Personnel expenses. The company currently has 227 employees (since IPO, the number of employees has increased from 97 in 2020 to current 227 due to the launch of new strategies). The management expects to add 20-30 new employees (mainly in the US). The model assumes 25 new hirings in 2024 and 5 more employees every year from 2025 to 2028 and 4% annual increase in salary expense. No more personnel is considered as it will require to launch a new strategy or increase fundraising to justify it.

The model doesn’t consider any new strategy or significant increase in AUM as the company has not disclosed any future plans.

Other opex forecast includes increasing other opex per employee of €85K in 2023 increasing to €104K in 2028 plus professional fees of €9-11m. No admin fees are considered as they are offset on the revenue line.

EPS consider fully diluted shares from the free shares plan established in 2021 and no more dilution in the future. Payment in shares to employees is considered in cash flow with annual share repurchases of €5m. No other free share program is considered.

Summary of financial projections:

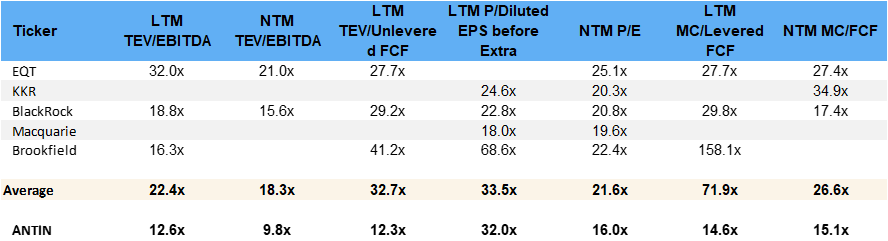

3. Valuation

The company went public in 2021 at a very high valuation. Since IPO, the stock has fallen by more than 50% and now is trading at a very reasonable valuation.

Today, the stocks trades at around €13 per share. On October 2023, the stock reached its lowest valuation at €10.65 per share. During 2023, the share reached €17 and has declined to the current €13 per share.

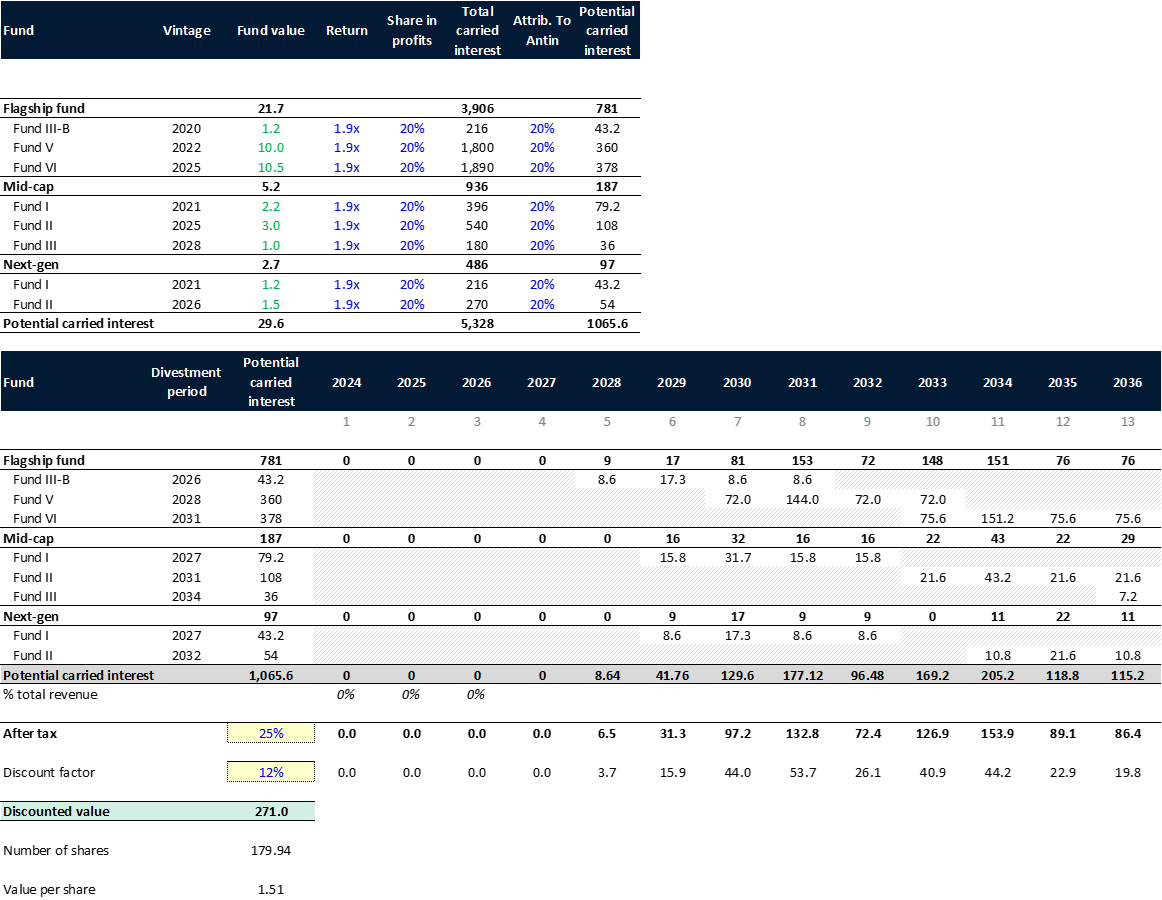

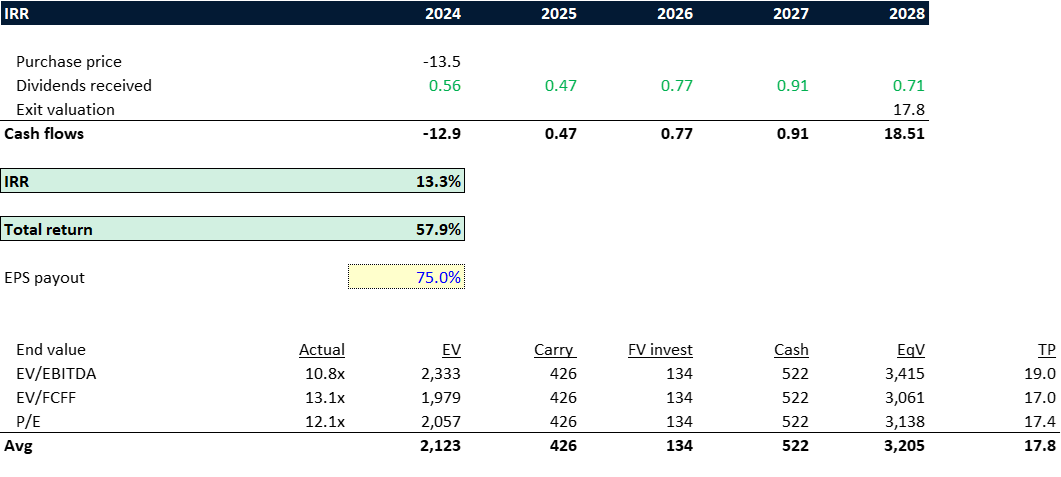

At current prices, and assuming a present value of carried interest of €271m, the company is trading at 12.1x ‘24E earnings and 10.8x ‘24E EBITDA. These are low multiples for an asset manager given the high quality of the business (predictable cash flows and high profitability).

An asset manager is typically valued using an EV/EBITDA multiple or a P/E. A DCF can also be applied as cash flows are predictable. To value the company we need to account for the management fees business plus the potential carried interest and the value of the investments made by the company on its own funds.

While a re-rating is not considered in the base case, these are the multiples from other competitors:

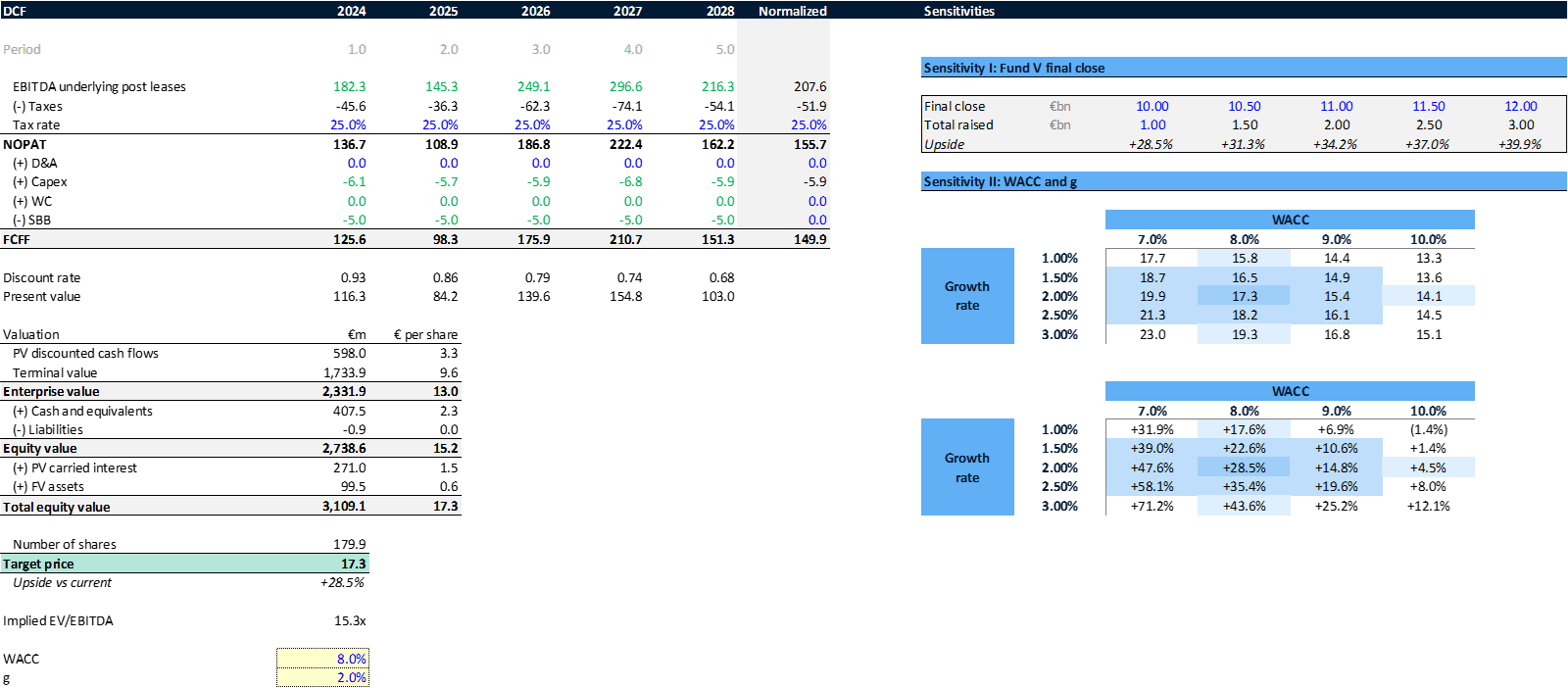

Using a DCF approach, the value of the company could be more than 25% higher than the current price. Additionally, the current price implies an EV/EBITDA multiple of 10.6x and a P/E ratio of 11.9x

Assumptions:

Projections including the mentioned assumptions

WACC 8.0% and perpetual growth of 2.0%

Company has no debt, only €0.9m of pension liability

PV value of carried interest of €271m (see below the calculations)

FV of assets assuming an additional investment of €46m (25% of current commitments; discounted from final cash position) to the current €46m already invested in Antin’s funds:

Valuing the carried interest

The company presents an estimated potential carried of €500m (which represents c.3.5% of total committed capital of €14.5bn). The model assumes additional €23bn raised in the next 5 years, which represents a total potential carried interest of €1.1bn (attributable to Antin).

To value carried interest, I made the following assumptions:

Estimated return of 1.9x, to match the simple calculations with Antin’s example

Carried to be earn in years 7 to 10 of the fund’s life (20%, 40%, 20% and 20%, respectively to take into consideration catch-up effect)

Tax rate of 25%

Discount rate of 12% to reflect uncertainty of returns

Takes into consideration Fund IIIb, Fund V, Mid cap I and Next Gen I plus future assumed funds (Fund VI, Fund VI, Mid cap II and III and Next Gen II)

Under these assumptions, the carried interest will have a present value of €270m, which will increase every year as we approach to the estimated first year of carried interest in 2029. By the fifth year of the model (2028), the present value of carried interest will reach €0.5bn

Should you have any question regarding this topic, feel free to message! Its a rough estimate, that can be conservative as company is talking of €500m of carry for the current funds while the PV of total funds included in the model is only half of it.

Section IV: Investment thesis conclusions

Potential returns

Investment thesis and conclusions

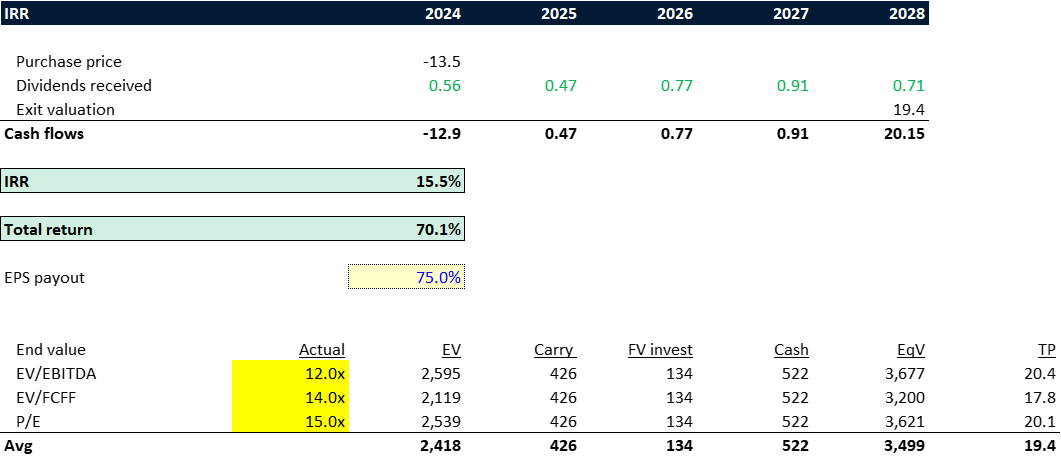

1. Potential returns

Assuming the actual 10.8x EBITDA multiple, the company could be worth €19.0 per share by 2028 (+40% increase in company valuation plus increase of PV of carried interest and the valuation of the investments in Antin’s funds).

Discounted carried interest includes the PV as of 2028 of future carry (estimated at €1.1bn).

Current fair value of assets of €133.5m by 2028 (+€80m vs 2023) assumes €225m invested in the next 5 years. The company currently has invested €46.3m in Flagship IIIb and V, Next Gen I and Mid Cap I. The projections assume 1.2% of the divested capital is returned at 1.7x to Antin. The net effect is very limited as its retained as cash and not distributed to shareholders.

Under these assumptions, the estimated IRR for a five year period will be 13.3%. This IRR includes a final valuation based on current multiples, which are low compared to how an asset manager should trade.

Projections imply the following growth in key metrics:

EBITDA CAGR of +9.2% (fueled by increase in AUM based on the size of current funds)

FCF CAGR +7.0% (in line with EBITDA as asset managers do not require significant capex)

EPS CAGR of +17.7% (2023 figures are affected by the investments in personnel and no new funds launched)

If the company trades in year 5 at more reasonable multiples (12.0x EBITDA, 14.0x FCF and 15.0x P/E), the potential IRR will increase to 15.5%. However, I don’t consider a re-rating in the base case scenario.

2. Investment thesis and conclusions

To conclude, Antin Infrastructure Partners has become the fifth investment of the portfolio.

Summary and conclusions of the investment thesis

Antin adds diversification to the portfolio in terms of sector and drivers of growth.

Its a high quality company with predictable cash flows that has grown significantly in the past years.

The company is well positioned in the infrastructure sector as it is one of the leading companies in Europe. The firm has a meaningful size and good investors, which is key in the current challenging environment.

The future growth expected in the model is reasonable, as it implies to replicate what they have done in the last 3 years. Should the company develop new strategies, growth will be even greater.

Because size is big, but not as big as other firms like Brookfield, the company can significantly improve its financials by adding extra €1bn in fundraising (e.g., €1.0bn capital raised, can imply €12-15m revenues, which is 5% the revenue of 2023)

While the expected IRR is not significantly high (expected around 13%), there are some catalysts that could increase the returns, which are:

Higher fundraising in the following funds

The launch of new strategies with meaningful size (e.g., launching a US mid-cap strategy with €2-3bn size)

Market to adjust Antin’s valuation to reflect the potential value of carried interest (which should start to be reflected in the P&L in 2-3 years)

Re-rating. Antin trades below other firms. While EQT should have a premium over Antin, the company is trading at low multiples given the quality of the company

The main challenge to the expected IRR is the fundraising environment. Currently, it is very difficult to raise funds, but these pressures should ease in the coming quarters as private equities divest the portfolios and return capital to LPs.

The shares where purchased at €13.41 per share.

The European Value Investor

Thank you for reading the report. Please leave a comment or send me a message if you have any questions or comments. I will be happy to discuss it!

You can also contact me through Twitter:

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

If you like my content and want to support it, I appreciate it!

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

Definitions

General Partner (GP): The managing entity responsible for raising and managing the private equity fund. GPs make investment decisions, manage portfolio companies, and typically receive management fees and a share of profits.

Limited Partner (LP): Investors in a private equity fund who contribute capital to the fund but have limited involvement in its management. LPs typically include institutional investors, pension funds, endowments, and high-net-worth individuals.

Carried Interest: A share of the profits earned by the General Partners of a private equity fund. Carried interest is typically a percentage of the fund's profits above a specified hurdle rate, and it serves as the primary incentive for GPs to generate returns for investors.

Fund Commitment: The amount of capital that Limited Partners commit to invest in a private equity fund over a specified period. This commitment is typically drawn down by the General Partner as needed to make investments.

Fund Term: The duration for which a private equity fund is structured to operate. Fund terms can vary but commonly range from 7 to 10 years, with the option for extensions if needed to manage and exit investments.

Extract from Antin’s 2023 Annual Report

Extract from Antin’s 2023 Annual Report

Extract from McKinsey report: McKinsey Global Private Markets Review 2024: Private markets in a slower era (link)

Source: FT (https://www.ft.com/content/482933e2-43a4-4d02-9a4f-f8b42f372638)

Source: https://pulsenews.co.kr/view.php?year=2023&no=351008