Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

IMPORTANT: This post reflects my opinion on the potential outcome of the CMA. It’s not an investment recommendation. You have to do your own research.

Index

Introduction to CVS Group

The Veterinary Industry

CMA Investigation

Business Plan and expansion through M&A

Management

Financial analysis

Competitive Advantages

Valuation

Final word

Executive Summary

CVS Group is a company specialized in veterinary services across the UK and Australia. The company is expanding across both geographies by acquiring veterinary practices.

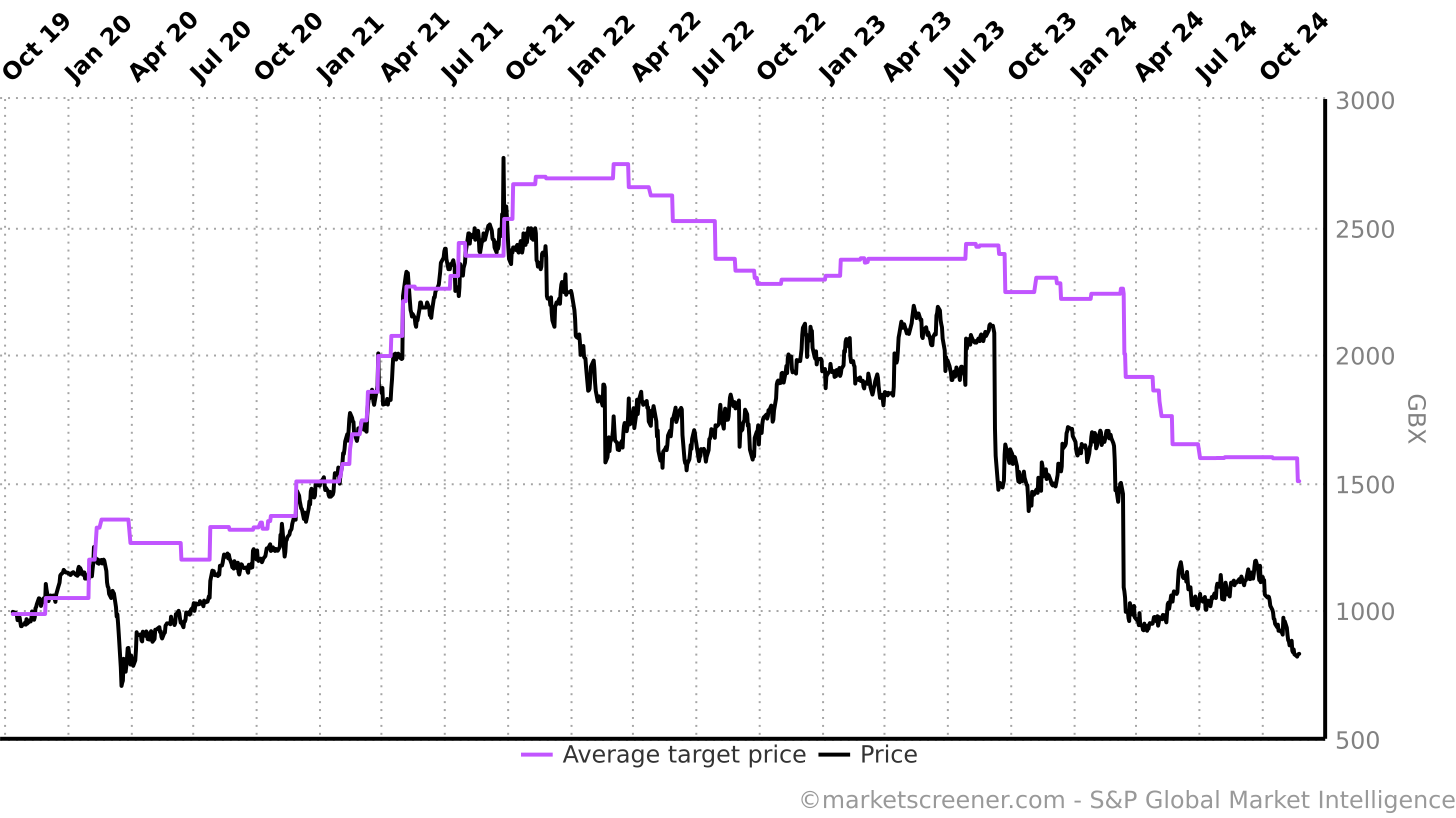

The share price has decreased dramatically during the last year after the CMA (the UK Competition and Markets Authority) decided to launch a formal market investigation after a review of the veterinary industry found that “pet owners could be paying too much for medicines or prescriptions.”

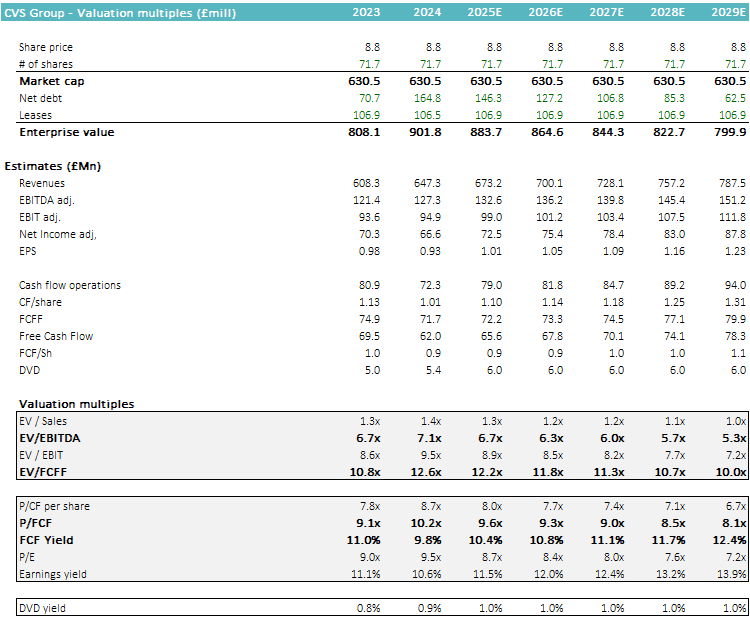

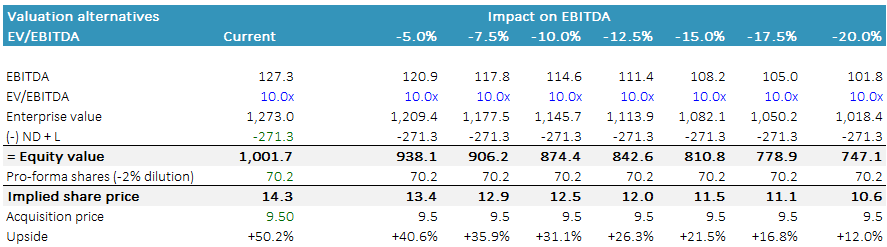

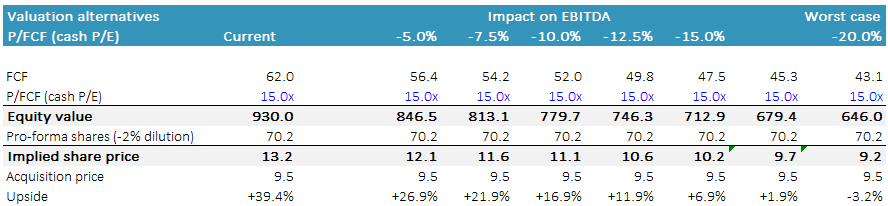

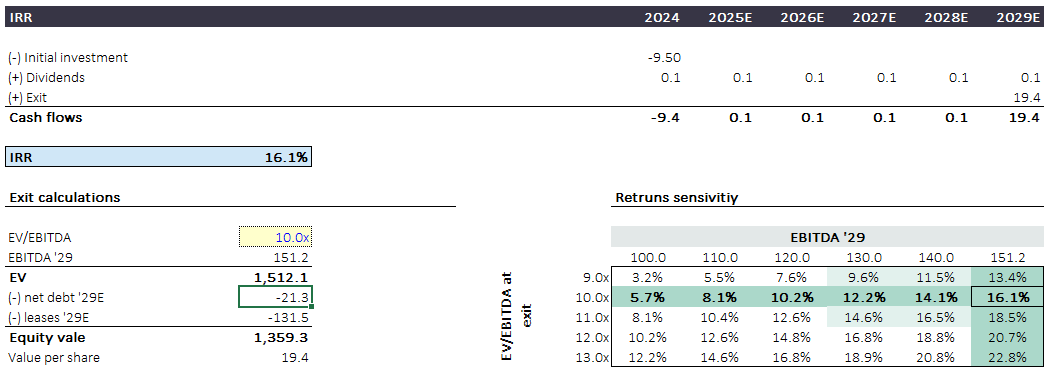

In my humble opinion, after reviewing the potential impacts of this market investigation, the impact will be limited. Even if the company looses 10% of its EBITDA, the valuation is so depressed that the stock will continue to be undervalued.

I started investing in March, and increased my stake during November. European Value Investor holds shares at an average price of £950 per share.

“We think investors with an 18-24 month investment horizon should see the current price as a great opportunity to buy shares with almost 3x upside potential which on a worst-case basis is the upside when applying 13x to Jun-26 EBITDA1”

RBC Capital Markets

Given its a special situation, I’m not including my investment checklist, as the UK veterinary market is under review. However, if applied, the rating will be high.

Investment Thesis

I. Introduction to CVS Group

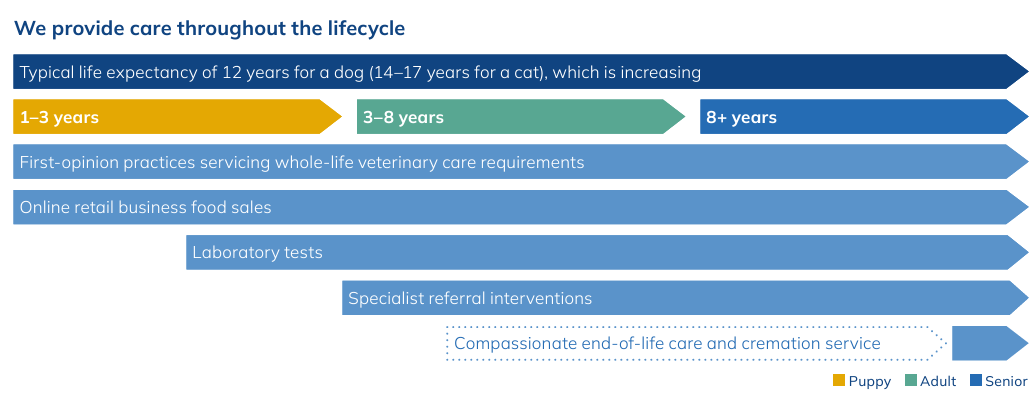

CVS Group is a company based in the UK. Its a company that follows a buy-and-build strategy by acquiring veterinary practices in the UK. As of December 2024, the company operates ~500 practices in the UK and 30 in Australia, offering multiple services:

First opinion practices servicing whole-life veterinary care requirements

Online retail business food sales

Laboratory tests

Specialist referral interventions

Crematory services

The company’s mission is “to give the best possible care to animals”, with the vision to “be the veterinary company people most want to work for”. This translates into four strategic pillars:

Recommend and provide the best clinical care every time

Be a great place to work and have a career

Provide great facilities and equipment

Take the responsibilities seriously

While I won’t dedicate too much time on this, you will see that some of these pillars are aligned to the market circumstances:

Veterinary services is a business were the trust in the teams is key. People go to a practice not only for the location, but also if they feel confident that their pet is receiving the best clinical care

UK market faces shortage of professionals. Dedicate resources to be a company were people want to work is essential.

I’m a pet owner and I don’t go to my nearest practice because I trust more one in which I received recommendation. Trustworthiness is key.

For that reason, CVS operates multiple brands, as the practices they acquired typically have strong recognition in their communities.

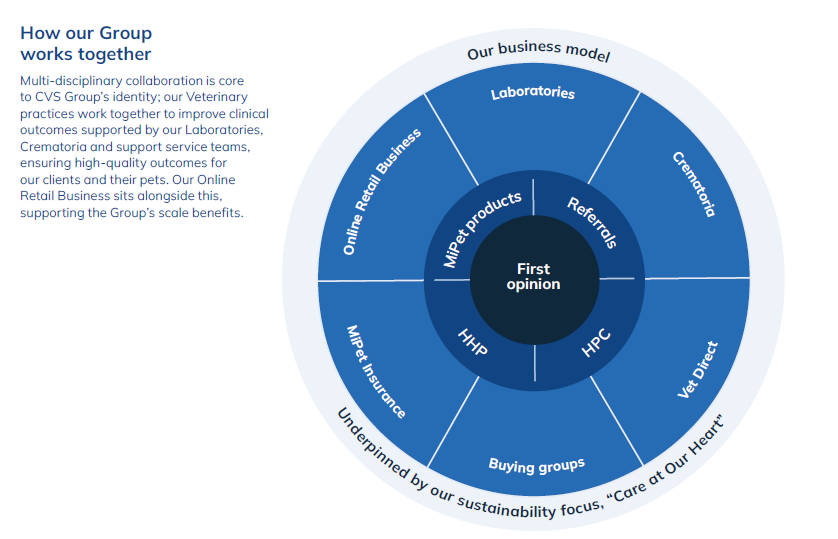

The business is divided in four sections

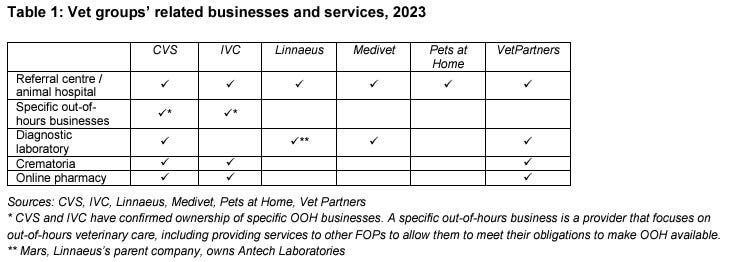

Together with IVC (the largest player), CVS Group has integrated all the services to pet owners: from first opinion practices, to diagnostic, crematoria, and online pharmacy. Its a one-stop-shop were clients have access to a wide variety of services.

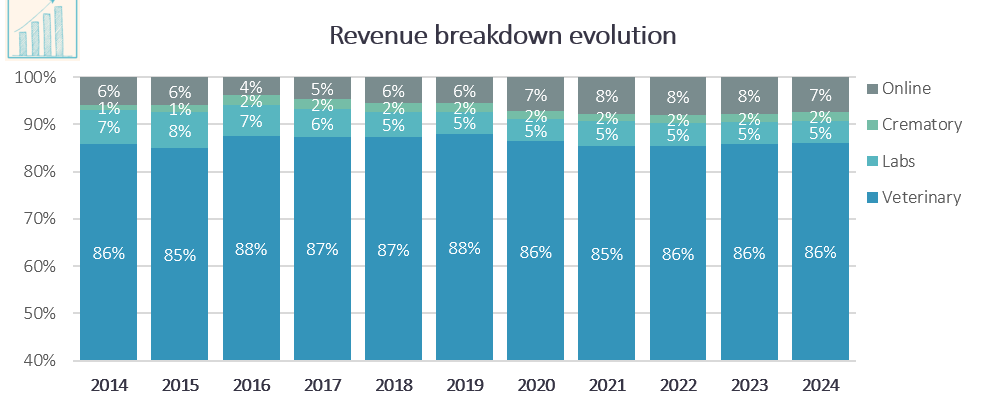

However, it is important to highlight that veterinary practices are the core of the business as they account for 85% of the revenue. These practices are the key contributors to the remaining areas of the group.

From the first opinion practices, the company develops a network effect and retains its clients to deliver complimentary services such as laboratories, and crematoria.

Veterinary practices

The company owns over 470 practices in the UK, covering a wide range of services. These practices retain their original names, as many have a reputation in their regions.

This is the core service of the company. Together with common veterinary practices, the company also covers other segments such as:

Out-of-hours emergency services through 40 MiNightVet practices to ensure 24/7 joined up care

9 specialist-led referral hospitals that provide multi-disciplinary care for more complex and urgent cases

Other services such as equine (22 sites across the UK), and farms (120 vets in 15 farm-specific practices)

I’m owner of a lovely pet and I visit regularly the veterinary so my pet can be supervised and to have their vaccinations administered several times a year. These type of businesses have strong competitive advantages, as you are a recurring client during more than 10 years.

Its a defensive industry, as owners of pets we need to visit these practices several times a year. In my case, I visit like 4-5 times, as I have mandatory vaccinations like rabies and other voluntary.

Voluntary vaccinations are a little expensive (lets say every visit is ~€70-90), but the risk-benefit is high, as you prevent your dog from dying of deseases that currently exist.

The industry benefits from strong tailwinds. As we will see, the pet population significantly increased during the covid pandemic, and the effects are yet to come (major effects to be send in the coming years with the aging of the pets).

Despite being a very attractive industry, the current shortage of professionals hampers the emergence of new competition (i.e., the offer of these services will continue to be limited)

On the demand side, there is a stable demand which is accurate to consider that it will increase during the next years, as the increase of the pet population during covid will start delivering returns to the industry once the pets start aging

CVS Group invests heavily to achieve strong growth, but they could stop investing in expanding their services and their practices will remain profitable. This is due to the fact that location is very important, and also recommendations.

In my personal case, the veterinary practice where I go has old facilities and prices increase every year because I use it for basic treatments

Veterinary practices do not require significant amounts of capital to maintain the business as a significant part of the treatments can be done in a room with no major technological advances.

However, the firm can opt to expand their service offering by investing in the latest technological equipment, and these investments will be profitable because of the humanization of pets. People are wiling to spend more on the treatments if they offer a better solution for their pet.

Pets are now members of the family. In Spain, for example, pets are legal family members and are considered “living beings endowed with sensitivity”

Laboratories

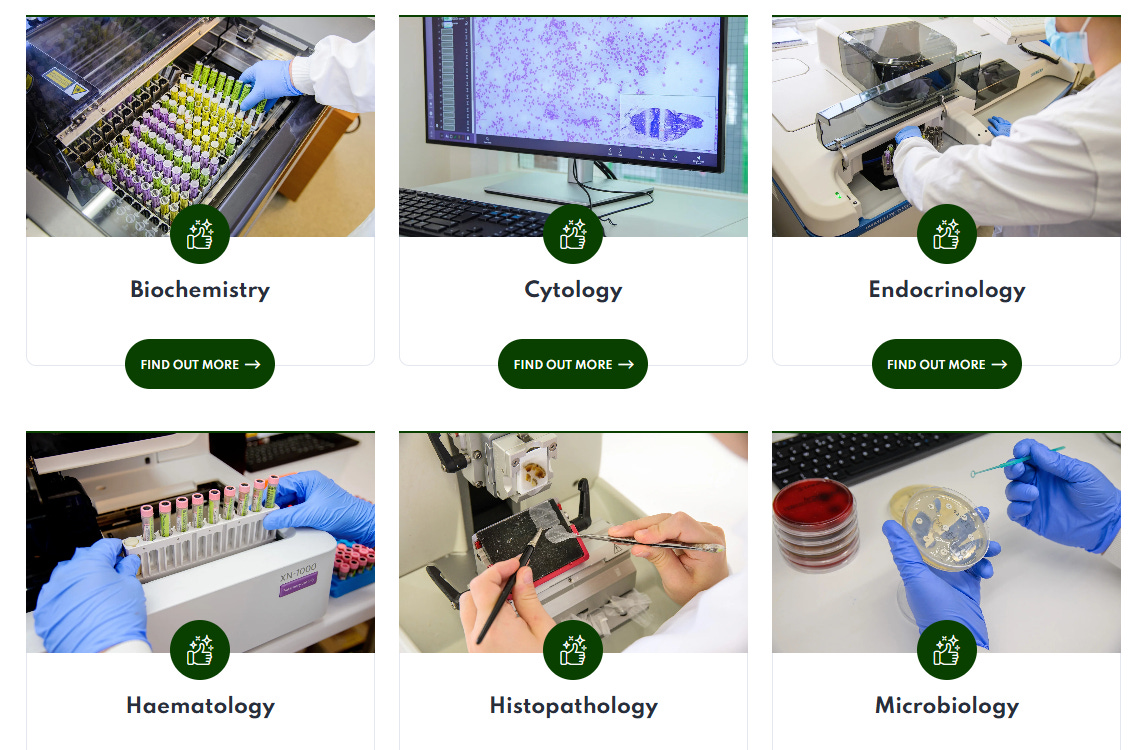

Over three sites, the Laboratory Division covers an extensive, fast and accurate diagnostic services to CVS practices and third party parties in the UK.

Its a great business that generates strong returns to the company, although the weight in the financials is ~7%.

In terms of competitive advantages, the barriers to entry are not high, given the fact that it will be just investing in equipment to analyze the samples received.

However, the beauty of this service comes from the network effect. CVSG owns 10% of the market, meaning that at least 1 out 10 potential clients will go directly to their services. If we consider that half of the market is dominated by large groups, the result is that the entrance of new competitors is very unlikely.

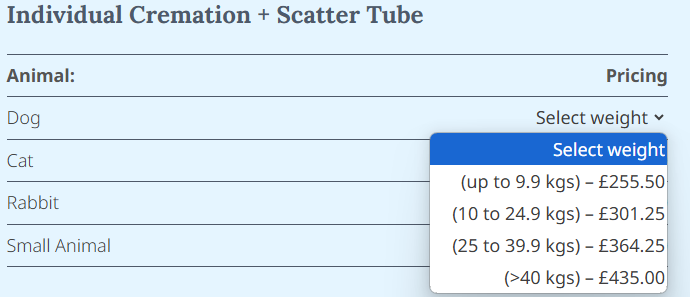

Crematoria

The company operates 7 pet crematoria and dedicated pet cemetery, that provide pet cremation and clinical waste services to CVS practices and third party practices.

It includes direct cremation to both small and equine owners across the UK.

These services are being more and more common, as a significant amount of pets live in cities, where the owners cannot bury them wherever they want. There are sanitary regulations to comply.

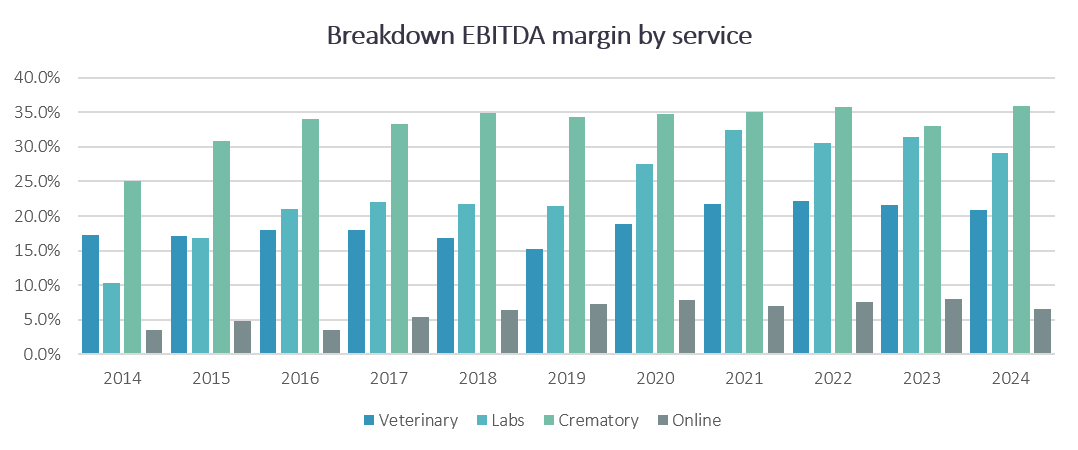

The business is relatively small (£11m; ~2% of revenues), but it will be one of those business that Peter Lynch will love: boring business, with probably boring name, but with really good returns. We are talking of EBITDA margins of ~35%.

The humanization of pets will continue driving growth to this business unit, that enjoys from very significant barriers to entry.

A dog cremation with range between £250 to £300 per dog. The pricing power is high given the niche of the business, and they have the capacity to outperform inflation. If owners don’t want to receive the ashes, price will range between £140-180.

The competitive advantages are mainly driven by the same network effect as the laboratories, but adding the location. Who is willing to invest in several acres of land to build a cemetery to compete with one already existing? The location and being the first, is guaranty of success.

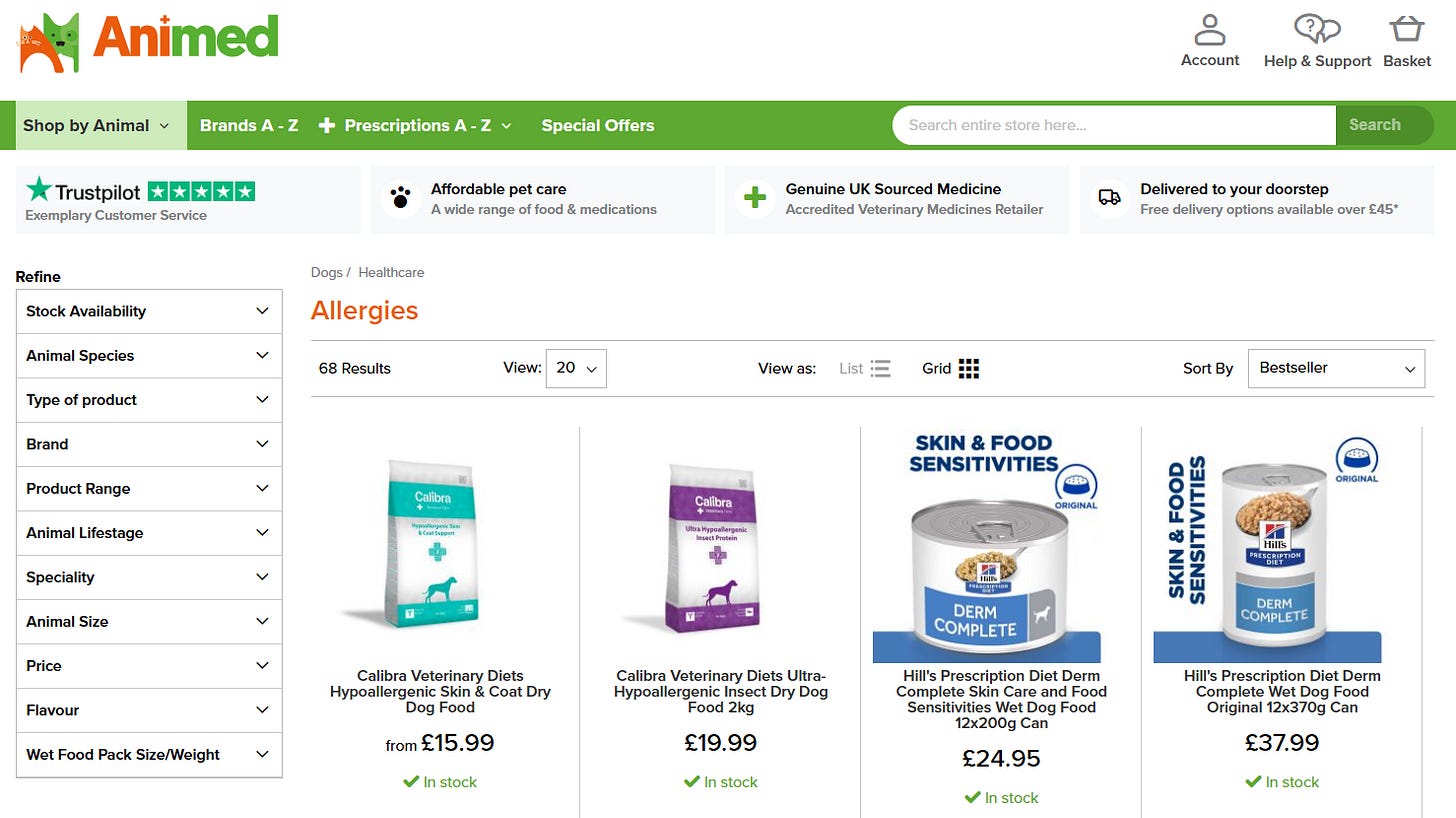

Online retail business

Last but not least, the company has an online retail business that delivers everything from prescription medications, non-prescription medications, health supplements and specialist food to stimulating toys, accessories and treats.

The company operates through Animed brand: www.animed.co.uk

In my modest opinion, this is the weakest business among the four. It faces strong competition are has low margins compared to the remaining.

The business represent ~7% of total revenues and generates £50 million revenues. EBITDA margin is very low - in the 6-7%, but EBITDA has been positive since inception.

The positive aspect of this business is that it acts as a defense against the customers that are not acquiring the prescription medicines in the veterinary practices. In many occasions, customers buy directly the medicine in the practices, which tends to be more expensive. Their online store acts as a defense against those clients that are buying the medicines outside their practices.

II. The Veterinary Industry

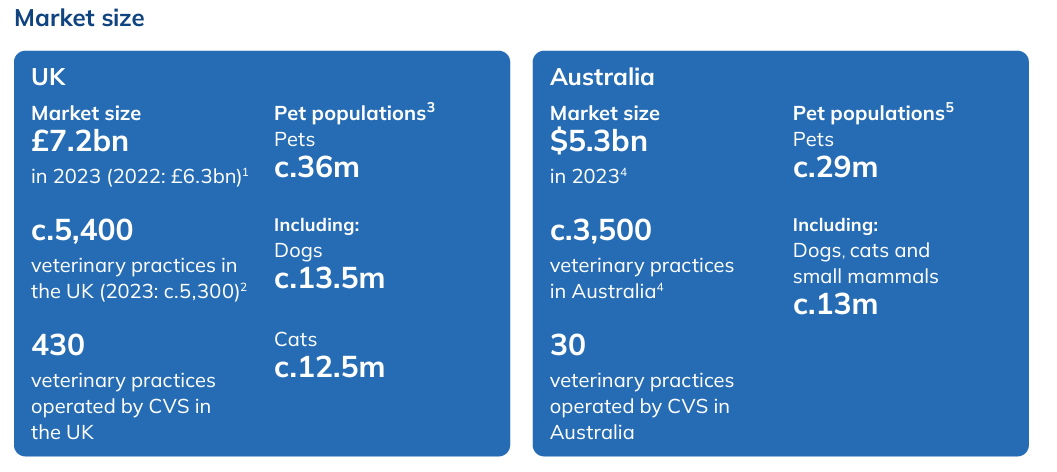

CVS Group operates in the UK and Australia. Previously, the group had also veterinary practices in the Netherlands, but they were disposed during 2024.

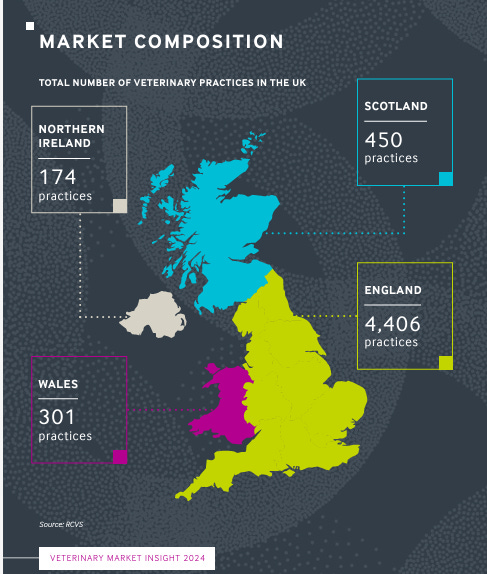

The core market for CVSG is the UK, were the company has over 430 veterinary practices, which implies a market share of ~8%.

In this section, I will focus on the UK market, which is a more mature market than Australia, given the consolidation experienced during the last decade, and because its the core region to CVS Group.

A. The UK market

The UK veterinary market has experienced a steady increase during the last decades, supported by:

Steady growth of pet population - Around 2-5% per year

Significant increase in household spending - 4x increase during the last two decades

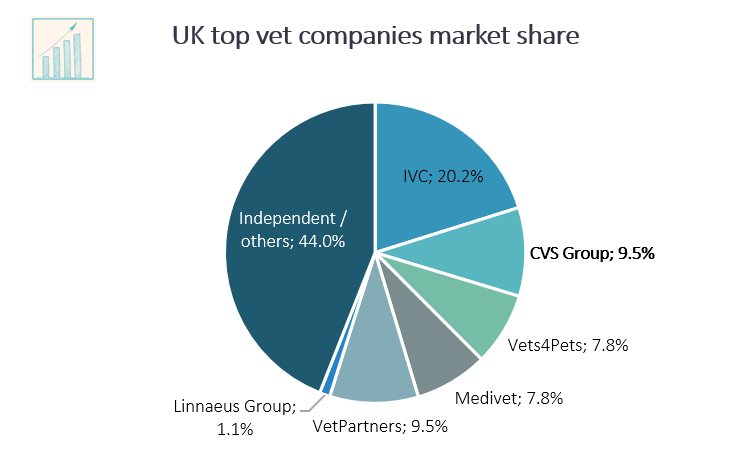

There has been a consolidation in the market, where the top 6 corporate groups hold a combined market share above 50%

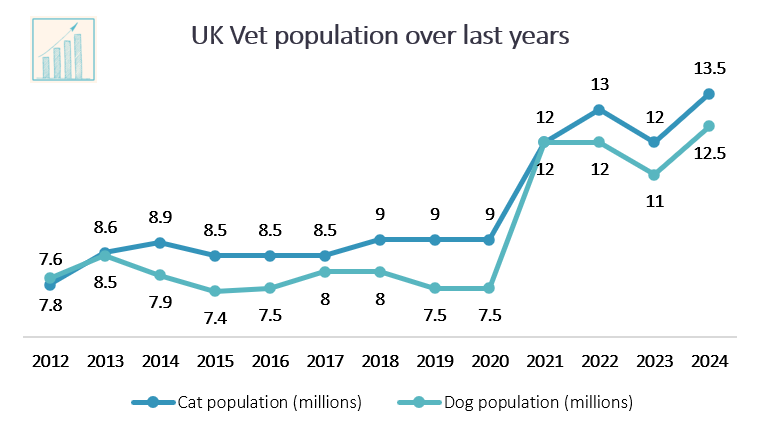

Pets population

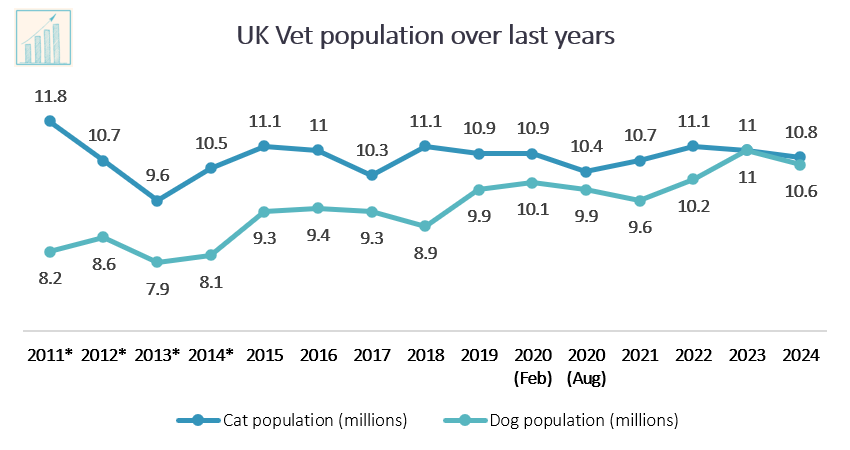

A steady increase in the dogs population of 2-5% per year

In the UK, there are approximately 69 million people living and nearly 50% of the population have a pet, being dogs and cats the predominant animals.

According to different sources (UK Pet Food and PDSA), there are:

Dogs: 10.6-13.5 million

Cats: 10.8-12.5 million

Using the most conservative data from PDSA of 10.6 million dogs2, we get the following historical evolution of dogs and cats population: the dog population has increased at a 2% per year, from 8.2 million in 2011 to 10.6 million in 2024.

On the other hand, the population of cats has decreased by a -0.7% per year.

Using the other relevant source, UK Pet Food3, the pet population has increased more than the estimates from PDSA:

Dogs and cats populations have increased by a CAGR of 4.9% and 4.0%, respectively, with a significant increase during the pandemic of Covid-19

The data from both providers is significantly different, as there is no official record, but there are similar takeaways and key data points:

Dog population is increasing every year

Both reports confirm that nearly a third of households own a dog, and 25-30% own a cat. Nearly 50% of households own a pet (including rabbits, fish, etc.)

There are more pets than children: around 20 million cats and dogs, vs. 12 million children under 16. In 2023, approximately 0.7 million live births occurred, while the cats and dogs population increased by nearly one million.

This data confirms there is a steady trend of growing pet population in the UK. The business benefits from a natural increase of population of pets between 2-4% per year.

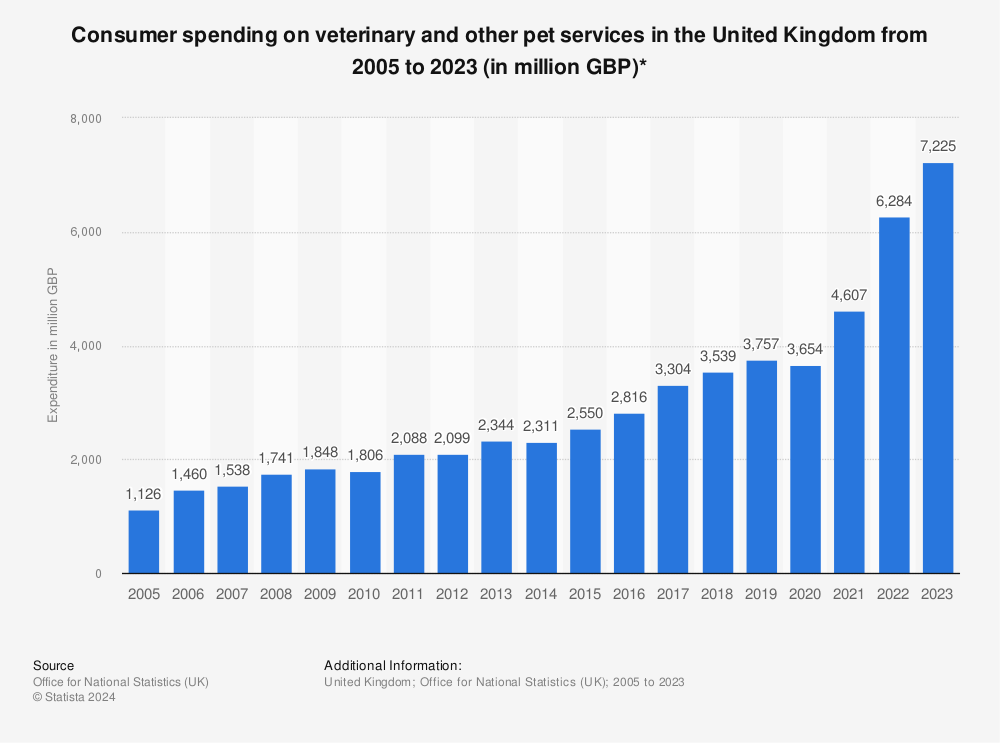

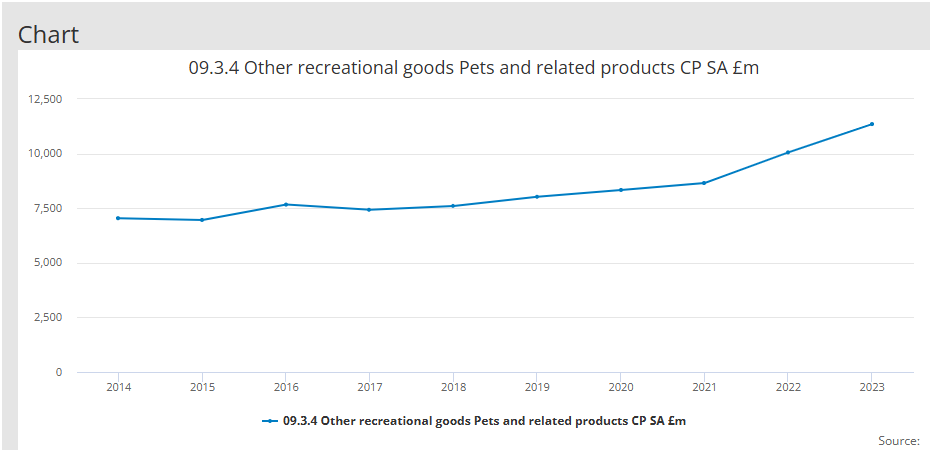

Total Spending in animal care

Spending has increased 4x in the last 2 decades

This chart from Statista, with the Office for National Statistics as the source, indicated how the consumer spending on veterinary services is increasing every year in the UK.

Although trend has accelerated in recent years, the historical data shows a steady growth during the last two decades:

From 2005 to 2013, consumer spending nearly doubled, growing at +9.6% annually

From 2013 to 2021, the growth was +8.8%, and spending doubled

Since 2005, the CAGR stands at +9.2%

In another statistic from the UK Office for National Statistics, the spending in other recreational goods Petas and related products stood above £10bn in 2022. This means that on average, every household in the UK is spending ~£300 per year.

Behind the growth of recent years stands the increase of pet population during covid-19 pandemic, where the number of pets increased significantly.

This interesting chart from the company PetsAtHome, illustrative the cycle of the spending in animal care over the life of the pet.

We spend the highest amount at the initial ages - as spending needs are high (new bed for the dogs, accessories, need to perform clinical tests, vaccines, etc.)

Spending reduces dramatically for pets between 2-3 years - which is the case for many of the pets introduced during 2021

Once the pets age, the spending increases every year - this will contribute to further growth in the UK during the next years - We are now in this positive trend, that will continue over the years

There is a clear tendency in the so-called humanization of pets. And in a sense, this is true, as many people are replacing kids with animals. Its said to say it, but there are far less pets than children in many European countries. This is due to the aging population, the worrying low birth rate, and change in preferences in the population.

Given that in many cases pets are the new “child”, people are willing to spend more money than before. This humanization of pets is a clear tailwind for the veterinary industry as people will continue spending money every year to take care of the pet.

Veterinary companies have some degree of pricing power, as you normally don’t see two veterinaries near each other.

Veterinary practices in the UK

There has been a strong consolidation - CVS is the second largest player

The UK veterinary market has experienced strong growth during the last decade. The amount of practices has increased and there has been a consolidation process. Back in 2015, CVS Group was the largest player in the UK with 298 practices.

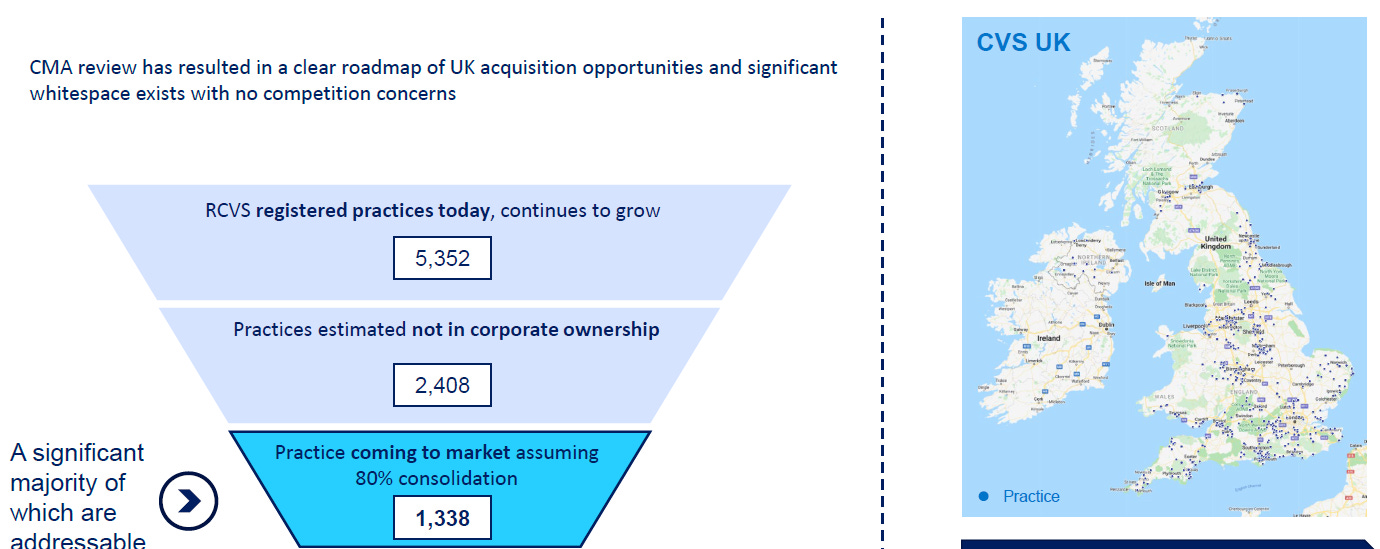

Today, the company has 430 practices across the UK and is the second largest player. As of 2023, there were near 5,400 veterinary practices in the UK:

The CMA (UK’s Competition and Markets Authority) flagged that the percentage of independent veterinary practices has fallen from 89% in 2013 to 45% in 20214. During the last decade, there has been multiple transactions that led to a consolidation in the market.

According to a report from Chrsitie & Co. the top six corporate groups own close to 56% of total veterinary practices (c. 3,000 out of 5,400).5

CVS Group is the second largest player in the industry with a market share of ~10%. The largest player is IVC, a private equity backed company.

IVC Evidensia. IVC was acquired in 2014 by EQT and merged with Evidensia in 2017, to create a European leader in veterinary services. According to the company’s website6, they operate ~1,000 veterinary practices across the UK, being the largest player

Vets4Pets. Its a company part of Pets at Home Group, the largest publicly-listed vet company in the UK, with a market cap of £1.3bn. The operate also around 400 practices; however, the majority of revenue comes from their online store. hese practices are structured as Joint Venture Partnerships (JVPs), allowing veterinary professionals to part-own and manage their clinics while benefiting from the broader support and resources of the Vets4Pets and Pets at Home network

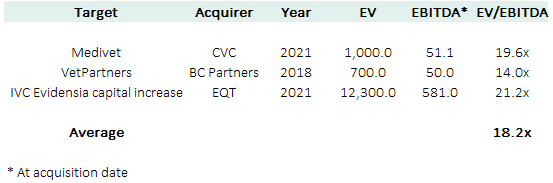

Medivet. The group was acquired in 2021 by CVC Capital Partners for over £1 billion. CVC’s involvement is aimed at driving both organic and acquisition-led growth while expanding Medivet’s services and presence in the UK and Europe. The operate around 400 practices in the UK. The company paid around 20x EBITDA for this company (according to the annual accounts, the company generate £51m EBITDA in 2021; £75m in 2023)

VetPartners. Founded in 2015, has grown significantly in the UK veterinary market, with a focus on small animal, mixed, and equine practices. VetPartners was acquired by BC Partners in 2018 for approximately £720 million. The investors paid around 14x EBITDA7

The CMA is now reviewing the veterinary market in the UK. This will pause the consolidation of the industry.

The interesting thing about the acquisitions from EQT or CVC is that these companies are signalling that the industry is highly profitable, with stable cash flows, and strong growth potential.

Current challenges in the UK

The lack of employees and the CMA investigation

With more than 20 million of cats and dogs, there is one veterinary practice serving c. 3,700 dogs and cats, combined.

In terms of veterinary nurses and surgeons, there are c. 18,500 and c34,500, respectively. This means that there are 53,000 professionals in the industry.8

If we include other animals such as rabbits (c.0.8-1.0 million), horses (c. 0.7 million), and other small animals, there are more than 22 million pets in the UK that need veterinary attention.

This means, a ratio of 415 pets per professional. Excluding nurses, there are ~1,200 pets per surgeon (i.e., trained professional who diagnoses, treats, and prevents diseases in animals, performs surgeries, and promotes animal health and welfare)

According to data from UK government, there are are over 1.3 million full-time equivalent staff working in NHS trusts and commissioning bodies in England9. According to some data providers, there are more than 130,000 doctors and more than 350,000 nurses and midwifes. This means a ratio one professional serving ~140 people, and one doctor serving ~530 people.

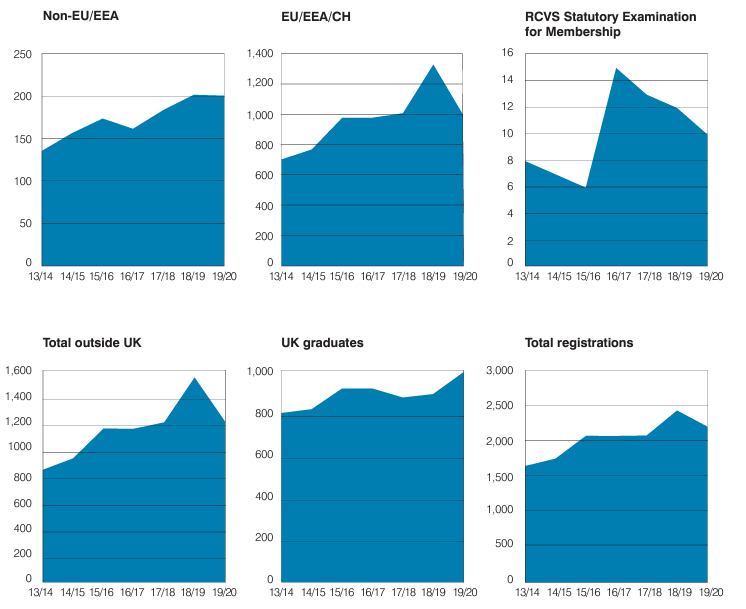

The ratio in veterinary is more than double the ratio of the NHS, signalling one of the issues and challenges in the UK’s veterinary market post Brexit: there is scarcity of professionals.

The effects of Brexit are clear: registrations from EU/EEA/CH are falling, leading to lower registrations in the UK.

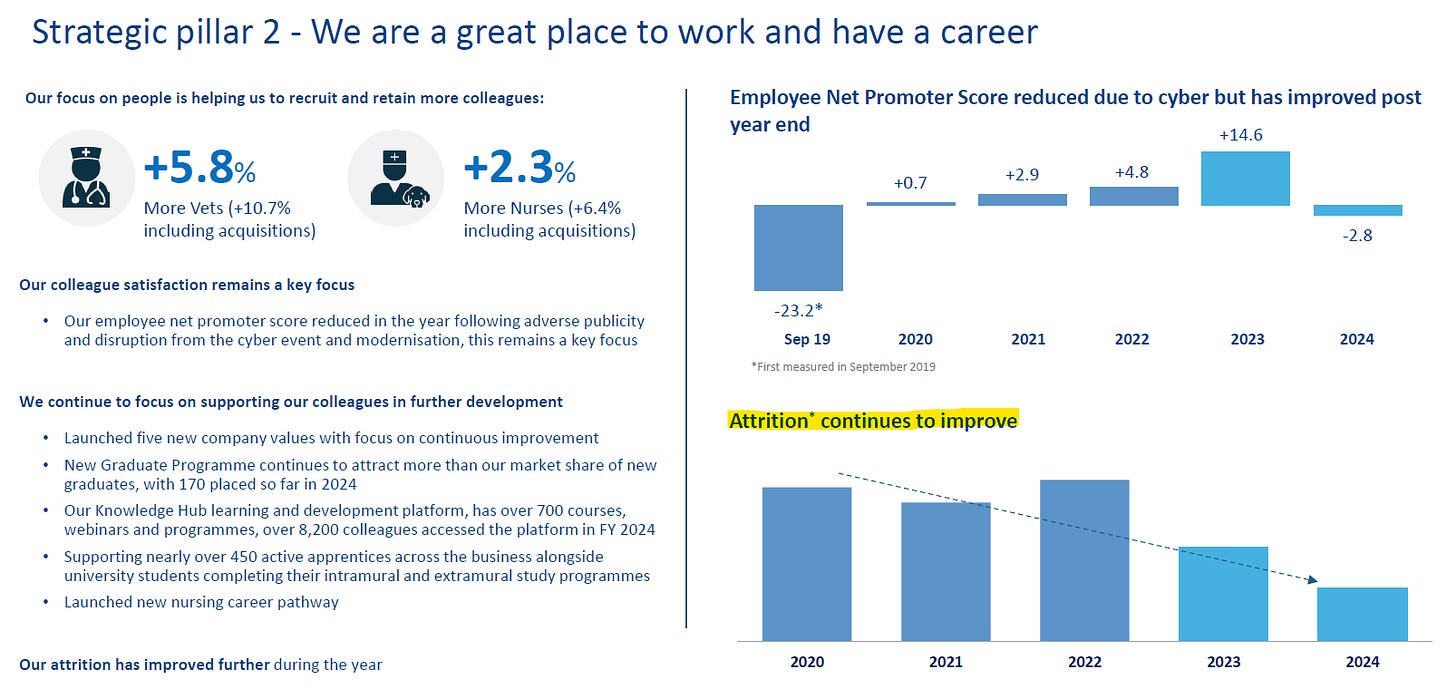

In this scenario, there are inflationary pressures to retain and attract employees. For that reason, one of the core pillars of CVS Group is “To be the veterinary company people most want to work for”.

To address this problem, the company has introduced over the years the following solutions:

Develop their own clinical training facilities and an online education platform

Develop strong links across all universities: CVS Group delivers formal training in 5 of the 8 established veterinary universities

Graduate program to attract young talent

Veterinary nurse training

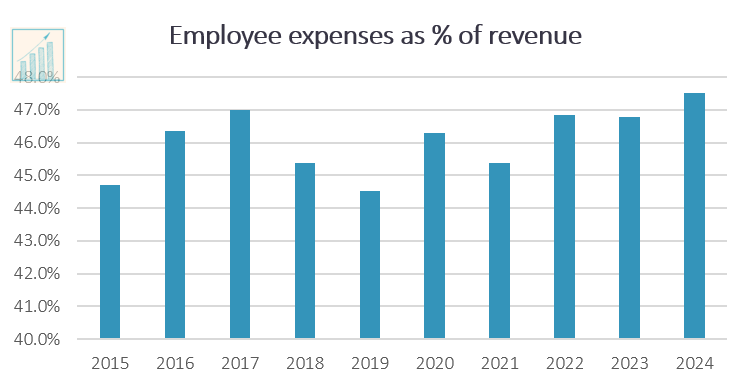

CVS business is a business of people, and the expense in personnel represents nearly 48% of the revenues.

On the positive side, the lack of professionals means that its very difficult to see the entrance of new competitors, as its a business that requires qualified professionals.

As seen in the update of this core pillar as of FY 2024 results, the company was doing great in the recent years, with a net promoter score increasing in the last years, and a clear reduction in the attrition, signalling company is retaining talent (however, we don’t have the scale of the chart, so we need to be prudent on this).

Final word on the UK market

Natural tailwinds to contribute delivering further growth

The CMA has launched an investigation on the UK’s veterinary market. This is the key point of the whole investment thesis - we will analyze it deeply in a separate section.

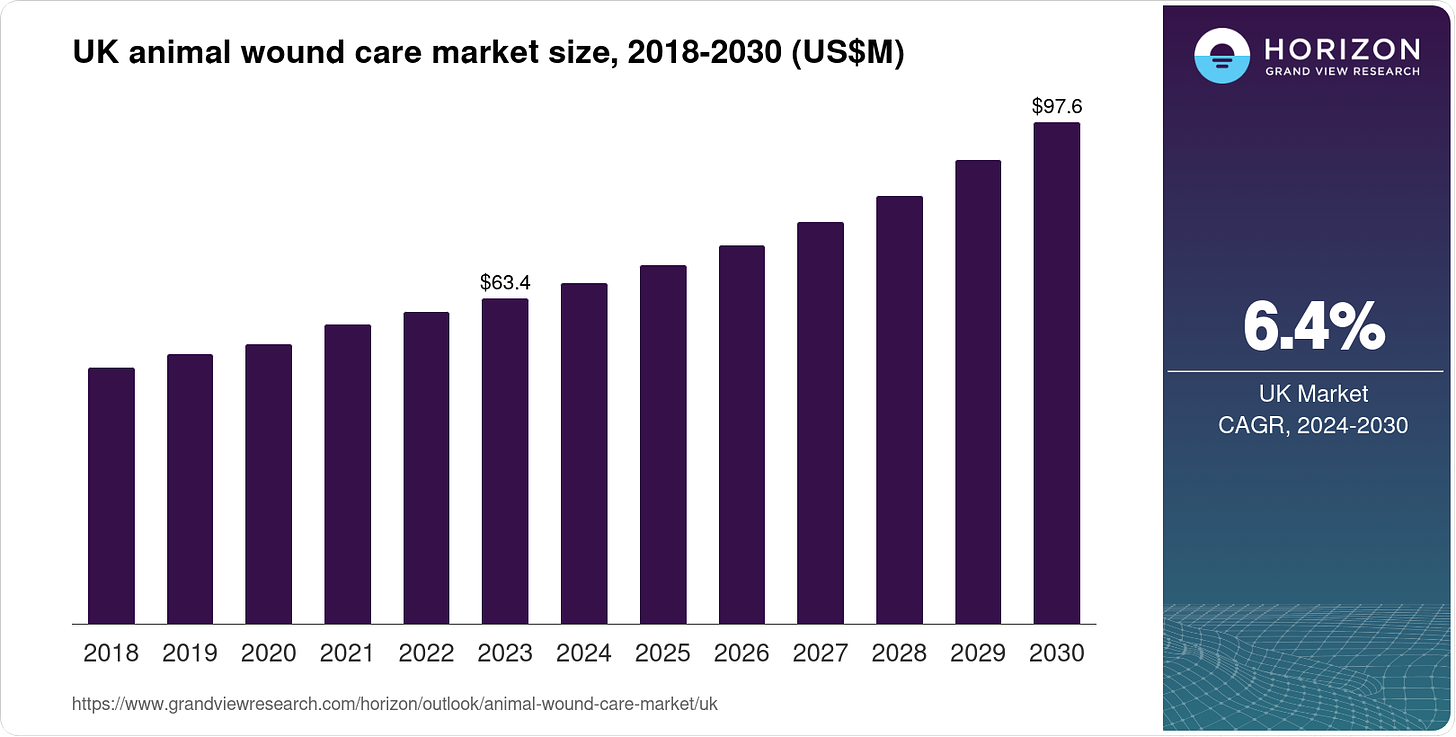

Excluding the potential impact from the CMA investigation, the UK’s veterinary market is set to continue increasing during the next decade fueled by:

Humanization of pets - Spending in veterinary / pets increases every year and has increase over 4x during the last two decades

Stable pet population - The dog population increases at 2-5% every year. The boom of the pandemic is set to contribute to further growth once pets start aging

Its a business with pricing power

The lack of professionals will limit the appearance of new competitors

With this in mind, the UK’s veterinary market can grow at mid-single-digit during the next decade - CVS Group ambition is an organic revenue growth of 4-8% per year.

Other data providers, such as Gran View Research, suggest a CAGR of 6.4% for next years, which is in line with the previous considerations.

Finally, the increase in the pet population over 2020-2022 period will have a very positive impact during the next years, once these pets will start to get older. As we previously analyzed, spending in veterinary services is directly correlated with the age of the pet. The older the pet, the more spending (similar as humans).

For that reason, the market will benefit from positive structural tailwinds. There is shortage of professionals (i.e., difficult to see new competitors), and there is an increase in the demand.

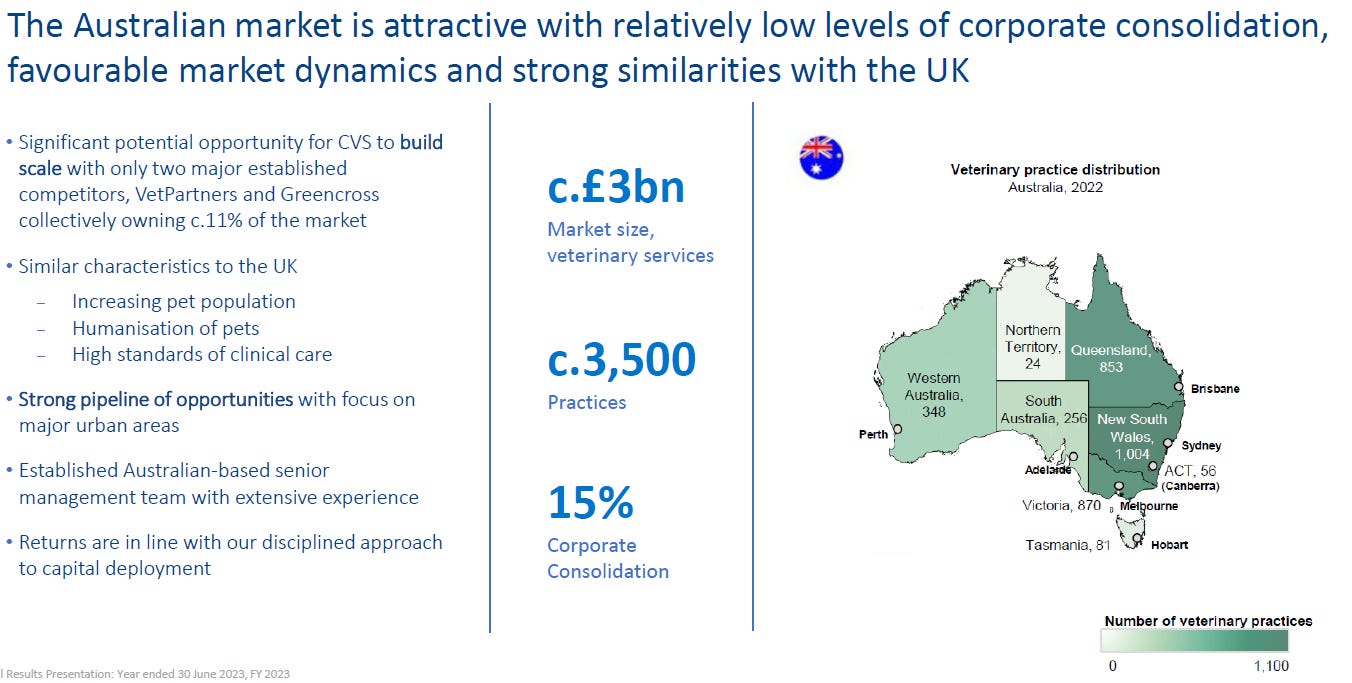

B. The Australian market

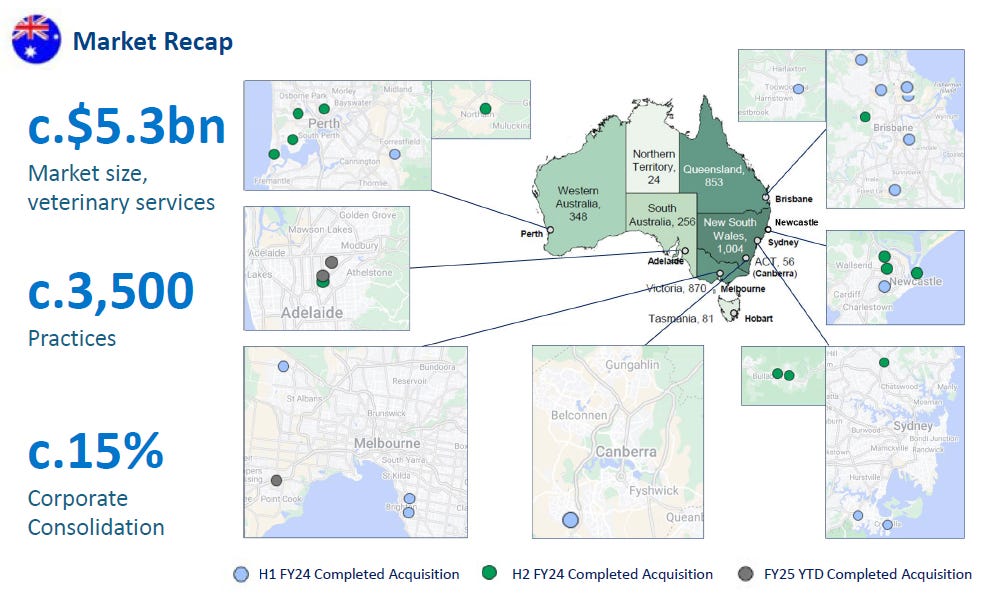

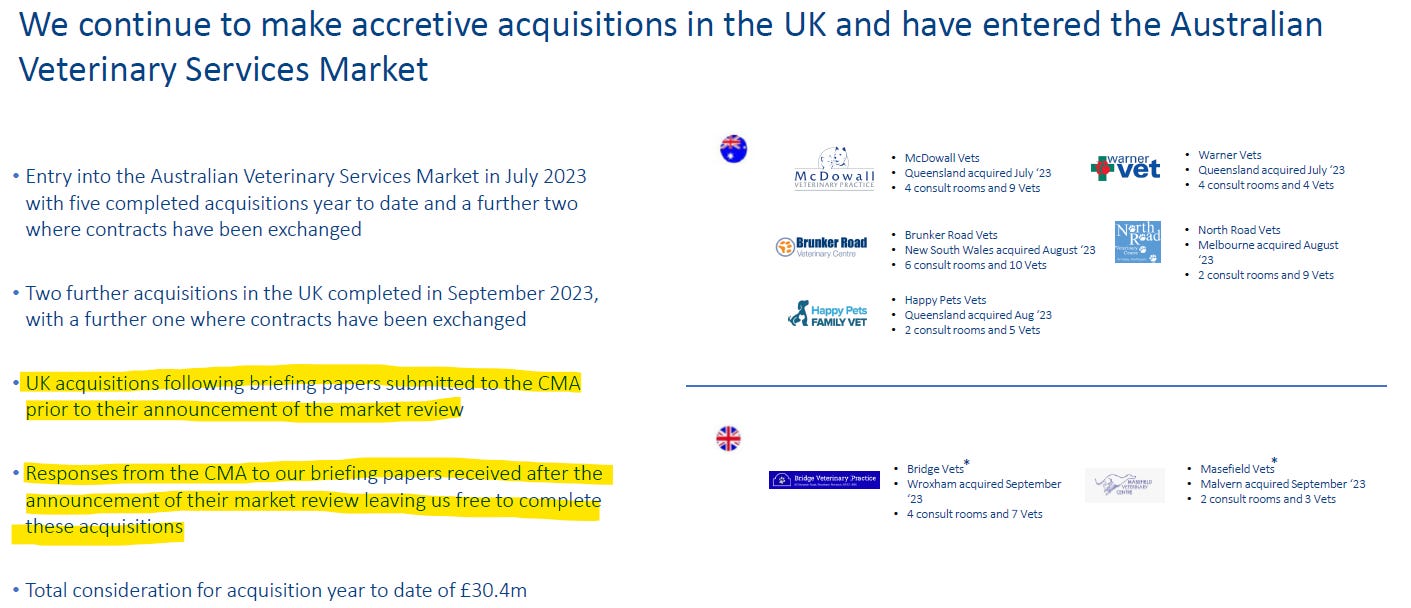

In 2023, the company announced that they will be entering the Australian market. Since July 2023, the company has performed multiple acquisitions and now currently own 30 veterinary practices.

The investment thesis of the Australian market is:

Its a more fragment market - there is 15% corporate consolidation vs. 55% in the UK, meaning that there is room for more consolidation

The market is smaller than the UK’s (£3bn size vs. 7.2bn); however, with similar characteristics:

Increasing pet population: around 70% of the households own a pet10

Increasing spending in pets/veterinary: according to a survey from Animal Medicines Australia, the average annual expense in dogs is AU$3,218 (~€2,000), where veterinary services represent nearly 1/3

Australia, although far from the UK, shares a similar culture with the UK

The company currently owns 30 veterinary practices located in Perth and in the East and South East of the country (Sydney, Brisbane, Melbourne, etc.)

The company acquired 29 sites during 2024, for a total consideration of ~£100 million. The company is acquiring large, high quality fir opinion practices.

These acquisitions have been performed with strong financial KPIs:

Multiples paid below the UK, as it is a less consolidated market

IRR comfortably above 10% (WACC used in my model is ~7.5%, therefore, the acquisitions are accretive

The synergies expected in the region are based on drug purchasing synergies, and obtain more favorable terms with preferred laboratory and crematoria suppliers (the more sites owned, the more favorable terms)

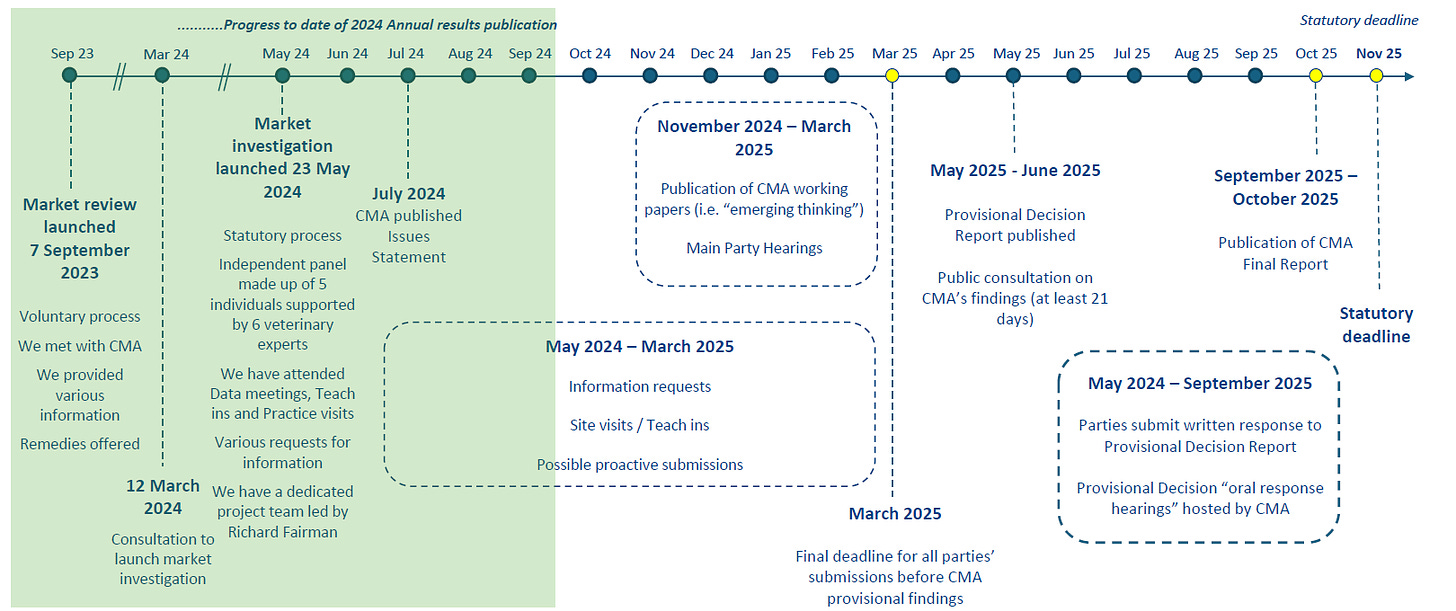

III. The CMA Investigation

Before continuing with the analysis of the company, the CMA investigation is probably the most relevant factor to analyze.

Any investor interested in this company needs to have a clear view on the CMA investigation.

These following ones, are my views, but in any case should be considered as the right ones - therefore, do your own research on the subject.

The CMA started a market review in September 2023

The Competition and Markets Authority (CMA), launched a review on September 2023 looking at consumer experiences and business practices in the provision of veterinary services.

The main concerns of the CMA where the following ones11:

1. Access to information

“The CMA is concerned that pet owners may not find it easy to access the information they need about prices and treatment options to make good choices about which vet to use and which services to purchase”

2. Rise of prices

“Households are under strain from the rising cost of living and it is important that pet owners get value for money from their vets - but figures suggest that the cost of vet services has risen faster than the rate of inflation, which is something that the CMA will be looking into as part of its review.”

3. The creation of big veterinary companies

“The ownership of vet practices has also changed in recent years – independent practices accounted for 89% of the UK veterinary industry in 2013, which fell to approximately 45% by 2021. In some cases, a single company may own hundreds of practices and it may be unclear to people whether their vet is part of a large group.”

4. Competition

“People may also be unaware if their vet is part of a group which owns other vet practices in their area or that the services which are being sold to them (such as diagnostic tests or treatments at a specialist animal hospital) are provided by that group. This could impact pet owners’ choices and reduce the incentives of local vet practices to compete.”

The CMA started the investigation surrounding these topics and wanted to hear from patients and people from the industry to hear about:

Pricing of services - Are consumers aware of the total cost and who pays for it?

How prescriptions and medication are sold?

Are people aware that vet surgeries might be part of a larger chain?

Out-of-hours and emergency vet services

During September 2023 to May 2024, the CMA gathered information regarding these topics. When the CMA announced this market review, the share price of CVS Group fell from £2.1 to 1.4, erasing 1/3 of the market value.

In March 2024, launched a market investigation - Outcome expected for November 2025

In May 2024, the CMA decided that there were enough factors to launch a formal investigation.

Since the CMA started the investigation, the share price has declined by more than 50%.

After analyzing responses from 45k patients and 11k from workers, the CMA decided to launch a formal market investigation based on the following concerns (all sourced directly from CMA’s webpage12):

Consumers may not be given enough information to enable them to choose the best veterinary practice or the right treatment for their needs

Concentrated local markets, in part driven by sector consolidation, may be leading to weak competition in some areas

Large integrated groups may have incentives to act in ways which reduce choice and weaken competition

Pet owners might be overpaying for medicines or prescriptions.

The regulatory framework is outdated and may no longer be fit for purpose

From now to March 2025, the CMA will gather all the information necessary and will publish the provisional decision on May 2025, and the final decision by the end of the year.

What can be the outcome and main impacts?

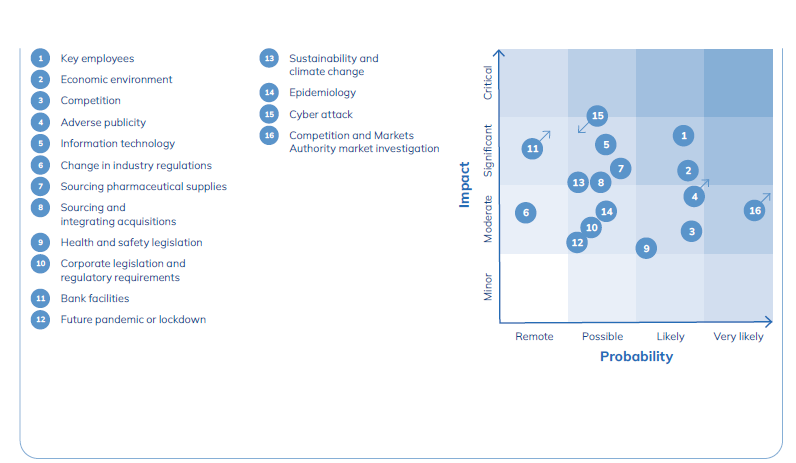

The investigation poses some risks to CVS Group and other major groups as it can affect pricing strategies, together with other factors such as cross-selling opportunities.

My view on the investigation is that, despite it can have negative impacts for the business, the total impact should be limited. The decision will probably include the mandatory disclosure of more information surrounding the costs of treatments and the alternatives, and make clear the ownership of the practices.

Before analyzing the research, I believe it is necessary to highlight the contradiction that these regulatory bodies represent.

The state, the largest monopoly on the planet, creates agencies to dictate what is a competitive market and what is not. When reading the report, its a clear attack to the free market.

To assess the impacts, I will review one by one the main concerns. The report from the CMA is available in their website:

Issues statement - pdf with all their concerns

Hypothesis #1: Pet owners might not engage effectively in the choice of the best veterinary practice or the right treatment for their needs due to a range of factors including a lack of appropriate information

CMA: “We have found that it may be difficult for pet owners to obtain and understand the information they need both to choose between local vet practices and to decide on a particular course of treatment.”

Overall assessment: Low risk🟢

According to the CMA, 80% of veterinary practices do not publish their prices on the website and the consumers are missing key information.

Potential decision: make mandatory to publish a price list

Mitigants:

We don’t check prices of a hospital before going. We just go and receive treatment. Same applies in vet services. Even the CMA found out in their study: “ pet owners we spoke to do not tend to consider pricing to any significant extent when considering or purchasing veterinary services.”

We tend to go to the nearest vet and/or by recommendation. Location maters a lot if you need to take your pet to periodical revisions.

According to the CMA “People are not always informed of the cost of treatment before agreeing to it: Around 10% of patients said they were not provided with cost information before their pet had surgery”

Potential decision: Make mandatory to explain and detail the total cost of an intervention. I see low risk, as this is just good practices. I want the companies of my portfolio engaged in good practices.

Mitigant:

It means, that only 1 out 10 might not receive the information, but that doesn’t mean that if they receive it prior to surgery, they won’t do pay for it

Even if the price is reported, the treatment might be necessary

CMA: “Because of the limited information presented to pet owners up to the point of sale, vet businesses may have weaker incentives to offer attractive prices, raise quality, offer a range of treatment options, or innovate (e.g., develop lower cost treatments or more advanced treatments) than would exist in a well-functioning market.”

I believe there are contradictions in this statement. Basically, the CMA wants the best treatments at lower cost than traditional treatments. Although its desirable to have better treatments at lower cost, the reality is that companies need to invest in expensive equipment to get precise diagnostic. This can’t reduce the prices, but rather the opposite.

It's like going to the physiotherapist. He can treat you with his hands, or use state-of-the-art machines that have cost him €25,000. The price of the treatment cannot be the same.

In a free market, there will always companies taking different directions to offer something different. Companies can provide more information to their customers, but each company is free to offer their services at the price they consider. The market will decide if those practices are acting well or not.

Hypothesis #2: Concentrated local markets, in part driven by sector consolidation, might be leading to weak competition in some areas

CMA: “Consumers tend to choose a practice that is close to their home and therefore local competition is important”

Overall assessment: Low risk🟢

The statement above is key, as it reinforces my view on the competitive advantages of any veterinary practice: location is important. Once established in a community, the practice benefits from barriers to entry in the form of relatively low TAM for 2-3 practices in a particular area.

In many sectors there are around 5 players dominating the market. The CMA is concerned that the large corporate groups have increased their market share from 10% to 60%.

A probable outcome from the investigation will be to forbidden any merger between these players. However, it is important to highlight that the CMA continues to approve the acquisitions made by companies like CVS.

The M&A market remains open and big players receive authorizations from the CMA.

There are several mitigants:

The CMA continues to authorize acquisitions from CVS in the UK

If big mergers are forgiven it shouldn’t materially impact CVS valuation - it only means no more inorganic expansion in the UK

The company is expanding its operations in Australia where the risk of an investigation is very limited given its a very fragmented market

CMA: “Consumers will not always be aware that they are faced with a limited choice of supplier because the branding does not always indicate the ownership of the veterinaries”

Overall assessment: Low risk🟢

CVS Group is one of those companies that currently operates with multiple brands rather than a single unified brand. The company owns and manages around 500 veterinary practices across the UK. Many of these practices retain their original identities and trade under established local names.

This strategy allows CVS to leverage the trust and recognition of existing brands within local communities.

The outcome from CMA’s investigation might be to include that these companies are part of CVS Group. I see a limited impact.

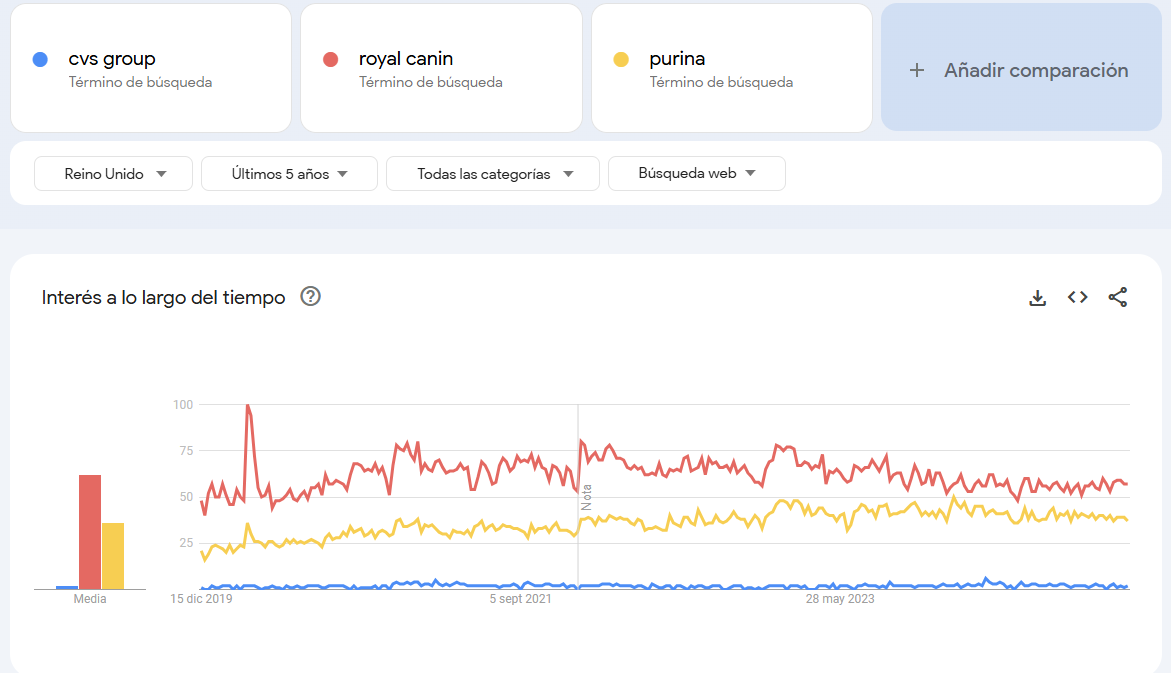

I believe the risk is low, as CVS Group is not a widely known company.

Using Google Trends, to see the relative searches of CVS Group vs. pet food brands such as Purina or Royal Canin, it is clear that pet owners do not search on the internet for CVS:

When people type the words CVS Group in Google, they want to know about their stock price:

“We observed that there are some local areas, potentially representing around 12% of postcode districts where a large corporate group both has a market share of above 30% and owns at least two vet practices”

Overall assessment: Low risk🟢

The impact is low, given the dispersion of CVS practices across the UK, and due to the fact that the 12% of postcode districts to which the CMA refers are probably not the most dense districts.

The potential outcome could be remedies could be to limit the market share in any given area. Its a very difficult task, given all the challenges surrounding this decision.

The largest placer ICV will be the most exposed to this. In many cases, the concentration issues could be solved by selling practices and reinvesting the proceeds to acquire the practices sold by other competitor. Its not an ideal strategy, but it can offset the impact.

Its a very preliminary and high level analysis, but after reviewing the locations of CVS practices, I see limited risk. There are few towns where I see CVS practices closer to each other.

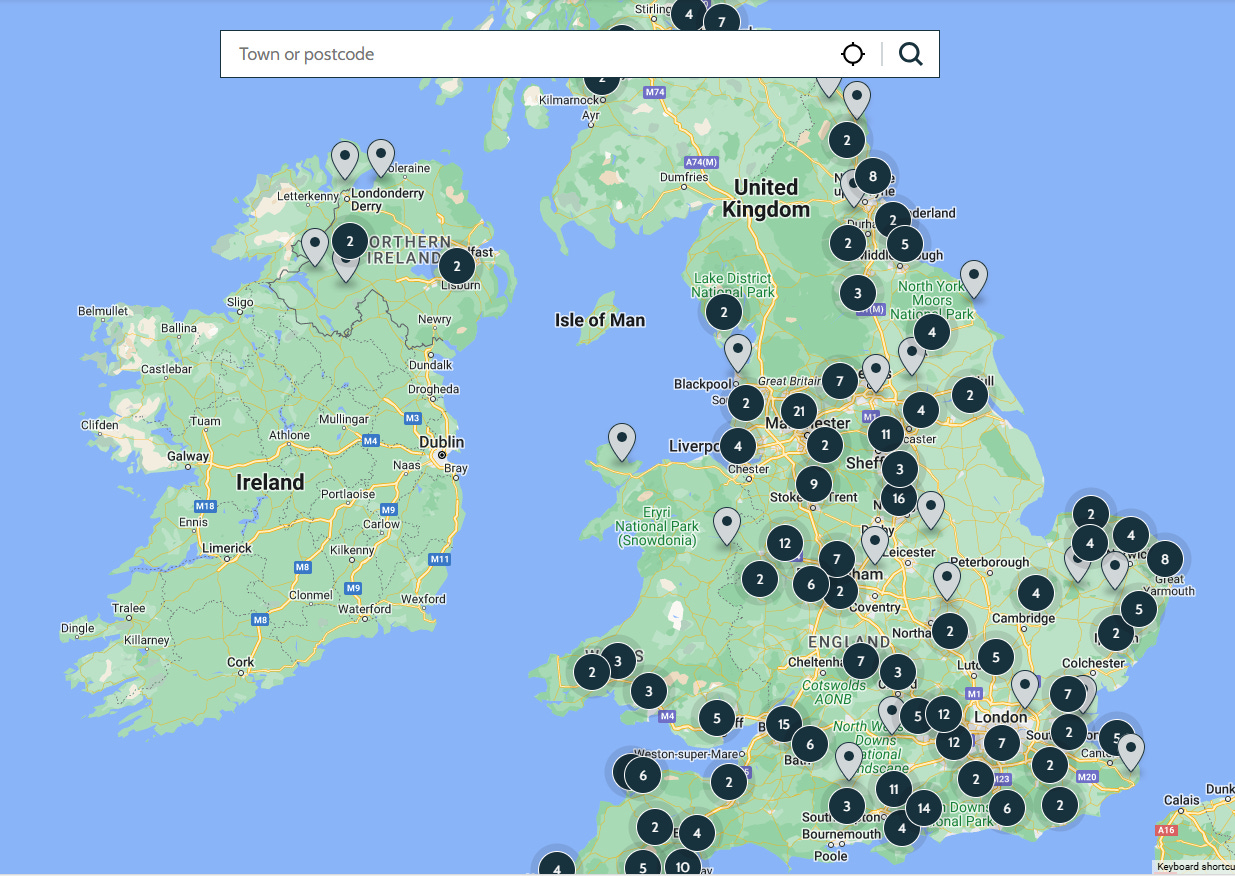

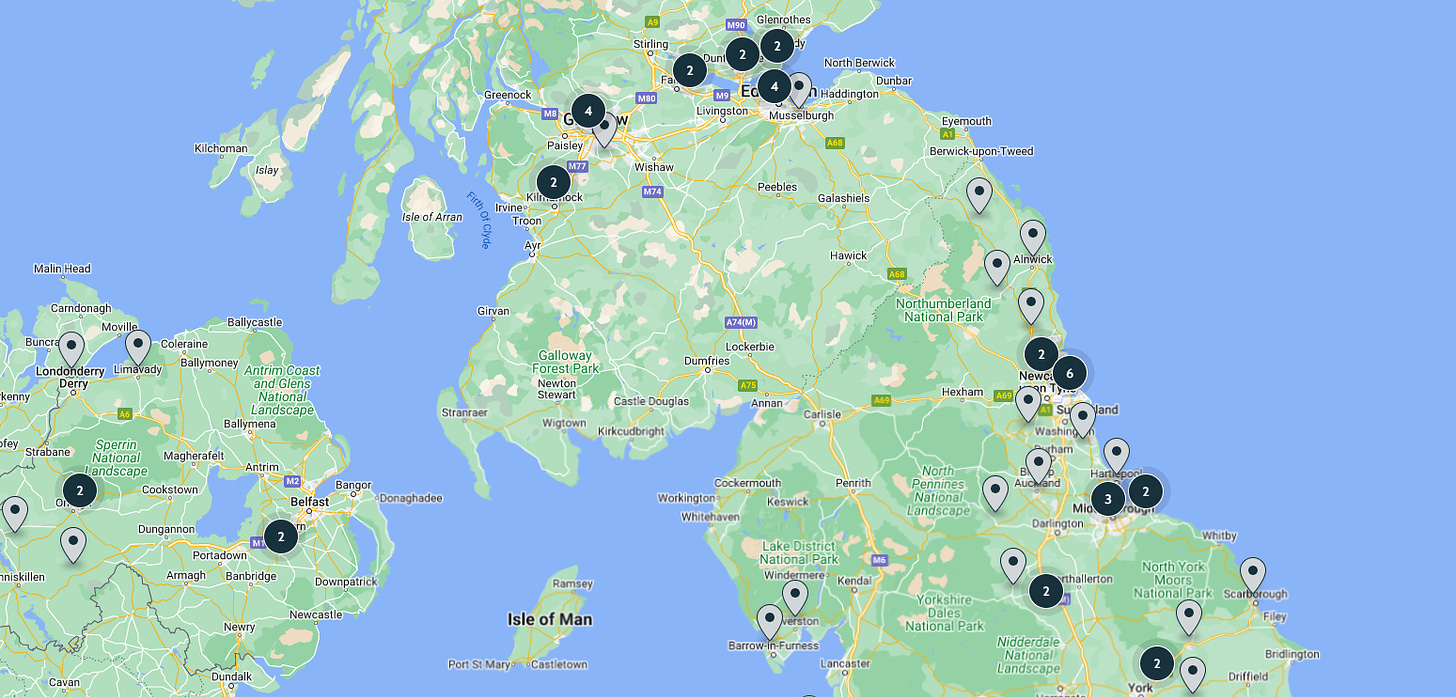

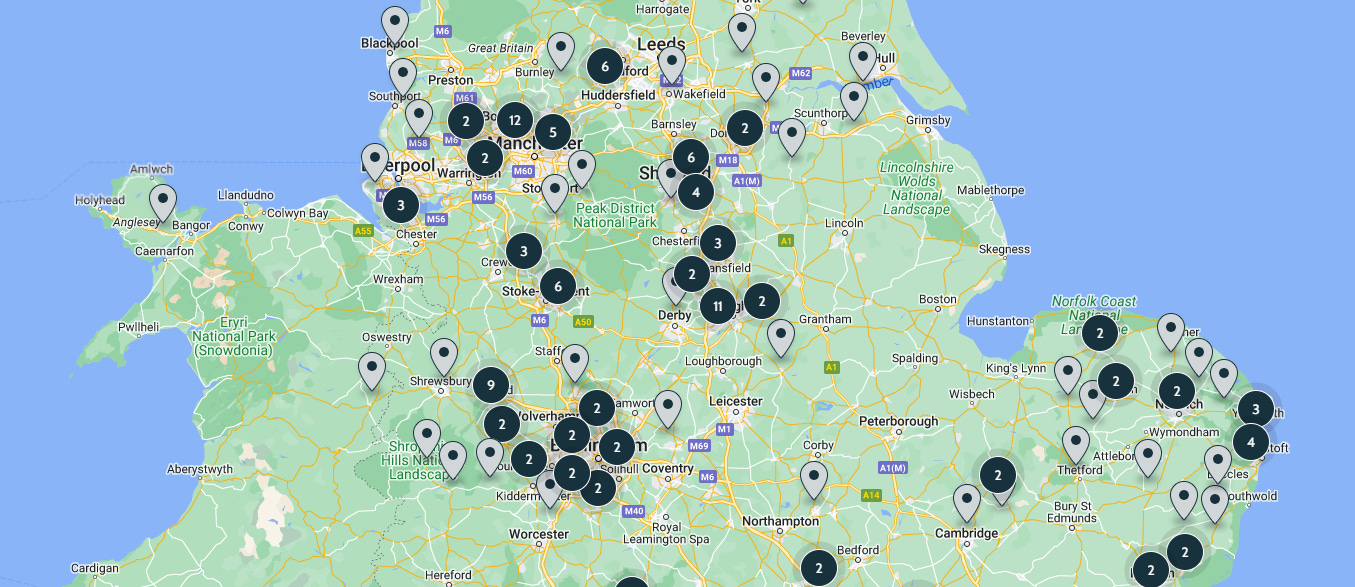

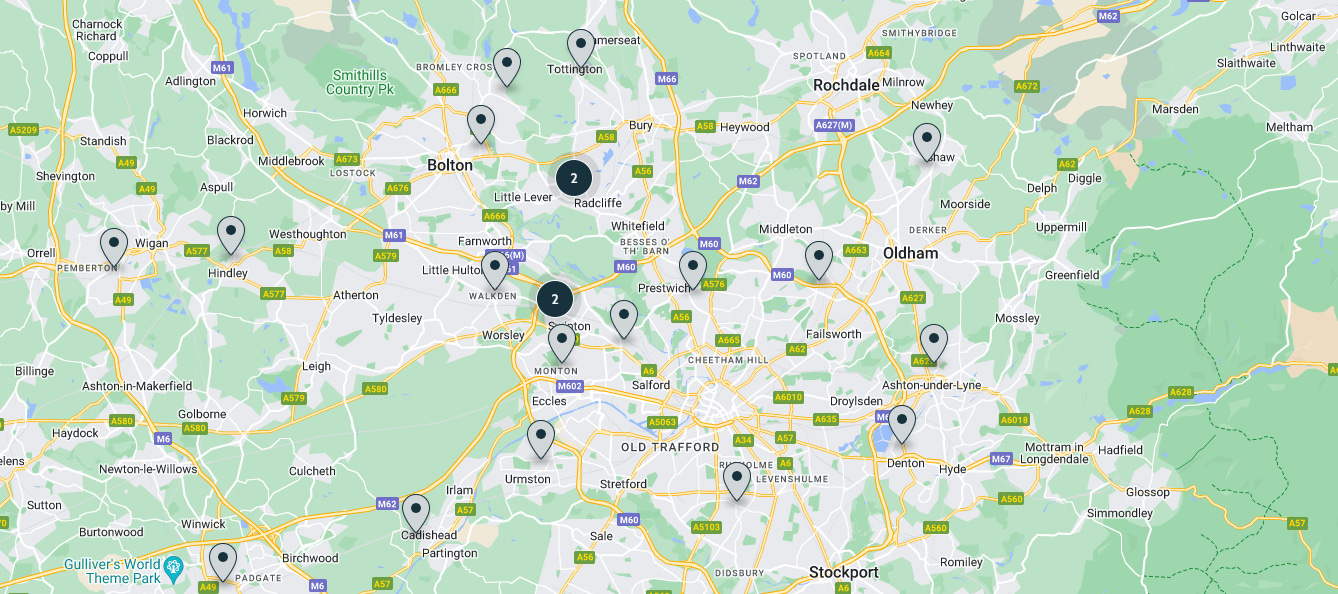

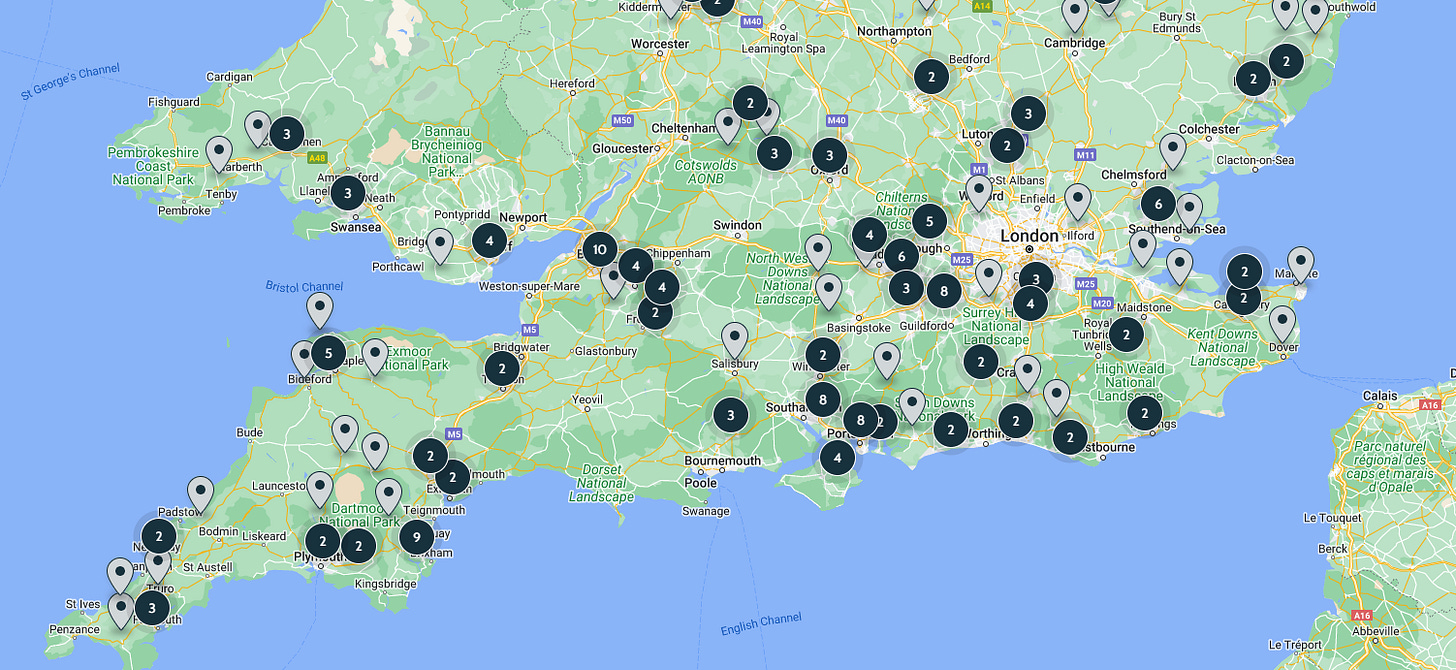

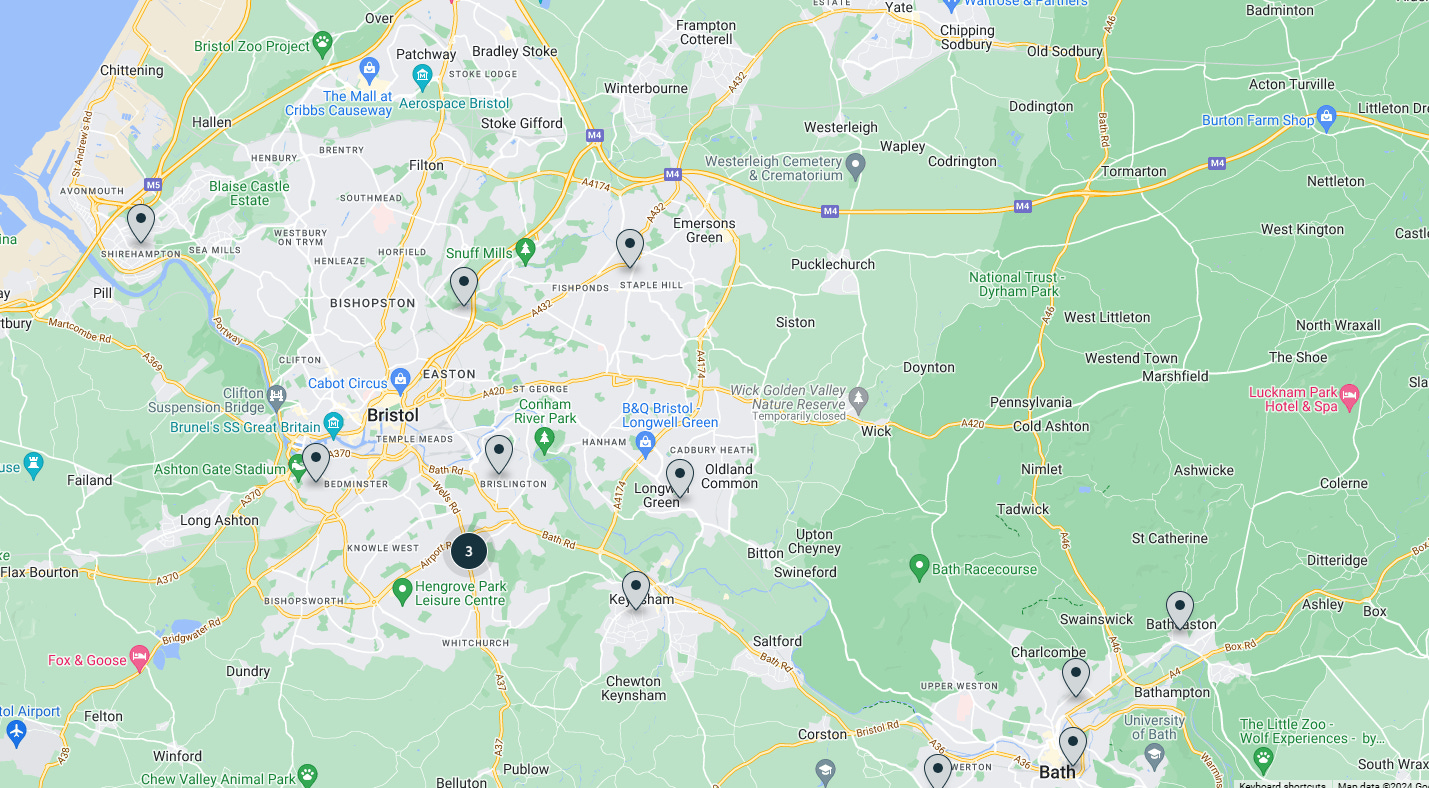

According to the following research, CVS is apparently well diversified. This is the map of CVS practices across the UK:

Looking at the map, we can see that CVSG is present all around the UK. I will now zoom to see the places with the greater concentration of CVS practices.

North area🟢

The dots with more than 2 practices represent Edinburgh, Leeds, Middlesbrough, and Newcastle. There are 0.8 million people living in these cities. Risk of concentration seems very low, as there could be around 250,000 dogs and cats in these areas.

Center area🟢

This is a very crowded area. The areas with the biggest number of practices are Liverpool, Manchester, Shefield, Leeds and Nottingham, some of the most important cities in the UK.

Zoom in the region of Manchester: very limited risk. Only in two places there are practices near each other. The risk in this area is low. Additionally, we are talking of a very dense area.

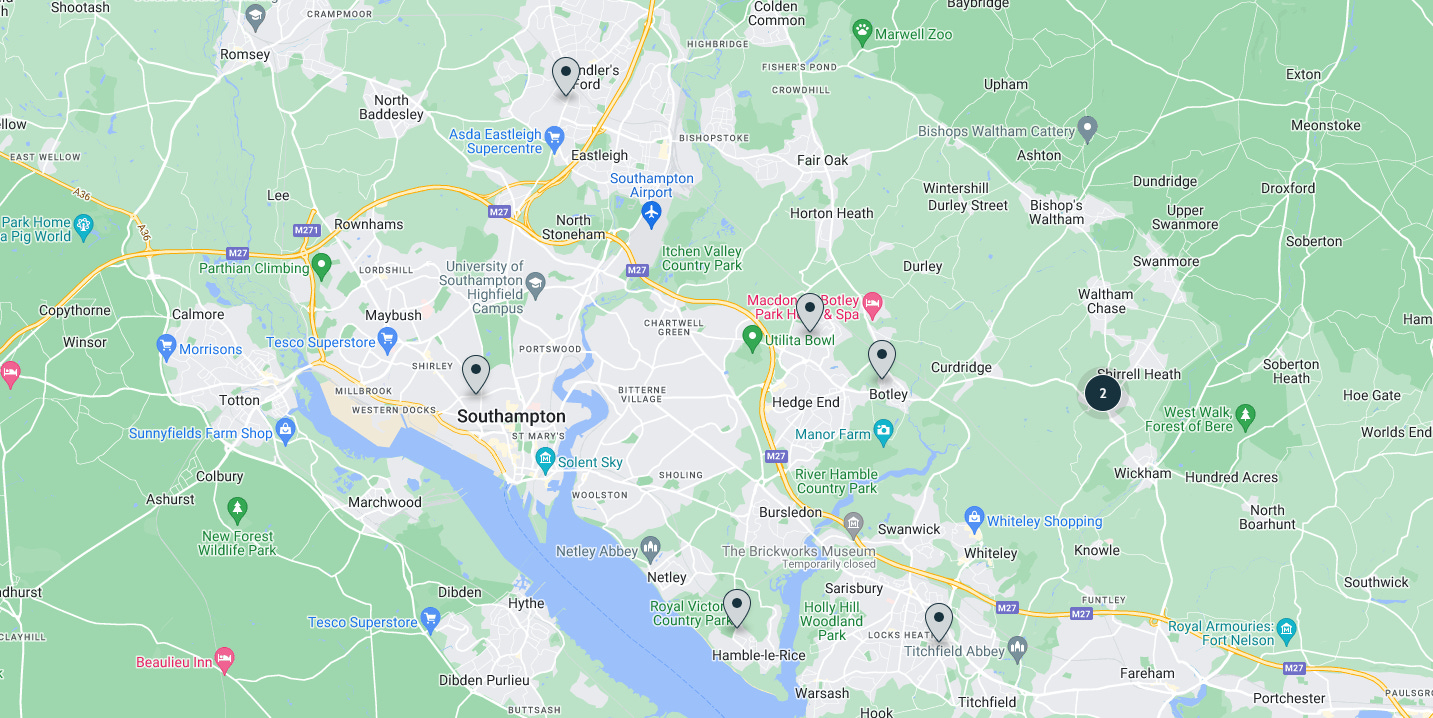

South of the UK🟢

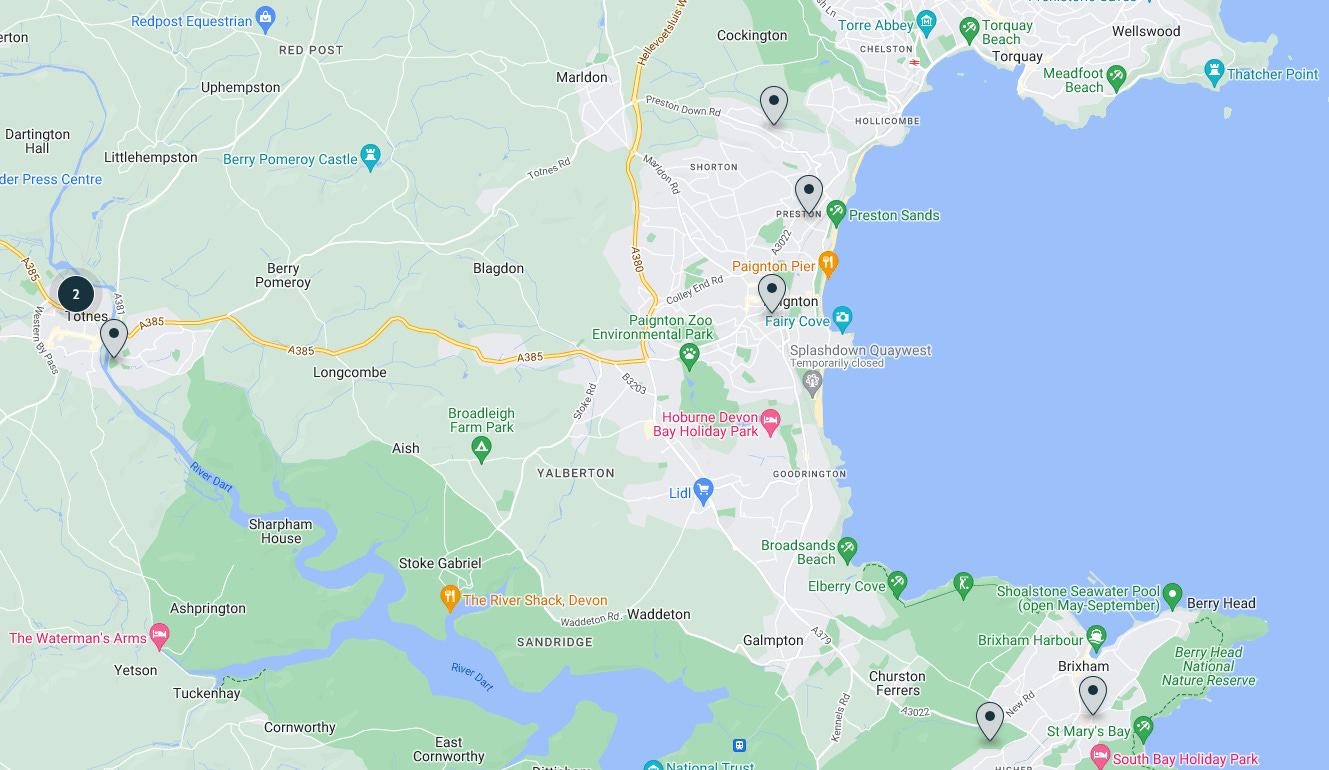

If we continue to the south of the country, there are some places with up to 10 practices, that need to be further analyzed: Bristol, Southampton, and the area near Plymouth.

Bristol area🟢

There are three sites together in the south part of the town. One is a hospital and the other an emergency practice operating overnight and weekends. Low risk as these sites offer different services. Additionally, its an area with a population of c.500,000-700,000 people.

The area near Plymouth🟢

I see low risk (there are some practices near each other, but the percentage over total CVS practices is very low). There are 9 practices out of the c.500 practices owned by CVS. If they were forced to dispose 1-3 practices, the impact is very limited. Its an area of c.265,000 people (i.e., CVS has 1 practice per 30,000, which seems reasonable).

Southampton🟢

Low risk as practices are not close to each other, in a city of c.250,000 people.

As a conclusion, after a high level analysis, the portfolio of veterinary practices of CVS seems to be fairly distributed among the different cities in the UK. There could be some areas of risk, but the overall assessment is low risk.

CMA: “As part of the market investigation, we intend to do more robust analysis to understand better the competition each FOP (First Opinion Practice) faces, including how far pet owners may travel to visit their vet”

Overall assessment: Low risk🟢

The risk is low because its not a question of concentration and mergers. The UK market faces shortage of veterinary professionals. Given this situation, and the fact that opening an independent practice is very costly, its natural to have places where there are a few of practices.

CMA: “We intend to examine the drivers of concentration including acquisitions and explore barriers to entry. Barriers to entry could include contractual restrictions on vets who have been employed by a large corporate groups from opening or working in new rival FOPs within a certain area, economic costs of setting up a new premises, and access to veterinary staff.”

Overall assessment: Low risk🟢

Non-compete agreements are part of many professions. From investment banking to lawyers, these agreements are legal and are temporary restrictions to compete against their employer. However, this only happens at a high level in the company, not for all employees.

Even if they can open a new practice, the issue comes from the shortage of employees and the fact that they will compete against other players. CVSG is investing heavily in training nurses, and receiving new graduates every year. A small practice could not compete against this, and will find itself with very limited personnel choices.

Even if the CMA encourages them to open their own practices, many wont as part of the human nature is to seek protection from the group

And if they open new practices, many will fail, others will succeed, and finally, I bet many owners will end up monetizing their investment and selling back to a big group.

There are barriers to entry, same as many other industries. The CMA highlights that “it may also take time for a new practice to build up a client base, and such a practice may not be economic until it reaches a certain utilisation rate which could take a number of years.”

This is the market and is present in many industries. There can be a remedy if there are tax incentives, attractive financing programs, etc. But it requires time and capital ti build a business. For that reason, there are big groups in the industry, because they have resources to invest in new practices.

Politician create environments where its difficult to build new businesses. Since Brexit, there is a strong shortage of employees, increasing the difficulties to open new practices.

There is no risk as CMA cannot implement any measure on this. Their role is to investigate and recommend actions, but they cannot provide grants or subsidies to companies. They can supervise those, but not provide any financial resource.

Hypothesis #3: Large integrated groups might have incentives to act in ways which reduce choice and weaken competition

CMA: “The expansion of large suppliers, and their integration with related services, creates the potential for efficiencies in terms of shared management costs and allows for reduced costs through greater purchasing power…. This can bring benefits for pet owners. However, we are concerned that weak competition may mean that these efficiencies are not being passed on to consumers.”

Overall assessment: Low risk🟢

This statement is against free market and against the role of companies. Companies aim to become more efficient to earn more profits, which will contribute to create wealth.

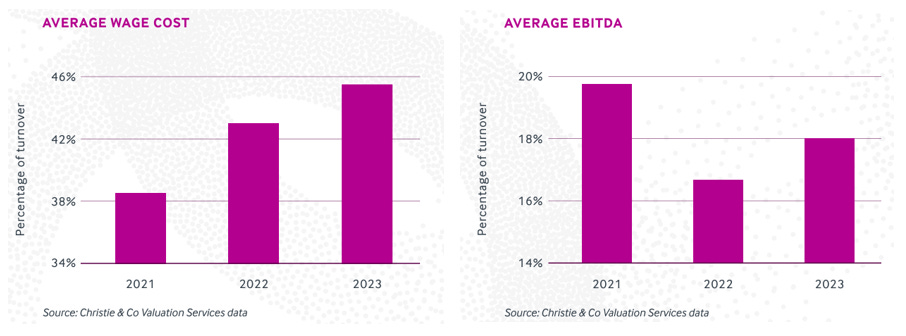

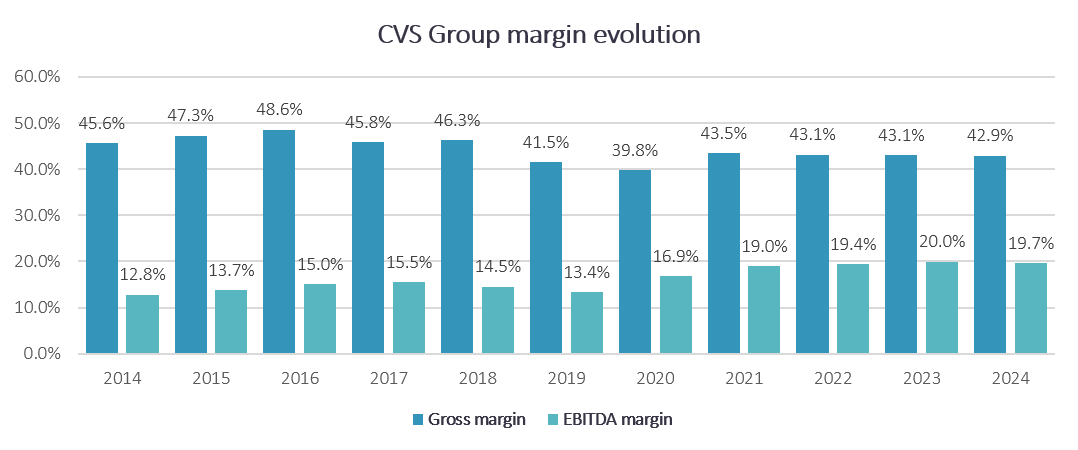

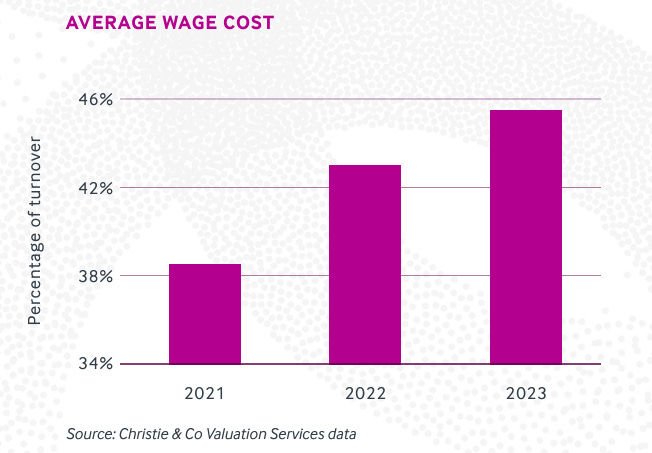

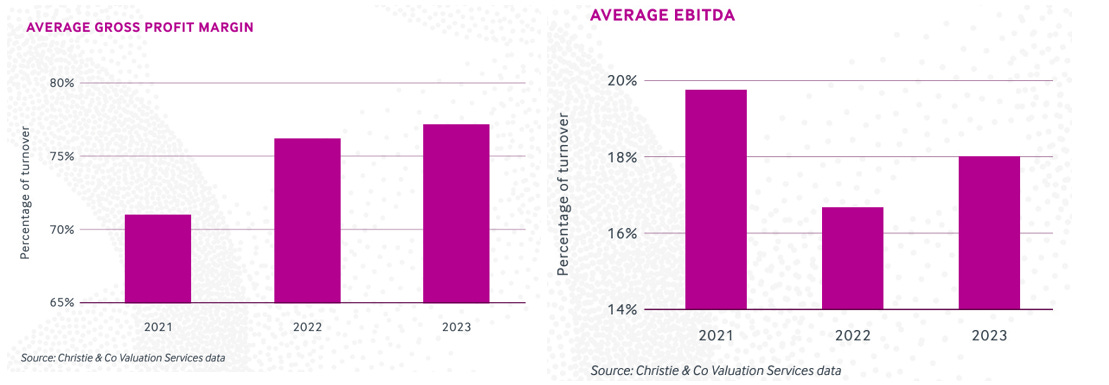

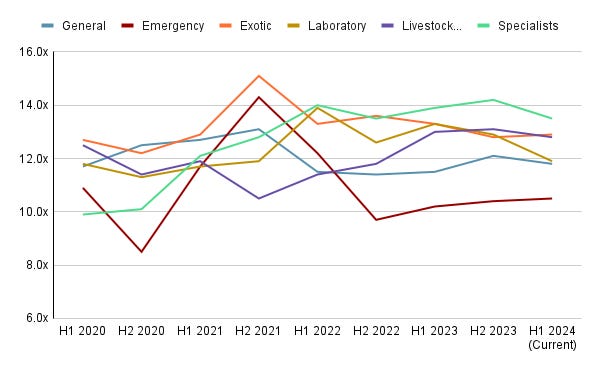

According to this report from Christie & Co. the average EBITDA margin has not increased during the last years. One of the problems that the sector faces is the scarcity of professionals. This happened as a result of Brexit. This is not addressed in CMA’s report.

The average gross margin has increased, but the average EBITDA margin has decreased, and bear in min that EBITDA do not include lease expenses, which have also increased.

This shortage of professionals generates inflationary pressures, and the smaller independent practices are suffering more.

This problem comes from politicians, and not by having large groups operating in the market. The level of the average EBITDA margin is not higher than many industries.

CMA: “The large, integrated groups (especially those whose business models include significant investment in advanced equipment and/or affiliated services) may concentrate on providing more sophisticated, higher cost treatments in place of simpler, lower cost treatments even if some consumers would prefer that option.”

The CMA cannot establish which treatments are appropriate for each case. These groups are investing high amounts of money to provide more sophisticated treatments, which benefits the whole country.

Its a very dangerous game to say that low-cost/simple treatments should be implemented instead of more sophisticated treatments.

CMA: “Respondents to the CFI reported an increasing trend of providing sophisticated, higher cost treatments in place of simpler, cheaper treatment options…some veterinary professionals told the CMA that the provision (and expectation) of a ‘gold standard’ level of care, not necessarily related to the needs and circumstances of the pet owner and pet, was a significant factor contributing to increased vet fees.”

Note that the statement says “some veterinary professionals”. I think there is nothing to add here. Practices are free to offer the service they want.

CMA: “The large integrated groups may have the incentive to offer and promote highly sophisticated treatments because a) they have invested in expensive equipment in order to offer these services, and b) they own related services (such as diagnostic labs and referral centres). If this is the case then, given that large integrated groups have become more prevalent across the sector, the full range of options – including lower cost treatments – might not be presented to pet owners as frequently as it could or should be”

Overall assessment: Low risk🟢

This hypothesis has very low correlation with competition. If some companies are offering higher cost treatments, other companies could come to offer low-cost services to attract customers. Working on a gold standard does no harm competition.

This happens in every industry. Some players will offer higher-cost (and higher quality) services, while others will focus on offering low-cost. Its part of the basic business strategies: either differentiation or cost leadership.

Same as in the aviation industry, you can fly on Ryanair or in British Airways. Both will transport you from point A to point B. One is cheaper than the other. This doesn’t mean that BA is acting against the consumers.

If CMA decides to take action, the risk to CVS Group might be medium. Under the current macroeconomic environment, pet owners might choose for lower cost treatments, rather than the more sophisticated and expensive ones. This can have negative implications in case companies have invested resources to provide these services.

However, any action taken by CMA is limited. They cannot establish which treatments should be offer in every situation.

Mitigants:

In some cases, these treatments can be more effective than the lower cost ones. We can’t measure the outcome only based on the total amount spent by the customers

The CMA acknowledges that in some occasions, there are pressures from consumers to do as much as possible to assist their pet

The humanization of pets can offset the impact of offering lower and higher cost treatments, as we are aiming to do whatever it takes to take care of our pets

The opinion of the vet should prevail, and not only the economic outcome of the treatment. Additionally, companies are free to offer the treatments they consider the best for their customers

The CMA cannot establish a framework for veterinary services (e.g., if a dog vomits, you should offer service A or B. No, its the vet who dictates the treatment).

In any case, its a good market practice to offer alternatives to the consumers. The final decision should depend on the benefit-to-cost assessment, which is always a grey area. I see a medium risk, depending on the remedies and how customers would face a potential change in how treatments are presented.

Is the CMA right that veterinary practices earn above-market returns?

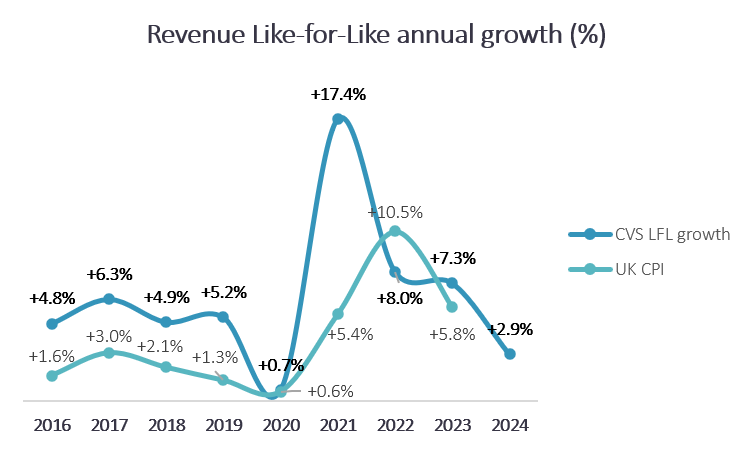

If we compare the revenue evolution against inflation, CVSG has achieved to grow above the market.

While politicians will see this as something wrong, in reality the company is simply maintain its margins to fight against the inflation created by governments.

However, this growth above inflation is one more incentive for the CMA to investigate the market.

The CMA can’t stick with revenue growth. If the company was abusing consumer, the margins should be increasing every year and earning very high returns, but its not the case.

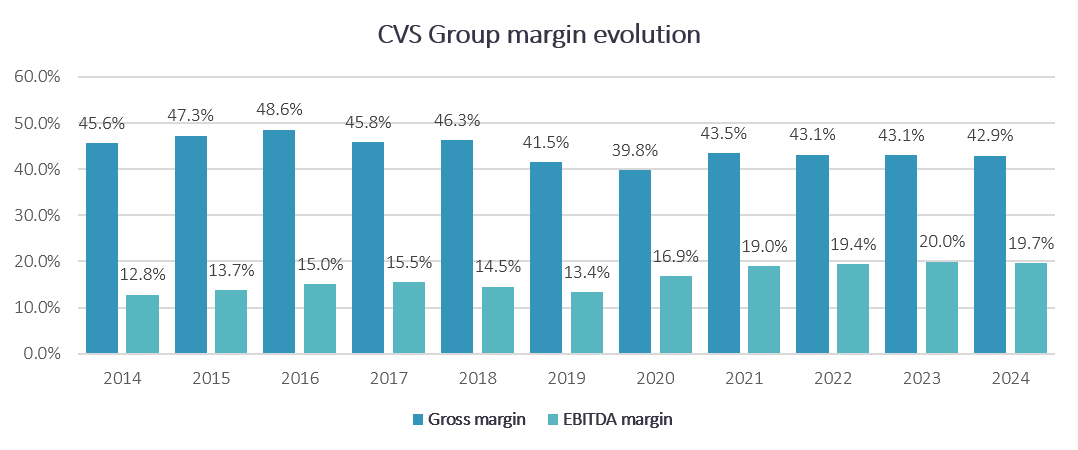

As seen in the chart below, this is not happening. There has been an uplift in EBITDA margin, but in terms of gross margin, there has been a contraction during the last years.

This means that the company has just passed on inflation to final consumption, as have the rest of the industries.

My opinion: if CVSG was earning above-market returns with non-competitive market practices, margins should be increasing every year. If gross margin is not increasing (revenue - cost of goods sold), it implies that they are just passing on the inflation, which is legal and legitimate.

The company is earning a 20% EBITDA margin, which is lower than many industries. This suggest that the veterinary practices are not abusing the market. If regulator is concerned about companies earning margins of 20%, it means that they don’t want any company to succeed.

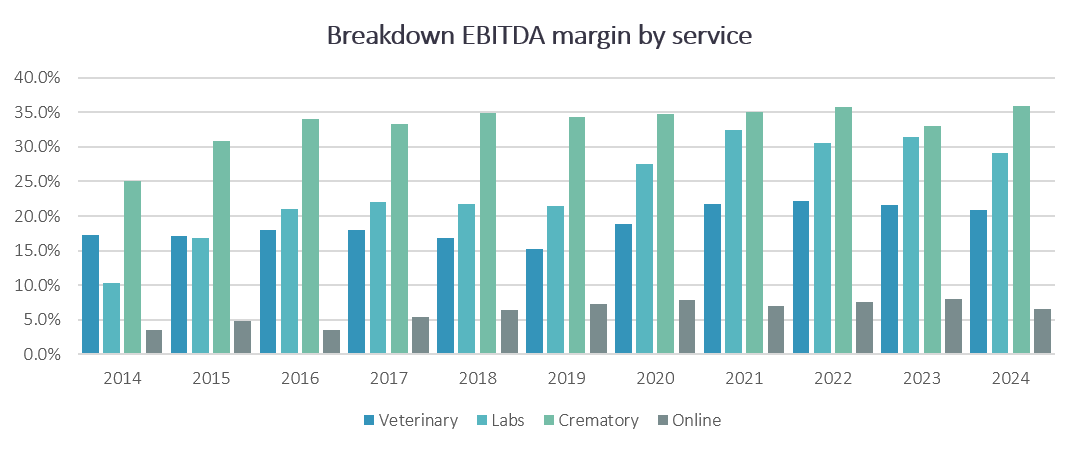

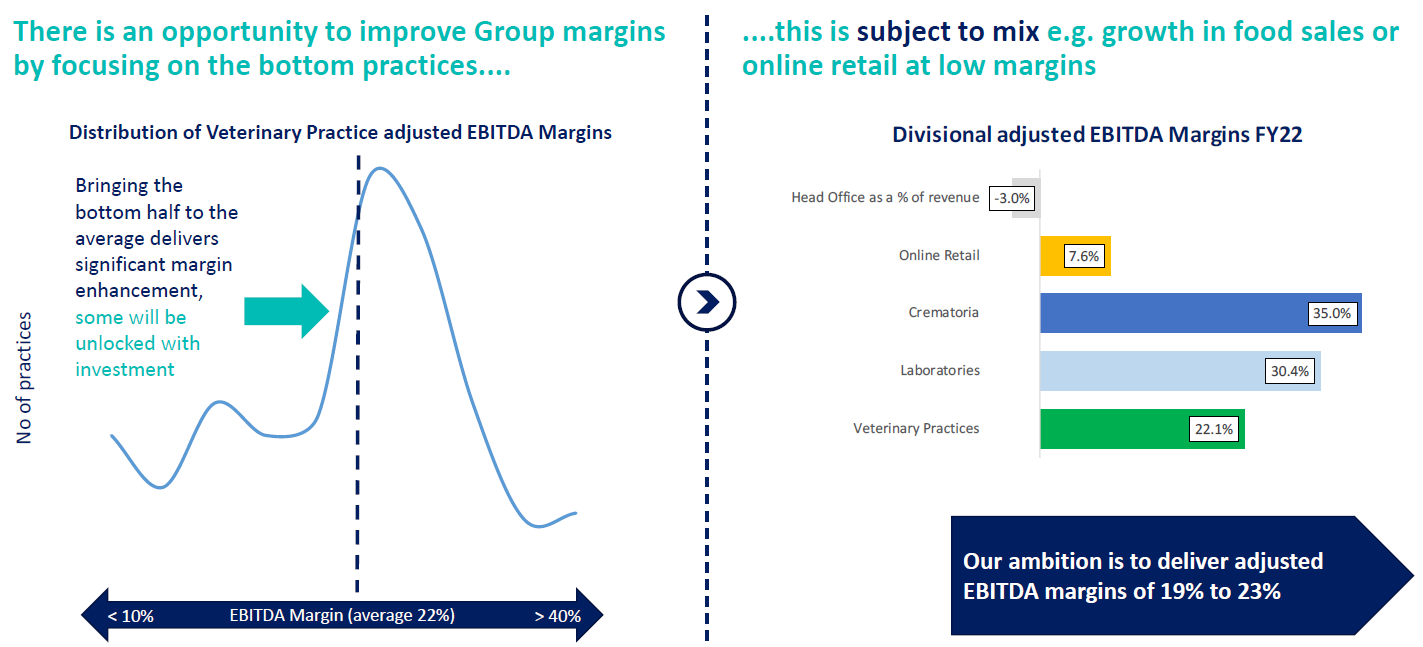

By service, crematoria has a high EBITDA margin close to 35%. This margin is similar to telecom companies, as its a business with limited competition.

Labs margin has increased from 15% to close to 30%. I believe the CMA will increase its focus here. However, earning higher margins doesn’t mean they are prescribing unnecessary services. It might also suggest that the company is achieving synergies by redirecting its consumers to their labs.

Referral is not bad and happens in many industries. I believe that even is customers are informed that the labs are from CVSG, they won’t look for other alternatives.

In any case, as I explained before, the impact is limited given that labs represent 5% of the total revenues. Although the impact might have ramifications as the practice will be also charging for the treatment, I don’t see a huge risk as the vets are the ones prescribing the treatment, and the CMA can’t dictate which treatment is best for every case.

Finally, bear in mind that EBITDA is a metric that excludes leases. Should we include lease expense in the margin, the EBITDA margin will be ~17%, which is not a margin suggesting monopolistic pricing.

CMA: “The large groups have, to varying extents, invested in related services such as referral centres, diagnostics, out-of-hours, and cremation services, and may therefore have an incentive to favour an in-group supplier for these services.”

Overall assessment: Low-to-medium risk🟤

The potential outcome from the CMA is to mandate veterinary practices to inform about alternatives outside their group. This could imply that some consumers will go to other companies for diagnostics, out-of-hours, or cremation services.

The risk should be limited, as these services are provided by less competitors, given the fact its a niche market.

This investigation might impact CVS’s revenue of their diagnostics and crematoria business.

Mitigants:

Few companies offer these services, not because of the existence of big corporate groups, but because its a niche

Even when offered, the alternative needs to be either cheaper or in better location, and not negatively impacting the timings. Are the other providers better? cheaper?

In defending against this, CVS Group can offer discounts and synergies, to ensure clients stay within the group. In case CMA tries to put remedies, in the end, only few companies offer these services.

Being part of the same group is more efficient, and clients appreciate this. If the dog requires a treatment, many consumers are willing to pay a little more to have the results faster, rather than try to save some dimes and be less efficient

Hypothesis #4: Pet owners might not engage effectively and might lack awareness of their options when a pet dies and, as a result, might be overpaying for cremations

CMA: “Vet practices sell cremation services to pet owners, for example when the owner’s pet has died at the FOP. Consumers may have other options available to them, such as arranging cremation with a crematorium directly or burying an animal at home, which may be substantially cheaper. As consumers may be particularly vulnerable when presented with cremation options at a FOP just after their pet has died and may not consider these outside options, this may result in consumers paying higher prices for cremation services or purchasing services which are not best suited to their needs.”

Overall assessment: Low risk🟢

Crematoria accounts for less than 2% of CVS services. The impact in the financials of the group will be minimal in case CMA introduces some remedies in this area of the market.

Pets can only be buried in private lands, and with restrictions (not close to a water source, etc.)

Mitigants:

Many consumers are already aware that they can bury their dog at home. But its not common. Many families have several dogs, so they are not willing to create a cemetery in their gardens

Additionally, people are not going to look for multiple alternatives. Loosing a pet is a very sad and difficult moment. Consumers want to be guided and helped, and solve the situation fast. That has also a price

Even if presented with alternatives, the impact for the group will be very low, as their are not lot of competitors

Hypothesis #5: Pet owners might be overpaying for medicines or prescriptions due to a range of factors including a lack of awareness of their options

CMA: “Vet practices sell prescription medicines as part of consultations and treatments, which may be convenient for the consumer (or necessary when the pet needs the medicine immediately or as part of a procedure)”

“However, consumers can also buy prescription animal medicines from a third-party pharmacy, including online retailers, often at a lower price. Vet practices must advise clients, by means of a sign displayed in the practice, that they can get a prescription and obtain the medicine elsewhere. Most of the pet owners in the qualitative consumer research were unaware of this option.”

“We have seen data from some large vet businesses which suggests that medicines account for around 20-25% of their revenue. We are concerned that vet practices might have the incentive and ability to deter consumers from purchasing medicines elsewhere… We will seek to understand how any profits are generated from the sale of medicines (included those administered as part of treatments), at independently owned vet practices, smaller chains and those belonging to large groups.”

Overall assessment: Medium risk🟠

If medicines account for 20-25% of the revenue, it means that the exposure at CVS Group will be around 21-22% of total revenue of the Group.

A potential remedy from CMA could be to implement measures to ensure customers are aware they can buy medicines outside the practice to third parties. However, in practice, this risk is limited as many treatments require immediate medication. Additionally, time is against online retailers, as it take 1-3 days to receive the product.

Another measure, which will be difficult and controversial, will be the application of limits to the prescription medicines. However, this will harm the independent practices as these are dependent on the revenue from medicines.

Mitigants:

From independent practices to large groups, all sell prescription medicines, and all earn profit from it. Its part of the business, and it doesn’t affect competition

A consumer can go outside to buy the medicine, but sometimes its pet-specific medicine, which might not be easy to obtain. Additionally, sometimes they need to be administered to the pet with syringes, pet needs to be in observation… Sometimes, its just not convenient to go outside to buy the medicine

Urgent treatments require medicines immediately

Even if consumers decide to purchase medicines outside the practices:

The impact will be limited. If for example 2 out of 10 consumers decide to purchase medicines outside, it will mean that ~4.5% of total revenue will be at risk, which limits the potential impact. For sure, many consumers will continue to purchase the medicines in their vets (e.g., I keep doing it as I make sure I receive the exact medicine)

This risk is mitigated by the fact that CVS Group has also an online business selling prescription medicines. If their website captures a 20% of these clients, the total revenue at risk will be ~3.5%, which is very limited

CMA: “The CMA received several representations from independent veterinary practices that online pharmacies sell animal medicines to consumers at a price lower than the cost to many vet practices of obtaining medicines via the wholesale channel. The regulatory regime stipulates that vet practices need to buy their medicines from a provider that is licensed for wholesale supply, so this cheaper channel is not available to them.”

Overall assessment: Low risk🟢

If vet practices buy their medicines from a cheaper channel, they could sell medicines at lower price, or simply earn more profits. The market will adjust, but its not a big risk for CVS Group.

The online channel represents around 7.5% of revenue, and if practices offer lower prices for medicines, part of the potential risk of loosing revenue will be redirected to CVS own practices. The result should be a neutral impact for CVS Group.

The impact is low because their online store sells more than prescription drugs.

Hypothesis #6: The regulatory framework is outdated and may no longer be fit for purpose and may currently be operated in a manner that does not facilitate a well-functioning market.

CMA: “As well as considering whether there are aspects of the current Veterinary Surgeons Act which could be updated, we would like to explore whether the current framework could be more effectively applied or enforced in so far as it relates to interactions with consumers or, potentially, other providers (such as competing referral centres or crematoria). “

Overall assessment: Low risk🟢

I see a limited impact as the CMA itself cannot change the regulation. They can propose to the RCVS (the entity regulating the veterinary market), and to other regulatory bodies to update regulations.

However, this takes time and the outcomes are uncertain.

What do experts, analysts and the press are telling about the investigation?

The British Veterinary Association

According to the British Veterinary Association, there are some potential negative consequences from the CMA market review13:

Quality/Outcome Measures for Clients: Requiring practices to provide outcome-related data for client decision-making is problematic as such data is often unavailable, statistically unreliable, and could mislead pet owners rather than aiding informed choices.

Annual Reassessment Letters: Encouraging pet owners to reconsider their veterinary practice annually could undermine the vet-client-patient relationship, risking fragmented care, miscommunication, and incomplete medical records, which may harm animal welfare.

Mandated Prescription Durations: Imposing longer prescription lengths without considering vets' clinical judgment could jeopardize animal welfare by increasing risks such as antimicrobial resistance, unmonitored side effects, or untreated worsening conditions.

Use of Generic Medicines: Recommending unlicensed generic medications as equivalent to licensed veterinary products is unsafe. Licensed products are rigorously tested under the Veterinary Medicines Regulations to ensure safety and efficacy, critical for maintaining high standards of animal health and welfare.

Research analysts: RBC Capital Markets

This statement from the RBC analysts signals that the impact is very low, and that investors who are patient can earn substantial returns. However, they have a hold rating because they are focused on the next 12 months…

"Based on our new scenario analysis, published today in our industry report, CVS' shares are significantly over-discounting the risk, based on our scenario analysis, but we doubt this valuation discrepancy will attract new investors until closer to a more final CMA outcome,"

We think investors with an 18-24 month investment horizon should see the current price as a great opportunity to buy shares with almost 3x upside potential which on a worst-case basis is the upside when applying 13x to Jun-26 EBITDA," RBC Capital Markets14

Isn’t just crazy that because analysts only focus on the next quarters, they give a rating of “hold”, despite potentially having an upside of almost 3x?

Which are the precedents in other market reviews?

There are some examples from previous CMA market investigations, that can give us some clues of what the potential outcome could look like15:

Private Healthcare market (2014)

Issues: dominance of large groups and lack of transparency in service pricing and performance

Outcome: CMA mandated divestment of some hospital facilities and improved patient access to information

Pharmaceutical and Prescription Medicines (2016 and 2022)

Issues: anti-competitive pricing and limited competition due to vertical integration

Outcome: Fines imposed on companies for overcharging (e.g., Pfizer fined £84 million in 2016)

Dental Services (2020)

Issues: Transparency in pricing and treatment costs and the rise of corporate-owned dental chains affecting competition

Outcome: Recommendations for clearer price disclosure and easier comparison tools for patients

Optometry Services (2013)

Issues: Vertical integration leading to limited product choice, price disparity across regions

Outcome: Encouraged separation of retail and optometric services to enhance competition

Funeral Services (2021)

Issues: Emotional nature of decision-making limiting competition, and non-transparent pricing structure

Outcome: CMA required funeral directors to publish price lists online and avoid practices that hinder consumer choice

Care Home Services (2018)

Issues: Opaque fee structures and difficulties for consumers in switching or understanding contracts

Outcome: CMA introduced measures to ensure contract clarity, fairer charges, and refund policies

Retail Energy Market (2016)

Issues: Limited consumer engagement with the market and dominance of incumbent suppliers

Outcome: Introduction of a price cap and other measures to promote switching among customers

Conclusion: What are the potential remedies to imposed by the CMA?

Based on all the information analyzed, including precedent market investigations, these are the main potential outcomes of CMA’s investigation:

Impose pricing transparency: Vets could be mandated to publish the list of prices in their websites. Given the complexity of including all their services, a list of basic services should be the most probable outcome.

Probability: This outcome is very likely to occur

Overall assessment: Low risk🟢Impose disclosure of ownership of the different practices and other services (labs and crematoria) and set rules around referrals. Groups like CVS operate with multiple brands. CMA might mandate to disclose the ownership of these practices, labs, and crematoria. Additionally, the company has multiple labs and crematoria, however they represent ~6.5% of total revenues. Therefore, the impact is very limited.

Probability: High for disclosure of ownership (very likely to occur), uncertain for rule around referrals.

Overall assessment: Low risk🟢Set limits to market share and mandate divestments in regions where large corporates have a dominant position. CVS has ~500 practices in the UK. As we have analyzed, these practices a well distributed across the geography. The impact should be very low, and it can also be an opportunity in the regions were the company is not present. The largest player IVC Evidencia is at higher risk as they own ~1,000 practices in the UK. This outcome is more difficult to occur as CVS doesn’t seem to hold a dominant position

Probability: Low

Overall assessment: Low risk🟢

What can be the impact on CVS Group business?

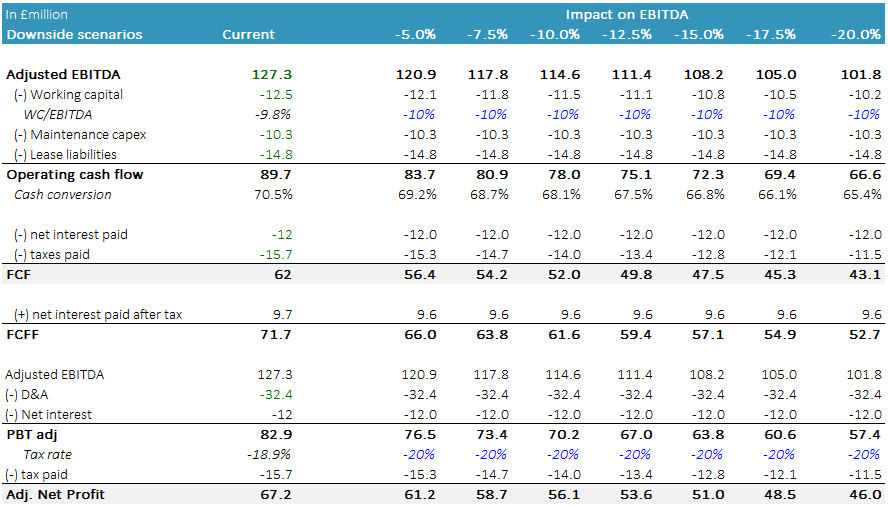

I believe that the impact on CVS business will be very limited. I don’t see more than 5-7% of revenue at risk, which is limited after the stock has plunged from £~2,500 per share to ~£800 per share.

Additionally, the company will continue to grow despite the outcome.

The impact is limited and it should be already reflected in valuation.

Having a 5% revenue at risk is very limited, and given I have a enterprise investor mentality (I invest in business, not in shares, with a long-term horizon), the potential outcome can be solved in just a few years.

I will analyze the impact on the valuation in the valuation section.

The management already assumes a moderate impact

I will address the impact on valuation at the end of the post.

IV. Business Plan and expansion through M&A

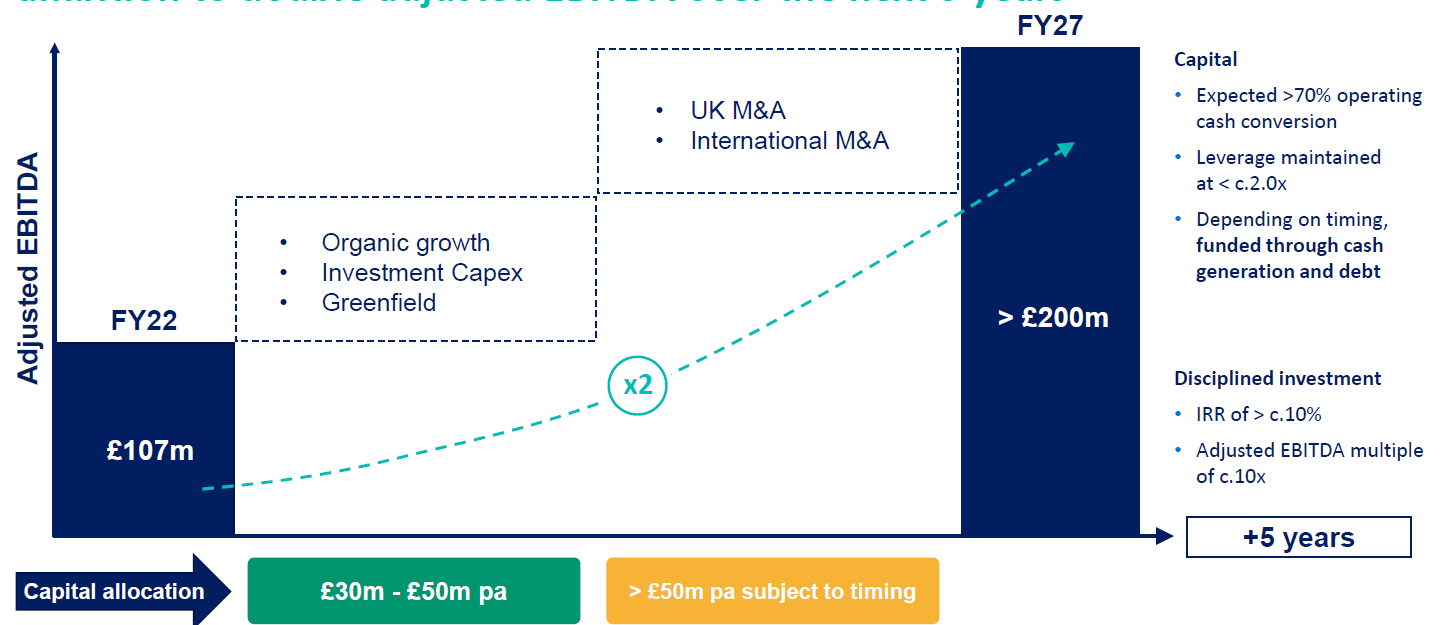

In 2022, the company presented their business plan for the next five years, in which the management aims to double EBITDA by 2027.

The main goals for the next years are the following ones:

Since 2022, the company is accomplishing their targets. The latest results are in line with expectations:

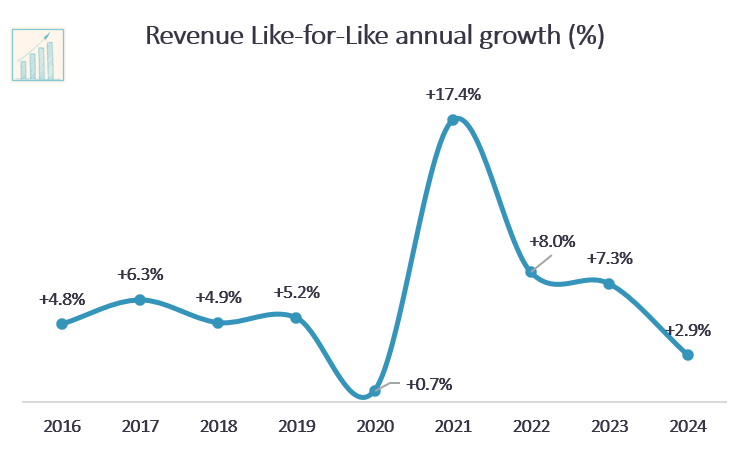

Revenue grew by +3% to 8% (LFL)

Adjusted EBITDA margin ranged 19.4%-20-0% (still in the low part of the range, mainly due to inflationary pressures on wages)

Company made significant acquisitions in Australia at apparently attractive multiples

Organic cash conversion of 70% in the last two years

Leverage at 1.5x after the Australian acquisitions

Overall the company is on track to grow significantly the EBITDA. Even in an adverse scenario, I expect that the 2027 EBITDA will be significantly higher than in 2022.

V. Management

CVS Group is not based in any major city, which allows them to have a lower cost corporate center. No fancy offices, not a London-based company…this is great. One additional reason of why investors are flying away. A company far from the City of London, in a sector under investigation..

Key Executives

There are three key executives in CVS, the CEO, CFO and Chief Veterinary Officer.

[Note: Due to time constraints, I’m doing this section shorter than normal]

When a CFO talks about IRRs, ROCE, etc., its because he understands the drivers of value creation. There are many executives that don’t understand these metrics.

Financially, the company is well managed, with a prudent financing and a proper capital allocation.

Remuneration of executives

Same as most of the companies, top executives earn a base salary and a variable bonus depending on performance.

Base salary: In terms of base salaries, these are reasonable. CEO earns ~£500k per year, and the CFO ~£340K.

Annual bonus: the annual bonus is divided into two componentes:

80% depends on adjusted EBITDA (including acquisitions). This EBITDA ranged from £129.6 to £141.7m, which is an increase of +6.8%. During 2024, the Group felt short by £2 million, and retribution was 0%.

20% based on non-financial targets such as patient care index, attrition, client NPS, medical waste, and Australia acquisitions

LTIP program, which depends on the adjusted EPS and Total Shareholder Return.

EPS growth threshold was set at 5.0% CAGR since October 2021

TSR based on relative performance to the index FTSE 250

Its not a perfect retribution system as the cash flow has no impact on their retribution.

Additionally, there is a conflict of interest with the EBITDA metric, as it can be increased through acqusitions. If management is not selective on acquisitions, it can be negative for shareholders.

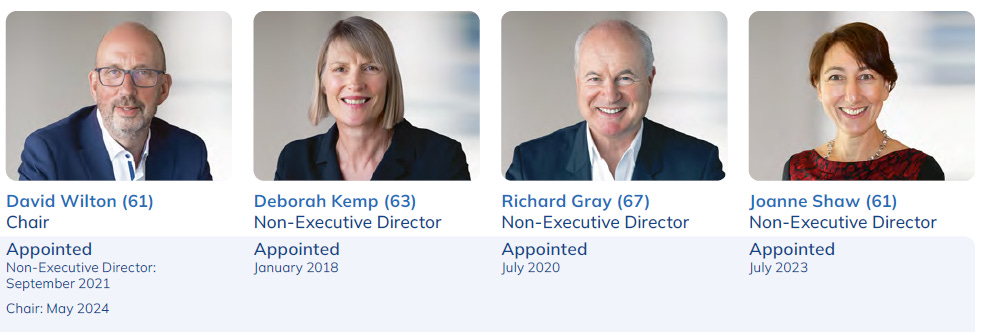

Board of Directors

The BoD has 8 members, of which 4 are non-independent. The CEO, CFO, Veterinary Officer and the company secretary are the non-independent members.

The remaining independent directors bring experience in healthcare, consumer/hospitality and finance (M&A, capital markets, etc.). Its an interesting board were the main pilars are finance and healthcare.

Independent directors

Because its a company investing a lot in expanding, it is critical to have a board that understands the drivers of value creation. The Chair of the board has a strong financial background, having started his career in PWC and Rothschild. Richard Gray brings extensive experience in investment banking which is critical to ensure a proper supervision of the expansion plan.

Deborah Kemp and Joanne Shaw bring complimentary capacities for the business. Deborah comes from the consumer and hospitality industry, which can support the CFO in terms of managing more efficiently the operations, and Joanne has significant healthcare experience.

Its a very experienced board, with decades of professional experience. On the other hand, the executive management remains young enough to continue

The Chair has been appointed recently after the previous, Richard Connell, had to resign due to ill health.

VI. Financial analysis

Revenue analysis

As we seen before in our CMA analysis, revenue growth was strong during the last years, and I expect it will continue in the next years as the company keeps investing in growth.

As stated before, veterinary services is the core of the business, as ir represents more than 85% of total revenue.

Operating margins and EBITDA

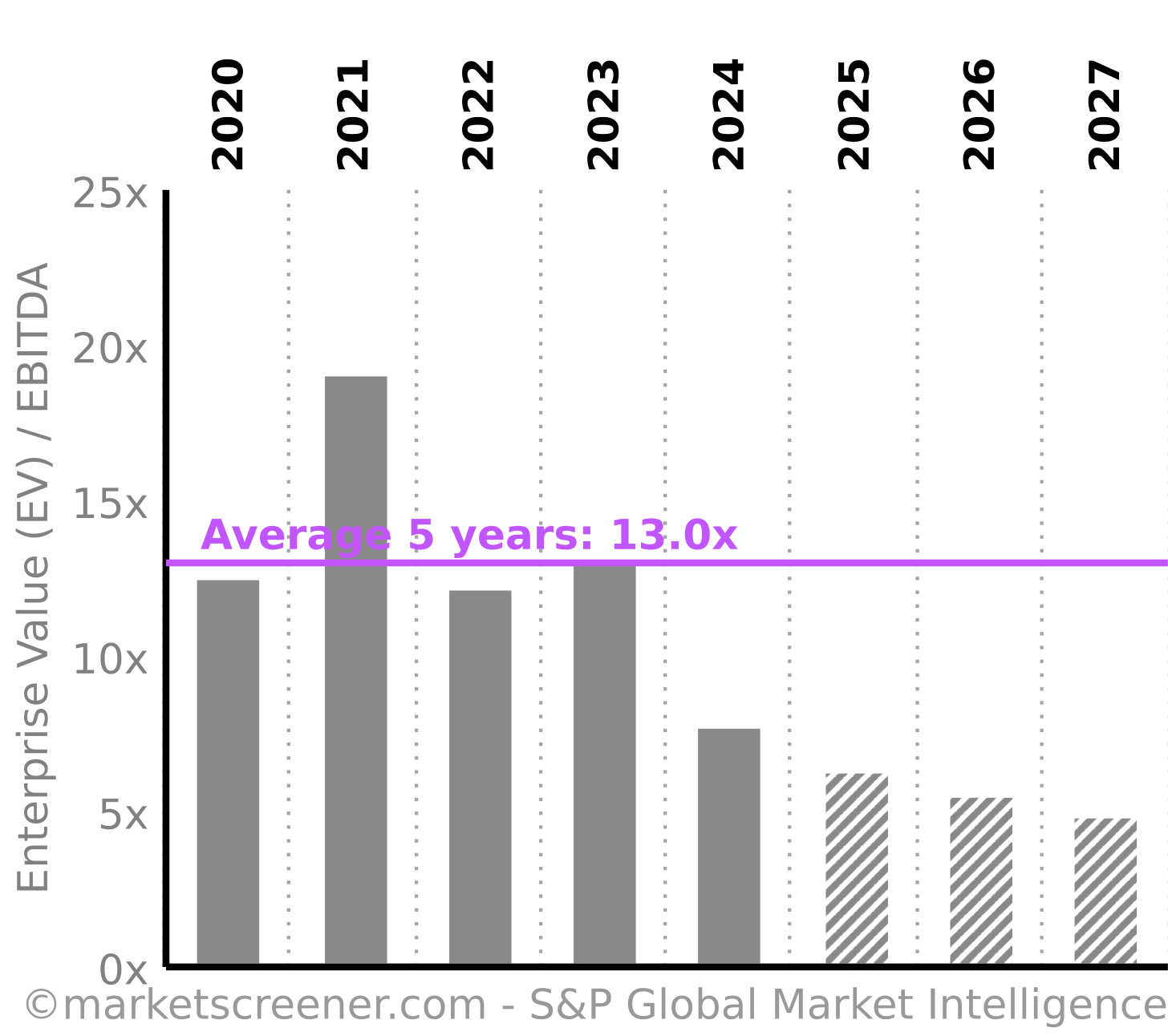

The company targeted to double EBITDA from 2022 to 2027. In 2022, EBTIDA was £107 million and today stands at £127.3 million (an increase of 18% in the first 2 years, signalling the difficulty to achieve that target).

However, the trend should accelerate after the recent acquisitions in Australia, which should deliver synergies in the coming years. Next year we will see the real EBITDA after the acquisitons, and synergies will follow next years, so the trend should accelerate.

It is important to understand that current M&A and investments will bring growth in the next years, not the next quarter.

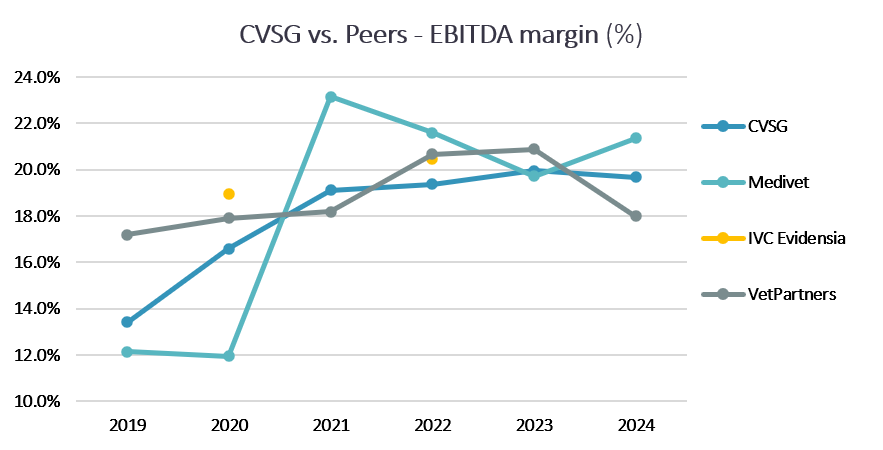

As seen in the chart, the EBITDA margin has increased over the past years, despite a significant increase in wages due to shortage of professionals. Current EBITDA margin stands close to 20%, which is higher than the average from competitors, which stands at c.18%:

The company has been able to achieve strong revenue growth during last years, however, in terms of margin, they remain the same. The main reason is the shortage of professionals in the industry after Brexit. As explained by Christie & Co., wages now represent close to 45% of total revenue, up from ~38% in 2021.16

In CVS, the impact has not been that high, partly because it already stood at 47%. Since 2019, the average salary by employee (total personnel expenses dividend avg. number of employees) has increased by 17%, which is a very high amount and confirms the problems of the industry.

CVC-backed Medivet Group reported employee expenses of 43% and 40% over revenue, in 2023 and 2024, respectively

CVS Group is above the market, suggesting a very complex environment. This has impacted negatively EBITDA. However, figures might not be comparable as CVSG includes board of directors, etc.

One important conclusion is that under the current inflationary environment, the company has been able to maintain gross margins, as its an industry with some pricing power.

Breakdown by service

Crematory services is the most profitable segment for the company, however it only represents 2% of revenues. The core contributor remains the veterinary practices, which yield an average EBTIDA margin of ~30%, prior to account for lease expenses.

Against peers, CVSG is aligned and most peers have an EBITDA margin between 18-22%. Given that information about peers is limited, its satisfactory to see that CVSG EBTIDA is in line to peers, lagging slightly behind Medivet.

Capital allocation

The management has set the target to double EBITDA in a 5-year period. To do so, the company is investing heavily in its practices and also making acquisitions across the UK and Australia.

Capital will be allocated to organic growth and M&A. On average, the company will allocate ~£100 million every year to fund future growth. Part of these investments will be financed with debt, as cash generation stands at around 60 million per year.

After the CMA started to run the investigation on the UK market, the company was fast at shifting gears in their plan to expand to Australia. Its a very good move by the company.

While the investors keep focusing in the UK, the company has now 30 practices in the country, which now represents 6.5% of total practices of the group.

It is still small compared to the UK, but the move is very smart. While the market keeps focused on the CMA investigation, the company continues with their plan, and accelerating their expansion to Australia and every year the company will be more diversified.

Capital expenditures

The company is investing around 5% of the revenues in improving the returns of their practices. Maintenance capex stands at ~1.5-2.0% of revenues, which is very low.

Investing in the facilities and/or new technologies brings not only higher returns, but also an improved experience for the customers. Many practices do not invest in technology and offer basic first opinion services. However, if customers receive opinions based on improved technology (i.e., better data), the outcome will be better.

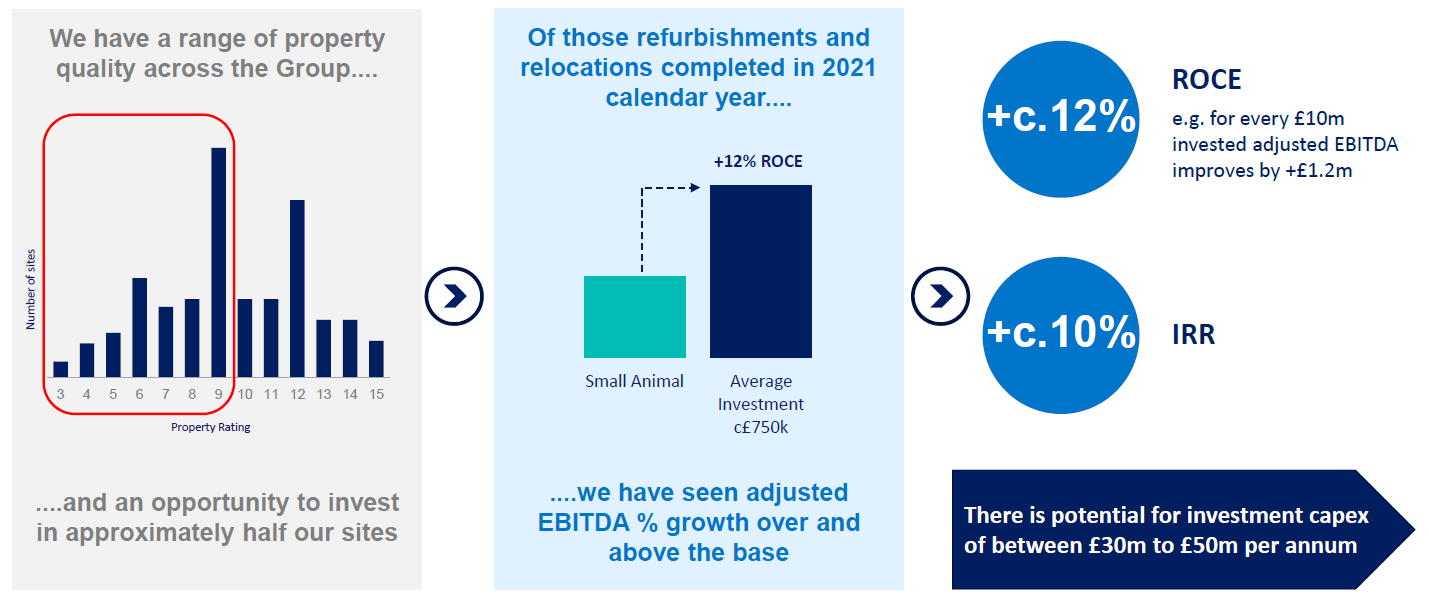

The company aims to bring the lowest performer practices to the average EBITDA margin of the group, which will enhance the overall performance.

Same as with M&A, the company targets returns of 10% on their investments, which is a rate higher than their WACC, and higher than the average returns in the equity markets.

The company claims that investments deliver:

An increase in EBITDA of +12% - However, this metric is based on refurbishments completed in 2021, which might be biased

An IRR of 10%, which is in line with their ROE

The company invested £30 million last year; which will bring additional ~£3 million in EBITDA the next year.

M&A - Acquisitions

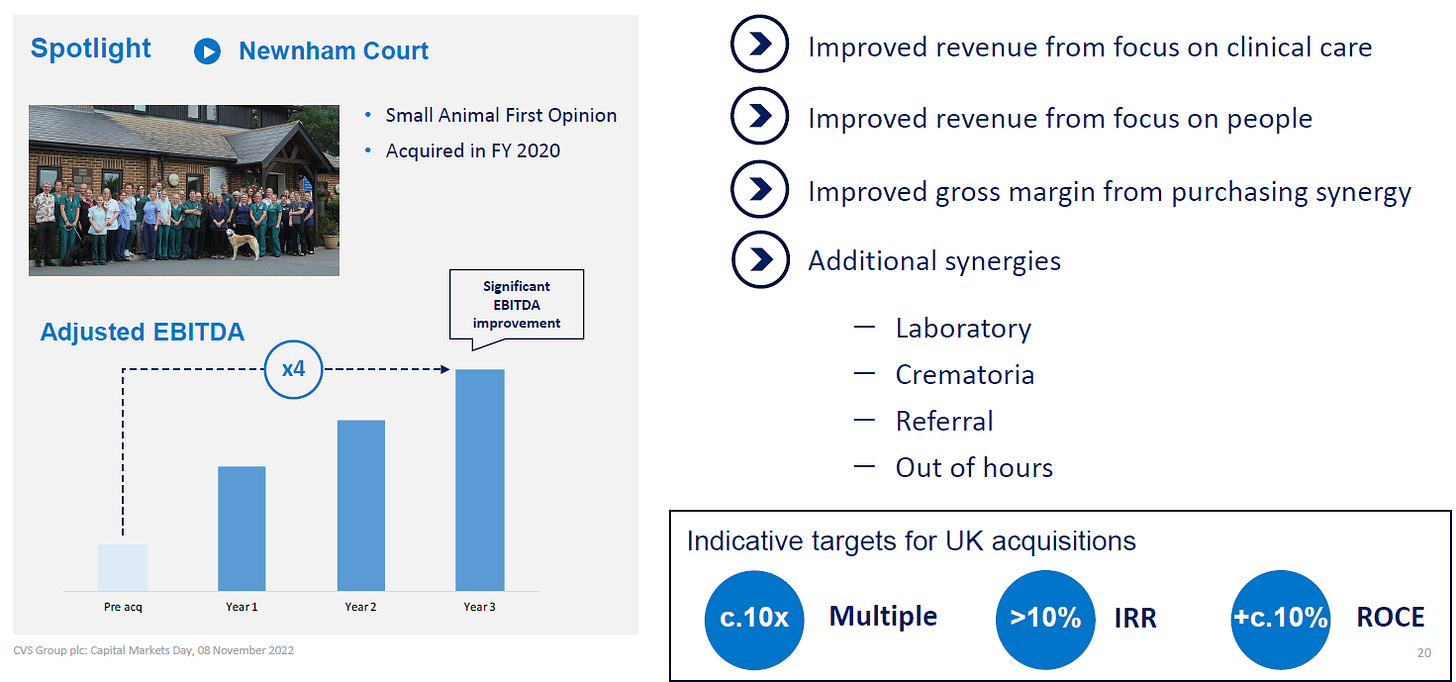

On the acquisitions side, the targeted returns are similar to investments. In the UK, the company is acquiring practices at multiples of 10x EBITDA in the UK, and is able to acquire at lower multiple in Australia.

The shift to Australia makes total sense as currently the group trades at 7-8x EBITDA. Its not time to invest in the UK at 10x EBITDA.

In the UK, part of these synergies will face some degree of risk, after the CMA review. However, I believe the risk is low if the outcome relates to more transparency to consumers.

The main synergies are:

On the revenue side, the improvements come from a focus on clinical care (delivering better treatments), and generating synergies with laboratory, crematoria and out of hours

On the cost side, there is an improved gross margin as the sites will benefit from purchasing synergies

The CMA review is currently slowing the acquisition of practices. However, there is going to be room for further acquisitions in the future, as many practices will continue to come into the market.

Dividend

The company distributes a very low dividend every year, of £0.8p, which implies a yield of ~1%. Its a testimonial dividend, that represents less than 10% of FCF.

Personally, I wouldn’t distribute the dividend as its better to invest in expanding the company across the UK and Australia. In any case, its a very limited.

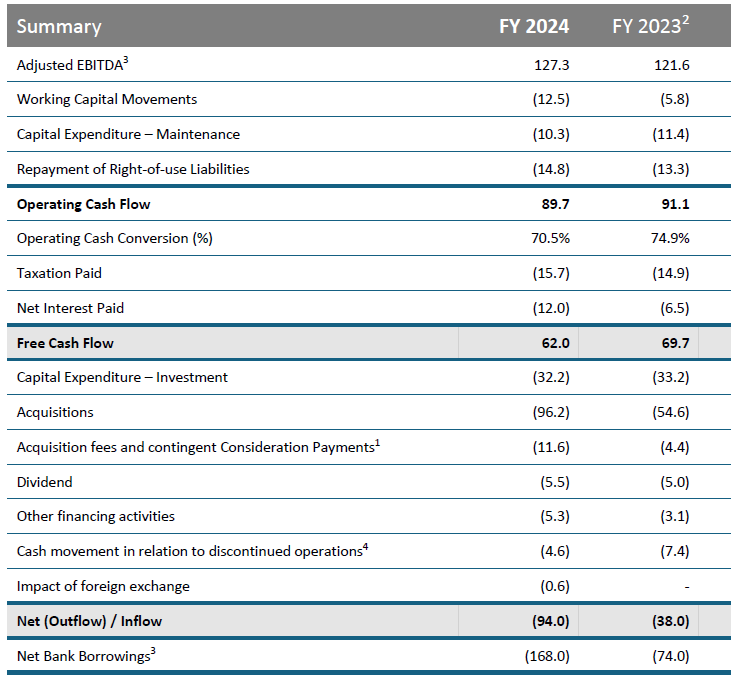

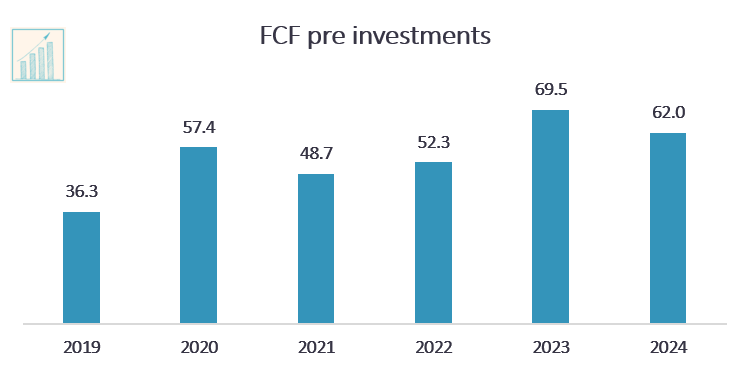

FCF generation

This is the FCF statement of the company. If the company decided not to invest in additional growth (i.e., not investing in expansionary capex and in acquiring new practices), the company generates around £62-70 million of FCF.

The company’s market cap stands at £600 million. The market is offering to purchase one of those businesses with no risk of disruption, with a stable demand and attractive returns at less than 10x FCF.

We have a FCF yield of 10% and a company that aims to double EBITDA in the next years.

Its important to highlight that if the company decided not to invest in further growth and simply grow at the inflation rate, FCF stands at £60-70 million, vs. a market cap of £600 million.

This is a realistic assumption as I know practices with very limited equipment that keep increasing prices every year (i.e., to survive to current inflation).

The trend of FCF generation is positive and has increased from £36.3 million in 2019 to £62 million in 2024.

Balance Sheet

During 2024, the company has made strong acquisitions in Australia. The company aims to maintain a leverage below 2.0x, which is very sustainable for a business considered defensive. The predictability of cash flows is high, given the fact that many pet owners recognize that they rather cut other expenses, before cutting on veterinary expenses.

The company currently has:

£164.8 million net debt: £181.3 million debt and £16.5 million in cash

£106.5 million leases liabilities

Leverage ratios stand at:

1.5x excluding leases

2.1x including leases

Its a business that generates £60-70 million FCF excluding investments, and a growing EBITDA at +5% every year.

Leverage is not a problem, even in a case of adverse CMA resolution. If the company decided not grow, they will be able to repay the debt in ~4 year period.

VII. Competitive Advantages

As explained before, the company benefits from strong competitive advantages. The integrated business allows the company to generate cross-sales across its divisions.

First opinion practices are the core of the business. From these practices, the company is able to retain their clients offering complimentary services such as laboratories and online retail sales.

Being the 3rd largest player in the UK implies a competitive advantage itself as the larger group benefit from better commercial terms, allowing them to be more profitable.

The industry is facing strong shortage of employees. Although this is a risk for the business, its also a positive thing for the larger companies like CVS. These larger companies are able to attract more people as they have agreements with universities, larger scale, etc., so the risk is mitigated.

The fact that there is a shortage of employees means that the appearance of new competitors is highly unlikely. The creates a moat, that protects the current business model, but this moat needs to be maintained and protected to prevent it from turning against the company (purely speaking, its not a moat, but acts as a moat if properly managed).

Larger groups like CVSG have also the potential to invest in further growth as given their network effect, they can operate emergency clinics, larger hospitals, etc. Many of these services are more profitable given their exclusivity.

Its not only in terms of cross-selling between practices, hospitals, and laboratories, but also in terms of being able to invest in the latest equipment to offer better treatments.

Although the company is investing heavily every year, the management could chose not to invest any more and earnings will growth in line with inflation.

In my experience as pet owner, my veterinary doesn’t invest in new equipment and relies on specialists when needed. Other clinics offer more sophisticated treatments, which sometimes are key to receive a better treatment. So basically, both business models are complimentary.