EssilorLuxottica Part I: Introduction

A quasi-monopoly in the eyecare and eyewear sectors

Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Dear reader,

Welcome to a new investment thesis from European Investor. This is not a value company, but I believe its a great company, with little research by the investment community.

Before starting, I would like to share a poll with all of you:

Executive summary

This month I’m presenting EssilorLuxottica, a company that is the result of the merger between the biggest eyecare player, Essilor, and the biggest sunglasses and distributor, Luxottica.

It is not a value company, as its trading at optically high multiples. However I think its worth talking about this company. Its a forgotten company by the quality investment community, although being one of the best companies in Europe, as it is the clear leader in a global market with low risk of disruption.

Its a very interesting company that keeps growing every year both organically and inorganically. The merger of these two companies has created the biggest player in the industry, ranking #1 in sunglasses, lenses, frames and number of stores.

The stock has nearly doubled since the merger of both companies, and there is still growth potential:

The eyecare and eyewear markets are very fragmented and EssilorLuxottica has the potential to continue consolidating the market

There are tailwinds in the eyecare industry as vision impairments such as myopia are a real pandemic in today’s world

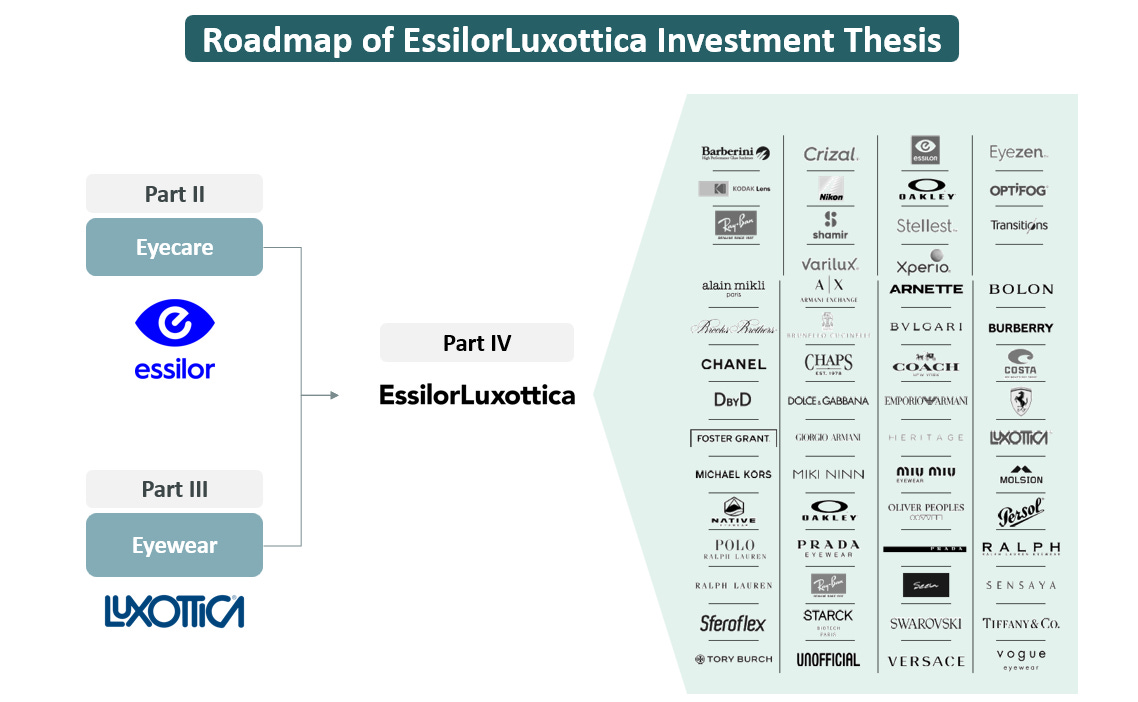

To be able to dive deep in both companies, this analysis will be done in 4 posts, given that the post I was writing was too longo to fit in an email.

Part I: In this post we are introducing the company with a brief summary

Part II: We will analyze Essilor and the eyecare market (corrective lenses, contact lenses, etc.)

Part III: Analysis of Luxottica and the sunglasses industry

Part IV: Full analysis of EssilorLuxottica

I will be publishing each part every Monday during the month of October, so I can have time to write everything. This post will be shorter, as its just the introduction of the company.

Part I: The Creation of a Quasi-Monopoly

Introduction to the company

Headquarters: Paris, France

Trades in Euronext Paris

Currency: Euros

Market cap: €95bn | €28+bn revenue | €4-4bn FCF

Sector: Healthcare (eyecare industry) and retail (eyewear industry)

Brands: Ray-Ban, Oakley, Varilux, Persol, etc.

EssilorLuxottica (from now on EL), a powerhouse born from the merger of Essilor and Luxottica in 2018, stands as a titan in the global eyewear industry. This strategic union seamlessly combined Essilor's expertise in precision optics and ophthalmic solutions with Luxottica's renowned craftsmanship in eyewear design and manufacturing.

The result is a dynamic entity that covers the entire spectrum of eyewear needs, from cutting-edge prescription lenses to iconic fashion-forward frames and sunglasses.

At the heart of EssilorLuxottica's success lies a rich portfolio of well-established brands that have become synonymous with quality, style, and innovation. Recognizable names like Ray-Ban, Oakley, and Persol grace the company's extensive lineup, showcasing its ability to blend fashion trends with cutting-edge optical technology.

With a global footprint and a commitment to ongoing research and development, EssilorLuxottica continues to shape the eyewear landscape, offering consumers a diverse range of choices that seamlessly merge form and function. Whether through its retail chains like LensCrafters or its influence in the optical industry, EssilorLuxottica remains at the forefront, setting the standard for eyewear excellence on a worldwide scale.

History of the company

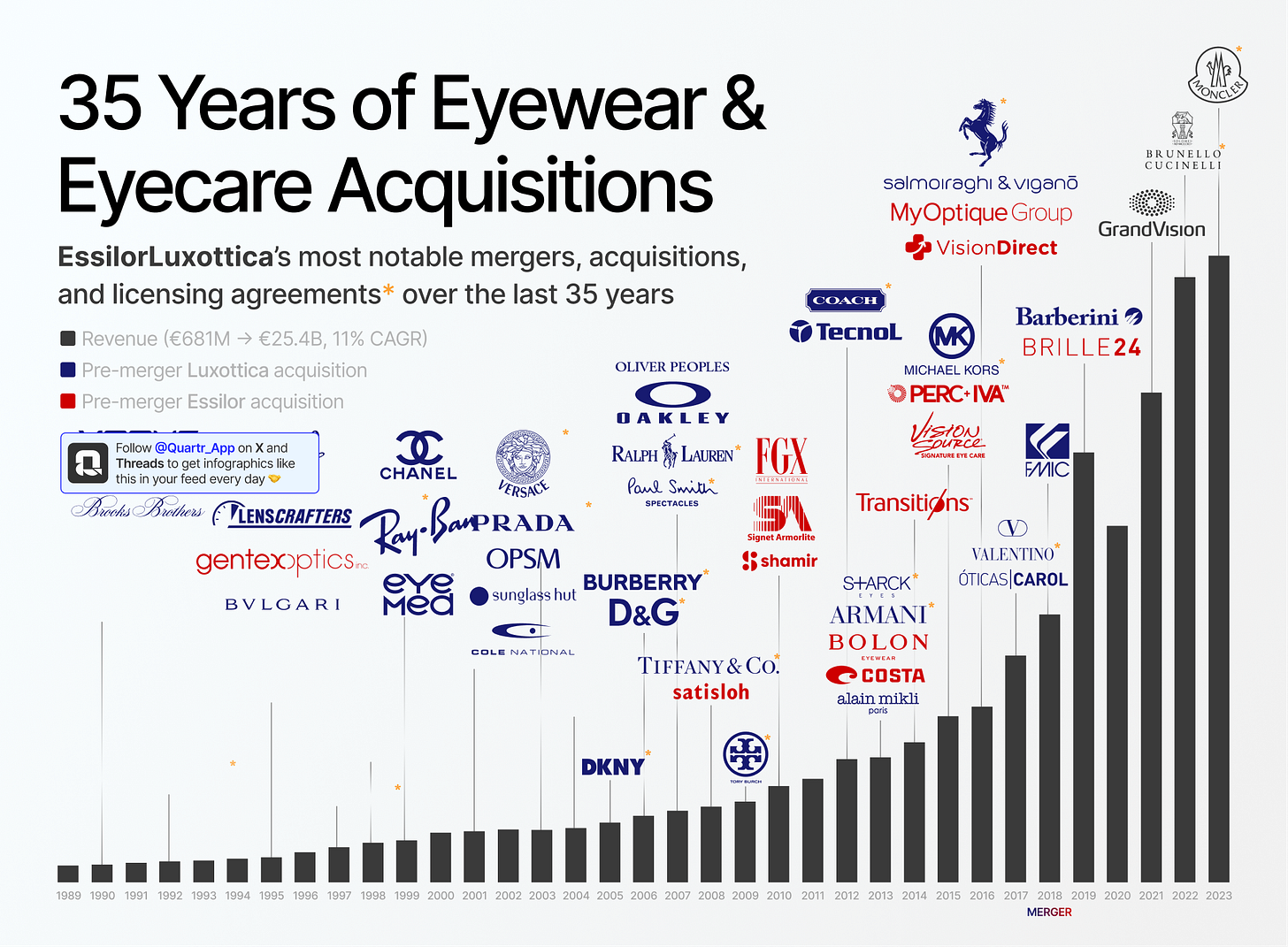

EssilorLuxottica is the result of the most important merger in the eyecare and eyewear industries in the last decade. Prior to the merger, both companies experienced a strong growth, partly fueled by mergers and acquisitions.

Although the history of the combined companies is short as the merger became effective on October 1, 2018, the individual companies have a long track record of positive value creation.

About Essilor

Essilor is a company with 100+ year history. It was founded in 1849 in Paris (France) and has evolved progressively throughout the 20th Century to become the global leader in progress. It is a result of the merger between ESSEL and SILOR in 1972

Essilor, the French eyecare leader, produces 800+ million lenses and 100+ million prescription and sunglasses frames. The core business encompasses:

Lens and Optical Instruments: Essilor develops lenses for correction, protection, and enhancement of vision. The flagship Varilux model leads the progressive lens market

Equipment: Manufacturing and distributing equipment for prescription laboratories, representing a residual segment with 3% of total revenues

Sunglasses and Readers: Essilor owns brands like Foster Grant (recognized as the first brand of sunglasses in the U.S., founded in 1929). Despite a limited size pre-merger, this segment now contributes significantly to revenues

About Luxottica

Luxottica was founded in 1961 in Agordo, Italy, and is the world leader in the sunglasses industry and the company with the highest number of eyewear stores in the world

If Essilor represents the highest standard of quality in the eyecare industry, Luxottica represents the most iconic sunglasses brands in the world: Ray-Ban, Persol, Oakley, Armani, Chanel, etc.

The company manufactures and sells the most iconic brands in the sunglasses industry such as Ray-Ban, Oakley, Persol and has agreements to with luxury brands such as Prada, Armani, Moncler, etc.

Most of the premium sunglasses are produced and sold by Luxottica.

The company had a very strong network of owned retail locations around the world such as Sunglass Hut, Optica 2000, etc. It is the biggest retailer in the US

The merger between Essilor and Luxottica

The two companies decided to merge together in 2017 and the deal was approved by the European Commission in 2018. Since then, the company is consolidating as a single company and the world leader in the eyecare and eyewear industries.

Rationale of the merger

The movement made a lot of sense: The biggest lens manufacturer joined forces with the biggest eyewear maker and one of the biggest distributors. It was not only the combination of two products but also the creation of the biggest eyewear direct-to-consumer business.

“Today, 60 years after the founding of Luxottica, I am proud to say that my life-long dream of creating a fully integrated, all-round champion in the eyewear industry has come true”1

Leonardo del Vecchio

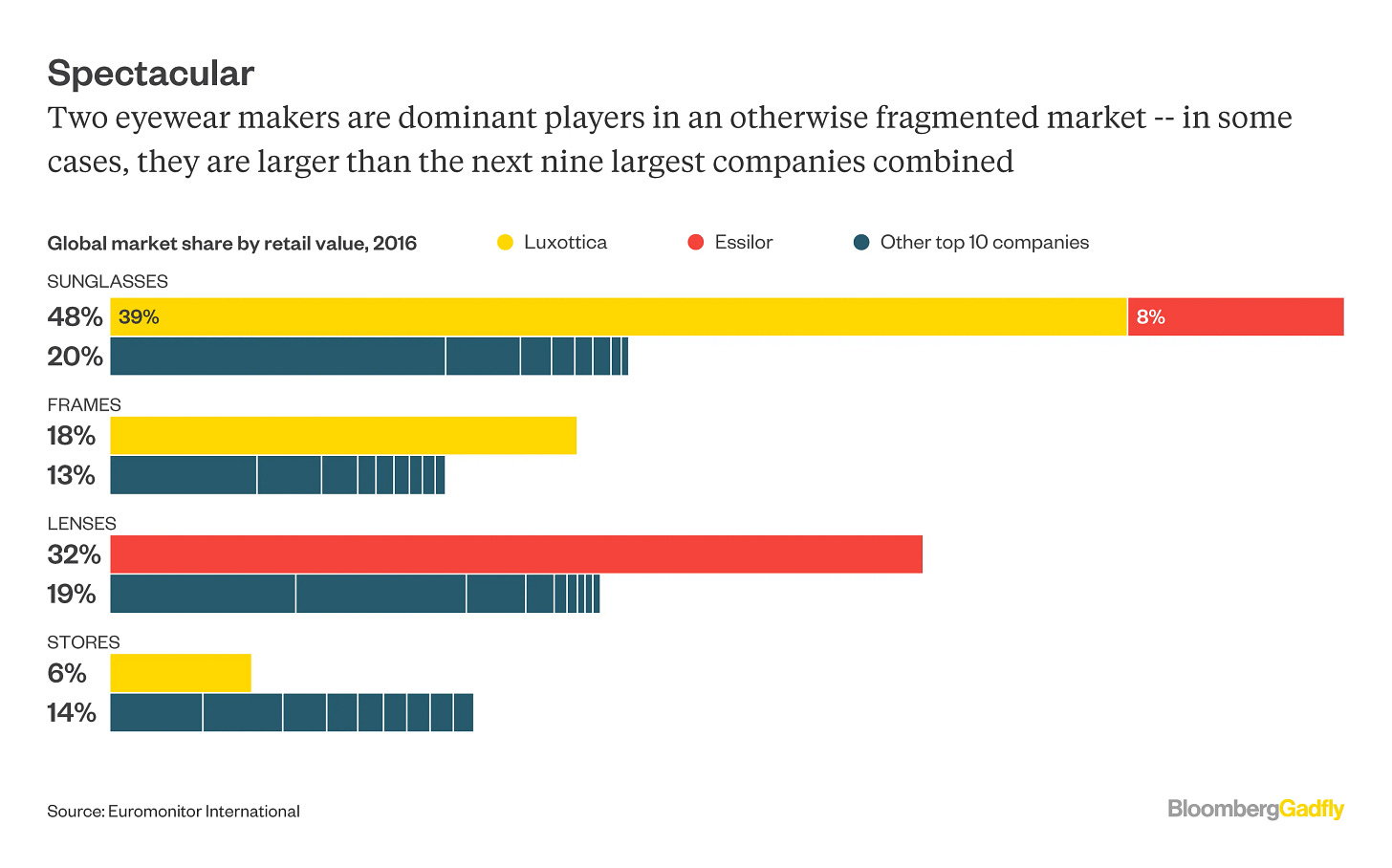

The resulting group will be the clear leader in the industry:

A comprehensive product offering, including eyecare and eyewear

Vertically integrated, controlling the whole value chain: from production to distribution to direct-to-consumer sales.

A quasi-monopoly: the #1 player by far in sunglasses, frames, lenses and stores

While this merger was the main corporate transaction of the history of the company, the company is executing constantly M&A transactions to gain more relevance in the industry.

Prior to the merger, both companies have significantly expanded through M&A:

Luxottica initially acquired Ray-Ban and other brands like Oakley, signed partnerships with luxury brands such as Prada, Chanel, Tiffany & Co., etc. It also expanded its distribution capabilities with acquisitions of Sunglass hut and many others

Essilor acquired Satisloh, Costa, FGX, Transitions, Vision Direct, MyOptique Group, and Brille24 to expand its product portfolio, enhance its market presence across various optical segments, and strengthen its global distribution and innovation capabilities in eyewear and vision care

EssilorLuxottica: The Creation of a Giant

In 2018, these two companies merged together, creating the biggest player in the eyewear and eyecare industry, with a very balanced portfolio, including lenses, sunglasses and retail (direct-to-consumer), and wholesale channels.

#1 player in the eyecare industry: the biggest company in prescription glasses

#1player in sunglasses

The biggest store count in the industry with leadership positions across the world

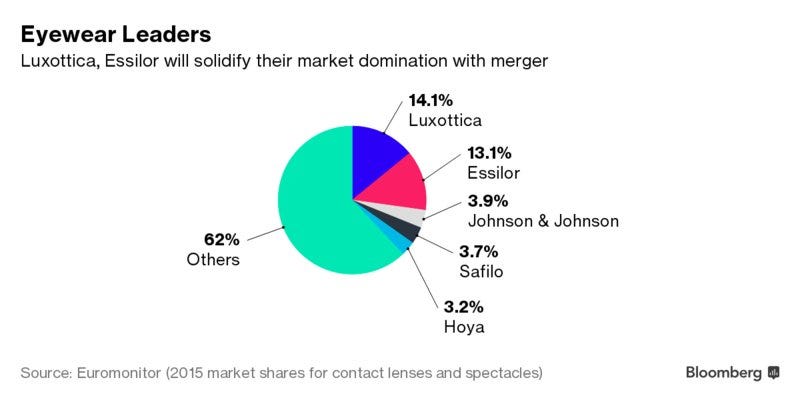

The eyewear industry is a massive market with a size above $150bn. According to Bloomberg, EssilorLuxottica will own around 27% by the time of the merger. We will question this market share in our analysis, but certainly, it stands as the biggest player in the industry.

1 + 1 ≠ 2, but much more

The management confirmed the synergy targets at adjusted operating profit level:

€300 to 350m by end 2021

€420 to 600m by end 2023

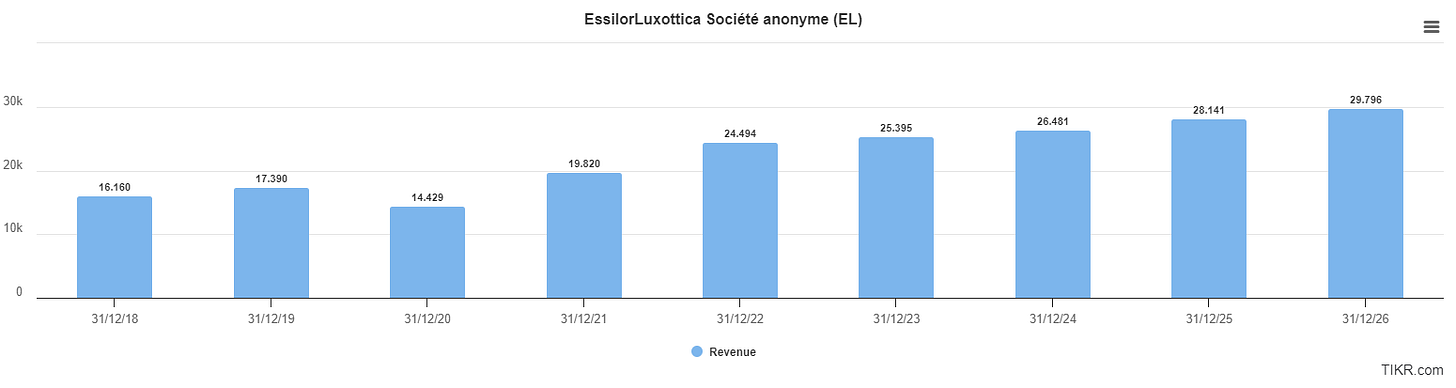

The merger has created a very solid Group, with a very strong sales momentum. According to analyst projection, by 2026, revenues will nearly double since the creation of the company: From €16bn in 2018, to c.€30bn in 2026

Every metric has expanded since the merger of the companies1:

Revenue: from €16.1bn in 2018 to €25.4bn in 2023

EBITDA margin: from 20.6% in 2018 to 28.2% in 2023

EPS: from 4.08 to 5.08

Free Cash Flow: from €1,800 to €3330 million

Today the stock trades at around €210 per share, and apparently with very limited or no potential upside from the target price of the analyst consensus.

However, analyst consensus has not being able to anticipate the 12 month valuation during a significant part of the time series. This is a company in which it makes no sense to have a target price of 12 months. This company is a compounder, a consolidator of the industry.

In any case, its something we will review in our following posts.

The next part will be about Essilor, and the eyecare market. We will discuss about the different vision impairments, the solutions and the whole industry.

Stay tuned!

European Value Investor

Thank you for reading the report. Please leave a comment if you have any questions or comments. I will be happy to discuss it!

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Thanks for reading The European Value Investor! Subscribe for free to receive new posts and support my work.

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

Footnotes

Source: tickr.com

Excellent article