Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Novem Group is a German supplier of premium car interiors. I invested in November 2023. Since then, the stock went up +33% during 2024 and now is trading -30% vs. purchase price (-47% since reaching our maximum).

In the link below, you can find the original investment thesis (November 2023):

Microcap located in Germany with exposure to Europe, China and North America

Strong skin in the game, the Brenninkmeijer family holds ~78% of the shares

Market leader in the supply of interiors to premium automakers (Mercedes, BMW, Porsche, etc.)

Technology agnostic company, with limited risk of disruption (Novem provides components to any kind of engine)

Potential tailwinds from electric vehicles that require more premium components in the interior

Trading at ~7-8x normalized FCF

Fundamentals have deteriorated during the last fiscal year, in line with all the European automotive sector.

Since IPO in 2022, the company’s stock is down by ~70%.

My position, currently flat:

Initial buy at €5.84 per share

Bought additional shares at €4.00 per share

Average price: €5.26 pre share. Current share price: ~€5.2 per share

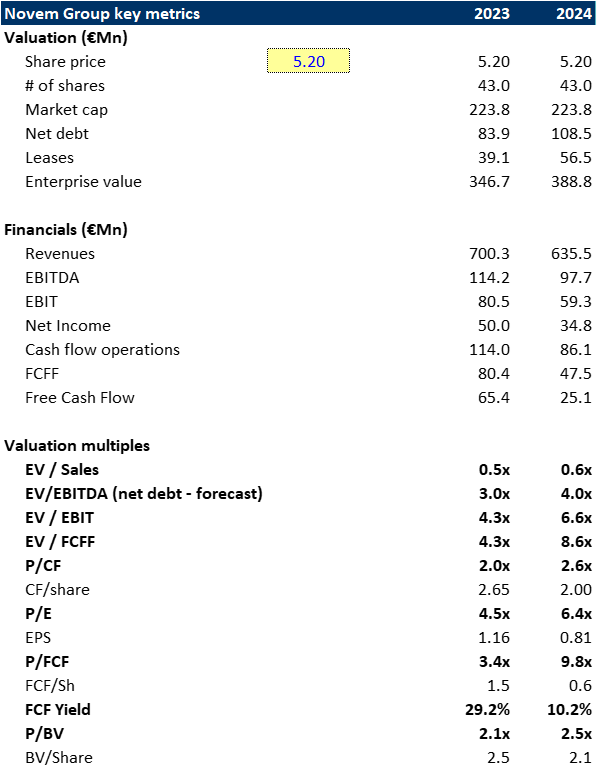

The current market cap stands at €220million, implying an Enterprise Value of €390 million:

EV/FCFF of 6-7x, assuming normalized levels, implying an equity Free Cash Flow yield of c.15%

EV/EBITDA of ~4-4.5x without normalizing

Using reported figures from the last two fiscal years:

Business Update

During the last quarters, the company secured contracts with new customers such as Avatr, Kia, and a premium American EV. Although these contracts do not apear to be significant, they are important to diversify the customer base and to continue expanding their footprint.

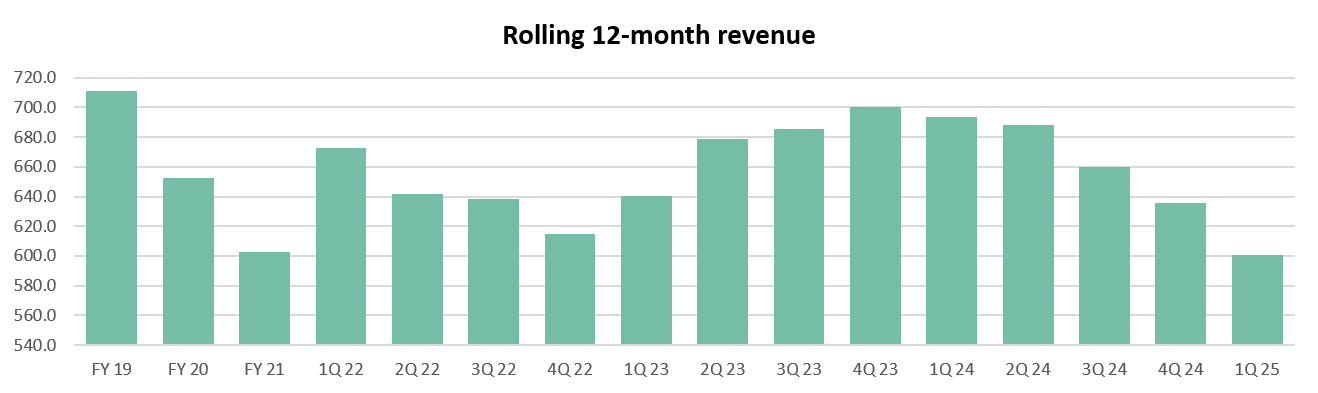

Revenue has significantly declined in the last quarters, given its a cyclical company. In the next section I will try to address if we might be close to the end of the downturn.

The European automotive industry is in a transition towards the EV, which is affecting the production of new vehicles:

On the demand side, customers are still waiting to make the decision and, countries like Germany have reduced the subsidies for electric cars. Additionally, higher interest rates make financing conditions tighter

This reduction in subsidies is creating great harm to the industry and sale cars are significantly affected. The higher volatility and lower call offs, the bigger the inefficiencies at Novem production sites

On the supply side, OEMs are adapting their production facilities and redesigning the vehicles, which impacts directly on Novem. There is huge volatility in the production.

Some like Mercedes are backing off their plans to sell only EVs by 2030

This creates lot of volatility as the OEMs are not manufacturing all the expected cars they should, affecting negatively to Novem, which had its pricing and production structure designed for those contracts

Brief example of the current situation and how Novem is dealing with it

When Novem secures a contract with an OEM, lets say they will be supplying the door panels of the Mercedes EQE. That contract has a pricing that takes into account production costs depending on materials, complexity, volume, etc. If Mercedes sells significantly less EQEs than initially estimated, Novem will not be manufacturing all the door panels as planned, and therefore, the use of its plants will be inefficient.

This leads to inefficiencies in terms of production, inventory management, and planning. If the opposite happens, then Novem inefficiency will come because they are not able to source all the demand, but we are far from there.

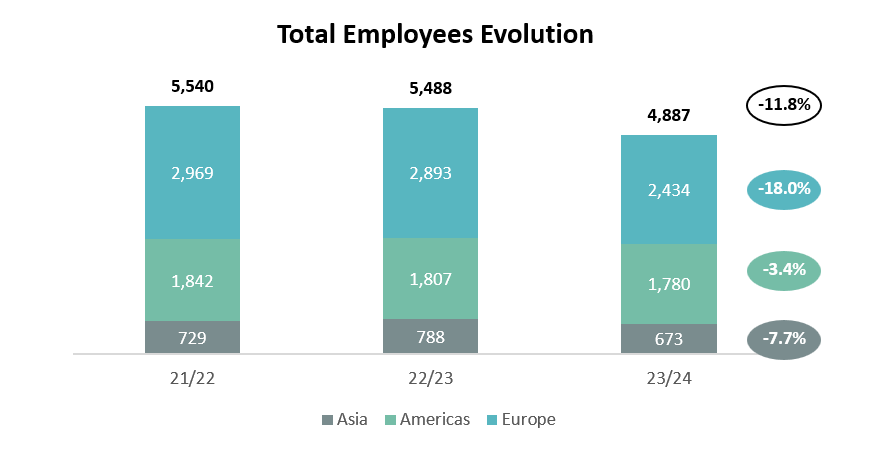

To deal with this situation, the company is reducing its operating leverage, to be more efficient:

During 2023, the company closed the production site in Bergamo, Italy

Personnel adjustments in Germany

Additionally, the company demanded compensation from OEMs and pass on some of the inflation-related additional costs for materials

On the revenue side, there are positive news for the mid-term; However, the present looks bad

The company claims that has secured significant contracts for the years to come. Among the most important developments include:

As per its financial report from 2023, “a substantial volume of incoming orders relating to platforms with start of production (SOP) spread over the next three financial years”

The company has developed its fist in-house light simulation, to develop elements that include lighting, something highly demanded nowadays in the premium vehicles

Acquisition of new customers such as KIA in South Korea and Avatr in China (a premium EV startup backed by CATL, Huawei, and Changan)

Company won a contract with a major US premium EV manufacturer, and will be the supplier of the Mercedes GLE in China

The year 2023 was a catch-up year, where OEMs sold a lot of cars after the pandemic and the chip shortage created production bottlenecks and long waiting lists. The year 2024 is a bad year for European premium OEMs, which are the main customers of Novem.

This leds to the lowest revenue since Covid-19, suggesting we should be reaching the bottom of the cycle sooner than later. But I don’t have a cristal ball, so the focus is to understand how is Novem performing under current circumstances.

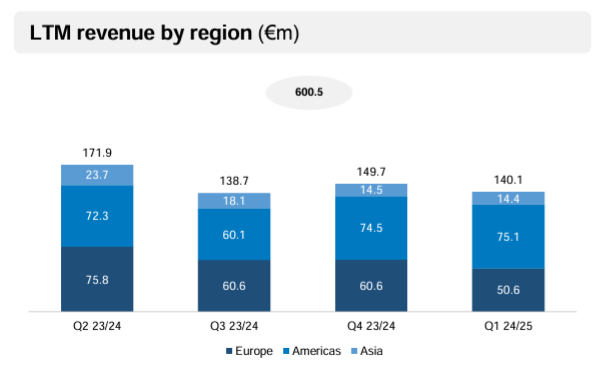

The impact comes mainly from Europe, which is currently the weakest region in the automotive market.

Americas is performing well and it seems that this trend should continue in the near term

Asia has also significantly declined, although exposure to Asia is lower.

On the other, the company relies much more in Europe

A part of the investment thesis is not working as expected; However, the overall the thesis remains intact

“Overall, the premium sector is even more affected depending on the underlying product, customer and regional mix. Geographically, the decline was once again most pronounced in Europe.”

Johannes Burtscher, CFO of Novem

Part of the lesson learned these months is that premium segments behave significantly different that true luxury. In the good times, premium segments are very profitable, but demand evaporates as soon as the macroeconomic headwinds arrive.

Premium cars are not performing as expected, therefore is not a category that is resilient in times of macro headwinds. We are seeing it with companies like Kering, that their revenues are declining every quarter.

Part of this decline is due to macroeconomic headwinds and the transition to the electric vehicle: customers are still waiting to acquire a new car, but overall, premium cars apparently are not performing as expected

Is the company performing according to expectations?

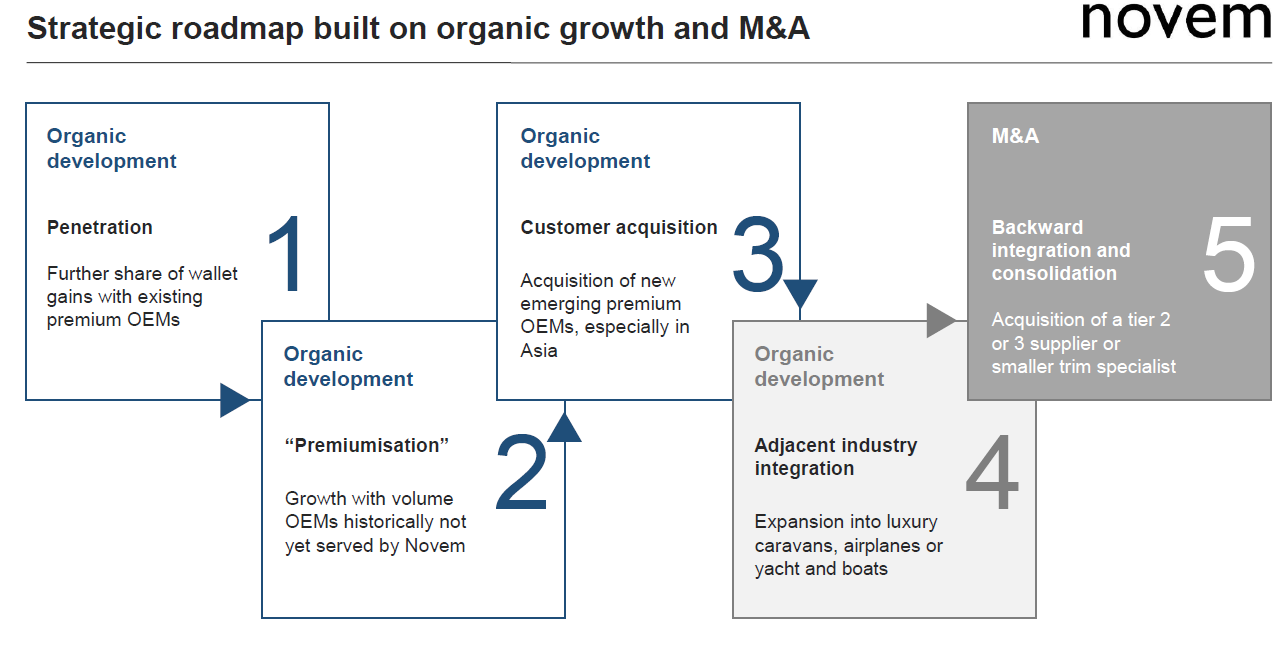

Leaving the market environment aside, this was the plan presented to the market, at least a year ago:

Penetration continues, with some examples such as the Mercedes GLE SUVs in China. However, I would like to see more announcements, but sometimes these can be confidential

Premiumisation: this is unclear under the current environment. Can the European OEMs offer premium cars if Chinese players or Tesla are selling cars at much lower cost, with superior software and interiors design?

Customer acquisition continues, with new acquisitions such as Avatr or a major EV producer in the US (I believe they are talking about the Tesla Model Y, to which they will supply aluminum decor

Adjacent industry integration: No news so far from this segment

M&A: No transactions in during the last year. It company is willing to transact, probably now is the best moment. In any case, I’m not worried if there is no M&A.

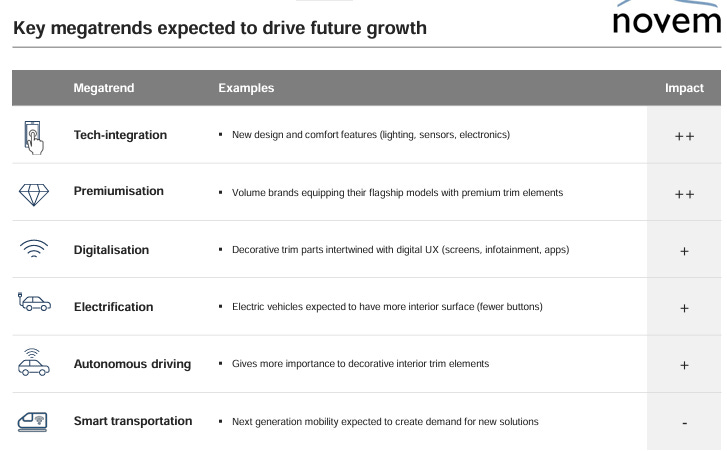

The megatrends supporting future growth remain the same, however premiumisation remains unclear to me. The remaining haven’t change at all.

Finally, prospects for future revenue remain positive. During the 23/24 fiscal year, the company booked an order intake of more than €150 million (i.e., one year of additional revenues)

In the lowest part of the cycle, the company remains profitable, but cash generation is starting to be significantly affected

“The decline in sales can be attributed to a confluence of economic factors and the general hesitancy in customer spending. Despite this revenue shortfall, we have successfully secured a solid EBIT margin of 10.1% in the first quarter.”

Markus Wittmann, CEO of Novem in the last Quarterly results conference call

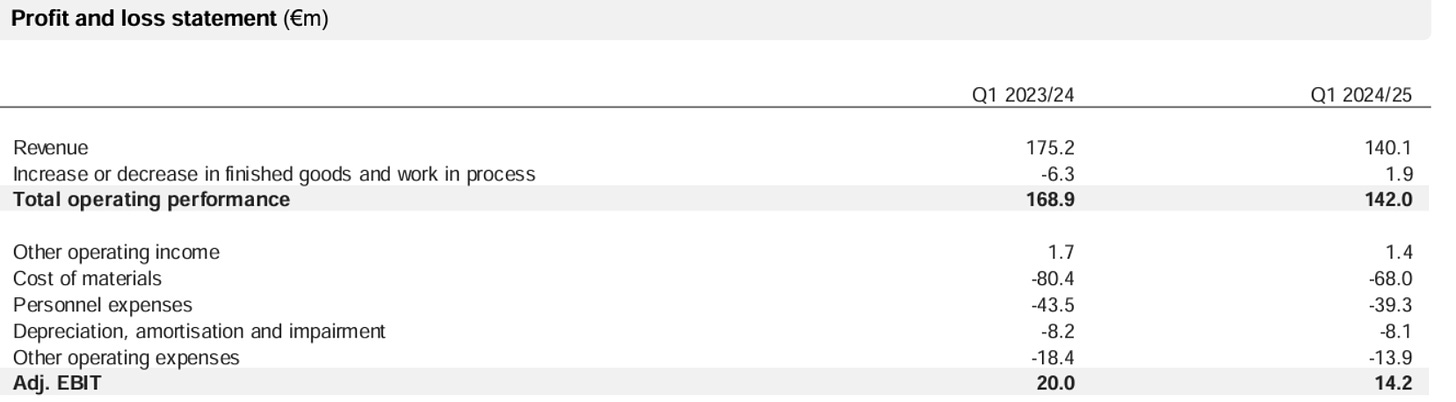

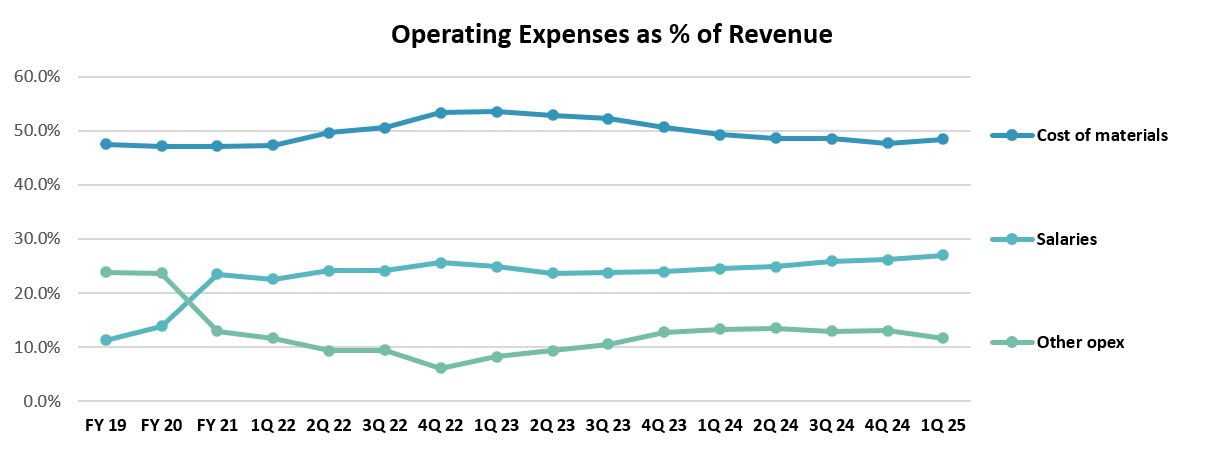

The company is navigating turbulent waters with a much lighter cost base than it had several quarters ago. All operating expenses are lower than a year ago:

Cost of materials represents 47.9% of revenue, with a clear downward trend to be below 50% of revenues as pre inflationary 22-23 period

Personnel expenses continue to increase proportionally to revenue on a rolling 12 month-basis

Other opex is reaching back 10% levels

Bear in mind that this company has a lot of fixed operating expenses, and revenues are at the lowest levels. Management is doing a really good job controlling the expenses.

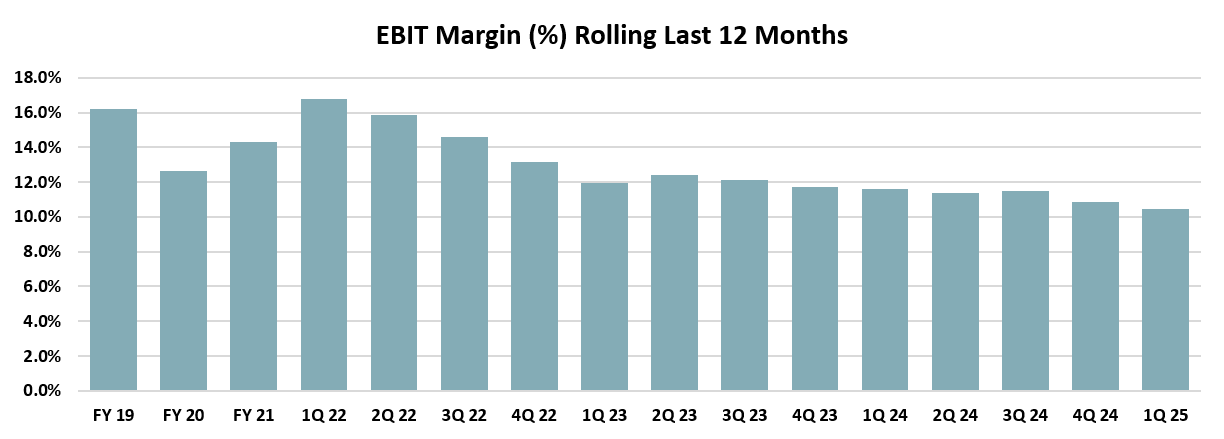

In terms of margins, there is a clear downward trend, affected by the operating leverage of the company. However, it remains above 10%.

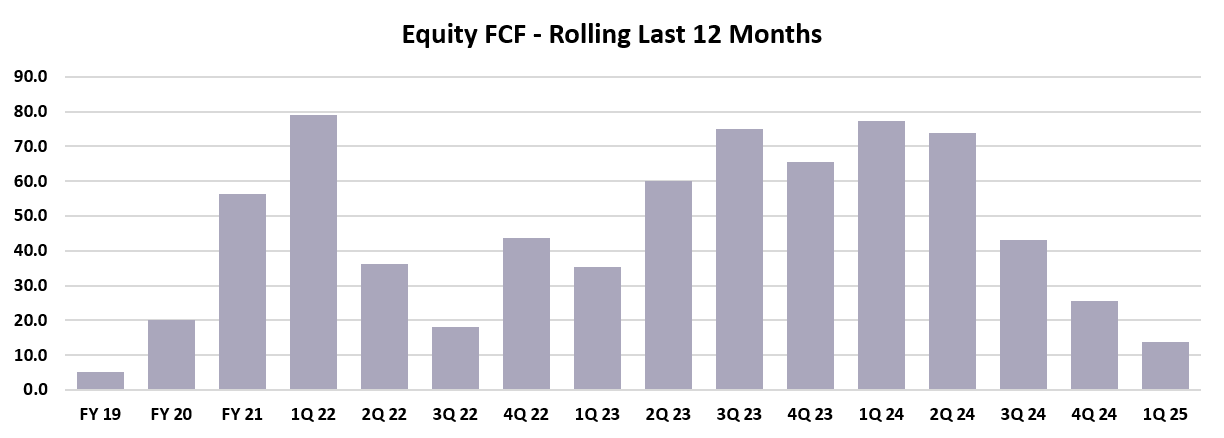

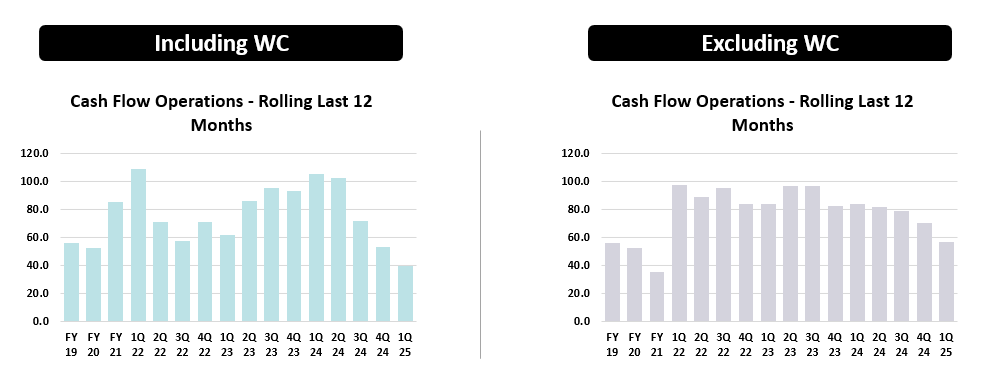

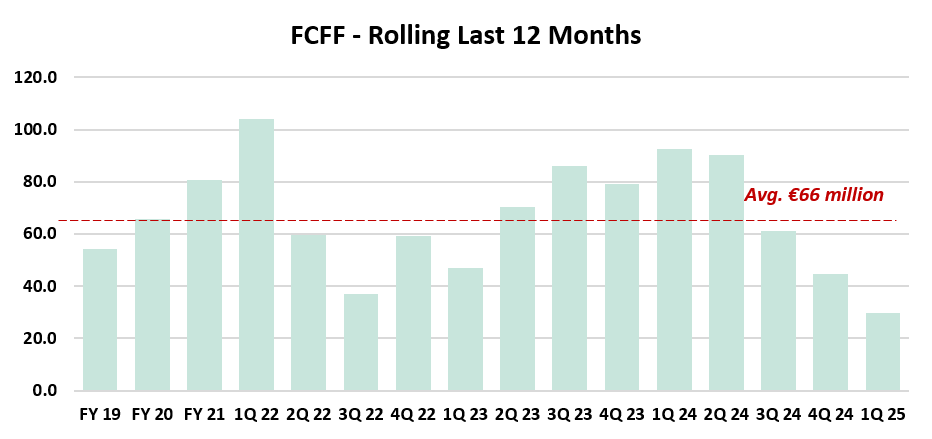

Despite maintaining margins above 10%, the FCF is reaching the lowest levels since pandemic, and currently stands at €13.8 million in the last 12 months. The company has burned cash in two of the last quarters.

The decline is due to the lower cash flow from operations, which was €2.7 million negative in the 1Q 25.

Is the last quarter, the new normal?

The last quarter has been the worst quarter since 2021, which marks a warning signal:

Revenue is down 20% YoY

Adjusted EBIT down 29.2%, however margin only falls from 11.4% to 10.1%

Negative FCF of €3.0 million, partly due to higher capex (company investing in further efficiencies in the factories), higher inventories and larger inventories

In terms of cash flow generation, the rolling 12 month cash flow from operations has declined by more than 60%, from €100 million in the peak of the 2Q 23/24, to €40 million in the last 12 months.

However, if we exclude working capital impacts, the decrease is significantly lower. Under the current volatile environment, it is extremely complicated to manage working capital, as the production is very volatile.

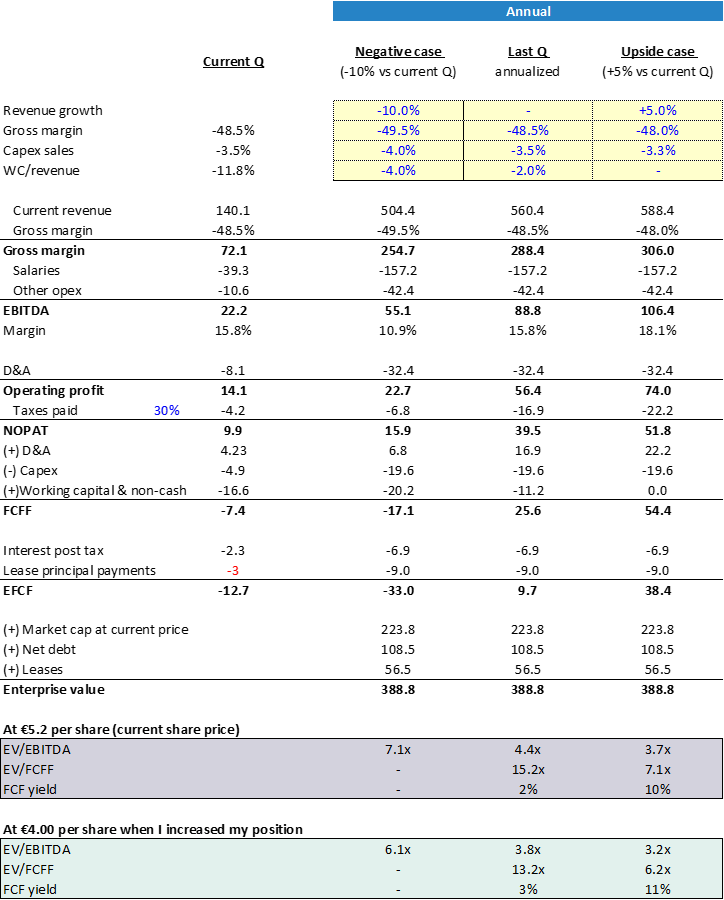

If these are going to be the results in the next year, financials and valuation could like this:

The exercise is very simple: I’m taking the last quarter, which has been one of the worst quarter since the company went public in 2021 and I’m annualizing it.

Base case: Only adjusting working capital, as the company won’t burn €16mill every quarter. The result is a free cash flow to the firm (excluding interest and lease payments) of €25 million. The EV stands at ~€400 million.

Using this quarter, the company will be trading probably slightly above the fair value, as the stock is up +30% since the minimum levels of August

However, it is difficult to believe that this is going to be the normalized level of FCF

Worst case: the company burns €17 million FCF. If that happens, it will be due to WC.

Upside case: If the European automotive industry recovers just a little bit by 2025 or 2026, and assuming just +5% increase in revenues and some slight improvement in margins and a neutral WC, FCFF will be close to €50 million, which will represent an EV/FCFF of ~8x

As explained above, FCFF excluding working capital has historically been around €60-80 million. I’m considering a lower level at €50 million to be more conservative

Equity FCF will stand at 2% of market if this quarter is the new normal, which is a very low yield. However, if situation recovers in the next years, FCF yield will stand at ~9%, which is a very high yield.

Why analyzing with such simplicity?

Because the environment is too volatile, it is extremely difficult to forecast. Any forecast done, will probably be wrong, including this one. Nobody knows how many cars will be sold next year, or which technology will dominate sales in 2-3 years. The only thing we can try to understand if we are reaching the bottom of the cycle, which we will do it in the end of the post.

Are these FCFF levels realistic?

The answer is yes: the average rolling last 12 month FCFF stands at €66 million, which implies an EV/FCFF multiple of 6.2x.

However, the answer is yes only is the industry recovers, or at least, situation doesn’t get much worst. Given the cyclicality of the company, we can expect that if the market improves in the next years, the FCF can reach the average of the historical period.

This gives me comfort that the investment has a lot of margin of safety given the cyclicality of the industry.

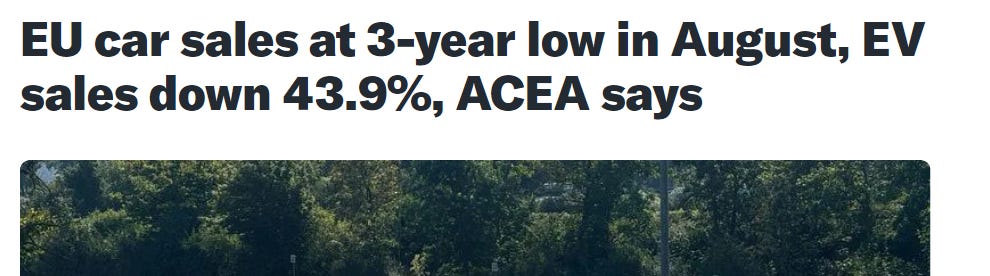

In the short-term, I think we will see bad results from the summer break, as per many of the news that apear recently:

New car sales in the European Union fell 18.3% in August to their lowest in three years, dragged by double-digit losses in major markets Germany, France and Italy

This is a call of action to politics, that need to implement measures to protect the most important industry in the continent

To inject new stimulus into the EV market, Germany agreed in September on tax deductions of up to 40% for companies on their sales of electric cars

There will be volatility in the short-term, but being up +8% since acquiring the shares in one the of most challenging environment in the recent decades gives me confidence that this might be a good investment for my portfolio.

For the quarters to come, it doesn’t really matter if the cars sold are hybrid, electric of fully gasoline. Novem is technology agnostic.

What are the competitors doing?

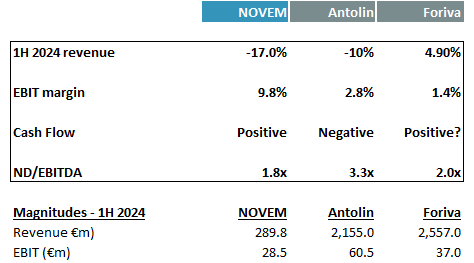

Competitors and peers in the car interiors segment are struggling.

Novem revenue has significantly declined, compared to peers, partly due to their high exposure to Europe as its a company that its core revenue comes from European premium car sales, which are performing worst than expected.

Despite this fall in revenue, the margin or Novem is significantly higher than the peers: 9.8% vs. 1.4-2.8%

Novem generates positive free cash flow, while Antolin is burning cash every quarter. Forvia doesn’t report any cash flow for its segments. It can be positive, but very low compared to the aggregate revenues.

In terms of leverage, Novem has the lowest leverage, despite it distributed an extraordinary dividend last year. In any case, leverage is higher than it should be for Novem.

Novem its a much smaller company, and that is positive as its easier to navigate the current environment with a lower structure

The question remaining is: Are we reaching the bottom of the cycle?

“We anticipate the continuation of these challenging times for the coming months.”

Markus Wittmann, CEO of Novem in the last Quarterly results conference call

Volumes in Europe are very low, and its a trend that might continue, but in the end, its a question of time that people will need to replace their cars. There are potential catalysts in the mid-term:

Lower interest rates, to increase demand

Politicians to set an updated framework, extending ICEs for longer (while this is not official, is a common understanding by many people, especially after big German OEMs are announcing that won’t reach the targets)

The main countries will grant new tax incentives to acquire cars in order to revive a key industry for the continent

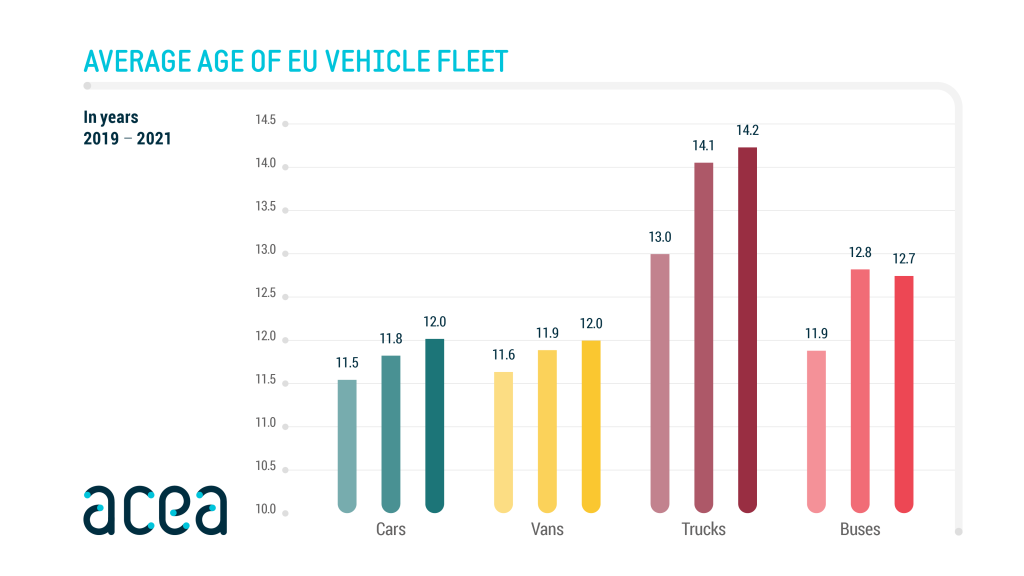

The average age of cars continues to increase and its a matter of time when we will see the people renewing their cars

OEMs are still introducing new platforms. During the next years, we will see the launch of many new cars, which should also contribute to increase demand

In Europe, one of the biggest industries is facing challenges. While I don’t invest depending on politics, I believe they will need to act to defend a core industry for the continent. This is one of the catalysts I see in the short/mid-term

Another factor to consider is the average age of the cars, which is increasing every year. This is partly due to the current macro headwinds, as financing a new car has become more expensive, and because consumers are still waiting to decide which car to buy.

In the end, people will need to purchase a new car. Its a question of time. The rate cuts, together with potential incentives from government could accelerate the change in this trend.

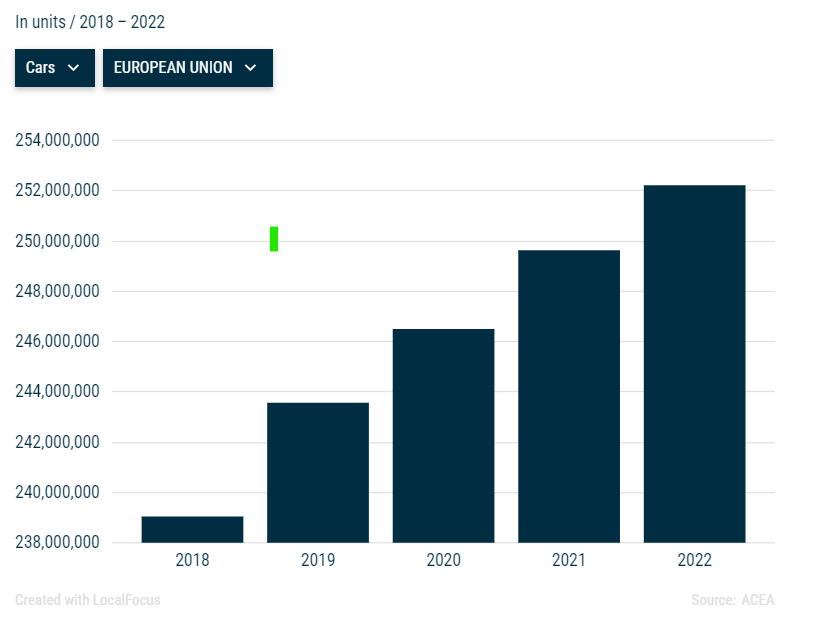

Finally, this chart contradicts the narrative that there are less cars on the road. It something that could eventually happen, but its not happening in the short term:

In Europe, the number of cars per 1,000 inhabitants has increased from 545 in 2019 to 574 in 2022, a CAGR of c.2%

“In Europe, we see the overall sentiment improving. The more detailed picture in Europe remains heterogeneous.”

Mercedes Benz

“We are building on a solid order bank in Western Europe of 900,000 cars, still above pre-COVID levels, with visibility into the fourth quarter and an overall encouraging order intake, which is above prior year level.

We expect a slightly growth of the Western European markets.”

Volkswagen

A lot is being written regarding electrification. It is important to understand that Novem is technology agnostic, so volumes are more important than technologies. However, depending on the forecasts, if OEMs produce less electric cars, this might have negative impacts for Novem as it can create innefficiencies.

Some peers like Forvia consider this situation as temporary:

“This slowdown in electrification is most probably temporary. It is due to market adaptations related to infrastructures, technologies, prices and ongoing regulations.

The European CAFE regulation sets a 15% CO2 emissions reduction target in 2025 compared to change in '21, so from '21 to '24. And because of that, in order to avoid penalties, additional EV volumes will be needed, and it needs to be prepared starting in H2 2024”

Patrick Koller, CEO of Forvia

Assessing the cycle with Novem’s financials

In terms of financials, we are at the weakest performance, below 2020, signalling we are in a downturn of the cycle. We can’t assume this is the bottom of the cycle, but al metrics are close to covid levels, suggesting that either we are approaching to the bottom, or people are not going to buy anymore new cars. I believe, we might be approaching the bottom, but I honestly can’t forecast the future.

All metrics are depressed, suggesting that we are in a recession in the industry. While the period is unknown, if financials are approaching the covid-19 levels (2020-2021), this should mean that the bottom should be close. Being below covid-19 levels persistently is something I perceive to be remote in the medium-term, which is my investment horizon (around 4-5 additional years).

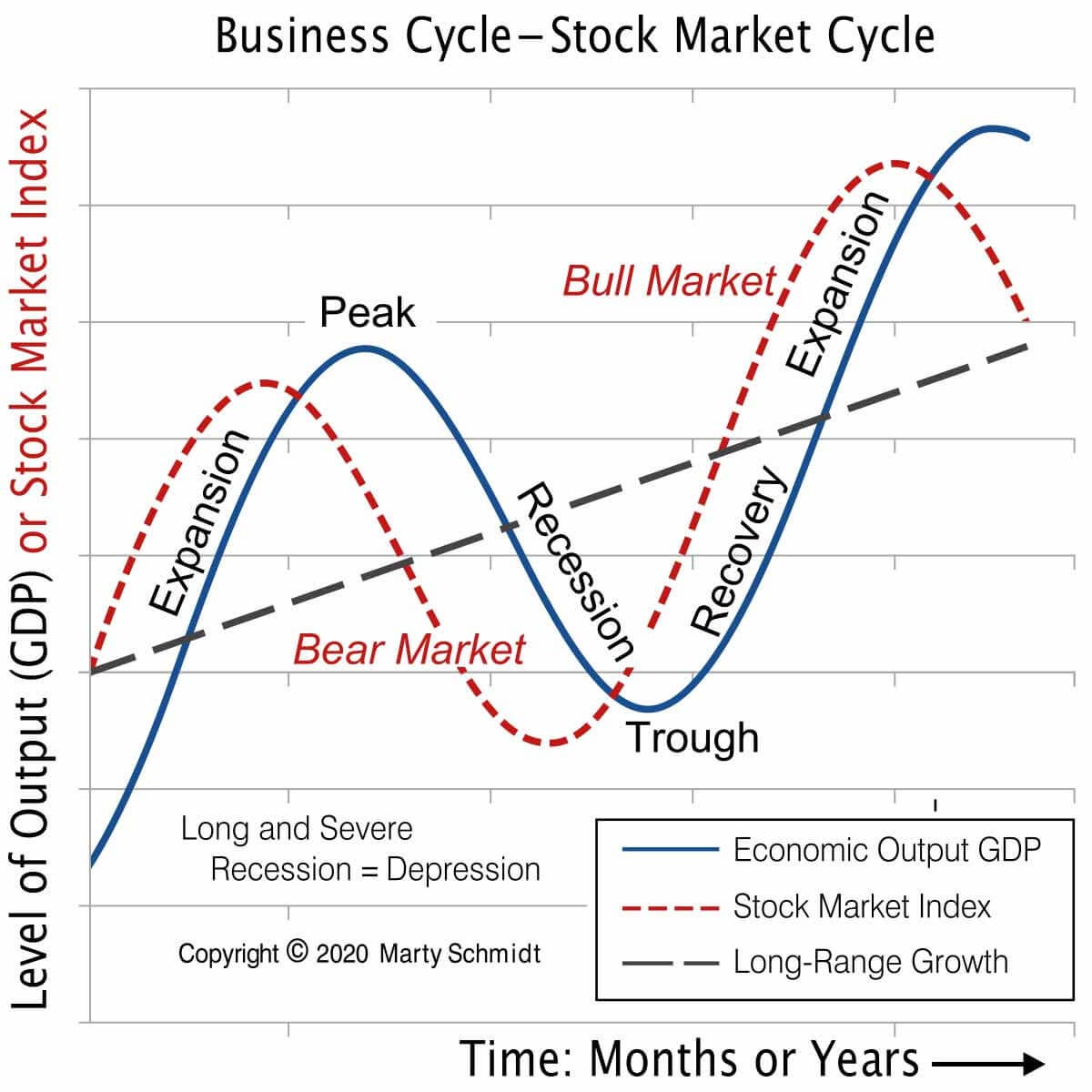

Why invest in recession and not wait for recovery?

This chart illustrates perfectly how the stock market relates to the business cycle. Markets typically anticipate recoveries; therefore, if I sit on cash and wait for a recovery in the industry, I will basically miss all the potential returns.

On the other side, it is difficult to predict in which part of the cycle we are. The only thing we one is that the peak is now several quarters away.

The Bear market continues in the sector, and the fall in share prices has been already dramatic. Here are some examples of Novem peers, and how they behave in the last months. Some of them are dramatic:

Situation is not good for many of the peers, and share prices are reflecting the fundamentals of the companies.

The main risk is obvious: how can this situation last? It can last several quarters, years, or the whole investment horizon of ~5 years.

This risk is mitigated by acquiring the shares at a very low valuation. The negative cycle might long last, but the company has been acquired at very cheap price, providing margin of safety given the company remains profitable and exposed to premium vehicles.

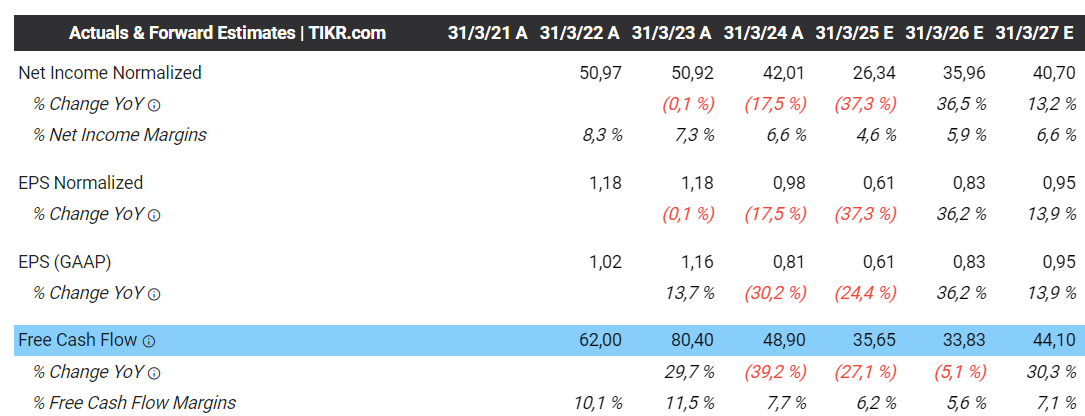

What do analysts forecast?

Analysts forecast a positive free cash flow between €35-44 million for the next three years, which is much higher than the numbers I’m using to value the stock

1 buy and 3 hold recommendations: median target price of €8.00 per share (€6.30 the lowest). This is a 12 month target price, I invest for a 5 year period.

I don’t rely on these forecasts, as analysts always lag behind the reality. In any case, what these forecasts show is that a slight recovery in the market will boost profitability of the company.

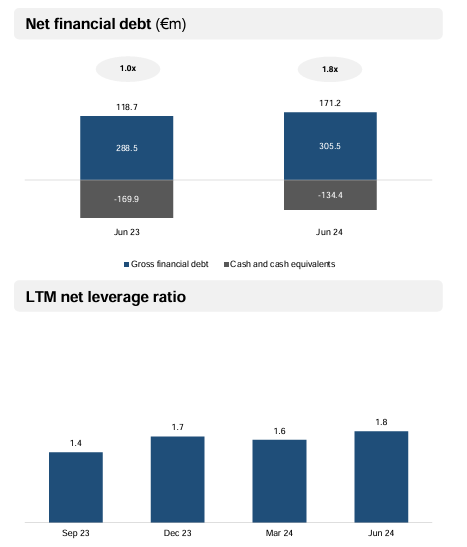

One last word about the debt and the dividend

Since investing nearly a year ago, the net debt has significantly increased, from €118.7 million to €171.2 million

The higher net debt and the lower EBITDA results in a significantly higher leverage: ND/EBITDA has increased from 1.0x to 1.8x

The increase in net debt is mainly due to an extraordinary dividend of €49.5 million. Excluding this dividend, the company’s balance sheet will have remained intact

This extraordinary dividend was not a good idea, and left the company with higher and unnecessary leverage. With the current volatility of the market, the company has suspended the dividend.

This is a good decision. No need to distribute a dividend given the current environment. Its a good decision. In the future, if the company recovers, it might distribute strong dividends.

Conclusion

The next year I expect the same volatility as this year, making it a difficult ride. But I remain confident it can be a good investment for the portfolio.

Valuation still low and the company is maintaining profitability in the worst period of the recent years.

Novem remains in the portfolio, unless something critical happens.

Thank you for reading

European Investor

Thank you for reading the report. Please leave a comment or send me a message if you have any questions or comments. I will be happy to discuss it!

Message European Value Investor

You can also contact me through Twitter:

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.