Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Dear reader,

Today I bring the updated investment thesis of Watches of Switzerland Group (WOSG)

Before starting, I would like to know your opinion on the company

Watches of Switzerland Group (WOSG)

Trading in the London Stock Exchange

Currency: £ GBP

Fiscal year ending in AprilIndex

Introduction

Part I: Valuation

Part II: Summary of 2024 and 1H 2025

Part III: Financial Analysis

Part IV: Roberto Coin

Part V: Conclusions

Introduction

On February 2024, I published the investment thesis of Watches of Switzerland Group (WOSG).

The main points at that time were:

The stock plummeted after Rolex acquired a retail company called Bucherer.

The market immediately interpreted that they were going to kill their distributors, which is not happening and Rolex confirmed it won’t happen

Yet, many people are still waiting for Rolex to open their own stores. However, apparently they didn’t read any statement or tried to understand the situation

Among Rolex distributors, WOSG is the leader in the UK and top #1-2 in the US. The stock was already suffering the consequences of an insane valuation from 2021, fuelled by the secondary market of luxury watches

I explained that Rolex is not entering the retail market, and it was a movement to preserve the Swiss company Bucherer. In a statement they clearly said they were not entering the retail market

WOSG published a new strategic plan with the approval of Rolex

It was clear that Rolex will continue relying on WOSG, a company that invest more capex in their stores than nobody else in the UK, a very strong luxury market

The stock went from £320 to current levels of ~£570-600 per share. Now, it was back at £470 levels, until Richemont presented solid results, leading to an increase of the share to £520 per share.

Its time to analyze the second part of the investment thesis: WOSG is a growth company with a very ambitious plan for the next years operating in a very attractive industry, with no risk of disruption.

Since I started drafting the post, WOSG has fell from c.£600 a share to current £520 The original title for the post was: Where are we after a +40% return? Since then, the share price has acted like a roller coaster.

During the process, I reviewed the valuation and future prospects and found out that my conviction is now even bigger.

I decided to purchase additional shares, and now WOSG is the largest position of the portfolio representing ~14% of the portfolio.

Because I might be wrong, I’m using very conservative assumptions and still find a high margin of safety.

Part I: Summary of Investment Thesis and Valuation

In this post, I will start from the end: the highlights of the investment thesis and the valuation.

Please consider that this is my personal opinion, and does not represent any financial advice. I will go through the valuation based on my knowledge and opinion, but if you are interested in the company, you have to do your own research.Investment thesis in a nutshell

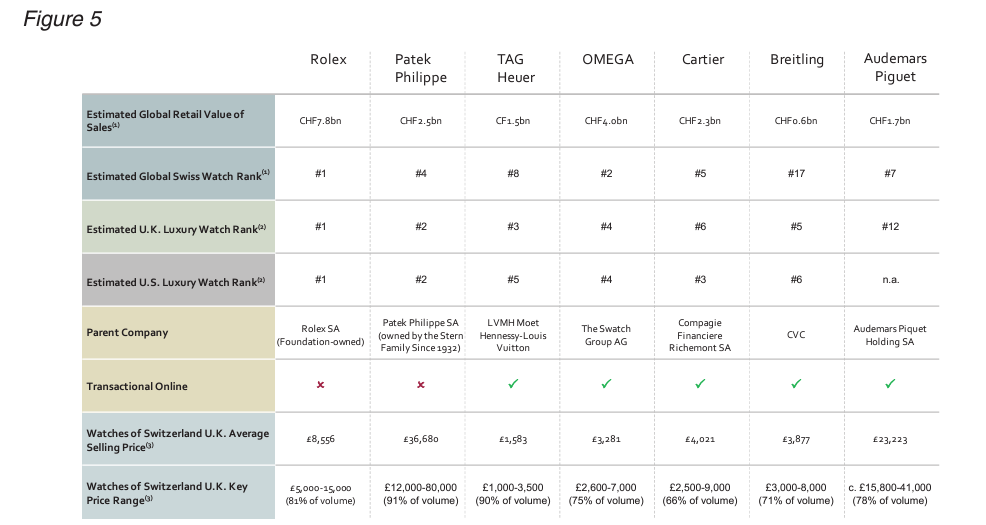

WOSG represents an opportunity to indirectly invest in Rolex, as a significant part of the revenue is generated from Rolex (both firsthand and secondhand watches)

Rolex is the most iconic brand in the luxury watches segment. Its not the most expensive, but its the most popular

Rolex benefits from all the long-term tailwinds of the luxury industry, mainly impacted by the psychology of humans and desire to socially scale, together with long-term economics that create and maintain the desire of watches

Wrongly, people were telling that smartwatches will displace mechanical watches. This is simply not understanding why people wear Rolex.

"A fine timepiece is part of dressing like a gentleman. When I first made a little money, I bought my first watch which was a Rolex Daytona. It was just one of those things that said I was successful." — Brian McKnight

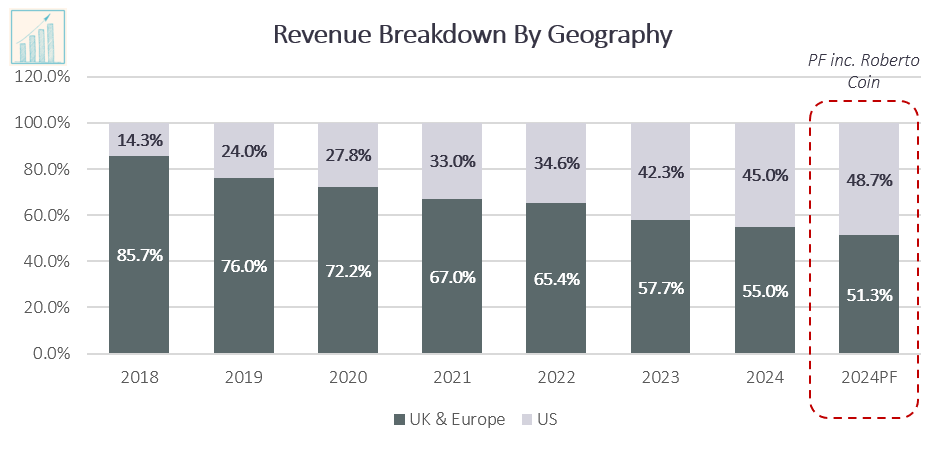

Its a growing business expanding rapidly through the US. Today, revenue from the US accounts for more than a half of total revenue

These two geographies are key for the Swiss watch exports, as they represented 22% of total exports during 2023 (UK 7%, and the US 15%)1

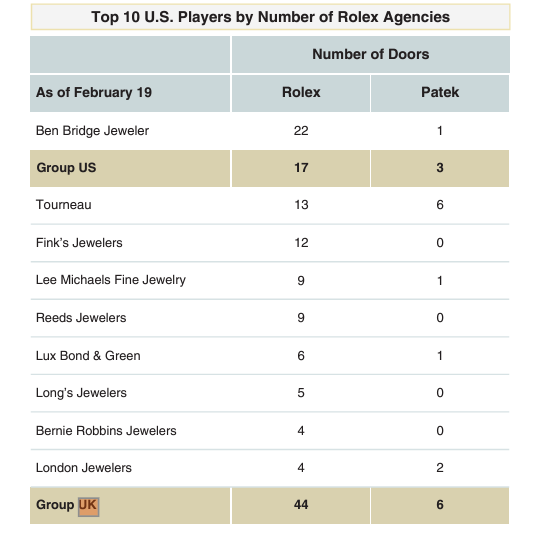

In the US, because the market is highly fragmented, and major brands still rely on independent distributors, the opportunity to continue consolidating the market is huge

The company is not dependent on the Chinese consumption or tourism as the majority of sales are generated from domestic clients

Its a unique player in the Western economies. You may find similar businesses in APAC, but not in the Europe and the US

WOSG is the leading player in the UK, and soon it will be in the US. There know-how and investment capabilities are the main reasons why brands like Rolex rely on WOSG

Last, the shift towards the US should contribute to eliminate the narrative of a local company based in the UK

Fortunately, the company doesn’t pay any dividend and invests the majority of its cash flow to further growth

"Sentiment remains low in WOSG, although we view its supplier relationships as more valuable than the market currently ascribes." RBC in their latest valuation report (source)

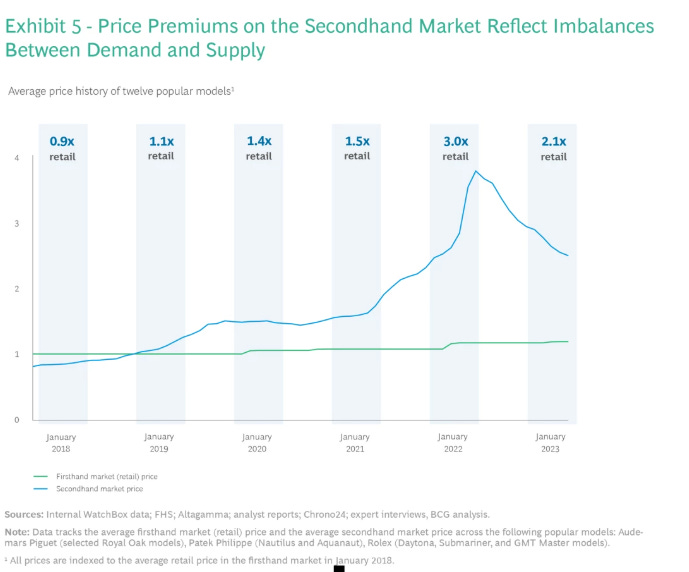

During the pandemic the stock was trading at unreasonable valuation levels, following the path of secondhand watches and the global mania to purchase luxury watches, as supply/demand dynamics drove the prices of secondhand watches to exorbitant levels.

Since then, the price of the share fell by nearly 2/3, as:

Price of secondhand watches reverted back to more rational levels, although could still be high

Rolex acquired a retail company, although publicly stated that it won’t affect the relationship with its current retailers (in fact, WOSG is opening new Rolex stores)

Consumption decreased during the last quarters, affected by the current macro environment

This created a very interesting long-term opportunity, as the company is trading at roughly 10-11x normalized FCF. Only by applying conservative inputs, FCF can increase at +5-10% annually.

“We do believe this is best in class retail, acting as a strategic partner in a resilient luxury category” - Deutsche Bank in latest valuation report (hold rating) (source)

At this valuation, you get a discount to acquire:

The biggest Rolex and Patek Philippe retailer in the UK (plus many other brands like Grand Seiko, Omega, Tag Heuer, etc.)

In a short period of time, the largest Rolex and Patek Philippe retailer in the US, and a diversified store network of other brands (Breitling, Tag Heuer…)

Plus, you get for free all the potential upside for the future.

Recent share performance

Although the narrative was changing, and market was regaining confidence, the stock has declined by more than 15% during the start of the year, to recover after strong results from Richemont.

During the last quarters, the company has delivered mixed results, given the current challenging environment.

In a moment were valuations are lower, the company has acquired several businesses and kept its expansion plan.

Some of the acquisitions were not related to the core business, which is somehow difficult to digest. However, they have been acquired at very attractive multiples, which should contribute to earn good returns:

Roberto Coin wholesale operations in the US, was acquired by ~£105m at less than 6x P/E (although, estimated at around 10-12x cash flow). With some synergies, the acquisition can yield very good returns

Hodinkee, the leading digital magazine in the US, for £10m is a questionable investment. However, it represents less than 1% of the market cap and I believe it can have positive impact on the US operations as the company is acquiring also market intelligence and building a very interesting ecosystem in the US

Acquisition of 15 luxury watch showrooms from Ernest Jones in the UK, which is the kind of investments I will like to see in the future

Apart from acquisitions, the company keeps expanding their business:

Around 26 new openings estimated for ‘24-25E, including several Rolex stores

Around 33 expansions/relocations for ‘24-25E

Cash flow generation remains robust, with cash flow from operations after leases standing at £100-120 million.

The company has firepower to continue consolidating the market. Despite this, the average target price continues to follow the stock behaviour.

Analysts seem to be following the trend of the share price, as its hard to justify a FCF multiple below 10x.

It is important to highlight that the company can continue to invest ~£300 million in the next 5 years, which is ~30% of the market cap, while the market starts to recover. Target prices focus on the next 12 months, but we need to project WOSG for the next 5-10 years.

The difference between both outputs, is huge.

WOSG is not a luxury company, its a retail company selling Rolex. The firm is growing its FCF generation at 5-10% every year. However, it trades like a poor quality stock at less than 10x FCF.

As I consider at the end of the post, management should start thinking in a strong share buyback program and to consider a dual listing in the US. If market is not recognizing value, time to create it through corporate actions.

Valuation

The aim of this post is to explain the reasons why I believe the stock is deeply undervalued.

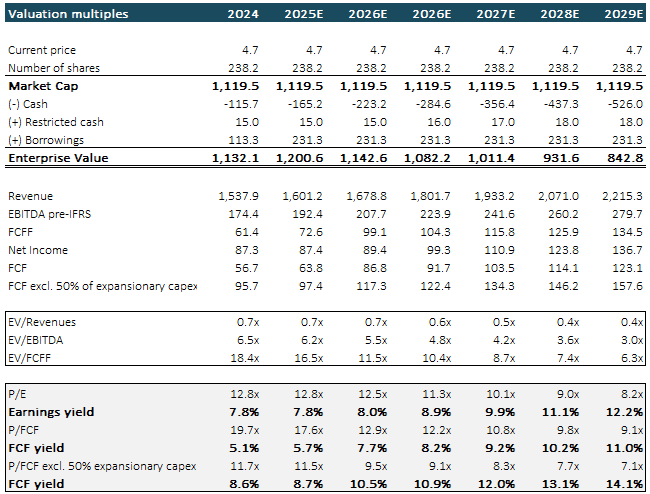

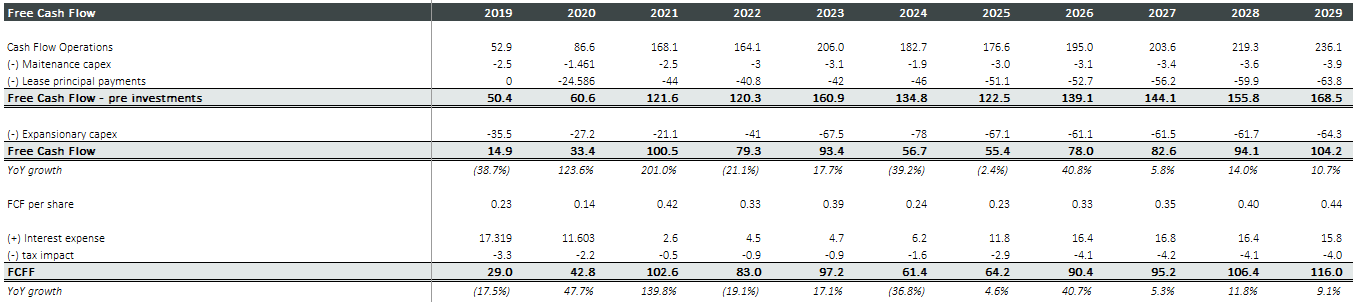

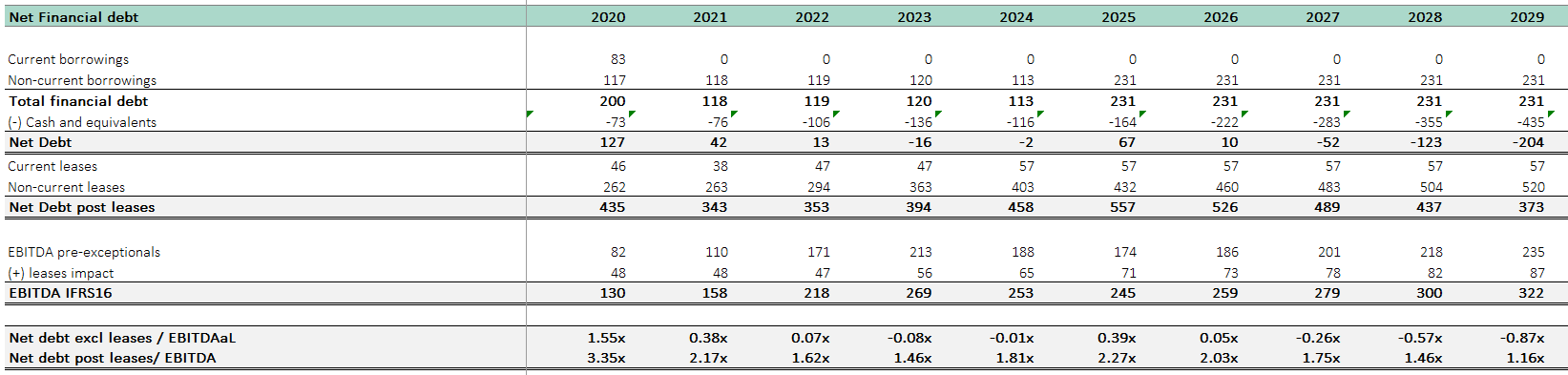

Its a solid company trading at 6x EBITDA, and around 10-11x normalized FCF*.

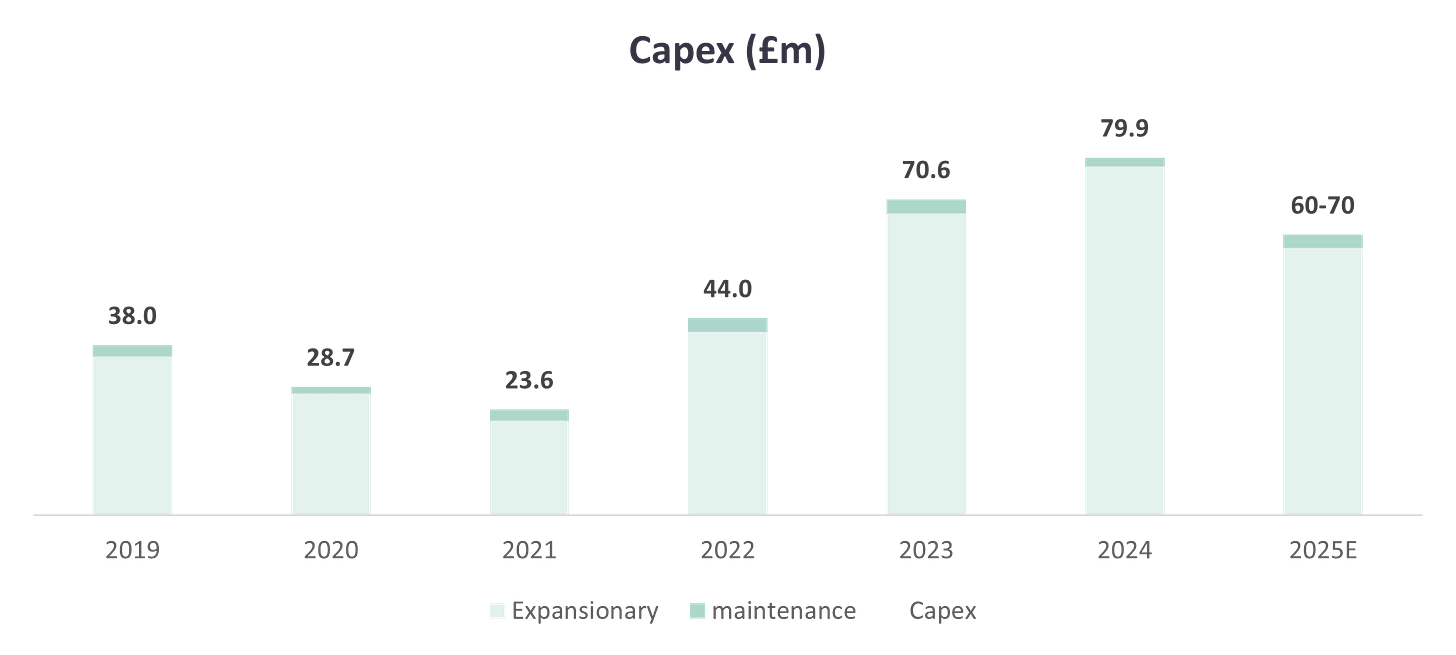

*Normalized FCF = FCF excluding 50% of expansionary capex Starting by including the current expansionary capex, the company is trading at a FCF yield of 6-8% (i.e., 13x-18 FCF). This seems reasonable or even quiet high, but the underlying assumption in the FCF is wrong.

The company can spend much less in capex and maintain its current operations and just grow with the inflation of the watch market (as an example, Rolex has announced significant price increases for 2025).

If we exclude just 50% of that expansionary capex, which is conservative (the company will be spending £35 million annually for 220 stores, ~160k per store annually), the company will be trading at just 10-11x FCF, implying a FCF yield around 9-10%.

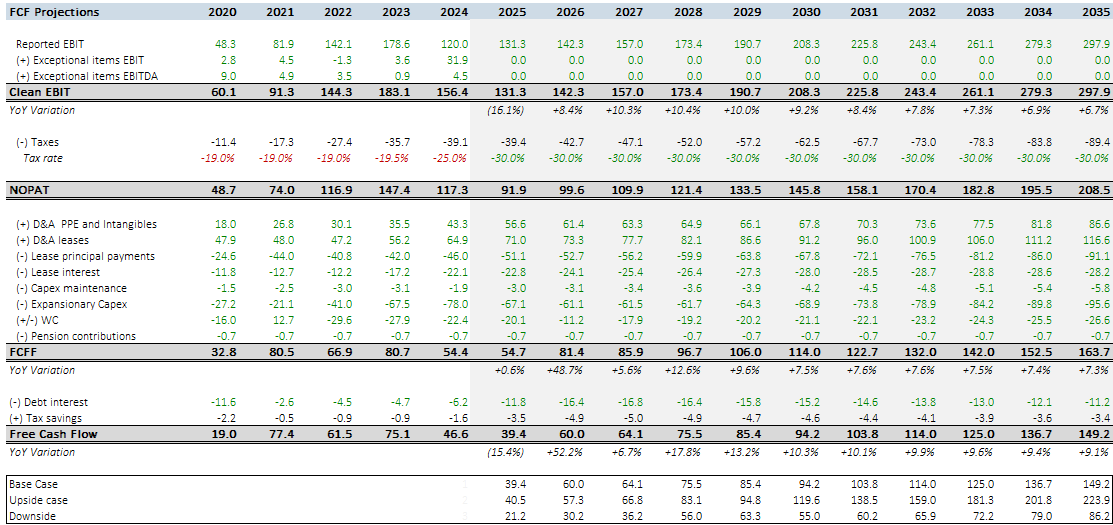

As a reference, the capex in 2018 and 2019, the years prior to the IPO stood at £15 and £38 million, with more than 150 storesWe have a FCF yield of 10%, plus an expected increase in FCF of 5-10% during the next years.

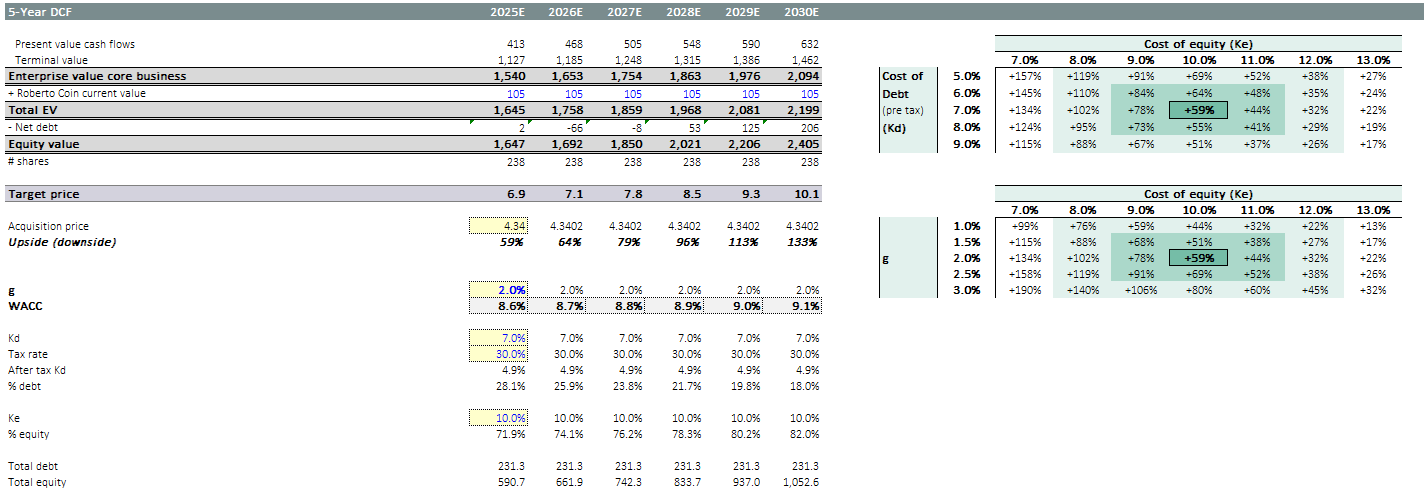

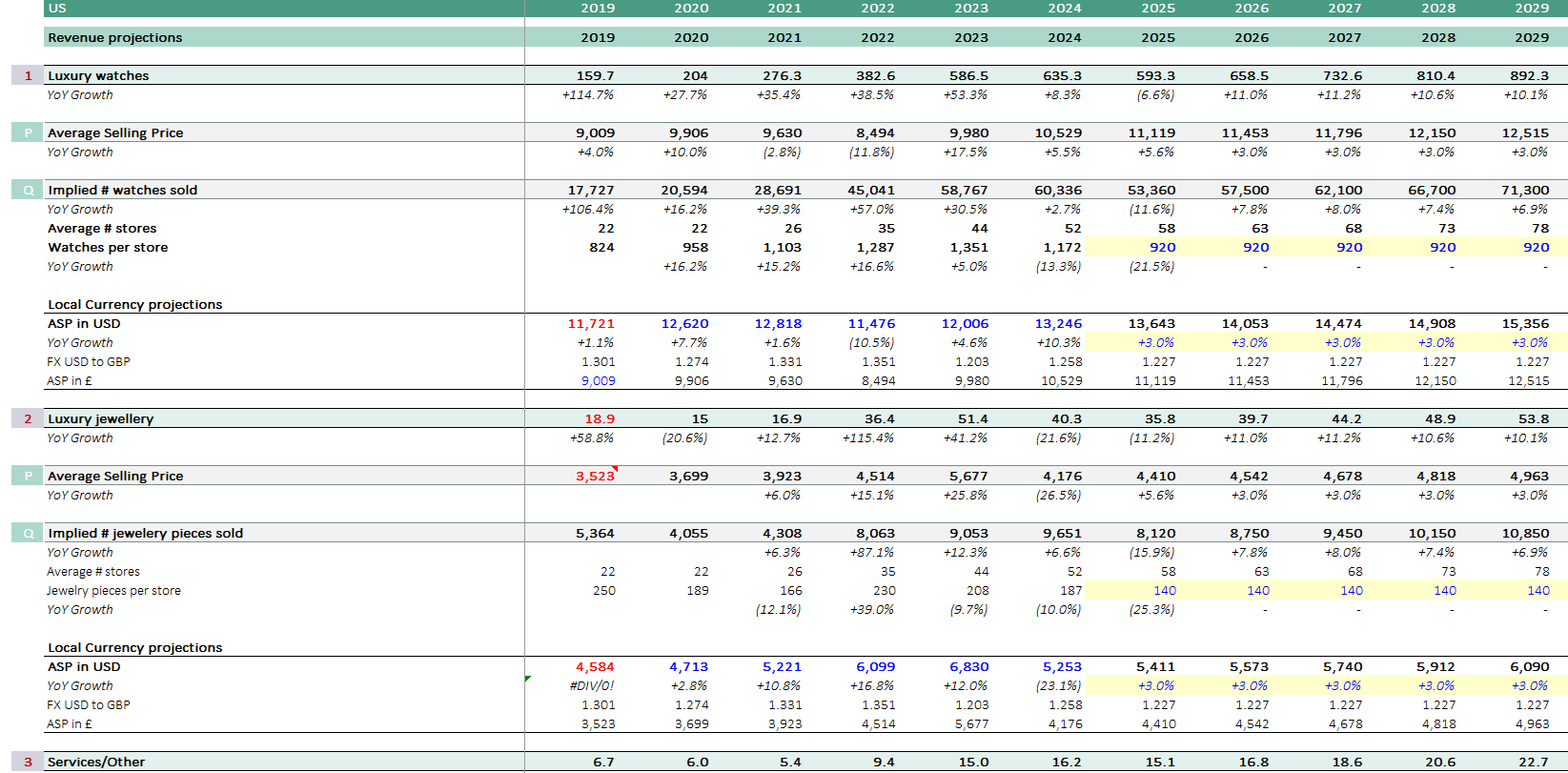

Running a DCF to confirm the undervaluation

The DCF valuation confirms this undervaluation. Using the following projections, the valuation results in a high margin of safety with potential upside of +50-60% at different WACC.

No growth in sales volumes: I assume company will not improve its sales from where we are now, and just increase sales by new openings and the inflation of the watches

Margins maintained from latest levels, which is reasonable given the market might be starting to stop declining

Capex to remain at £60-70 million, which means that I assume no normalized capex and it will imply ~£300K per store annually, which is insane

WACC of c.9% (including a 10% cost of equity), although we can use higher rates and undervaluation will continue to apply.

Although is not a luxury company, I don’t see any reason to charge a cost of equity above 10%, especially when the major indexes are yielding a 4.5% (22x P/E for the S&P 500)

We could argue that the risk of Rolex and other brands to open their own stores will justify a higher WACC, but if properly assessed, the risk is minimal

Note: the projections will be commented throughout section III.

I’m projecting a ver poor FCF generation for this year, but I believe it should recover as the company keeps expanding their stores and market stabilizes.

Am I far from consensus?

Consensus is predicting £2bn revenues by 2027E, which is slightly higher than my estimates

EBIT at £200m in 2027, higher than my £157 million estimate

Capex in line at £65-75 million per year

Using these projections, the margin of safety of the investment is high. The following table presents a rolling 5-year DCF, by which I discount the next 5 years at the WACC of the period.

I’m using a pre-tax cost of debt of 7% and a cost of equity of 10%. I’m including sensitivities on the right hand side for the current upside vs my average investment price. We could use a Ke of 12%, and still have a 35% margin of safety.

Under my estimates, valuation as of today will be around £6.9 per share.

If expansion plans continue, I’m estimating returns of 15% annually.

[🚫this is my own view, not investment recommendation]Consensus target price stands at £5.5 per share, with a few analysts having a target price of £6.5-7.3, being the lowest at £4.3 per share. Although I don’t invest based on consensus figures, I’m including it here as an alternative metric.

However, 7 out 11 analysts maintain a buy recommendation.

During the next part of the post I will analyze these projections to find out if I’m being wrong or not.

But before, I want to review the activity of the year and the market situation

Part II: Summary of 2024 and 1H 2025 Activity

Last year, I presented the investment thesis of WOSG and I addressed the narrative of the moment: was Rolex and other brands going to develop their own DTC segment? The answer was no, especially for Rolex.

As a reminder, this is what Rolex told in their press release2:

Now, no analyst is asking about the Rolex partnership in the earnings calls. Why? Because the company keeps working with Rolex and other brands.

WOSG is opening new stores, not only multi-brand, but also mono-brand, including Rolex, Tag Heuer, Grand Seiko, Breitling, etc.

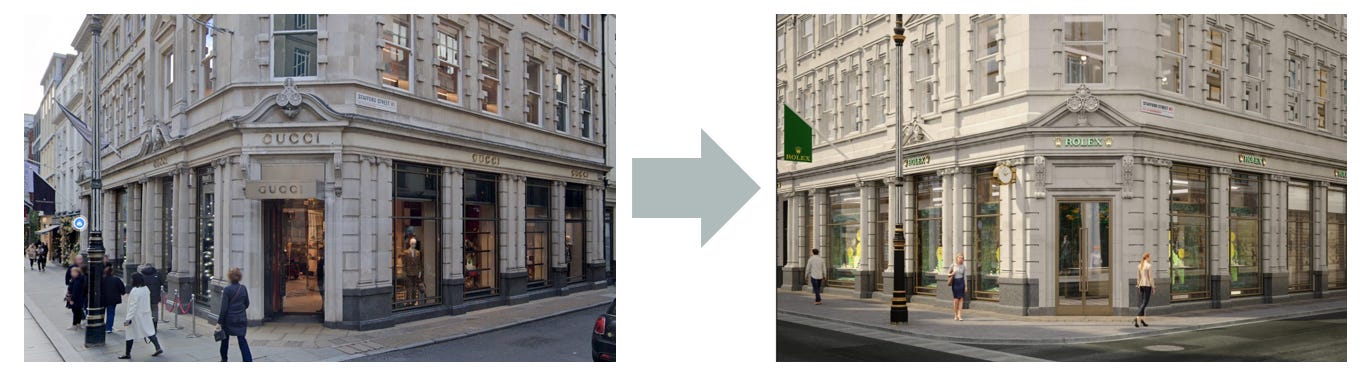

The company is elevating the level and quality of their stores, with openings like the one below in the City of London.

Additionally, the company is opening a fully dedicated Rolex store, with 3 dedicated floors in Old Bond Street, London.

They are turning this Gucci store into a Rolex store. This should be enough to demonstrate that WOSG is the best partner for Rolex in the UK. Old Bond street is the most iconic shopping street in London. If you take a look though Google Maps, you will find out that all luxury brands are located in that particular street.

“This store will be the only place you can buy a Rolex on Bond Street” - Brian Duffy, CEO of WOSG

One thing to highlight is that WOSG celebrates its 100 years anniversary (as one of the stores was established 100 years ago), and many brands are offering a special edition for them.

As it can be seen, the relationship that WOSG maintains with the brands is very powerful.

♥️ Short break: if you're liking it, I'd appreciate it if you hit like when you finish and subscribe to receive more theses like this one!

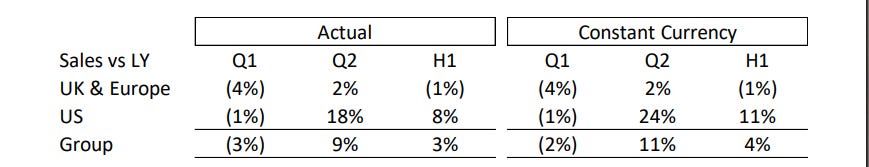

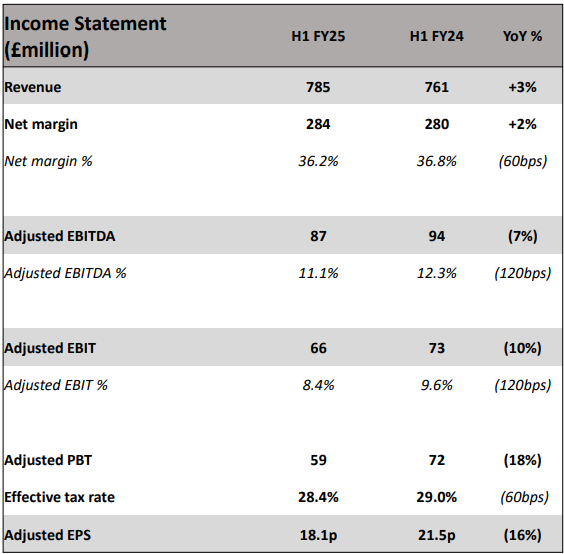

1H 2025 results

The company published the first half of 2025 on December 6th, and I have to admit that results were not good. However, they were anticipated.

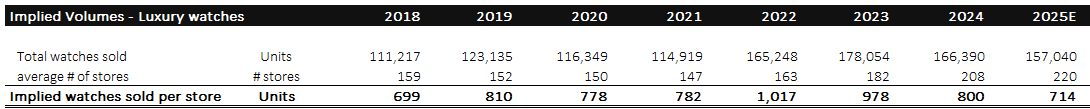

The decreasing trend in volumes continued, and those levels are the ones I’m reflecting in the model. Which in one sense, its good as I will use a conservative assumption.

I might be wrong and volumes can continue to decrease, but ASP will continue increasing too, offsetting part of this decline. As an example, Rolex has announced a 5% increase in the UK and US for this year.

Especially concerning was the US, where sales where down by 7%, which I would suspect that it implies a fall in volumes by more than 10%. Jewellery performed worse with -13% YoY variation.

On the other hand, the performance in the Q2 was positive, with a +2% increase in the UK, which could be the start of a slowdown in the declining volumes. The management is now providing a more positive view of the business and is investing heavily in inventory.

Cash flow generation was impacted by investments in inventory. Given the 2H is a better quarter, is premature to consider that working capital will be so negative for the full year.

In any case, WOSG can invest in inventory, as its inventory has a very low risk of disruption or obsolescence.

Given their high operating leverage, the negative impact on EBITDA and EBIT was higher.

We need to understand that the first half of WOSG goes from April ‘24 to October ‘24, which is reflecting the worst part of the year. The year 2024 is being challenging for the luxury sector, so these results were already anticipated.

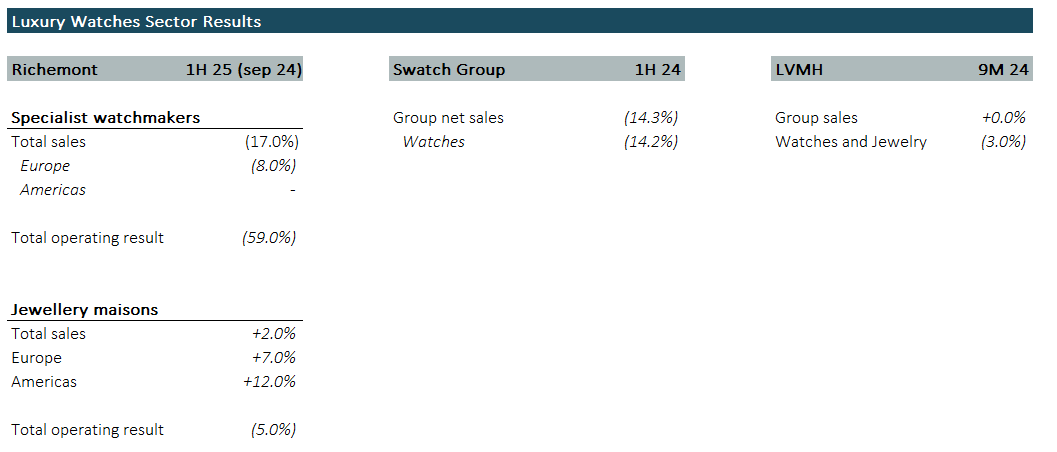

The declining sales is affecting the whole sector, its not WOSG specific

The decline in sales is generic to the sector; However, big companies are experiencing slightly lower impact than WOSG. Their share prices are being more resilient because they are the brands.

The important thing to highlight is that, on average, sales from watches are falling.

Misery loves company, right?

Well, I do think we are approaching the bottom because the volumes are lower than 2019, which means below pre-pandemic levels. the company has 30% more stores, yet volume in terms of average stores, is flat compared to 2019.

I know that I’m not applying a distinction between multi-brand and mono-brand, but the reality is that current volumes compare to 2019. And the company has larger stores, with more brands and better locations.

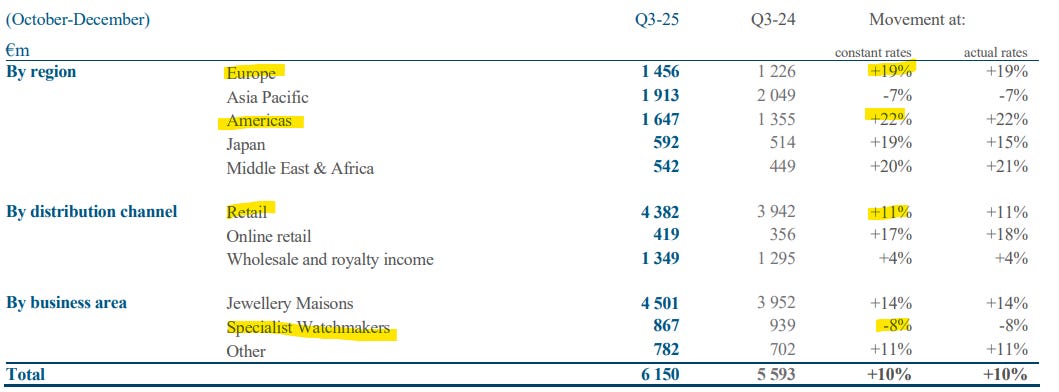

On January 16th, Richemont presented very solid results for October-December 2024 period.

Even if its premature, there is a clear sign of improvements in the negative trend:

Europe and Americas have performed very well during the quarter, with sales up by +19-22%

Retail performed well, with an increase of +11% during the quarter

Although specialist watchmakers (with brands that I consider less powerful than the ones sold by WOSG), say a decrease of -8% during the quarter. What is positive? That trend is improving. During 1Q and 2Q, sales of this segment were down by -14% and -19%, respectively

WOSG management seems to be more confident

"Momentum in the second quarter was positive. The markets have settled following a period of volatility” - Brian Duffy, CEO WOSG in 1H 25 results presentation

Now, the management is providing a much more positive message, and I believe its because the worst is over. However, as investors we should never take the word of CEOs as the base for our investments. I still think its premature, but we are seeing positive signs in the last quarters.

I’m confident for the future because the company’s stores are bigger, and better, and are selling more brands than before. The company has invested a lot of resources to expand their stores and brands, making them the perfect choice for consumers.

Although I don’t expect any recovery in sales volumes from current levels, I do expect a stabilization. I might be wrong, but the sooner or later, volumes will stabilize.

During Q2 (Aug-Sep), growth was positive, signalling that potential reversal of the trend.

Rolex, the main brand sold by WOSG announced price increases in January. Depending on the material, some increases are massive. This is partly due to the higher costs of raw materials such as gold.

Some examples of the new pricing3:

The ultimate impact on WOSG will depend on the mix of watches (steel, gold, etc.), but the information we have is that Rolex is increasing its prices.

Last, the company incorporated Roberto Coin into its accounting, which will make it slightly more difficult to analyze the financials of the company. In my model, I continue to work separately, as only 6 months of accounting is not enough to draw conclusions.

Management is confident they will execute synergies from the transaction. I think they should be able, given their know-how of retailing. In any case, the impact will be limited given the size of the operations vs. the whole group.

Some people criticize the capital allocation of the management. Are they right?

As mentioned before, during the last 12 months, the company has acquired:

Roberto Coin wholesale operations in the US

Hodinkee, the leading digital magazine in the US

Acquisition of 15 luxury watch showrooms from Ernest Jones in the UK

From an operating point of view, only the later seems to be related with the core business. The two others, are surprising moves. However, even if I prefer to see acquisitions of showrooms, these acquisitions make sense:

Roberto Coin was acquired at 6x earnings, which is really cheap. WOSG trades at 18x PE, making it immediately accretive. Additionally, it addresses the main concern of the market: concentration of Rolex

Because other brands follow their own DTC approach (mainly the big public companies like LVMH and Richemont), the move makes total sense to continue diversifying product, and supplier concentration. It also reinforces jewellery operations.

The acquisition of Hodinkee by £10m only represents ~1% of total market cap. The impact is very low and I believe it provides market intelligence, together with some synergies. With that acquisition, the management is creating an ecosystem in the US that should contribute to continue capturing growth. Company has access to consumer’s interests, marketing campaigns, etc.

So, overall, I understand is not exactly what many investors expected a year ago, but the current company looks promising and more diversified than it was a year ago.

Now, I really think management should start thinking about share repurchases.Part III: Financial Analysis of Watches/Jewellery Segment

Important: This part excludes Roberto Coin financials.

The aim of this post is to share my thoughts on the current and future cash generation of the company. To do so, I will share screenshots of the financial model used.

The model is available for professional investors only. Should you be interested, please contact me

The goal of the financial model is not to predict the future earnings of the company, but rather understand the company and how they make money.

The company recently acquired Roberto Coin, which is a wholesale business. I will value it separately, as it will distort all the current data. Therefore, all this section relies on figures as of 2024 FY.

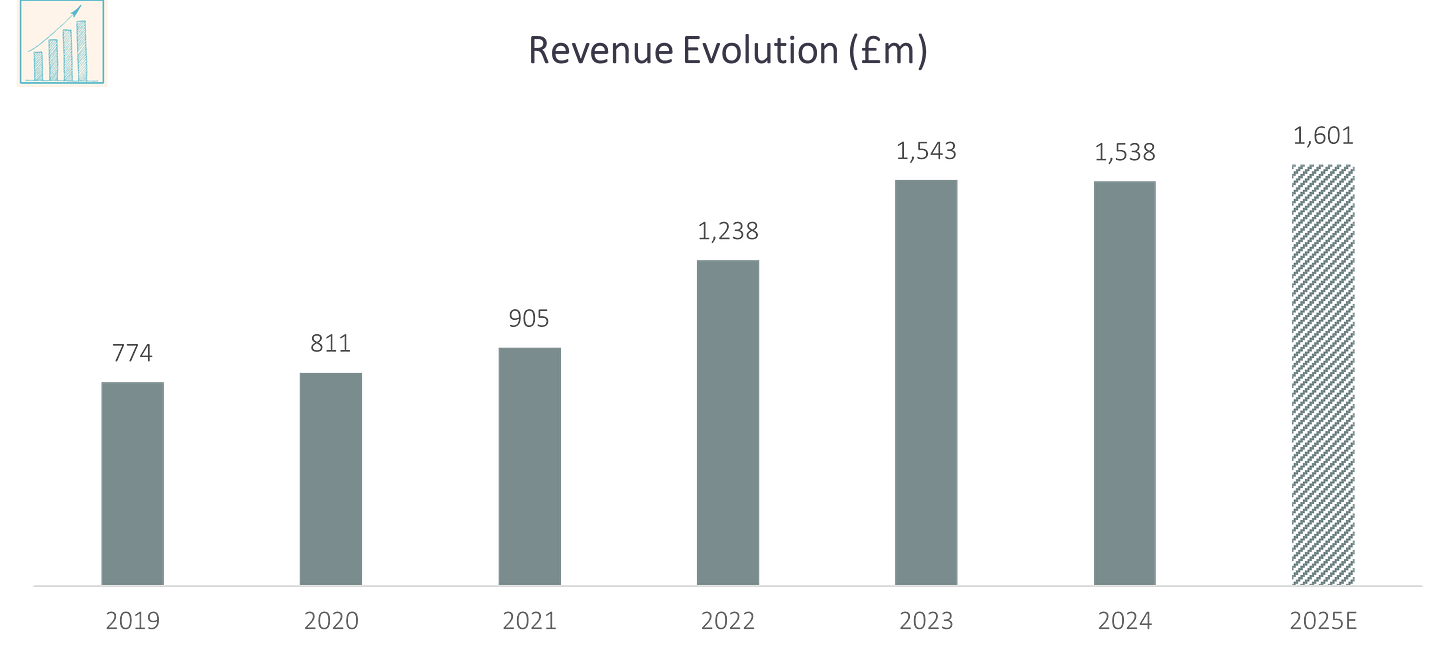

1. Revenue

Introduction

Sales have increased exponentially over the last years, as the company continues to open and acquire new stores. The company presented a long-term plan to 2028, where the company plans to reach £3bn in revenue.

Under current conditions, I don’t think they will reach that target as they are half way of it, but the company will be very well positioned to generate strong revenues if demand boosts again.

If demand remains flat, the company will be benefitted from the dynamics of the pricing of luxury items. During the last years, revenue is almost flat, despite having increased the number of stores. This is mainly due to the current macroeconomic environment, with more spending constraints.

Only the high-end luxury remains resilient. This is important to understand, because many people believe (wrongly) that luxury is not affected by economic cycles. It is, but the high-end will always be more resilient.

Brands like Patek Philippe are more resilient. Plus, the company has opened lot of mono-brand boutiques of Tag Heuer, which is a premium brand.

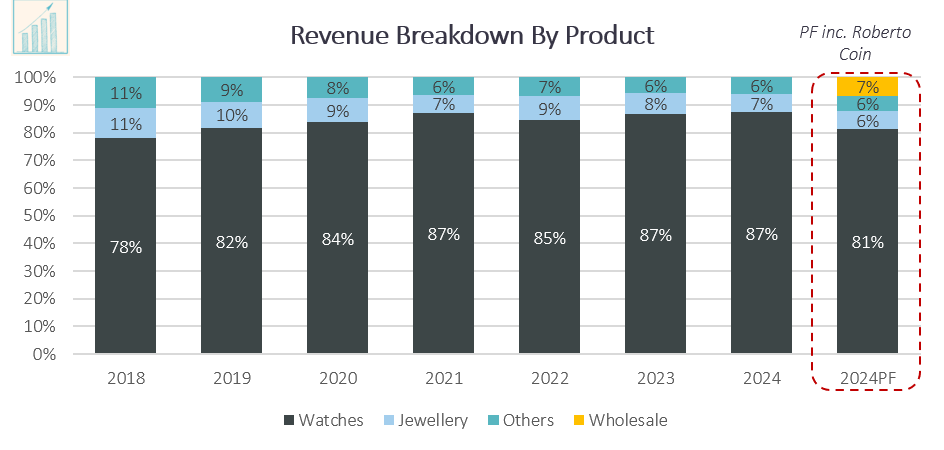

Revenue Breakdown by product/service

WOSG generates revenue through three different products and services:

Watches and jewellery. This is the core segment and what WOSG does. If we need to summarize it, it will be “WOSG mainly sells Rolex, Patek Philippe, and also many other brands like Cartier or Omega, in both the UK and the US”.

Wholesale: The company acquired Roberto Coin wholesale operations in the US during 2024, which is a jewellery brand.

Others: From reparations and maintenance of watches, to sales from the most important dedicated magazine to watches in the US, Hodinkee. This segment represents 6% of total sales.

The main channels are their own showrooms, which are operated under different brands (Watches of Switzerland, Mappin & Webb, Goldsmiths, etc.), and mono-brand stores.

There is an additional channel which is the online segment. However, the company does not report its figures. In any case, Rolex and Patek Philippe, do not sell online, so its relevance is limited given majority of the sales come from Rolex.

Physical channels remain the core points of sale as the luxury sector relies on store experience.

The management is transforming WOSG from the leading Rolex retailer in the UK to a more diverse company, with sales diversified between the UK and US, more diversified product mix with the acquisition of Roberto Coin, and they are developing an interesting ecosystem with the acquisition of Hodinkee

Main Product: Rolex

In 2018-2019, Rolex sales accounted for 45-50.6% of total sales.4 This means that the company sold £377.4 million worth of Rolex watches(£746 total 9M x 50.6%). With and average selling price of £8,5565 back in 2019, the company sold 44K watches.

The company doesn’t report Rolex revenues, but after the Roberto Coin acquisition, the total weight in sales might have decrease to ~40% of total revenues, but it should remain a high figure.

Note that the Certified Pre Owned (CPO) is gaining strong traction, sustaining a high weight of Rolex share in WOSG revenues.

Breakdown by Geography

The company has done an amazing job in expanding to the US. This is very important as the US is the most important market and still very under-developed, with no big player dominating it.

After the recent acquisition of Roberto Coin, the US now represents more than 50% of total sales.

This shift towards the US is a key element in the investment thesis, as since Brexit, many companies in the UK have seen their valuations impacted.

In case of WOSG, it had negative effects, as the government eliminated tax-free, which has led to fewer watches being purchased in this market by wealthy tourists visiting the UK.

This transition towards the US signals that the company is no more a domestic player in the UK, and its valuation should be readjusted accordingly during the next years

I even consider that the company should start thinking in a dual listing in the US. This will attract capital to the company, as it is no longer a UK-based company. In 5 years, the US should account for a bigger portion of the revenues.

Accounting principles

Before analyzing the revenue components (price and quantity), it is mandatory to analyze the revenue recognition in the P&L.6

“Revenue from contracts with customers is recognised when control of the goods or services is transferred to the customer at an amount that reflects the consideration to which the Group expects to be entitled in exchange for those goods or services” - Extract from Annual Accounts

No adjustments need, as they recognize the revenue when they sell a watch.

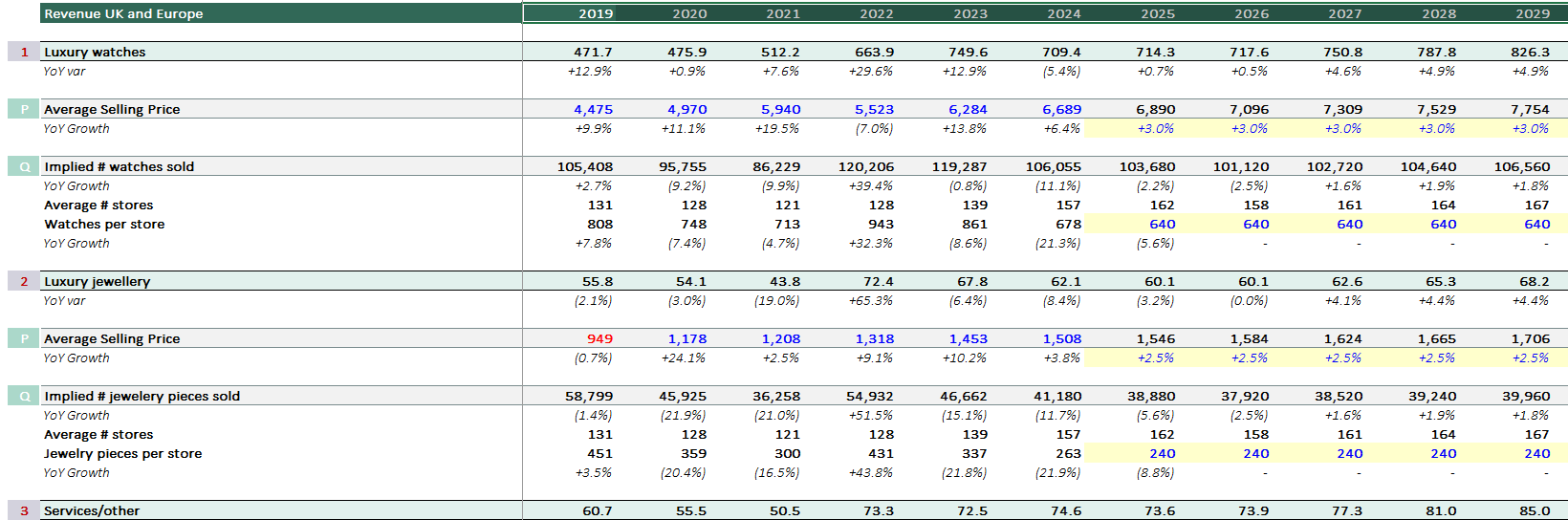

Revenue breakdown - Watches - (PxQ)

To properly understand the revenue generation and to be able to understand the forecast of future revenue, two variables need to be understood: price and quantity.

Price: WOSG reports the annual average selling price (ASP) of watches and jewellery. Because its a luxury product, it is feasible to consider that prices will continue to increase over the next years. This is intrinsic to the luxury segment.

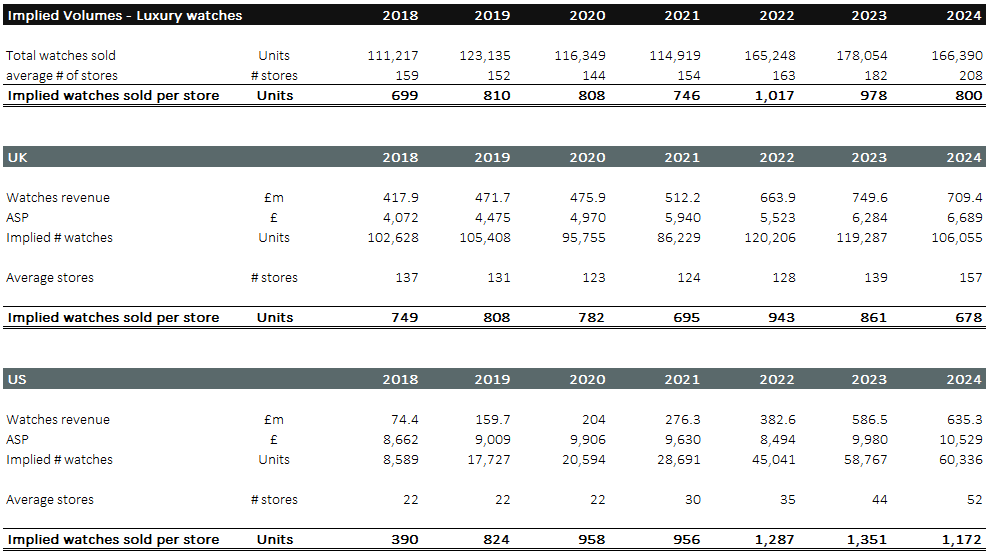

Quantity: the total number of watches sold depends on the total stores and how many watches each store sells on average. Currently, volumes are down after the excess we saw in the pandemic.

Average Selling Price (P)

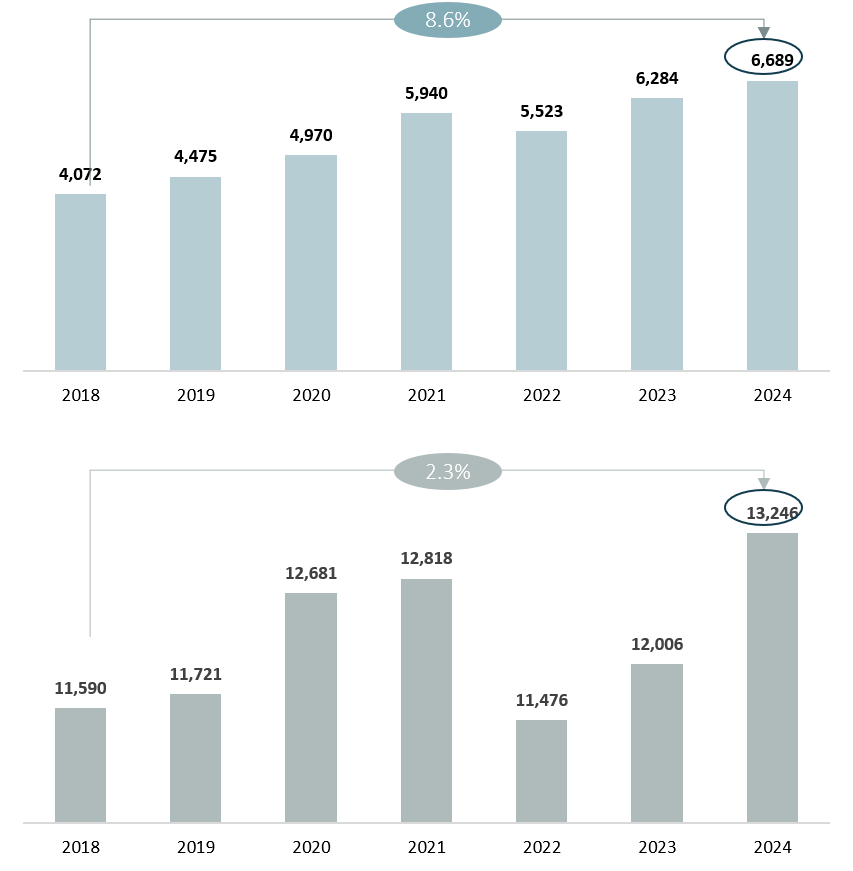

During the last years, the average selling price has increased by +8.6% and +2.3%, in the UK and US, respectively.

UK data is more reliable given their higher and more stable number of stores

In the US, there has been volatility, but CAGR of +2.3% is relatively closer to the +3%-+5%, of the average CAGR in the industry

The ASP in the US is significantly higher than in the the UK: £10,529 vs. 6,689

Price in luxury items does not follow the classical rules of demand and offer.

Prices increase every year to increase desire and maintain a solid demand. However, as we seen before, the industry overall average selling price increase annually at low-single-digit

In the case of WOSG, 2022 was the exception. This was particularly due to the 2021 price bubble. Due to the high liquidity, people were overpaying to have immediate access to watches.

Additionally, the ASP is affected by the product mix (i.e., steel vs. gold, etc.)

To forecast future ASP, I believe that using a historical average is fair.

The product mix should continue to remain similar (i.e., Rolex to be the dominating brand, followed by Patek Philippe). The only consideration is the Rolex Certified Pre-Owned (CPO), which consist on the selling of second hand watches in their stores.

Given the premium of second hand watches, the company’s ASP should not lower with the introduction of CPO.

Collecting data points for price and volume

A) Swiss Watch Federation

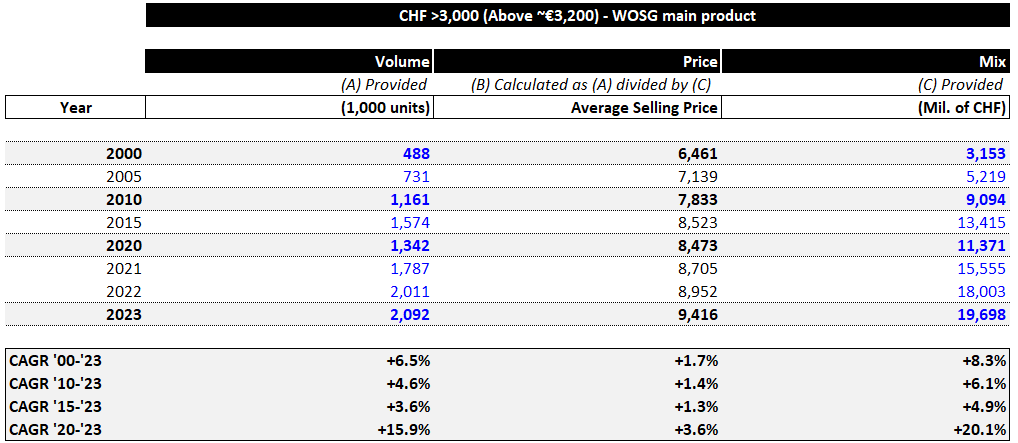

Using the data from the Swiss Watch Federation, the long-term CAGR (‘00-’23) of luxury watches (>3,000CHF), stands at +8.3%, mainly driven by volume. This data shows interesting considerations:

Although prices increase, the cumulative price increase stands below 5%

The main driver of growth for Swiss exporters is volume, which has nearly doubled since 2010

Note that these are worldwide statistics, but its important given its data for new watches and from the Swiss players directly

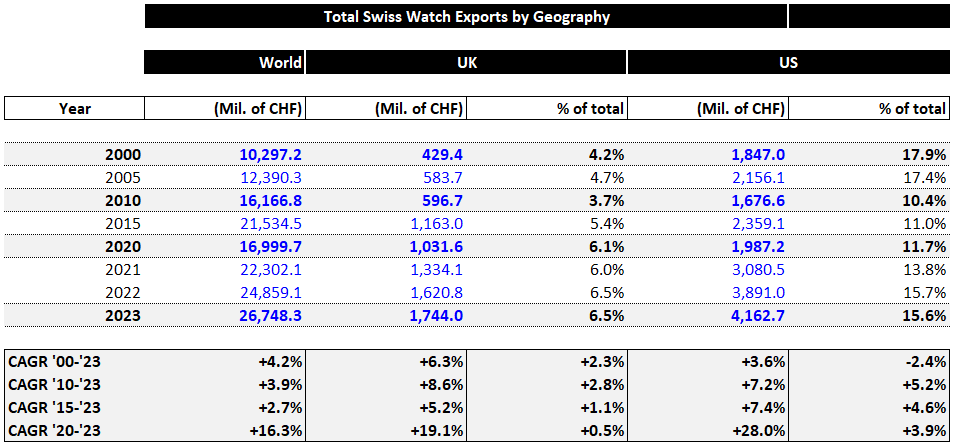

Using data by region, total Swiss exports have increased close to +3%-4% worldwide (+16.3% since 2020)

The UK and US markets have outperformed other regions, suggesting that WOSG is present in two attractive markets

The US is the biggest region, representing 15.6% of total Swiss watch exports

Exports to the UK have increased above +5% using long-term averages

Exports to the US present a similar growths, above +5%

Therefore, in the long-term, the PxQ of Swiss watches is positive due to the dynamics of the luxury sector.

B) Chrono24 Index

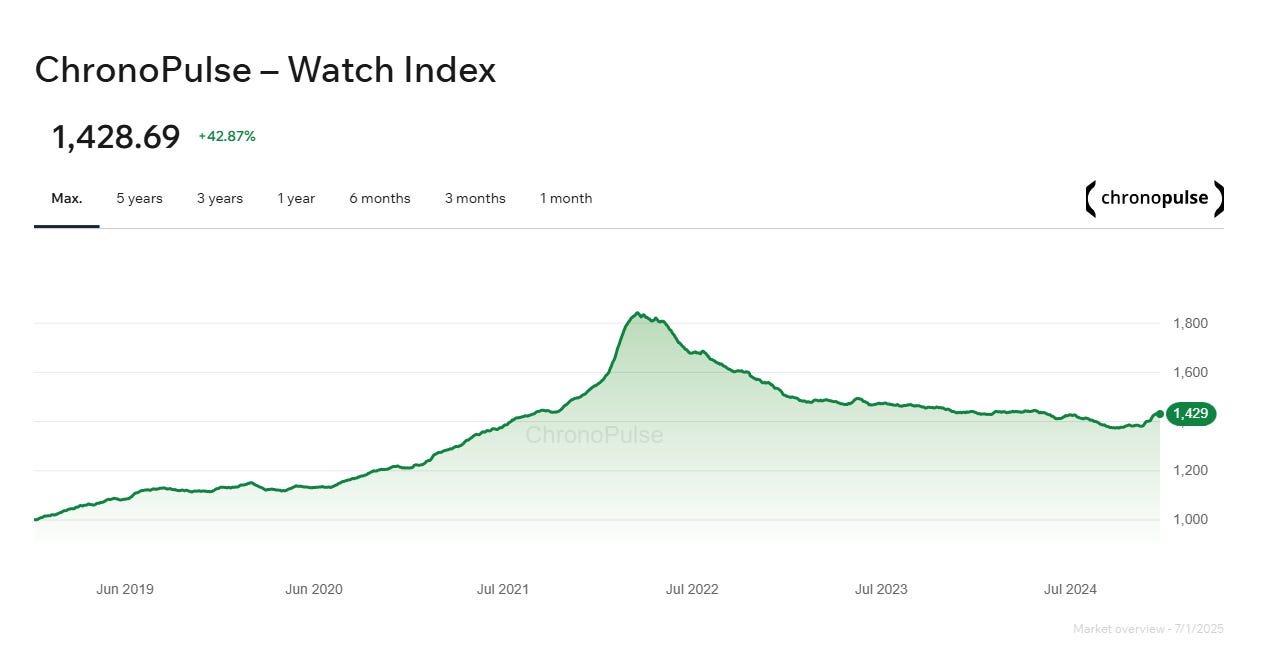

The website Chrono24 provides price index made from the daily price of the watches sold in their website. You can visit the website to see the components of the index.

Note that we are talking of secondhand watches, which have increased more than firsthand.

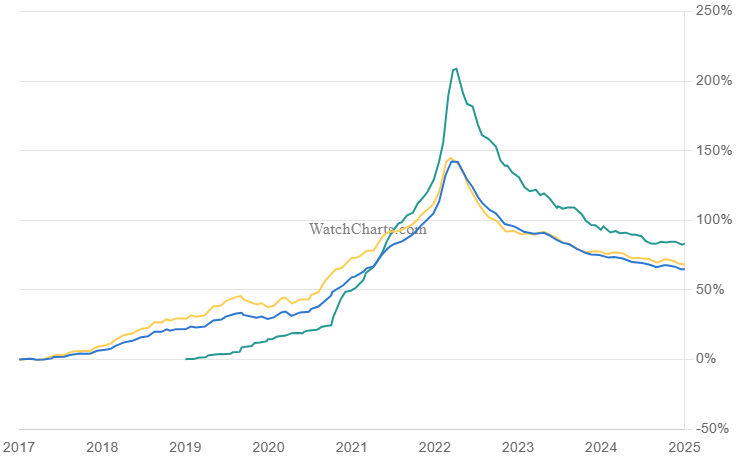

The index is up +42% since January 2019, after a severe correction since the peak of 2021. This implies a CAGR of ~7.3%

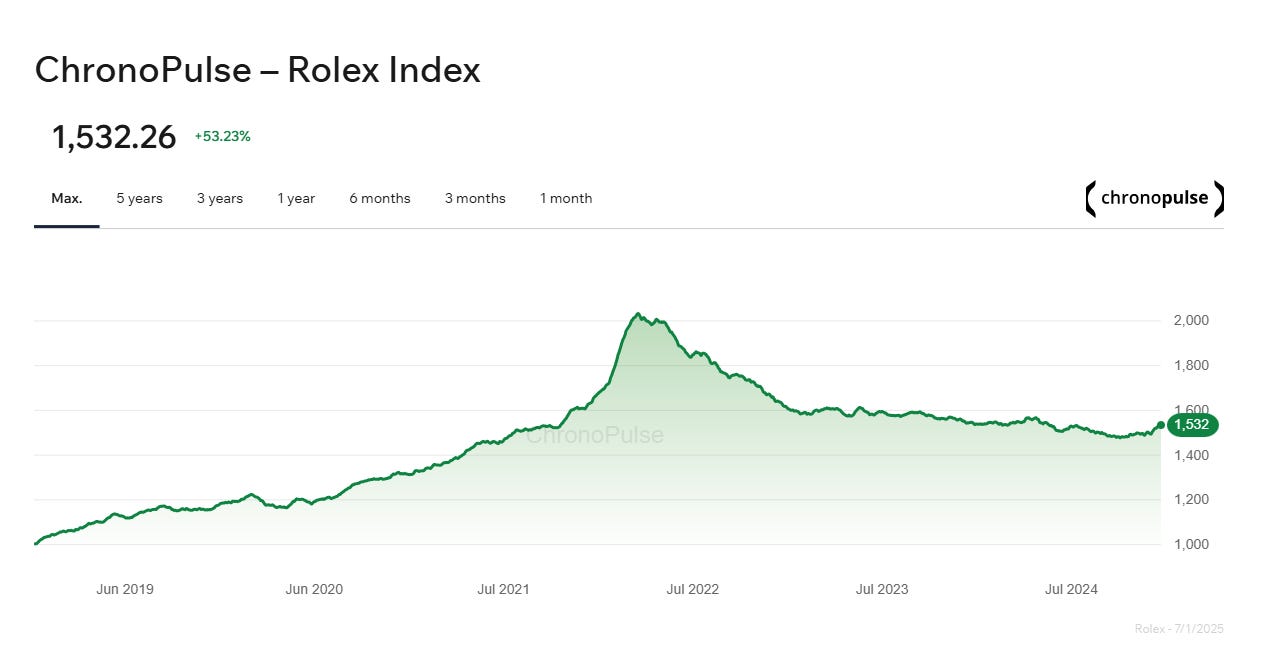

Rolex and Patek Philippe are the most representative brands of WOSG and had even stronger performances:

Rolex: +53% (~8.9% annual growth)

Patek Philippe: +86% (~13.2% annual growth)

C) WatchPro Market Index

Again, we are using here secondhand data, but it provides a estimate of long-term growth rates.

WatchPro Market Index contains data from 2017. Using the data, we obtain the following data:

Overall Market Index (blue): Total growth of +64.8%, annual CAGR of 7.4%.

Rolex Market Index (yellow): Total growth of +68.2%, annual CAGR of 7.7%.

Patek Philippe Market Index (green): Total growth of +83.2%, annual CAGR of 9.0%.

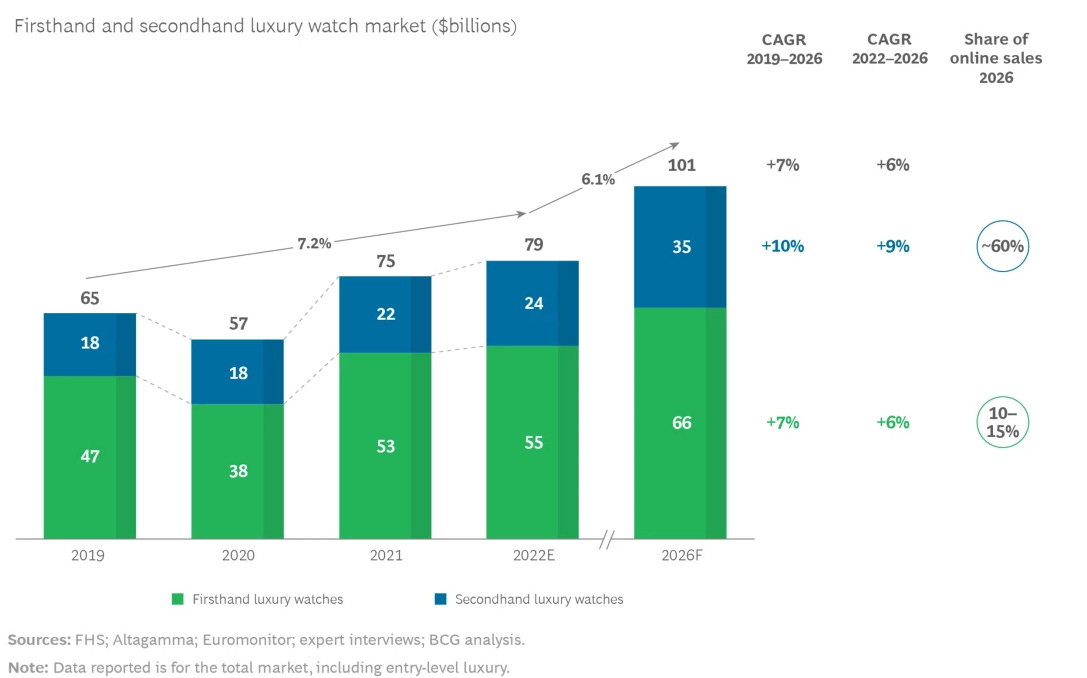

D) Boston Consulting Group

BCG published a report in march 2023 which is very interesting. You may find it in the following link:

https://www.bcg.com/publications/2023/luxury-watch-market-trendsThe company reported an expected CAGR ‘19-’26 of +7%, which is in line to the recent history.

An interesting data point is the premium of secondhand over first hand. It currently stands at 2.1x, which is the double than 2019.

Although we can think that the adjustment will continue, the scarcity and the long waiting lists for the luxury watches will keep supporting a premium between secondhand and firsthand.

Conclusions and model inputs

Using different data points, we can determine that the historical growth in the UK has been in the mid-to-high single digit.

This means, that on average, growth stands between +5% to +10%. However, to be conservative, a growth between 3-5% looks more appropriate.

In the model I’m using an annual increase of the ASP of +3%. I believe this is conservative, especially given that the company is accelerating its partnership with Rolex, with the introduction of the Certified Pre Owned in many stores, and with the opening of new stores.

This is very positive as Rolex has an ASP higher than other brands like Tag Heuer or Breitling (which are the main brands of the recently opened mono-brand stores).

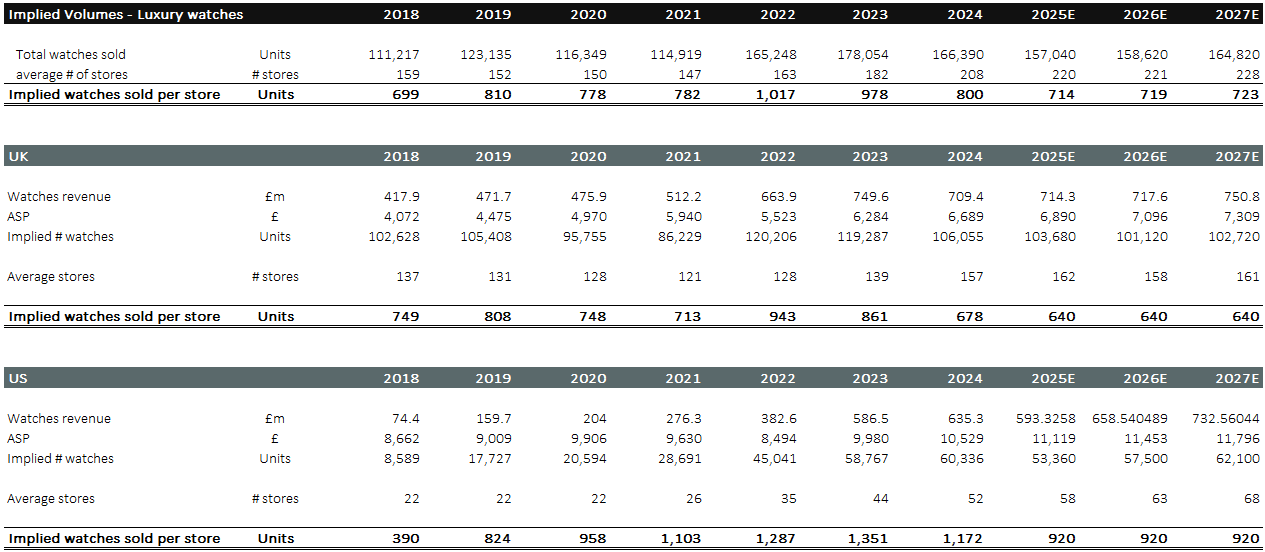

Total Watches Sold (Q)

Quantifying the watches sold is more challenging, especially for any short-term forecast. We need to determine the average watches sold per store and the total number of stores.

Watches sold per store

The difficulty relies on calculating the average watches sold per store as the company is opening and closing stores constantly.

By diving the total watches of the year divided average number of stores of the year (average of EoP stores t and t-1), we obtain that the company sells around 800 watches per store annually , which means each store will be selling around ~3 per day).

Although this data is not very accurate because we don’t have normalized levels of store sales, the numbers are useful and follow a logical trend. The year 2022 (ending in April ‘22) was a record year in the UK, which is in line to what happened during 2021.

The forecast of future volumes should be conservative given current challenging environment

In my case, I’m forecasting 640 watches per store in the UK (lower than 2023), and 920 in the US (20% less than 2024), which are the volumes of the last available data (1H 25)

This will be the result of a conservative scenario, in which revenue only increases with the inflation of the luxury watches. I’m being very conservative to evaluate this opportunity.

Number of stores

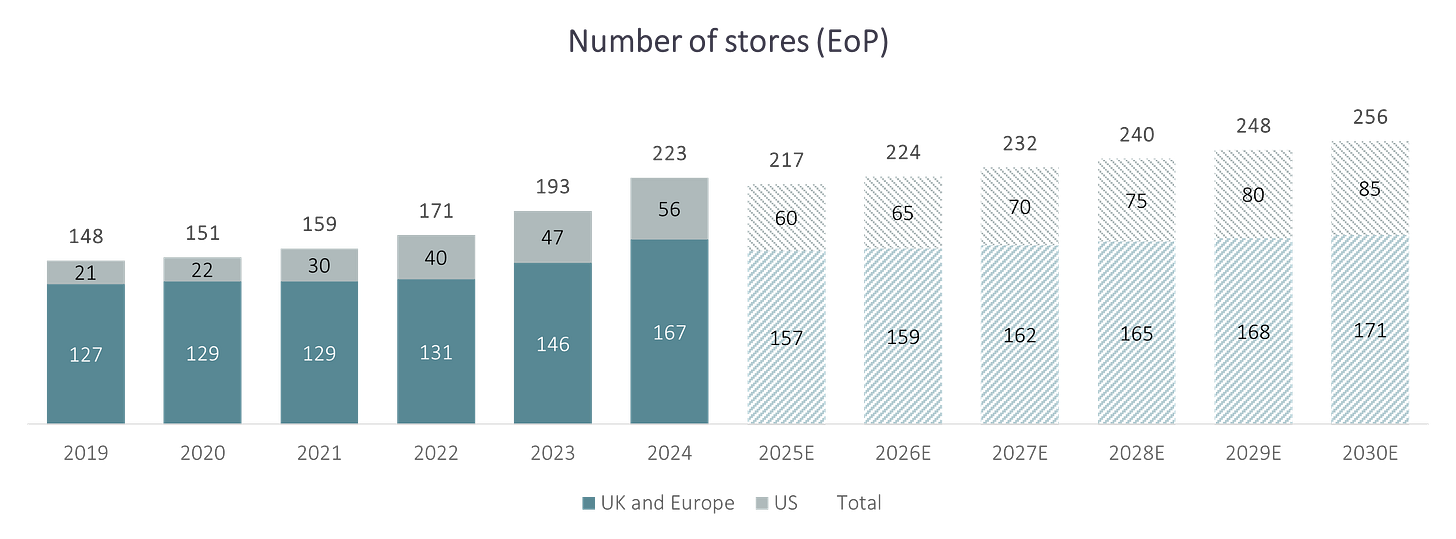

The number of stores has significantly increased since the company IPOed in 2019.

Total count has increased from 148 in 2019 to current c.220. This growth has come predominantly from the US. The growth in stores was both organic and through acquisitions:

In the UK, the company has increased its footprint from 127 stores in 2019 to c.156 in 2025

In the US, the company had 21 showrooms in 2019 and now has around 60. The majority was through the opening of WOS and mono-brand stores of Tag Heuer, Breitling, Omega, Grand Seiko, etc.

The opportunity to continue increasing the number of stores remains very high, given the size and importance of the country.

The company opened 9 stores in Europe (mainly in the Nordics), but has cancelled its plans to expand to Europe and has now sell/closed all but one.

The reversal of its plan to expand to Europe is a smart move given the current environment in Europe. Plus, the US is the most important market for luxury products.

Although we can question the initial decision to enter Europe and then reverse it 2 years later, but its more important to be fast in taking decisions and switch priorities when needed.

But definitely, it was not a good strategy as time and resources were lost during the process.Is the opportunity in the US big?

At the time of the IPO, the largest Rolex retailer had only 22 stores. This means, that these company had a market share of 7%.

According to the site Millenary Watches, there are 317 Rolex stores in the US7. WOSG has a tiny fraction of them, making the opportunity very large.

The is room for more Rolex stores, and many other brands like Patek.

Will WOSG continue to open stores?

One of the fears that the market had last year was that major watches brands will open their own stores. Although its something that may happen, they still need to rely on distributors such as WOSG.

This is due to the fact that the brands can’t open a store in all locations with individual stores for several reasons:

The complexity to operate a large number of stores,

The scarcity of real estate in some locations, and

The economics of the stores. Sometimes it is much more profitable to be in a multi-brand store than having a mono-brand store with high lease and low profitability

WOSG invests every year £60-70 million in their stores. Either opening and expanding their current footprint, or developing their stores to improve customer experience.

“We see compelling mid-term opportunities for growth, most notably in the US, and we don't believe there is a meaningful risk to WOSG model from Rolex's acquisition of Bucherer.” - Deutsche Bank (hold rating) (source)

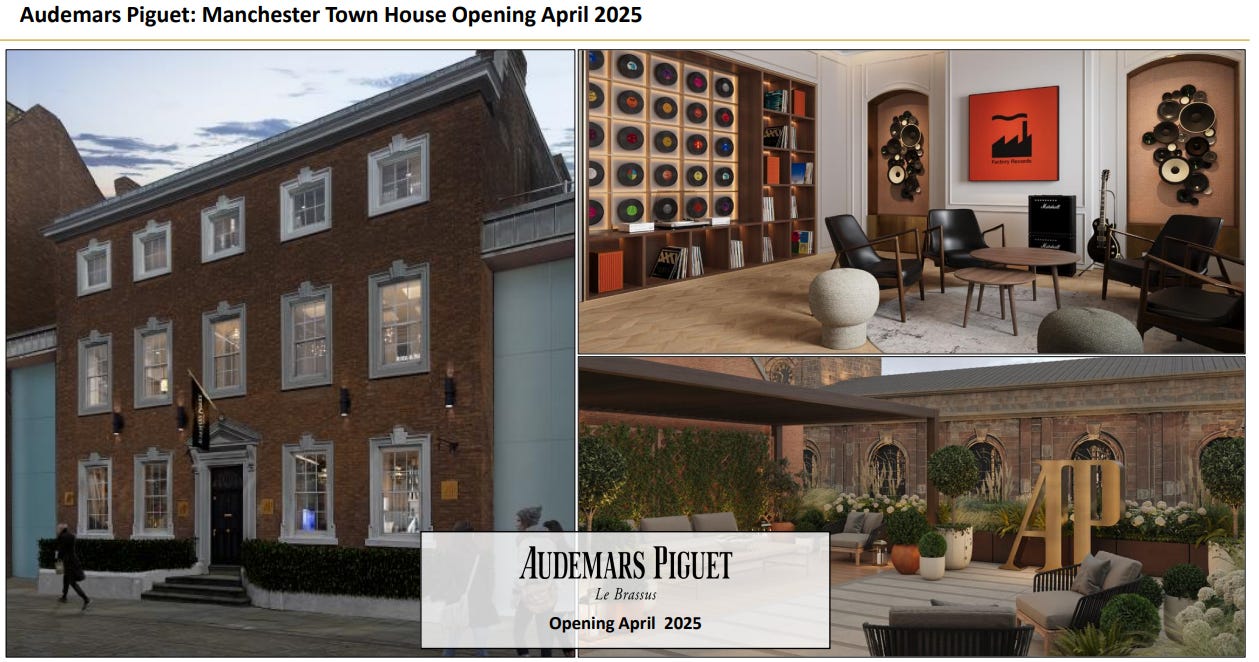

They have a unique know-how in building and operating stores. As an example, see the new store they are developing together with Audemars Piguet.

To forecast future stores, I’m being conservative and mostly focused on the US.

For 2025, I’m using the current pipeline of the company, and for future years I’m projecting +5 stores per year in the US and 3 stores in the UK. Please note that UK includes Europe, where the company has decided to close or sell its 9 stores.

I believe this forecast is conservative, as the company will have the capacity to continue investing £60-70 million annually in expanding, and still generate positive FCF.

Revenue breakdown - Jewellery and others

For jewellery I applied the same principle as for watches: price x quantity. Given it only represents 6% of revenue, the assumptions behind are simpler, and I will skip a long explanation to make the post shorter.

Tu summarize, I’m assuming a 2.0-2.5% ASP increase in the next ten years, and maintain volumes flat from the implied 1H ‘25 figures:

UK: Average last 5 years c. 45K pieces sold (c. 340 per store) - Forecast: 240 per store (nearly 33% less than in 2022), flat during the next decade.

US: Average last 5 years c. 7K pieces sold (c.192 per store) - Forecast: 140 per store (-40% less than in 2022), flat during the next decade.

Other revenue, which includes insurance, maintenance, etc. has normally represented around 9-11.5% (avg. of 10%) of revenue in the UK, and 1.8-3.8% (average of 2.6%) of revenue in the US.

I’m applying slightly lower than average to forecast this item: 9.5% of watches + jewellery in the UK, and 2.4% in the US.

Estimating revenue

Now we have analyzed price and quantity, the forecast in revenue is as follows:

Flat volumes assuming current 2025 volumes. Volumes can continue to decline, but probably at a lower rate. These volumes are significantly lower than in 2019, which is conservative

ASP increase of +3% annually for watches, +2.0-2.5% for jewellery. It can be higher, but to be conservative I will apply a 3% per year.

Rolex has announced a 5% increase in prices for the UK and the US8

Remaining growth will come from the opening of new stores

Flat FX for the US

Revenue in the UK and Europe

From 2026 onwards, I assume no revenue from European stores.

To be conservative, I assume that the year will close in negative, on a same proportion as 1H 25. This implies a decline in volumes by c.6% from last year, leading to a three consecutive years of decline.

Although it seems as a bad situation, in reality is just a correction from the excess of 2021-2022, and the consumer is now adapting to the new post-pandemic reality. By assuming only growth from new stores and a +3% price increase, revenues will start growing again in 2027.

Revenue in the US

In the first half of 2025, revenue in the US is down by 6.5% (excluding Roberto Coin). According to the management it “was impacted by one-off increases in showroom stock levels to enhance displays and client experience in Q1 FY25, particularly in the US”.

In order to be conservative, I’m assuming that this is not the case, and that volumes are down by 21%, which is extremely conservative. I believe it has no sense, but I’m trying to reach a valuation of a very conservative scenario.

I’m assuming that the company will focus to open new stores in the US (assumed 5 per year, which is lower than the previous years), and that ASP increases at 3%. FX projected flat at 1.227 (figure reported in 1H25, currently stands at 1.21)

Output

With these assumptions, the revenue of WOSG will reach £2bn in 2029, mainly driven by increase in ASP and number of stores. If volumes stabilize and start increasing in the next years, the company has the potential to reach even higher revenues.

Is there room for volume increases?

I believe that there are reasons to believe that volumes should start to stabilize, and might even have the chance to increase in the future.

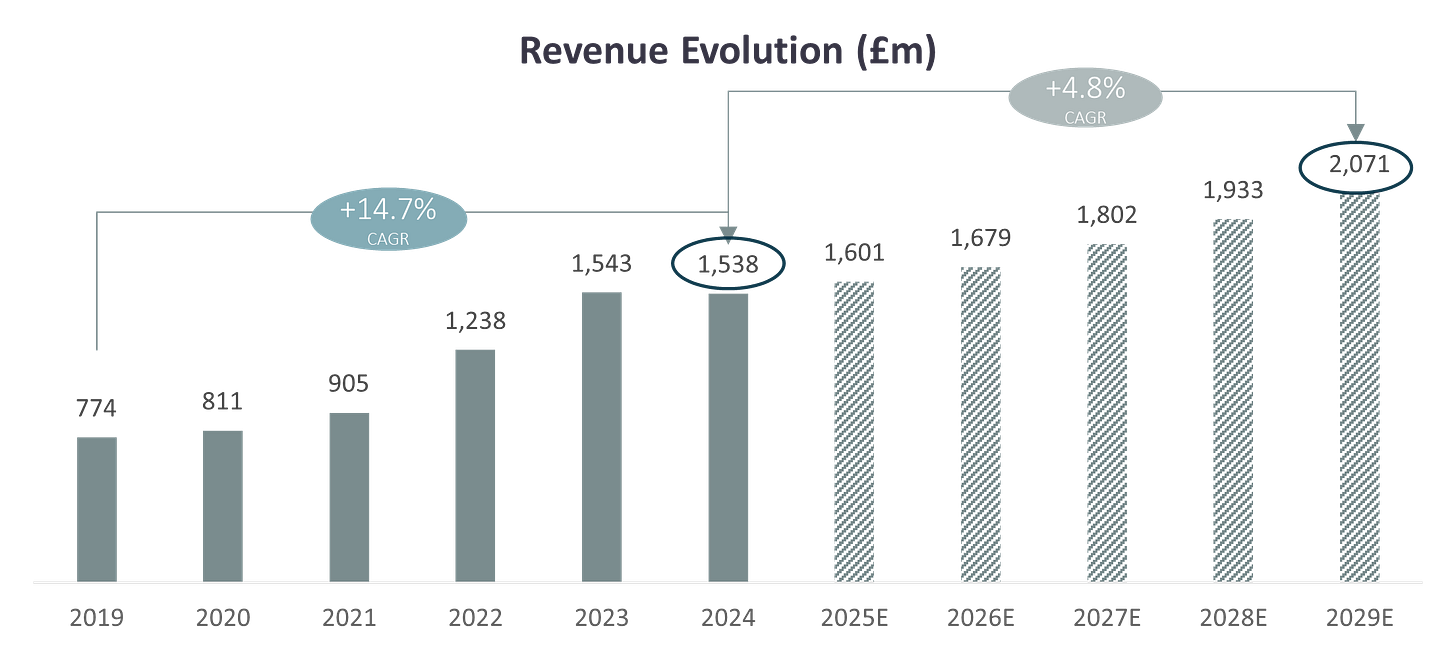

Recently, the company reported the main 4 categories of clients, being the special occasion and the serious collector their main clients, representing 82% of clients, ant 71% of sales.

The client of special occasion is probably the one of the categories suffering more right now. In the UK, with a lower rates environment we should see the financial sector expanding during the next years, which should contribute to increase the volume of watches sold.

On the other hand, in the US, 10% of the clients, represent 45% of the sales. Although at first glance it looks attractive, this increases the concentration risk in the region. However, this category might be a very resilient one, with a high purchasing power, as collectors tend to acquire very limited editions, that come with a higher selling price.

So, on both markets there is room for further growth. However, I’m not taking it into account in my forecast. I treat it as an optionality.

2. Expenses

Introduction

The main expenses for WOSG are:

Cost of inventory (i.e., the watches and jewellery they sold)

Salaries and staff costs

Store leases and other expenses

The most important expenses are the inventory costs, which is a variable cost. The company earns ~36-38% net margin on the watches sold, which means that inventory represents 62-64% of total expenses.

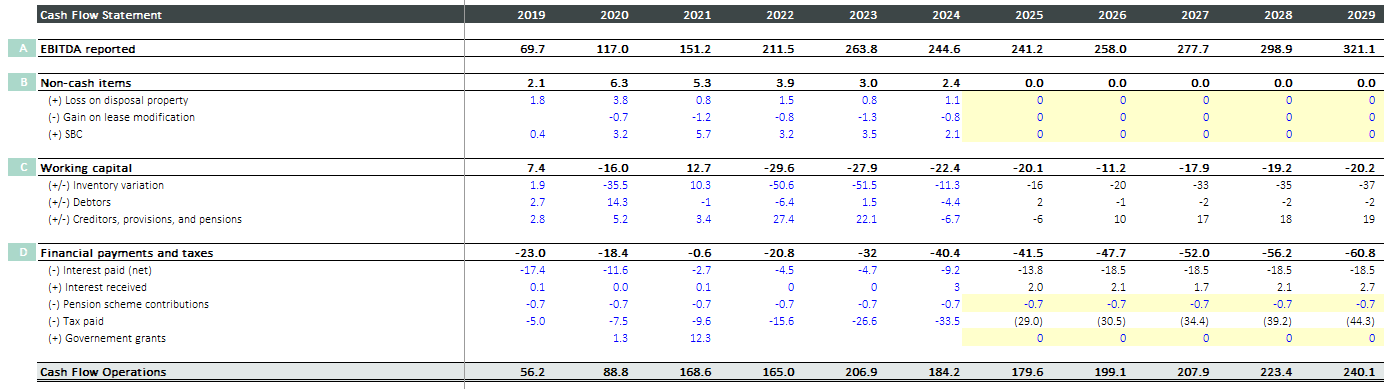

The EBITDA margin stands at 10-12%, which means that salaries, leases, etc. represent around 20-25% of revenues, or c.50% of the net margin.

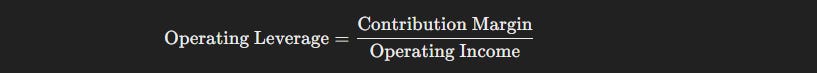

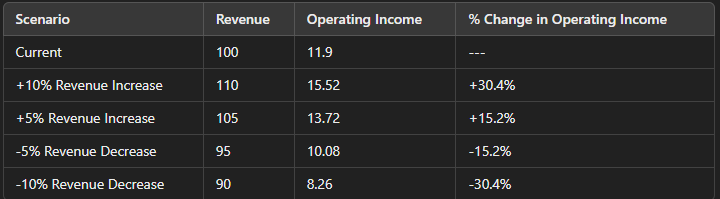

If we assume that the majority of the expenses at EBITDA level are fixed (leases, salaries, etc.), this implies that the company has an operating leverage of ~3x, meaning that a +5% increase in revenues organically, will increase EBITDA by 15%.

Although operating leverage will probably be lower than 3x, the reality is that the company has a significant amount of fixed costs, which poses some risks in the investment.

During the first 6 months of 2025, revenue from watches and jewellery is down by 2.5%. Assuming Roberto Coin is flat, the company reported a lower EBITDA and EBIT by -7%, and -10%, respectively. This suggests that these calculations are not that far from reality.

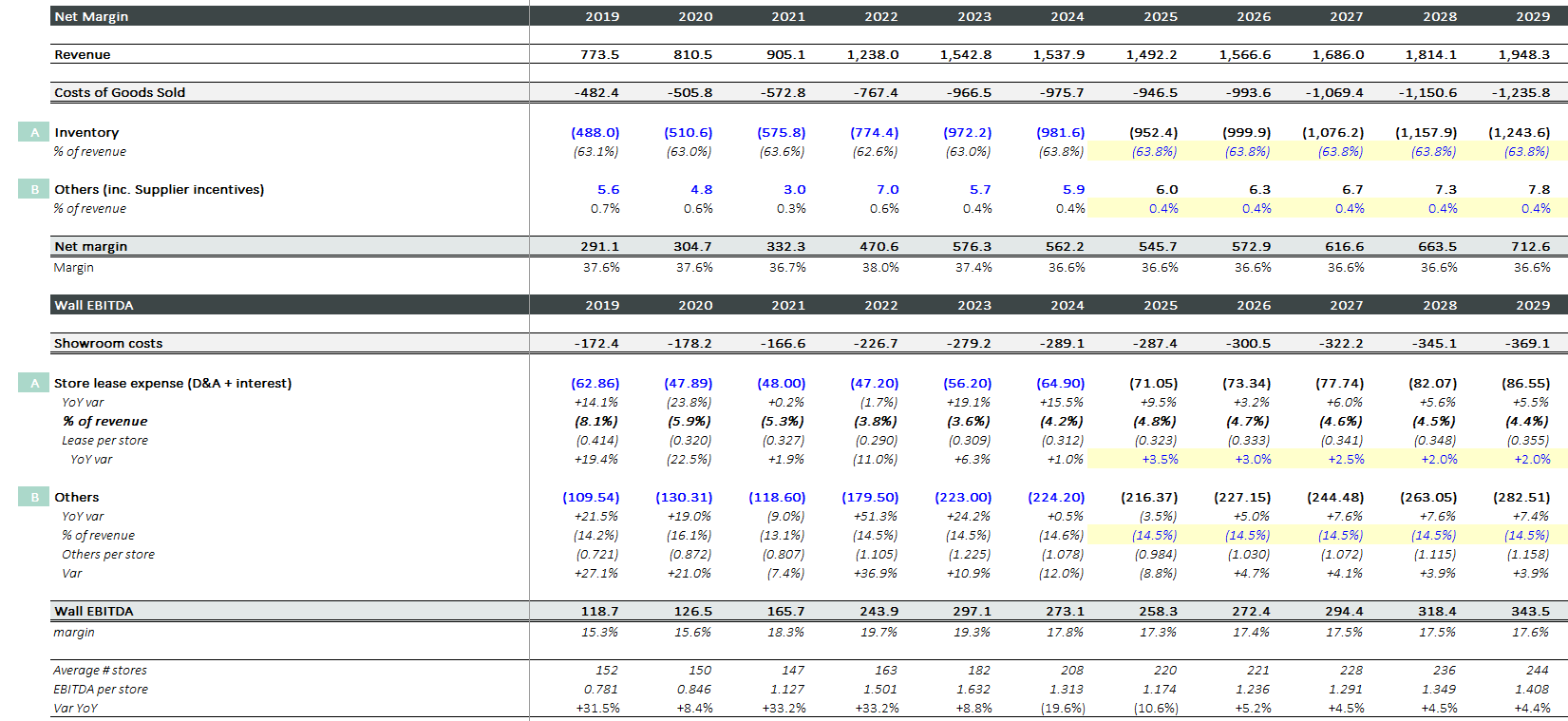

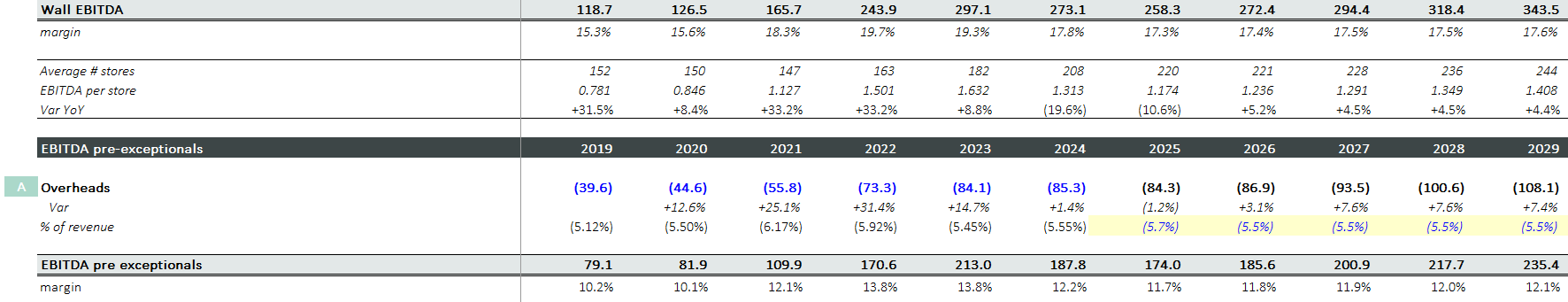

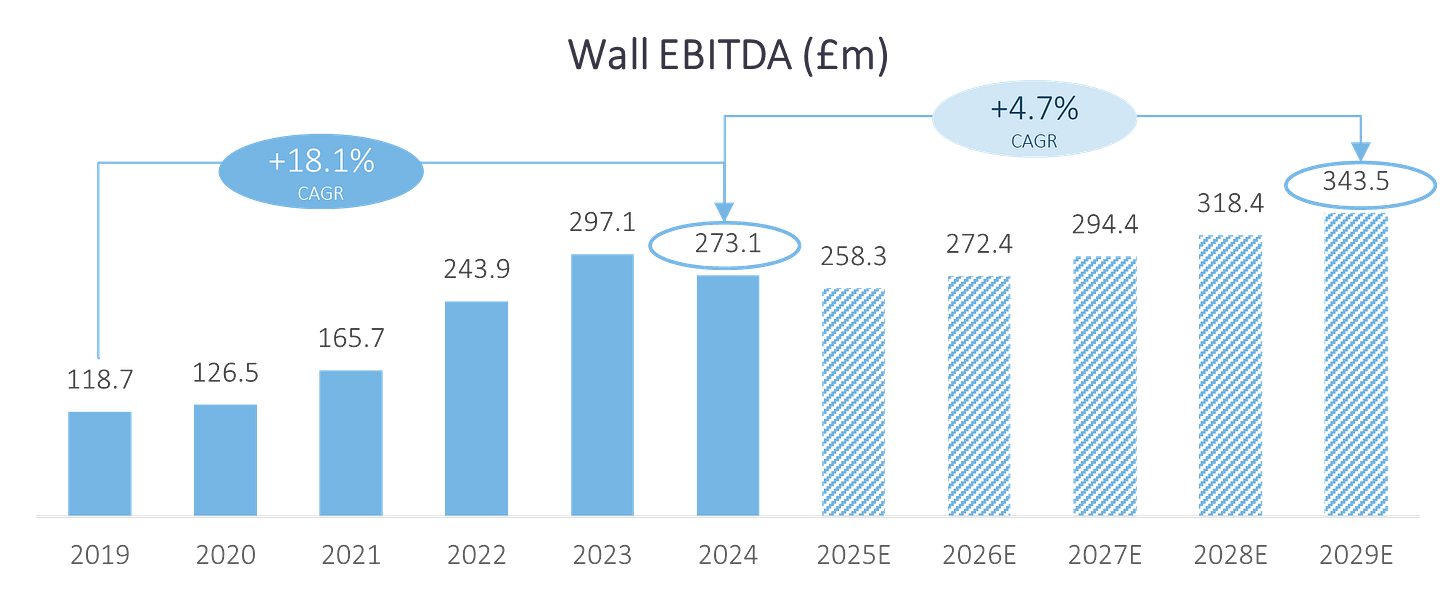

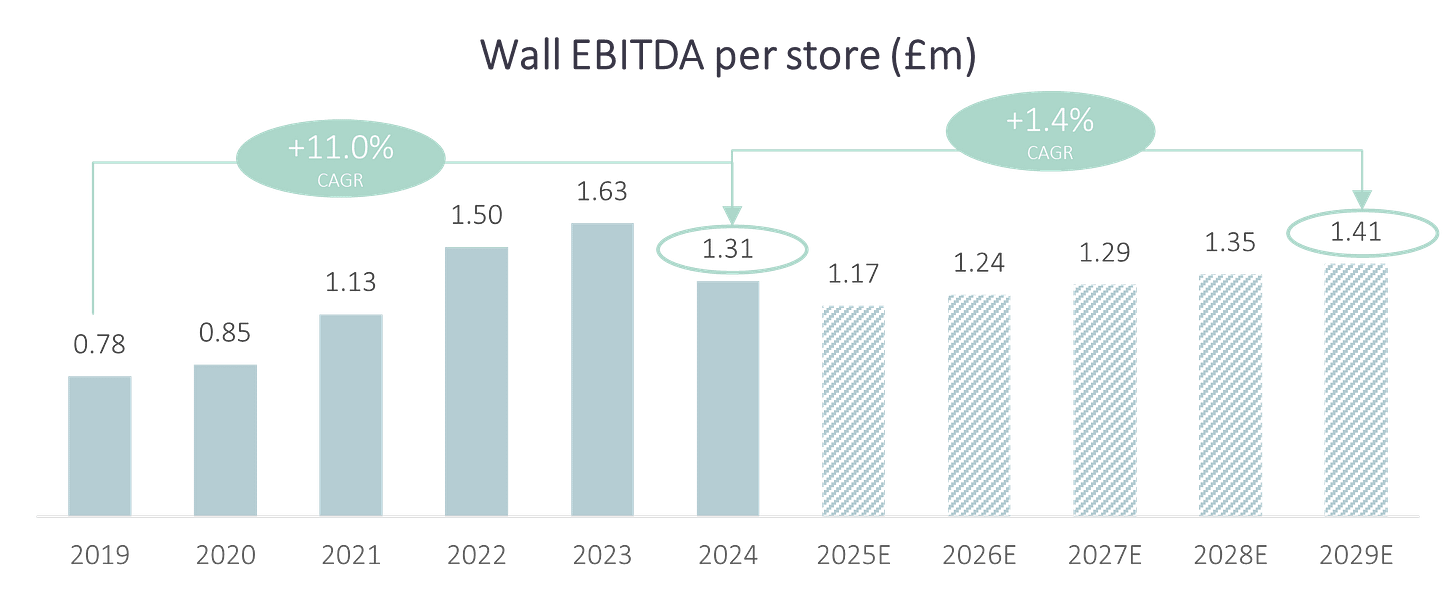

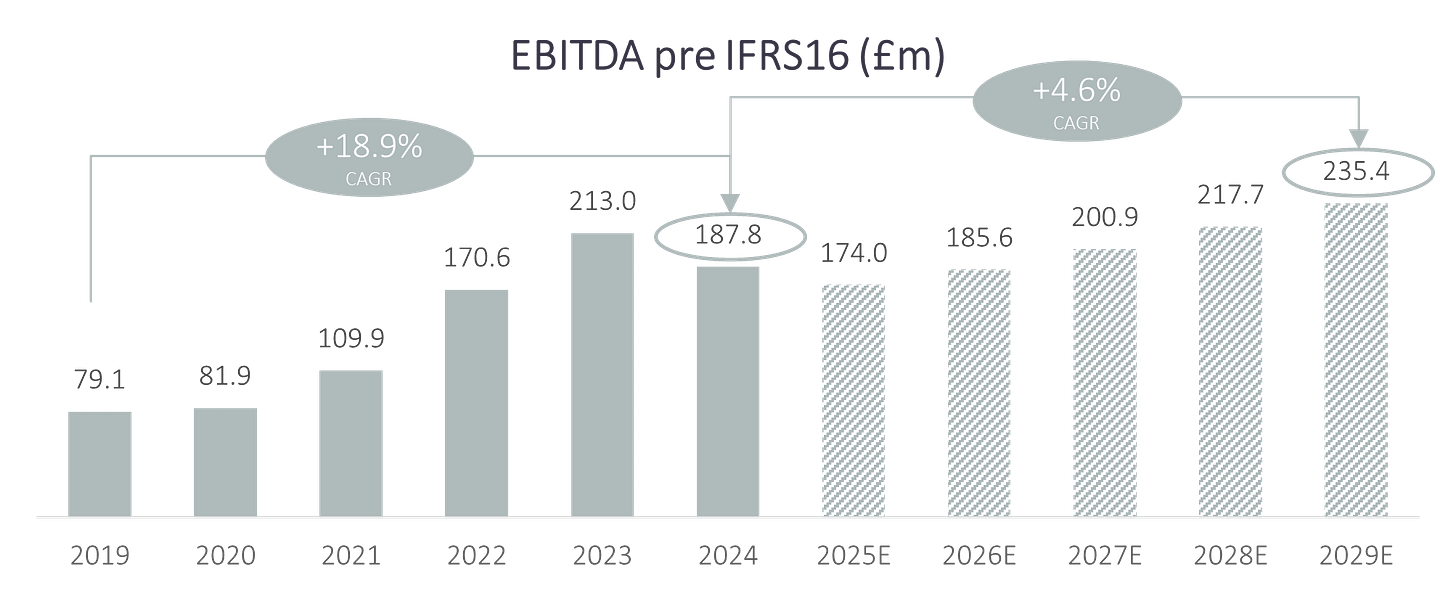

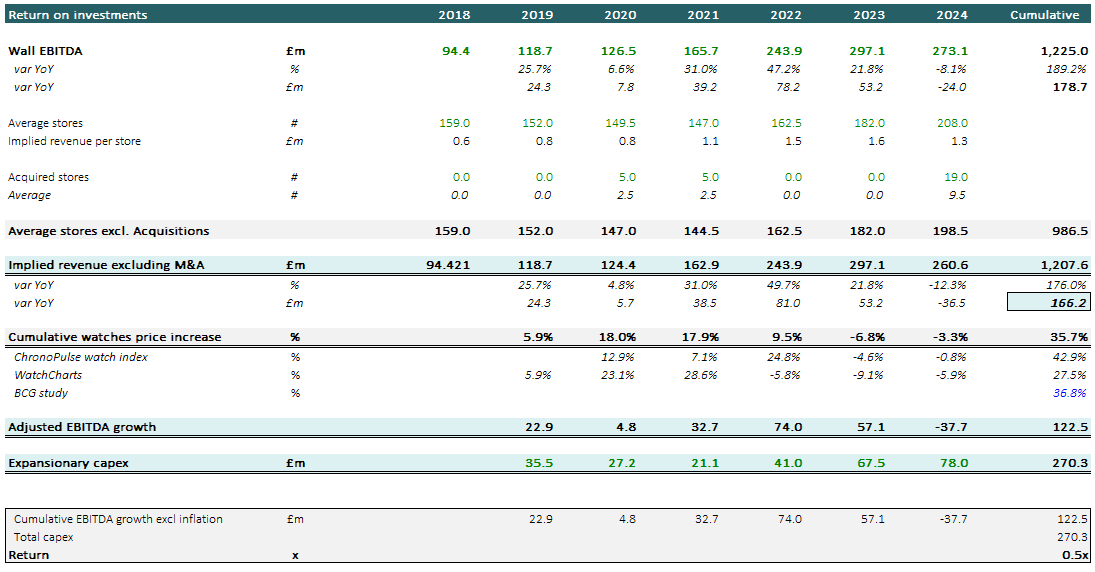

To measure the profitability, the company reports an alternative performance metric called “Wall EBITDA”. It is an appropriate measure as it includes the lease expense of the stores, which is very meaningful in a company that doesn’t own its stores.

Additionally, the company reports its EBITDA after deducting overheads (i.e., central services, IT, etc.), but pre-IFRS, meaning that it includes the lease expense.

Wall EBITDA

Wall EBITDA measures the profitability of the stores.

(+) Revenue

(-) Inventory costs (COGS)

(-) Store leases

(-) Others (salaries, etc.)

= Wall EBITDA

(-) Overheads

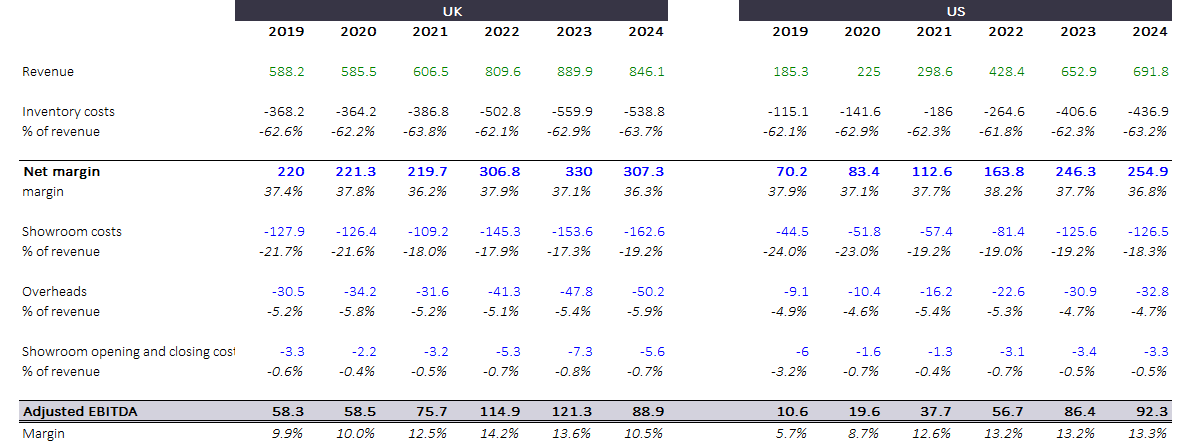

= EBITDA (pre-IFRS 16)The following table is an output of the model I’m using. As we can see, the margins of this company are not very high, but they are very stable.

The margin of the stores has expanded from 15.3% in 2019 to 17.8% during 2024. This is the result of the expansion plan designed by the management. WOSG invests in its own stores like no one else does.

The trends and margins have been very stable during the last years. What this signals is that the luxury sector has been able to pads through inflation, but profitability in terms to how many pounds the company earns per pound of revenue remains similar.

Inventory expenses

The net margin has remained quiet stable during the years. The company earns a margin of around 36.6-37.6% per sale, implying that inventory represents around 2/3 of total revenue.

2024 was the worst year since the IPO in 2019. I use that figure in my forecast to be conservative.

Store leases

Lease expense is difficult to predict given the company is opening and closing stores every year, and each store is different in size, location, etc.

What I tried to do is to measure the average lease expense per store. Although the inputs are not precise, we can conclude that the average lease expense is around £300k per site, based on the last 5 years (lease expense / average stores).

The forecast is based on the total stores and an increased lease expense

Other expenses and Overheads

Other expenses include the remaining costs associated with the business. These includes the salaries of the staff, marketing, store expenses, insurance, etc.

Overheads have considerably increased during the last 5 years, as the company has expanded from a local player focused in the UK to an international player with operations in the US, UK, and Europe.

This involves the need to invest in additional resources to support the business, like having proper corporate services, strong IT systems, etc.

During the last 2 years, the management has stabilized these expenses at c.£85m, and in the first 6 months of the year, the overheads expense was reduced by £1m.

Under the new reporting with Roberto Coin, this expenses will grow to c.£100m.

EBITDA by Geography

The margins earned by the company are similar in the US and the UK. This is another input to consider: to be conservative, the expansion through the US will not imply an uplift in margins.

Margins can increase with higher volumes, but not with the expansion.

EBITDA Output

Given the company’s operating leverage, once the cycle stabilizes and volumes will start to recover, the impact on EBITDA will be even more positive.

As I didn’t forecast any volume improvement, the result is a vert low growth compared to the past. However, a retailing company that can grow conservatively at mid-single-digit is something to highlight.

The implied wall EBITDA by store (wall EBITDA of the year divided by average number of stores), will increase at a very modest rate with these estimates. This is explained by the fact that no improvements in volume are consider, and assuming that the expansionary capex has no effect in the financials.

After deducting the overheads, the company’s EBITDA pre IFRS (i.e., including lease expense), will increase at mid-single digit. This will result in an EBITDA of £235.4 million

The management still believes that they will double the EBIT by 2028, from 2023 base. I don’t consider they will materialize it, but if they do, the impact on valuation should be very positive.

Note: to be consistent, FCF figures include around £6m of opening/closing costs3. Capex

The company reports both maintenance and expansionary capex.

The definition of expansionary is “every investment dedicated to new showrooms, offices, relocations or refurbishments greater than £250,000”9.

Determining the level of maintenance capex

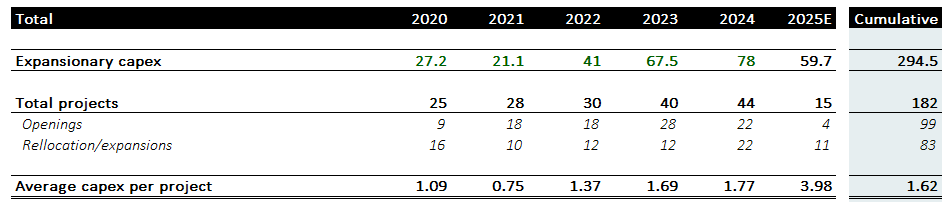

In practice, its difficult to determine the real level of maintenance and expansionary capex. The company invests on average around £1.5-1.6m per project.

Since 2020, according to my estimates, the company has relocated/expanded more than 80 showrooms, opened a hundred new stores, and closed c.30

This implies that from the ~220 current stores, around 180 are new or have been relocated or expanded

Additionally, around 3/4 of the openings were mono-brand stores, which are smaller than multi-brand and therefore, future capex should be lower

Although this could imply that future capex might be lower, I prefer to remain conservative and assume at least £60-70 million capex per year

I believe the company could cut by half the capex, and operations will work correctly. This will imply investing £35 million annually with a network of c.220 stores (around £160K annually per store).

This seems reasonable, given many stores are new and/or have been refurbished. The company could be doing 20 projects per year, which is 10% of the store count.

Other competitors are investing lower than WOSG, partly due to their lower size.

For instance, Bucherer, the company acquired by Rolex, is investing lower than WOSG. They are investing around £1-4 million a year, which is significantly lower than WOSG capabilities.10

Assessing the capital allocation of the management

Finally, the management claims that the projects deliver a deliver a payback of 2-3 years for relocations and expansions.

With the data provided by the company is difficult to assess the effectiveness and return of the investments.

In the following table, I tried to analyze the returns of the expansionary capex using the following calculations:

First, the wall EBITDA grew from £94.4 million in 2018 to £273.1 million in 2024. This represents an increase of £178.7 million

Given that the company acquired stores during the period, I excluded those stores from the total count to obtain an estimated EBITDA per store. The result is that EBITDA has grown by £166 million

This figure needs to be adjusted by inflation. Several websites provide data from the second hand watches. Using this data, we obtain a cumulative increase of c.36% during the period, which is probably higher than the first hand market, given that currently the second hand watches trade at significant premium

The inflation-adjusted EBITDA grew £166 million.

This figure, divided by the cumulative expansionary capex of £270, we obtain a current return of 0.5x the money invested in a period of 6 years (i.e., EBITDA growing at ~8% per year, despite recent negative performance)Given it currently accounts for investments made in 2023 and 2024, I believe that returns are high, and that paybacks might be low

This implies that revenue should increase more than I forecasted in the future.

In the end, it doesn’t make sense to include expansionary capex and maintain volumes unaffected. But its part of the model error.

I want to be conservative to avoid any value trap. I believe that assuming £60-70 million of capex, without any incremental volume in the years ahead is very conservative, and probably makes no sense. But valuation gives margin of safety with these numbers, and provide some cushion in case I’m making mistakes.

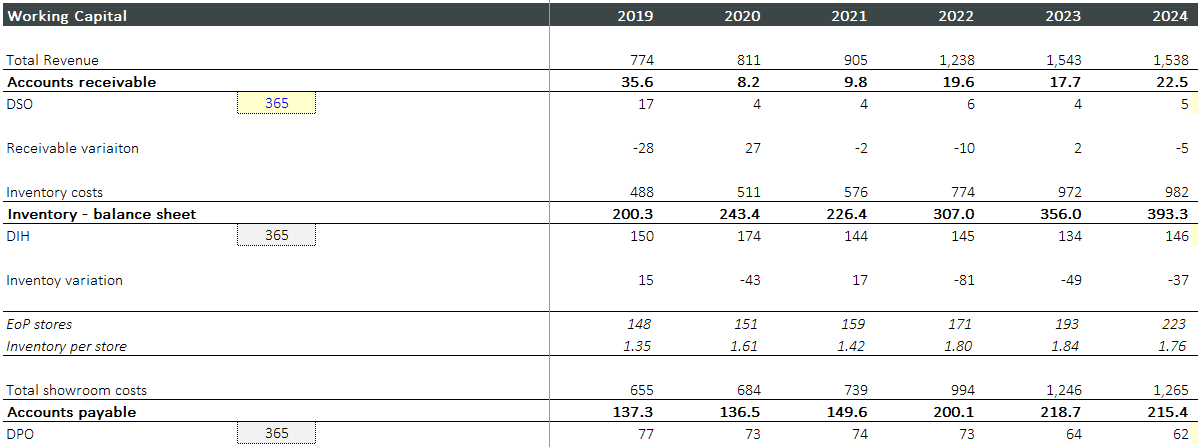

4. Working capital

As a retailer, one of the key metrics to watch is inventory. In the retail space, managing inventories is crucial. In the case of WOSG, not so much.

Accounts payable are also an important part of working capital.

Inventory

Inventory represents a significant amount of WOSG’s working capital.

Because the company needs to invest in inventory for the store openings, it is normal to see negative impacts from inventory in the working capital of the company.

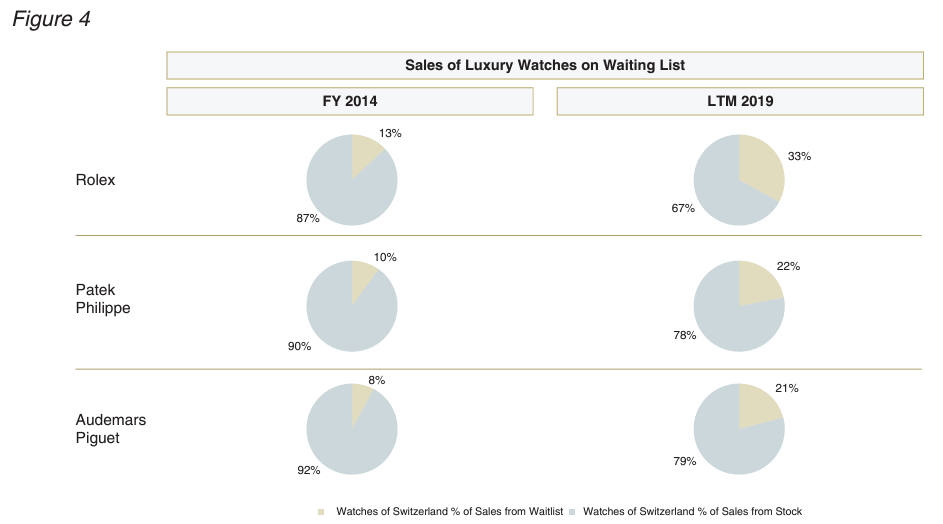

A significant part of revenues are generated from waiting lists, making inventory less reliable metric to measure performance. However, the company is starting to invest more in the inventories to provide a better consumer experience.

During the last decade, more watches were sold directly. However, the pandemic changed this for a while, as consumers were willing to buy the watch immediately. Now, the trend should continue towards a balance between waiting lists and stock.

Last but not least, the inventory of WOSG has limited risk of obsolescence, and the storage is very simple.

For the future years, I’m assuming a lower WC consumption in line with lower openings and a lower sales volume. However, any additional investment in inventory should not have negative implications, given its low risk.

5. FCF

After considering all above explanations of revenue, EBITDA, Capex, and Working capital, and increasing the tax rate to 30%, the FCF of the company is set to grow at very healthy rates.

The company’s definition of FCF excludes expansionary capex. Although this makes sense, because the maintenance capex seems to low to be true (around 0.2% of revenue), a conservative definition of FCF should include these investments for two reasons:

As part of the business, the stores need to be refurbished periodically to remain attractive to clients. Its part of the differentiation strategy of WOSG.

Second, by including them in FCF, the model is much more conservative and will discount these cash flows periodically. If not included, they must be captured in the valuation formula as a negative future adjustment.

For 2025, the FCF of c.£70m is in line with the guidance of the company. The company will generate an EBITDA of ~£180m, with a conversion of 70%, which implies a FCF of ~£126m. After deducting a capex of £70m (guidance is £60-70), we would obtain a FCF of ~£50m, in line with the model’s £57 million.

Note that I’m including full capex in the projections, although the company could probably survive with half of it.

What is the difference between 2026 and current 2025 figures?

The majority of the impact will come from a ~£20 million higher cash flow from operations, mainly driven by:

a) normalization of inventory (this year the company invested more in inventory to enhance customer experience)

b) Normalization of accounts payable

b) Improvement in EBITDA metric based on flat volumes and price increases

Cash Flow Operations

Cash Flow from Operations is set to continue increasing during the coming years. This is partly due to a continuing improvements of the top line.

In the working capital, I’m assuming lower WC consumption in the future, partly due to the fact that the company is opening less stores. I might be wrong, but I tried to tide the WC with my conservative EBITDA projections.

For interest payments, I’m assuming constant gross debt and all cash flow generated is held as cash and cash equivalents earning a modest 0.75% in the long run, down from 1.75% estimated for 2025.

Tax rate is maintained at 30% throughout the period.

6. Balance Sheet

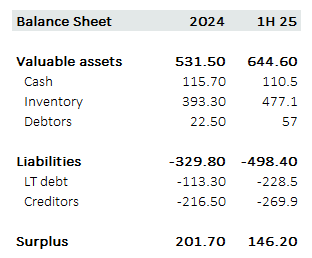

The company has made several acquisitions during the last years, but maintains a solid balance sheet, with low leverage.

Capital structure

The company has low fixed assets, and these are made of PPE (mainly the refurbishments made in the stores, as the company doesn’t own their showrooms), and intangible assets (mainly goodwill from prior acquisitions).

Its a relatively asset-light business, as the showrooms are leased, and the only main asset the company owns is inventory.

Inventory is higher than their current liabilities, but is not a 100% liquid inventory.

The current inventory metric of £477 million, plus the cash of £110m compares to a market cap of £1.2 billion, which means that nearly half of the market cap is supported by inventory and cash.

A solid balance sheet:

The company has more than £600 million in semi-liquid assets, and no owned stores or offices.

On the liabilities side, the company owes ~£500 million, which provides a cushion of ~£150 million

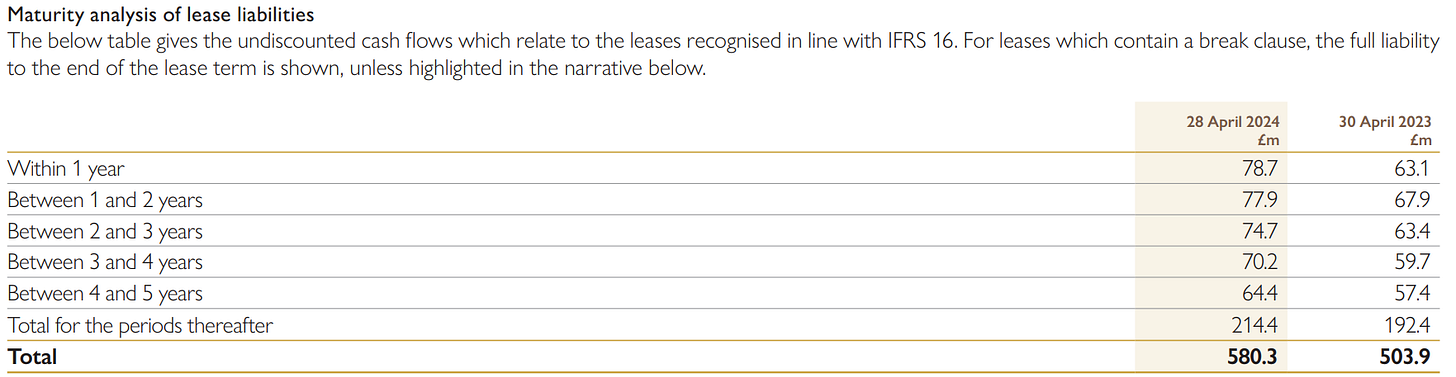

(figures excluding lease liabilities which are considered as an expense)Given that the showrooms are leased, it is important to have a high average lease term, to avoid any risk of termination of the leases.

From the £580m of lease liabilities, 40% have a lease term above 5 years, while a smaller fraction (13%), are set to terminate within one year. Its normal to see an important fraction between 1-5 years, as commercial leases might not be higher than 5-7 years.

In any case, WOSG as tenant has a very high quality, given its profitability and low leverage, making them a very sustainable alternative for landlords.

Leverage

The leverage of the company is relatively low. Currently, leverage will stand at 0.4x pre-IFRS16, and 2.3x post IFRS 16. It has been impacted by the acquisition of Roberto Coin and Hodinkee.

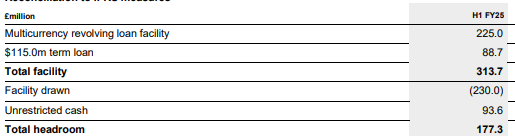

I consider the leverage relatively low as the company has only ~£70 million of net debt (excluding leases), and they can generate £100 million in FCF if they decided not to invest in expanding.Liquidity

Liquidity remains strong as the debt maturities should not be a problem in the mid-term.

The company has £230 million gross debt and £180 million of available liquidity:

From the available £225 million of revolving loan, the company has used ~£130 million

The $115m (c.£95m) term loan expires in February 2026, which compares to a cash position of £95 million (£110m - ~£15m of restricted cash), and available ~£95 million of the revolving facility

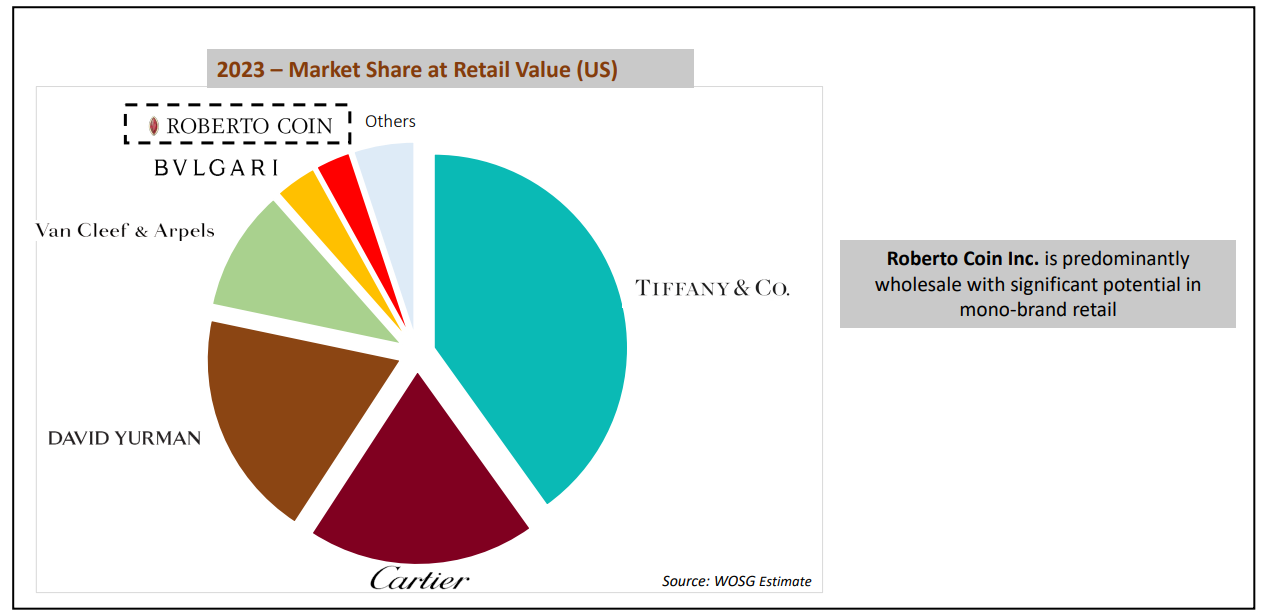

Part IV: Roberto Coin

In May 2024, the company acquired Roberto Coin’s wholesale operations in the US. This came as a surprise, as its a different segment than what WOSG used to operate.

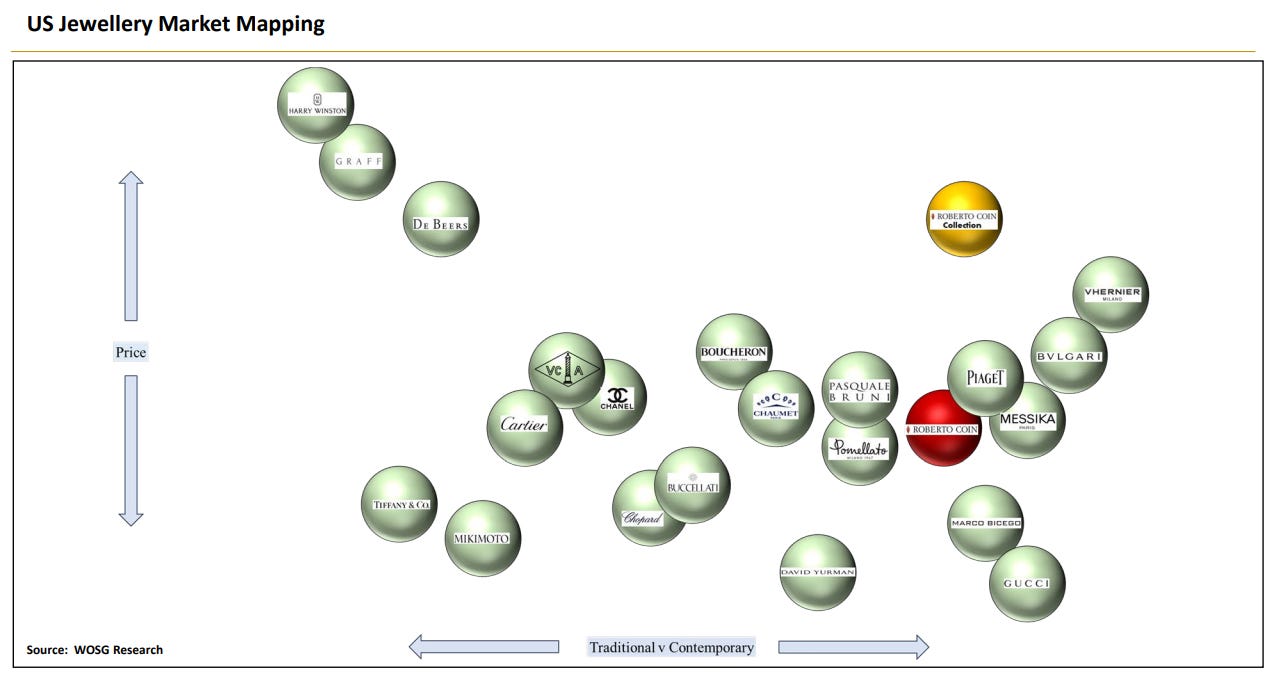

The company acquired these operations at a very attractive valuation. They paid a total consideration of $130 million for a company that generates $140 million revenues and a pre-tax profit of $30 million. The implied P/E was around 6x.

The company believes that there is a strong opportunity in branded jewellery. The major brands are capturing more market share, and WOSG wants to be part of it.

To put some perspective, Roberto coin has a similar price range to Cartier, Pomellato, Chaumet, etc., although less brand power.

I personally didn’t know Roberto Coin at the time of the acquisition, but I’m not an expert in jewellery.

According to the presentation held the day of announcement, the retail value of Roberto Coin might not be far from Bulgari’s.

Management is envisaging synergies through:

Opening mono-brand boutiques - Owned and franchised with wholesale partners

Develop online direct and with existing partners

Enhance in-store presentation

Expand and elevate brand in WOSG distribution

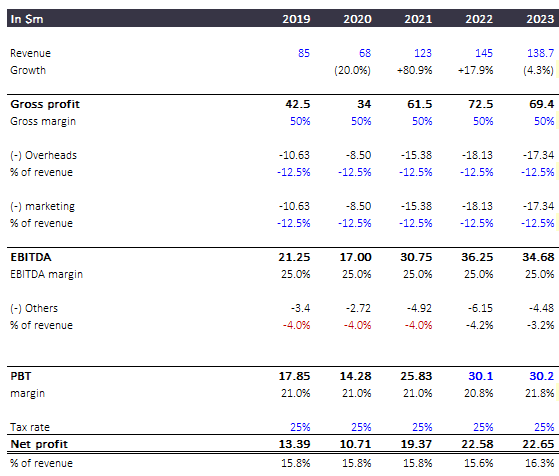

In my model, I’m considering the $130 million paid as the current valuation (£105 million). Although I’m certain that in a in 5-year period the management will deliver synergies, I continue to be conservative.I estimated the historical P&L was as follows:

Given its a wholesale business, the cash flow should be significantly lower than net profit, affected by inventory management.

To be honest, I’m not 100% convinced that this acquisition was the right step, as I would prefer to continue growing the core business.

However, the company was acquired at very attractive valuation, which should be north 10x cash flow (6x P/E), and should deliver positive returns.Part V: Conclusions

After carefully reviewing the financials of the company and the future prospects, I strongly believe its a great opportunity. After the decline of the share price, I bought more shares and now its the largest position in the portfolio.

I’ve been very conservative, but I believe that in 2-3 years there is upside in the projections I made, as I’m not forecasting any volume growth.

The recent rate cuts will probably boost part of the financial activity and governments will continue to increase the money supply. The watch market will probably face some lag before it recovers, but I believe it will recover.

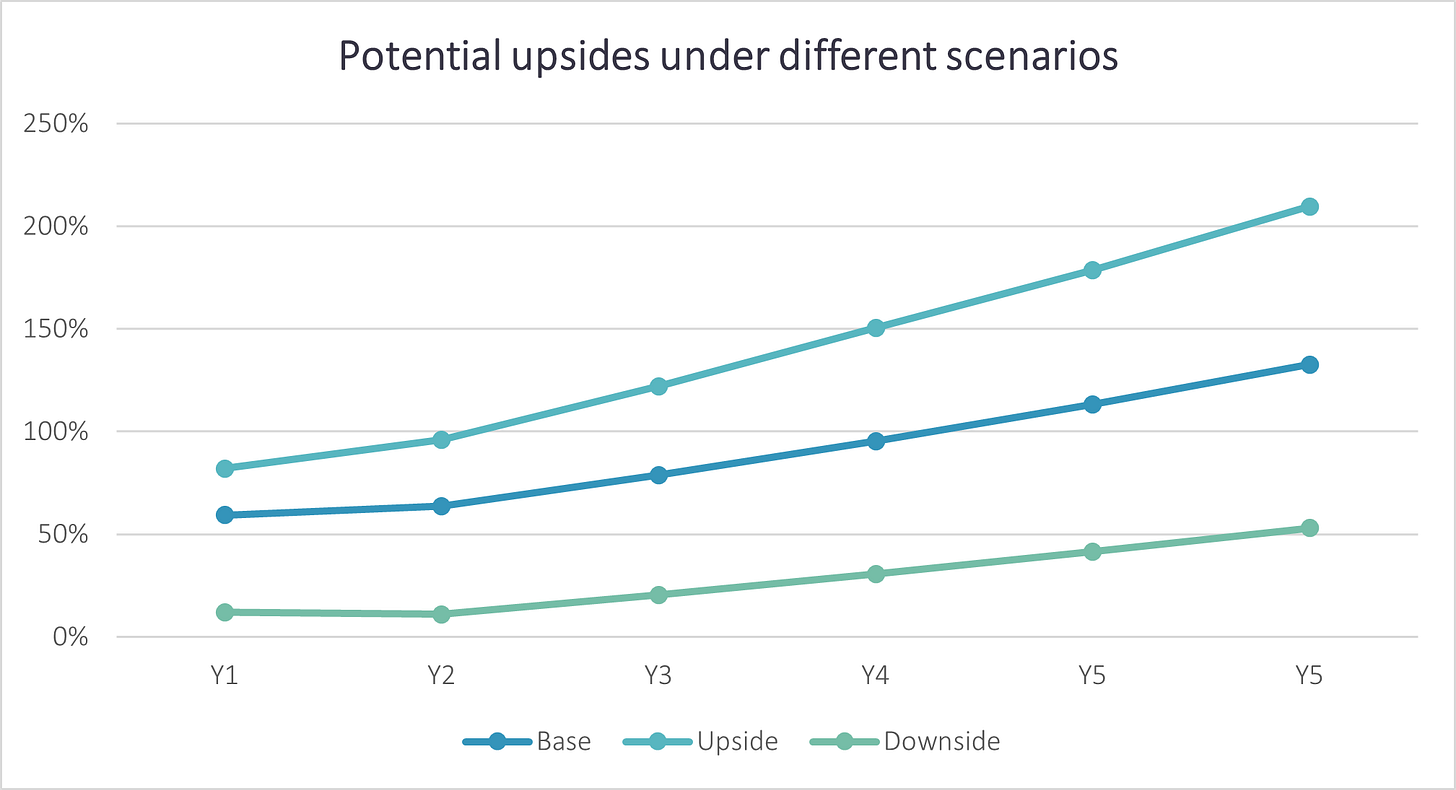

If volumes don’t recover, the company is able to increase FCF at a 5-10% annually, which added to the current 10% FCF yield, will provide very attractive returns.

WOSG has always been volatile, and it will certainly be slightly difficult to have the largest position in the portfolio in such a volatile stock.

However, as I always said, I don’t invest to beat the index every quarter, but rather to manage my wealth, enjoy the process, and obviously, try to achieve strong results. This is a long-term play.

Last, I see some potential measures to bring out the value of the company:

Buyback some of the stock: the company could maintain current leverage and dedicate the excess cash of ~£50m to buyback 5% of the company. It will also provide some stabilization of the share price

The company trades around £2.5m every day. Assuming a 20% of the average daily traded volume (ADTV), the company can buyback a significant amount of the company is just a few months

Consider a listing in the US to attract capital from the US, now that more than half of the sales are located in the country

Thank you for reading the report

European Value Investor

Ps. These will be the current scenarios I will be considering (but again, this is illustrative and is not investment recommendation).

Thank you for reading the report. Please leave a comment if you have any questions or comments. I will be happy to discuss it!

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Thanks for reading The European Investor! Subscribe for free to receive new posts and support my work.

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

End notes

Source: Swiss Watch Federation - https://www.fhs.swiss/eng/statistics.html

Source: https://newsroom.rolex.com/about-rolex/rolex-acquires-bucherer

Source: https://monochrome-watches.com/news-2025-rolex-price-list-2024-2025-increase-year-to-date-minimal-evolution-steel-models-massive-increase-gold-watches/

Source: WOSG IPO Prospectus page 20: “Rolex watches represented 45.0 per cent. and 50.6 per cent. of its total revenue in FY 2018 and Nine Months FP 2019, respectively”

Source: WOSG IPO Prospectus page 117: “Rolex was ranked first in the U.K. and U.S. luxury watch markets. The Group’s U.K. average selling price of a Rolex watch in LTM 2019 was £8,556;”

Source: Annual Report 2024 WOSG

Source: https://millenarywatches.com/how-many-rolex-authorized-retailers-in-use/?utm_source=chatgpt.com

Source: https://www.investing.com/news/stock-market-news/barclays-says-rolex-price-hikes-boost-watches-of-switzerland-despite-resale-dip-3795332

Source: Annual Report

Source: UK Gov Companies House

Very detailed and good analysis.

Really good analysis!! 🙌👏