Watches of Switzerland Group

A value company in the luxury watch sector

Watches of Switzerland Group: Investment thesis

Disclaimer. Please read full disclaimer at the end:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Index

Introduction to WOSG

The luxury watch sector

Competitive advantages

The Rolex issue

Financials and expansion plan

Valuation

Investment thesis conclusions

1. Introduction to WOSG

Name of the company: Watches of Switzerland Group

Ticker: WOSG

Market: London Stock Exchange

Country: UK

Reporting currency: British Pound

Watches of Switzerland Group (WOSG) is a UK-based retailer specializing in luxury watches and jewelry. The company holds a prominent position in the luxury watch market in the UK and is currently undergoing significant expansion into the US and Europe.

WOSG offers timepieces from renowned brands such as Rolex, Patek Philippe, Audemars Piguet, Omega, Cartier, and Tag Heuer. With over 190 showrooms across the UK, US, and Europe, they provide a wide range of luxury offerings. They also sell jewelry from its own brands and from others such as Bulgari. Finally, they also offer after sales services like repair and maintenance.

History of WOSG

In 2024, the company celebrates its centenary. Established in 1924 in London, it initially operated as G&M Lane & Co., selling watches via mail order.

During the 1960s, WOSG began cultivating partnerships with prestigious Swiss watchmakers, notably Patek Philippe. This historical trajectory underscores the company's investment thesis, rooted in its enduring relationships with esteemed brands.

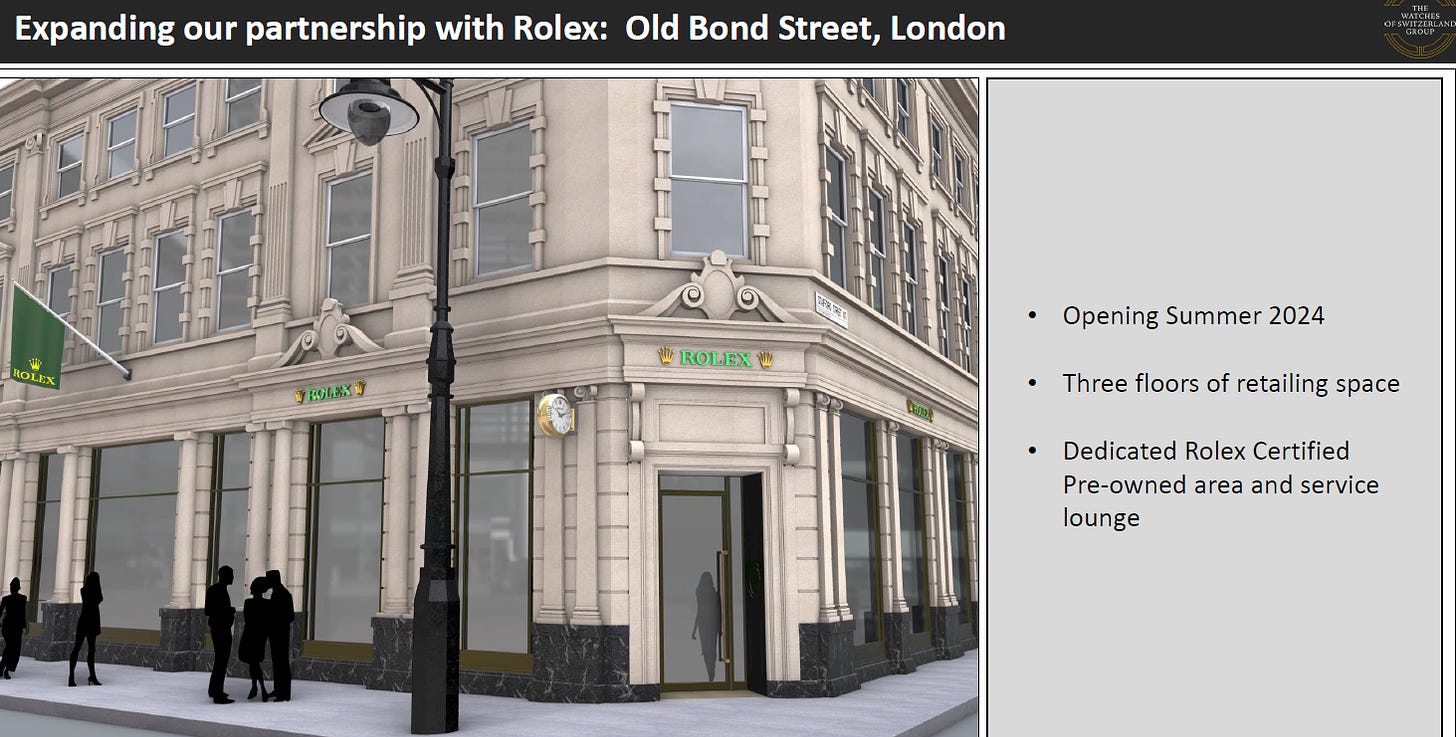

In the 1970s, the company opened one of the world's first mono-boutiques for Rolex. Situated on Bond Street, this store marked the beginning of a legacy. Today, Watches of Switzerland operates seven Rolex mono-boutiques across the UK and US.

During the late 1990s and early 2000s, Watches of Switzerland underwent significant strategic developments, notably acquiring Mappin & Webb and Goldsmiths, two prominent jewelry retailers in the UK. These acquisitions solidified Watches of Switzerland's standing as a premier luxury watch and jewelry retailer in the UK.

Mappin & Webb, founded in 1775, initially specialized in crafting high-quality silverware. Over time, its product range expanded to include fine jewelry, watches, and luxury gifts. The company earned royal warrants and commissions from monarchs worldwide before its acquisition by WOSG in 2008.

Goldsmiths, established in 1778 in Newcastle (UK), expanded its presence throughout the UK, with its stores offering watches and jewelry for centuries. Acquired by WOSG in 2007, Goldsmiths holds a significant place in British jewelry and watch history. The first Goldsmiths store, for instance, remains operational to this day. Mappin & Webb's designation as Crown Jeweller further underscores its prestigious heritage as the custodian of the Crown Jewels and the preparer of state regalia.

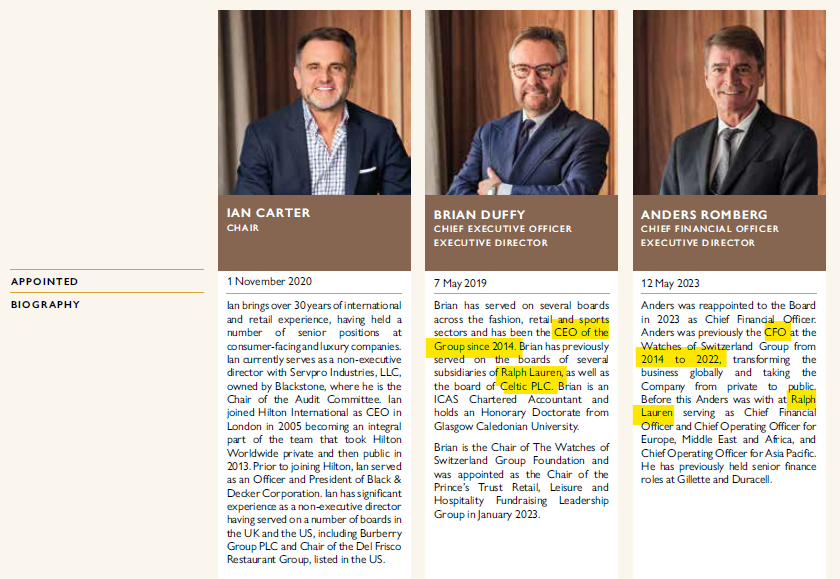

Brian Duffy, the current CEO since 2014, has spearheaded the company's transformation by investing in stores, systems, personnel, and, most importantly, enhancing the luxury experience.

Since 2014, the group has undertaken robust expansion efforts in the US and Europe, investing heavily in creating top-tier showrooms with uncompromising standards.

Expanding its footprint across the US and select European markets has been a strategic focus, both organically and through acquisitions:

2017: Acquisition of Mayors Jewelers, expanding the company's presence in the US with 17 stores across Florida and Georgia.

2018: Opening of stores in Soho and Hudson Yards (NYC).

2019: To commemorate the centenary of its partnership with Rolex, the company went public on the London Stock Exchange in June.

2021: Acquisition of Betteridge to further its US expansion, acquiring stores in Aspen, Greenwich, and Vail.

2022: Commencement of European expansion with the launch of a mono-brand boutique with Breitling in Stockholm, Sweden.

Watches of Switzerland Group Today

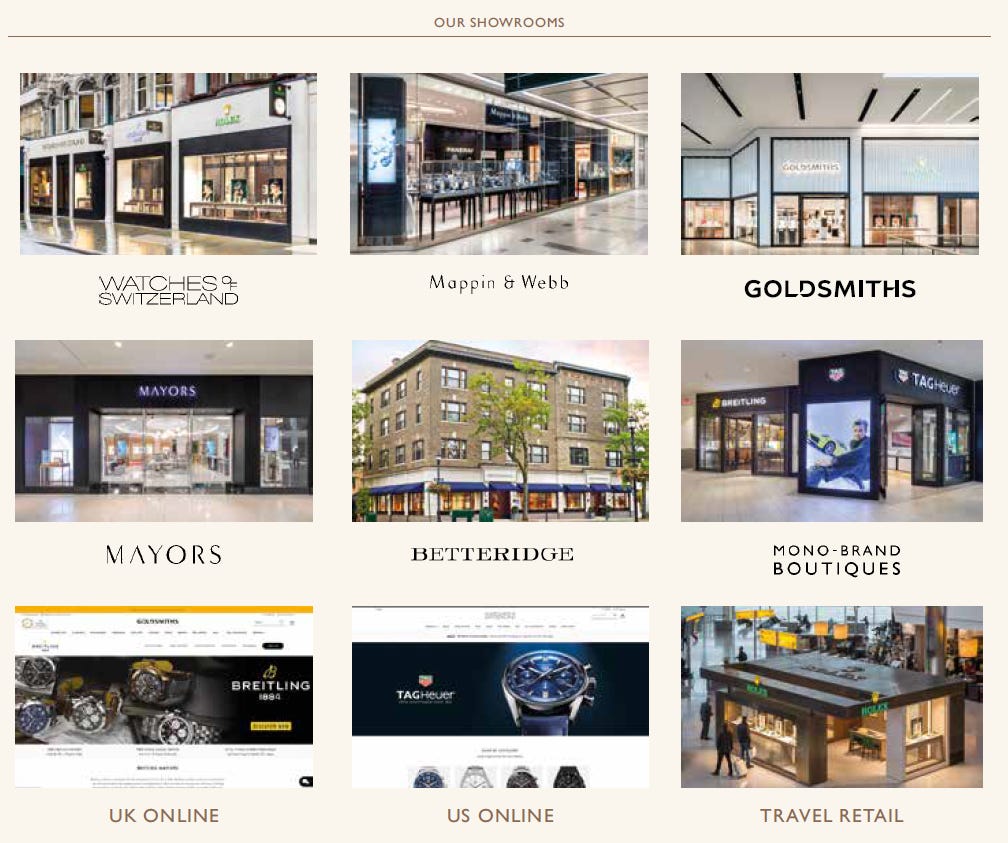

With over 211 showrooms in the UK, US, and select European markets, as well as seven retail websites, the company employs more than 2,800 individuals. It proudly offers the most iconic brands of luxury watches.

The company operates with the historical brands it has acquired over the years, encompassing physical stores and online channels alike.

The company primarily specializes in the sale of luxury watches and jewelry. Luxury watches constitute the most significant category, accounting for 87% of sales, while jewelry follows closely behind at 7%. In addition to its core offerings, the company provides supplementary services, including watch maintenance.

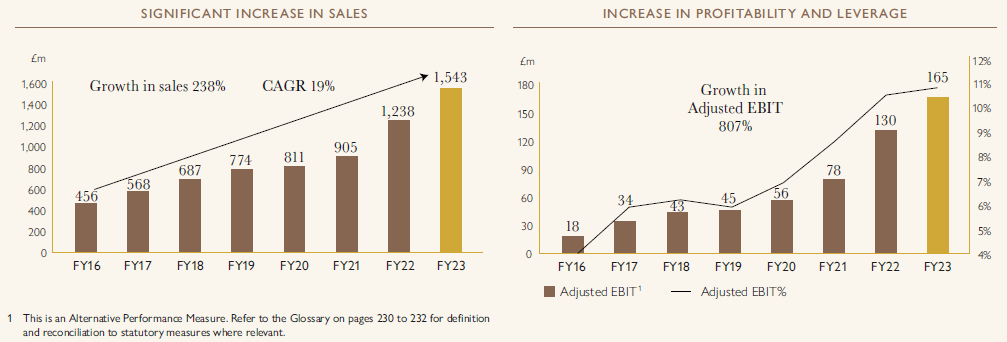

The company has demonstrated exceptional performance, particularly in recent years. Since 2016, revenue has surged from £456 million to £1.543 billion in the fiscal year ending in June 2023.

Furthermore, the company has seen an expansion in margins, which now exceed 10%.

Brand partnerships

The company has a long standing relationship with the most iconic brands of the world. The company sells these brands plus many other brands, from big conglomerates like LVMH or independent companies.

Rolex: The year 2019 marked the 100th anniversary of the partnership between WOSG (through Goldsmiths) and Rolex. Presently, the company operates seven mono-brand boutiques and retails Rolex watches in numerous multi-brand boutiques. Beyond sales, the company collaborates with Rolex on marketing initiatives, events, and media communications. To commemorate the centenary, Rolex introduced a special edition timepiece.

Patek Philippe: WOSG's relationship with Patek Philippe spans over half a century. The company currently retails iconic Patek Philippe watches in the UK and US, offering extensive training programs to ensure employees possess the knowledge and tools to effectively communicate the brand's rich history. Additionally, WOSG partners with Patek Philippe on advertising campaigns.

Audemars Piguet: WOSG has maintained a partnership with Audemars Piguet for over five decades. During the 50th anniversary celebration, Audemars Piguet introduced new color variations of its flagship Royal Oak watch. The company retails Audemars Piguet watches in multi-brand boutiques and operates a mono-brand boutique in Georgia, US.

Omega: Established in the 1950s, WOSG's partnership with Omega extends over several decades. The company retails Omega watches in multi-brand showrooms and operates several mono-brand boutiques across Scotland, Denmark, Sweden, Las Vegas, NYC, Florida, and England. Beyond retail, WOSG collaborates with Omega on digital campaigns and hosts specific events.

Cartier: WOSG's partnership with Cartier spans over 70 years. Today, Cartier watches are available in 15 boutiques in the UK and 11 in the US. Like with other brands, WOSG collaborates closely with Cartier on brand development initiatives.

Tag Heuer: With a partnership lasting over 40 years, WOSG continues to expand the Tag Heuer brand by developing mono-brand boutiques in Europe and the US. The company operates more than ten mono-brand boutiques and collaborates closely with LVMH, Tag Heuer's parent company, on marketing campaigns in the UK and US.

Breitling: WOSG is expanding the Breitling brand with the development of approximately ten mono-brand boutiques in Sweden, Denmark, the UK, and the US. The company collaborates closely with Breitling to ensure each boutique hosts local and regularly scheduled client events. As a testament to their strong relationship, Breitling developed a limited edition timepiece for WOSG in 2020.

TUDOR: Owned by Rolex, TUDOR is managed by WOSG, which currently operates five mono-brand boutiques in the UK and US.

Lastly, the company maintains partnerships with other top luxury brands, albeit without dedicated mono-brand boutiques. While these brands contribute to revenue diversification, it's crucial to emphasize that the most robust partnerships exist with the top five best-selling luxury Swiss brands. Some of these enduring partnerships span decades and remain exceptionally strong, despite lesser collaboration compared to brands like Rolex.

Business model

The company operates what it terms as "showrooms," which are multi-brand stores featuring exclusive corners for some of the brands. Additionally, the company runs mono-brand boutiques for prestigious brands such as Rolex, Omega, or Tag Heuer.

The existence of these mono-brand boutiques underscores the strength of the relationships with these brands and demonstrates their reliance on WOSG to expand their businesses.

Furthermore, the company maintains a presence at Heathrow Airport in London, UK, where it operates three WOS boutiques and three Rolex mono-brand boutiques. These boutiques are meticulously designed to uphold the highest standards, even within an airport setting.

The showrooms are present in some of the most iconic streets of London and NYC and also, in many regional shopping centers in the US and UK.

At this point, one can think that WOSG is a plan vanilla retailer, but its quite the opposite. There are several factors that make WOSG the ideal partner for the luxury watches brands:

The company understands luxury. Contrary to normal retailers, the company not only has developed state-of-the-art boutiques, but also has put strong focus on the client experience. Maintaining the highest standards is critical to offer the best experience and act on the best interest of the brands

Xenia Client Experience Program: WOSG has implemented the Xenia Client Experience Program, setting industry standards by training employees to deliver exceptional client experiences.

Collaborative Marketing and Communications: WOSG collaborates with brands to develop marketing and communication strategies. For instance, they conduct joint training sessions with brands like Patek Philippe to ensure employees possess in-depth knowledge of the brand and its heritage.

Integrated IT Systems: WOSG has integrated IT systems to manage CRM, inventories, and retail operations globally, enhancing efficiency.

Global Capabilities: WOSG is the leading luxury watch retailer in the UK and is initiating consolidation in the fragmented US market while expanding into European capitals.

Close Collaboration with Brands: WOSG collaborates closely with brands to develop marketing campaigns, events, and gain insights into current demand trends.

WOSG adopts a multi-channel approach, operating both multi-brand and mono-brand boutiques, along with ecommerce platforms in the UK and US.

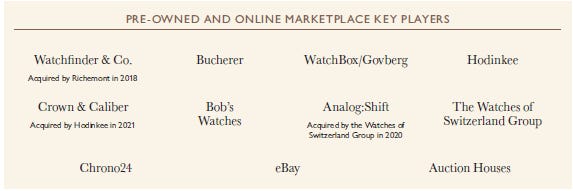

The online market is especially important in the pre-owned watches segment. The company competes against big players like Chrono24 or Watchfinder & Co (acquired by Richemont in 2018).

While online presence is crucial, especially in the pre-owned watches segment, luxury brands like Rolex, Patek Philippe, or Audemars Piguet do not sell online. WOSG maintains a strong positioning in physical stores, emphasizing the importance of physical channels in the luxury market. Other groups like LVMH are continuously opening new stores, a clear sign that luxury relies on physical channels and the internet acts more as a catalog.

To recap, this are some figures that summarize the business model of the company:

193 stores as of April 2023: 146 in the UK and Europe, and 47 in the US.

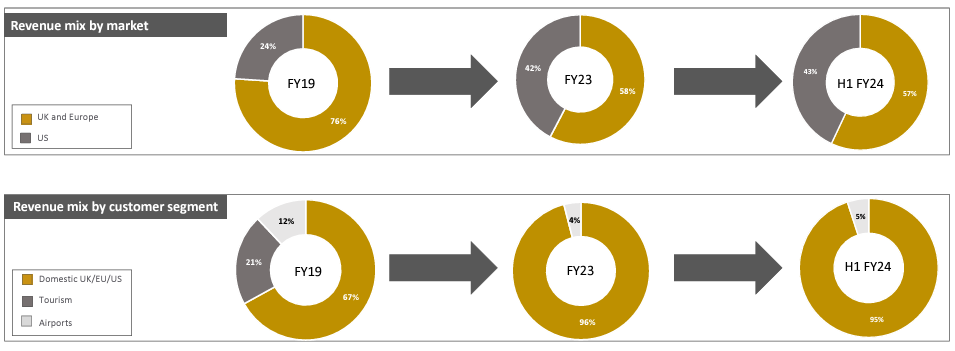

£1,543 million revenue in FY 2023 (ending in april), equivalent to €1,815 million at current FX rates. UK and Europe represent 58%, and the US represents 42% of revenue.

Adjusted EBIT of £163 million (€192 million), with an 11% operating margin.

ROCE of 27.9% (as reported by the company).

These elements encapsulate the robust business model of the company, highlighting its success and strategic positioning in the luxury watch retail industry.

The management

These are the three top executives of the firm:

Brian Duffy is the CEO of the company. The has been serving since 2014. He has been responsible for delivering the current expansion of the company. He understands very well the business and the luxury sector. By promoting a huge investment in its stores, the company is creating a very strong ecosystem in the watch and jewelry industry.

He has skin in the game as he has more than £30m in shares (€36m representing 3% of the company’s shares). However, the CFO has only 907 shares as of May 2023 (€4,300), which is a very low amount. He has awarded shares valued at £665,000 as of May 2023.

Remember that luxury is about experience. Its not only price and exclusivity, but also experience. The company is building great stores and more important, they are developing the best-in-class customer service, adapting very well of the brands’ needs. This is what Brian Duffy is doing extremely well.

He is 67 years old, but apparently will continue running the firm. In 2022, the company promoted two key persons, which could possibly be the next leaders of the company:

David Hurley as president for North America and Deputy CEO

Craig Bolton as president for UK

This episode is very interesting and you have the opportunity to listen directly from David Hurley:

“CEO Brian Duffy is an important asset in the WOSG story, a strong communicator and executor, and well valued by investors”, they said. “Although there are no suggestions that Duffy may imminently leave, we think a succession plan is appreciated in this case. Hurley has been effective at establishing the WOSG brand in the US and has also driven a confident acquisition strategy and we expect him to continue to build a more prominent external facing role. In addition, we think the role of 'North America' may imply entry into Canada at some point”. Jefferies analyst1

The remuneration of the CEO is based on (CFO is similar, but a little bit lower):

Annual salary of £500K

Variable bonus up to 150% of the salary, based on adjusted EBIT, with several thresholds (20%-50%-100%)

LTIP (Long-term incentive plan), based on:

80% cumulative EPS

20% ROCE

The target was not very challenging as it was set in 2020 and management have earned 100% of the shares

2. The luxury watch sector

In this section, we will review the luxury watch sector. Its a high level analysis. I expect to write a post on the luxury market in the future, as I’m doing a deep research.

Part of the explanation of the dynamics of the sector can be found on the LVMH qualitative assessment

Brief history and characteristics of the luxury sector

The luxury watch industry dates back centuries, with early timepieces crafted by skilled artisans for royalty and nobility. The Swiss watchmaking industry emerged as a leader in the 18th century, with brands like Patek Philippe, Audemars Piguet, and Vacheron Constantin setting the standard for precision and elegance. Throughout the 20th century, technological advancements, marketing strategies, and iconic designs propelled luxury watch brands to global recognition.

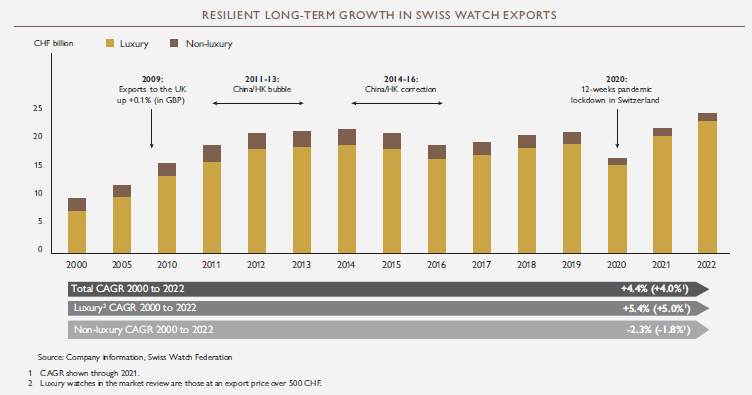

Today, Swiss watchmakers dominate the luxury watch sector. Its a sector with very high barriers to entry, that has grown steadily over the last two decades at CAGRs of +4-5% explained by an increase in volume and steady price increases.

Swiss luxury watches represent several key values that have become synonymous with the industry over time2:

Precision and Quality Craftsmanship: Swiss watches are renowned for their precision and high-quality craftsmanship. They are often made with intricate mechanical movements that are meticulously assembled by skilled artisans.

Heritage and Tradition: They take pride in their heritage and traditional craftsmanship techniques and most of them have been existing for centuries.

Innovation and Technology: While rooted in tradition, Swiss luxury watchmakers also embrace innovation and technological advancements by incorporating new materials, aesthetics, etc.

Elegance and Sophistication: From classic dress watches to sporty timepieces, Swiss brands often prioritize timeless elegance and refined aesthetics, making their watches coveted symbols of style and status.

Exclusivity and Prestige: Swiss luxury watches are often associated with exclusivity and prestige (limited editions, collectors all over the world, etc.)

Reliability and Longevity: They are often built to last for generations

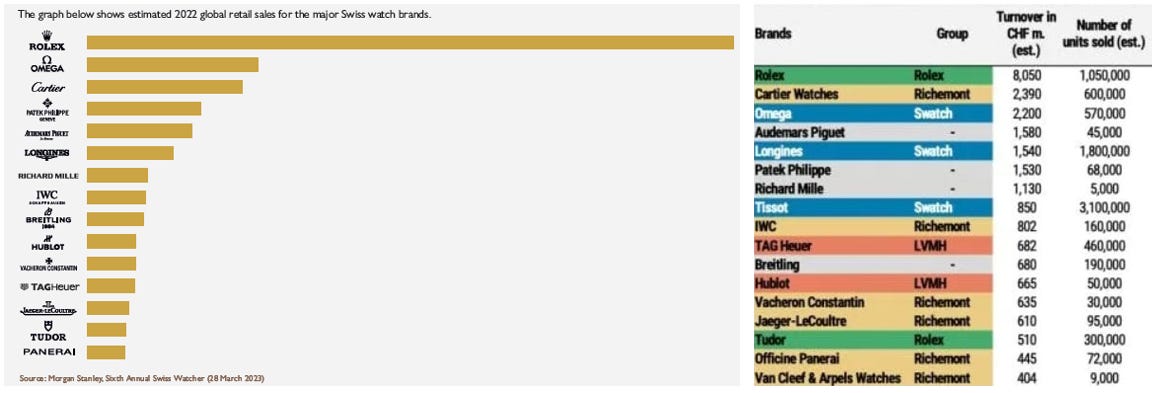

The global luxury watchmakers

There are three types of players:

Major independents: Rolex, Patek Philippe, Audemars Piguet, Breitling and Tudor (from Rolex)

Big conglomerates: Swatch Group (Omega, Longines), Richemont (Cartier, IWC, Panerai, etc.) and LVMH (Tag Heuer, Hublot, and Zenith)

Small independent firms: small players that are not part of big conglomerates

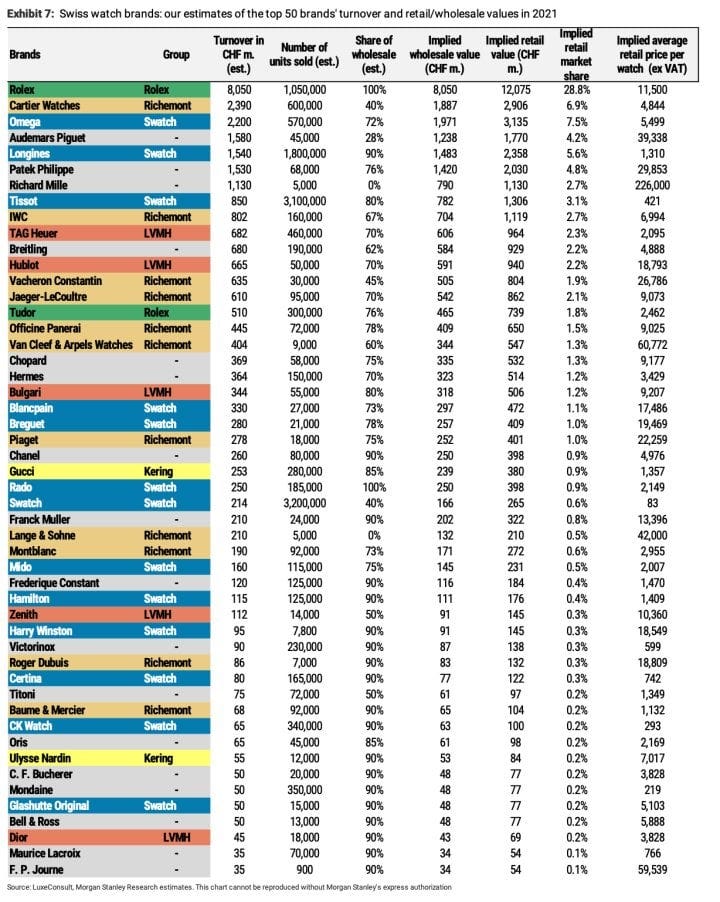

Rolex dominates the market as the largest brand in terms of turnover, followed by Omega and Cartier, all of which are major manufacturers in the luxury watch industry. WOSG sells watches from many of these top brands, leveraging their popularity and market dominance.

According to 2021 data, WOSG's top 17 brands collectively generated more than CHF 18 billion (approximately €20 billion) in sales. The 50 largest brands accounted for around CHF 30 billion (€31 billion) in turnover.

Estimates value the overall luxury watch market at approximately €40 billion. Despite the market's highly fragmented nature and WOSG's absence in Asia, the company achieves sales of over €1.5 billion in luxury watches, indicating its significant share of the market.

The luxury watch industry

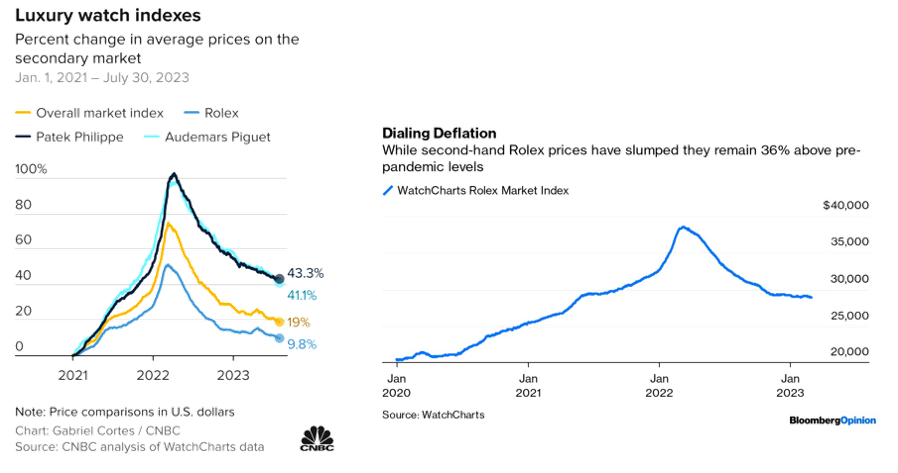

It is perceived that the luxury industry is anti cyclical (i.e., is not affected by economic downturns). The chart below illustrates how this statement is incorrect. The watch industry has its own cycle with a clear positive trend.

It's possible that we are entering a downturn similar to the period of 2015-2017, but forecasting macro or demand trends is deemed irrelevant to the investment thesis.

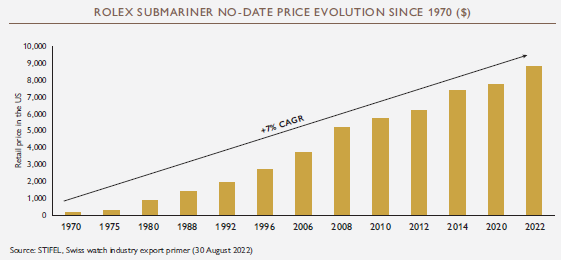

What's crucial to grasp is that this market primarily grows through price increases, as watchmakers strictly control supply to maintain scarcity and enhance brand desirability. While prices have certainly risen over the past decade, it's the pricing strategy that largely drives the luxury sector.

If companies are unable to implement annual price increases, it may indicate that they do not truly operate as luxury firms. Presently, the average price of the top 10 luxury brands falls within the range of €2,500 to €38,000. WOSG holds the distinction of selling the two most expensive brands (Patek and Audemars), alongside the largest luxury brand, Rolex.

The reliance on physical stores

As discussed earlier, luxury watch brands like Rolex, Patek Philippe, or Audemars Piguet refrain from selling online. This decision is grounded in two factors:

Control over Distribution Network: These companies exclusively sell through authorized retailers to maintain control over their distribution network. This ensures that their watches are presented and sold in environments that uphold their brand image and values.

Personalized Experience: Physical stores enable brands to provide personalized services and expertise to customers, an aspect that cannot be replicated online.

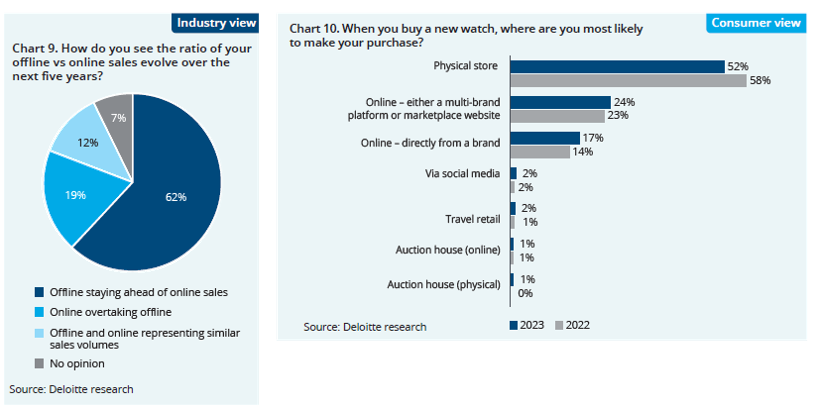

According to a recent survey by Deloitte, 62% of industry executives believe that offline channels will continue to dominate over online channels3. Only 2 out of 5 executives anticipate online channels overtaking offline ones. From a consumer perspective, 52% prefer to buy from physical stores, while 41% opt for online purchases (either from multi-brand shops or directly from the brand).

The distribution agreements

Distribution is facilitated through exclusive distribution agreements, meaning only authorized retailers can sell products such as Rolex watches. This model is effective due to the presence of a high-quality sales network and the significant after-sales service requirements associated with the products.

Distribution of luxury watches takes place under Selective Distribution Agreements, strict legally binding contracts entered into with brands. These are ordinarily limited by geography and ensure retailers maintain strict presentation standards. Selective Distribution Agreements enable brands to manage the number of points of sale and qualitative criteria on retailer approval. Product presentation and client experience are closely monitored by the brand owners.

Globally, the retail market for luxury watches is fragmented, predominantly comprised of a large volume of small retailers.

Annual report 2023 WOSG

While the current trend leans towards developing own-brand stores, the existing distribution model continues to yield significant success for watchmakers. Rolex, for instance, has attained the top position without establishing its own stores.

This model offers several advantages:

Flexibility: The system is more adaptable than owning stores outright.

Lower Break-even Point: Shared costs among multiple brands result in a lower break-even point for each store, facilitating the development of a widespread network. For Rolex, replicating this network through proprietary stores would require substantial investment, likely in the billions.

Preservation of Brand Image: High standards maintained by companies like WOSG ensure that the exclusive distribution model does not compromise the brand image.

While some companies like Cartier adopt a mixed model of own-brand stores and exclusive distributors like WOSG, the prevailing fear in the market, contributing to the sharp drop in share prices, is that major brands may transition to distributing on their own, potentially displacing companies like WOSG. However, I believe this scenario is unlikely in the short to medium term, as we will discuss in section 4.

The key geographies where WOSG owns stores

The UK and Europe

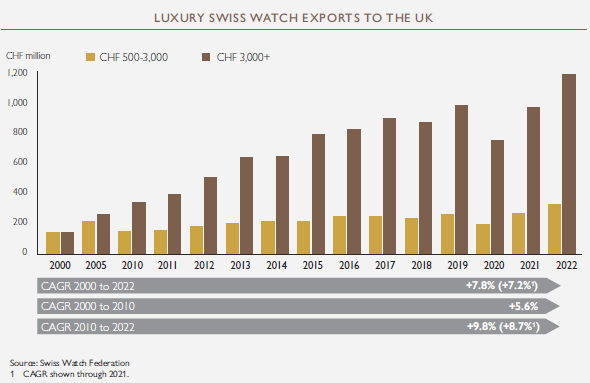

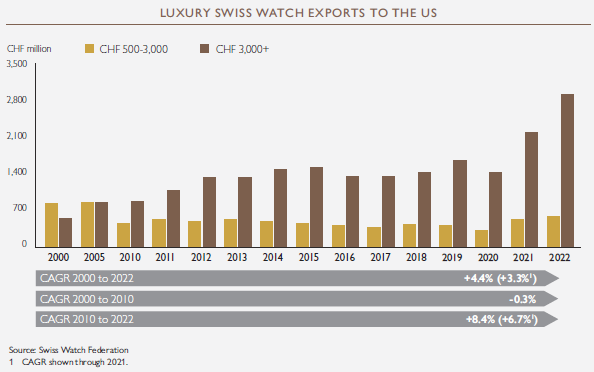

According to the company, the UK is the biggest market in Europe on a per capital spending. The exports of luxury watches in the high-end segment (above €3,000 per watch) have increased by c.6x in the last 20 years.

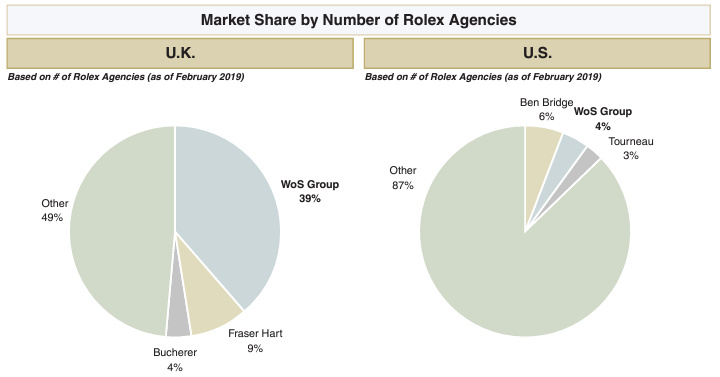

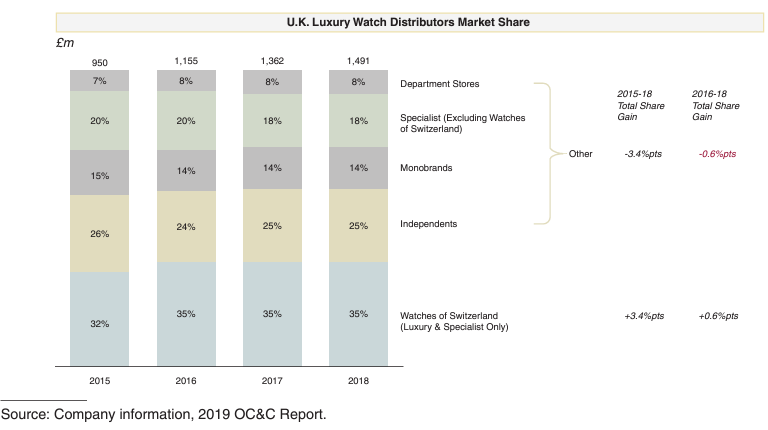

The UK luxury watch market is estimated to be €3.4 billion in size, with the company currently holding a commanding 45% market share. The market is consolidated, with limited threats from new players. Rolex leads the market, supported by other strong brands such as Patek Philippe, Omega, Cartier, Breitling, Tag Heuer, and Tudor.

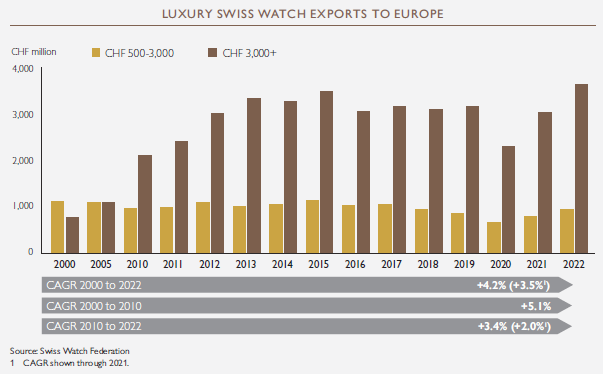

In Europe, the market size is approximately €3.5 billion. Exports have experienced a slowdown since 2015, but in 2022, the market rebounded to 2015 levels. Per capita spending in Europe is lower than in the UK, and prices are harmonized across all regions.

The US

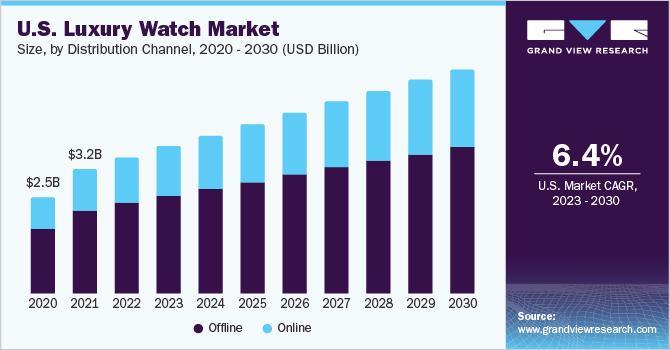

The US is anticipated to outperform the UK and Europe as a lucrative market for luxury watches. Projections suggest that the market will experience growth rates exceeding 5% CAGR (Compound Annual Growth Rate).

The luxury watch market has experienced substantial growth since the onset of the pandemic. Prior to the pandemic, the market was somewhat underinvested. However, in the current landscape, the market has witnessed significant expansion, emerging as the largest market for Swiss watch exports.

Over the past decade, the luxury watch market has grown at a rate of approximately 6.7%, with the current size standing at around €3.1 billion. This figure is approximately 2.5 times larger than the UK market, despite the US having a GDP nine times higher. This indicates a significant opportunity for growth in the US market over the next decade.

The market is highly fragmented, presenting a substantial opportunity for consolidation. In recent years, brands like Rolex and Patek Philippe have begun reducing distribution to a select number of high-quality retailers. This shift presents an opportunity for WOGS, given their commitment to maintaining among the highest industry standards.

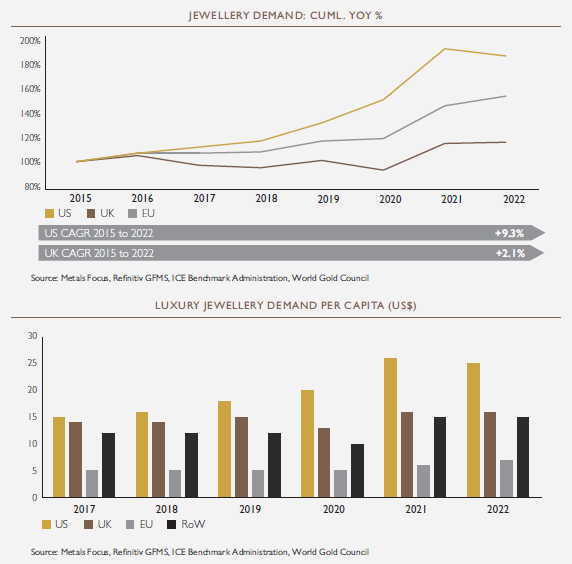

A brief word on luxury jewelry

Luxury jewelry currently contributes 7% to the company's sales, and there is a strategic initiative to expand this segment.

The jewelry market has seen significant growth over the past decade, particularly in the US, while the UK has experienced slower evolution.

Per capita spending on jewelry is highest in the US, followed by the UK, with EU countries lagging behind. Notably, WOSG does not currently sell jewelry in Europe.

The company's goal is to strengthen its presence in the UK market and expand into the lucrative US market, which aligns well with market trends and opportunities.

A brief word on luxury jewelry

Because the market in the US is very fragmented, I’m not publishing a competitors analysis. The biggest players have market shares of 4% or less. In this occasion, we will skip the analysis.

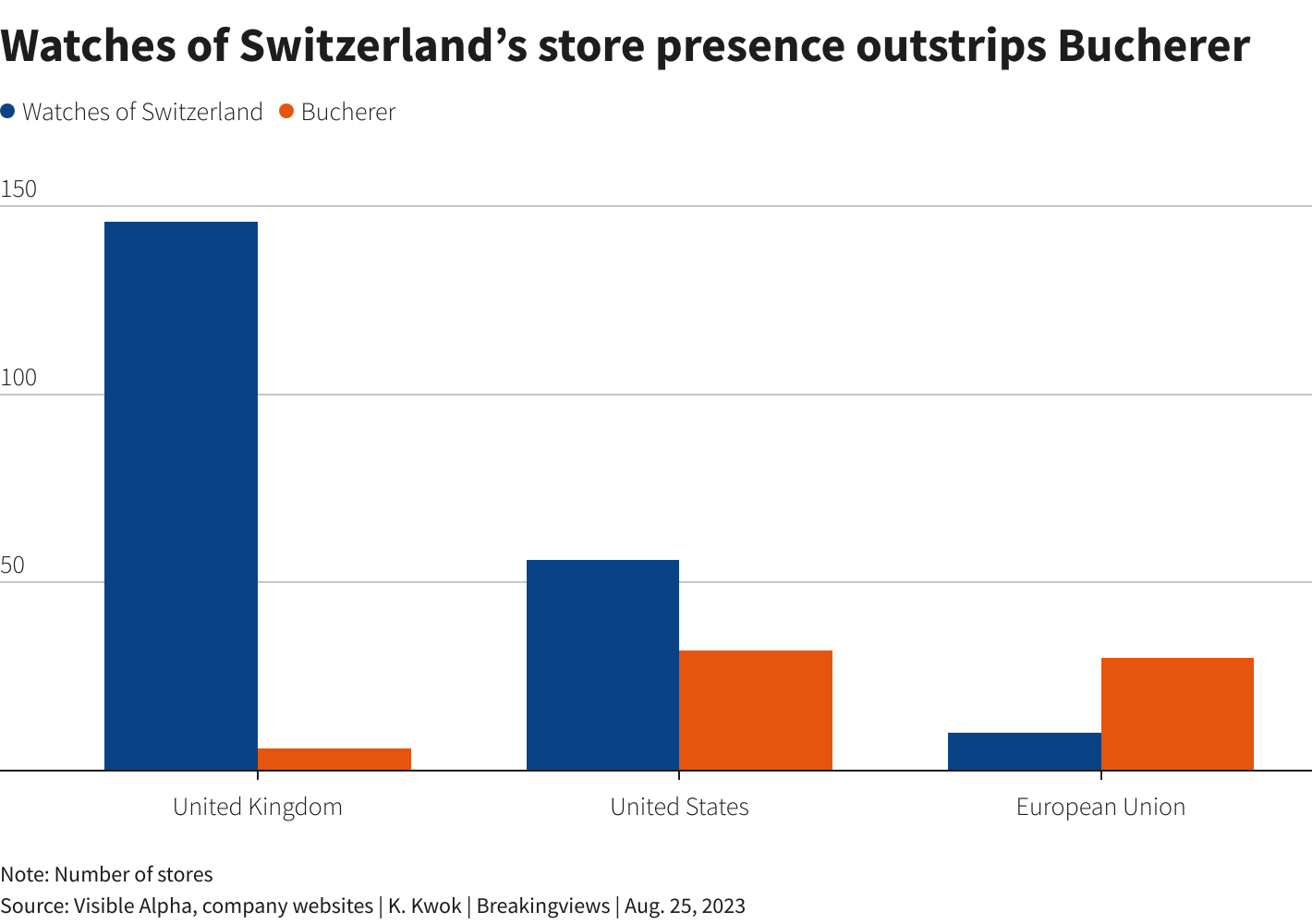

Just keep in mind that Bucherer is a key competitor with a size comparable to WOSG. The remaining are regional or local players.

3. Competitive advantages

High barriers to entry. The brands want to control supply in order to maintain the desire of the brand. Additionally, the supply is limited as the watches can only be sold through authorized retailers.

It seems reasonable to believe that no new competitors will enter the market as i) supply is constrained, ii) brands are starting to develop mono-brand boutiques that only the strongest players can develop and iii) there is a pre-requisite to be an authorized retailer and, because distribution is limited, new competitors will face huge difficulties to receive the approval

Revenue diversification. The company has agreements with a wide range of brands. Rolex represents a significant percentage of the revenue from the company (estimated at 50%). However, the recent developments include multiple mono-brand boutiques from Breitling, Tag Heuer, etc.

The company scale. Both in terms os reach and financial resources. The company is investing heavily to expand its operations in the US and in refurbishing the current stores to offer to their partners the best brand image.

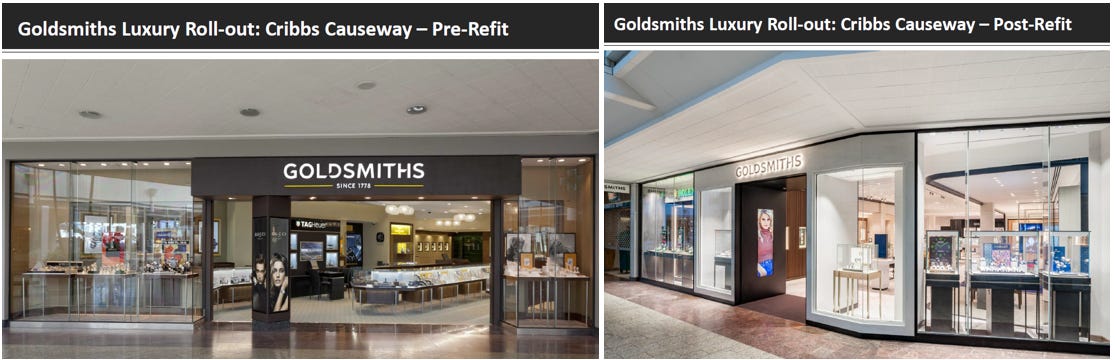

State-of-art boutiques. WOSG is not a typical retailer. They are a true luxury brand as they have developed showrooms with the highest standards that maintain the power of the brands. The company is investing in refitting the old stores to adapt them to the current trends.

Xenia Client Experience Program. This is the name of the training program that the company has in place since 2021. The initiative is based on three pillars: Know Me; WOW Me; Remember Me, and provides the universal standard for all the retail and support services.

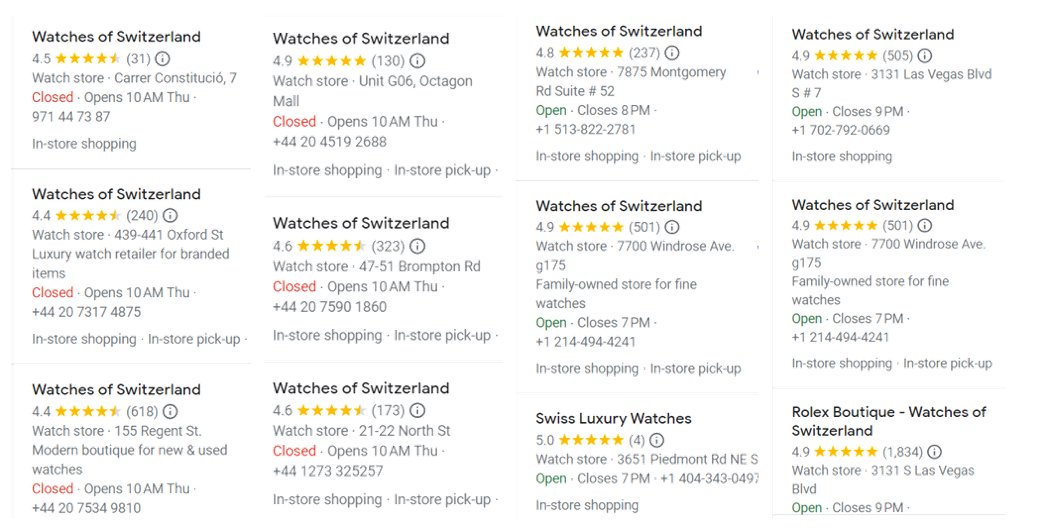

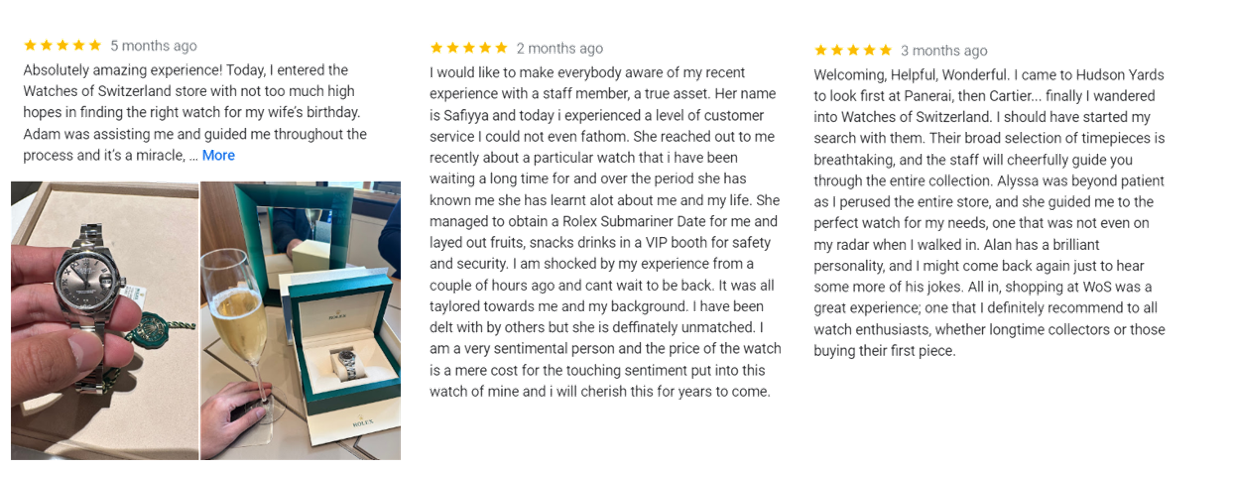

Excellent service. The quality of the service provided is really high. I have search dozens of stores and the all have around 4.5 to 5.0 stars on Google. The excelente service is a reality. Some stores, like the one in Hudson Yards (NYC) have over a thousand reviews and a 4.9 rating. By reading the reviews of the customers, one can see that all of them are sharing positive comments about the excellent service they have received. Even some of the negatives do specify that the treatment is excellent. However, when looking for other stores using the word “Rolex”, the results are different and many stores have ratings below 4.0. I don’t think its coincidence

Main risks of the company

Digital ecosystem. As of today, there is little threat of digital platforms as brands generally require prior showroom approval as a pre-requisite for online selling and, the luxury segment still heavily relying on the physical channels to maintain a unique customer experience that cannot be obtained through online channels.

The smartwatch might reduce consumption from brands like Tag Heuer, as these brands are not real luxury brands. Brands like Tag Heuer are developing smartwatches, which are sold in WOSG stores. It might be complicated to compete against Apple, but any gains in share in this market will benefit WOSG.

The distribution model. We will discuss this point in the next section, but basically will be a transition from distribution agreements to direct sales by the brands. This might happen, but the risk is limited as we will see.

Brand concentration. WOSG is exposed to 8 brands. Rolex could represent 50% of the sales of the Group, leaving c.27% to the remaining brands. Its a really high concentration, but Rolex and WOSG maintain a very solid relationship. Finally, because Rolex is by far the biggest brand, it seems logical that they represent the majority of the sales.

♥️ Short break: if you're liking it, I'd appreciate it if you hit like when you finish and subscribe to receive more theses like this one!

4. The Rolex issue

On August 2023, Rolex made headlines by acquiring Bucherer, one of the largest distributors of Rolex and Tudor brands. This unexpected move had an immediate impact on Watches of Switzerland Group (WOSG) shares, which plummeted nearly 30% on the same day. Investors reacted with apprehension, fearing that Rolex's acquisition of Bucherer might signal a shift towards direct sales from its own stores, potentially undermining WOSG's market position.

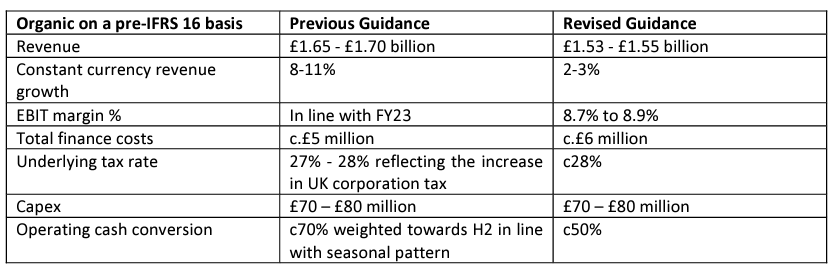

The stock eventually recovered, from £480 in December to £730 in January 2024. However, the stock plummeted in January 2024 due to a profit warning. A profit warning is something you don’t want t see in your portfolio; however, in this case its an overreaction. Part of it is explain by the fears from the Rolex transaction. We will retake the subject in the financial analysis

The acquisition of Bucherer

Bucherer is an independent retailer with c. 100 stores in Europe and the US. It has the biggest network of stores in Switzerland. The company was acquired by Rolex with the following statements (copy paste directly, no changes made):

“To preserve the long-standing partnership between the two companies and perpetuate their shared history, Rolex has decided to acquire Bucherer

Bucherer will keep its name and continue to independently run its business

The fruitful collaboration between Rolex and the other official retailers in its sales network will remain unchanged. “

After the plunge of the share price, WOSG issued a statement, which was reviewed and confirm by Rolex:

In the short-to-medium term, it's evident that Rolex will maintain its partnership with Watches of Switzerland. Looking ahead to the long-term, predictions become more challenging. However, considering the advantages of the current model and the potential challenges associated with transitioning to a fully owned network, I consider the following:

I believe that it is very unlikely that Rolex will terminate the relationship with WOSG. However, its a risk that every investor needs to assess before investing in the company.

Why I believe that Rolex will maintain the current model?

Rolex intends to maintain the autonomy of Bucherer. While it's not unreasonable to consider Rolex testing a direct sales model through Bucherer in the future, the company's public commitment to preserving its existing network suggests continuity for now.

First, WOSG already has a deep network in the UK, with a 50% market share. For Rolex to directly compete with WOSG, it would not only need to terminate their partnership but also establish a new network of stores or pursue market consolidation through mergers and acquisitions. This process is both time-consuming and costly.

WOSG and Bucherer are complimentary:

In the UK, WOSG market share is significantly above Bucherer

In the US, both companies have similar market shares, but different geographies

Bucherer is stronger in Europe (especially in Switzerland, where WOSG is not present)

After the announcement, WOSG and Rolex are developing important projects together. Some of these projects include mono-brand boutiques in the UK and the support of Rolex to the new Strategic Plan 2024-2028

As the largest retailer of Rolex, Watches of Switzerland Group holds a formidable position in the luxury watch market. Should Rolex transition to a direct-to-consumer model, it's unlikely they would initially compete directly against WOSG or terminate their partnership. Instead, they may focus on cities where neither WOSG nor Bucherer has a presence, allowing Rolex to test the direct sales approach without disrupting existing relationships.

WOSG's sustainable model is further bolstered by its strategic focus on underdeveloped areas. While major brands concentrate on prominent cities, WOSG is expanding into regions with high interest but limited luxury watch presence. For instance, if Rolex were to establish its own stores, it would likely target cities like NYC or Miami rather than areas where WOSG is actively developing markets, such as Jacksonville. This proactive approach aligns with WOSG's ongoing discussions with brands to develop these regions, presenting a promising opportunity for growth.

Moreover, the longstanding partnership between WOSG and Rolex, spanning over 100 years, underscores the strength and depth of their relationship. This legacy relationship carries significant weight and contributes to the stability of WOSG's model.

Considering potential synergies, collaboration between Rolex and WOSG could yield mutual benefits. If Rolex tests marketing strategies in its stores, sharing these insights with key partners like WOSG could enhance the group's overall revenue. This collaborative approach leverages the strengths of both parties and fosters a mutually beneficial relationship in the luxury watch market.

What is the current model among the top luxury brands?

As you can see in the table extracted from a search in Google (the author of the table is Morgan Stanley), most of the companies follow a mixed model where wholesale (i.e., retailers like WOSG) have a significant share. Among the top brands that are sold at WOSG:

Rolex sells 100% through wholesale channels

Patek Philippe: 76%

Omega sells 72% through retailers

Tag Heuer: 70%

Breitling: 62%

Audemars Piguet: 28% (AP controls the stores but they also rely on retailers*)

Even big conglomerates rely on wholesale: LVMH around 70-80%, Richemont around 70%, Swatch Group above 70%.

The current model, as widely adopted and deeply embedded in the system, is supported by the available data, affirming the strength of Watches of Switzerland Group's (WOSG) approach. While this dynamic may evolve in the future, it accurately reflects the current landscape according to the research.

*For instance, WOSG's partnership with Audemars Piguet (AP) exemplifies this model. In the case of the Audemars Piguet Manchester Town House, AP will oversee the store while WOSG will handle operations. Subsequently, WOSG will share in the profits generated by the venture. This collaboration underscores the effectiveness of the current business model embraced by WOSG.

What says LVMH about the model?

The business group, which enjoys a strong international presence, has reaped the benefits of its excellent coordination and pooling of administrative, sales and marketing teams. A worldwide network of after‑sale multi‑brand services has been gradually put in place to improve customer satisfaction. LVMH Watches and Jewelry has a territorial organization that covers all European markets, the American continent, northern Asia, Japan, and the Asia-Pacific region. This business group is focusing on the quality and productivity of its retail networks and is also developing its online sales. It selects multi‑brand retailers very carefully and builds partnerships so that retailers become genuine brand ambassadors when interacting with end‑customers. In an equally selective approach, the Maisons also continue to refurbish and open their own directly operated stores in buoyant markets in key cities. The Watches and Jewelry brands’ directly operated store network comprised 865 stores as of year‑end 2022 at prestigious locations in the world’s largest cities. The Watches and Jewelry business group also developed a network of franchises4

My thoughts on why watchmakers will keep the current model

The foremost players in the realm of pure luxury watches tend to be independent entities, prioritizing brand identity and craftsmanship over maximal efficiency or profitability.

A cornerstone of the luxury strategy involves maintaining high demand while restricting supply. Achieving this equilibrium necessitates an extensive network of stores.

However, due to production constraints imposed by these companies, establishing a widespread network of stores may not be feasible for many firms. Only major conglomerates with substantial resources and expertise, such as LVMH and Richemont, can feasibly undertake direct-to-consumer (DTC) sales on a large scale. These conglomerates boast significant financial backing, expansive teams, advanced IT systems, and other resources crucial for managing extensive retail operations.

Consider the production outputs of some prominent luxury watchmakers: Patek Philippe manufactures approximately 60,000 watches per year, Audemars Piguet around 40,000, while Rolex surpasses these figures with an estimated production exceeding 800,000 watches annually.

For companies to transition to a pure DTC model, they would need to either acquire existing retailers or establish their own stores. However, this endeavor presents numerous challenges, including securing desirable locations, negotiating leases, managing a sizable workforce, and developing intricate IT systems. The complexities involved in such an undertaking may outweigh the perceived benefits.

Moreover, Watches of Switzerland Group's strategy of expanding into regions beyond major cities presents an attractive opportunity for luxury brands to increase demand for their products. This approach is more cost-effective and requires less management overhead, allowing brands to concentrate on their craftmanship while leveraging WOSG's established infrastructure.

Do I see risks in the current model?

I certainly think there is a risk. My personal opinion:

It's essential to acknowledge the inherent risks involved, particularly the potential for luxury watch brands to alter their distribution policies. While the possibility exists for brands to shift towards a direct-to-consumer (DTC) model, it's likely that both retail and direct channels will coexist in any new distribution framework.

However, it's crucial to recognize that the market has already factored in this risk, as evidenced by the high valuation assigned to it. While Rolex's move in 2023 may have initially sparked concerns among retailers, the company's public assurances regarding the preservation of existing relationships offer some reassurance.

Taking into account the current data and market conditions, the risk posed by potential changes in distribution policy appears limited. Despite initial apprehensions, the ongoing coexistence of retail and direct channels, coupled with Rolex's stated commitment to its retail partners, suggests that any transition towards a pure DTC model may be gradual and measured.

Investing implies taking risks and I think currently the risk of Rolex to terminate with WOSG is unlikely. This is my opinion. Should you be interested in WOSG, you have to develop your own opinion.

5. Strategic Plan and Financials

5.1 The Strategic Plan 2024-2028

The company unveiled its new Strategic Plan 2024-2028

The plan has set a very ambitious target: double revenues and operating profit. According to the CEO, a significant aspect of the plan is that the top brands support it.

Before continue reading, I suggest to watch this brief interview to Brian Duffy (CEO) where he presents the long-term plan:

Strategic roadmap

To double revenue, the company has established a clear path for growth:

Product: Expand the pre-owned watches market and the brand jewelry

Geographies: Keep expanding in the US and Europe

They plan to invest significant amounts in the 2024-2028 period:

Expansionary capex: £300-350m in the period 24-28 in their stores to increase the space and/or relocations.

M&A: £350-500m in the period 24-28 to expand in the US and Europe.

Pre-owned market

During the pandemic and the subsequent post-pandemic period, the pre-owned luxury watch market witnessed a remarkable increase in value. This surge was driven by supply shortages resulting from restrictions and heightened demand fueled by savings and expansionary policies. Now, valuations are gradually declining towards a more sustainable level. As illustrated in the chart, luxury timepieces have historically increased in value over time, retaining a significant portion of their worth

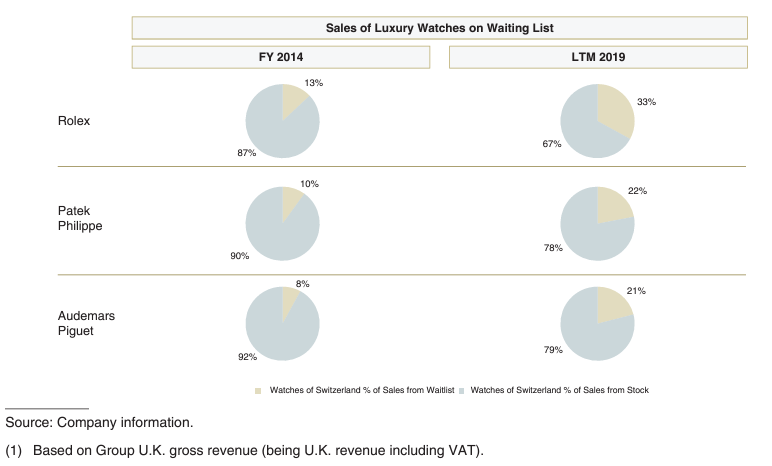

The market is expanding, and luxury watch brands are implementing programs to uphold the highest standards within this growing market. Rolex, for instance, has introduced the Certified Pre-Owned Certificate, through which the company verifies the authenticity of pre-owned watches. This certification provides customers with assurance regarding the originality of the timepiece.

Delivered at the time of sale, the Rolex Certified Pre-Owned guarantee card officially confirms that the watch is genuine on the date of purchase and guarantees its proper functioning for two years from this date in accordance with the guarantee manual.5

This certificate is exclusively available through authorized retailers. Management views it as a substantial growth opportunity and anticipates that Certified Pre-Owned (CPO) sales will comprise 20% of the watch segment by 2028.

Part of the appeal of this pre-owned market is its online accessibility. While brands like Rolex, Patek Philippe, or Audemars Piguet do not sell their timepieces online, the pre-owned market thrives in the digital space.

Rolex's CPO program has already been launched in the UK and the US. The company foresees robust growth in the US, where the pre-owned market is significant. This opportunity is compelling as the pre-owned market sees an increase in supply each year, while consumers seek to bypass long waiting lists for their desired timepieces, driving demand.

However, the company will encounter fierce competition, particularly in the online sphere. Large groups are actively selling pre-owned watches online, competing on a global scale with the capability to deliver products worldwide.

The competitive advantage of WOSG lies in its physical stores. Many customers initially visit the stores intending to purchase a new Rolex but ultimately opt for a pre-owned one due to the desire to avoid waiting lists. Additionally, despite the costliness of the pre-owned market, customers prefer the assurance of inspecting the product for any damages or scratches in person.

While prices in this market are expected to continue increasing, the pace of growth is anticipated to slow compared to previous years. For instance, the price of a Rolex Submariner has only risen by 7% over the last 50 years. Nevertheless, prices are projected to sustain a strong level in the second-hand market.

Ultimately, this business opportunity is expected to have a neutral impact on profitability, aligning with their current business model. The company anticipates implementing the Rolex Certified Pre-Owned (CPO) program in all of their showrooms, which currently stands at 12 locations.

The branded jewelry

The expansion of branded jewelry, such as Bvlgari, represents another growth opportunity for the company. Although this segment currently contributes only a small fraction of revenues (7%), management remains optimistic about its potential.

However, it's worth noting that the impact of this growth lever will be limited initially. Nevertheless, it is crucial for the company to explore and expand in this segment, considering its domination by luxury conglomerates like LVMH (owner of Bulgari and Tiffany) and Richemont (owner of Cartier, Van Cleef, etc.).

This strategy is particularly relevant given that the US ranks as the top country on a per-capita basis, with the UK leading in Europe. While these conglomerates have established a significant presence in major cities worldwide, they have yet to fully develop many regions in the US and UK. WOSG aims to capitalize on this opportunity by expanding into these underdeveloped areas.

Management acknowledges that the current space allocated to brand jewelry in their stores is insufficient and plans to invest in expanding this segment. The goal is to increase the number of jewelry agencies from 115 to 260 by 2028.

Additionally, the company expects to add brands such as Pomellato (owned by Kering) and Fred (owned by LVMH). They believe there is a solid opportunity to collaborate with these brands to develop less-penetrated regions across the US and UK.

Geographical expansion

The US

The management perceives the United States as an underdeveloped market with significant potential for consolidation. They anticipate actively acquiring stores during the period to strengthen their presence in the country, aiming to elevate the US as the most significant region for the group by the end of the plan. Currently, it represents 43% of the company's operations.

In 2019, the Group held the #2 position as a supplier of Rolex and Patek Philippe in the US. Its primary competitor is Tourneau, now owned by Bucherer (acquired by Rolex).

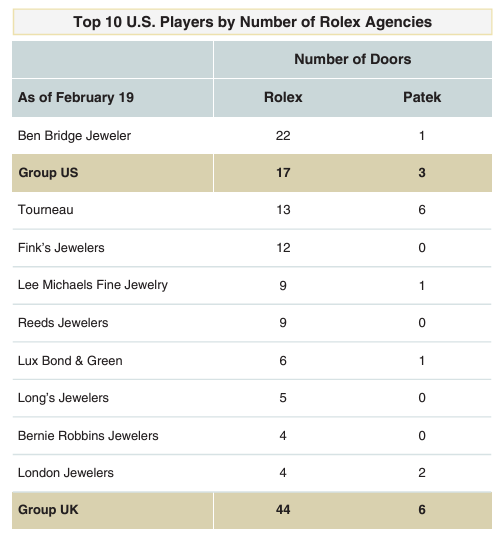

As illustrated in the table below, there is ample opportunity for expansion through inorganic acquisitions, given the relatively small size of existing players. Notably, the largest player, Ben Bridge Jeweler, owned approximately half of WOSG's Rolex agencies in the UK, highlighting the significant market fragmentation in the US.

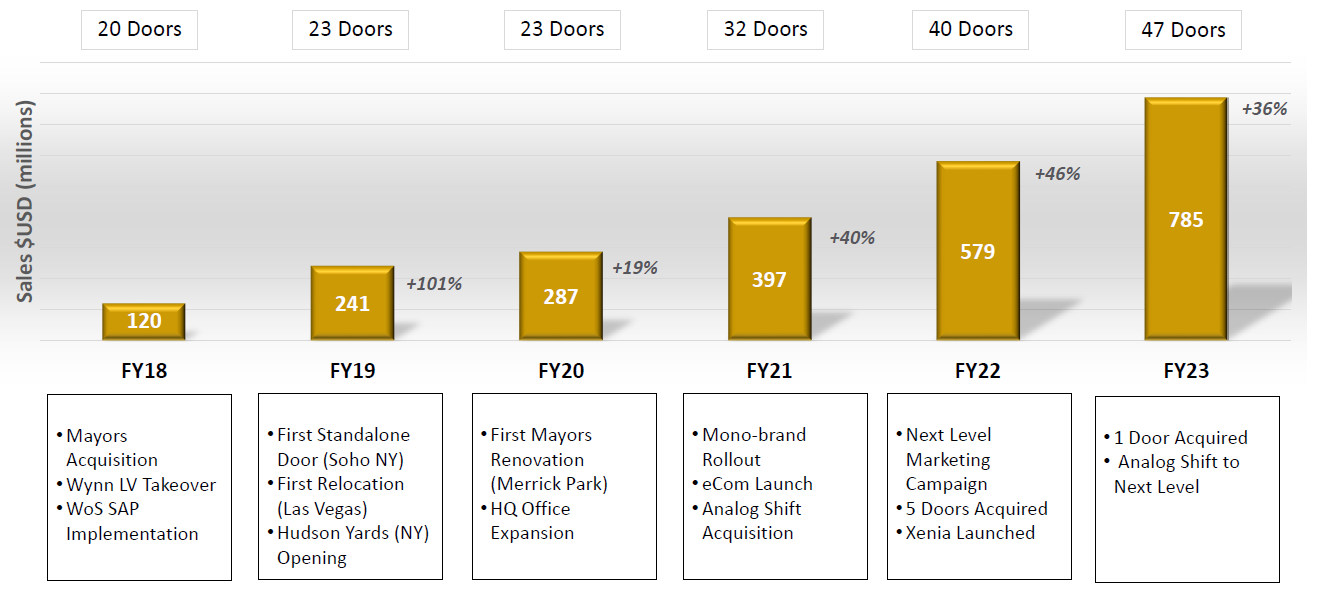

The US has experienced a strong growth since the company entered in 2018:

Finally, the company can even increase it share of Rolex in the US, as market share is highly fragmented:

Europe and UK

The group has recently initiated expansion efforts into European countries, beginning with Scandinavian nations and establishing mono-brand boutiques such as the Breitling mono-brand boutique in Stockholm. This strategy will persist, likely encompassing the addition of multi-brand boutiques as well. For instance, they are entering the Dutch market with a 2,400-square-foot multi-brand boutique offering brands like Omega, Cartier, Breitling, Tudor, Tag Heuer, among others. The objective is for Europe to contribute 4-6% of total revenues by 2028, compared to its current share estimated at c.1%.

In the UK, where the market is more consolidated, growth will be pursued by expanding existing showrooms, introducing new brands, and incorporating offerings such as Rolex pre-owned watches.

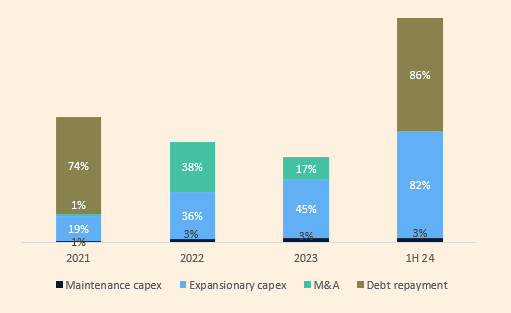

Capital allocation

The group plans to invest £650-850 million during the period from 2024 to 2028. With the company generating approximately £100 million in free cash flow annually (excluding expansionary capital expenditures), borrowing of around £350-500 million will be necessary. Currently debt-free, the company's EBITDA stands at around £200 million, poised for significant growth if the plan is executed successfully.

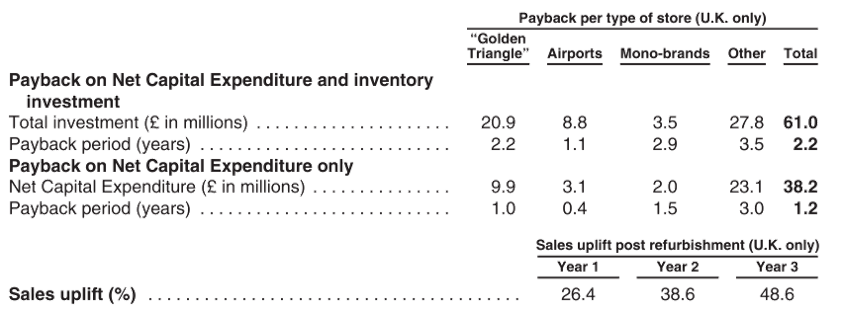

Given the anticipated increase in free cash flow metrics, leveraging the company to expand its operations appears feasible. Management indicates that cash payback periods are expected to be brief, ranging from 2-4 years for expansionary capital expenditures and 4-5 years for M&A activities. Moreover, expectations of decreasing interest rates in the short-to-mid term, particularly in the UK, are anticipated to facilitate favorable financing conditions.

While achieving the target may prove challenging if market conditions remain tough, the company retains flexibility for investments.

Importantly, the company has a track record of creating value through its investments:

Sales uplift on average reaches +48.6% in the third year following the investment.

Payback periods for mono-brand boutiques are less than 3 years, while top stores and other multi-brand outlets range between 1-4 years, demonstrating swift returns for a retailer.

In conclusion, investments by the company yield immediate returns.

5.2 Financials

Currency: GBP million (£)

Fiscal year ending in April

Considering the company's substantial leasing commitments, where all properties are rented, the analysis incorporates leases as an operating expense, consistent with pre-IFRS 16 standards. This primarily affects EBITDA, with no impact on cash flows

5.2.1 Revenue

Since the IPO in 2019, revenue has increased from £774m to an expected £1,530m in 2024E. This implies a CAGR of +14.6%. The growth is driven by:

Increase in volume: mainly due to an increasing number of stores and partly by higher demand in recent years. Store count has increased from 128 in 2019 to 2022 as of January 2024 (CAGR +11.6%)

Increase in average selling price of both watches and jewelry: from 2019 to 2023, average selling price of luxury watches have increased by 40% in the UK and +30% in the US (CAGR of +8.9% and 7.2%, respectively)

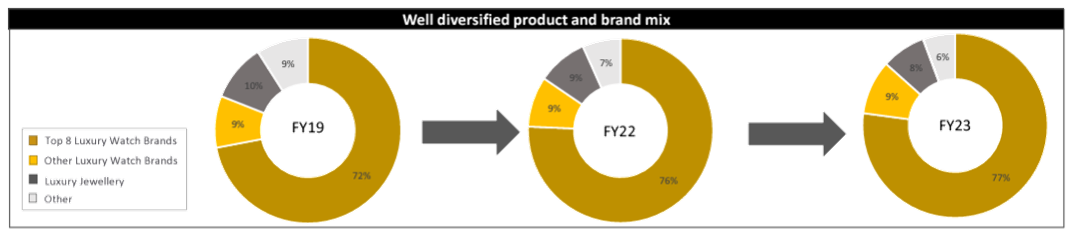

Revenue by product

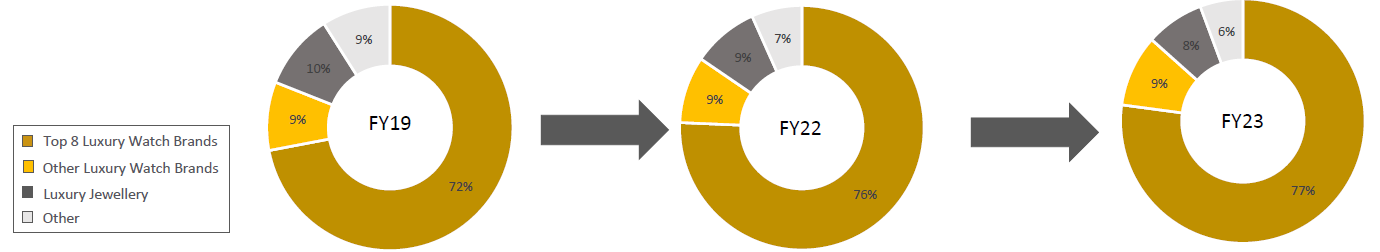

The luxury watch segment constitutes approximately 85% of the total sales, with the top 8 brands collectively representing 77% of this segment. Among these brands, Rolex holds the largest share, estimated at 50% of the revenues, while the remaining 7 brands contribute approximately 27%.

Jewelry accounts for around 10% of the revenues.

The "Other" category, which encompasses services such as repair and maintenance, represents approximately 6% of the revenues.

Revenue by region

UK is the largest region of the Group representing c.55% of the revenues. The company is expanding to Europe, but its weight is very limited at the moment (c.1% or less).

In 2018, the company entered the US market and its share has increased from 24% in 2019 to current 43%.

As depicted in the chart, revenue from tourism and airport sales accounted for nearly a third of the company's revenues in 2019. However, following Brexit, the UK government abolished VAT-free shopping within the UK, meaning tourists could no longer claim VAT refunds on their purchases unless the items were shipped outside the UK.

This change had a substantial impact on WOSG, prompting the company to shift its focus towards domestic customers.

Recent reports from the Guardian6 indicate that the government is reevaluating this measure, with conclusions expected in the spring of 2024. There are indications that the government may reverse this decision, which could have a highly positive impact on WOSG, potentially adding an additional £200-250 million in revenue from tourism.

Several reasons support the potential resumption of tax-free shopping7:

Economic Impact: Studies from the Centre for Economics & Business Research suggest that the removal of tax-free shopping has led to a loss of £10.7 billion in GDP and dissuaded approximately two million tourists annually. The revenue earned from VAT (£2.3 billion) is outweighed by the benefits of reinstating tax-free shopping.

Industry Support: Over 350 business leaders, including prominent figures from British Airways, Marks & Spencer, Heathrow, and Burberry, have signed an open letter to the Chancellor, criticizing the removal of tax-free shopping as a detrimental move.

Political Pressure: MPs from various political parties have joined calls to revoke the "tourist tax," recognizing its negative impact on the UK's competitiveness compared to other European cities.

If the government decides to reinstate tax-free shopping, it could significantly boost WOSG's earnings and profitability. While the effects may not be immediate, such a decision would contribute to increased revenues and cash flows for the company.

5.2.2 EBITDA and margins

Because the company doesn’t have any property and reports EBITDA adjusted after leases, EBITDA is a good measure to evaluate the business.

Adjusted EBITDA has grown from £59.9m in 2019 to £201.4m in 2023, expanding the EBITDA margin from 9.6% to 13.1%.

This metric excludes exceptional items not related to the business like costs associated with business acquisitions and the IPO costs of 2019-2020. On average, the extraordinary items are small (£1.6m and £0.9m in 2022 and 2023 , respectively).

The metric includes the lease expense (both depreciation and interest), being one of the most important expenses of the group

The business main expenses are:

The inventory (62-64% of total sales)

Store costs (mainly rental costs). Represents 18% of the sales

Personnel expenses: 5-6% of revenue

Store openings/closings costs: Typically 0.7-0.8% of the sales

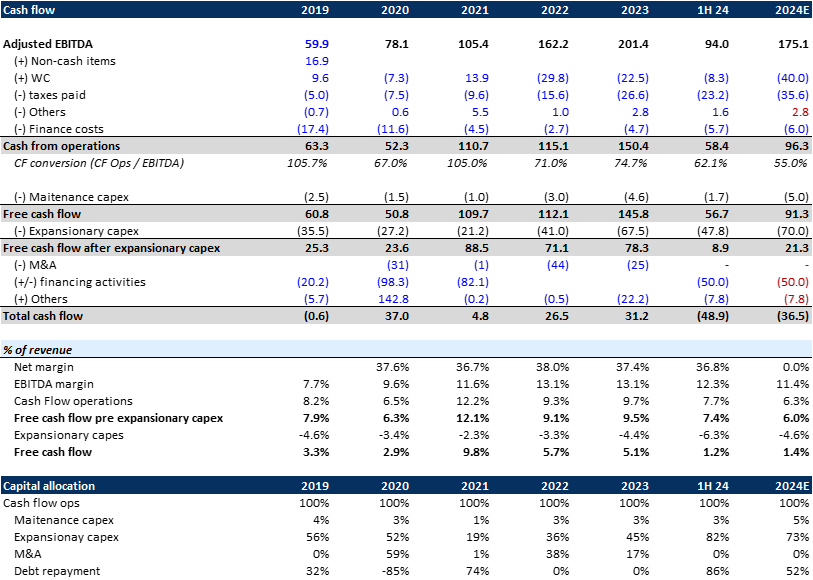

5.2.3 Cash Flow and capital allocation

Since the IPO, the cash flow from operations hace increased from £63.3m to £150.4m, converting in cash nearly 70% of the EBITDA. While the EBITDA has multiplied 3x, CF has multiplied by 2x to 2.5x. As the company gets bigger, the company needs to invest in working capital affecting the cash flow of the company.

For the FCF, there are two calculations that can be done:

FCF pre expansionary capex. The company could stop expanding its stores and revenues will cease to increase at the current rates. Given the maintenance capex is very low (around 3% of sales), FCF will stand at around £100-120m in a normalized environment, which is £0.4-0.6/share (stock trades at £4.2/share)

FCF post expansionary capex. If we consider this capex as something operational, which might make sense, FCF will be around £70-80m under normal conditions, £0.30-0.40/sh (stock trades at £4.2/share)

Capital allocation. for every £100 of cash generated from operations (net of WC, taxes and interest):

£3 are destined for maintenance capex

£50 (on average) are destined to expand the stores

Between £0-60 can be employed in M&A

The company repays debt if necessary

Except for current 1H 24 results, the company generates positive cash flows (cumulative since IPO £50m, which might sound little, but the company has invested £102m in acquiring companies and £240m in expanding their stores).

5.2.4 Other metrics and Balance Sheet

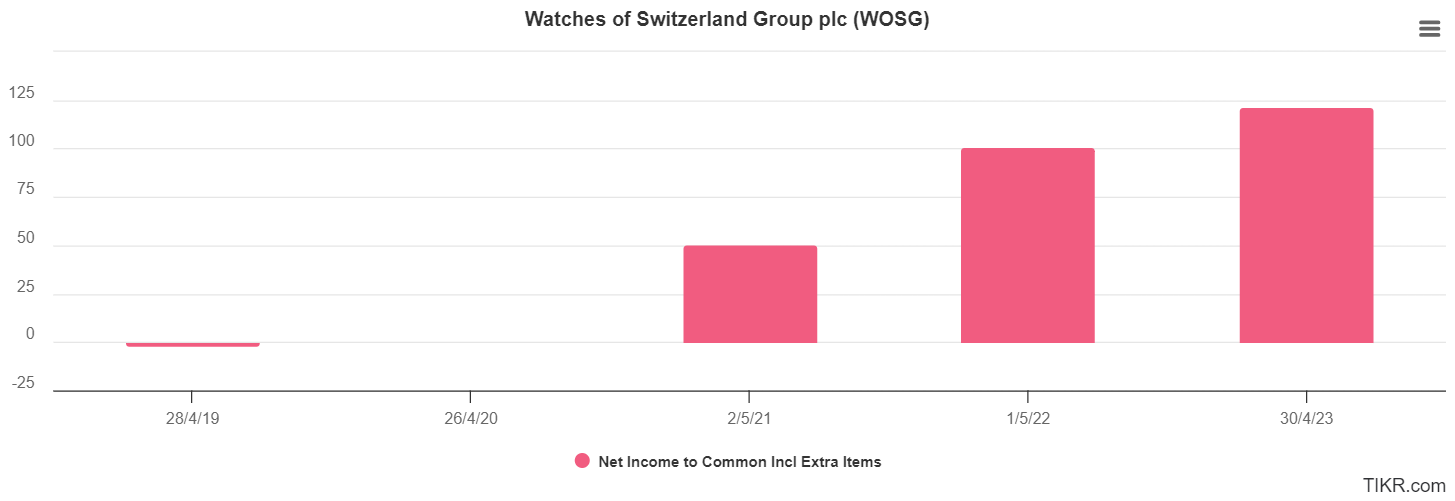

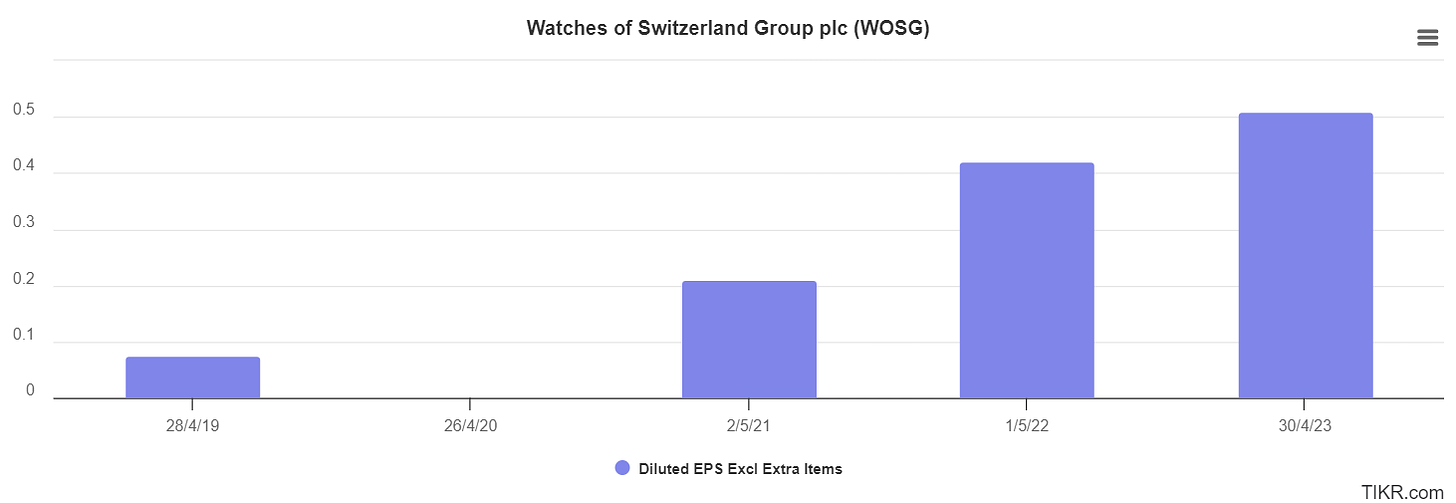

Since the IPO, the net profit has significantly increased to more than £100m, implying an EPS of £0.51.

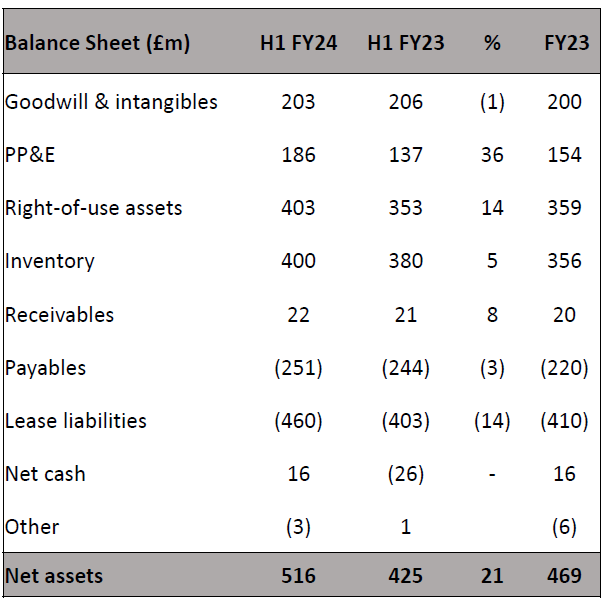

The company has a solid balance sheet, with net cash of £16m (as of October 2023). Including leases, the net debt will be £444m, which could imply a leverage ratio of c.1.5x. However, the key element is that the company has no debt, which is a strong starting point as the company plans to acquire several companies in the following years.

Inventory of £400m, represents 40% of the market cap.

6. Valuation

As of February 16, 2024, the stock trades at £423.6p per share:

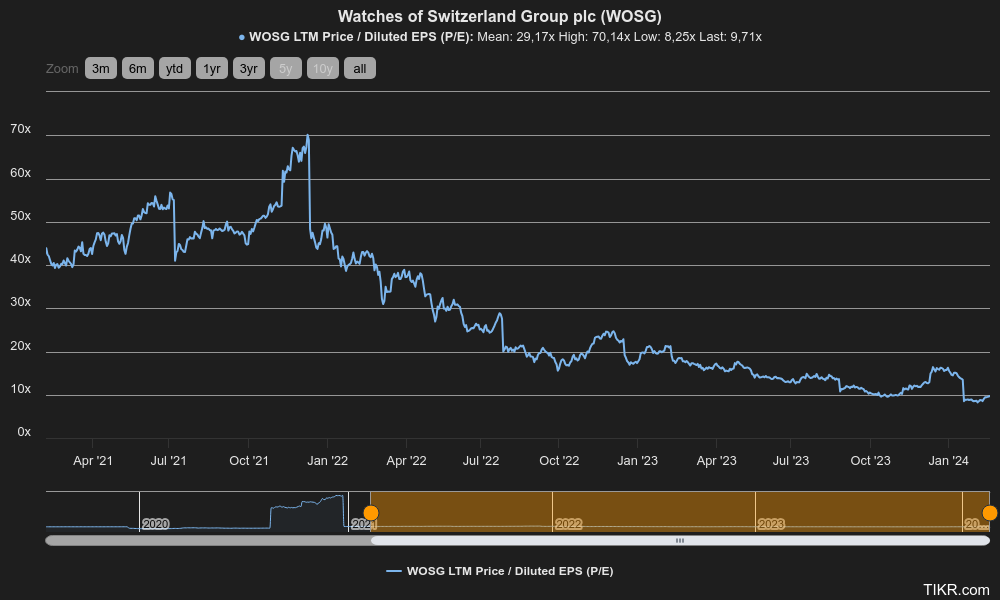

During 2023, the stock lost nearly half of its value, explained by:

The Rolex deal with Bucherer

The profit warning where the company was cutting the estimates for 2024 (impact of -£100m in revenues, wiping £516m off its value)

These two events had a significant impact on the company and can be consider an overreaction of the market.

The stock currently trades at:

FCF pre expansionary capex. Assuming the historical level of £100-120m (excluding record year 2023, to be conservative), the FCF will be £0.4-0.6/share. The stock trades at £4.2/share, implying a Price/FCF multiple of 7.0x-10.5x

FCF post expansionary capex. Assuming a FCF around £70-80m will represent £0.30-0.40 per share. The stock trades at £4.2/share, implying a Price/FCF multiple of 10.5x-14.0x

Adjusted EPS has increased from £0.24 to £0.53. In the first six months of 2024, EPS stood at £0.215. Doing simple math, it will be c.£0.4 for the whole year. This will imply a multiple of 10.5x

Is the stock cheap?

It depends on whether the perception the risk of Rolex is high or not. Currently, the market has priced this company at around 10x earnings and FCF. The management plans to double the revenue and the operating profits in 4 years.

While this strategic plan is very aggressive, the opportunity they have is real. They can consolidate in the US and develop non-core areas to the brands, therefore allowing them to maintain the current model.

Historically, the multiple has been significantly higher than the current multiple. However, 20-30x earnings seems excessive. To me, the key thing is that this company should be worth at least 15x earnings. The re-rating together with the delivery of the strategic plan should provide positive returns in the medium term.

The current multiple offers an attractive margin of safety.

The main risk: disruption of the current distribution model in the medium to long-term and macro headwinds in the short term.

The expected return for a 4 year period is uncertain. However, achieving a 20-30% CAGR might be feasible (this is my personal view, don’t take it as correct):

Fundamentals: +50-100% of return, or more. If the company is able to increase FCF by 50-100%. Paybacks have historically been low and the expansion in the US can be very profitable.

Multiple re-rating: Currently trading at 10x, company should be trading more at around 15x given they are high quality retailers. This will imply another 50% return.

🚫 Not investment recommendation🚫

7. Investment thesis conclusions

In conclusion, the risk of disruption to WOSG's distribution model appears low in the mid-term, given Rolex's heavy reliance on companies like WOSG. While the company may face a period of lower growth in the short term, the luxury watch market tends to be resilient to demand fluctuations, with prices maintaining stability even during downturns.

Should Rolex opt for direct sales, the transition would likely span over a decade. Meanwhile, WOSG occupies a niche market and is strategically positioned in regions that Rolex may not prioritize, offering growth opportunities.

With the stock trading at 10x earnings and FCF, the valuation appears attractive considering WOSG's ambitious growth plans, including doubling revenues and expanding in the US. The company's investment of £650-700m, equivalent to 65-70% of the current market cap, underscores its commitment to growth through expansion and M&A.

Furthermore, WOSG's exposure to the luxury watch sector provides inflation hedging benefits, although it remains vulnerable to economic downturns.

In the short term, any deviation from guidance or uncertainty surrounding the Rolex transaction may weigh on the share price. However, in the long term, if Rolex maintains its current distribution strategy, WOSG stands to realize significant value creation in the years ahead.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Benjamin Graham

Additionally, there is a positive optionality if the UK government reinstates tax-free tourism. Prior to its elimination in 2020, this segment accounted for 20% of the company's revenues, approximately £200m.

Moreover, in February, both the Chairman and CFO made significant investments in the company, with amounts totaling £180k and £100k, respectively. This demonstrates a strong commitment from management, particularly during a period of stock price correction.

I have allocated approximately 5% of my portfolio to the company at an average price of £414.87p per share. While the road ahead may be challenging, if the analysis proves accurate, the potential for strong profits is compelling.

Patience will probably be required

The European Value Investor

Thank you for reading the report. Please leave a comment if you have any questions or comments. I will be happy to discuss it!

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Thanks for reading The European Value Investor! Subscribe for free to receive new posts and support my work.

This month I activated buy me a coffee. If you like my content and want to support it, I appreciate it!

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not have a vested interest in any of the companies mentioned in this article, and we do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

https://ww.fashionnetwork.com/news/Watches-of-switzerland-makes-key-management-moves-adds-to-board,1396025.html

Wording with the help of Open AI

www2.deloitte.com/content/dam/Deloitte/ch/Documents/consumer-business/ch-deloitte-swiss-watch-industry-study-2023_EN.pdf

LVMH Annual Report 2022

Rolex website

Tax-free shopping for tourists in UK may return as government eyes rethink | Travel & leisure | The Guardian

https://cebr.com/reports/removal-of-tax-free-shopping-costing-10-7bn-in-lost-gdp-and-deterring-two-million-tourists-a-year-report-concludes/

That is an epic piece on WOSG. Thank you very much!

thx, a lot for putting in the effort.

1- WOSG buys at wholesale prices from luxury brand manufacturers, and then sells at retail prices to wealthy end users - this margin is their Gross Margin- Am I right? If yes, who sets the retail prices, Rolex or WOSG by themselves?

2- Their revenue came from both - Volume and Prices increase. I understand luxury brands have pricing power, you shared a 7% CAGE Rolex price increase but this is only for 1 model, By any chance, we can get data for an overall AVERAGE price increase across EVERY brand they sell. I am trying to gauge what their revenue would be in 2035. For example, if the industry volume is growing by 6%, and it increases revenue by 5% through m&a & then let's say adds 3-4% average price increasing power, then it would be a 15% overall CAGR Revenue increase, let's say average operating margin is 10% then I would DCF and try to do valuation.

your guidance would be appreciated.