Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

In part I, I introduced the company EssilorLuxottica. In this second post, I will be talking about Essilor. In case you missed the prior post:

Part II: Essilor

In the second part of the EssilorLuxottica investment thesis, we focus on Essilor, the division of the company that operates in the eyecare segment.

Essilor is a company with more than a century of history, and is the global leader in the eyecare industry, dominating the prescription glasses market.

I. Introduction

Essilor was created in 1972 from the merger of two leading French optical companies: ESSEL and SILOR. ESSEL, founded in 1849, launched the first progressive lens, Varilux®, in 1959. SILOR, originating in the 1930s, introduced the first organic lens, Orma®, in 1954. The merger focused on ophthalmic optics, gradually phasing out unrelated activities.

Essilor has more than 1.5 centuries of history, a milestone that just a few companies have achieved and a proof of the resilience of the business

By the 1970s, Essilor became an export-driven company, expanding into Japan, the U.S., and Europe. It went public in 1975, continuing innovation with the Varilux® Orma® lens and setting up international manufacturing, including a major plant in the Philippines in 1979. In the 1980s, facing increasing competition, Essilor expanded production to Brazil and Thailand, growing its global distribution network.

Throughout the 1990s and 2000s, Essilor strengthened its leadership in corrective lenses and treatments. Innovations like Crizal® anti-reflective lenses and Transitions® photochromic lenses boosted growth. The company expanded globally through acquisitions and partnerships, notably with Nikon, Shamir Optical, and ventures in China and India. It also developed new divisions in lab equipment and ready-to-wear eyewear through key acquisitions like FGX International and Satisloh.

In 2017, Essilor announced a merger with Luxottica to form a global optical leader. During the last years, Essilor continued expanding into high-growth markets like China, India, and Brazil, while focusing on innovation in lenses for UV and blue light protection, and solutions for digital device users.

Prior to the merger, the company had acquired several brands of sunglasses like Costa, which is especializad in high performance polarized sunglasses. They also produce equipment for eyecare professionals. However, given that the core business is the prescription glasses, I will not cover the sunglasses segment from Essilor.

The share price evolution was remarcable: from €3.5 in 1985 to around €100 by the time of the merger.

II. Main vision problems and solutions provided by Essilor and competitors

Vision problems continue to increase every year. People (like me) are using screens half of the day: from using the phone first thing in the morning, to working hours in computers, to finalize the day watching TV.

Although screens are better every year, the increase in vision impairment is unfortunately unstoppable. There is a pandemia of Myopia in the children due to constant uses of electronic devices and less exposure to the sun.

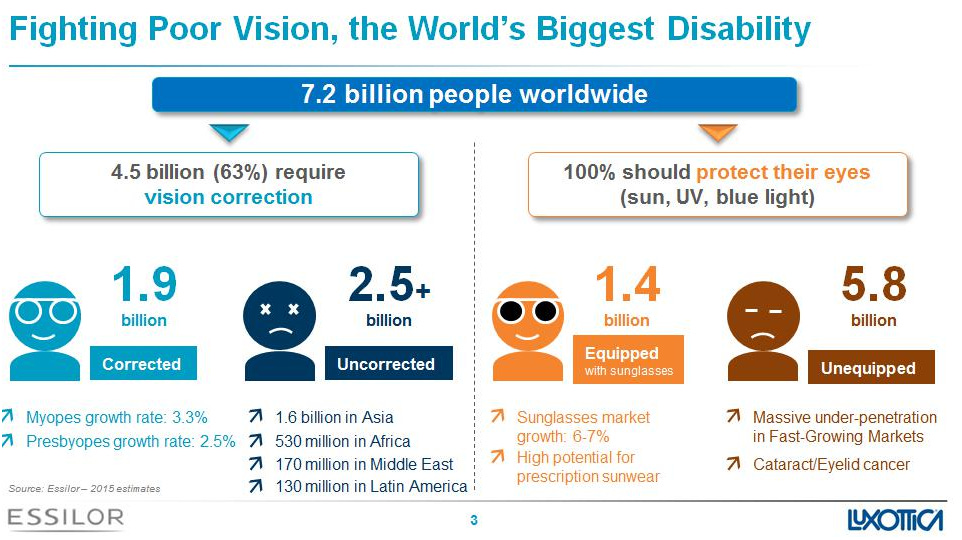

This slide from a presentation with estimates from 2015 give a sense of how big the market is and how under-penetrated it is, as more than half of the people with vision impairment remain uncorrected.1

Essilor offers a wide range of lenses covering multiple vision problems and covering also new trends such as protection from UV lights.

The main vision impairments are myopia, hyperopia, presbyopia, and astigmatism. We will review them and the available solutions (I’m not optician, so this is very high level)

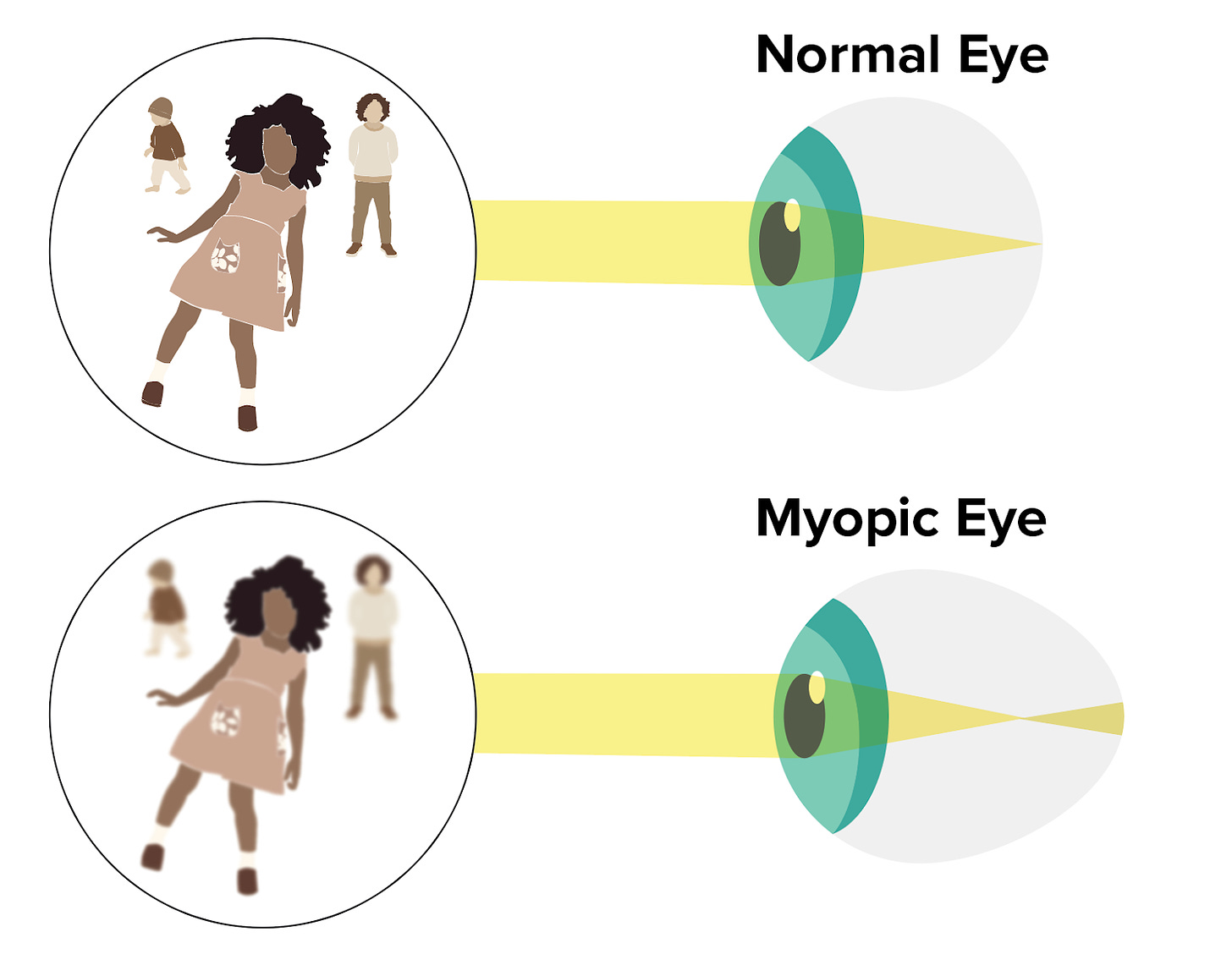

Myopia (Nearsightedness):

Problem: Distant objects appear blurry due to an elongated eyeball or overly curved cornea. This problems normally starts in children between the ages of 6-12.

Myopia is a problem that increases every year, especially in children. The lack of sun together with the constant use of screens is damaging the vision of the youngest generations.

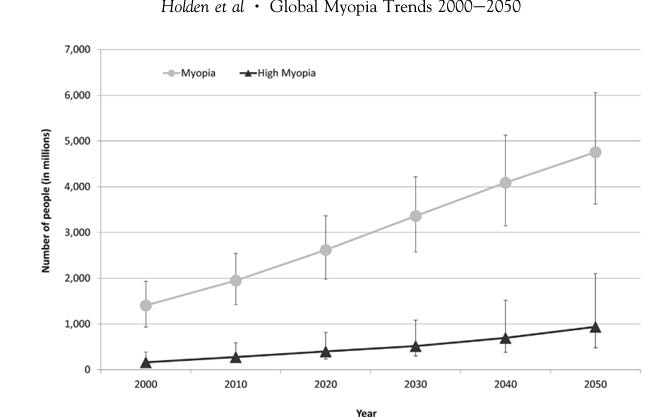

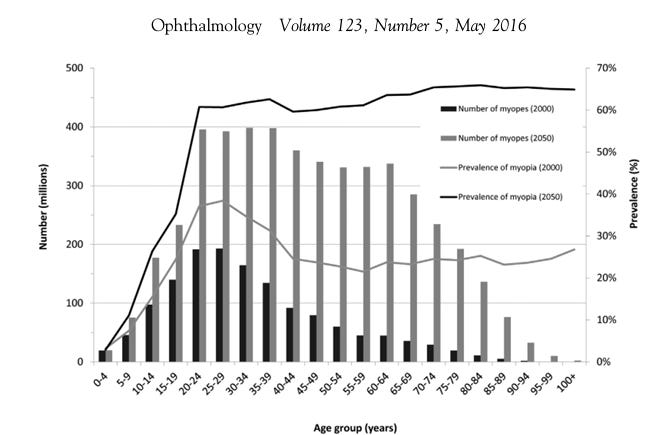

According to a recent study from the American Academy of Ophtalmology, nearly half of the population will have myopia by 2050. Since the 2000s, the number of people with myopia has increased from ~1.5 billion to close to 3 billion actually.2

Countries like China have big problems relating to myopia. Vision impairment is no more a question of aging population. According to media, around 50% of the children in China have myopia3

“Our biggest assets in China, the Stellest lens for myopia, management delivered more than 1.5 million pair of lenses just in 2023, representing more than 15% of our revenue base in Greater China, a category to just a few years back, didn't even exist”

Stefano Grassi, CFO EssilorLuxottica

China is not the only country facing myopia problems. In the US, around 36% of the children will have myopia.4

Solutions available:

It is very important to control myopia as people with myopia will have a higher risk to develop other problems such as catarats.

Glasses: Concave lenses for clear distance vision. Its the most common and easiest solution, especially for children, because its easy to adapt and its non-invasive

Contact Lenses: Alter light entry to correct myopia. Contact lenses are another common solution for myopia and are often favored by people with active lifestyles who find glasses restrictive

Refractive Surgery: Reshape the cornea for reduced reliance on corrective lenses.

Essilor Solution: Essilor offers specialized lenses designed to address myopia, providing enhanced clarity and visual comfort. They offer the Stellest® brand and claim that the lenses slow down myopia progression by 67% on average.

There isn’t a one-size-fits-all answer for myopia control, but glasses remain a very convenient solution given it affect a lot of young people.

Spectacle lenses are probably the best option for children in order to avoid eye infections. Hoya and Essilor are the companies offering a product that can slowdown myopia by about 60%

“We believe MiYOSMART and Stellest could become the standard way to slow down myopia progression. It’s also the cheapest among the most effective myopia control methods”5.

The company is targeting the youngest generations with their Stellest brand. This is key, because children will demand several lens during their younger period, before many will move to other solutions such as contact lenses or surgery.

The Stellest was launched in Greater China, Russia and Singapore in 2020, in France and Italy in 2021, and continues to be rolled out in other regions. China is the key market right now.

China is the main region for this product, and its rapidly growing

Company is now introducing the lens in Europe (already well established in the UK and France)

Essilor is preparing to launch its products in North America and its currently working with the FDA (Food and Drug Administration), to introduce its products during next years

SightGlass Vision in 2025. This is a JV with Cooper Industries, to develop and commercialize myopia solutions

Stellest glasses to be introduced early 2026

“If we look at Stellest, we sold more than 1.5 million pair of lenses in the full year 2023 with a triple-digit growth versus 2022”

Stefano Grasi, CFO

Its a lengthy process as the company needs approval to sell the products and also needs to prepare the distribution network (doctors, distribution centers, etc.). This category will contribute to further growth in the P&L of the company.

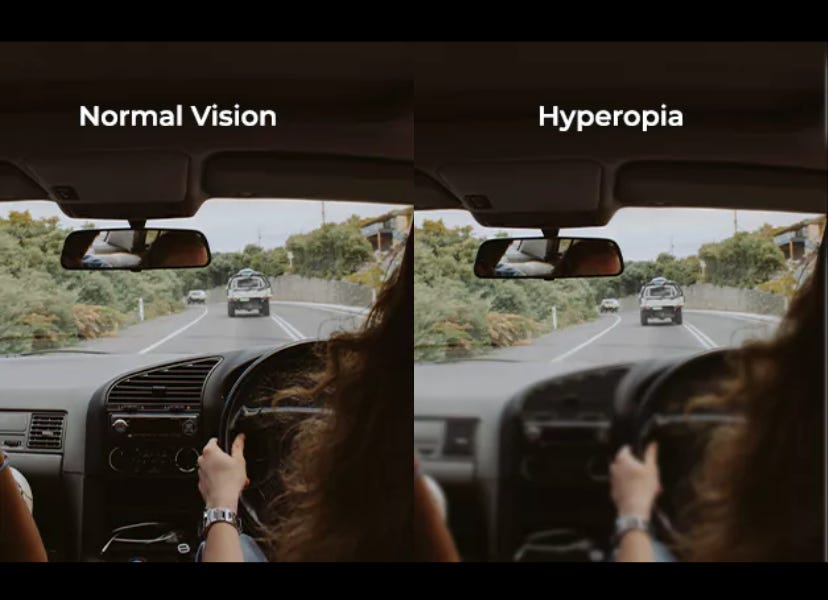

Hyperopia (Farsightedness)

Problem: Difficulty focusing on close objects, often caused by a short eyeball or insufficiently curved cornea.

Solution:

Glasses: Convex lenses for clear close vision.

Contact Lenses: Correct hyperopia similarly to glasses.

Refractive Surgery: Reshape the cornea to address hyperopia.

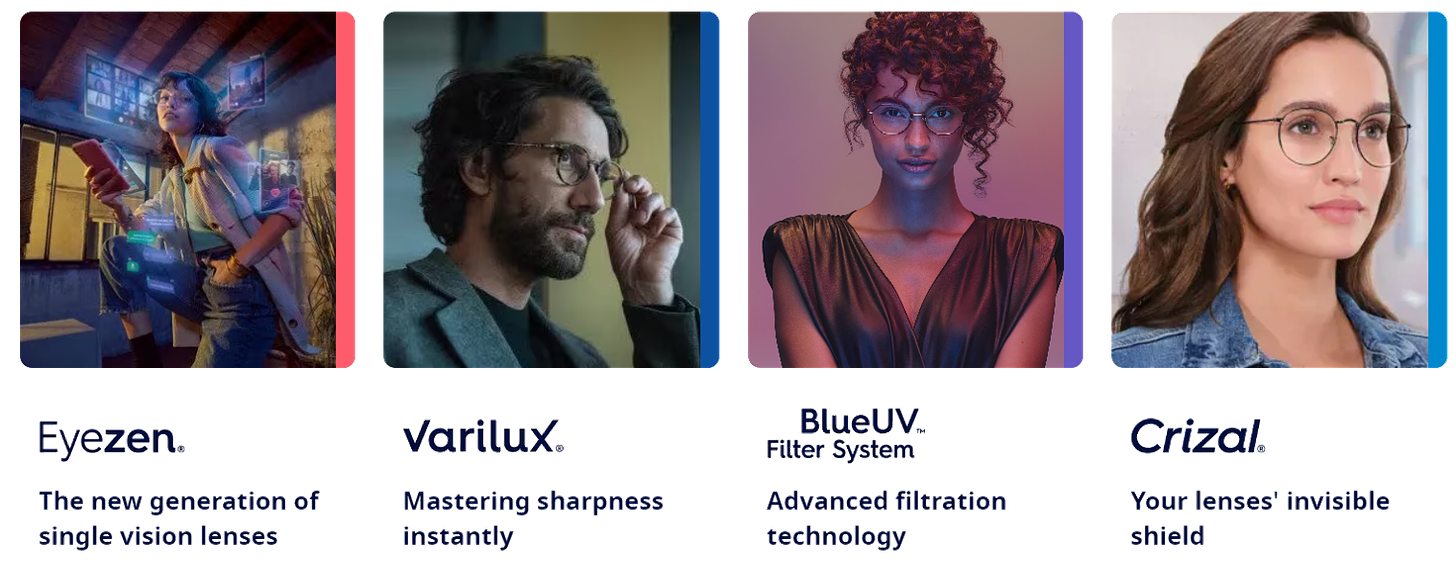

Essilor Solution: They offer the Eyezen® brand and claim that 88% of customer satisfaction and that 3 out of 4 users experienced a reduction in eyestrain

These lens are designed to relieve the eyes of eye strain, particularly in near vision, and help protect them from blue light. The use of lens to protect against the blue light of screens is gaining relevance. Not as rapidly growing as the myopia lens, these lens are also being introduced in countries like China.

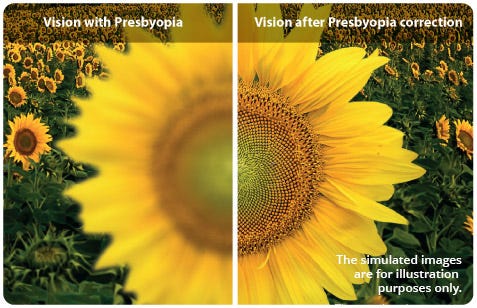

Presbyopia

Problem: Age-related loss of lens flexibility, leading to difficulty in focusing on close objects.

Solution:

Glasses: Bifocals or progressives for both near and distance vision.

Contact Lenses: Multifocals with varied prescriptions.

Refractive Surgery: Options like monovision LASIK for presbyopia.

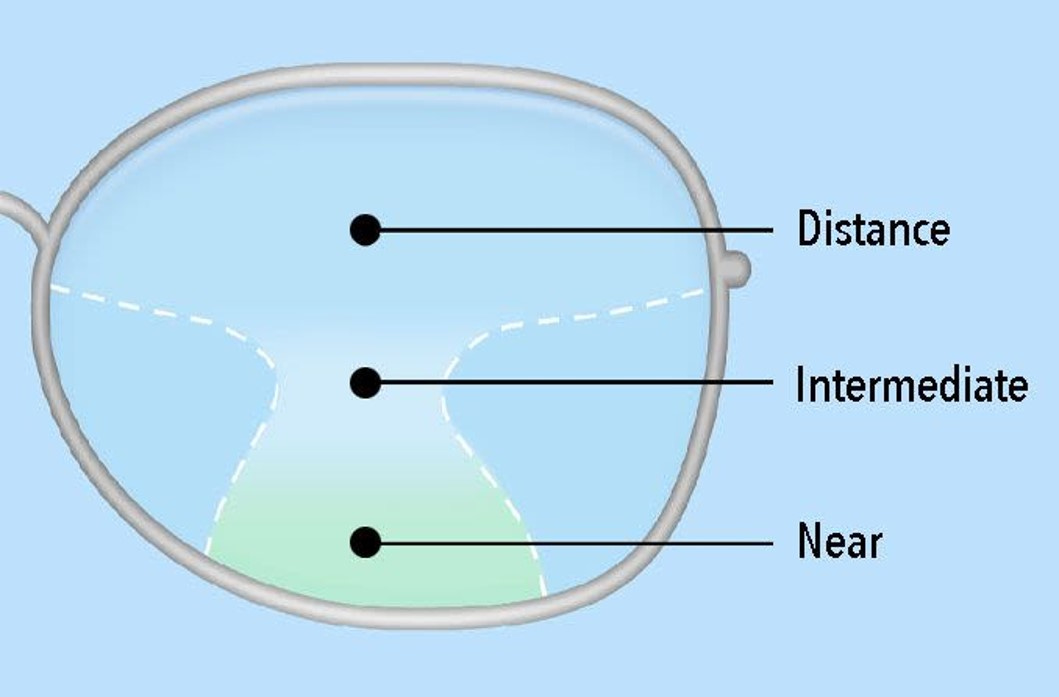

Essilor Solution: Essilor's progressive lenses offer a seamless transition between different prescriptions, addressing presbyopia with precision. They offer the Varilux® brand.

Varilux is the flagship brand of Essilor and the most famous and prestigious lenses in the market.. They were the first to introduce progressive lens in 1959. As we will see later on, progressive lens allow people to see objects far away, but also to be able to read.

Since introduction, around 500 million people have used the Varilux lens

Sold in 100 countries

Protected with around 70 patents filed

Astigmatism

Problem: Distorted or blurred vision due to an irregular corneal or lens shape.

Solution:

Glasses: Toric lenses to correct irregular corneal shape.

Contact Lenses: Specifically designed toric lenses for astigmatism.

Refractive Surgery: Reshape the cornea to address astigmatism.

Essilor Solution: Essilor's toric lenses are crafted to provide sharp and clear vision for individuals with astigmatism, ensuring visual accuracy. The brand is Eyezen®

New trends and sunglasses

Essilor is also offering lenses to protect the vision. Not all people wearing glasses have myopia, astigmatism, etc. Some people decide to wear special glasses that protect our vision.

UV protection glasses: Many people are opting to protect their eyes against the blue light, which is is a high-energy, short-wavelength light emitted by electronic devices such as computers, smartphones, and LED screens, which can impact circadian rhythms and potentially affect sleep patterns. Essilor offers great lenses with the brand Blue UV

Transitions® Light Intelligent Lenses™ seamlessly adapt to changing light situations, darkening when outdoors and returning to clear when indoors. The lenses protect the eyes from UV rays and help filter blue-violet light

Protection and vision: Crizal® anti-reflective coating not only protects the vision from scratches and smudges but also reduces front, back and lateral reflections

Conclusions

Every problem requires a specific solution and the final solution made by each individual will depend on different circumstances.

I’m sure many of you are thinking right now about contact lenses vs eyeglasses.

Eyeglasses vs contact lens

Eyeglasses remain the most common solution, as the market value of prescription glasses is more than 2x the contact lens market.

Both alternatives are valid and its a question of what the individual prefers. Both have pros and cons:

Glasses: Perfect for daily use, eye health, and adding a stylish element to a person’s look. However, they might be uncomfortable for some people, can break or scratch, and normally don’t cover the entire field of vision

Contact lenses: Great for active individuals or people who don’t want to wear glasses. They provide a better peripheral vision but they require more maintenance and attention to higiene, as they carry a higher risk of eye infections.

Sometimes, these two alternatives are simply complementary.

Which one is cheaper?6

In the long-term, glasses are cheaper:

Glasses

Initial cost: From $100 to $600 or more

Daily costs and maintenance: No daily costs, and maintenance is minimal

Contact lenses:

Initial cost: $30-$60 per box (30 lenses per box), which implies around $400-1,000 per year

Glasses are cheaper that contact lenses (around $200-600 every few years), vs. contact lenses (at least $400 per year).

Eyeglasses vs surgeries

Surgery is normally a private solution which is expensive (between €1,000-4,000 per eye, or more), with risks associated with the surgery, etc. As humans, we tend to avoid unnecessary risks when glasses or contact lens work.

The cost of surgery has significantly decreased during the last decades, and it will continue gaining market share. However, I don’t see this alternative as a key competitor

Essilor is a global player, operating all over the world. Surgeries are not equally developed in every country

Surgeries are expensive: although are cheaper than before, on a world of budgeting constraints, surgeries might not be the chosen alternative by many people

Even if surgeries are extended, the vision impairment pandemia keeps on progressing. Myopia and other vision impairments are affecting more people every year (i.e., the TAM increases every year)

III. Eyecare Industry

Introduction to the eyecare industry

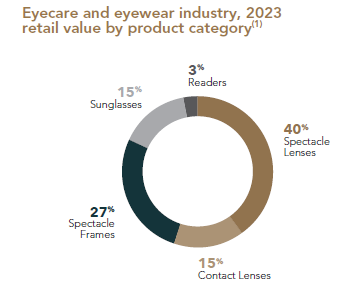

The eyecare industry is a massive industry with c. 1.4Bn lenses produced every year, and c.700 million customers. The market value of spectacle glasses is significantly higher than sunglasses or contact lens.

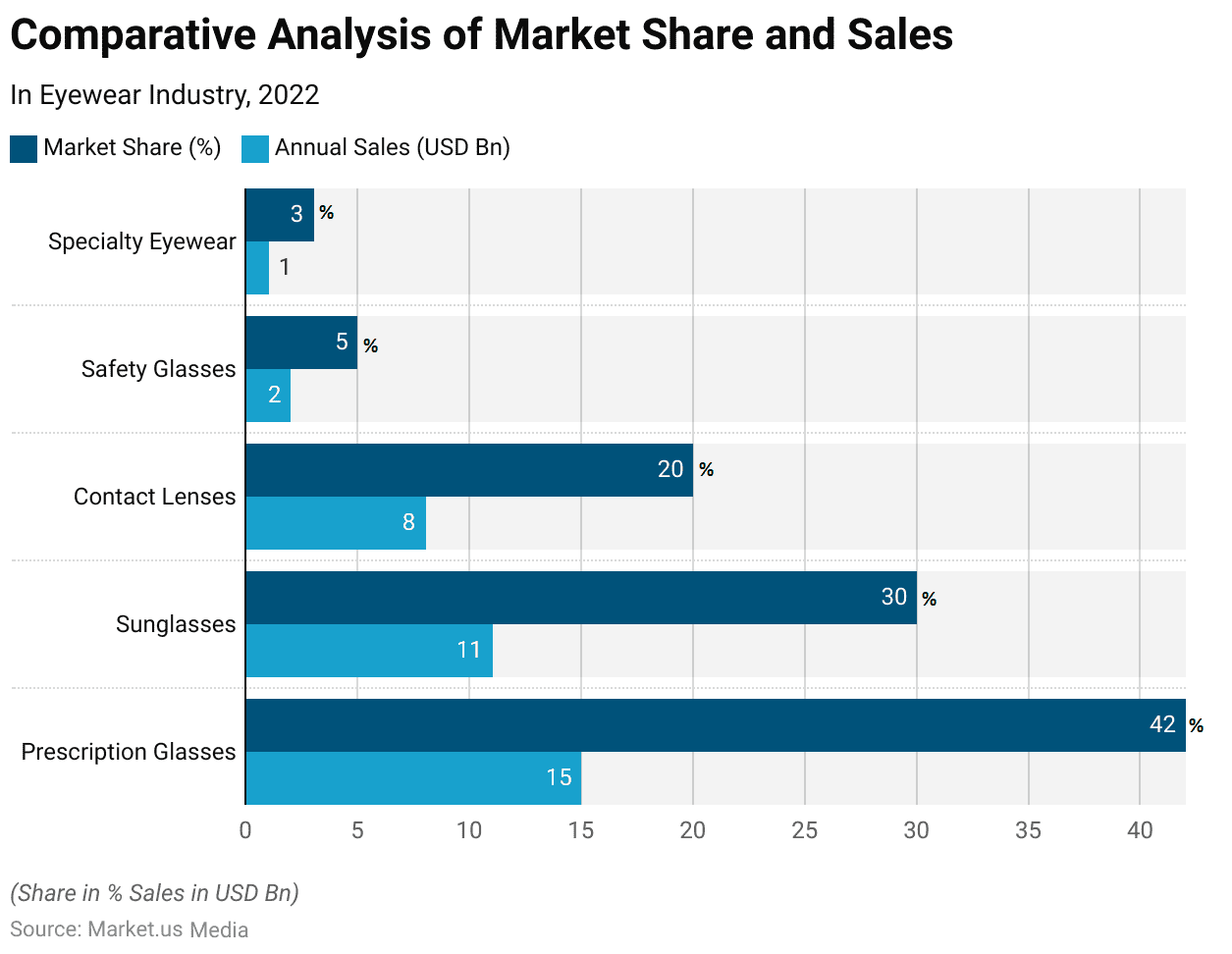

When we talk about eyecare industry, there are many types of lenses. From sunglasses to protect from the sun, to contact lenses, or safety glasses. Essilor is one of the leaders in prescription glasses, which is the biggest category in the industry. As an example, in the US, it represents more than 40% of the market, significantly higher than contact lenses, given its a much more expensive product.7

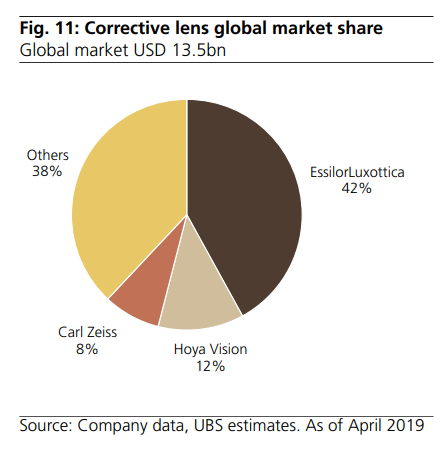

The prescription glasses is a very fragmented industry with only 3 global players (Essilor, Hoya and Carl Zeiss). On average, the lens and optical instruments industry is growing at a 3-4% per year.

Total Addressable Market

There are billions of people with vision impairment. Either using glasses or contact lens, the industry is huge, and it will continue to increase as the pandemic of myopia continues to expand every year.

Some of the conditions categorized under refractive errors include myopia, hyperopia, astigmatism and presbyopia. Refractive errors constitute the majority of causes leading to vision complications. For example, astigmatism develops in one of every four people, hyperopia affects over 14 million people, and myopia develops in 34 million people across the United States.

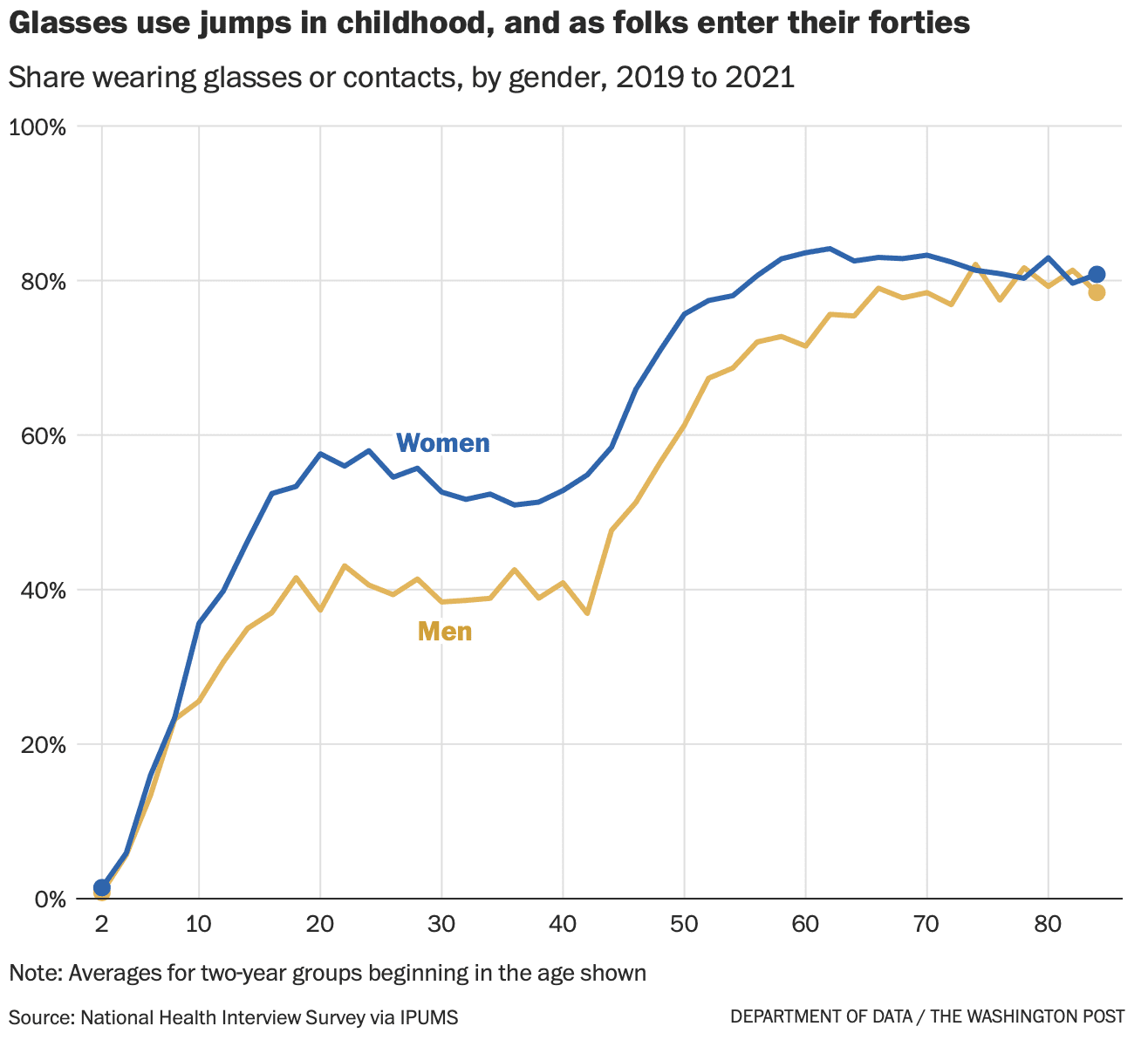

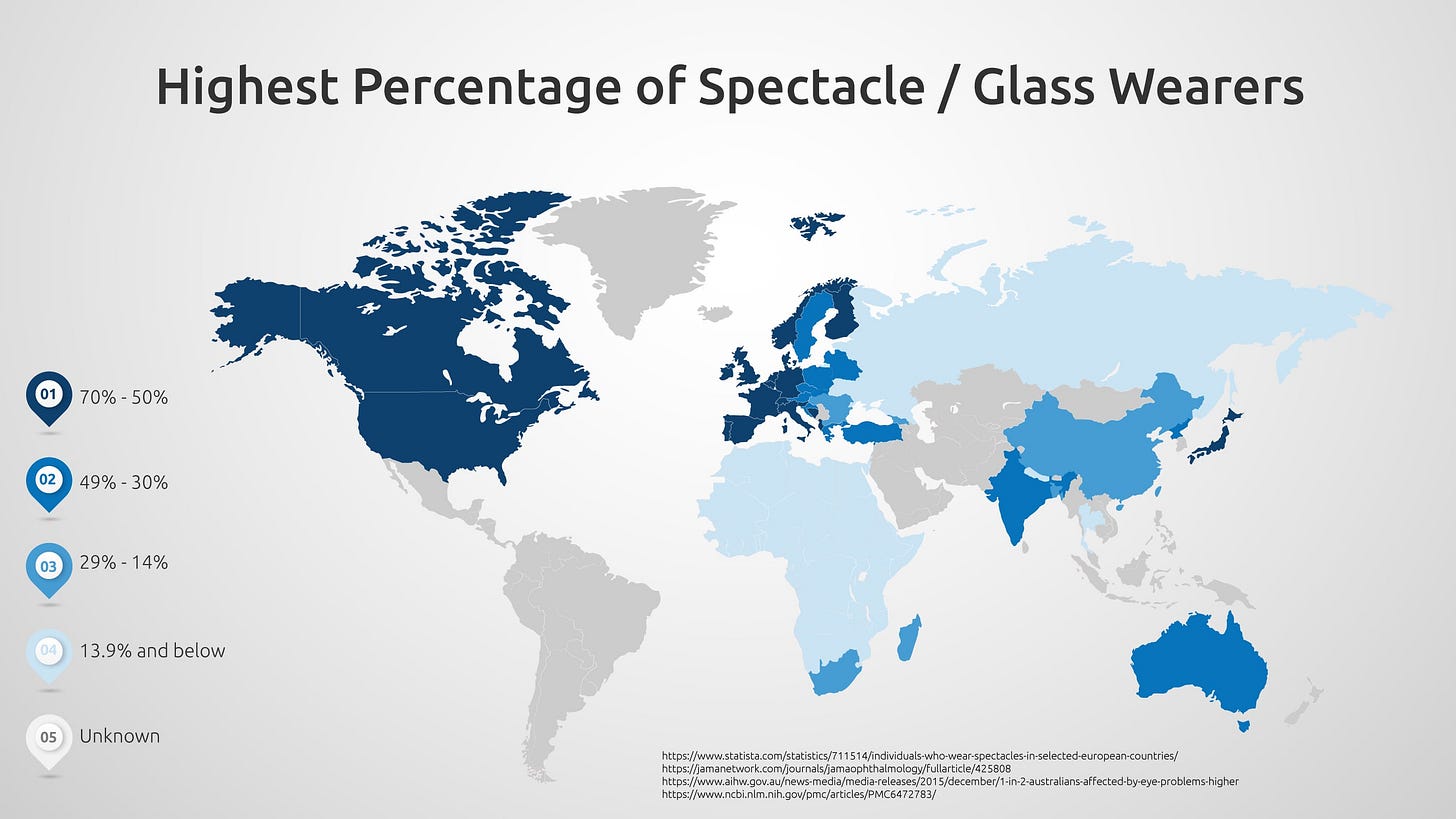

It is hard to find reliant data on how many people use glases, but its a fact that many people around us wear glass or contact lens. As seen in this chart, more than half of the people use glasses.8

The more the people live, the more probable they will wear glasses. And, many of those glasses, aren’t cheap. The total addressable market is huge and keeps expanding every year. As analyzed in next section, Essilor is by far the largest company in the sector.

“Vision impairment is the world’s biggest unaddressed disability with large untapped opportunities in terms of vision correction and protection. Today 2.7 billion people around the world suffer from uncorrected refractive errors (URE) due to barriers to awareness and access, with 90% living in base-of-the pyramid economies, and 6.2 billion people who do not protect their eyes from harmful rays”

EssilorLuxottica Annual Report 2023

According to statistics of the US Centers for Disease Control and Prevention (CDC):

Myopia: It is estimated that by 2050, 50% of the population will be affected. We are talking about billions of people. Essilor has one of the best products in the market.

Presbyopia: there are an estimated 1.09 billion cases of presbyopia in the middle-aged to elderly population9. Essilor has the most renowned product in the market: the Varilux© progressive lenses.

Astigmatism occurs in about one out of every three people in the United States

Farsightedness occurs in about 8.4 percent of the population over the age of 40 (over 14.2 million people in the US)

Nearsightedness occurs in about 23.9 percent of the population over 40 years old (about 34 million people in the US)

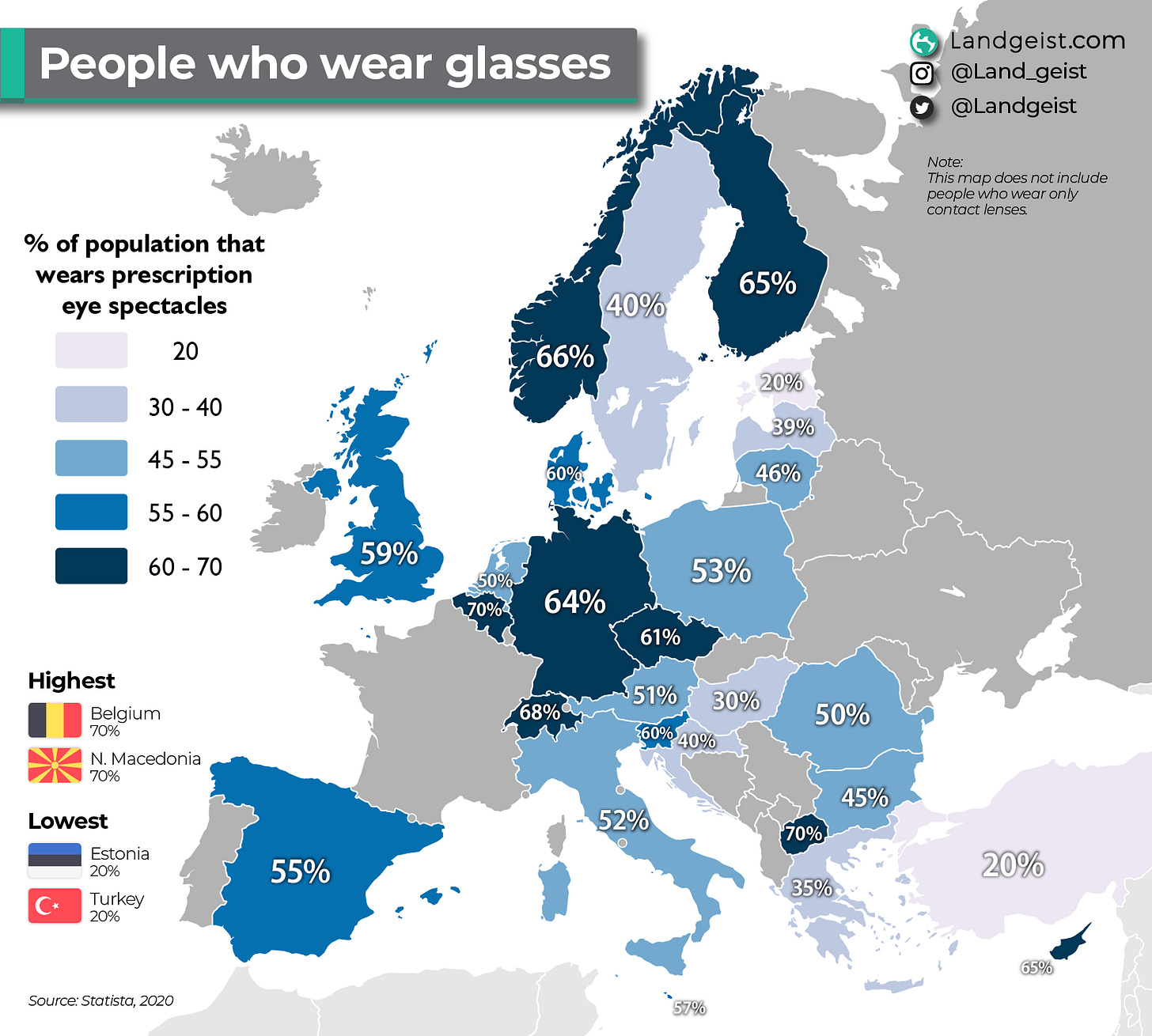

In places like Europe, half of the people wear glasses, with some countries with 2 out of 3 people wearing them.10

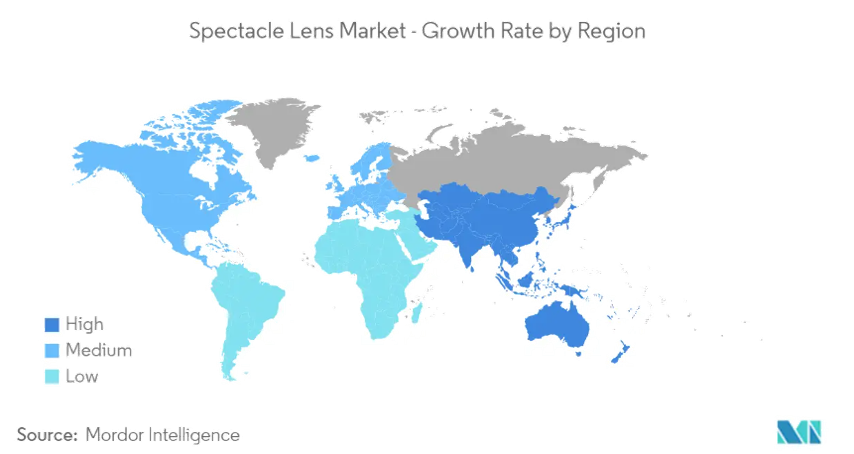

And the opportunity is still massive as many countries are still very under developed. The rising of China and India and Middle East will contribute to further growth. And in the countries with higher penetration, the sector benefits from tailwinds from the aging population.11

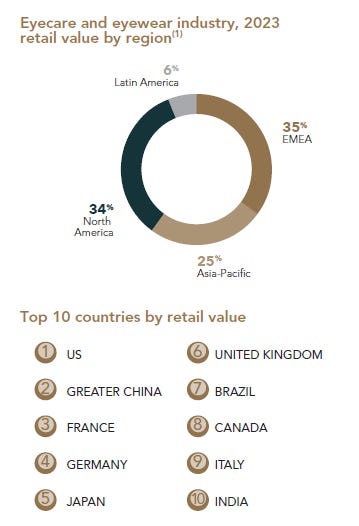

According to the company, the US remains as the biggest country by retail value, followed by China. Europe has 4 countries in the top 10:

Addressing the value of the market

According to different data providers, the eye care market has a size of around $70bn:

$70.8bn (Grand View Research)12

$74.9bn (market.us)13

$113bn (Research and Markets)14

~$70bn (MMR)15

~$70bn (Techsi research)16

Data for corrective glasses is more vague, but we can assume it represent at least 1/3 of the market: ~$20-25bn. To be more conservative, we can assume a total market of €30bn. The last available data from 2019, Essilor generated €6.8bn in revenues (~$7.5bn), which implies that Essilor has a market share of close to 30-35% of the corrective glasses market and around 10% in the aggregate eye care market.

Note that estimate is using 2019 figures (i.e., highly conservative without considering 4 years of inflation, business development, and synergies with Luxottica).

Anticipating our analysis of the combined company, EssilorLuxottica, the market share is significantly higher: revenue of the vision care business stands at ~€19bn (~$21bn), which implies a market share of 35% of the eyecare market.

The customers are not the consumers, but the opticians

The customers of Essilor can be opticians/optometrists, prescription laboratories and the end consumers. In countries like the US, optometrists own the market, so they are the real customers while in other countries or segments like protection glasses, the final customer might be the customer.

Here comes the magic of the merger: Although Essilor didn’t own its own stores, Luxottica owns the biggest number of stores in the eyewear industry. The biggest distribution network backing the one of the best products in the industry.

The eyecare industry caters to a diverse range of customers with varying needs related to vision health and ocular well-being. One of the primary customer segments includes individuals seeking vision correction solutions, such as eyeglasses and contact lenses. These customers may be afflicted with common refractive errors like nearsightedness, farsightedness, or astigmatism, and they turn to the eyecare industry to enhance their visual acuity.

Another significant customer group consists of those in need of more specialized eyecare services, such as individuals with eye diseases or conditions like glaucoma, cataracts, or macular degeneration. These customers often require medical interventions, surgeries, or ongoing treatments provided by eye care professionals, including ophthalmologists and optometrists. It is not a segment covered by Essilor.

Lastly, a growing segment within the eyecare industry caters to consumers interested in fashionable eyewear as a lifestyle accessory. Eyeglasses and sunglasses have evolved beyond mere vision correction tools to become fashion statements, appealing to individuals who view eyewear as a style component. This customer group seeks trendy frames, designer brands, and personalized eyewear options to complement their personal aesthetic.

In essence, the customers of the eyecare industry encompass a broad spectrum, ranging from those seeking basic vision correction to individuals requiring specialized medical interventions, preventive care, and those looking to express their style through fashionable eyewear. The industry's ability to address the diverse needs of these customer segments contributes to its continued growth and adaptability.

I see different market dynamics, depending on the sophistication of the lenses:

Protection glasses such as UV filter systems or protection against the light of the screens, etc. Here, people will not invest in the most expensive glasses as normally these products are designed for protection. The frame might be more important than the quality of the lens.

Myopia, hyperopia or astigmatism. As an example, Myopia is a vision condition where distant objects appear blurry while close objects can be seen clearly. Correcting myopia typically involves the use of lenses to adjust the way light rays enter the eye and bring the focus back onto the retina. The technology requirements apparently are not huge, so local players can compete against the big players

In cases such as Prebypoia, which is a common age-related vision condition where the eye gradually loses its ability to focus on nearby objects due to a decrease in the flexibility of the lens require more complex solutions and local players might not be able to match the characteristics of the Varilux brand.

According to many forums, there might not be huge differences between the lens manufactured by the biggest players and the ones manufactured by local players. It always depends, as many opticians have their own conflicts of interest.

Differentiation in some segments might be low, but in Myopia, the difference between the top products and the average ones remains high.

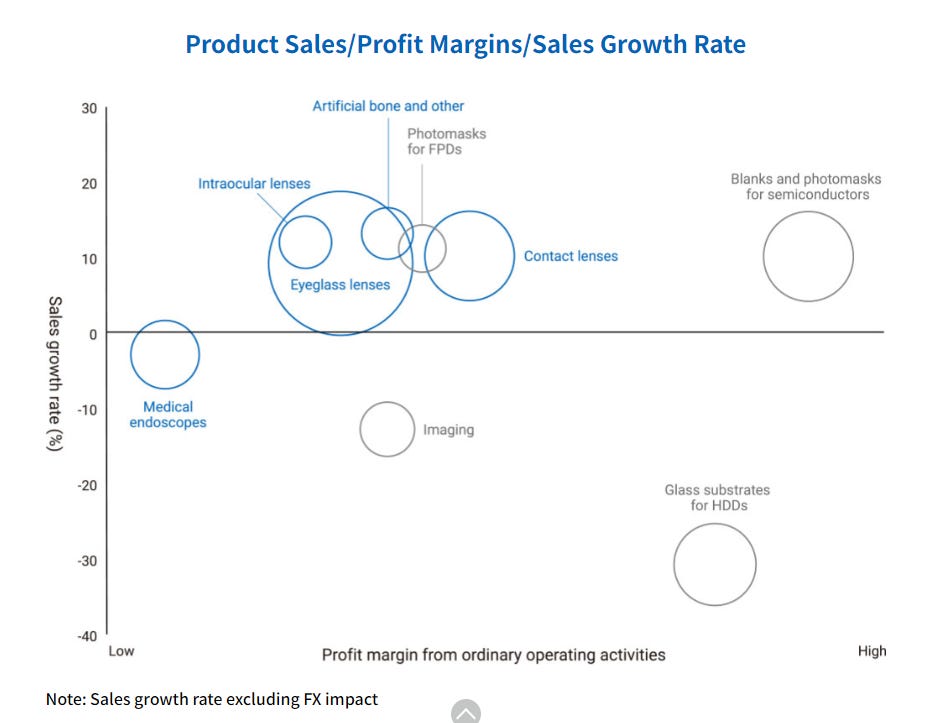

Finally, in this chart from Hoya (competitor to Essilor), illustrates the eyeglass lenses profitability is lower than contact lenses, but benefit from similar growth trends

Essilor’s competitors

The market is very fragmented and there are 3 global players, Essilor, Hoya (Japan) and Carl Zeiss (Germany). There are other strong players such as Johnson & Johnson Vision Care and many local players. Essilor competes against all of them in a global scale.

As stated before, the market size of the eyecare industry is around $70bn. EssilorLuxottica has a market share of ~35% ($21bn revenue from eyecare products and a total market of $70bn)

According to data from UBS, the market share of Essilor was more than 40% back in 2019. Hoya and Carl Zeiss held 12% and 8%, respectively. I believe market share is slightly lower, but still very high.

Other reports suggest a more fragmented market. In any case, Essilor the main players, and there are two other global players in the industry. It is very difficult to compete against the biggest players that achieve economies of scale and benefit from a global network. When looking at the data:

Essilor: €6.9bn in 2019 from eyeglass lenses (no updated figures since 2019)

Luxottica: Unknown revenues from frames and glasses, but very strong business.

Hoya: €1.9bn from eyeglass lenses in 2023

Carl Zeiss: €1.6bn from Consumer Markets division (includes eyeglass lenses, contact lenses, and optical retail solutions) in 2023

If we analyze the contact lens market, revenues are lower:

J&J Vision: €4.7bn

Alcon AG (Novartis): €2.3bn

CooperVision: €2.3bn

Hoya: €0.8bn

The important thing is that Essilor is the biggest player in the world, which provides clear advantages. The group has a history of M&A that eventually could made EssilorLuxottica has a potential consolidator of the industry.

Essilor is the clear leader company in the eyecare industry, selling more than any other firm, when comparing its 2019 revenue to the 2023 revenue of peers (i.e., no inflation, additional synergies, etc.). The difference might be even higher.

How does Essilor competes in this fragmented market with apparently low differentiation?

There is differentiation as many customers are willing to pay a premium on their lens. Especially for progressive lens, because the process is complex, many customers prefer brand names than local players

Most important, many of these products require approval from the regulators. This creates strong barriers to entry and very lengthy processes.

Many opticians will tend to recommend the highest quality products to avoid reputation risk. Essilor is the top brand.

The brand is still very powerful, however it is not as differential as with, for example, Ray Ban products. The Varilux brand has been in the market for over 60 years and it has associated a status of high quality.

To compete against Essilor, the local players need to compete in price. Essilor is a huge player with many facilities around the world operating with strong economies of scale. However, the output from the local players cannot match the quality of the Essilor’s premium products. They will offer lower quality, lower price products (i.e., they will compete in the lower end segment which is typically less profitable)

Competitors not only compete against a strong brand, but also against a massive distribution network. This is one of the key competitive advantages of Essilor.

R&D capacities of Essilor are the biggest among the competitors

New technologies are protected with patents (thousands filled by Essilor)

Do customers have much more alternatives, rather than buying an Essilor product? This is something we will analyze in the final assessment, but given the high network and the total stores from Luxottica, it seems that they may not have lot of alternatives.

IV. Value Chain of the Industry

The production cycle of prescription glasses

Essilor designs and customizes corrective and plano lenses adapted to each person requirements and preferences.

The production cycle depends on the type of product. While sunglasses normally do not require further adjustments once they are sold, corrective lenses do require to make adjustments to the exact client’s needs and specifications.

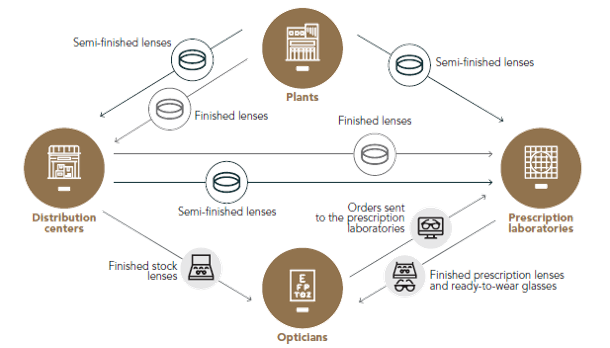

The chart represents the cycle of the eyecare industry, which depends on the type of lenses:

Finished lenses: produced for simple eyesight corrections such as myopia, hyperopia and minor astigmatisms. Theses lenses are manufactured and then distributed to opticians and prescription laboratories.

Semi-finished lenses are intended for more complex corrections, mainly presbyopia, which require complex solutions to solve this problem. Presbyopia occurs when the eye has difficulties to focus on close objects.

The lenses are manufactured in plants and supplied to the end customer through distribution centers

If they are finished lenses, they will be supplied to distribution centers, who will deliver the finished stock lenses to opticians

In case being semi-finished lenses, plants will deliver the stock to either distribution centers, or to prescription laboratories

The sale takes place in the optician, who will examine the client and recommend the best solution

If the lenses require further adjustments, to adapt exactly to the customer, the optician will send the specifications to prescription laboratories, and might send together the lenses to customize

Prescription labs will make adjustments to the lens, and send back to opticians

In this video, you can see that this is a complex process that requires cutting-edge technology in order to (i) create lens with the exact specifications, (ii) meet the entire demand in a faster manner and (iii) avoid high scraps rates

Why such a complex process?

Because to correct presbyopia, the lens need to have different vision zones so the eye can focus to long, medium and short distances. It is a very complex solution because its key that the customer feels comfortable with the product and doesn’t have any vision problems. Here is a traditional progressive lens and why its very complex to create lens that do not generate distortions in vision and focusing:

EssilorLuxottica is an integrated company, that controls the whole value chain

The company controls the whole value chain of the eyecare industry, and now after the merger has a more prominent position:

R&D: Prior to manufacturing, the product requires a lot of research and development. The company five several R&D centers, and multiple partnerships and collaborations with institutions

Production: The company has 35 production sites across the world, 27 of which produce the prescription glasses

Prescription laboratories to customize the lenses: The Group has a network of 583 prescription laboratories and edging-mounting facilities worldwide, of which 504 are proximity laboratories and 79 are industrial laboratories. As of December 2023, the company has manufactured:

~550 million prescription lenses

~160 million non-prescription lenses

Distribution: EssilorLuxottica has a global network of 128 distribution centers for lenses, eyewear, contact lenses, instruments, equipment. Part of the merger rationale is to re-design the roadmap of distribution and more than 20 facilities have been closed or relocated

Sale to the customer:

Direct-to-consumer: EssilorLuxottica’s Direct to Consumer business consisted of 13,366 stores and 4,223 franchised locations as of December 2023

Professional solutions: The company has agreements with thousands of opticians around the world. They have a partnership called Essilor Experts, with more than 20,000 partners. Additionally, the have the EssilorLuxottica 360 program to drive total practice growth for independent eyecare professionals (ECPs).deployed in more than 10,000 stores around the world.

V. Financial analysis of Essilor

This section will summarize the evolution of Essilor’s financials prior to the merger, as post merger, there are no more individual reports.

Given the company is completely different since the merger, this section will be a high level presentation, as the nitty-gritty is the combination of the two companies.

North America is the biggest region in the eyecare market. Essilor is the global market leader, and North America was also their biggest country. These are great news as the company is mainly exposed to hard currencies.

Now, the company is expanding in China with their myopia glasses, capturing new growth opportunities.

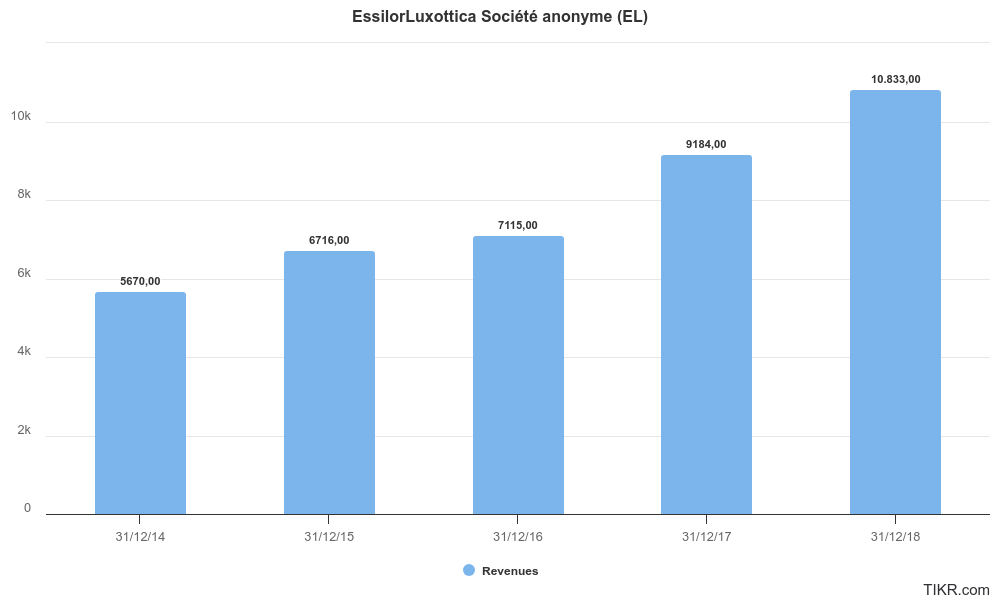

Essilor historical performance has been very strong, doubling revenues from 2014 to 2018, partly driven by acquisitions.

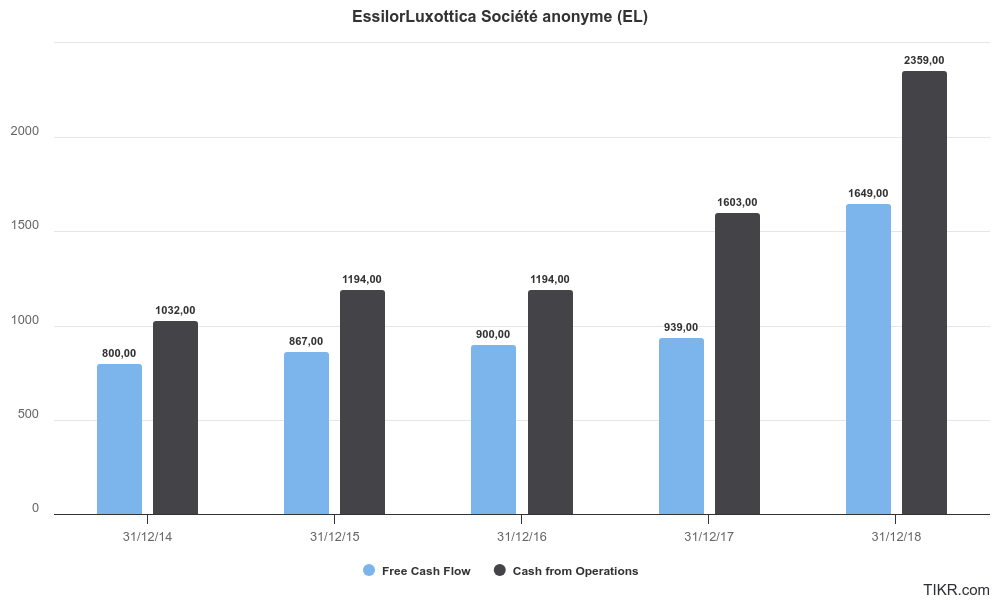

In terms of cash flow, same trend as revenue: from €800 million in 2014 to €1,649 million in 2018. The globalization of the company, together with the launch of new products fueled the growth of cash generation.

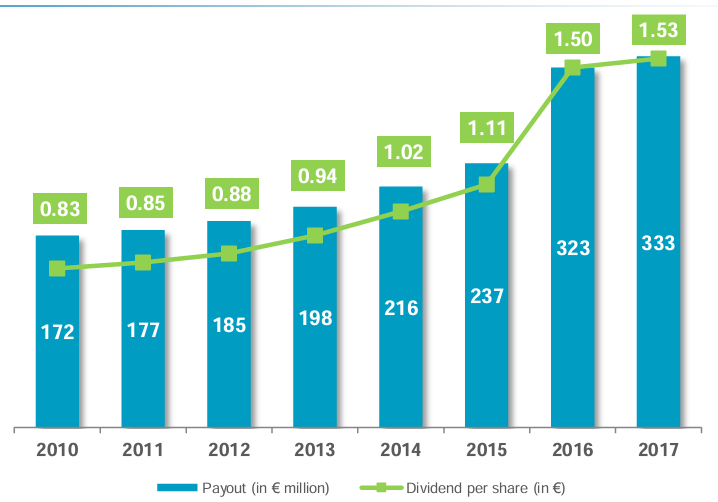

Historical dividends also explain the performance of the company. They nearly doubled from 2010 to 2017.

The conclusion I wanted to point out is that the company has performed very well prior to the merger. The financials will be deeply analyzed in the last part of these series of posts about EssilorLuxottica.

VI. Future growth opportunities

As state before, vision impairments are expected to continue to increase due to the more frequent use of screen devices. By 2050, it is expected that 50% of the population will be affected by myopia.

There are many growth levers for the company:

Growing with the market: the CAGR estimated by some of the previous research platforms stands around 5%17. Although forecasting long periods made no sense, the trend is clear and, its reasonable to expect this level of growth. With some degree of operating leverage, this can translate in nearly mid-single-digit to double-digit returns for the company

The opportunities in China are huge, as it is the country with more myopia in the world. Essilor made important acquisitions in the past to be present in the geography. Now, the company is growing at double-digit in the country. To give a sense of how big the myopia market is in China:

“Our biggest assets in China, the Stellest lens for myopia, management delivered more than 1.5 million pair of lenses just in 2023, representing more than 15% of our revenue base in Greater China, a category to just a few years back, didn't even exist.”

Stefano Grassi, CFO of EssilorLuxottica

Growth from myopia will come also from other regions like North America. The US is expected to come by 2026, which should provide a solid growth to the company, given its the most important market in the eyecare industry.

The company can also have a key role in further consolidating the market. Although I’m not a fan of big M&A, the company can target interesting opportunities and generate strong synergies now that its a vertically integrated player with Luxottica.

Geographic expansion: APAC and Latam only represent 12% of the direct-to-consumer channel. Total revenues from these regions represents 18%

Growth within the market: Capture growth opportunities in the whole value chain (e.g., acquiring more stores, prescription laboratories, etc.)

VII. Main Risks

1. Risk of copying Essilor’s technology

Essilor products are in the top range of the spectacle lenses:

Varilux brand has always been associated with the highest standards of quality

In myopia, the Stellest lenses offer the best results to control myopia in children, together with its competitor Hoya

The main risk for Essilor is that other competitors can copy their product. I believe this is especially important in regions like China, in which the market opportunity is huge and local producers can always produce cheaper than Essilor.

This risk is mitigated by the fact that Essilor has 1,780 patent families each representing an invention protected in France and around the world (8,780 pending or granted patents).

2. Government regulations

If regulation is a problem for manufacturers, only bigger ones will end up taking over the market. Let's remember that Essilor is the largest. Essilor has a huge network, and the biggest R&D capabilities in the industry.

Regulation can negatively impact the financials of the company, but its hard to see that happening in the short term. On the other hand, government spending can be an opportunity, if, as an example, governments decide to subsidize treatments for myopia.

3. Industry stagnation

On the other hand, it doesn't look like the market is going to slow down its growth. The pandemic of myopia is unfortunately not going to stop increasing, as well as other vision problems. It's an industry with strong tailwinds:

The constant use of screens. We probably spend half of our days in front of screens. Whether it's at work, then with social media and ending the day watching Netflix. The correlation between use of screen and vision impairment is very strong

The aging population brings with it age-related vision problems such as presbyopia

The trends are clear. We need to protect our health, but unfortunately, the constant use of electronic devices, exposure to artificial light, etc. will continue to increase vision impairments.

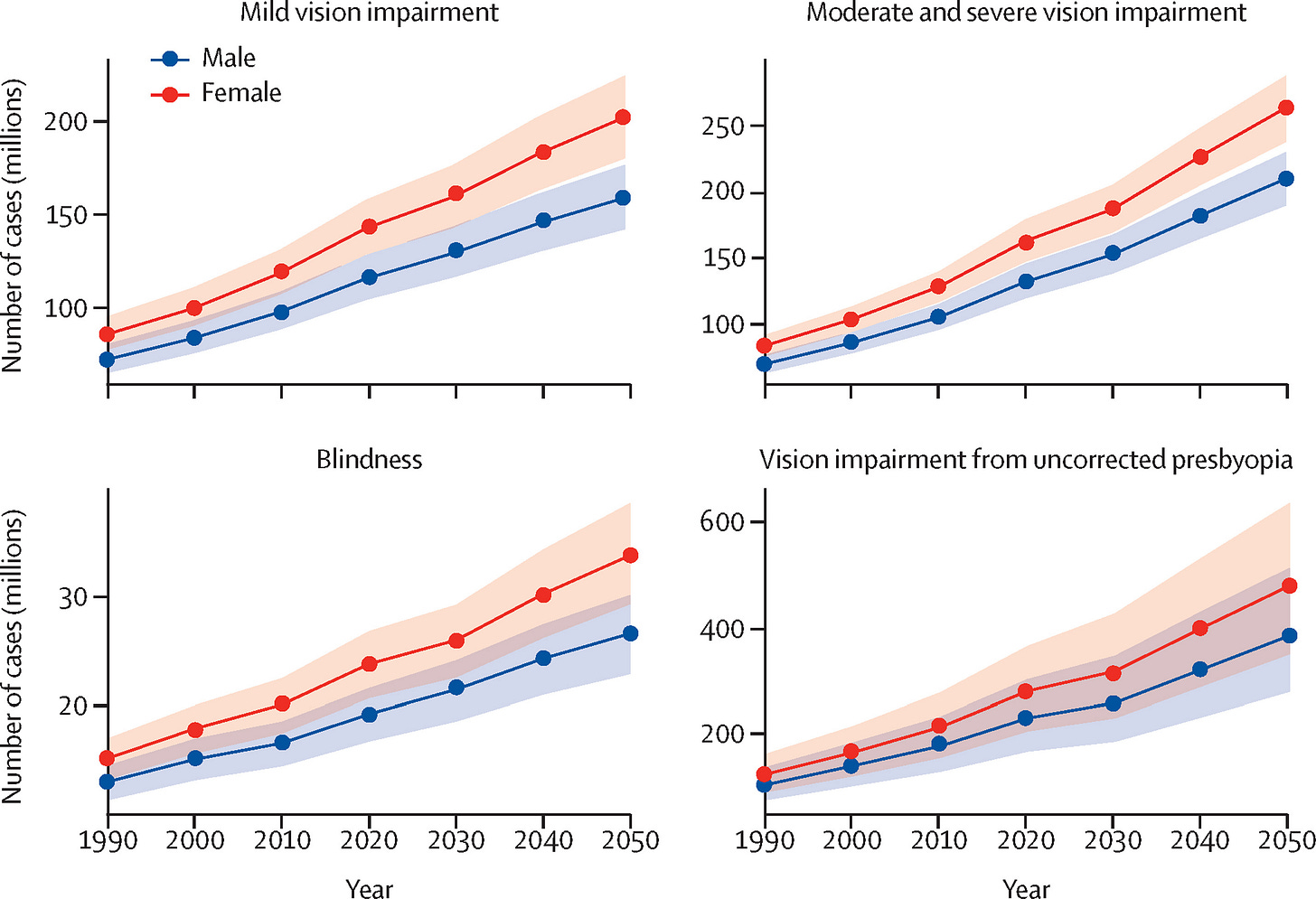

This report from The Lancet is probably the best report you can find to understand how bad the situation is:

VIII. Conclusions

Essilor is not an easy company to understand as their product offering is sometimes not easy to understand. They have many brands, different product offerings in the different regions, covering a wide range of vision impairments.

In this post I tried to give an explanation of the main vision impairments, the solutions available and Essilor product offering, together with the market share of the company.

The eyecare industry continues to benefit from strong tailwinds. Vision impairments will continue to increase and Essilor will continue to play a key role in trying to solve these health problems.

Essilor is the key player in this industry, with limited risk of disruption. They own 35-40% of a market that (sadly) keeps increasing every year.

The long-term growth prospects remain very strong for this company, which should have improved with the merger with Essilor.

Thanks for reading the report. Next week, I will be covering the other part of the merger: Luxottica.

Stay tuned!

European Value Investor

Thank you for reading the report. Please leave a comment if you have any questions or comments. I will be happy to discuss it!

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Thanks for reading The European Value Investor! Subscribe for free to receive new posts and support my work.

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

End notes

Source: https://www.sec.gov/Archives/edgar/data/857471/000090342317000022/essilor425-3.htm

Source: Global Prevalence of Myopia and High Myopia and Temporal Trends from 2000 through 2050 from American Academy of Ophthalmology

Source: https://www.globaltimes.cn/page/202403/1308787.shtml

Source: https://health.mil/News/Dvids-Articles/2023/08/09/news450942#:~:text=In%20a%20recent%20U.S.%20study,the%20National%20Institutes%20of%20Health.

Source: https://evershineoptical.com.sg/2021/03/11/comparison-between-different-myopia-control-methods/

Note: Calculations are made with ChatGPT

Source: https://media.market.us/wp-content/uploads/2023/10/comparative-analysis-of-market-share-and-sales.png

Source: https://statmodeling.stat.columbia.edu/2023/10/01/wait-is-everybody-wearing-glasses-nowadays/

Source: https://www.grandviewresearch.com/industry-analysis/eye-care-market-report

Source: https://landgeist.com/2021/11/05/people-who-wear-glasses/

Source: https://www.reddit.com/r/MapPorn/comments/127okj2/map_showing_the_percentage_of_people_with_glasses/

Source: https://www.grandviewresearch.com/industry-analysis/eye-care-market-report

Source: https://market.us/report/vision-care-market/

Source: https://www.globenewswire.com/news-release/2023/08/30/2734141/28124/en/Global-Eye-Care-Market-Analysis-Report-2023-2031-Personalized-Treatment-Approaches-Gain-Momentum-in-the-Evolving-Eye-Care-Market.html

Estimate from 2022. Source: https://www.maximizemarketresearch.com/market-report/global-vision-care-market/72274/

Source: https://www.techsciresearch.com/report/eye-care-market/4879.html

Grand View Research stands at 6.7%, mart.us at +5%, Research and Markets at +5.0%, Reports and Data +3.8%, maximize market research stands at 4.5%

![WORLDKINGS] Top 100 companies over 100-years and still in business – P60 - Essilor International S.A. (France): 171 years of developing journey of the world's largest manufacturer of ophthalmic lenses (1849) - Worldkings - World Records Union WORLDKINGS] Top 100 companies over 100-years and still in business – P60 - Essilor International S.A. (France): 171 years of developing journey of the world's largest manufacturer of ophthalmic lenses (1849) - Worldkings - World Records Union](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F8211e7b4-8f1b-4e73-9fe0-9efba92f2ab1_698x392.jpeg)

Thanks for this very nice article.

I have been wearing glasses since 2022 for farsightedness (I'm now 46 year old and didn't need to correct my sight before).

My opthalmologist prescribed Essilor Eyezen glasses and said it would be very comfortable and reduce stress on my eyes and indeed it is. The first time I wore the glasses I immediately started to see the text on my phone screen clearly again, but the rectangular shape of the phone looked curved to me. Then I got used to glasses and I see the phone rectangular again.

When doing my glasses at optician shop I was very impressed with the robot taking measurements of my eye to make perfect glasses for me. It felt very futuristic.

Now I want to buy Essilor stock but I hesitate because of the large premium. Quality has its price I guess.