EssilorLuxottica Part IV: Full Analysis

EssilorLuxottica investment thesis

Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Index

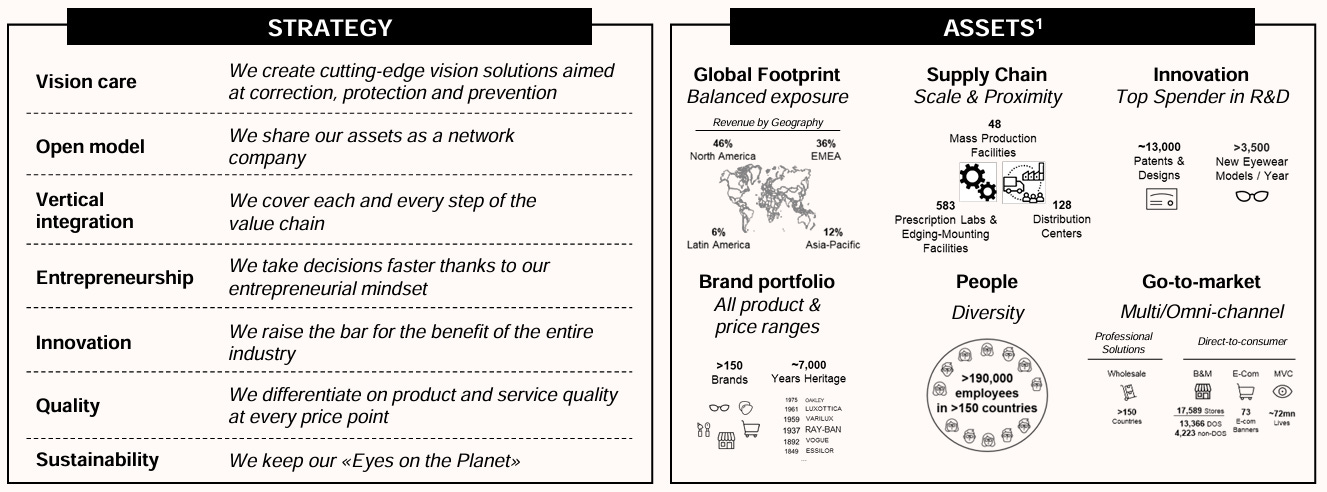

The creation of the leader in the eyecare and eyewear industries

Industry analysis and market positioning of EssilorLuxottica

Competitive positioning

Management and ownership

Smartglasses and partnership with Meta

Post Merger evolution: M&A and financials

Additional Growth prospects

Risks

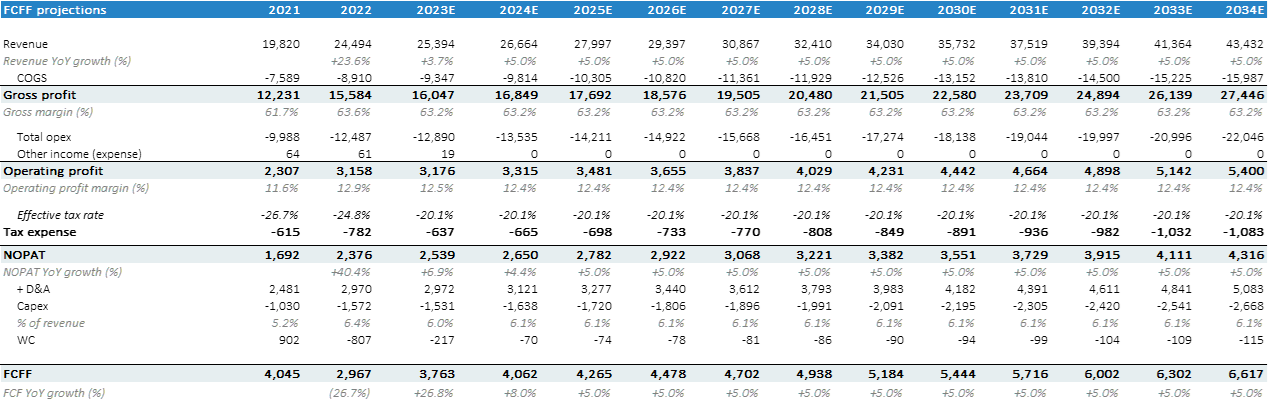

Valuation

Final word

Part IV: EssilorLuxottica Full Analysis

Summary of the investment thesis

During July and August 2024, I invested a very little fraction of the portfolio in EssilorLuxottica, the biggest and most important company of the eyecare and eyewear industry. Shares were acquired at €200.5 per share and currently represents ~3% of the portfolio with the goal to remain at ~2% once the portfolio is fully invested (depending on the valuation on the company during the next quarters).

EssilorLuxottica is the result of the merger between Essilor and Luxottica. During the last couple of weeks, we have analyzed separately both companies, as they were completely different companies. I recommend to read them if this thesis is of interest, as they dive deep into the business of each company.

My thoughts were that I was investing in the clear leader of a sector that benefits from very strong tailwinds: myopia pandemic unfortunately keeps expanding, and the aging population implies higher vision impairments in the population. Add to the equation the biggest store count in the industry, and the most iconic sunglasses brands such as Ray Ban and Oakley, and the result is EssilorLuxottica.

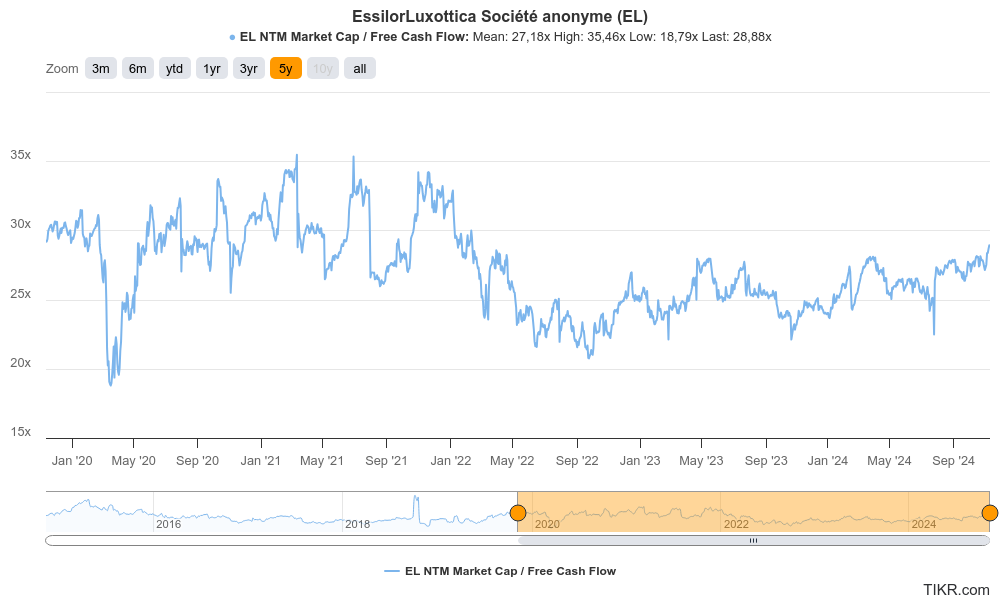

Allocation is low, given the current multiples of the company. However, many high quality companies appear optically overvalued (EssilorLuxottica trades at a EV/FCFF of ~25-30x), and those multiples end up to be cheap in a 5-7 year period.

There are risks in this investment, partly the valuation, but also the current macro environment, as the company offers high quality products that are more expensive than many competitors, and Luxottica’s brands such as Ray Ban are more sensible to market cycles.

On the other hand, there are opportunities such as myopia treatments that are growing double-digit in China and will be launched in the US from 2026, or a natural organic growth coming from the aging population.

The moat of this company is huge because its a vertically integrated company. The market share is around 35-40% of the eyecare industry. In the sunglasses segment, they also control 1/3 of the global market.

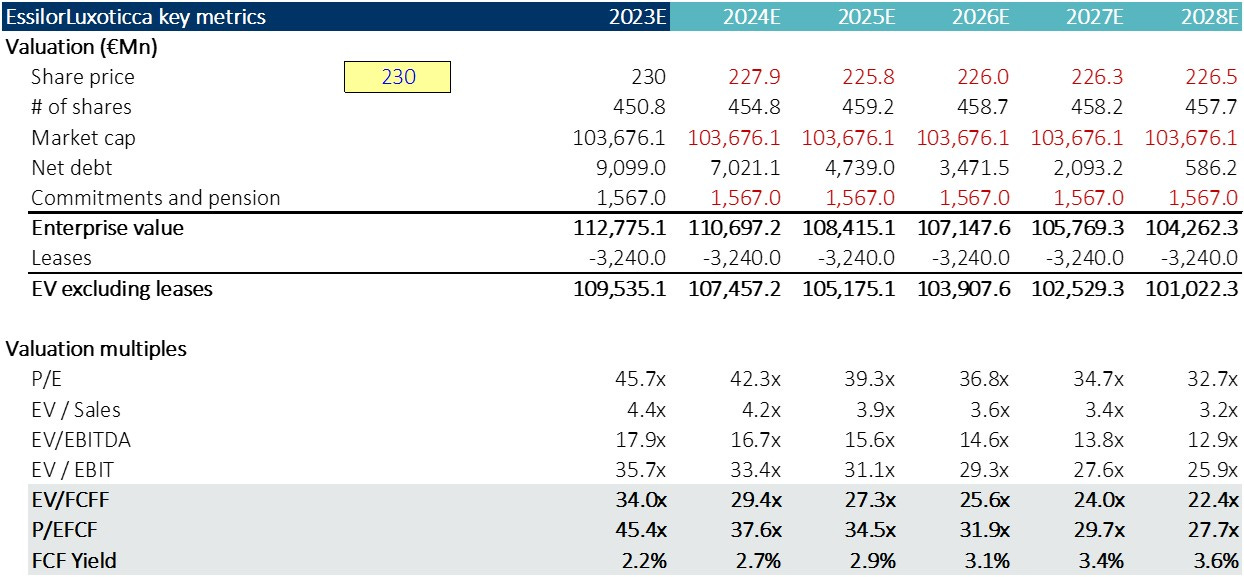

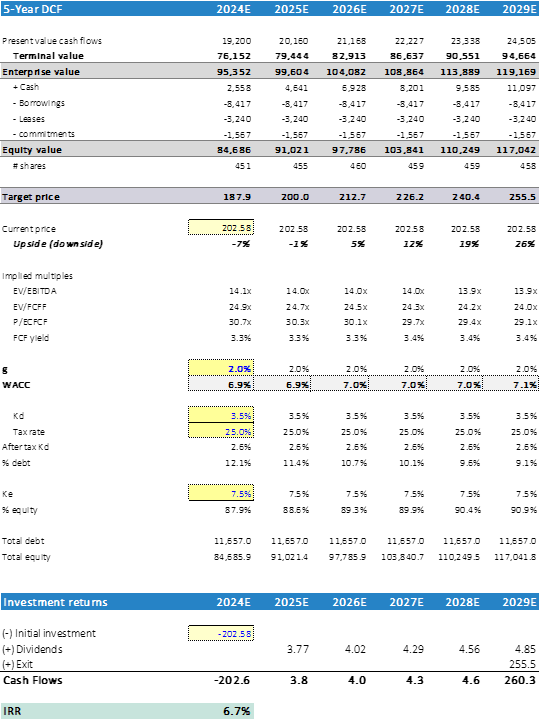

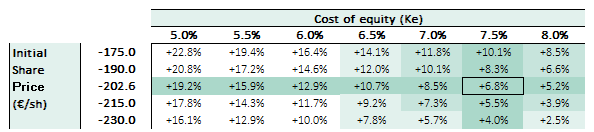

My conclusion is that at current valuation, expected returns are not attractive. At the valuation I acquired the shares, returns might be north of ~7% annually, which is in line with the average equity returns.

I will keep the stock with very low exposure, but won’t buy more shares at current valuation. I keep the shares, although are quiet expensive right now. Its sounds contradictory, as a value investor price-value is the core driver of decisions, but this company has strong potential for the next decade. Unless I have liquidity constraints, I will keep the stock.

I have applied my recently introduced checklist. The result is a score of 100 out of 150 possible points (67%). Its in line with the analysis of Porsche, as the company lacks a very attractive valuation and a proper shareholder retribution policy.

Industry: Eyecare and eyewear (22/30 points)

6️⃣Industry overview. The industry is highly fragment, with hundreds of brands in the sunglasses space and dozens of competitors in each segment of the eyecare industry. However, there are only a few global players. On the other hand, the industry benefits from strong tailwinds from the vision impairment pandemic that the world suffers. In eyecare, barriers to entry are high due to the investment and time required to develop products.

8️⃣Competitive landscape and positioning. EssilorLuxottica is the clear leader of the eyecare (35-40% market share), and the leader in the sunglasses market (1/3 of market share). Additionally, it is the company with the highest number of stores (i.e., the one with the biggest proprietary distribution network). The company more than doubles the second competitor in terms of revenue.

8️⃣Protection against disruption. As of today, there are limited alternatives to wearing glasses, which are contact lenses or surgeries. They have been living together for decades. On the other hand, sunglasses do not have risk of disruption. Part of the risk, is copying the technology of Essilor’s lenses, which are protected with patents. The company is embedding technology in the frames, making them very well positioned for the future.

Company - qualitative (40/50)

7️⃣Company easy to understand. Although is not that hard to understand, it has some level of complexity given all the brands, products and segments were the company operates.

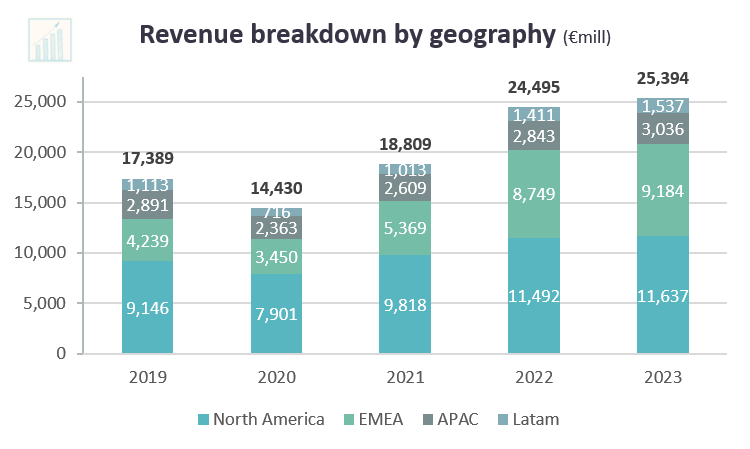

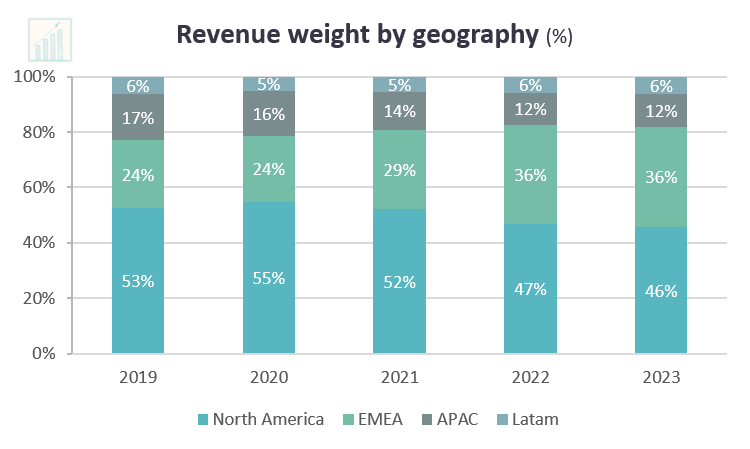

9️⃣Global business. Its a global business, with real strong growth prospects in China, through their myopia solution. In the US, the opportunity is high, once the company will introduce this myopia lenses. 70% of the revenue comes outside Europe (~44% North America, 17% APAC, and 7% Latam).

8️⃣Competitive advantages. In the eyecare segment, Essilor has the biggest R&D capabilities in the industry and develops the best products. In eyewear, they own most iconic brands (Ray Ban, Persol, and Oakley), and has partnerships with Prada, Chanel, Armani, Moncler, etc. Last, but not least, they own the biggest distribution network in the market.

🔟Market share. The market share is around 35-40% of the eyecare industry. In the sunglasses segment, they also control 1/3 of the global market. The revenue is at least 2x largest than the second largest competitor. Finally, they own the largest number of stores in the industry, with more than 17,000 stores worldwide. In a highly fragment market, EssilorLuxottica owns the market.

6️⃣Management and corporate governance. There has been a battle between French and Italians to take the leadership in the company. Finally, Del Vecchio won the battle and Italians run the company. Now things look more calm, and management is executing well, with solid revenue growth. There is skin in the game. However, profitability seems stagnated during the last years.

Company - quantitative (34/60)

6️⃣Future growth. Growth prospects remain solid as, in a difficult macro environment, the company is growing fast. The myopia lenses are growing at double-digit in China, and the company is introducing them progressively worldwide. In 2026, they will introduced them in the US. Last, the partnership with Meta adds more growth optionality. Company should bring a mid-single digit during the next decade.

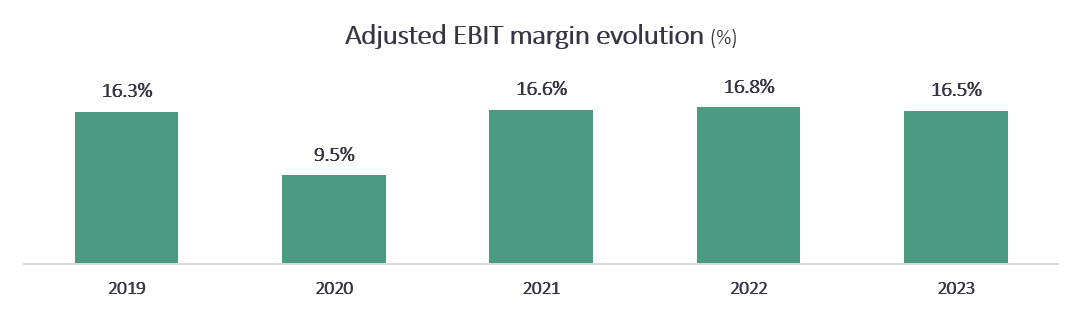

7️⃣Margins. The company earns an adjusted operating margin of 17%, which is high considering the industry and competition. Margins are in line to Cooper Industries and Kering, which provides a sense of the strong margin of the company.

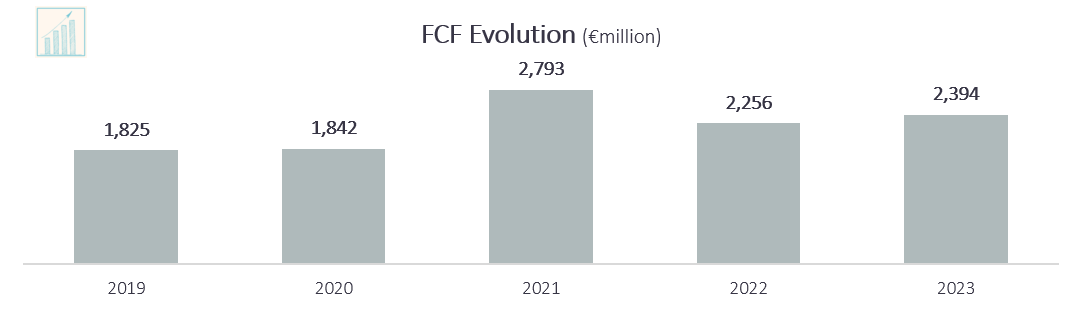

6️⃣Cash generation. The company generates a FCF of ~€2.1-2.3bn FCF, which implies generating 10 cents of cash per euro of sales (i.e., 10% FCF margin), which is not formidable, but not bad.

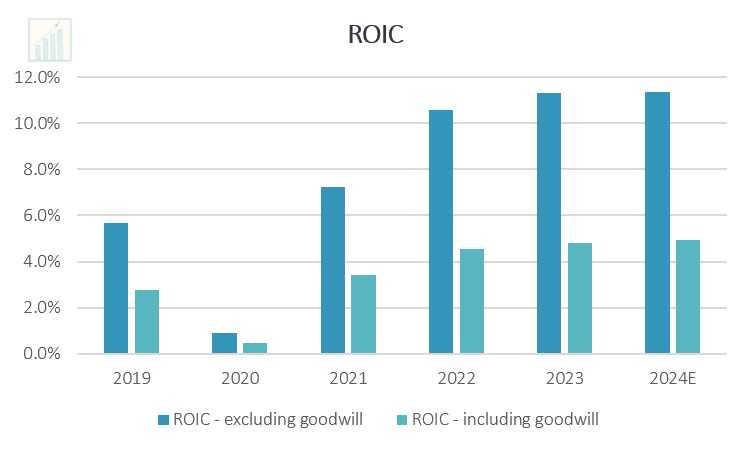

6️⃣ROIC stands at around 11%, with a slight increase over the last years. Its a good return, however not great.

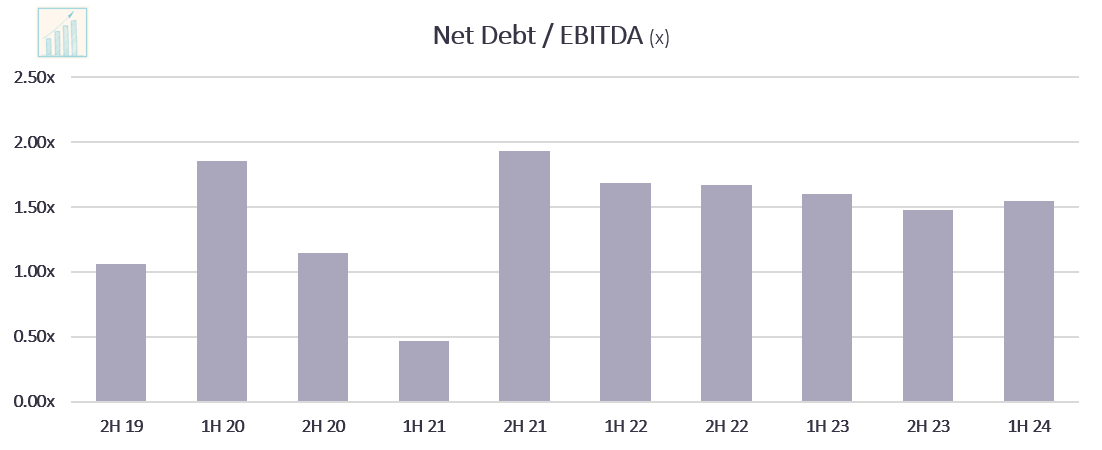

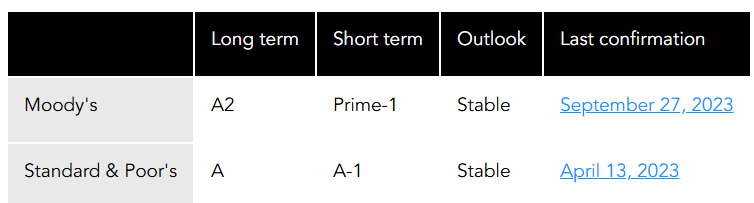

6️⃣Capital Structure and balance sheet. After several M&A acquisitions, balance sheet is starting to get tight, with a ND/EBITDA ratio of 1.5x, prior to the Supreme acquisition. Balance sheet is healthy, but as an investor, I always prefer lower amounts of debt. Credit ratings are high: A for S&P and A2 for Moody’s

3️⃣Shareholder retribution. Company is distributing dividends through the scrip dividend formula, without buying back shares. This is just issuing shares, without receiving cash. I’m very against these dividends are they are not friendly to shareholders.

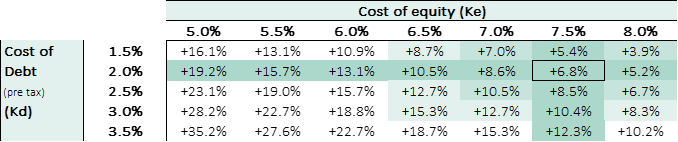

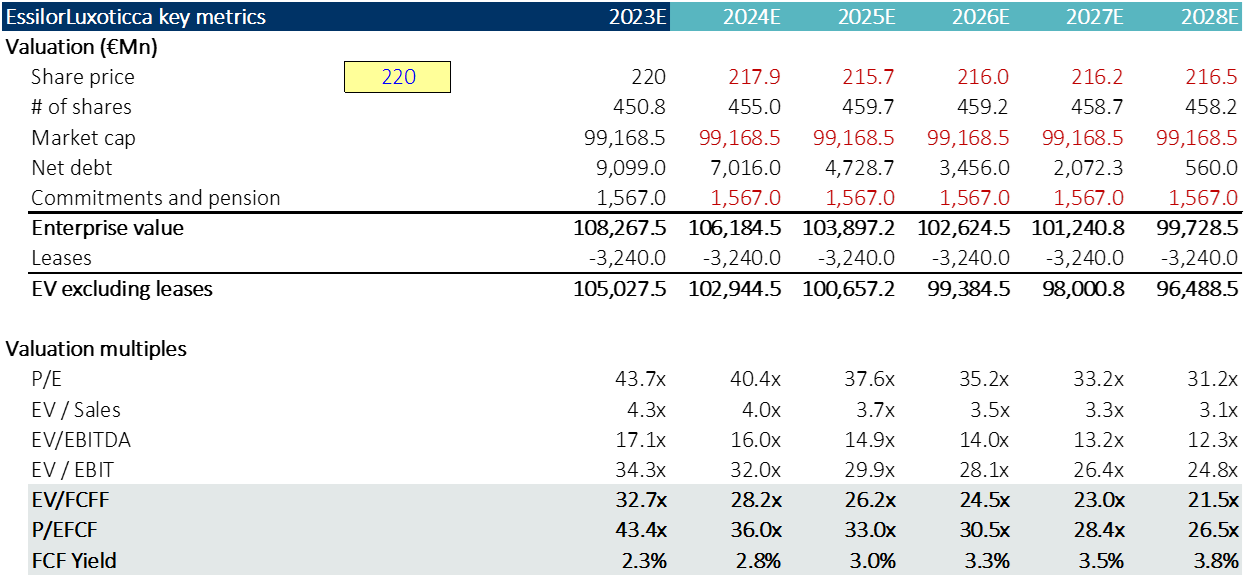

Valuation (4/10)

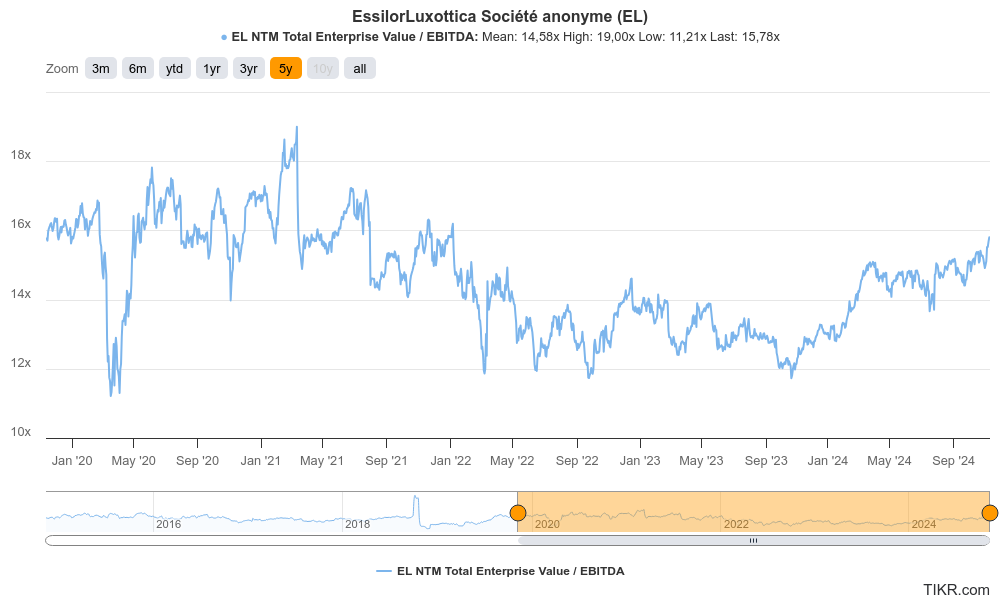

4️⃣Valuation. Company looks optically expensive, currently trading at 16x EBTIDA and ~30x FCFF. This valuation is very stretch, even if its a high quality company. At current price, expected returns are low.

Investment thesis

I. The creation of the leader in the eyecare and eyewear industries

The merger between Essilor and Luxottica

Essilor

Founded in 1849, Essilor began as a small French company focused on ophthalmic lenses and grew into a global leader in vision correction. With a strong commitment to research and development, Essilor has been at the forefront of lens technology, creating groundbreaking products such as Varilux, the first progressive lens. Over the decades, Essilor has prioritized innovation and accessibility, striving to improve lives by providing clear vision solutions to people worldwide.

Luxottica

Established in 1961 in Italy, Luxottica started as a small eyewear manufacturer and transformed into one of the largest eyewear companies globally. Known for designing and producing frames for iconic brands like Ray-Ban and Persol, Luxottica has a diverse portfolio, including high-end designer collaborations and its own retail chains. Luxottica's focus on fashion, design, and quality craftsmanship has set new standards in eyewear, making it a prominent force in both luxury and everyday optical markets.

EssilorLuxottica

EssilorLuxottica has deep roots in the eyecare and eyewear industry, encompassing design, production, distribution, and innovation, with iconic brands like Essilor, Ray-Ban, and Luxottica. Formed in 2018, EssilorLuxottica is the merger of two pioneering companies, Essilor and Luxottica, each with a legacy of transforming the industry. United by a shared vision and entrepreneurial spirit, the combined Group delivers innovative products worldwide. The 2021 acquisition of GrandVision strengthened EssilorLuxottica’s global retail presence, enhancing its ability to meet diverse vision needs and lead the industry's evolution responsibly.

The creation of a giant

The merger of both companies created a fully vertically integrated company, covering each step of the value chain.

The resulting company will has very spectacular numbers:

More than 190,000 employees

More than 150 brands, covering all price ranges

More than 17,000 stores located in North America, Europe, APAC and Latam

More than 13,000 patents and designs

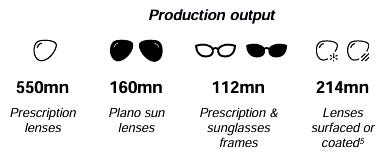

The production figures are also impressive:

They sold 550 million prescription lenses in 2023. Assuming its individual output, they will be selling 275 million pairs, which is a pair lenses for every 6 out of 100 individuals in the world. If we exclude China and India, the output will represent a par of lens for 13 out of every 100 individuals1

(note: this refers to total population)

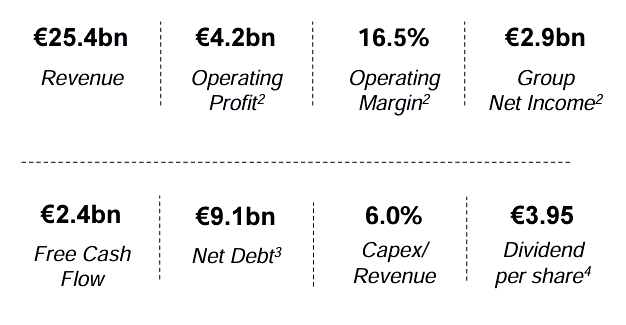

In terms of financials, this was the picture in 2023:

The company generates €25+bn of revenue, and translates into cash c. 10% of the revenues(FCF of €2.4bn).

Company has debt, as they are a very active player in the M&A industry, and currently pays ~€4/sh of dividend (~1.8% dividend yield)

The Company dominates the eye sector

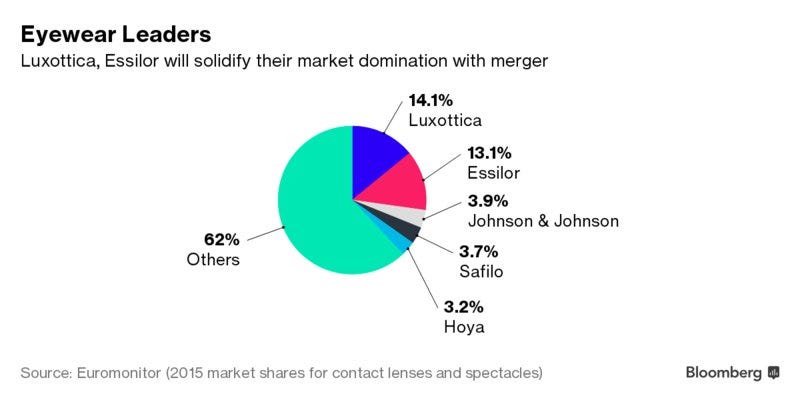

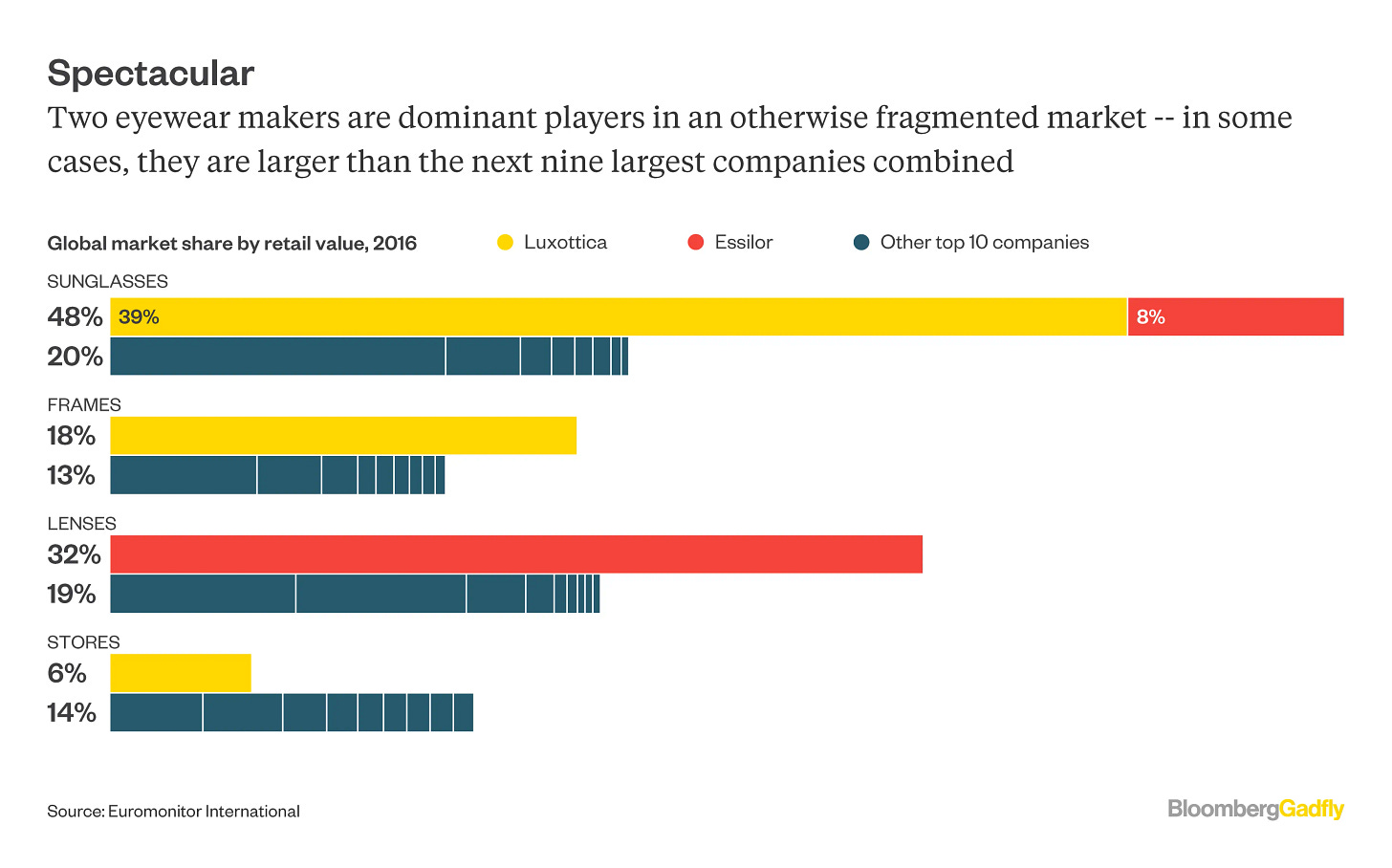

The combination of both companies has created the biggest player in the industry, dominating the fragmented competitive landscape:

Eyecare: more than 10% market share; 30-35% of the corrective glasses market (using data from 2019 for Essilor)

Sunglasses: At least 33% of the market

Stores: 6% market share in 2019, being the largest player; It should be ~10% after the acquisition of GrandVision

Note: Conservative assumptions using 2019 financials of individual companies. Additionally, The company also generates revenue from 4,000+ franchises that is not consolidated in the P&L and can add €3bn in sales (assuming 5% over revenues franchise royalty)

Some of this data is backed by research from Bloomberg:

The company has a dominant position as it more than triples the revenue generated from the second largest competitor:

In Eyecare, Hoya generated €1.9bn from eyeglass lenses in 2023, compared to more than €7bn of EssilorLuxottica

In sunglasses, Kering Eyewear generates €1.5bn, compared to more than €7bn of EssilorLuxottica

II. Industry analysis and market positioning of EssilorLuxottica

As stated in the individual reports of Essilor and Luxottica, the two companies dominated their market. Combined, the dominate the whole eye industry.

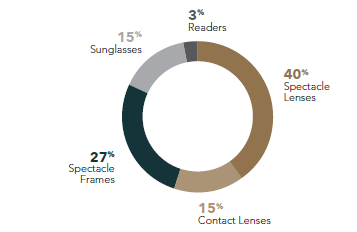

The eyecare industry

The eyecare industry is a massive industry with c. 1.4Bn lenses produced every year, and c.700 million customers. The market value of spectacle glasses is significantly higher than sunglasses or contact lens, although is a cheaper alternative.

According to data from the company, the eyecare industry can be broken down as follows:

Spectacle lenses and frames represent 2/3 of the market

The remaining third is equally distributed between contact lenses and sunglasses

There are billions of people with vision impairment. Either using glasses or contact lens, the industry is huge, and it will continue to increase as the pandemic of myopia continues to expand every year, and the population continues to age every year.

EssilorLuxottica is focused on spectacle lenses (i.e., prescription lenses), which is the biggest category in the industry. Its a solution from vision impairments such as myopia, presbyopia, Astigmatism, etc.

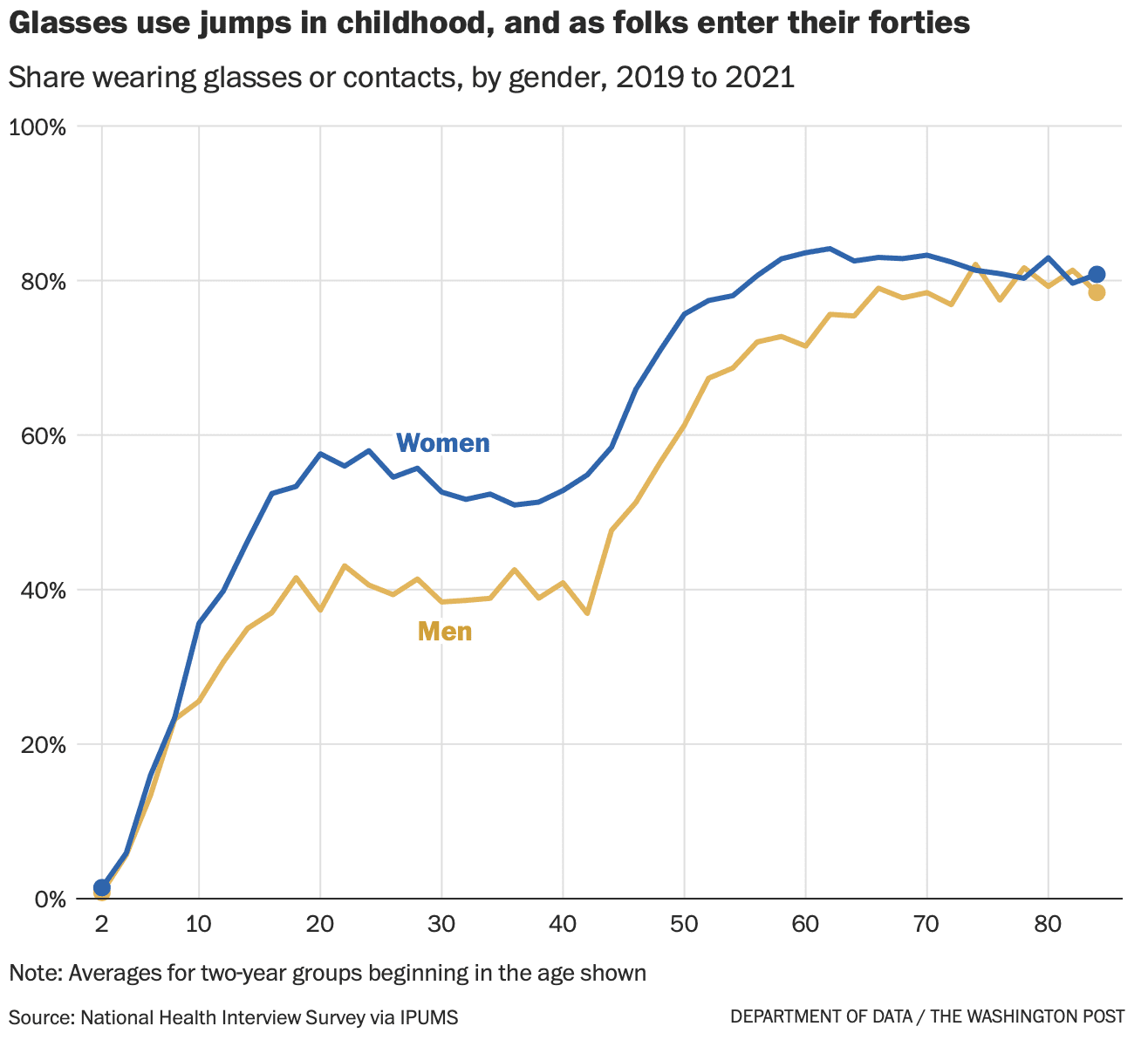

It is hard to find reliant data on how many people use glases, but two trends support the continuous growth in the use of glasses:

Permanent use of screens, and exposure to artificial light

Aging population, which brings more vision problems

The more the people live, the more probable they will wear glasses. And, many of those glasses, aren’t cheap. The total addressable market is huge and keeps expanding every year.

“Vision impairment is the world’s biggest unaddressed disability with large untapped opportunities in terms of vision correction and protection. Today 2.7 billion people around the world suffer from uncorrected refractive errors”

EssilorLuxottica Annual Report 2023

According to statistics of the US Centers for Disease Control and Prevention (CDC):

Myopia: It is estimated that by 2050, 50% of the population will be affected. We are talking about billions of people. Essilor has one of the best products in the market.

Presbyopia: there are an estimated 1.09 billion cases of presbyopia in the middle-aged to elderly population. Essilor has the most renowned product in the market: the Varilux© progressive lenses.

Astigmatism occurs in about one out of every three people in the United States

Farsightedness occurs in about 8.4 percent of the population over the age of 40 (over 14.2 million people in the US)

Nearsightedness occurs in about 23.9 percent of the population over 40 years old (about 34 million people in the US)

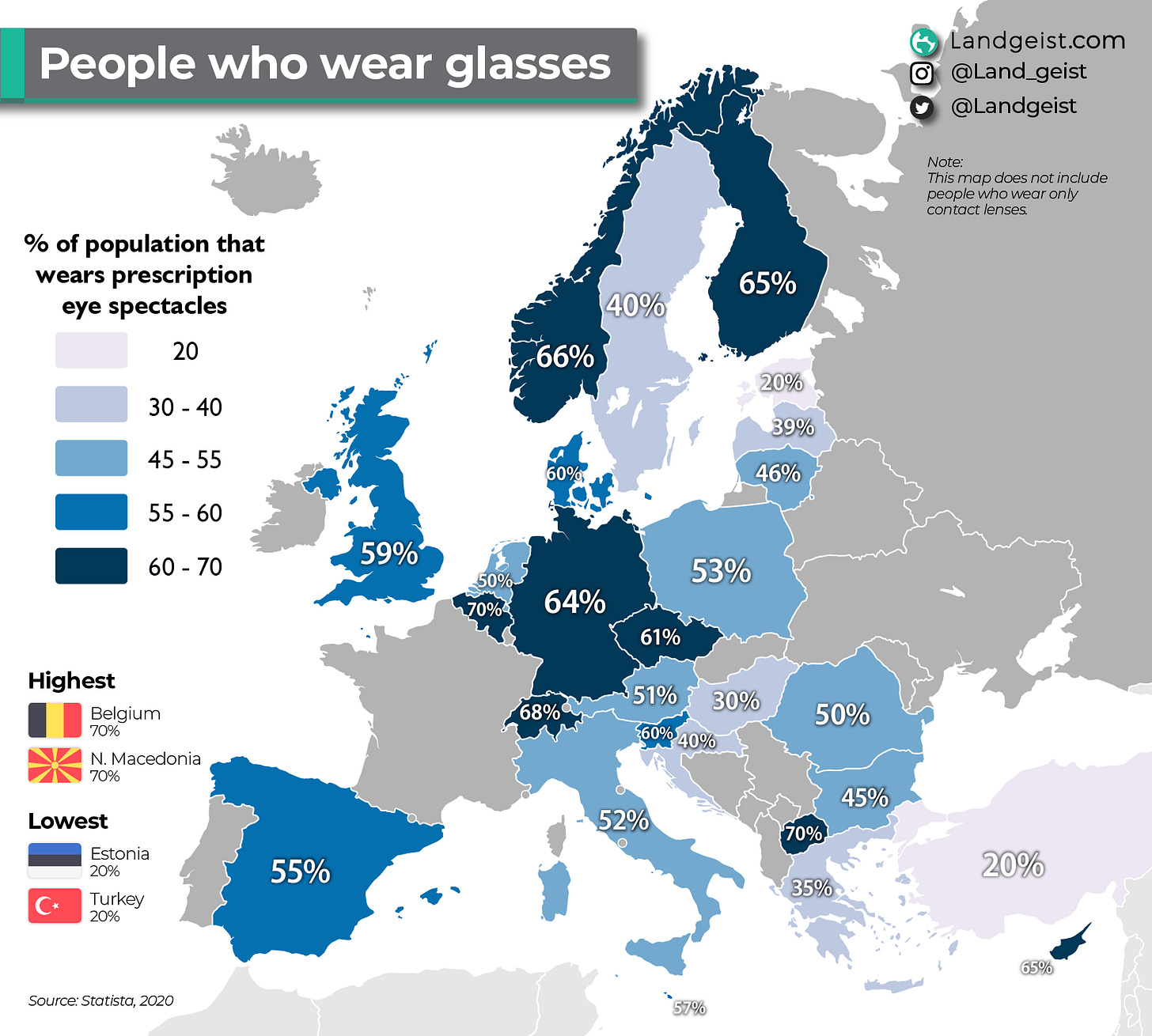

In places like Europe, half of the people wear glasses, with some countries with 2 out of 3 people wearing them.

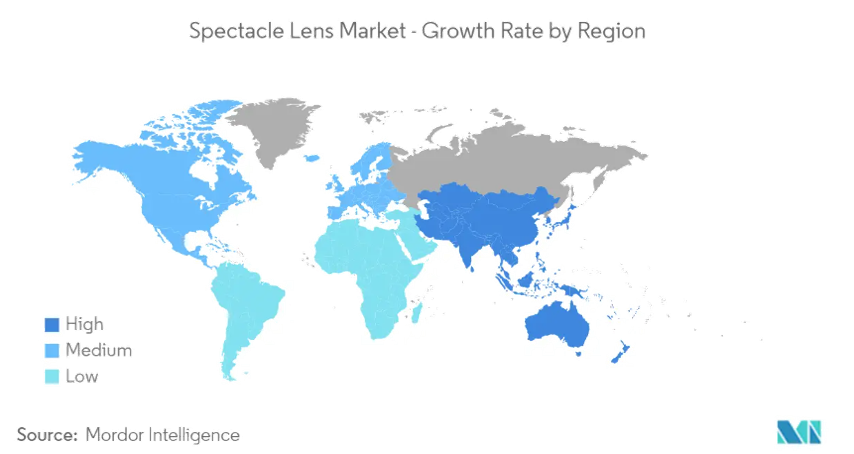

And the opportunity is still massive as many countries are still very under developed. The rising of China and India and Middle East will contribute to further growth. And in the countries with higher penetration, the sector benefits from tailwinds from the aging population.

According to the company, the US remains as the biggest country by retail value, followed by China. Europe has 4 countries in the top 10.

Essilor product offering

Essilor main product offering are lenses, operating under different brands:

Varilux: helps against Presbyopia (difficulty focusing on near objects due to aging). Its the most iconic brand in the industry

Stellest: Myopia. Slow the progression of myopia by an average of 67%, which is among the highest rates in the industry, and its price is similar to competitors

Eyezen: Reduces and prevents the symptoms of eyestrain

Transitions: These lenses adjust automatically to changing light conditions

Crizal: Eye strain, glare, UV protection

TAM and market share

The market size of the industry, according to several sources (see Essilor post), stands at:

The whole eyecare industry has a market size of ~$70bn

The corrective glasses segment represents around ~$20-25bn

The last available data from Essilor is from 2020, as the company doesn’t report anymore individual data. The revenues 2019 (2020 was affected by Covid-19) were €6.8bn (~$7.5bn), which implies that Essilor has a market share of close to 30-35% of the corrective glasses market and around 10% in the aggregate eye care market, which includes also contact lenses, and others.

Note that we are talking of global market share. Having a 30-35% is massive.

Main competitors

The prescription glasses is a very fragmented industry with only 3 global player, and Essilor is twice as big as the sum of the top #2 and #3:

Essilor: €6.9bn revenues in 2019 from eyeglass lenses (no updated figures since 2019)

Hoya: €1.9bn from eyeglass lenses in 2023

Carl Zeiss: €1.6bn from Consumer Markets division (includes eyeglass lenses, contact lenses, and optical retail solutions) in 2023

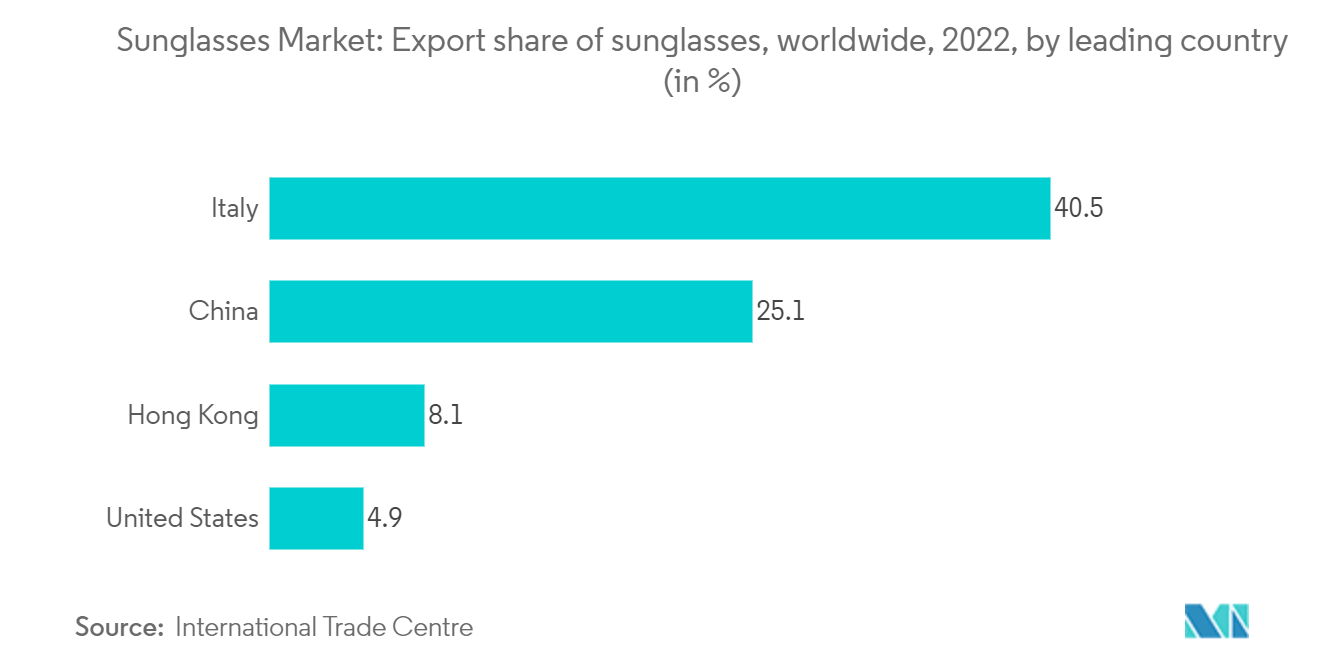

The sunglasses industry

The sunglasses industry, is a highly fragmented market with hundreds of brands, and with a lower market size.

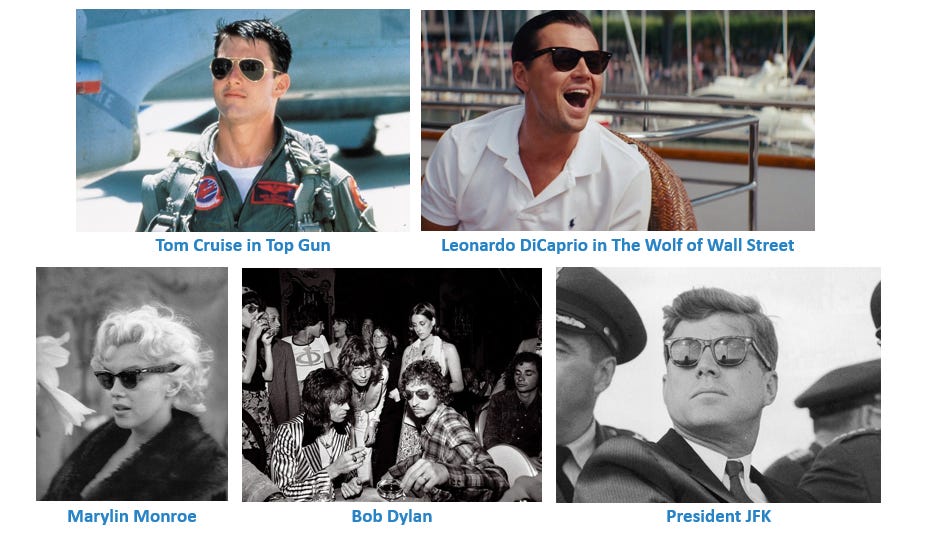

In this segment, Luxottica has the biggest and more important brands in the world: Ray-ban, Persol, Oakley, plus multiple franchise agreements (Prada, Chanel, Ralph Lauren, etc.)

Sunglasses has no risk of disruption. Its a product that has existed from more than a century and has remained essentially the same. The lens, materials, and designs are different, but the essence of the product is the same.

Its the kind of industry that has solid prospects for a dominating company like EssilorLuxottica

EssilorLuxottica can use their scale and resources to keep consolidating the market, either by acquiring other brands or by acquiring new stores, or both

Its a virtuous cycle as, the more parts of the value chain are controlled by the company, the more profitable will be

Despite being mature, there is still room to grow as the world’s population keeps improving their lifestyles.

TAM and market share

According to different estimates, the estimated market size will be around $28bn (~€31bn). The global eyewear market grows at around mid-single-digit per year. Its a fragmented market with many brands offering their products.

The main competitors generate around €5bn in revenues. Luxottica generates 2x the revenue of the six largest players combined. This gives Luxottica a huge market share above 30%, assuming a market size of $31bn:

#1: EssilorLuxottica: ~33%

#2: Kering: ~5%

#3: Safilo: ~3%

Note that I’m using data from 2019 for Luxottica and Essilor to be conservative. This market share includes all its retail network, which might sell brands from competitors, so its fair to say they control around 1/3 of the market.

According to Bloomberg, the company will have a higher market share of 39% and Essilor of 8% (combined of 48%).

Main competitors

The market is highly fragmented with hundred of brands. Its a market similar to clothing, with many players, pricing ranges and styles.

Luxottica is the biggest player in the industry, however its market share is very difficult to obtain, but they are leaders in the premium, luxury, and sport segments.

The sunglasses market is still dominated by Italian players, as sunglasses are a fashion item deeply rooted in European firms:

The three largest players are:

Luxottica: €9,600 million in 2019 (last year reported individually), EBITDA margin ~20%; EBIT margin of 17.5% - Not a perfect metric as this figure includes revenue from shops. We can take only revenue from wholesale, and the amount will be €6.3bn (which is in any case significantly higher than competition)

Kering eyewear: €1,500 million in 2023 (adjusted operating income of €276; operating margin of 18.4%)

Safilo Group (Italy): €1,025 million in revenue in 2023 (adj. EBITDA margin 8-9%) in 2023

You can find additional details in the individual report of Luxottica.

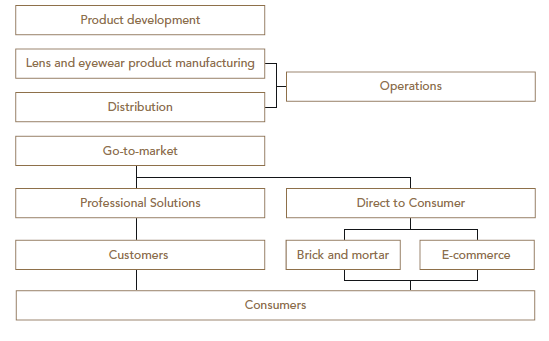

Vertical integration

The value chain in corrective glasses can be quiet large: from mass production to distribution centers, prescription laboratories, etc. EssilorLuxottica has strong influence in all the value chain in the industry

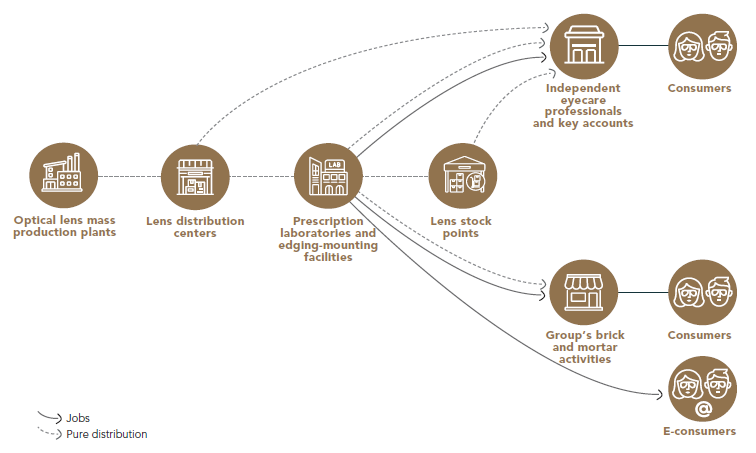

This chart illustrates the vertical integration of the company, and how the company reaches its customers.

Sunglasses: From product development and manufacturing, to distribution and two different go-to-market strategies, to reach then end customer

Prescription glasses: The process is slightly more complex as some times, the lenses need to be further adjusted depending on the customer needs (there is no one size fits all). Prescription laboratories and eyecare professionals play a key role

How big is Essilor and how they control the value chain?

Product development (R&D): a massive network, very difficult to replicate by competitors, given its scale and geographical distribution:

Prescription glasses: 9 research centers in Europe, Israel, the US, and in Asia (Singapore, Shanghai and Bangkok). Multiple collaborations with institutions and universities across the globe.

Eyewear (Sunglasses, frames, and packaging): 5 research centers (US, Italy, and Thailand), plus ~14 trend, design, creative/innovation centers in the US, Brazil, Italy, Germany, China, Japan, and South Korea), together with some collaborations with institutions

New products and technologies: 7 R&D centers (2 in US, 5 in Europe) plus scientific collaborations in the different regions

Mass production facilities: 35 facilities (27 for prescription lenses and 8 for sunglasses), located in the US, Mexico, Ireland, Germany, France, Italy, and Asia (China, India, Thailand, Philippines, Laos, South Korea, etc.).

The output is massive: ~550 million prescription lenses and ~160 million sun lenses

Prescription laboratories: To control this intermediate part of the value chain, the group owns 583 prescription laboratories (490 in 2020, signalling a continuous investment in the value chain):

79 industrial laboratories, balanced between North America, Latam, Europe, and Asia

504 proximity labs, which include prescription laboratories and edging-mounting facilities. Distribution by geography: Asia ~33%, Latam ~33%, North America ~20%, and Europe ~15%

Distribution: 128 distribution centers, being half of them in Europe

Go-to-market: The company has its own go-to-market strategy and also relies on third parties:

Professional solutions (wholesale; 48% of revenue): over 300,000 third party eyecare professionals

Direct to c consumer (retail, 52% of revenue): 17,000+ stores (13,300 proprietary) and around c.30 specialized eCommerce websites.

Is this network replicable? I bet its not. For two reasons:

EssilorLuxottica already owns the market. Trying to capture their market share would require years and billions in investments, as they are deeply rooted in the industry

How much investing is needed to replicate a network of 13,300 proprietary stores generating ~€1 million revenue each?

Even if competitors are able to grab market share in the end-points (i.e., more stores), can they survive without EssilorLuxottica’s brands like Ray-Ban, Essilor, Persol, Chanel, Prada, Ralph Lauren, Moncler, Brunelo Cucinelli, Armani, Coach, Costa, D&G, miu miu, Versace, Vogue, etc.?

III. Competitive positioning

As seen before, EssilorLuxottica is a vertically-integrated player, with massive distribution capabilities (over 17,000 stores and more than 300,000 third party professionals), the company owns and has licensing agreements with the most iconic brands in the industry.

EssilorLuxottica brands

After completing the merger, these are the main brands of the company:

Eyecare brands: Varilux, Stellest, Transitions, etc. Next time you walk next to a optic store, look at their advertising inside or outside the store. I bet you will find some of one of these brands:

Eyewear brands: Some of these brands are proprietary, and others are through licensing agreements:

Proprietary brands: Ray-Ban, Oakley, Persol, Costa, Oliver Peoples, Arnette, Vogue, etc.

Licensed brands: Chanel, Prada, Armani, Moncler, Brunello CUcinelli, etc.

The big groups such as LVMH or Kering are developing their own sunglasses platforms, including all their brands, something more difficult to players with less scale such as Chanel, Prada, etc. The exposure to LVMH/Kering is very limited: only Tiffany & Co. which expires in 2027.

For the remaining brands, licensing agreements last beyond 2030, except for a small number of brands, which I believe they can be renewed at term, as they are smaller player compared to LVMH and Kering. Does it makes sense for Chanel to develop their own sunglasses and distribute them? Probably not

List of near ending licensing agreements that will need to be renewed:

Prada and Miu Miu: Ends in December 2025

Chanel: Ends this year; can be extended until December 2027

Ralph Lauren: Ends in December 2027

Moncler until 2028 (signed the first agreement last year)

Last, but not least, the company has strong brands in the retail space. Take a look at the following image, I bet you will recognize one of these in your city:

Some examples for the readers, which we all might now in your respective countries:

France: c.400 stores of Générale d'Optique

Spain: 100+ MultiÓpticas

Germany: ~700 Apollo stores

Netherlands, Belgium, Austria: 500+ Pearle stores

UK: 850+ Vision Express stores

US: ~3,800 stores of Sunglass Hut and LensCrafters

Latam: ~500 MasVisión, ~300 GMO and ~400 Sunglass Hut, plus many others

Competitive advantages

Scale: The company dominates the market. Not only in terms of market share, but also distribution. Nearly 1 out of 10 stores belongs to EssilorLuxottica. Additionally, they have a network of 300,000+ eyecare professionals. This increases every year, making it more difficult to replicate. No company has a scale close to EssilorLuxottica.

Vertical integration. The company controls the whole value chain, which is key to be more efficient and to rapidly adapt to changing trends. There is no company with this level of integration, and becoming vertically integrated in the same proportion as EssilorLuxottica is very challenging, as their stores represent ~50% of sales.

Brands. EssilorLuxottica owns and manages more than 150 brands. Some of them, are the most iconic in the industry. In sunglasses, Ray-Ban is by far the most iconic and most popular brand. A brand by itself might not be a competitive advantage, but owning many of them, it is (Ray-Ban, Oakley, Persol, agreements with Chanel, Prada, Armani, Moncler, Ralph Lauren, etc.)

R&D and Investment Capabilities: Company is investing €1.5bn annually in Capex, which represents c.6% of revenues. Its not high investment needs, but relative to other competitors, their capabilities are much stronger. Most of the capex goes to PPE, while around €300 million is dedicated to intangibles.

In addition, R&D recorded in the P&L amounts ~€600 million. In total, the company is investing ~8% of revenues.

E.g., In 2023, the Group launched Varilux XR series, its latest generation of progressive lenses that responds to the wearer’s visual behavior predicted by Artificial Intelligence based on exclusive real-life data. The five years of conception and development of Varilux XR series lenses involved the study of more than 6,500 consumers to enrich presbyopes’ lifestyles and visual challenges, analysis of more than one million exclusive pieces of real-life data, and real-life wearer tests conducted by an independent institute

EssilorLuxottica management during an investor call

To compete against EssilorLuxottica, competitors will need very high amounts of capex and R&D. Additionally, these investments take time to materialize as in the eyecare industry, the product needs to be tested during years, prior to launch it.

Innovation: Their innovation capabilities can be recognized with the Oakley Prizm technology or by the fact that Meta has chosen the company to develop the smart glasses Ray Ban Meta. An example of how the Oakley Prizm works, and it is real (I use these lenses when riding my bike):

You see the road and other elements better

The vision field is wider, allowing to see more than with traditional glasses

EssilorLuxottica is not only a clear leader in glasses innovation, but they are also developing new segments that embed technology into the glasses:

Smart glasses: They recently signed a 10yr partnership with Meta to develop this new category, and its having success. Being selected by Meta as a partner clearly represents the innovation capabilities and power/scale of the company

New ventures: Nuance. Company will launch in the following months glasses with audio technology to serve people with both vision and audio impairments, a category that its increasing every year.

Moat

How the company protects their competitive advantages?

#1 Player in the market

As seen in the Essilor and Luxottica individual posts, the company generates 2-3x the revenue of the second and third largest competitors, combined.

The scale is so big, that it is very difficult to compete against them. However, is not only the scale, but also the fact that they own close to a 10% of total stores.

Do consumers have alternative choices?

It is difficult to go to a store and not been offered Essilor products. Or going to a shop to acquire sunglasses and not acquire EssilorLuxottica’s brands and/or purchasing the glasses in a store owned by the company.

With more than 300,000 agreements with independent professionals, combined with a tier-1 product, the result is that consumers have little choices.

The company owns at least 10% of global stores, which implies that in some countries they might be the leaders, by far. This limits the alternative for consumers and increases the moat of the company.

Brand, R&D, and Patents

The combination of strong brands such as Ray-Ban, Oakley, Varilux, etc. combined with high R&D investments to continue developing products, and thousand of patents to protect against competition is another way to protect the competitive advantages.

At the end of 2023, the company held more than 2,400 patent families each representing an invention protected in several countries with ~13,000 patents, pending or granted)

More than 4,500 trademark families protect in several countries around the world, with ~23,000 trademarks pending or registered

Counterfeit is a real threat to the company. As a reference, just in 2023, the company’s initiatives led to the seizure of 9.5 million of counterfeit products and the closing of more than 2,000 domains,

Skin in the game

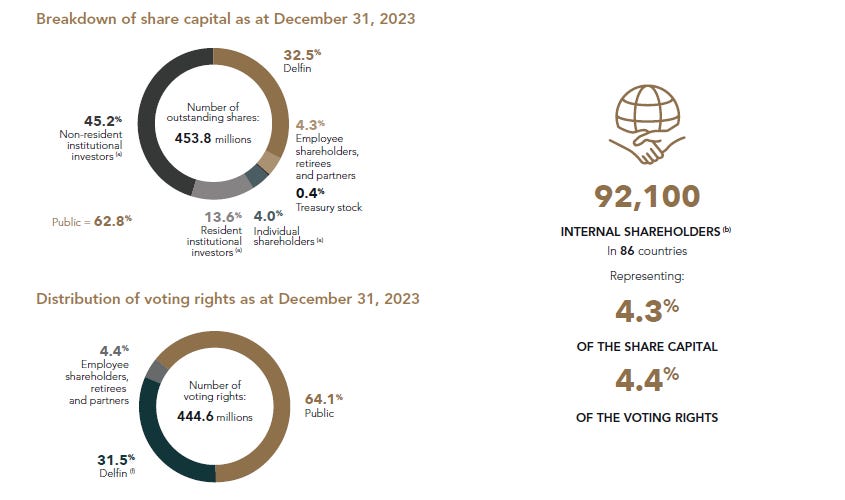

Delfin, the holding company of the Del Vecchio family, has a 32.5% stake, representing 31.5% of the voting rights. Additionally, current and retired employees hold 4.3% stake. This gives a ~37% of the shares held by insiders.

For a public company, this is big, and creates strong alignment of interest. Remember that some family members are already working in the company and the CEO is head of the family holding company, which has investments in banking, real estate and others. He is the trusted partner by the family to run their Family Office plus EssilorLuxottica

Branding positioning to defend the competitive advantages

Branding by itself is a delicate moat, as it can be destroyed if poorly managed such as Kering has done with Gucci. EssilorLuxottica owns 150+ brands and some of them are iconic.

Competition may come from:

New competitors: New competitors or brands might emerge. They need to compete against Ray-Ban, and many other brands. Its feasible, so there is no real moat in the brand against new competitors entering the market. A new brand could emerge and surpass Ray-Ban in a decade. It takes time, but it could happen, although we can agree its something very difficult.

New competitors in the distribution (i.e., in the stores). In this case, the brands are key, given the company owns iconic brands. Can optic stores live without Ray-Ban, Oakley, Persol, Chanel, Prada, etc.? Very difficult, almost impossible. The stores need products from EssilorLuxottica to be able to offer what consumers are demanding.

Can they live without Essilor products? Very difficult too, given they are among the top products and their distribution capabilities are higher than any other competitor

Finally, their partnership with Meta clearly puts EssilorLuxottica in a very strong position against competitors. The business is evolving to more than just selling glasses.

IV. Management and ownership

After the merger of the company, there was a strong dispute between the French side (Essilor) the Italian (Luxottica), for the leadership of the company. In the end, the Italians won the battle and now are leading the company, although maintaining the headquarters in France.

The Italians take the control of the company

The merger in 2018 from two different companies created some frictions in the management of the new combined entity.2

To balance the French and Italian sides, a dual leadership system was established. Essilor’s CEO, Hubert Sagnières (representing the French side), and Luxottica’s founder, Leonardo Del Vecchio (representing the Italian side), became executive vice-chairmen of the new company. The idea was that they would work together to lead the combined entity.

However, the Italian side had around one third of the shares, and this will create several conflicts during the years after.

Initiation of governance conflicts

The conflict started right after the merger, and from the first year, both managements started to disagree on how to run the company:

Italian side (Del Vecchio): Despite stepping back from day-to-day operations in Luxottica, he remained deeply involved. Del Vecchio began pushing for more control and a more centralized management structure, which clashed with Essilor's traditionally collaborative and consensus-driven approach.

French side wanted a gradual and methodical integration of the companies, while Del Vecchio wanted a faster integration. The problem was that Essilor was not a fully vertically-integrated player, and Del Vecchio was going to take advantage of that.

The dual leadership structure became unwieldy. Sagnières and Del Vecchio frequently disagreed on appointments to key leadership positions and strategic decisions. Sagnières accused Del Vecchio of trying to take control of the company, while Del Vecchio accused Sagnières of blocking important decisions and slowing down integration efforts.

Escalation of the power struggle (2019-2020)

The tensions became public in 2019, with both sides accusing each other of undermining the merger’s success.

By early 2019, Del Vecchio had openly clashed with Sagnières over key appointments. Del Vecchio pushed for the appointment of Francesco Milleri, his close confidant and the then-CEO of Luxottica, to become CEO of the combined company. Sagnières resisted, arguing for a more neutral candidate.

Del Vecchio became increasingly frustrated with the governance structure and openly moved to consolidate power. By late 2019, he began lobbying for a change in the management structure that would give him more direct control over the company’s operations, arguing that the dual CEO structure was inefficient.

Sagnières fought back, defending the governance framework that was established at the time of the merger.

At this stage, it was clear who will eventually win the conflict: the owner of one third of the capital, and the strongest manager of the company. In less than two years, the Italians won the governance battle.

Del Vecchio’s victory (2020)

In 2020, Sagnières and Del Vecchio agreed to step down from their executive roles, effectively ending the power struggle. In this resolution, Francesco Milleri, Del Vecchio’s ally, was appointed as CEO of EssilorLuxottica.

With Milleri at the helm, Del Vecchio's influence over the company was cemented. Milleri, who had been Del Vecchio’s protégé at Luxottica, was seen as an extension of the Italian side’s control.

Leonardo Del Vecchio passed away in June 2022 at the age of 87. Despite his death, the power dynamics within the company did not immediately shift, as Del Vecchio had laid the groundwork for his succession. Delfin, the holding company he used to control his stake in EssilorLuxottica, retained significant influence over the company’s direction. Francesco Milleri remained CEO, continuing to drive the Italian-led vision for the company.

Brief considerations on the current management

On June 28, 2022, in the wake of Leonardo Del Vecchio's passing, the Board of Directors appointed Francesco Milleri as the new Chairman and CEO of EssilorLuxottica.

Simultaneously, Paul du Saillant assumed the role of Deputy Chief Executive Officer, representing the French perspective within the company.

Francesco Milleri, a key member of Luxottica's management team during the merger, had served as Chairman and CEO of Luxottica. Following Del Vecchio's passing, Milleri took the helm of EssilorLuxottica, representing the Italian facet of the company.

On the other side, Paul Du Saillant, who had previously been Chairman and CEO of Essilor, now holds the responsibility of Deputy CEO, embodying the French aspect of the company.

Despite only three years since their appointments, the overall performance under their leadership has been notably positive. Sales have experienced significant growth in recent years, and the business maintains a robust competitive position.

The year 2023 signifies the commencement of a new era for the company, and both executives seem adept at managing the evolving landscape. The presence of two key managers, each focusing on the specific trends and needs of their respective businesses, is a positive strategic approach.

Board of directors

The BoD has 14 members, and its a clear representation of the company’s fight for governance:

6 of them are French, and 5 are Italian, while the three remaining come from Monaco, Germany, and India

There are only 7 are independent directors, which is just half of the members. Its not the ideal solution, as boards should be more independent to guarantee company is serving the interests of the shareholders. In terms of qualification, the independent members have a strong background in management, however they are not from the retail or healthcare industry

CEO of illycaffé (coffee company) - Italy

Member of Siemens AG Supervisory Board (healthcare) - Germany

EVP and CEO New Markets & Business of Sky Group (telecom.) - Italy

Executive Director of Direct Investment of Bpifrance (finance) - France

Chairperson of Sonepar Group (electrical components) - France

Chairman of the Strategic Committee of Calcium Capital (finance) - Monaco

Vice Chairperson of Piramal Enterprises Limited (conglomerate - pharma, real estate, financial services, etc.) - India

The non-independent members are:

The CEO Francesco Milleri, and the Deputy CEO, Paul du Saillant

Three French members representing the company’s employees

Two Italian members: one board member and the CEO of Delfin (i.e., representing the Del Vecchio’s family)

The board is a clear representation of the company’s governance war. From the independent directors, three are outside Italy and France.

There are no directors from other regions of the world (except one from India), and the independent directors have no background from retail or healthcare, which are the main segments of the company. Some independent have strong financial background, which is important given the constant M&A in the company.

The chairman of the board is also the CEO of the company. In my view, its positive given the fact that after governance war, the company needs a clear leader.

“There is no need to separate the two roles if you have a leader who is responsible and has the trust of the shareholders.” Warren Buffet

Compensation policy

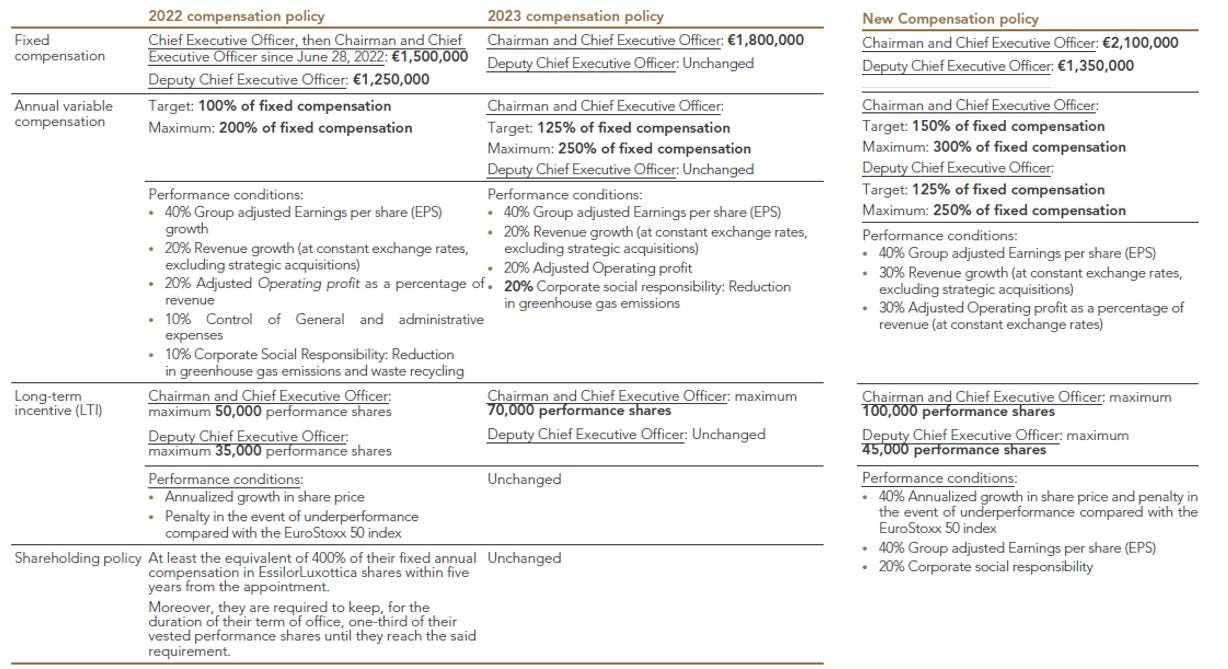

The compensation policy consists on three components: fixed compensation, variable compensation and a long-term incentive plan.

Fixed compensation: it has increased from €1.5 million in 2022 to €2.1 million in 2024 for the CEO (+40% increase in just two years)

Variable compensation: it has increased from a target of 100% to 150%, and a maximum of 300% (up from 200%). Conditions have also changed.

Long-term incentive plan has also doubled, from 50,000 performance shares to 100,000 performance shares

On first impression, something seems to be going on with the payout. It doesn't seem normal to see so many changes every year. Let's analyze them.

Fixed retribution: Is the CEO fairly paid? The company made a benchmark with an independent company. The result: compensation is in the top quartile (i.e., amongst the 25% highest paid). The median stands at €1.8 million, vs. €2.1 million.

Variable retribution: There has been an increase in the target and max amount, and a change in criteria. The variable retribution is always a strong component, as it is dependent on several goals. These have changed over the last years:

Current criteria are 40% EPS, 30% adjusted operating income margin, and 30% revenue growth.

These criteria have several drawbacks:

No criteria is based on cash flows, which is the ultimate value driver

EPS metric excludes integration costs from M&A, which makes sense, but on the other hand, the more M&A, the higher the EPS if earnings are higher than interest expense

Companies tend to fix the revenue growth excluding FX changes. This is not fair, as FX affects the returns of the company (i.e., to the shareholders), so they should be applied to the management too

The positive thing is that the variable retribution is not focus on ESG factors, as these are normally too subjective criteria

What have been the variable retribution over the last years? It seems they could be more challenging:

2019: 0% of variable retribution

2020: 22.9% (affected by covid)

2021: 197.8%

2022: 162.5%

2023: 140.1%

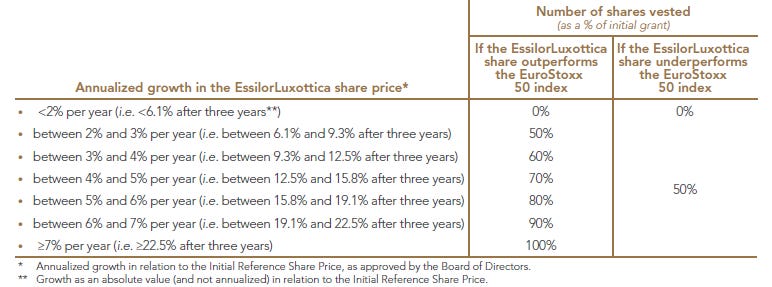

Performance shares: these have doubled from 50k performance shares to 100k performance shares. It looks quiet a lot. The criteria are also not perfectly aligned to shareholders’ best interest:

40% linked to share price performance (with very low thresholds)

20% linked to EPS growth (the more M&A, the higher EPS)

20% linked to corporate social responsibility

Thresholds of performance shares are not aligned with investor’s cost of capital, as the management earns 50% of the performance shares with just +2-3% annual growth in share price and outperform the index. Threshold should much higher, as they are not creating value with a +2-3% of share price increase.

The ratio of total CEO compensation vs. median compensation has increased from 109 times in 2021, to 156 times in 2023 (i.e., CEO’s compensation is 156x the median compensation of the company).

On a positive note, the requirement for the Chairman, CEO, and Deputy CEO to hold at least 400% of their fixed annual compensation in EssilorLuxottica shares is a commendable policy. This ensures a significant personal investment, exceeding €6m in shares for the key executives, reinforcing alignment with shareholder interests.

As a conclusion:

There has been a war between the Italian and French companies, with a victory of the Italians

The compensation of the CEO is partly aligned to shareholders interests, but total compensation is excessively increasing every year

The board seems not to be diverse enough, with only half of the members being independent

Ownership and skin in the game

Delfin, the family office of Del Vecchio’s family, owns nearly a third of the shares of the company. The actual CEO, Franceso Milleri, is also running Delfin, creating strong alignment of interests between the family members and the remaining shareholders.

As discussed in the Luxottica’s post (Part III of EssilorLuxottica analysis), Leonardo Del Vecchio family structure was complex (several wife, multiple sons, etc.). This could create potential problems and loosing skin in the game, but he was very smart to build a strong legal structure to ensure Delfin's continuity within the company.

Today, two family members hold key roles in the company:

Leonardo Maria is the Chief Strategy Officer of EssilorLuxottica and CEO of the brand Salmoiraghi & Viganò, part of EssilorLuxottica

Matteo Del Vecchio: Head of Integration (Responsible for Group Integration Synergy achievement)

Finally, the employees hold 4.3% of the shares of the company. This, added to Delfin’s stake, represents 37% of the shares held by insiders.

Strategic Vision

A CEO earns its salary to do several things in a company. Apart from going to dinners and events, a CEO must do two critical things: set the right strategic vision and culture, and allocate capital adequately.

On the strategic vision, the rationale of the merger was to vertically integrate all the business units and create a quasi-monopoly in the eye industry. Once that has almost being completed, the management has executed new business division and levers of growth:

Expanding the myopia solution worldwide

Extending their partnership with Meta

Acquiring GrandVision and other firms to boost the vertical integration

Further acquisition: company acquired Supreme, which is questionable (something we will analyze lately)

New markets: the Group is developing a new market which is the combination of optical and hearing care. Management is exploring the hearing impairment market, which is also a very interesting and synergetic market

“From med-tech and digital to luxury and now hearing solutions, we are a catalyst for change” EssilorLuxottica Annual Report 2023

I think the above statement is completely true. The company is evolving very fast, which makes it stronger every year. Management isn’t becoming complacent, and

Capital Allocation

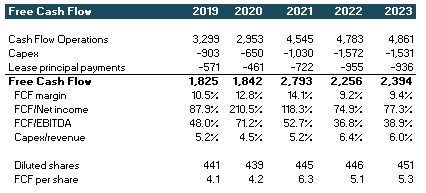

Since the merger, the company has significantly evolved. Cash from operations has increased from €3.3bn in 2019 to €4.9bn in 2023, representing a cumulative cash generation of €20.4bn. After deducting leases, and interest expense, the use of the cash was for the following:

€5.6bn in capex, increasing from 5.2% to 6.2%

€3.0bn in dividends (at a cost to the shareholder given its a scrip dividend)

€3.6bn un debt repayment

The remaining €5.6bn were invested in the acquisition of companies (mainly GrandVision for €7.2bn

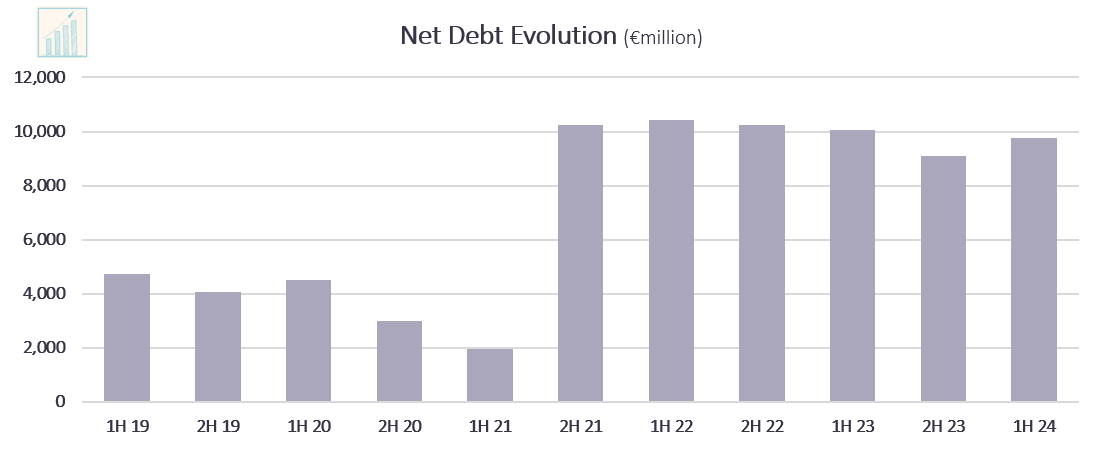

To finance the M&A, the company issued €7.9bn in 2019-2020. Net debt has increased from €3.8bn in 2019 to €9.1bn, increasing leverage ratio from 1.4x EBITDA to 1.5x in 2023.

Additionally, the total shares issued has increased from 427 million in 2019 to 448 million in 2023 (+5% during the period). This is explained by the fact the company pays the dividend in shares, and very limited share repurchases. This is something that adds no value to shareholders, given the buybacks are only for stock compensation.

V. Smart Glasses and Partnership with Meta

Partnership with Meta and the smart glasses opportunity

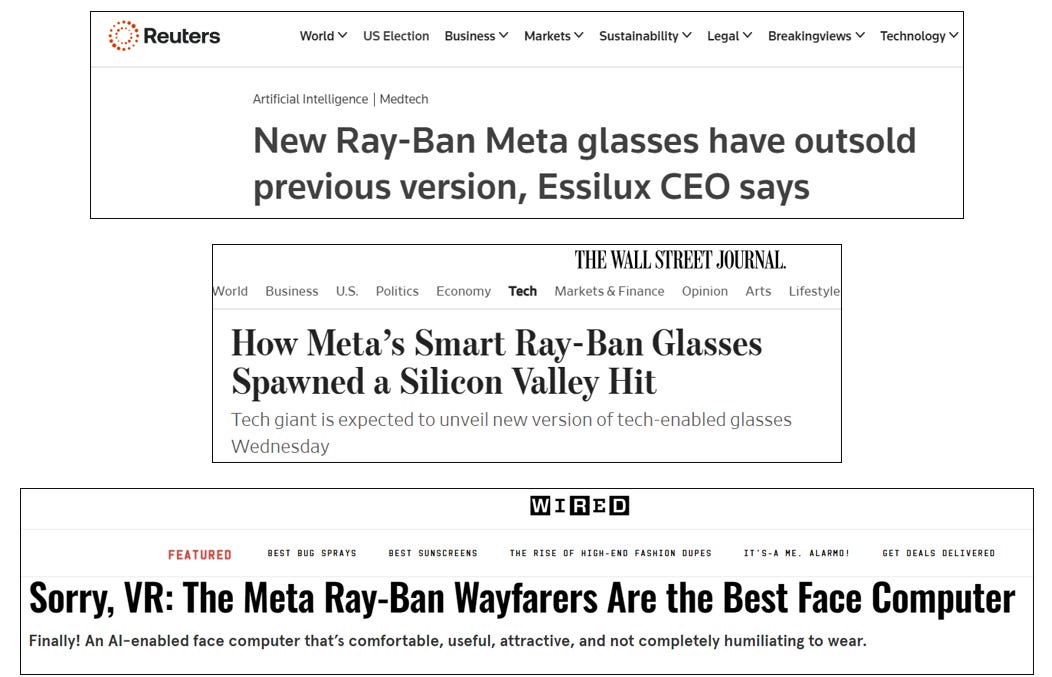

Since 2019, Meta and EssilorLuxottica have been partnering in developing the Ray-Ban Smart Glasses.In 2021, they launched the Ray-Ban Stories, one of the pioneering smart glasses.

Now, in 2024, they launched the second generation of the smart glasses called the Ray-Ban Meta. This change in the name makes total sense:

It signals further commitment from Meta, by adding their brand in the product’s name

One of the uses is for recording videos for Social Media, where Meta is the king

What are the Ray-Ban Meta smart glasses?

The Ray-Ban Meta are the typical Wayfarer, but with cameras, sound, and microphone. The only difference with normal sunglasses are the two cameras on each side of the frame.

There are multiple models, with different colors and lenses. Its remarcable how both companies have introduced technology in a product not design to have technology embedded:

It has two cameras, two speakers and a microphone

You can use them to record videos, take photos, and even stream live and have video calls!

Battery is still a weakness, as it last around 4 hours, but given the space constraints, is something logical

It has also 32 gb of memory and the latest update includes AI in several models. With Meta AI, you can ask the assistant anything, from taking notes to recording messages and sending them from WhatsApp. The smart glasses have the ability to give information on the item a user is looking at.

This is the second generation of a product that has been in the market for little more than two years.

A change in narrative: from pessimism to running out of stock

The first model, came short of expectations. Despite selling around 300,000 units since then, falling short of Meta's target, almost 90% of owners don't wear them or use them for its purpose.

Now, the company has launched the new Ray-Ban Meta, with a clear change in narrative:

According to the WSJ, Meta (or EssilorLuxottica) has shipped more than 700,000 units, which compares to ~300,000 units sold from previous version. Some other reports suggest over a million units sold.

After the recent success, both companies have extended their partnership for an additional 10 years, and Meta has reported it might acquire a 5% stake in EssilorLuxottica.

“I'm proud of the work we've done with EssilorLuxottica so far, and I'm excited about our long term roadmap ahead. We have the opportunity to turn glasses into the next major technology platform, and make it fashionable in the process," said Mark Zuckerberg, Founder and CEO of Meta.

No details have been made public yet, especially about the economics of the partnership.

The market is starting to understand the potential of these glasses

Its not only Instagram, the possibilities and use cases are huge. The glasses can capture what you see, hear and say, without holding anything on your hands. Its a change in the way of communicating.

I recently heard about a Streamer talking about the glasses, and this can be a game changer in the streaming industry, as you can record exactly what your eyes are seeing. Or even better, record what you are doing with your hands.

Imagine the possible use cases:

Hands free content creation

Potential augmented reality (AR) applications in the future, such has navigation tools

Imagine a doctor live-streaming and getting help to improve the diagnostic

They have the potential to be used by people with both vision and hearing impairments. With one device, two problems solved at once

Even for personal safety, by recording life in emergency situations

If combined with AI, it can have additional applications such as asking for assistance on anything the glasses are recording

I believe this is just the beginning, and it makes total sense for Meta to acquire a 5% stake in the company. It signals two things:

The company sees strong potential in the opportunity and is willing to invest €5bn to acquire equity in the company (not even financing the project, as it will not be a capital increase)

Meta wants to influence in the strategy of EssilorLuxottica

For EssilorLuxottica, Meta is the best possible partner, as they are the biggest player in social media.

Potential risks

There are obvious drawbacks, such as privacy, real sustained demand, etc. We are only in the very early stages of something that can turn to be very big, and the positive thing is that the stock is not trading like a growth stock, but as a high quality stock.

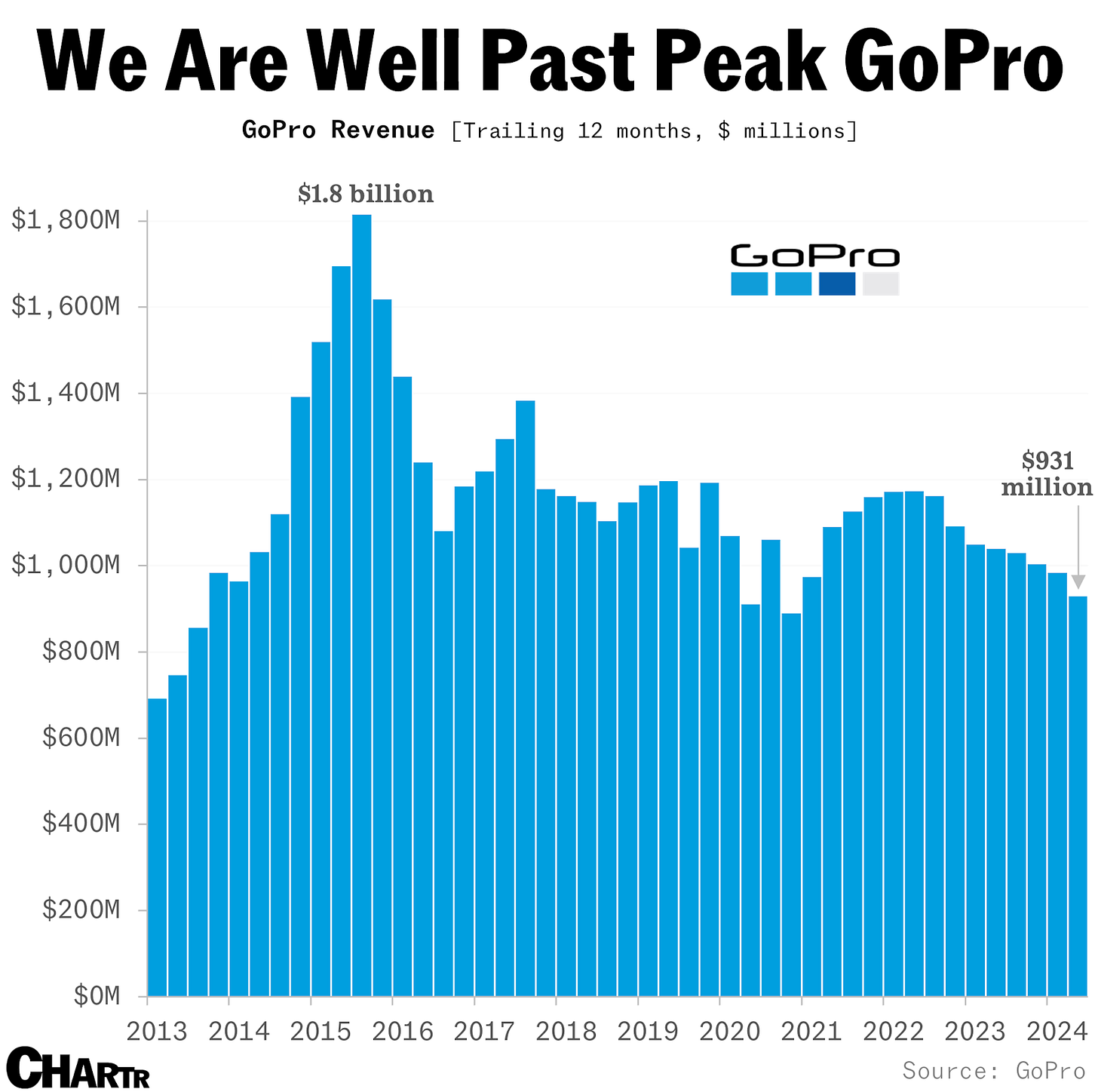

Is the opportunity a long-term sustainable one? GoPro sales reached the peak long ago, and history can repeat with smart glasses. The future is unknown, but GoPro still generates close to $1bn revenue per year, and has sold more than 50 million cameras. I think the total addressable market for smart glasses is significantly bigger than GoPro, as it increases the use cases.

Its a very early stage and the product needs to prove that is going to be a great selling product with strong demand. The price is not very expensive and right now there is low competition.

However, this is the main risk that will certainly come in the near term, and I bet that mainly from other Chinese brands. Its something that is already coming:

We are in the early-stages, but Chinese are trying to accelerate the introduction of new features, in a clear attempt to compete against Meta. I believe Meta will gradually introduce more technology, as they can leverage on their brand and follow an Apple style strategy to unveil new technology in every new generation, but without taking huge steps, to benefit from recurrent revenues.

Can Ray-Ban Meta defend against the Chinese threat? The answer is yes:

Ray Ban Meta can be incorporated in the Meta ecosystem, with Instagram, Facebook, WhatsApp, etc. and includes also an AI assistant (not sure how useful yet, but increases optionality)

Who controls the sunglasses distribution? Yes, EssilorLuxottica. These brands will need to find alternative distribution channels, which might not be directly linked to the optical market

The Ray-Ban brand and its legacy. A unique characteristic of Ray-Ban Meta is the fact that you can wear the iconic Wayfarer and other Ray-Ban models, with this technology embedded. Other brands can develop new sunglasses, but can these remain as fashion as Ray-Ban?

Future collaborations. EssilorLuxottica owns 150 brands. Can they extend the smart glasses offering to other brands like Oakley? This can be huge in the sports market

Ray-Ban Meta can also offer prescription glasses, leveraging on Essilor’s brand and capabilities. This is more complicated for competitors too.

Quantifying the opportunity

It is challenging to quantify the market opportunity as it is a combination of sunglasses, traditional glasses, and the GoPro

Sunglasses: The market size is around $25-30bn, with North America accounting for c. 1/3 of the market (i.e., ~$7bn)

Digital cameras: The market size is around $7bn and maintains a solid growth partly fueled by professional uses.

Action cameras have a market size of $3-5bn. Its a declining market, were GoPro, who was the clear leader, is now a small cap trading at a valuation of ~$200 million, a clear signal that the smart glasses will replace this product

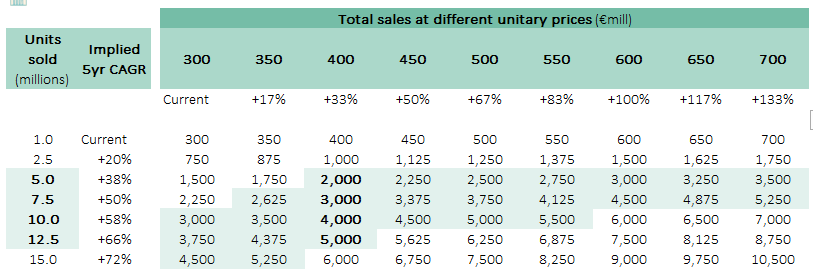

It is difficult to obtain reliable data on the smart glasses segment. Mixing all these data points, I believe the mid-term total addressable market should be close to $3-5bn, given its a combination of sunglasses and corrective glasses, with digital cameras and action cameras.

As of today, there is no clear data on how many smart glasses have been sold. Some suggest between 700,000 and 1.0-1,3 million. I will take the 1.0 million as intermediate.

With one million units sold, at around €300, implies a small revenue size of €300 million. If GoPro sells more than €1bn revenues per year, in a declining market, the Ray-Ban Meta can easily reach that number.

What are the potential valuation impacts?

After considering a potential market of €3-5bn, the first step is calculate how many pairs of glasses need to be sold. The current price stands between €280-340. Assuming a current average of €300, and a price increase to €400 after including additional functionalities, improvement in performance, etc., the company will need to sell between 5 and 12.5 million glasses every year, implying a 5-year CAGR of +38% to +66% vs. current production of c.1 million units.

Its is premature to think about more expensive models, but if the company introduces more complex smart glasses (e.g., including a display in the lenses) priced at higher prices, it will be more feasible to reach €3-5bn revenue

The demand needs to increase significantly to meet these targets (selling 5-12x more than current version). Its not impossible, but 10 million pairs, are a lot of smart glasses to sell

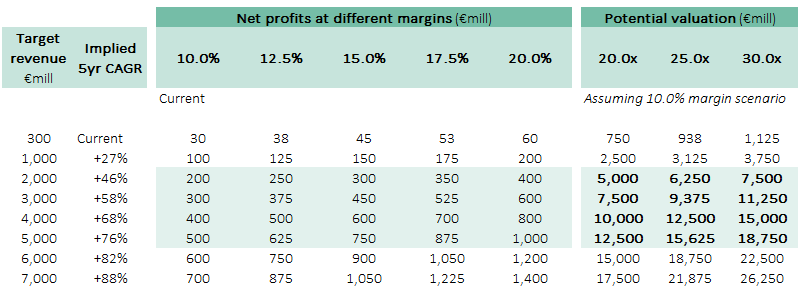

If the target is reached, what is the potential value?

Current EssilorLuxottica net margin (net income / revenue) stands at 10%. For reference, Apple reaches 20%, after pricing iPhones at €1,500. We will consider it the high range, although not reasonable to think of that in the short-mid term

Valuation can reach between €5bn-20bn, which is 5-20% of EssilorLuxottica market cap. This is without assigning a stake to Meta, which is not something realistic as Meta will retain part of the cash flows (i.e., impact is even lower)

Its something meaningful, but signalling two things:

We are still very far from a sufficient revenue level that can sustain an increase in EssilorLuxottica’s valuation

The potential is lower than I would originally expected

Apple sells around 200 million iPhones every year. According to my calculations of selling between 5-12 million smart glasses represent 2.5-6% of total iPhones (i.e., 3-6 smart glasses per one iPhone, which is not impossible). I’m using iPhones as a reference because its the most widely used device and its a premium device, same as Ray Ban Meta.

My conclusion is that much of this is already priced in current share price, unless I’m being too conservative on my assumptions, but I think selling a proportion of 3-6 smart glasses per iPhone is more than reasonable.

VI. Post Merger evolution: M&A and financials

In this section we will cover the evolution of the company’s financials, together with the major acquisition of GrandVision in 2021.

M&A post integration

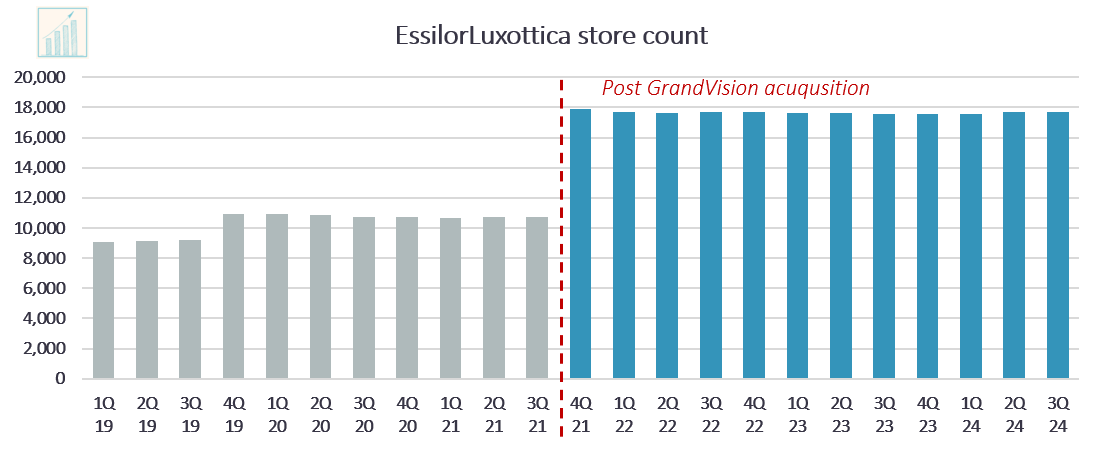

Since the integration of both companies, EssilorLuxottica has continued with the strategy of both companies to continue acquiring other companies. The most relevant milestone during the last 5 years was the acquisition of GrandVision in 2021.

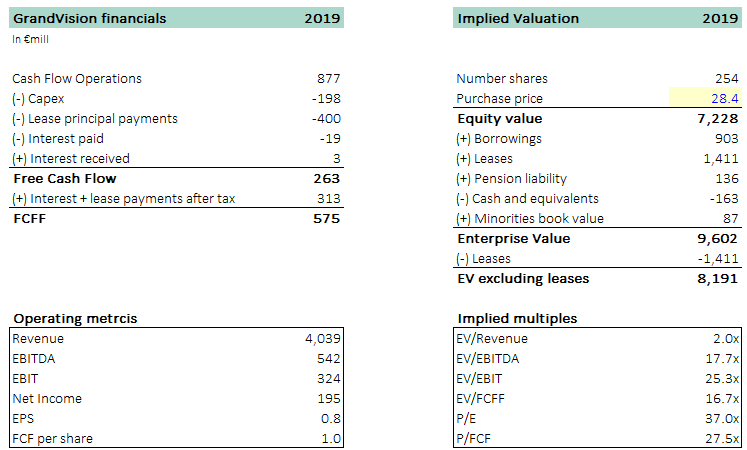

Acquisition of GrandVision

At the time of its acquisition by EssilorLuxottica in 2021, GrandVision was a major global optical retail chain, operating over 7,000 stores in more than 40 countries. It specialized in eyewear, contact lenses, and optical services, providing EssilorLuxottica with a stronger retail footprint to complement its eyewear manufacturing and distribution.

The deal was already agreed at the time of the merger, as the company made the offer to purchase GrandVision on July 2019. The agreed purchase price was €28 per share, totaling around €7.3 billion for the acquisition. The premium paid was c.33%.

The acquisition made a lot of sense as it was a way to become a clear leader in the retail space and continue to strengthen the vertical integration of the company. At the time of the acquisition, Grandvision was a key player in Europe:

7,000+ stores (93% of owned by them), including 30 brands across Europe

With global presence, c.90% of revenue came from Europe, which would further strengthen the European operations

Additional 3-4% market share for EssilorLuxottica

This merger will transform the company’s operations:

Revenue from direct-to-consumer channel with increase from 35% to 47%

Number of stores will increase by 70%, from 10k+ to 18k

Store in Europe will represent 35% of total stores (up from ~10%)

According to the 2019 figures, the acquisition made by the company was not a cheap one, as the company paid high multiples: c.15x EBITDA. However, these multiple are pre-synergies.

The deal was financed with debt, and the company issued €7.8bn debt during 2019 and 2020

Other M&A

After GrandVision came other acquisitions. Some related to stores located in specific industries, and others related to technology (e.g., acquisition of Heidelberg Engineering, a platform of early detection of vision-threatening conditions).

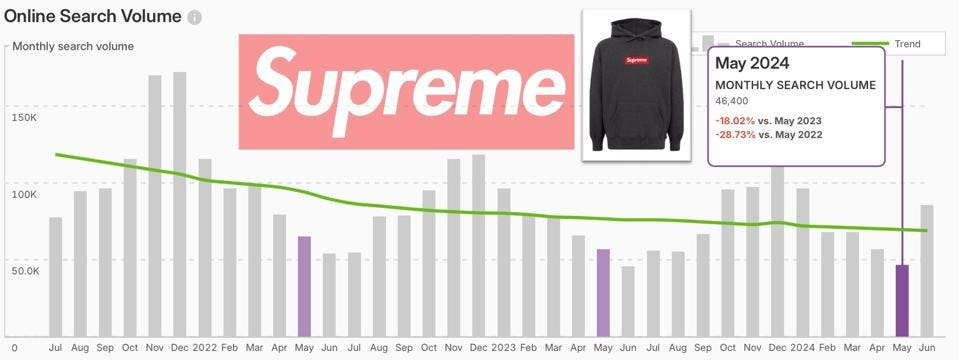

The last acquisition was the Supreme brand, which has generated some controversy. We will analyze it later in the Risks chapter.

Evolution of the financials

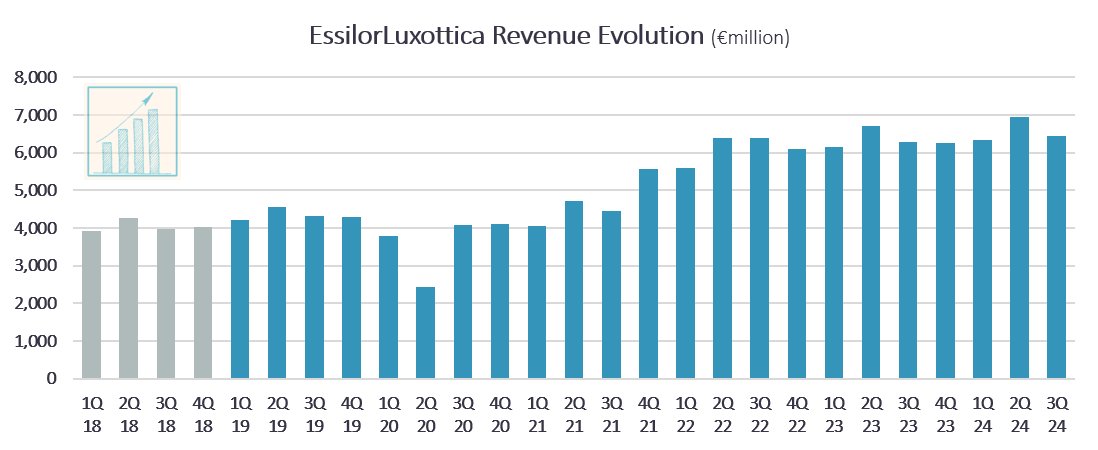

Revenue

Since the merger, revenue has increased by nearly +50%. However, a significant part of the growth was due to M&A. After acquiring GrandVision, the company made a step forward and is generating c.€6bn of revenue per quarter, compared to €4bn at the time of the merger.

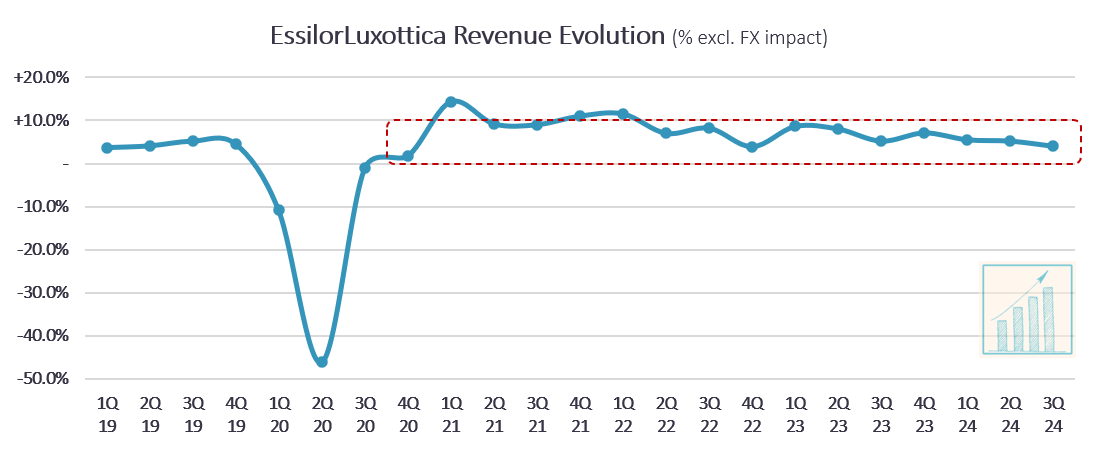

Revenue is increasing at a fast pace, and since 2020 (Covid-19), the company had always positive revenue growth every quarter in the region of the mid-to-high single digit.

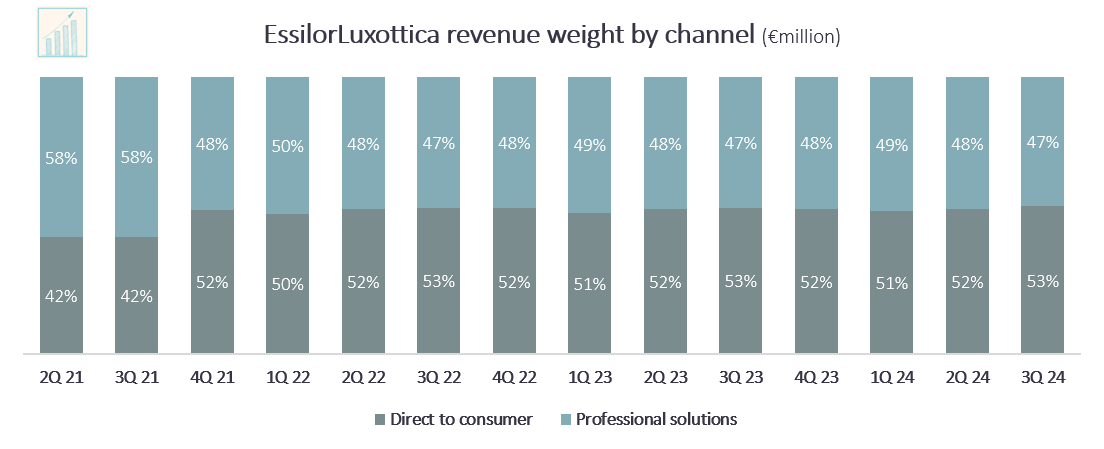

Since the acquisition of GrandVision, the direct-to-consumer segment has increased its weight and now account for 53% of total revenue (up from 42% in 2021).

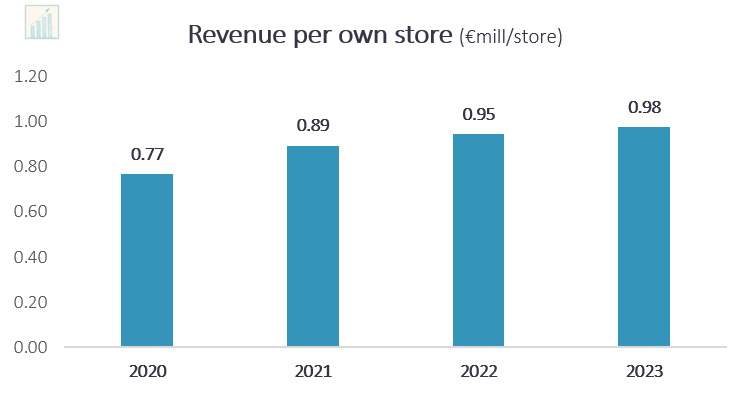

Since the acquisition of GrandVision, the number of stores has remained relatively flat between 17.6-17.9k stores.

This suggest that revenue per store has significantly increased during the last years, signalling the Group has unlocked synergies during the recent years, as CAGR stands at +8%, significantly above inflation.

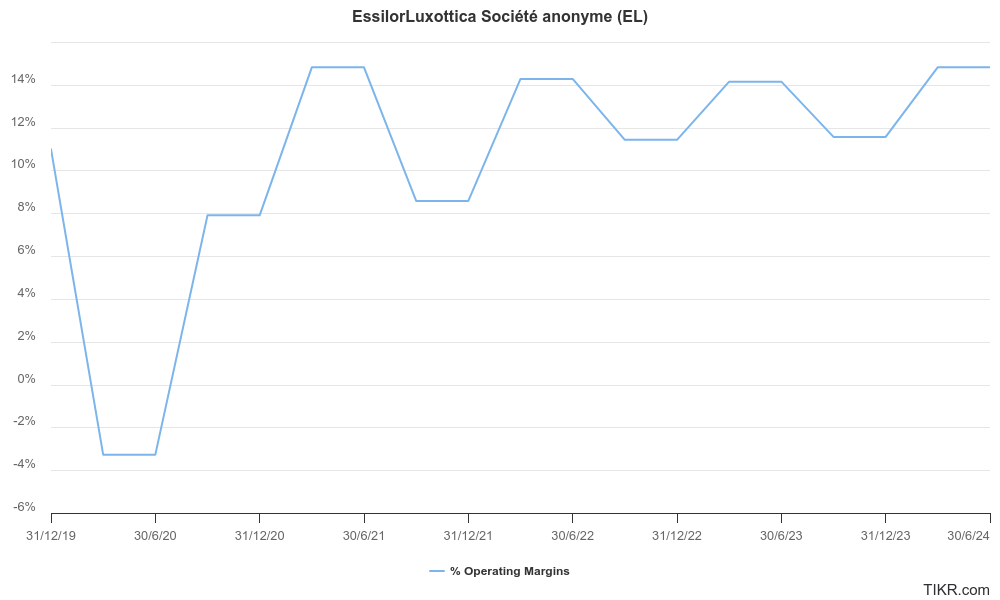

Operating margins

Operating margins of the company are not really that high, considering its a quasi-monopoly in the eyewear and eyecare industries. Part of the explanation is due to integration costs of the recent corporate transactions.

To better analyze the operating performance, we need to use the adjusted metrics provided by the company. Before doing so, it is important to understand the adjustments in case these might be too aggressive:

Purchase Price Allocation (PPA) process, where the acquisition price is allocated among the acquired company's assets and liabilities, including intangible assets like customer relationships, patents, and brand value, and then are amortized.

Restructuring impacts (layoffs)

M&A fees and expenses

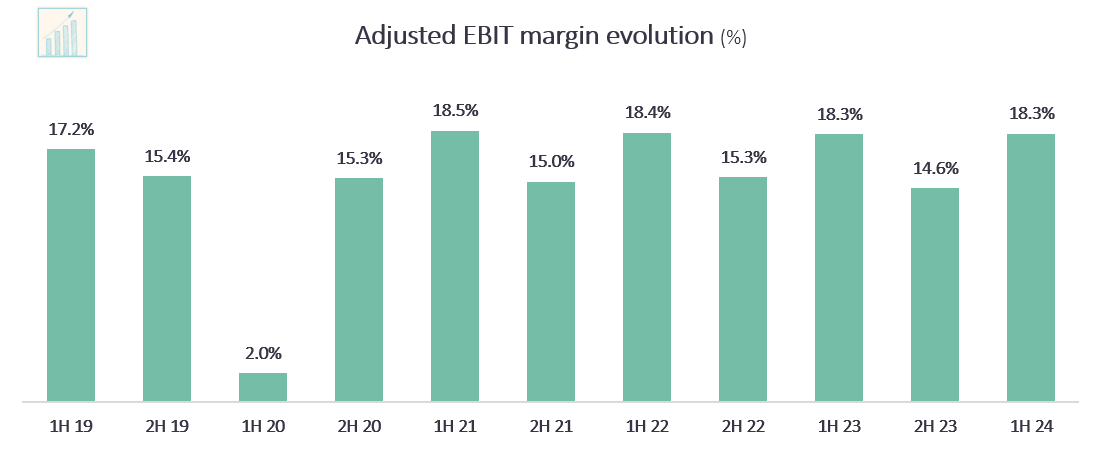

The long-term goal (2026) is a range of 19-20%. This is the same target as Porsche AG, one of our investments, which signals that the company is doing quiet well in a very fragmented and competitive industry

As we can see in the above chart, the adjusted operating margin has not grown during 2022-2024 period. There is a strong seasonality component, explained by the fact that 2H includes the summer and Christmas season, although coming at a lower margin:

1H margin peaked at 17.2% in 2019. Recently, the best year was 2021, with a margin of 18.5%. During the last years, margin has not increased, but remains fairly stable at 18.3%

2H margin peaked at 15.4% in 2019 and has remained in the low 15s during the recent years, expect for 2H 23.

Overall, there is no margin expansion since the merger, and remains stuck in the mid-high 16s. The adjusted EBIT margin remains far from the mid-term target to reach a 20% adjusted operating margin.

Part of this flat margins comes from the current challenging environment. The sunglasses market is facing headwinds, especially in the U, as consumer demand for retail products remains low.

The current chart illustrates how EssilorLuxottica has a strong performance compared to peers, as its the only group serving multiple industries at the same time. It has a margin in line with Cooper Companies and slightly below Kering, which is a high premium company that earns strong returns on sales.

ROIC

In terms of ROIC, since the merger, the ROIC has increased from less than 6.0% to current levels of 11%. Including goodwill, ROIC has increased from 3% to 5%, signalling that M&A is creating value.

For a company like this, the ROIC is not that high. The company doesn’t report different segments, so its very difficult to understand the underlying trends of the different divisions.

Although not very high, the trend is very positive, with returns improving over the years.

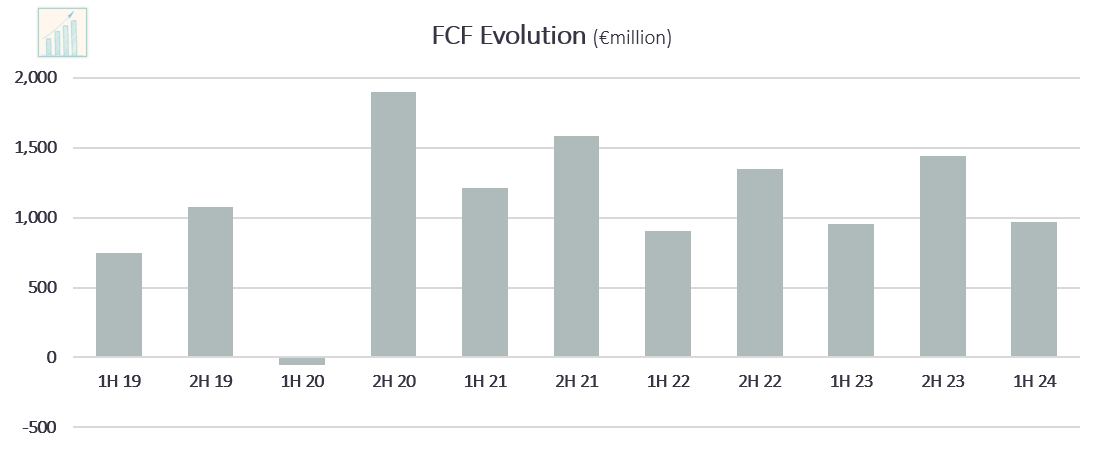

Cash flow generation

Same as with revenues, FCF shows seasonality, with a second half of the year better than the first half. The FCF has increased to a minimum of c. €1.0bn every semester, vs. €750 million in 2019.

However, on an annual basis, we can see how the FCF has stagnated during the last years. FCF generation is increasing but at a reduced pace:

The cash generated from every €100 of revenue has declined from levels above 10% to current 9.2-9.4%. The EBITDA conversion has declined from c.50% in 2019 to current levels below 40%.

In addition, the company is investing more capex. According to the Capital Markets Day of September 2022, the capex in terms of revenue should have reached its peak.

When initially thinking of the merger, the market positioning, and the potential synergies, I expected a higher FCF and margin. However, it is not the case and FCF has stagnated during the last years. Although its higher than 2019, part is due to the acquisition of GrandVision.

As we will analyze further, the company trades at €230 per share, while generating €5.3 FCF per share.

According to the management, the company could be in the peak of investing in Capex. However, every business plan incorporates any kind of peak in the mid-term. My assumption is to maintain the current 6% capex/revenue figure for the long-term.

Final word on FCF: Although not increasing every year, the business is showing a certain level of both resilience and stable cash flows. The company will generate on average €2.5bn cash; however this needs to be compared to a market cap of c.€100bn, which implies a FCF yield of 2.5%

Dividend

One of the weaknesses of the company is the fact that the management has decided to pay dividends through the scrip dividend formula:

As a shareholder, you can decide how to receive the dividend: either in cash or in shares

To encourage the payment in shares, the new issued shares at issued at a 10% discount over the 20 prior trading days

This formula adds no value to the shareholders, as its just issuing shares without the benefit of a capital increase (i.e., issue shares in exchange of nothing). Its the same way as inflation: management issue shares, and 3 years later, the count has increased by 5% (i.e., one share represent 5% less interest in the company after just 3 years after initiating this system).

“In 2018, we paid EUR 0.9 billion in dividends. 6 years later, we have doubled that value, distributing dividend for EUR 1.8 billion.” CEO of EssilorLuxottica

Management claimed during the last Annual Shareholder’s Meeting that dividends have doubled in the last 6 years. This is completely misleading, as the company is not distributing cash, but simply issuing paper. I think its OK not to distribute dividend if the company is executing M&A to grow. The worst thing is to dilute without any benefit.

The main issue here is that company is not doing buybacks to offset the increase in shares. There are companies that offer this formula, but also buyback shares to maintain the share count stable.

All our buyback program have been directed to serve the employees' performance plan.

CFO EssilorLuxottica

What surprises me is the fact that no analyst has asked a question about the dividend policy during the last 3 years. And, by the way, there is no dividend policy, which is not something bad. But, there is no dividend policy,

Finally, current dividend yield stands at 1.8%.

Balance Sheet

At the time of the merger both companies had leverage, given that both were under a strategy of consolidating their respective industries through acquisitions.

Since the merger, net debt has increased from €4bn, to €10bn mainly due to the acquisition of GrandVision (acquired by ~€8bn)

Despite the increase in net debt, leverage has remained stable at 1.5x EBITDA.

Its not a problematic situation, given the recurrent cash flows and the type of industry, but its a little high considering the company is not increasing the cash flow significantly every year. As a reference, net debt has increased from 1.6x FCFF (excluding leases and interest), to 2.6x, which is not significantly high (the net debt is 2.6x the cash flow generated by the business)

Its not an unhealthy balance sheet, but given the management apetite for M&A, leverage should be a little lower, to have room for additional M&A. Additionally, this leverage is what pushes the management to distribute a scrip dividend, by issuing shares.

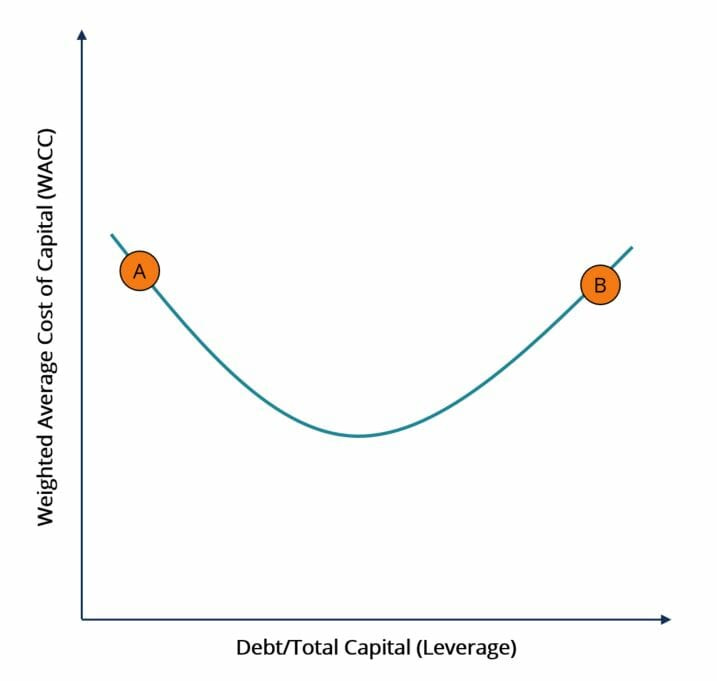

The current rating of A by S&P confirms the company is in good shape. As an investor, I prefer avoiding companies highly indebted. However, EssilorLuxottica has a recurrent cash generation, not exposed to high volatility. This increases tolerance for debt, and a ratio of 1.5x EBITDA is not high, and it might be financially optimal (companies without debt tend to operate at higher WACC).

Having debt at a very low cost reduces the cost of capital. In the case of EssilorLuxottica, given its a high quality company, they can finance at a very cheap cost of debt.

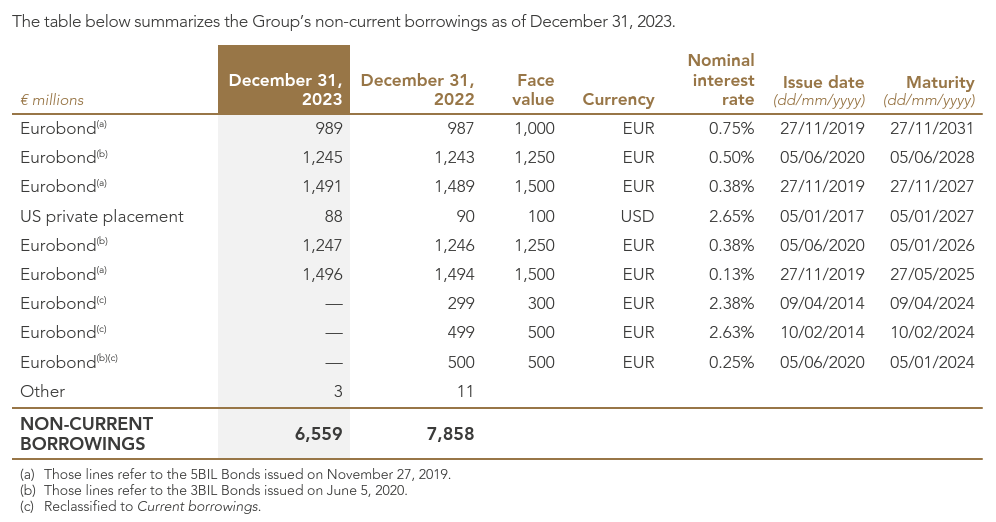

The latest bond issue was in August 2024, and the company issued €2bn bonds with tenors of 4.5 and 7.5 years, carrying respectively a coupon of 2.875% and 3.00% with an average rate after hedging of 2.99%. The after-tax debt cost is north 2.25-2.5% according to this last issue.

VII. Additional Growth prospects

Aging population

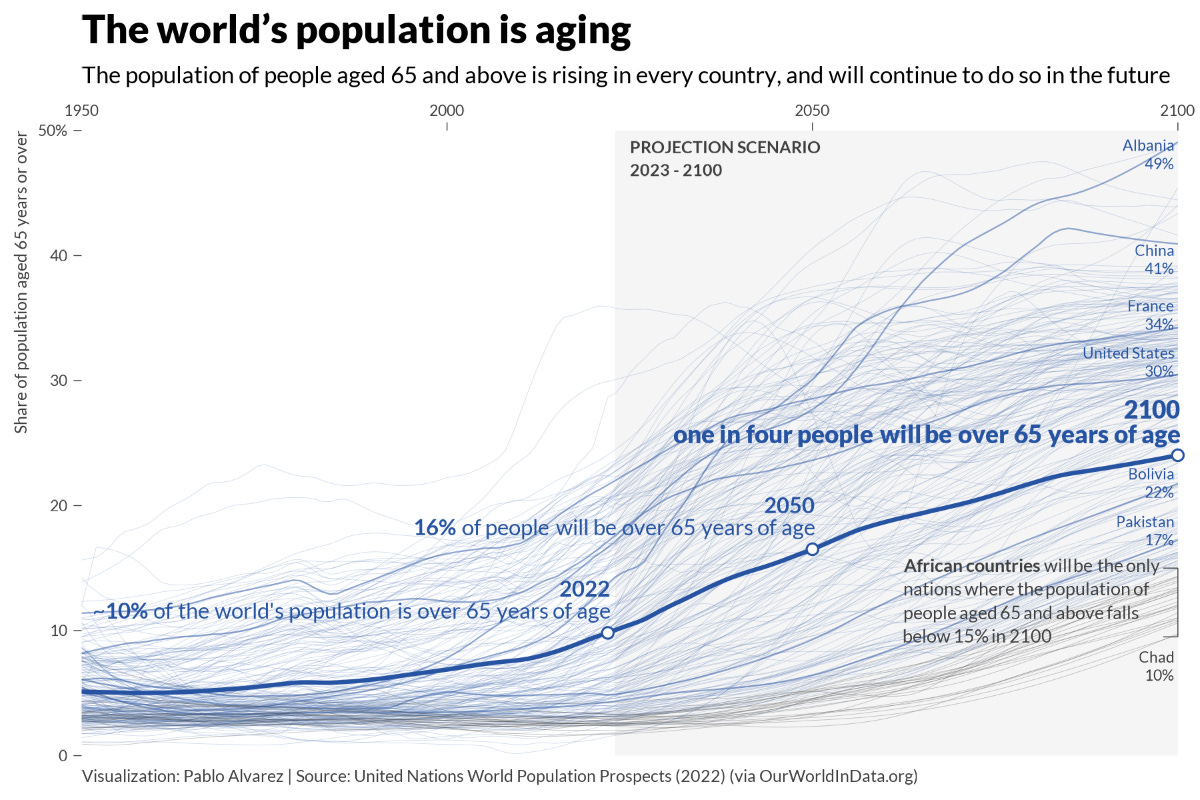

The world’s population is aging, and this implies more vision impairments, and increases the demand for Essilor’s products. Its a reality that vision impairments are increasing every year, with more and more people affected.

The aging population will continue to contribute for top line growth in the company. This, combined with the expansion to new markets and products, represents a strong tailwind for a solid organic growth.

Demystifying the Myopia market in the US

Myopia is probably one of the most important growth lever, together with smart glasses. In the case of myopia, the market size is more than €15bn.

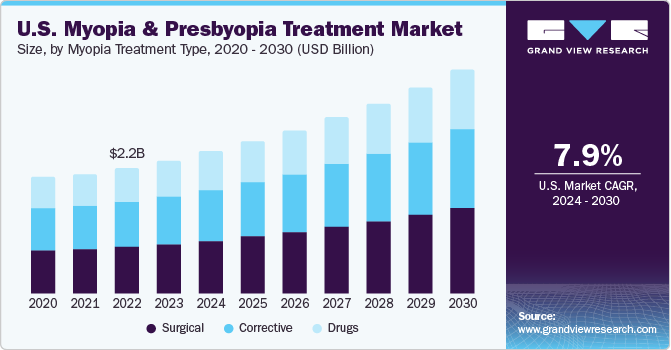

In the US, the company is launching its myopia solution in 25-26, and there are high expectations. The market size is $4bn, and it is expected to grow at high-single-digit CAGR.

“By 2050, the global population aged 60 and above is predicted to be 22%. The number of people aged 65 and above in the U.S. is expected to nearly double from 52 million in 2018 to 95 million by 2060, likely increasing the prevalence of presbyopia.” Grand View Research3

According to this provider, prescription lenses represent ~25% of the market, which means a TAM of ~€1bn as of 2024. If the company reaches 20% market share in the coming 5-7 years, and achieves a 10% FCF margin (current group’s level), the company will generate ~€20 million FCF per year (~€500 million of valuation impact).

After this calculation, I’m cooling down my expectations on myopia. However, we need to consider that this market will also increase at a solid rate during the next decade, and China is expected to be a solid market given the high number of people affected by myopia.

M&A

M&A will continue to drive future growth. The company’s positioning is so strong that they can continue to further consolidate the industry and absorb potential new challengers.

M&A has the potential to strength the company in areas of strong growth or to create new revenue streams, such as the introduction of new hearing solutions

However:

Management should deleverage the balance sheet to be in a comfortable position to execute potential M&A transactions

There is a risk of underperformance in M&A transactions. The recent acquisition of Supreme brand raises questions whether the management is going too far in the strategy of consolidation

I’m always cautious with M&A, but if executed well, it can drive value creation to shareholders.

Geographical expansion

As of today, North America is the biggest region in terms of revenue contribution. This is aligned with the size of the market as the US is the biggest market for eyecare and eyewear.

In all four geographies there is room for growth:

In the US, the company has multiple growth opportunities to uplift their growth, which is currently at 1.6-1.7%:

Company will introduce their myopia solution, which should by some additional growth (not as much as we saw before).

In addition, this region will be very important for smart glasses and can be attractive for the new sight and sound solutions that the company is developing

Finally, the company has room to continue expanding their store count, as they own 3.8k stores (vs. 6.0k in EMEA region)

EMEA: Aging population will continue to drive growth, and keep the revenue growth strong (currently at +6-8%). The middle east represents a strong opportunity for both products, eyewear and eyecare.

APAC: In China, myopia market is expected to grow fast, as the country has a really strong problem with myopia in children. Although the country is currently facing strong macroeconomic challenges, in the long-term it remains a very strong opportunity.

Other countries such as South Korea, or India, are also key levers of growth in the region. The opportunity in India for the next 20 years is massive.

Latam: Growth is organic terms should remain strong in the region, as the countries continue to grow and the middle class keeps on expanding. However, FX impact remain the key issue, which will probably limit the contribution of the region

Sight and sound solutions

In July 2023, EssilorLuxottica announced its plans to expand into the hearing solutions market, enabled by its acquisition of Nuance Hearing earlier in the year.

With a dedicated Super Audio team and in-house R&D resources, the Group plans to introduce an integrated technology at the intersection of vision and sound for the 1.25 billion people experiencing mild to moderate hearing loss.

Visit their website —> https://www.nuanceaudio.com/en-us/c/hearing-glasses

The move makes total sense and has synergies with the smart glasses. Its basically an invisible product as the audio component will be incorporated in the frame, removing a psychological barrier that has historically stood in the way of consumer adoption of traditional hearing aids.

Nuance is expected to be launched by end of the year / beginning of the year, while in the US the company is in the process to get FDA approval.

The product seems interesting, but it will now face competition from Apple’s AirPods. However, its completely different, and this is more suitable for people wearing glasses.

This kind of innovation is what makes EssilorLuxottica a clear leader in the industry. Its a great decision to incorporate technology in the glasses, making them more valuable and profitable.

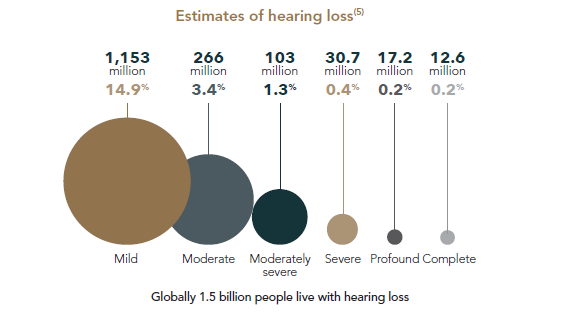

It is still early to quantify the impact, as they are not ready to commercialize yet, but I don’t think it has the same potential as other products such as smart glasses, given that the number of people with hearing loss is not huge:

According to the company, there are globally 1.5 billion people with hearing loss

However, 75% (1.15 billion), have mild hearing problems, and raises the question if these people will invest in this product

This product will be suitable for people that also have vision impairment, and are wearing glasses, which is very difficult to estimate. If we take the 1.5 billion people, assume 2/3 have also vision problems, and out of those, 1/3 wear glasses, the total target will be ~330 million people.

If company is able to attract 5% of those, they will be selling 16 million pairs of glasses, which implies ~€6.5bn revenues assuming a unitary price of €400. At a 15% margin, it will generate €1bn in profits. Should this be recurrent, valuation uplift could be ~€25 billion (+25% vs. current valuation).+

Note: These are high level calculations just to provide a sense of the opportunity, but are not precise at all, so shouldn’t be consider to make any investment decision.

VIII. Risks

1. Current valuation

As we will further explore, the current valuation is challenging and its probably not a good moment to invest in the company, given its trading at an EV/FCFF of ~30x, which implies that growth and profitability needs to be strong.

This is the main risk, as the company should benefit from natural organic growth in the future. However, value today is below the share price (valuation estimated of ~€180-210 per share; current price €230 per share)

2. Operational risks

In the eyecare space, there is competition from global players. Although the risk of disruption is currently limited, there is potential for other companies to develop similar products. Even if protected with patents, competition might rise. The main mitigan is their strong market positioning and the fact that they own the major distribution network in the world.

In the eyewear space, there are two main risks:

Increasing competition from other brands and companies; however it is difficult to compete against Ray-Ban or Oakley, but not impossible. Big groups like LVMH and Kering are developing their own brands, which should increase competition with EssilorLuxottica’s brands such as Chanel, Prada, etc.

The company risks to loose licensing agreements in the future. However, just a few partnerships end in the coming years, and for independent players such as Chanel or Moncler, it might be a better solution to rely on EssilorLuxottica rather than developing their proprietary go-to-market solution

3. Weak demand in the sunglasses market

Despite having the biggest store network among competitors, not all brands are performing well. This is due to the fact that some store chains are focused on sun, while others are more exposed to the eyecare segment, which tends to be more resilient.